Interim Results

September 02 2008 - 9:09AM

UK Regulatory

RNS Number : 5537C

Kenetics Group Limited

02 September 2008

For immediate Release

Kenetics Group Limited

2 September 2008

Kenetics Group Limited

Unaudited Interim Results for 30 June 2008

Kenetics Group Limited ("Kenetics" or "the Company" or "the Group"), the Radio Frequency Identification (RFID) company focused on

Security and RFID systems and products, announces its interim report for the 6 months ended 30 June 2008.

Key Points

* Consolidated turnover versus the comparable period fell by 17% to �235,000 (H1 2007: �283,000).

* Consolidated loss on ordinary activities after tax and expenses was �289,000 (H1 2006: �177,000). Material costs, employee

benefits and marketing expenses have increased, resulting in greater losses.

* The Company participated in 3 major RFID trade shows in Las Vegas (USA), Hanover (Germany) and Tokyo (Japan)

* The Company is continuing its efforts in expanding its sales and distribution network. A major step forward is the appointment of

a distribution partner in Japan. Sales enquiries have been received and we are expecting to turn some of these enquiries into sales orders

in the second half of the year.

* The Company is pleased to announce that in the last week of August it has secured a substantial contract with the Singapore Land

Transport Authority ("LTA"). The contract calls for the supply of a Contactless Smart Card ("CSC") Reader capable of reading both the

current public transport fare card and a new CSC. The tender requires the design, development and supply of an initial number of readers to

be used in the public transport systems.

* The contract allows the LTA the option to purchase additional card readers, reportedly requiring a number of 22,000 card readers

on buses and at train stations with the implementation of the new CSC.

* The directors believe that this contract will enable the Company to offset the earlier uncertainty of its project business which

affected its overall business performance in the first half of the year.

Commenting on the results Ken Wong, Chairman and CEO said:

"Although the first half year performance has been disappointing, the project contract that we gained in the last week of August is a

milestone for the Company and a successful outcome of this initial contract would leave Kenetics well-placed to compete for any related work

which this project may generate. Notwithstanding this contract, we will be continuing our push towards less dependence on our project

business and concurrently, working to improve our product sales. Our participation in 3 major RFID trade shows in USA, Europe and Japan has

enabled us to create greater visibility on our new Gen 2 products. We are beginning to establish distribution channels in new market

segments predominantly in the USA and Japan. Initial indications and interests in our products in these two markets are encouraging, as

sales enquiries have come in. Although there will be a lead-time before the sales orders are generated, we are optimistic that these

enquiries will lead to greater sales revenue in the second half of the year as we build up our market share in Europe, USA and Japan."

For more information, please contact:

Kenetics Group Limited

Ken Wong - Chairman, Tel: +65 6749 0083

Hin Yuen Yeong - Chief Operating Officer, Tel: +65 6749 0083

www.kenetics-group.com

Zimmerman Adams International Ltd.

Nominated Advisor/Broker

Graeme Thom/Dominique Doussot, Tel: +44 (0) 20 7060 1760

www.zimmint.com

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2008

CONSOLIDATED INCOME STATEMENTS

6 months 6 months 12 months

Ended Ended Ended

30 June 30 June 31 December

2008 2007 2007

(Unaudited) (Unaudited) (Audited)

�*000 �*000 �*000

Continuing operations

Revenue 235 283 700

Other operating income - - 50

Changes in inventories of

finished

goods and work-in-progress (13) (74) 80

Raw materials and consumables (36) (408)

used (83)

Employee benefits expenses (245) (217) (492)

Depreciation of plant and (35) (24) (60)

equipment

Other operating expenses (145) (109) (301)

Finance costs (3) - (2)

Loss before tax (289) (177) (433)

Income tax expense - - 6

Loss for the period (289) (177) (427)

Attributable to:

Equity holders of the Company (282) (177) (427)

Minority interests (7) - -

(289) (177) (427)

Loss per share (pence) * (1.07) (0.67) (1.62)

Basicand diluted

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2008

CONSOLIDATED BALANCE SHEETS

30 June 30 June 31 December

2008 2007 2007

(Unaudited) (Unaudited) (Audited)

