RNS Number:7055T

Kenetics Group Limited

02 May 2008

Kenetics Group Limited ("Kenetics" or the "Group" or the "Company")

Preliminary Results for the Year Ended 31 December 2007

Kenetics Group Limited ("Kenetics" or the "Group" or the "Company"), the Radio

Frequency Identification ("RFID") Group focused on Security and RFID systems and

products, announces the Preliminary Results for the year ended 31 December 2007.

Period Highlights

* Sales revenue increased by 121% to #699,768 (2006: #316,176). Sale of

industrial products amounted to #694,500 as compared to #269,780 in the

previous year, representing an increase of #424,720 (157%).

* Reduction in pre-tax losses to #433,084, including a write-down due to

impairment loss in an investment of #122,159 in 2007 (2006: Pre-tax loss of

#449,034). Without this impairment loss, the pre-tax loss would have been

#310,925, which represents a 31% reduction over the previous year.

* Significant investments in research and development ("R&D") and product

development resulting in the successful development of a range of High

Frequency ("HF") and Ultra High Frequency ("UHF") GEN2 products to replace

older existing products.

* A partnership with Intel expedited the development of a new Kenetics UHF

Technology platform based on Intel's new R1000 RFID chip, opening up markets

in US and Europe.

* Enlarged global sales network and improved customer support provided the

platform for increased sales revenue.

* Recruited and retained a team of skilled R&D engineers to form the

backbone for the development of core technologies and new products

* Structural changes were implemented to improve operational efficiencies

and controlling operating costs.

Commenting on the Preliminary Results, Ken Wong, Chairman of Kenetics said:

"2007 has shown a marked improvement in sales revenue over the previous year.

With the implementation of several structural changes, we are beginning to see

our efforts bearing fruit. Sales revenue has more than doubled and the operating

loss before an impairment charge was reduced by a third. The substantial

investments in R&D and product development have resulted in a range of new RFID

GEN2 products that will be rigorously marketed in 2008. The new UHF platform

developed by Kenetics based on Intel's R1000 RFID chip is expected to open the

substantial US UHF market for Kenetics. With the new products and backed by the

support from our distribution channels, our focus for 2008 will be placed on

expanding our Europe and US markets, increasing market share, strengthening our

Sales team and further developing our distribution networks. With our clear

strategy in place, we are confident that further progress will continue into

2008 and that the Group is in a strong position to seize the opportunities to

grow the business."

Contact :

Ken Wong

Kenetics Group Limited

Tel: +65 9616 6883

Website: www.kenetics-group.com

Graeme Thom

Zimmerman Adams International Ltd

Tel: + 44 (0) 20 7060 1760

Website: www.zimmit.com

Chairman's Statement

Review of Operations

One of the major focuses for 2007 was to re-organise the Company and its

subsidiaries with the objective of overcoming the structural deficiencies and

thereby prepare Kenetics for sustainable growth and profitably as a public

listed company. Taking this to heart, Kenetics have identified major areas for

improvements among which are the development of a new generation of products ("

GEN2") to replace the existing product lines which had been in existence since

2001, recruit and develop a core team of highly-skilled technical staff, and to

expand the marketing and distribution networks for greater sales revenue. I am

pleased to report that while it takes time to fulfill these objectives, we are

making good progress on all these fronts, forming the foundation for the future

growth.

Financial Results

Group sales in 2007 were #699,768, an increase of 121% on the previous year

(2006: #316,176), brought about by very significant improvements in Industrial

Product sales. In delivering on our strategy of reducing reliance on the

Original Design Manufacturers ("ODM") and Systems business that had previously

brought about great fluctuations in sales revenue, new products were introduced

in the second half of 2007 to complement the range of existing products that

have been in the market for the past few years. With the product sales expected

to increase over the next few years, we should be on track for a more balanced

and even revenue growth between ODM project business and Industrial Product

sales.

Operating expenses in 2007 were #1,182,456 (2006: #765,297), with a substantial

element being invested in research and development ("R&D") and product

development.

