TIDMKLR

RNS Number : 4596L

Keller Group PLC

01 August 2011

Monday, 1 August 2011

Keller Group plc

Interim Results for the six months ended 30 June 2011

Keller Group plc ("Keller" or "the Group"), the international

ground engineering specialist, announces its interim results for

the six months ended 30 June 2011.

Results summary:

-------------------------- ---------- ----------

2011 2010

-------------------------- ---------- ----------

Revenue GBP545.5m GBP496.9m

-------------------------- ---------- ----------

Operating profit GBP6.4m GBP13.7m

-------------------------- ---------- ----------

Profit before tax GBP3.4m GBP11.3m

-------------------------- ---------- ----------

Earnings per share 4.6p 12.5p

-------------------------- ---------- ----------

Total dividend per share 7.6p 7.6p

-------------------------- ---------- ----------

Highlights include:

-- Results in line with expectations at the time of the IMS in

May

-- Revenue up by 10%

-- Revenue from Australia and developing markets up by 23% to

GBP216.0m, continuing the success of our strategy of geographic

diversification

-- Profitability impacted by floods in Australia and

geopolitical issues in the Middle East and North Africa

-- Net debt of GBP127.8m (2010: GBP121.5m); gearing of 39%

(2010: 40%)

-- Interim dividend maintained at 7.6p per share

-- Order book 14% ahead of this time last year

Justin Atkinson, Keller Chief Executive said:

"While we continue to make progress in our developing markets, a

recovery in our more mature construction markets is taking longer

than expected and over-capacity remains an issue, particularly in

the US, maintaining pressure on margins in the near term.

"In addition to the usual seasonal improvement, our recent

mobilisation on several large jobs will help to support a much

stronger second half. Overall, the expected results for the full

year remain within the current range of market expectations."

For further information, please contact:

Keller Group plc www.keller.co.uk

Justin Atkinson, Chief Executive 020 7616 7575

James Hind, Finance Director

Finsbury

James Leviton, Talia Druker 020 7251 3801

A presentation for analysts will be held at 9.15 for 9.30am at

The London Stock Exchange, 10 Paternoster Square, London, EC4M

7LS

A live audio webcast will be available from 9.30am and, on

demand, from 2.00 pm at

http://www.keller.co.uk/keller/investor/result-centre/latest-results/

Notes to Editors:

Keller is the world's largest independent ground engineering

specialist, providing technically advanced and cost-effective

foundation solutions to the construction industry. With 2010

revenue of GBP1,069m, Keller is a member of the FTSE-250. It has

over 6,000 staff world-wide, with offices in around 40 countries on

five continents.

Keller is the market leader in the US and Australia; it has

prime positions in most established European markets; and a strong

profile in many developing markets.

Chairman's Statement

Financial overview

Our results for the six months ended 30 June 2011 cover a period

in which we saw no significant easing of the challenges that have

beset our industry for the past couple of years. In particular,

recovery in our construction markets most severely impacted by the

global recession - the US and Western Europe - is taking longer

than expected and over-capacity remains an issue, particularly in

the US, maintaining pressure on margins in the near term.

Revenue from Australia and our developing markets(1) was up by

23% at GBP216m, reflecting the strategy of geographic

diversification. Although we continue to make progress in these

markets, as we have previously indicated, the combined impacts of

the floods in Queensland in the first quarter and geopolitical

issues in the Middle East and North Africa curbed our first-half

profitability in these regions.

Group revenue was up 10% at GBP545.5m (2010: GBP496.9m).

Following a loss in the first three months, performance improved in

the second quarter, resulting in a first-half operating profit of

GBP6.4m (2010: GBP13.7m), with an operating margin of 1.2%,

compared with last year's 2.8%.

Profit before tax was GBP3.4m (2010: GBP11.3m) and earnings per

share were 4.6p (2010: 12.5p). The Board has decided to leave the

interim dividend unchanged at 7.6p per share (2010: 7.6p). The

dividend will be paid on 1 November 2011 to shareholders on the

register at the close of business on 7 October 2011.

Cash generated from operations was GBP0.2m, down on last year's

GBP15.0m, reflecting the lower profit and the usual, seasonal

first-half working capital outflow.

