Statement re Possible Offer

May 14 2010 - 3:48AM

UK Regulatory

TIDMMWB TIDMLBE

RNS Number : 9272L

Pyrrho Investment Limited

14 May 2010

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, IN, INTO OR

FROM ANY JURISDICTION WHERE TO DO THE SAME WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

14 May 2010

Liberty Plc ("Liberty")

POSSIBLE HIGHER OFFER FOR LIBERTY PLC BY PYRRHO INVESTMENTS LIMITED

ANNOUNCEMENT OF A POSSIBLE OFFER UNDER RULE 2.4 OF THE TAKEOVER CODE

THIS ANNOUNCEMENT DOES NOT AMOUNT TO A FIRM INTENTION TO MAKE AN OFFER AND,

ACCORDINGLY, THERE CAN BE NO CERTAINTY THAT ANY OFFER WILL BE MADE EVEN IF THE

PRE-CONDITIONS SET OUT BELOW ARE SATISFIED OR WAIVED.

Pyrrho Investments Limited announces that it has today made a proposal to

Liberty's board that it wishes to make an offer for the entire issued and to be

issued share capital of Liberty at a higher aggregate price than the possible

offer by BlueGem Capital Partners LLP that was announced on 7 May 2010. This

aggregate price will comprise both a cash offer and the payment of a special

dividend by Liberty, a structure which is in line with the possible offer

announced by BlueGem Capital Partners LLP on 7 May 2010.

Background

On 7 May 2010, Liberty announced a possible offer (the "Possible BlueGem Offer")

by BlueGem Capital Partners LLP on behalf of BlueGem L.P. ("BlueGem") at an

aggregate price of 186 pence per Liberty ordinary share which the board of

Liberty had resolved to recommend once such offer has been made (the "2.4

Announcement").

Liberty later announced on the same day that it had also received an approach in

relation to a possible offer from a third-party (the "Other Party"), unconnected

with BlueGem, at an aggregate price of 185 pence per Liberty ordinary share (the

"Possible Pyrrho Offer") which had been rejected by the board of Liberty after

"due and careful consideration".

Pyrrho Investments Limited ("Pyrrho") announces that it is the "Other Party"

referred to in the second announcement. It also wishes to clarify for Liberty

shareholders certain events preceding the release of Liberty's announcement of

the rejection of the Possible Pyrrho Offer.

In particular, Pyrrho would like to express its dissatisfaction with the bidding

process for Liberty and that it was deprived of the opportunity to increase the

Possible Pyrrho Offer. This is materially to the detriment of Liberty

shareholders as Pyrrho would have made a further higher offer for Liberty on or

before 7 May 2010 if it had been given the opportunity to do so.

Pyrrho Investments Limited

Pyrrho is the single largest shareholder with a holding of 20.38 per cent. in

MWB Group Holdings Plc ("MWB"), the largest shareholder in Liberty. Pyrrho does

not have any representation on the board of MWB nor does it have any

participation in the day to day management of MWB.

Competing approaches for Liberty

Pyrrho wishes to clarify the events which led up to the release of the

announcement of the Possible BlueGem Offer and the rejection of the Possible

Pyrrho Offer:

(1) on 4 May 2010, Pyrrho made an approach to Liberty to acquire its

entire issued and to be issued share capital in cash (the "Initial Proposal").

The Initial Proposal included a price range of 190 pence to 200 pence per

Liberty share. The Initial Proposal was subject to standard due diligence

pre-conditions and was rejected by the board of Liberty for this reason;

(2) on 6 May 2010, Pyrrho revised its bid and made the Possible Pyrrho

Offer to Liberty which supersedes the Initial Proposal and was not subject to

any due diligence pre-conditions. Pyrrho's new proposal included the same terms

as the competing proposal from BlueGem at that time, save that the Possible

Pyrrho Offer included an aggregate price per Liberty share which was higher than

the aggregate price per share contained in the competing BlueGem proposal;

(3) having made a higher approach to Liberty and clearly stated Pyrrho's

continuing interest, Pyrrho requested that Liberty and its advisers keep Pyrrho

informed of any developments and Liberty's advisers agreed to provide updates;

(4) on 7 May 2010 at 6.47 a.m. Pyrrho was notified by email that BlueGem

had improved the aggregate value of its proposal to a level which was superior

to the revised Pyrrho proposal and that the board of Liberty had decided not to

proceed with the proposal from Pyrrho; and

(5) the announcement of the Possible BlueGem Offer was released 13 minutes

later at 7.00 a.m. on 7 May 2010.