�*000 �*000 �*000

Non-current assets

Plant and equipment 124 123 143

Available for sale financial 24 136 22

asset

Total non-current assets 148 259 165

Current assets

Stocks and work-in-progress 248 234 237

Trade receivables 55 125 139

Other receivables 41 41 32

Cash and cash equivalents 107 187 173

Total current assets 451 587 581

Total assets 599 846 746

Equity

Share capital 264 264 264

Share premium 280 280 280

Share option reserve 28 27 27

Merger reserve 370 370 370

Foreign currency translation (33) (24) (27)

reserve

Accumulated losses (914) (383) (632)

Total equity (5) 534 282

Non-current liabilities

Amount owing to director - 32 -

Obligations under finance - 3 -

leases

Total non-current liabilities - 35 -

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2008

CONSOLIDATED BALANCE SHEETS (continued)

30 June 30 June 31 December

2008 2007 2007

(Unaudited) (Unaudited) (Audited)

�*000 �*000 �*000

Current liabilities

Excess of progress billings

over contract

work-in-progress - 31 -

Trade payables 76 116 147

Other payables 132 109 138

Amount owing to directors 223 16 51

Obligations under finance 4 5 6

leases

Bank overdraft - secured 169 - 122

Total current liabilities 604 277 464

Total liabilities 604 312 464

Total equity and liabilities 599 846 746

KENETICS GROUP LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR 6 MONTHS ENDED 30 JUNE 2008

Attributable to Equity Holders of the Company

Group Sharecapital Sharepremium Shareoptionreserve Mergerreserve Foreigncurrencytrans

Accumulatedlosses Subtotal Minorityinterest Total

lation reserve

�*000 �*000 �*000 �*000 �*000

�*000 �*000 �*000 �*000

Balance as at 1/1/07 264 280 27 370 (18)

(206) 717 - 717

Currency translation - - - - (6)

- (6) - (6)

differences

Net loss for the period - - - - -

(177) (177) - (177)

Balance as at 30/6/07 264 280 27 370 (24)

(383) 534 - 534

Currency translation - - - - (3)

- (3) - (3)

differences

Net loss for the period - - - - -

(249) (249) - (249)

Balance as at 31/12/07 264 280 27 370 (27)

(632) 282 - 282

Currency translation - - - - (6)

- (6) - (6)

differences

Share option granted - - 1 - -

- 1 - 1

Net loss for the period - - - - -

(282) (282) (7) (289)

Acquisition of additional - - - - -

- - 7 7

interest in subsidiary

Balance as at 30/06/08 264 280 28 370 (33)

(914) (5) - (5)

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2008

CONSOLIDATED CASH FLOW STATEMENTS

6 months 6 months 12 months

Ended Ended Ended

30 June 30 June 31 December

2008 2007 2007

(Unaudited) (Unaudited) (Audited)

�*000 �*000 �*000

Cash flows from operating

activities

Loss before taxation (289) (177) (433)

Adjustments for:

Depreciation 35 24 60

Interest paid 4 - 3

Interest received (1) (1) (2)

Impairment loss - - 122

Provision for inventory - - 10

obsolescence

Share options expenses 1 1 1

Unrealised translation loss - 2 -

Operating loss before working (250) (151) (239)

capital changes

Decrease/(increase) in - (29)

contract work-in-progress/ 4

excess of contract

work-in-progressover progress

billings

Decrease/(increase) in trade

and otherreceivables 85 (3) 3

Decrease/(increase) in 3 (83) (84)

inventories

(Decrease)/increase in trade

and otherpayables (116) 64 106

Cash used in operations (278) (169) (243)

Interest paid (4) - (4)

Income tax refunded - - 6

Net cash flows used in (282) (169) (241)

operating activities

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2008

CONSOLIDATED STATEMENT OF CASH FLOWS (continued)

6 months 6 months 12 months

Ended Ended Ended

30 June 30 June 31 December

2008 2007 2007

(Unaudited) (Unaudited) (Audited)

�*000 �*000 �*000

Cash flows from investing

activities

Purchase of plant and (6) (5) (56)

equipment

Capital contribution from 8 - -

minority interest

Interest received 1 1 1

Net cash flows generated from/ (55)

(used) ininvesting activities 3 (4)