Net debt at 30 June 2011 was GBP127.8m, compared to GBP121.5m at

the end of June 2010. Capital expenditure in the first half

totalled GBP15.0m (2010: GBP12.7m), of which around two thirds was

deployed in our developing markets and Australia, as we continue to

build our presence in these higher growth regions.

Net debt at 30 June 2011 represented 1.6 times annualised EBITDA

and annualised EBITDA interest cover was 18 times. Towards the end

of 2010, the Group refinanced its main central banking facilities,

replacing GBP145m of committed facilities that had been due to

expire in the summer of 2011 with a new GBP170m revolving credit

facility, expiring in April 2015.With these extended facilities and

the Group's US$100m private placement, the financial position of

the Group remains healthy and it continues to operate well within

its financial covenants.

(1) Our markets in Asia, Brazil, Eastern Europe, the Middle East

and North Africa.

Board

I am pleased to announce that the Board has today appointed Mr

David Savage as a Non-executive Director of the Company. David has

had a long and successful career in international construction,

most recently as the Chief Operating Officer of Leighton Holdings.

His strong entrepreneurial skills and track record in building

contracting businesses in developing markets will be of immense

value to the Group, as we continue our expansion into new, higher

growth geographic regions.

Operational overview

US

From a market perspective, the value of US non-residential

construction spending in the year to date was down by 6% from the

2010 level. This compares with a fall of 17% in the corresponding

period last year, indicating that, although expenditure continues

to fall, the rate of reduction has slowed. Within non-residential

construction, an increase of 11% in power meant this was the only

sector to show any growth, whereas spend in the commercial

sector(2) fell by a further 12% and has now contracted by almost

60% since the peak. Following a year-on-year reduction of 3% in

2010, the first decline in US public infrastructure spending in at

least 20 years, public expenditure fell again by 6% in the year to

date.

Despite this further contraction in their markets, our US

operations reported revenue of GBP207.9m (2010: GBP198.0m), with

revenue 11% ahead of last year on a constant currency basis, the

increase being mainly in Hayward Baker. Continuing over-capacity

maintained the pressure on margins, particularly in McKinney, which

is that part of our US business most exposed to smaller contracts

in the commercial sector. The US business as a whole reported an

operating loss of GBP1.8m (2010: GBP1.0m loss).

In the face of these severe challenges, our foundation

contracting businesses continue to adapt to their tough trading

environments. At Hayward Baker, there was a change of company

President early in the year and, more recently, a reorganisation

and change of management in its under-performing western region.

Following a disappointing result at McKinney in the first quarter,

actions taken following a review of the business have led to

improvements both in the results and the order book, returning the

business to profitability.

One of the factors influencing performance in the first six

months of the year was the scarcity of large jobs. However, towards

the end of the first half, and after a somewhat delayed start, two

major jobs did get underway which are expected to be important

contributors in the second half. The first of these is a foundation

package comprising caissons and continuous flight auger (CFA) piles

for an extension to the Vogtle nuclear power plant at Augusta, in

Georgia. The other comprises the second phase of CFA piling works

at the BP oil refinery at Whiting, Indiana. The successful first

phase, undertaken jointly by HJ and Case during 2009 and 2010, was

the single largest foundation project we have undertaken in the

US.

The order book of the US foundation businesses, which at the end

of June was similar to the previous year, should underpin activity

levels in these businesses through the second half of the year.

However, we remain of the view that margins will not improve

materially until there is confidence in a sustained recovery in US

construction.

US housing starts appear to have stabilised. As a result, and

following further cost reductions undertaken in the second half of

2010, Suncoast's losses reduced significantly in the first half of

the current year, with the business trading in line with our

expectations.

(2) Office, Commercial, Leisure and Lodging, US Census Bureau of

the Department of Commerce, 1 July 2011.

Continental Europe, Middle East & Asia (CEMEA)

CEMEA reported revenue of GBP207.2m (2010: GBP190.1m) and

operating profit of GBP8.5m (2010: GBP9.3m). On a constant currency

basis, revenue was up 8% on the previous year, whilst operating

profit trailed by 9%. Whilst the results for the division as a

whole were much as we expected at the start of the year, individual

performances across our diverse markets within this division were

varied.

