Cancellation of admission to trading on AIM

December 18 2008 - 2:00AM

UK Regulatory

RNS Number : 3544K

ITIS Holdings PLC

18 December 2008

ITIS Holdings PLC

18 December 2008

ITIS Holdings plc ("ITIS", the "Company" or the "Group")

Cancellation of admission to trading on AIM ("Cancellation")

Introduction

ITIS, the AIM quoted provider of real time traffic information services announces today that it has notified the London Stock Exchange

of the proposed cancellation of trading of the Company's shares on AIM to focus on continuing to grow the inherent value of the Company

across a range of markets. It will also carry out a strategic review to consider how to best maximise shareholder value and enhance the

Company's ability to meet the needs of its customers.

As part of that process, the Board has engaged Rothschild to help it review the alternatives available to develop the Group beyond its

organic growth plan. These alternatives include a merger, strategic partnership or a sale of the Group, and this process may or may not lead

to an offer for the Group.

In accordance with the AIM Rules, a circular is today being sent to shareholders of the Company ("Shareholders") explaining the

rationale behind the Cancellation, the reasons for and background to the proposal and convening a general meeting for the purpose of

approving the Cancellation (the "General Meeting").

Background to and rationale for the Cancellation and Strategic Review

Following careful consideration, the Directors have concluded that it is no longer in the best interests of the Company or its

Shareholders to maintain the admission to trading on AIM of the Ordinary Shares. The current economic crisis has led to significant falls in

the values of the global stock markets, which have been exaggerated in small cap, low liquidity stocks.

It is the opinion of the Directors that in the acute market turmoil the Company's current market capitalisation has become completely

disassociated from the inherent value of the Company. Whilst there are many factors affecting a company's share price, the impact of the

generally depressed nature of the automotive sector has been exacerbated by the Company's small free float resulting in very low liquidity.

This is evidenced by the fact that the Company's share price has declined by 82 per cent between 2 June 2008 and 16 December 2008, being the

latest practicable date prior to the date of this document, with an average daily volume of less than 0.1 per cent of the issued Ordinary

Shares being traded during that same period.

The Directors also believe that the Company's continued Admission:

* results in a disproportionate amount of senior management time being spent in meeting AIM Rule and related regulatory

requirements, including reporting, disclosure and corporate governance requirements;

* may no longer serve a useful function in terms of access to capital or the ability to use the shares of the Company to effect

acquisitions; and

* results in significant direct costs to the Group, which management estimate to be in excess of �100,000 per annum.

The Directors' intention is that the Company should remain a public but unlisted company.

Approving the Cancellation and irrevocable undertakings and non-binding letters of intent

Under the AIM Rules, it is a requirement that the Cancellation must be approved by not less than 75 per cent. of the Shareholders voting

in the General Meeting. The General Meeting is to be held at 10:00 am on 9 January 2009. If approved, it is expected that the Cancellation

will take effect at 8:00 am on 19 January 2009.

Directors and other shareholders holding an aggregate 50,090,994 Ordinary Shares representing approximately 49.78 per cent of the entire

issued share capital of the Company have given irrevocable undertakings to vote in favour of the Resolution at the General Meeting. In

addition, the Company has received non-binding expressions of intent to vote in favour of the Resolution to be proposed at the General

Meeting from Shareholders holding an aggregate 10,392,358 Ordinary Shares representing approximately 10.33 per cent of the entire issued

share capital of the Company.

Accordingly, the Company has received in aggregate, irrevocable undertakings and non-binding letters of intent from Shareholders holding

an aggregate 60,483,352 Ordinary Shares representing approximately 60.11 per cent of the entire issued share capital of the Company.

Following the Cancellation

Whilst the Board believes that the Cancellation is in the Shareholders' interests, it recognises that the Cancellation will make it more

difficult for the Shareholders to buy and sell Ordinary Shares should they so wish.

Following the Cancellation, the Board intends to set up a matched bargain arrangement to enable Shareholders to trade the Ordinary

Shares. Under this facility, it is intended that Shareholders or persons wishing to acquire shares will be able to leave an indication with

a matched bargain facility provider that they are prepared to buy or sell at an agreed price. In the event that the matched bargain

settlement facility provider is able to match that order with an opposite sell or buy instruction, the matched bargain settlement facility

provider will contact both parties and then effect the bargain. Shareholders who do not have their own broker may need to register with the

matched bargain settlement facility provider as a new client. This can take some time to process and therefore Shareholders who consider

they are likely to use this facility are encouraged to commence it at the earliest opportunity. Once the facility has been arranged, details

will be made available to Shareholders on the Company's website at www.itisholdings.plc.uk.