Cash flows from financing

activities

Receipt/ (Repayment) of loan 168 (8) (8)

from director

Repayment of hire purchase (3) (2) (5)

loan

Difference of fixed deposit (1) (2) (2)

balance dueto accumulation of

interest

Net cash flows generated from/ 164 (12) (15)

(used in)financing activities

Net decrease in cash in (115) (185) (311)

handand at bank

Effect of exchange rate (5) (4) (19)

changes

Cash in hand and at bank at (39) 291 291

beginning of period

Cash in hand and at bank at (159) 102 (39)

end of period

Fixed deposit 97 85 90

Bank overdraft 169 - 122

Cash and cash equivalents per 107 187 173

balance sheet

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2008

Kenetics Group Limited * Interim financial information

Six months ended 30 June 2008

1. Business of Kenetics Group Limited

The Company was incorporated in Jersey on 22 June 2006. The consolidated financial statements of the Company for the six months ended 30

June 2008 comprise the Company and its subsidiaries, Kenetics Innovations Pte Ltd and Kenetics Innovations (Beijing) Co., Ltd.

The registered office of the Company is located at Walker House, 28-34 Hill Street, St Helier, Jersey JE4 8PN.

The Group is in the business of electronics design and manufacturing and producing of electrical and electronic goods.

2. Basis of preparation of interim financial statements

The interim financial statements for the six months ended 30 June 2008 has been prepared in accordance with the accounting policies set out

in the annual report and financial statements for the year ended 31 December 2007.

3. Loss per share

Basic loss per share has been calculated on the basis of the losses attributable to ordinary shareholders divided by 26,349,466

(30/06/07: 26,349,466, 31/12/07: 26,349,466), being the weighted average number of ordinary shares issued by the Company.

In accordance with IAS 33 and as the Group has reported a loss for the period, the potential

ordinary shares are not dilutive.

4. Exchange rates

The reporting currency of the Company is deemed to be Sterling Pounds. The functional currencies of Kenetics Innovations Pte Ltd and

Kenetics Innovations (Beijing) Co Ltd are in Singapore dollars and Chinese Renminbi respectively. The following exchange rates have been

used in preparing this financial information:

S$1 = RMB1 =

� �

30 June 2008 0.3680 0.07318

Average rates 0.36472 0.07185

Kenetics Group Limited - Interim financial information

Six months ended 30 June 2008

5. Income tax

There was no income tax expense for the 6 months ended 30 June 2008 and the 6 months ended 30 June 2007 as the Group has been loss making

during these periods. The income tax credit for the year ended 31 December 2007 amounted to �6,000 and was an over-provision of tax

provision in prior year.

6. Nature of financial information

The interim financial information set out above is neither audited nor reviewed and does not represent the statutory financial statements

for Kenetics Group Limited or for any of the entities comprising the Kenetics Group for the period ended 30 June 2008. The figures for the

year ended 31 December 2007 were extracted from the consolidated financial statements which have been presented to the shareholders. The

auditors* report on those financial statements was unqualified.

The Board approved the interim financial information for the period ended 30 June 2008 on 2 September 2008.

These interim results are available on the Company's website www.kenetics-group.com.

7. Subsequent event

On 28 July 2008, the Company entered into a convertible loan agreement with Wong Kai Yun, sister of the Chairman of the Company, to

obtain a principal loan of S$1,000,000 (approximately �372,000). The loan may be converted on written notification at any time from 1 August

2008 in whole or in part. The principal loan will be due for repayment on 30 June 2009 if it is not converted to shares. Interest will be

payable at the rate of six per cent per annum if the Company fails to repay the loan on the due date.

The loan amount of S$1,000,000 has been received in cash by the Company.

For the terms of conversion of the above loan, please refer to the announcement made by the Company on 30 July 2008.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SSEFEESASELU

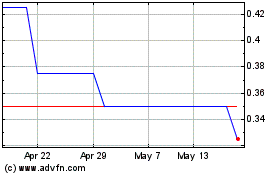

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

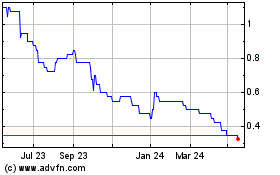

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024