The loss before tax amounted to #433,084 (2006: #449,034) a reduction of 4%,

despite a write-down due to impairment loss (#122,159) relating to an investment

made prior to the Company's admission to the AIM Market of the London Stock

Exchange. Without this impairment loss, the loss before tax from its business

would have been #310,925, a reduction of 31% over the prior year.

Sales and Marketing

The priority for Kenetics for 2007 was for sales growth and capturing market

share. Following closely to the long-term strategy of giving equal emphasis to

ODM projects and sales of industrial products, the Company implemented a series

of actions to bring this about.

1) Developing New Generation ("GEN2") Industrial Products

Some of the products that have been developed in the past, are moving gradually

towards obsolescence as new Global Radio Frequency Identification ("RFID")

standards are introduced. Coupled with new competitors entering into the market,

such products have become more price-sensitive with a gradual erosion of margins

in a wide range of first generation ("GEN1") products. This move is critical as

it allows Kenetics to maintain its competitive advantage and to tap on a growing

early user market where margins are higher. In the longer term, this strategy

allows the Company to offset any potential shortfall in sales from industrial

products or more importantly, a hollowing out of its Industrial Product sales.

2) Developing New Ultra High Frequency ("UHF") Technology Platform

It was becoming more apparent that while there is some demand for High Frequency

("HF") products in the USA, the market preference is essentially towards the use

of Ultra High Frequency ("UHF") products for logistics and pharmaceutical

industries as examples. Without UHF products in the past, Kenetics was not able

to effectively tap into the substantial US market. Taking full advantage of its

partnership with Intel, the leading international chip manufacturer, Kenetics

embarked on the development of a new UHF GEN2 technology platform from which it

can launch a series of new UHF industrial products. To date, Kenetics had

introduced two of these products and a third will be launched during the first

half of 2008.

3) Increasing Product Visibility and Branding

In 2007, our partners exhibited Kenetics products in 3 shows in Hanover,

Germany, Birmingham, UK and Dallas, USA. Response to our products was

encouraging but the impact on potential customers was generally small as only a

handful of Kenetics products were displayed along with those of our partners. It

was felt that without its own presence at these shows, Kenetics' branding and

product visibility could not be achieved. Nevertheless, the exposure in these

different geographical exhibitions has provided us with useful feedback on

customers' preferences and requirements. This has led us to develop a marketing

strategy to gain more market exposures through direct participation at selective

exhibitions where connectivity to targeted customers are expected to be high.

Our marketing plans have been finalised and these initiatives will be

implemented in 2008.

Research and Development

In addition to new product development to replace the older products, we

remained focused in investing in R&D to maintain our position as one of the

leading players in the RFID industry. This has enabled Kenetics to put what we

believe to be the most advanced products into the market, targeting specific

niche customers, avoiding price-sensitive and lower margin markets.

To expand our outreach beyond Asia, the Group has placed special emphasis on R&D

for a new UHF Technology platform, which has been predominantly adopted as the

RFID platform of most applications in the USA. On this front, we are proud to be

one of the original group of partners worldwide selected by Intel to develop UHF

readers based on its new integrated GEN2 RFID reader chip. The chip was

officially launched in Dallas in March 2007, together with Kenetics' long range

GEN2 UHF reader. One of the unique product features introduced by Kenetics is a

more compact and smaller footprint coupled with its long reading distance and

competitive pricing. As a result of this product introduction, several potential

customers have requested product prototypes for evaluation before adoption.

Based on this new technology platform, Kenetics will be poised to develop

products that will meet a wider range of applications and functionalities

demanded by the market. With multiple products offered, Kenetics can expect to

gain wider acceptance in the US, an increase of share of the vast UHF market and

cater to the needs of the existing and emerging market needs.

