TIDMKEN

RNS Number : 7516P

Kenetics Group Limited

31 March 2009

Embargoed Until: 0700, 31 March 2009

Kenetics Group Limited

("Kenetics", the "Group" or the "Company")

Preliminary Results for the year ended 31 December 2008

Kenetics Group Limited (AIM:KEN), the Radio Frequency Identification ("RFID")

group focussed on security and RFID systems and products, announces its

Preliminary Results for the year ended 31 December 2008.

Highlights

* Consolidated revenue fell to GBP556,397 (2007:GBP699,768)

* Operating expenses reduced 3% to GBP1.15 million (2007:GBP1.18 million)

* Pre-tax loss for the year of GBP590,741 (2007:GBP433,084)

* Board satisfied that the Group has sufficient cash reserves for foreseeable

future

* Major agreements signed with Singapore Land Transport Authority for Contactless

Smart Card Readers, On board Bus Equipment and wireless local area network

* Appointment of distribution partner in Japan

Commenting on the results, Ken Wong, Chairman of Kenetics said:

"The agreements we have signed with the Singapore LTA are transformational for

Kenetics enhancing our capabilities and growth in the Automated Fare Collection

Systems market." He added: "The global markets remain volatile and challenging,

however your board feels that the significant transitional steps taken during

2008 will stand us in good stead to realise the significant opportunity our

technology afford us and drive the business forward during the coming year."

For more information, please contact:

+--------------------------------+------------------------------------------+

| Ken Wong, Chairman and CEO | Graeme Thom / David Newton |

| Kenetics Group Limited | Zimmerman Adams International Ltd |

+--------------------------------+------------------------------------------+

| Tel: +65 6749 0083 | (Nominated Advisor) |

+--------------------------------+------------------------------------------+

| Website:www.kenetics-group.com | Tel: +44 207 060 1760 |

+--------------------------------+------------------------------------------+

| | |

+--------------------------------+------------------------------------------+

| Peter Ward / Ian Callaway | Jeremy Carey / Andrew Dunn |

| SVS Securities (PLC) | Tavistock Communications Ltd |

+--------------------------------+------------------------------------------+

| (Broker) | Tel: +44 207 920 3150 |

+--------------------------------+------------------------------------------+

| Tel: +44 207 638 5600 | |

+--------------------------------+------------------------------------------+

Chairman's Statement

In my last annual statement I reported that the Group had embarked upon a

reorganisation programme with the objective of overcoming structural

deficiencies and preparing the business for sustainable growth and

profitability.

During 2008, the Group maintained good progress with the restructuring and the

development of a new generation of products, recruiting a team of highly skilled

technical staff and expanding the sales and distribution networks.

These efforts have resulted in our securing contracts with the Singapore Land

Transport Authority ("LTA"), which are transformational for the Group, and which

we anticipate will be reflected in our results in 2009 and beyond.

Financial results

Consolidated revenue for the period fell to GBP556,397 (2007: GBP699,768)

reflecting both the downturn in the global economy and the Group's focus during

the first eight months of the year on securing the relationship with LTA.

Operating expenses were GBP1.15 million (2007: GBP1.18 million) down 3% on the

previous year with a substantial part being the continued investment in research

and product development as well as sales and marketing.

The pre tax loss for the year was GBP590,741 (2007: GBP433,084).

Finances

In July 2008, the Group announced that it had raised S$1 million (GBP372,000) by

the issue of a convertible loan, due on 30 June 2009. Interest was not due and

payable save in the event that the Company fails to repay the loan on the due

date. The lender has subsequently agreed to extend the loan for a further twelve

months with interest being payable at 6% per annum from 30 June 2009.

Post the period end, in March 2009 the Group received a S$500,000 (GBP232,340)

bridging loan from United Overseas Bank to provide additional working capital in

respect of our contracts with the LTA, 80% of which was underwritten by the

Government of Singapore. The loan is repayable over two years and carries a

fixed interest rate of 5% per annum. We are pleased to receive two such

endorsements of our strategy in the support provided both by the bank and the

Government of Singapore. This shows confidence in our model and our capabilities

as a technology leader in our field.