Despite continued strong competition, our German subsidiary

again performed well, with its continued focus on productivity

improvements and careful targeting of contracts, such as one at

Lohsa, a former open-cast mining area close to the Polish border,

where it has been undertaking ground improvement works as part of

an ongoing railway upgrade project. Elsewhere in Western Europe,

conditions remained challenging but stable. Restructuring measures

taken in France and Spain in the latter part of 2010 brought these

businesses back into profit in the first half, although the

outlook, in Spain in particular, remains difficult.

In Eastern Europe, our Polish subsidiary achieved record

first-half revenue and operating profit, in a competitive

marketplace. Once again, large road and rail projects dominated the

workload, such as the installation of piled foundations for a

bridge construction on the A1 motorway and ground improvement for

the modernisation of the Warsaw to Gdynia railway line. Elsewhere

in Eastern Europe, trading in the first six months of the year was

subdued, with very few public infrastructure projects being

progressed.

Our businesses in the Middle East and North Africa were severely

disrupted by the 'Arab Spring', which brought many projects to a

halt and resulted in a loss from the region in the first six months

of the year. Whilst we do not expect a substantial improvement in

trading in those countries most impacted by the geopolitical unrest

until confidence in a stable political environment is restored,

prospects for the second half across the region as a whole are more

encouraging.

Overall, our key markets in Asia remained strong in the first

half of the year and our companies there continued to perform well.

In Singapore and Malaysia, activity levels were high, with our

businesses working on a wide range of industrial and infrastructure

projects.

In India we continue to steadily strengthen and extend our

operations. A new office opened in Hyderabad in the first half and

a regional "Keller Academy", designed along the same lines as that

in Europe, was established to support our focus on recruitment and

training. In this rapidly growing market, we continue to target

jobs in the power, coastal development, transportation and

industrial sectors, where our design and build capability, advanced

techniques, specialist equipment and international standards give

us a competitive advantage.

Amongst the various projects worked on in the first half of

2011, our contract at the Bangalore Metro, where we are installing

2,000 ground anchors as part of the metro upgrade and extension

project, continued to perform well. Also, following our successful

introduction of bored piling last year, we have recently started

work on another major piling contract for a new power plant in the

state of Andhra Pradesh, which will benefit the second half.

Australia

The Australian construction market now appears to be moving at

two different speeds: resources and related infrastructure projects

continue to gain momentum, whereas the remainder of the market is

relatively slow.

Australian revenue was GBP107.7m (2010: GBP80.7m) and operating

profit was GBP3.5m, compared to GBP8.0m in the first half last

year. On a constant currency basis, revenue was up 22% on last

year, mainly reflecting the first-time inclusion of Waterway

Constructions (Waterway), which was acquired in June 2010. The

first-half results were significantly impacted by the flooding in

Queensland in the first few months of the year, the effects of

which proved to be longer lasting than we had at first

anticipated.

Towards the end of the period, Waterway was awarded an A$86m

(c.GBP57m) design and construct contract for a materials offloading

facility at a liquid natural gas (LNG) project, to be undertaken in

a 50:50 joint venture with a local civil construction company. With

the design now underway, construction is expected to start in

December 2011 and to complete a year later. The award of this major

contract reflects the value we are able to bring to businesses that

we acquire, underlining the benefits of our acquisition

strategy.

Looking beyond its own shores, Keller Australia, with support

from Hayward Baker in the US, has recently started work in

Christchurch, New Zealand, where it is re-levelling structures

damaged in the recent earthquakes. This is another example of our

ongoing cross-border transfer of skills and knowledge. Elsewhere,

one of our Australian piling businesses is about to start work on

an LNG project in Papua New Guinea.

With an excellent order book and still several sizeable projects

in the pipeline, the prospects for Keller Australia look good for

the remainder of the year.

UK

The UK business reported revenue of GBP22.7m (2010: GBP28.1m)

and an operating loss of GBP2.0m (2010: loss of GBP0.1m).

As we expected, the UK business had a difficult first half.

However, the second quarter showed an improvement on the first

three months, following the merger of our equipment yards and a

further reduction in headcount. The performance of the UK business

is expected to improve further in the second half of the year, as

some of the transport infrastructure projects in which it will be

involved get underway.

