TIDMIPX

RNS Number : 2933U

Impax Asset Management Group plc

02 December 2021

Impax Asset Management Group plc

Results for the year ended 30 September 2021

London, 2 December 2021 - Impax Asset Management Group plc

("Impax" or the "Company"), the specialist investor focused on the

transition to a more sustainable global economy, today announces

final audited results for the year ending 30 September 2021 (the

"Period").

Business highlights

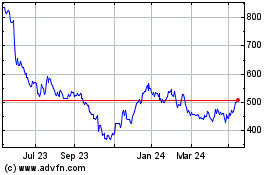

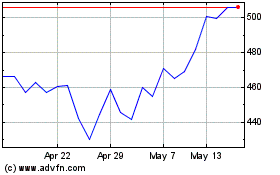

-- Assets under management ("AUM") increased 84.4% to GBP37.2 billion (2020: GBP20.2 billion).

-- Record net inflows of GBP10.7 billion (2020: GBP3.5 billion)

-- Largest investment strategies have continued to outperform global and regional markets

-- By 31 October 2021, AUM had risen further to GBP38.9 billion

Financial highlights

-- Revenue increased 63.5% to GBP143.1 million (2020: GBP87.5 million)

-- Adjusted operating profit grew by 139.5% to GBP55.8 million (2020: GBP23.3 million)

-- Profit before tax grew by 173.7% to GBP45.7 million (2020: GBP16.7 million)

-- Adjusted operating margin grew to 39.0% (2020: 26.6%)

-- Shareholders' equity increased 54.5% to GBP110.5 million (2020: GBP71.5 million)

-- Adjusted diluted earnings per share grew to 33.9 pence (2020: 14.5 pence)

-- Proposed final dividend of 17.0 pence per share bringing

total for the year of 20.6 pence per share (2020: 8.6 pence) up

139.5%

-- Cash reserves increased 87.4% to GBP70.1 million (2020: GBP37.4 million)

Sally Bridgeland, Chair, commented:

"Against any measure this has been an excellent year for the

Company, and I have been inspired by the team's ongoing dedication

and delivery to our clients. We have expanded to ensure that we

have the necessary resources to match ever-increasing client

demand. By the end of the Period the team had grown by 24%, with

hires across the investment management, client services and

corporate services teams. We are also delighted with the progress

of the integration of our New Hampshire-based business, which has

helped further establish Impax in the strategically-important North

American market."

Ian Simm, Chief Executive, added:

"Impax has enjoyed a year of exceptional growth. During the 12

months ending 30 September 2021, the Company's assets under

management increased by 84% which included a record GBP10.7 billion

of net new inflows, up from GBP3.5 billion last year. This helped

drive an increase in revenue to GBP143.1 million, up 64%. Overall,

we performed very well against all key indicators of financial

performance and our largest investment strategies maintained their

record of outperformance versus global equity indices.

"Impax has a deeply held investment philosophy focused on the

opportunities arising from the transition to a more sustainable

economy. During the Period, this authentic and differentiated

approach helped the Company to attract significant new mandates

with asset owners and expand relationships with intermediaries and

distribution partners globally.

"Impax continues to be well positioned to benefit from many

regulatory, policy, market, and investor tailwinds. We believe that

the focus on climate change at COP26 and the post-pandemic fiscal

boost will help catalyse further investment in companies

benefitting from the transition to a more sustainable economy."

Enquiries:

Impax Asset Management Group plc

Ian Simm, Chief Executive

Paul French, Director of Communications +44 (0)20 3912 3000

p.french@impaxam.com +44 (0)20 3912 3032

Montfort Communications

Gay Collins

Louis Supple +44 (0)77 9862 6282

impax@montfort.london +44 (0)77 3943 0102

Peel Hunt LLP, Nominated Adviser

and Joint Broker

Rishi Shah +44 (0)20 7418 8900

Berenberg , Joint Broker

Alex Reynolds +44 (0)20 3207 7800

LEI number: 213800AJDNW4S2B7E680

Chair's Introduction

The publication of this report marks a year since I succeeded

Keith Falconer as Chair of the Board. Having served on the Board

since 2015, I am honoured to have taken up the role at such an

exciting point in Impax's history. I relish the opportunity to

build on the legacy that Keith forged with Ian, the management team

and the Directors, and would like to thank them all for their

continuing support over the last year.

I would also like to acknowledge the dedication of my Impax

colleagues. While we have benefitted from unprecedented growth in

2021, working mostly virtually has meant that we have had few

opportunities to celebrate this success in person. I have been

inspired by the team's ongoing dedication and delivery to our

clients; this is a tribute to Ian and the management team for their

leadership and the strong culture that they have built

together.

Against any measure, this has been an excellent year for the

Company. Assets under discretionary and advisory management ("AUM")

grew by 84.4%, revenues by 63.5% and the majority of our investment

strategies maintained their record of outperformance against global

equity indices. We have expanded our team to ensure that we have

the necessary resources to match increasing client demand. By the

end of the Period the team had grown by 24%, with hires across the

investment management, client services and corporate services

teams. During the Period we also completed the acquisition of our

New Hampshire-based business, acquiring the remaining 16.7% of the

business held by management. We are delighted with the progress of

the integration of the business, which has helped further establish

Impax in the strategically-important North American market.