These loans coupled with the beginning of payments from the LTA contracts means

that the Board is satisfied that the Group has sufficient cash reserves for the

foreseeable future. The Group will be seeking additional funds in the form of

equity financing in the later part of the year to build on its business and

allow the Company to exploit the potential provided by the LTA contracts.

Dividend policy

Because of its continuing commitment to invest in growing further the business

and establishing Kenetics at the forefront of RFID technology and services, the

Company does not have distributable reserves at this time. Consequently the

Board is not recommending a dividend.

Product Development

Kenetics remains committed to its strategy of replacing existing product lines

by developing new generation products ("GEN2") and growing our core team of

leading technical staff to help us achieve this.

We are also reducing our reliance on Original Design Manufacturers ("ODM") and

systems business where traditionally returns on sales revenue have fluctuated,

to better balance the income stream between ODM project work and Industrial

product sales.

One of these new products, the Ultra High Frequency (UHF) USB RFID Reader has

received wide interest in USA, Europe and Japan. This reader is believed to be

the smallest currently commercially available in the market, being the size of

an ordinary thumbdrive. Initial shipments have been made and it is expected that

volume sales will pick up during 2009.

Sales and Marketing

During the year we have taken major steps to improve our brand presence in our

markets. During the first half of the 2008, we began exhibiting at industry

trade shows in Hanover, Germany, Tokyo, Japan and Dallas, USA. Several of our

products were displayed and we received very useful feedback from potential

customers and partners alike, highlighting that Kenetics would benefit from a

higher profile at such trade shows.

A major step forward has been the appointment of a distribution partner in

Japan. Several of Kenetics' RFID products were tested by TELEC, Japan and

subsequently qualified for sale in Japan. In passing these stringent tests,

Japanese customers are reassured of Kenetics product quality and advanced

technology. Sales enquiries have been received from major Japanese companies and

we are expecting to turn some of these enquiries into sales orders in the near

future.

We are aware that these transitional processes will take time, and whilst they

are very much ongoing, we are pleased to report that they are progressing well

and in line with our expectations.

Research and Development

Besides continuing to enhance its new UHF technology platform and developing new

generation RFID products, Kenetics began investing into the development of

advanced Automated Fare Collection (AFC) technologies in early 2008.

Strategically, Kenetics has identified a growing market towards automation in

the public mass transport sectors, particularly in automated fare collection for

rail and bus systems. To cater for global requirements, we have developed a

short-range reader that is capable of reading most of the world's fare cards

including the Oyster card used by London Transport.

Singapore Land Transport Authority

With our Interim results in September 2008, we announced that we had secured a

contract with the LTA for the supply of a Contactless Smart Card ('CSC') Readers

capable of reading both the current public transport fare cards and new CSCs. We

also announced that the contract allows the LTA the option to purchase

additional card readers, reportedly requiring a number of 22,000 card readers on

buses and at train stations with the implementation of the new CSC.

The relationship with the LTA developed further post the period end as we

announced in January 2009 an additional agreement to supply on-board bus

equipment ("OBE") with a wireless local area network ("WLAN"). The agreement

includes the design, manufacture, supply, delivery, installation, testing and

commissioning of the new OBE and WLAN. The contract is expected to complete

within 15 months of the contract award and is subject to extensive trials on

existing buses. If successful, the Board anticipates that the contract will

enhance Kenetics' capabilities and growth in the Automated Fare Collection

Systems market.

Advisers

In March 2009, Kenetics appointed SVS Securities Ltd as broker to the Company.

We welcome their enthusiasm and contribution and look forward to working with

them over the coming months. SVS will work alongside Zimmerman Adams

International, which remains the Company's nominated adviser.

Directors and Employees

Kenetics was pleased to appoint Mr Terry Fuller to our Board as non-executive

director in March 2008. Mr Fuller has contributed considerable experience to the

Group and his assistance during the year has proven invaluable.

We thank our dedicated staff across the Group, whose hard work and enthusiasm

has helped us progress this year.

Outlook

The global markets remain volatile and challenging, however your Board feels

that the significant transitional steps taken during 2008 will stand us in good

stead to realise the significant opportunity our technology affords us and drive

the business forward during the coming year.