The business was recently awarded a GBP37m contract for grouting

works that form part of the GBP700m Victoria Underground Station

upgrade. Keller will undertake the installation of over 2,400 jet

grout columns, which will allow approximately 400m of new tunnels

to be excavated to connect the new (North) and existing (South)

ticket halls. The project will be undertaken in co-operation with

our German subsidiary, which brings considerable experience of

large-scale tunnel stabilisation projects of this kind, including

major contracts in Antwerp, Leipzig and Cologne. Works will start

in late 2011 and are scheduled for completion early in 2014.

Outlook

Since our May 2011 interim management statement, we have seen

little if any change in our key construction markets, with our more

mature markets in the US and Western Europe reasonably stable but

still challenging and our developing markets continuing to offer

good opportunities. However, with continued economic uncertainty

and intense competition in our more mature markets, pressure on

margins remains.

In addition to the usual seasonal improvement, our recent

mobilisation on several large jobs will help to support a much

stronger second half.

The Group's order book is now 14% ahead of this time last year

on a constant currency basis following the two significant recent

contract awards, albeit that they will not come on stream until the

end of the year.

Overall, the expected results for the full year remain within

the current range of market expectations. Longer term, we are

confident that the Group's geographic diversification and strong

financial position mean that it is well placed to take advantage of

growth opportunities in both existing and new markets.

Roy Franklin

Chairman

1 August 2011

Consolidated Income Statement

for the half year ended 30 June 2011

Half year Half year Year to 31

to 30 June to 30 June December

2011 2010 2010

---------- ---------- ---------

Before

goodwill Goodwill

impairment impairment Total

------------- ---- ---------- ---------- ---------- ---------- ---------

Note GBPm GBPm GBPm GBPm GBPm

------------- ---- ---------- ---------- ---------- ---------- ---------

Revenue 3 545.5 496.9 1,068.9 - 1,068.9

Operating

costs (539.1) (483.2) (1,025.6) (21.8) (1,047.4)

------------- ---- ---------- ---------- ---------- ---------- ---------

Operating

profit 3 6.4 13.7 43.3 (21.8) 21.5

Finance

income 1.1 0.8 3.3 - 3.3

Finance costs (4.1) (3.2) (7.0) - (7.0)

------------- ---- ---------- ---------- ---------- ---------- ---------

Profit before

taxation 3.4 11.3 39.6 (21.8) 17.8

Taxation 4 (0.9) (3.2) (11.0) 4.7 (6.3)

------------- ---- ---------- ---------- ---------- ---------- ---------

Profit for

the period 2.5 8.1 28.6 (17.1) 11.5

------------- ---- ---------- ---------- ---------- ---------- ---------

Attributable

to:

Equity

holders of

the

parent 3.0 8.0 28.3 (17.1) 11.2

Minority

interests (0.5) 0.1 0.3 - 0.3

------------- ---- ---------- ---------- ---------- ---------- ---------

2.5 8.1 28.6 (17.1) 11.5

------------- ---- ---------- ---------- ---------- ---------- ---------

Earnings per share

Basic 6 4.6p 12.5p 44.0p 17.3p

earnings per

share

Diluted 6 4.5p 12.3p 43.2p 17.0p

earnings per

share

Consolidated Statement of Comprehensive Income

for the half year ended 30 June 2011

Half year Half year Year to

to 30 to 30 31 December

June 2011 June 2010 2010

GBPm GBPm GBPm

---------------------------------------- ---------- ---------- ------------

Profit for the period 2.5 8.1 11.5

---------------------------------------- ---------- ---------- ------------

Other comprehensive income

Exchange differences on translation of

foreign operations 2.1 (15.5) 12.0

Net investment hedge gains/(losses) 0.6 (0.7) (0.3)

Cash flow hedge gains/(losses) taken

to equity 3.7 (6.2) (3.0)

Cash flow hedge transfers to income

statement (3.7) 6.2 3.0

Actuarial (losses)/gains on defined

benefit pension schemes (0.1) 0.1 (1.3)

Tax on actuarial losses on defined

benefit pension schemes - - 0.3

---------------------------------------- ---------- ---------- ------------

Other comprehensive income for the

period, net of tax 2.6 (16.1) 10.7

---------------------------------------- ---------- ---------- ------------

Total comprehensive income for the

period 5.1 (8.0) 22.2

---------------------------------------- ---------- ---------- ------------

Attributable to:

Equity holders of the parent 5.3 (7.1) 22.2

Minority interests (0.2) (0.9) -

---------------------------------------- ---------- ---------- ------------

5.1 (8.0) 22.2

---------------------------------------- ---------- ---------- ------------

Consolidated Balance Sheet

as at 30 June 2011

As at As at As at

30 June 30 June 31 December

2011 2010 2010

Note GBPm GBPm GBPm

-------------------------------------- ---- -------- -------- ------------

Assets

Non-current assets

Intangible assets 107.2 128.0 106.8

Property, plant and equipment 270.2 261.3 275.0

Deferred tax assets 10.1 8.8 10.0

Other assets 15.6 16.2 16.1

-------------------------------------- ---- -------- -------- ------------

403.1 414.3 407.9

-------------------------------------- ---- -------- -------- ------------

Current assets

Inventories 39.2 37.8 32.9

Trade and other receivables 360.5 313.6 334.6

Current tax assets 9.4 7.2 6.2

Cash and cash equivalents 7 36.9 30.2 41.4

-------------------------------------- ---- -------- -------- ------------

446.0 388.8 415.1

-------------------------------------- ---- -------- -------- ------------

Total assets 849.1 803.1 823.0

-------------------------------------- ---- -------- -------- ------------

Liabilities

Current liabilities

Loans and borrowings 7 (31.3) (79.2) (25.9)

Current tax liabilities (5.2) (4.3) (7.1)

Trade and other payables (263.7) (248.5) (260.8)

Provisions (9.6) (6.8) (9.1)

-------------------------------------- ---- -------- -------- ------------

(309.8) (338.8) (302.9)

-------------------------------------- ---- -------- -------- ------------

Non-current liabilities

Loans and borrowings 7 (133.4) (72.5) (109.5)

Retirement benefit liabilities (20.8) (19.0) (20.1)

Deferred tax liabilities (18.7) (20.9) (18.4)

Provisions (4.4) (5.0) (4.5)

Other liabilities (35.5) (40.9) (36.8)

-------------------------------------- ---- -------- -------- ------------

(212.8) (158.3) (189.3)

-------------------------------------- ---- -------- -------- ------------

Total liabilities (522.6) (497.1) (492.2)

-------------------------------------- ---- -------- -------- ------------

Net Assets 326.5 306.0 330.8

-------------------------------------- ---- -------- -------- ------------

Equity

Share capital 6.7 6.6 6.6

Share premium account 38.0 38.0 38.0

Capital redemption reserve 7.6 7.6 7.6

Translation reserve 50.8 21.2 48.4

Retained earnings 213.8 223.2 220.1

-------------------------------------- ---- -------- -------- ------------

Equity attributable to equity holders

of the parent 316.9 296.6 320.7

Minority interests 9.6 9.4 10.1

-------------------------------------- ---- -------- -------- ------------

Total equity 326.5 306.0 330.8

-------------------------------------- ---- -------- -------- ------------

Condensed Consolidated Statement of Changes in Equity

for the half year ended 30 June 2011

Share Capital

Share premium redemption Translation Retained Minority Total

capital account reserve reserve earnings interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------- ------- ------- ---------- ----------- -------- --------- ------

At 30 June

2010 6.6 38.0 7.6 21.2 223.2 9.4 306.0

-------------- ------- ------- ---------- ----------- -------- --------- ------

At 31 December

2010 6.6 38.0 7.6 48.4 220.1 10.1 330.8

Total

comprehensive

income - - - 2.4 2.9 (0.2) 5.1

Share-based

payments - - - - 0.6 - 0.6

Shares issued

in the

period 0.1 - - - - - 0.1

Dividends - - - - (9.8) (0.3) (10.1)

At 30 June

2011 6.7 38.0 7.6 50.8 213.8 9.6 326.5

-------------- ------- ------- ---------- ----------- -------- --------- ------

Consolidated Cash Flow Statement

for the half year ended 30 June 2011

Half year

Half year to Year to

to 30 June 30 June 31 December

2011 2010 2010

Note GBPm GBPm GBPm

---------------------------------- ---- ----------- --------- ------------

Cash flows from operating

activities

Operating profit 6.4 13.7 21.5

Goodwill impairment - - 21.8

---------------------------------- ---- ----------- --------- ------------

Operating profit before goodwill

impairment 6.4 13.7 43.3

Depreciation of property, plant

and equipment 20.8 19.4 40.0

Amortisation of intangible assets 0.7 0.3 1.7

Loss/(profit) on sale of property,

plant and equipment 0.5 0.1 (0.5)