Sir Trevor Chinn, Chairman of ITIS, commented:

"Having given the matter careful consideration, the Board has concluded that the regulatory burden and costs associated with the AIM

quotation outweigh the benefits that would be derived from its continuation. The Board is of the opinion that the inherent value of the

company is not reflected by the current market capitalisation of the Company and that it is no longer in the interests of the Company, or

shareholders as a whole, to maintain the quotation on AIM. Accordingly, the Board unanimously recommends that shareholders vote in favour of

the Cancellation"

Enquiries:

ITIS

Stuart Marks 0161 929 5788

Andrew Forrest 0161 929 5788

Investec (Nomad)

Andrew Pinder 020 7597 4000

Rule 2.10 Disclosure

The Company announces, in accordance with Rule 2.10 of the City Code on Takeovers and Mergers, that as at the close of business on 17

December 2008 its issued share capital consisted of 100,620,099 ordinary shares of 2p pence each.

The International Securities Identification Number for the Company's ordinary shares is GB0009751206

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the Takeover Code (the "Code"), if any person is, or becomes, "interested" (directly or indirectly)

in 1% or more of any class of "relevant securities" of the Company, all "dealings" in any "relevant securities" of that company (including

by means of an option in respect of, or a derivative referenced to, any such "relevant securities") must be publicly disclosed by no later

than 3.30 pm (London time) on the London business day following the date of the relevant transaction. This requirement will continue until

the date on which the offer becomes, or is declared, unconditional as to acceptances, lapses or is otherwise withdrawn or on which the

"offer period" otherwise ends. If two or more persons act together pursuant to an agreement or understanding, whether formal or informal, to

acquire an "interest" in "relevant securities" of ITIS, they will be deemed to be a single person for the purpose of Rule 8.3.

Under the provisions of Rule 8.1 of the Code, all "dealings" in "relevant securities" of the Company by the Company, or by any of its

"associates", must be disclosed by no later than 12.00 noon (London time) on the London business day following the date of the relevant

transaction.

A disclosure table, giving details of the companies in whose "relevant securities" "dealings" should be disclosed, and the number of

such securities in issue, can be found on the Takeover Panel's website at http://www.thetakeoverpanel.org.uk/new/.

"Interests in securities" arise, in summary, when a person has long economic exposure, whether conditional or absolute, to changes in

the price of securities. In particular, a person will be treated as having an "interest" by virtue of the ownership or control of

securities, or by virtue of any option in respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Code, which can also be found on the Panel's website. If you are in any doubt as to whether

or not you are required to disclose a "dealing" under Rule 8, you should consult the Panel.

The Directors accept responsibility for the information continued in this announcement. To the best of the knowledge and belief of the

Directors, who have taken all reasonable care to ensure such is the case, the information contained in this announcement is in accordance

with the facts and does not omit anything likely to affect the import of such information.

N M Rothschild & Sons Limited ("Rothschild"), which is authorised and regulated by the Financial Services Authority in the United

Kingdom, is acting for the Company and no one else in connection with the strategic review described in this announcement and will not be

responsible to anyone other than the Company for providing the protections afforded to clients of Rothschild nor for providing advice in

relation to the strategic review.

Investec Bank (UK) Limited, which is authorised and regulated in the United Kingdom by the FSA, is the Company's nominated adviser and

broker and is acting exclusively for the Company in connection with the Cancellation and will not be responsible to any other person for

providing the protections afforded to customers of Investec Bank (UK) Limited or for advising any other person in respect of the

Cancellation. Investec Bank (UK) Limited's responsibilities as the Company's nominated adviser under the AIM Rules for Nominated Advisers

are owed to the London Stock Exchange and are not owed to the Company or to any Director or to any other person in reliance on any part of

this announcement. No representation or warranty, express or implied, is made by Investec Bank (UK) Limited as to any of the contents of

this announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCTRBPTMMJBBAP

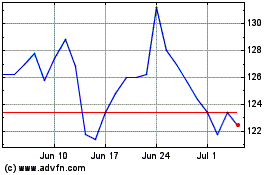

Ithaca Energy (LSE:ITH)

Historical Stock Chart

From Jul 2024 to Aug 2024

Ithaca Energy (LSE:ITH)

Historical Stock Chart

From Aug 2023 to Aug 2024