Ken Wong

Chairman

Kenetics Group Ltd

30 March 2009

KENETICS GROUP LIMITED

(Incorporated in Jersey)

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2008

+-------------------------------+------+-----------+--+-------------+

| | Note | 2008 | | 2007 |

+-------------------------------+------+-----------+--+-------------+

| | | GBP | | GBP |

+-------------------------------+------+-----------+--+-------------+

| Continuing operations | | | | |

+-------------------------------+------+-----------+--+-------------+

| Revenue | | 556,397 | | 699,768 |

+-------------------------------+------+-----------+--+-------------+

| Other operating income | | 512 | | 49,604 |

+-------------------------------+------+-----------+--+-------------+

| Changes in inventories of | | | | |

| finished goods | | | | |

+-------------------------------+------+-----------+--+-------------+

| and work-in-progress | | (3,515) | | 80,075 |

+-------------------------------+------+-----------+--+-------------+

| Raw materials and consumables | | (292,738) | | (408,045) |

| used | | | | |

+-------------------------------+------+-----------+--+-------------+

| Employee benefits expenses | | (463,182) | | (491,594) |

+-------------------------------+------+-----------+--+-------------+

| Depreciation of plant and | | (90,938) | | (59,578) |

| equipment | | | | |

+-------------------------------+------+-----------+--+-------------+

| Other operating expenses | | (283,418) | | (301,405) |

+-------------------------------+------+-----------+--+-------------+

| Finance costs | | (13,859) | | (1,909) |

+-------------------------------+------+-----------+--+-------------+

| Loss before tax | | (590,741) | | (433,084) |

+-------------------------------+------+-----------+--+-------------+

| Income tax | 5 | (315) | | 6,217 |

+-------------------------------+------+-----------+--+-------------+

| Loss for the year | | (591,056) | | (426,867) |

+-------------------------------+------+-----------+--+-------------+

| | | | | |

+-------------------------------+------+-----------+--+-------------+

| | | | | |

+-------------------------------+------+-----------+--+-------------+

| Attributable to: | | | | |

+-------------------------------+------+-----------+--+-------------+

| Equity holders of the company | | (580,254) | | (426,867) |

+-------------------------------+------+-----------+--+-------------+

| Minority interests | | (10,802) | | - |

+-------------------------------+------+-----------+--+-------------+

| | | (591,056) | | (426,867) |

+-------------------------------+------+-----------+--+-------------+

| | | | | |

+-------------------------------+------+-----------+--+-------------+

| Loss per share (pence) | | | | |

+-------------------------------+------+-----------+--+-------------+

| - Basic and diluted | 4 | (2.24) | | (1.62) |

+-------------------------------+------+-----------+--+-------------+

CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2008

+---------------------------+------+--+-------------+--+-----------+

| | | | 2008 | | 2007 |

+---------------------------+------+--+-------------+--+-----------+

| | | | GBP | | GBP |

+---------------------------+------+--+-------------+--+-----------+

| | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Non-Current Assets | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Plant and equipments | | | 120,749 | | 143,437 |

+---------------------------+------+--+-------------+--+-----------+

| Available for sale | | | - | | 22,332 |

| financial asset | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Total non-current assets | | | 120,749 | | 165,769 |

+---------------------------+------+--+-------------+--+-----------+

| | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Current Assets | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Inventories | | | 332,314 | | 236,610 |

+---------------------------+------+--+-------------+--+-----------+

| Trade receivables | | | 68,253 | | 139,226 |

+---------------------------+------+--+-------------+--+-----------+

| Other receivables | | | 71,421 | | 31,774 |

+---------------------------+------+--+-------------+--+-----------+

| Cash and cash equivalents | | | 168,952 | | 172,865 |

+---------------------------+------+--+-------------+--+-----------+

| Total current assets | | | 640,940 | | 580,475 |

+---------------------------+------+--+-------------+--+-----------+

| Total assets | | | 761,689 | | 746,244 |

+---------------------------+------+--+-------------+--+-----------+

| | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Equity | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Share capital | | | 263,495 | | 263,495 |