Other non-cash movements 1.4 0.3 5.8

Foreign exchange (gains)/losses (0.1) 0.6 0.2

---------------------------------- ---- ----------- --------- ------------

Operating cash flows before

movements in working capital 29.7 34.4 90.5

(Increase)/decrease in inventories (5.9) (1.0) 5.2

Increase in trade and other

receivables (22.7) (17.2) (23.8)

(Decrease)/increase in trade and

other payables (0.7) (0.9) 2.2

Change in provisions, retirement

benefit and other non-current

liabilities (0.2) (0.3) (3.8)

Cash generated from operations 0.2 15.0 70.3

Interest paid (2.6) (1.5) (4.5)

Income tax paid (6.2) (7.3) (10.2)

---------------------------------- ---- ----------- --------- ------------

Net cash (outflow)/inflow from

operating activities (8.6) 6.2 55.6

---------------------------------- ---- ----------- --------- ------------

Cash flows from investing

activities

Interest received 0.2 0.5 0.5

Proceeds from sale of property,

plant and equipment 0.1 0.3 1.0

Acquisition of subsidiaries, net

of cash acquired (0.2) (22.2) (23.4)

Acquisition of property, plant and

equipment (15.0) (12.7) (28.2)

Acquisition of intangible assets (0.6) - (1.4)

Acquisition of other non-current

assets (0.1) (0.4) (0.3)

---------------------------------- ---- ----------- --------- ------------

Net cash outflow from investing

activities (15.6) (34.5) (51.8)

---------------------------------- ---- ----------- --------- ------------

Cash flows from financing

activities

Proceeds from the issue of share

capital 0.1 - 0.2

New borrowings 29.0 41.5 99.5

Repayment of borrowings (6.3) (10.0) (76.8)

Payment of finance lease

liabilities (0.1) - (1.3)

Dividends paid (10.1) (9.7) (14.9)

---------------------------------- ---- ----------- --------- ------------

Net cash inflow from financing

activities 12.6 21.8 6.7

---------------------------------- ---- ----------- --------- ------------

Net (decrease)/increase in cash

and cash equivalents (11.6) (6.5) 10.5

Cash and cash equivalents at

beginning of period 39.1 29.3 29.3

Effect of exchange rate

fluctuations 0.1 (2.1) (0.7)

---------------------------------- ---- ----------- --------- ------------

Cash and cash equivalents at end

of period 7 27.6 20.7 39.1

---------------------------------- ---- ----------- --------- ------------

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of financial statements has been prepared

in accordance with IAS 34 - Interim Financial Reporting;

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R - indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year; and

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R - disclosure of related party

transactions and changes therein.

By order of the Board

J R Atkinson Chief Executive

J W G Hind Finance Director

Notes to the Condensed Financial Statements

Half year ended 30 June 2011

1. Basis of preparation

The condensed financial statements included in this interim

financial report have been prepared in accordance with IAS 34 -

Interim Financial Reporting, as adopted by the European Union. They

do not include all of the information required for full annual

financial statements, and should be read in conjunction with the

consolidated financial statements of the Group as at and for the

year ended 31 December 2010. The same accounting policies and

presentation are followed in the financial statements that were

applied in the preparation of the Company's published consolidated

financial statements for the year ended 31 December 2010.

The figures for the year ended 31 December 2010 are not

statutory accounts but have been extracted from the Group's

statutory accounts for that financial year. The auditor's report on

those accounts was not qualified and did not contain statements

under section 498(2) or (3) of the Companies Act 2006. A copy of

the statutory accounts for that year has been delivered to the

Registrar of Companies and has been made available on the Company's

website at www.keller.co.uk.

The financial information in this interim financial report for

the half years ended 30 June 2011 and 30 June 2010 has neither been

reviewed, nor audited.