The conduct of the process denied any opportunity for Pyrrho to respond to the

Possible BlueGem Offer. In particular the failure to keep Pyrrho informed of

Liberty and MWB's views on the Possible Pyrrho Offer prevented Liberty's

shareholders from being able to consider the competing proposals with the

benefit of sufficient time and information to enable them to reach a properly

informed decision before agreeing to grant irrevocable undertakings to accept

the Possible BlueGem Offer, should it be made.

Improved Proposal

Pyrrho announces that it has today made a revised proposal to Liberty's board

that it wishes to make an offer for the entire issued and to be issued share

capital of Liberty at a higher aggregate price than BlueGem's aggregate 186

pence per share offer.

It would be desirable and in accordance with the General Principles on which the

City Code on Takeovers and Mergers is based for both Liberty shareholders and,

since MWB is the majority owner of Liberty, MWB shareholders to be given a full

opportunity to consider any approach from Pyrrho in a properly informed and

advised manner.

For further information, please contact:

Arbuthnot Securities Limited

Nick Tulloch

Tel: +44 (0) 207 012 2000

Ben Wells

Hogarth PR

Reg Hoare

Tel: +44 (0) 7884 494112

Katie Hunt

+44 (0) 207 357 9477

Ian Payne

Copies of this announcement are available on the London Stock Exchange website:

www.londonstockexchange.com

Disclosure requirements of the Takeover Code (the "Code")

Under Rule 8.3(a) of the Code, any person who is interested in 1% or more of any

class of relevant securities of an offeree company or of any paper offeror

(being any offeror other than an offeror in respect of which it has been

announced that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer period and,

if later, following the announcement in which any paper offeror is first

identified. An Opening Position Disclosure must contain details of the person's

interests and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any paper offeror(s). An

Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made

by no later than 3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later than 3.30 pm

(London time) on the 10th business day following the announcement in which any

paper offeror is first identified. Relevant persons who deal in the relevant

securities of the offeree company or of a paper offeror prior to the deadline

for making an Opening Position Disclosure must instead make a Dealing

Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1%

or more of any class of relevant securities of the offeree company or of any

paper offeror, must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any paper offeror. A Dealing

Disclosure must contain details of the dealing concerned and of the person's

interests and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any paper offeror, save

to the extent that these details have previously been disclosed under Rule 8. A

Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no

later than 3.30 pm (London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or understanding,

whether formal or informal, to acquire or control an interest in relevant

securities of an offeree company or a paper offeror, they will be deemed to be a

single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any

offeror and Dealing Disclosures must also be made by the offeree company, by any

offeror and by any persons acting in concert with any of them (see Rules 8.1,

8.2 and 8.4). Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing Disclosures must be

made can be found in the Disclosure Table on the Takeover Panel's website at

www.thetakeoverpanel.org.uk, including details of the number of relevant

securities in issue, when the offer period commenced and when any offeror was

first identified. If you are in any doubt as to whether you are required to make

an Opening Position Disclosure or a Dealing Disclosure, you should contact the

Panel's Market Surveillance Unit on +44 (0)20 7638 0129.

This information is provided by RNS

The company news service from the London Stock Exchange

END

OFDLIFVDERISLII

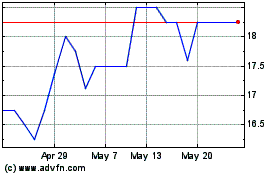

Longboat Energy (LSE:LBE)

Historical Stock Chart

From May 2024 to Jun 2024

Longboat Energy (LSE:LBE)

Historical Stock Chart

From Jun 2023 to Jun 2024