Employees

Despite a very tight labour market in Singapore, higher wages and increasing

competition for highly skilled and capable technical staff, we are pleased to

report that Kenetics have a strong R&D team in place to bring about innovations

and new products into the market. I am grateful for the team's dedication and

hard work during the year. Their intense energy and late nights have enabled

Kenetics to successfully develop an impressive range of technologies and

products that the Group will fully exploit in the years ahead. I am confident

that their commitment and motivation will continue into 2008 as we work towards

maintaining our technological leadership and market expansion.

Outlook for 2008

We are beginning to see a positive upturn in our business that was reflected in

a strong fourth quarter of 2007. We are confident that the progress made will

continue into 2008 as our new GEN2 products enter into the market. For 2008, the

Group will be participating selectively in key RFID shows, notably in USA,

Europe and Japan. Coupled with our efforts to rapidly increase our distribution

channels especially in Europe and the USA, we can expect to grow our industrial

products business rapidly to complement our ODM business.

On the ODM project front, we have been maintaining strong customer support and

service, which has helped us to keep close track on customers needs. A number of

significant projects are in the pipeline for 2008 and Kenetics is ready to seize

these opportunities. These projects are expected to roll out in 2008 and some

will stretch over to 2009 and beyond.

With the building of a strong customer and distribution channel relationship,

greater marketing efforts in Europe and the USA, a new range of GEN2 products,

together with encouraging projects on offer, Kenetics is expected to benefit

significantly in 2008 and the years ahead. We expect further improvements over

2007 and a turnaround for the Group.

Ken Wong

Chairman

Kenetics Group Limited

KENETICS GROUP LIMITED

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2007

2007 2006

# #

Continuing operations

Revenue 699,768 316,176

Other operating income 49,604 87

Changes in inventories of finished goods

and work-in-progress 80,075 29,112

Raw materials and consumables used (408,045) (139,210)

Employee benefits expenses (491,594) (382,398)

Depreciation of plant and equipment (59,578) (49,605)

Other operating expenses (301,405) (225,649)

Finance costs (1,909) 2,453

Loss before tax (433,084) (449,034)

Income tax 6,217 -

Loss for the year (426,867) (449,034)

Attributable to:

Equity holders of the Company (426,867) (446,414)

Minority interests - (2,620)

(426,867) (449,034)

Loss per share (pence)

- Basic and diluted (1.62) (1.93)

KENETICS GROUP LIMITED

BALANCE SHEET

AS AT 31 DECEMBER 2007

2007 2006

# #

Non-Current Assets

Plant and equipments 143,437 144,950

Investment in subsidiaries - -

Available for sale financial asset 22,332 138,861

Total non-current assets 165,769 283,811

Current Assets

Contract work-in-progress - 5,277

Inventories 236,610 155,114

Trade receivables 139,226 101,159

Other receivables 31,774 65,644

Cash and cash equivalents 172,865 375,751

Total current assets 580,475 702,945

Total assets 746,244 986,756

Equity

Share capital 263,495 263,495

Share premium 280,204 280,204

Share option reserve 27,411 26,481

Merger reserve 369,579 369,579

Foreign currency translation reserve (26,514) (17,649)

(Accumulated losses)/

Retained profits (632,423) (205,556)

Total equity 281,752 716,554

Non-Current Liabilities

Amount owing to director - 47,977

Obligations under finance leases 457 5,758

Total non-current liabilities 457 53,735

Current liabilities

Excess of progress billings over

contract work-in-progress - 33,554

Trade payables 146,521 31,633

Other payables 138,225 136,506

Amount owing to directors 51,447 9,710

Obligations under finance leases 5,535 5,064

Bank overdraft - secured 122,307 -

Total current liabilities 464,035 216,467

Total liabilities 464,492 270,202

Total equity and liabilities 746,244 986,756

KENETICS GROUP LIMITED

CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2007

2007 2006

# #

Cash Flow From Operating Activities

Loss before taxation (433,084) (449,034)

Adjustments for:

Depreciation 59,578 49,605

Impairment loss 122,159 -

Plant and equipment written off 266 -

Provision for inventory obsolescene 9,654 -

Share option 930 -

Interest received (1,579) (3,123)

Interest paid 3,488 670

Operating loss before working capital changes (238,588) (401,882)

(Increase)/decrease in contract work-in-progress/

Excess of progress billings over contract

work-in-progress (29,424) 24,738

Decrease in trade and other receivables 2,632 98,885

Increase in inventories (84,376) (118,010)

Increase in trade and other payables 105,937 37,548

Cash used in operations (243,819) (358,721)

Interest paid (3,488) (670)

Income tax refunded/(paid) 6,378 (52,688)

Net cash flows used in operating activities (240,929) (412,079)

Cash Flows from Investing Activities

Purchase of unquoted shares - (138,861)

Purchase of plant and equipment (56,392) (64,321)

Capital contribution from minority interests - 2,620

Interest received 1,579 3,123

Net cash flows used in investing activities (54,813) (197,439)

Cash Flows from Financing Activities

Loan to director (8,579) (26,513)

Proceed from issue of ordinary shares of holding

company - 827,000

Proceed from issue of ordinary shares of subsidiary - 449,939

Payment of AIM admission expenses - (492,748)

Payment of dividend - (1,522)

Difference of fixed deposit balance due to

accumulation of interest (1,603) (1,426)

Loan from hire purchase creditor (5,269) (4,808)

Net cash flows (used in)/generated from financing

activities (15,451) 749,922

KENETICS GROUP LIMITED

CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2007

2007 2006

# #

Net (decrease)/increase in cash and cash equivalents (311,193) 140,404

Effect of exchange rate changes (19,062) (17,359)

Cash and cash equivalents at beginning of year 290,417 167,372

Cash and cash equivalents at end of year (39,838) 290,417

Abbreviated notes to the financial statements

1. Financial information

The preliminary results were approved by the Board of Directors on 30 April

2008. The financial information set out above does not comprise the Company's

statutory financial statements for the years ended 31 December 2007 and 2006,

but is derived from those financial statements. The auditors have reported on

the statutory financial statements for the years ended 31 December 2007 and

2006; their report was unqualified.

2. Exchange rates

The financial statements of the Group are presented in Pound Sterling ("#")

which is the Company's functional currency. The functional currencies of

Kenetics Innovations Pte Ltd and Kenetics Innovations (Beijing) Co Ltd are

Singapore Dollars ("S$") and Renminbi ("RMB") respectively. The following

exchange rates have been used in preparing the financial statements as at 31

December 2007:

S$1 = # RMB1 = #

31 December 2007 0.3465 0.06868

Average rates 0.3319 0.06582

3. Basis of preparation

These preliminary results have been prepared in accordance with the

accounting policies adopted by the Company which are consistent with those

adopted in annual report and accounts for the period ended 31 December 2006.

These preliminary results have also been prepared in accordance with

International Financial Reporting Standards.

4. Loss per share

Basic loss per share has been calculated by dividing the net loss

attributable to equity holders of the Company of #426,867 (2006: #446,414) by

the weighted average number of ordinary shares outstanding during the financial

year of 26,349,466 (2006: 23,125,500).

The number of ordinary shares used for the calculation of basic loss per

share in 2007 and 2006 where merger accounting is applied, is based on the

contributed capital of Kenetics Innovations Pte Ltd, adjusted to equivalent

shares of the Company whose shares are outstanding after the combination.

5. Income tax

The income tax credit attributable to the loss of #6,217 (2006: Nil) is

made up of over-provision of tax provision in prior year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR GGGGKVZZGRZM

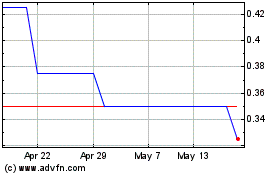

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

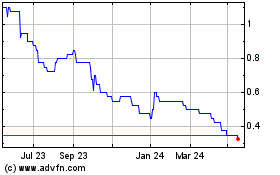

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024