+---------------------------+------+--+-------------+--+-----------+

| Share premium | | | 280,204 | | 280,204 |

+---------------------------+------+--+-------------+--+-----------+

| Share option reserve | | | 3,415 | | 27,411 |

+---------------------------+------+--+-------------+--+-----------+

| Equity component | | | 16,260 | | - |

| of convertible loan | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Merger reserve | | | 369,579 | | 369,579 |

+---------------------------+------+--+-------------+--+-----------+

| Foreign currency | | | 21,343 | | (26,514) |

| translation reserve | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Accumulated losses | | | (1,186,196) | | (632,423) |

+---------------------------+------+--+-------------+--+-----------+

| Total equity | | | (231,900) | | 281,752 |

+---------------------------+------+--+-------------+--+-----------+

| | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Non-Current Liabilities | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Obligations under finance | | | - | | 457 |

| leases | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Amount owing to a | | | 272,007 | | - |

| director | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Total non-current | | | 272,007 | | 457 |

| liabilities | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Current liabilities | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Trade payables | | | 49,989 | | 146,521 |

+---------------------------+------+--+-------------+--+-----------+

| Other payables | | | 115,205 | | 138,225 |

+---------------------------+------+--+-------------+--+-----------+

| Amount owing to directors | | | 20,489 | | 51,447 |

+---------------------------+------+--+-------------+--+-----------+

| Obligations under finance | | | 632 | | 5,535 |

| leases | | | | | |

+---------------------------+------+--+-------------+--+-----------+

| Convertible loan | | | 362,938 | | - |

+---------------------------+------+--+-------------+--+-----------+

| Bank overdraft - secured | | | 172,329 | | 122,307 |

+---------------------------+------+--+-------------+--+-----------+

| Total current liabilities | | | 721,582 | | 464,035 |

+---------------------------+------+--+-------------+--+-----------+

| Total liabilities | | | 993,589 | | 464,492 |

+---------------------------+------+--+-------------+--+-----------+

| Total equity and | | | 761,689 | | 746,244 |

| liabilities | | | | | |

+---------------------------+------+--+-------------+--+-----------+

CONSOLIDATED CASH FLOW STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2008

+--------------------------------------+----+-----------+--+-----------+

| | | 2008 | | 2007 |

+--------------------------------------+----+-----------+--+-----------+

| | | GBP | | GBP |

+--------------------------------------+----+-----------+--+-----------+

| Cash Flow From Operating Activities | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Loss before taxation | | (590,741) | | (433,084) |

+--------------------------------------+----+-----------+--+-----------+

| Adjustments for: | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Depreciation | | 90,938 | | 59,578 |

+--------------------------------------+----+-----------+--+-----------+

| Impairment loss | | 30,884 | | 122,159 |

+--------------------------------------+----+-----------+--+-----------+

| Plant and equipment written off | | - | | 266 |

+--------------------------------------+----+-----------+--+-----------+

| Provision for inventory obsolescence | | 39,774 | | 9,654 |

+--------------------------------------+----+-----------+--+-----------+

| Share option | | 2,485 | | 930 |

+--------------------------------------+----+-----------+--+-----------+

| Interest income | | (1,358) | | (1,579) |

+--------------------------------------+----+-----------+--+-----------+

| Interest expense | | 15,217 | | 3,488 |

+--------------------------------------+----+-----------+--+-----------+

| Operating loss before working | | (412,801) | | (238,588) |

| capital changes | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Increase in contract | | (23,969) | | (29,424) |

| work-in-progress | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Decrease in trade and other | | 94,220 | | 2,632 |

| receivables | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Increase in inventories | | (19,752) | | (84,376) |

+--------------------------------------+----+-----------+--+-----------+

| (Decrease)/increase in trade and | | (362,997) | | 105,937 |

| other payables | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Cash used in operations | | (725,299) | | (243,819) |

+--------------------------------------+----+-----------+--+-----------+

| Interest paid | | (7,766) | | (3,488) |

+--------------------------------------+----+-----------+--+-----------+

| Income tax (paid)/refunded | | (315) | | 6,378 |

+--------------------------------------+----+-----------+--+-----------+

| Net cash flows used in operating | | (733,380) | | (240,929) |

| activities | | | | |

+--------------------------------------+----+-----------+--+-----------+

| | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Cash Flows from Investing Activities | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Purchase of plant and equipment | | (12,851) | | (56,392) |