The key risks and uncertainties facing the Group, as explained

in the Group's Annual Report for the year ended 31 December 2010,

continue to be: market cycles, acquisitions, tendering and

management of contracts and people.

2. Foreign currencies

The exchange rates used in respect of principal currencies

are:

Average for Period Period End

----------- ------------------------------- --------------------------------

Half year Half year Year to Half year Half year

to to 31 to to Year to 31

30 June 30 June December 30 June 30 June December

2011 2010 2010 2011 2010 2010

----------- --------- --------- --------- --------- --------- ----------

US dollar: 1.62 1.53 1.55 1.60 1.51 1.55

Euro: 1.15 1.15 1.17 1.11 1.23 1.17

Australian

dollar: 1.56 1.71 1.68 1.51 1.76 1.52

----------- --------- --------- --------- --------- --------- ----------

3. Segmental analysis

The Group is managed as four geographical divisions and has only

one major product or service: specialist ground engineering

services. This is reflected in the Group's management structure and

in the segment information reviewed by the Chief Operating Decision

Maker. There have been no material changes to the assets of these

segments since the year end. Revenue and operating profit of the

four reportable segments is given below:

Revenue Operating profit (2)

------------- ------------------------------ -------------------------------

Half year Half year Year to Half year Half year Year to

to to 31 to to 31

30 June 30 June December 30 June 30 June December

2011 2010 2010 2011 2010 2010

GBPm GBPm GBPm GBPm GBPm GBPm

------------- --------- --------- -------- --------- --------- ---------

UK 22.7 28.1 49.6 (2.0) (0.1) (2.5)

US 207.9 198.0 425.2 (1.8) (1.0) 6.9

CEMEA (1) 207.2 190.1 400.3 8.5 9.3 22.4

Australia 107.7 80.7 193.8 3.5 8.0 19.1

------------- --------- --------- -------- --------- --------- ---------

545.5 496.9 1,068.9 8.2 16.2 45.9

Central items

and

eliminations - - - (1.8) (2.5) (2.6)

------------- --------- --------- -------- --------- --------- ---------

545.5 496.9 1,068.9 6.4 13.7 43.3

------------- --------- --------- -------- --------- --------- ---------

1 Continental Europe, Middle East and Asia.

2 Operating profit in the year to 31 December 2010 totalled

GBP21.5m after goodwill impairment charges of GBP13.5m and GBP8.3

in the US and CEMEA divisions respectively. After these impairment

charges, the US division made a loss of GBP6.6m and the CEMEA

division made a profit of GBP14.1m.

4. Taxation

Taxation, representing management's best estimate of the average

annual effective income tax rate expected for the full year, based

on the profit before tax and goodwill impairment is: 27% (half year

ended 30 June 2010: 28%; year ended 31 December 2010: 28%).

Taxation for the year ended 31 December 2010 based on profit before

tax after goodwill impairment was 35%.

5. Dividends paid to equity holders of the parent

Ordinary dividends on equity shares:

Half year Half year Year to

to 30 to 30 31 December

June 2011 June 2010 2010

GBPm GBPm GBPm

---------------------------------------- ---------- ---------- ------------

Amounts recognised as distributions to

equity holders in the period:

Second interim dividend for the year

ended 31 December 2009 of 14.5p per

share in lieu of a final dividend - 9.3 9.3

Interim dividend for the year ended 31

December 2010 of 7.6p (2009: 7.25p)

per share - - 4.9

Final dividend for the year ended 31

December 2010 of 15.2p (2009: nil) per

share 9.8 - -

---------------------------------------- ---------- ---------- ------------

9.8 9.3 14.2

---------------------------------------- ---------- ---------- ------------

In addition to the above, an interim ordinary dividend of 7.6p

per share (2010: 7.6p) will be paid on 1 November 2011 to

shareholders on the register at 7 October 2011. This proposed

dividend has not been included as a liability in these financial

statements and will be accounted for in the period in which it is

paid.

6. Earnings per share

Earnings per share of 4.6p (half year ended 30 June 2010: 12.5p;

year ended 31 December 2010: 17.3p) was calculated based on

earnings of GBP3.0m (half year ended 30 June 2010: GBP8.0m; year

ended 31 December 2010: GBP11.2m) and the weighted average number

of ordinary shares in issue during the year of 64.2 million (half

year ended 30 June 2010: 64.2million; year ended 31 December 2010:

64.2million).

Diluted earnings per share of 4.5p (half year ended 30 June

2010: 12.3p; year ended 31 December 2010: 17.0p) was calculated

based on earnings of GBP3.0m (half year ended 30 June 2010:

GBP8.0m; year ended 31 December 2010: GBP11.2m) and the adjusted

weighted average number of ordinary shares in issue during the year

of 65.3 million (half year ended 30 June 2010: 65.3million; year

ended 31 December 2010: 65.3 million).

Earnings per share before goodwill impairment of 4.6p (half year

ended 30 June 2010: 12.5p; year ended 31 December 2010: 44.0p) was

calculated based on earnings of GBP3.0m (half year ended 30 June

2010: GBP8.0m; year ended 31 December 2010: GBP28.3m) and the

weighted average number of ordinary shares in issue during the year

of 64.2 million (half year ended 30 June 2010: 64.2million; year

ended 31 December 2010: 64.2 million).

Diluted earnings per share before goodwill impairment of 4.5p

(half year ended 30 June 2010: 12.3p; year ended 31 December 2010:

43.2p) was calculated based on earnings of GBP3.0m (half year ended

30 June 2010: GBP8.0m; year ended 31 December 2010: GBP28.3m) and

the adjusted weighted average number of ordinary shares in issue

during the year of 65.3 million (half year ended 30 June 2010:

65.3million; year ended 31 December 2010: 65.3 million).

The total number of shares held in Treasury was 2.2m (30 June

2010: 2.2m; 31 December 2010:2.2m).

All shares issued related to share options exercised.

7. Analysis of closing net debt

As at As at As at

30 June 30 June 31 December

2011 2010 2010

GBPm GBPm GBPm

----------------------------------------- -------- -------- ------------

Bank balances 35.1 25.9 39.3

Short-term deposits 1.8 4.3 2.1

----------------------------------------- -------- -------- ------------

Cash and cash equivalents in the balance

sheet 36.9 30.2 41.4

Bank overdrafts (9.3) (9.5) (2.3)

Cash and cash equivalents in the cash

flow statement 27.6 20.7 39.1

Bank and other loans (154.1) (135.5) (132.1)

Finance leases (1.3) (6.7) (1.0)

----------------------------------------- -------- -------- ------------

Closing net debt (127.8) (121.5) (94.0)

----------------------------------------- -------- -------- ------------

8. Related party transactions

Transactions between the parent, its subsidiaries and jointly

controlled operations, which are related parties, have been

eliminated on consolidation and are not disclosed in this note.

During the period the Group undertook various contracts with a

total value of GBP1.2m (half year to 30 June 2010: GBP1.5m; year

ended 31 December 2010: GBP3.3m) for GTCEISU Construccion, S.A., a

connected person of Mr Lopez Jimenez, a Director of the Company. An

amount of GBP2.2m (30 June 2010: GBP1.4m; 31 December 2010:

GBP2.3m) is included in trade and other receivables in respect of

amounts outstanding as at 30 June 2010. During the period the Group

made purchases from GTCEISU Construccion, S.A with a total value of

GBP1.7m (half year to 30 June 2010: GBP2.0m; year ended 31 December

2010: GBP3.6m). An amount of GBP1.8m (30 June 2010: GBP4.0m; 31

December 2010: GBP2.8m) is included in trade and other payables in

respect of amounts outstanding as at 30 June 2010.

All amounts outstanding from related parties are unsecured and

will be settled in cash. No guarantees have been given or received.

No provisions have been made for doubtful debts in respect of the

amounts owed by related parties.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UASVRASAWRRR

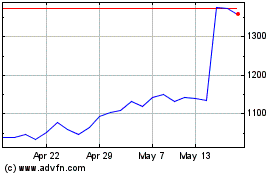

Keller (LSE:KLR)

Historical Stock Chart

From Jun 2024 to Jul 2024

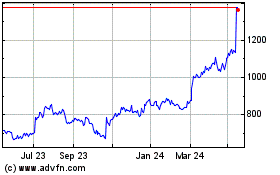

Keller (LSE:KLR)

Historical Stock Chart

From Jul 2023 to Jul 2024