+--------------------------------------+----+-----------+--+-----------+

| Capital contribution from minority | | 10,802 | | - |

| interests | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Interest received | | 1,358 | | 1,579 |

+--------------------------------------+----+-----------+--+-----------+

| Net cash flows used in investing | | (691) | | (54,813) |

| activities | | | | |

+--------------------------------------+----+-----------+--+-----------+

| | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Cash Flows from Financing Activities | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Loan from/(to) director | | 221,346 | | (8,579) |

+--------------------------------------+----+-----------+--+-----------+

| Proceeds from convertible loan | | 371,747 | | - |

+--------------------------------------+----+-----------+--+-----------+

| Difference of fixed deposit balance | | (2,250) | | (1,603) |

| due to accumulation of interest | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Loan from hire purchase creditor | | (7,654) | | (5,269) |

+--------------------------------------+----+-----------+--+-----------+

| Net cash flows generated from/(used | | 583,189 | | (15,451) |

| in) financing activities | | | | |

+--------------------------------------+----+-----------+--+-----------+

| | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Net decrease in cash and cash | | (150,882) | | (311,193) |

| equivalents | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Effect of exchange rate changes | | 60,077 | | (19,062) |

+--------------------------------------+----+-----------+--+-----------+

| Cash and cash equivalents at | | (39,838) | | 290,417 |

| beginning of year | | | | |

+--------------------------------------+----+-----------+--+-----------+

| Cash and cash equivalents at end of | | (130,643) | | (39,838) |

| year | | | | |

+--------------------------------------+----+-----------+--+-----------+

NOTES TO THE FINANCIAL INFORMATION

1. Financial information

The preliminary results were approved by the Board of Directors on 30 March

2009. The financial information set out above does not comprise the Company's

statutory financial statements for the years ended 31 December 2008 and 2007,

but is derived from those financial statements. The auditors have reported on

the statutory financial statements for the years ended 31 December 2008 and

2007; their report was unqualified.

2. Exchange rates

The financial statements of the Group are presented in Pound Sterling ('GBP')

which is the Company's functional currency. The functional currencies of

Kenetics Innovations Pte Ltd and Kenetics Innovations (Beijing) Co Ltd are

Singapore Dollars ('S$') and Renminbi ('RMB') respectively. The following

exchange rates have been used in preparing the financial statements as at 31

December 2008:

+----------------------------------+-------------+-----------+

| | S$1 = GBP | RMB1 = |

| | | GBP |

+----------------------------------+-------------+-----------+

| 31 December 2008 | 0.47920 | 0.10140 |

+----------------------------------+-------------+-----------+

| Average rates | 0.38437 | 0.07863 |

+----------------------------------+-------------+-----------+

3. Basis of preparation

These preliminary results have been prepared in accordance with the accounting

policies adopted by the Company which are consistent with those adopted in

annual report and accounts for the period ended 31 December 2007.

These preliminary results have also been prepared in accordance with

International Financial Reporting Standards.

4. Loss per share

Basic loss per share has been calculated by dividing the net loss attributable

to equity holders of the Company of GBP591,056 (2007: GBP426,867) by the

weighted average number of ordinary shares outstanding during the financial year

of 26,349,466 (2007: 26,349,466).

The number of ordinary shares used for the calculation of basic loss per share

in 2008 and 2007 where merger accounting is applied, is based on the contributed

capital of Kenetics Innovations Pte Ltd, adjusted to equivalent shares of the

Company whose shares are outstanding after the combination.

5. Income tax

The income tax credit attributable to the loss of GBP315 (2007: Over-provision

of GBP6,217) is made up of under-provision of tax provision in prior year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR URUNRKSROOAR

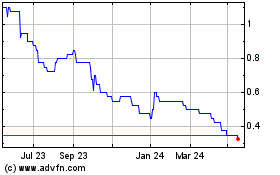

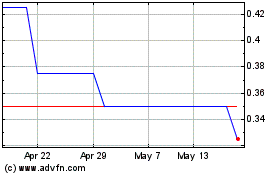

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024