Impax's mission is to invest in the transition to a more

sustainable economy; this informs how we create value for all our

stakeholders and how we think about risk.

At a time when all businesses are assessing their response to

climate change, our own approach draws on Impax's long heritage in

backing the companies at the forefront of sustainable development.

This encompasses our investment specialism; our policy and advocacy

activity; and how we manage our own business operations. We are

committed to reducing our operational emissions across Scope 1, 2

and 3, and will measure and report our results in this area in line

with established practices. We have included additional reporting

in this year's Strategic Report and will publish more detail in

this area using the Taskforce for Climate-related Financial

Disclosures ("TCFD") framework, in our 2022 Annual Report. Our

approach is coordinated by the Environment Committee, for which

Vince O'Brien acts as Sponsor on behalf of the Board.

As a Board we believe that diversity and inclusion is vital to

performance of the business and a critical governance topic for a

fast-growing firm where we are making new appointments at all

levels and face new risks. I have a personal commitment to this

topic, reflecting my own career experiences and my still rare

position as a woman chairing an asset management company. Lindsey

Brace Martinez acts as the Board Sponsor of our focus on equality,

diversity & inclusion ("ED&I") and attends the meetings of

the staff ED&I Group.

The Company has made some important progress in formalising its

ED&I strategy this year. This has included a stated aim that by

December 2025 our overall gender mix should be 48-52% women and

that the representation of women and racial or ethnic minorities in

key roles should be meaningfully ahead of the industry average. We

believe that this focus will also reduce the senior management

gender pay gap.

Following the retirement of Keith Falconer, we were pleased to

welcome Simon O'Regan as a Director in December 2020. Simon is a

highly knowledgeable investment industry Non-Executive Director and

business leader, with a background as a CEO of the US business of

the investment consultancy firm, Mercer. He adds considerable

international expertise to the existing mix of skills and

experience on the Board across relevant sectors and markets.

Sally Bridgeland

1 December 2021

CHIEF EXECUTIVE'S REPORT

BUSINESS UPDATE

Impax has enjoyed a year of exceptional growth. During the 12

months ending 30 September 2021 (the "Period"), the Company's

assets under discretionary and advisory management ("AUM")

increased by 84.4% to reach GBP37.2 billion, which included a

record GBP10.7 billion of net new inflows.

We performed very well against all key indicators of financial

performance and in particular our largest investment strategies

maintained their record of outperformance versus global equity

indices.

By 31 October 2021, our AUM had risen further to GBP38.9

billion.

Impax has a deeply held investment philosophy focused on the

opportunities arising from the transition to a more sustainable

economy. During the Period, this authentic and differentiated

approach helped the Company to attract significant new mandates

with asset owners and expand our relationships with intermediaries

and distribution partners globally.

SUPPORTIVE EXTERNAL ENVIRONMENT

Two events in early November 2020 helped to frame the Period,

during which global equity markets posted strong returns.

The emergence of COVID-19 vaccines led to earnings upgrades, as

businesses glimpsed a potential exit from months of protracted

lockdowns. While rising rates of the Delta variant meant localised

restrictions remained in place, economic data was largely positive.

Meanwhile, efforts to "build back better" out of the crisis helped

to attract capital towards markets that offer inherent resilience

to environmental and social problems.

The victory of Joe Biden in the US presidential elections in

November 2020 immediately brought fresh impetus globally towards

tackling climate change. His announcement that the US would be

brought back into the Paris climate agreement helped to accelerate

a succession of "net-zero" commitments by corporates and

policymakers in anticipation of the COP26 climate summit in

Glasgow, which concluded last month.

While there were disappointments in the final text, the

emergence at Glasgow of coalitions of key actors around single

issues like coal power, deforestation and methane emissions was a

standout success, with business and finance driving ambitious

commitments alongside governments. The transition to a net-zero

economy catalysed by COP26 should create considerable opportunities

for investors. Although there will clearly be rapid market growth

in renewable power generation and energy efficiency, we also expect

to back innovative companies in less visible sectors, for example

new materials and agriculture.

INVESTMENT PERFORMANCE

Overall, our range of strategies, managed by our investment

teams in the UK, US and Hong Kong, performed well over the Period.

Longer term, eight out of the largest ten strategies, accounting

for a combined 91% of AUM, have outperformed their benchmarks over

three years. Of the eight that have five-year track records, seven

have outperformed their benchmarks 1 .

Five of our six thematic, Environmental Markets strategies

outperformed their benchmark index over the Period, with the

Specialists strategy delivering a gross total return of 40.5% in

comparison to 22.2% from MSCI ACWI 2 . The overall outperformance

was notwithstanding the headwind from the broad rotation into value

stocks, to which these strategies have limited exposure.

Our Sustainability Lens products also performed well. Four of

the five strategies outperformed their benchmarks over the Period,

with the Global Opportunities strategy delivering a gross total

return of 24.9% 3 .

We continue to focus on managing our capacity and have

significant headroom within our existing strategies.

Private Markets

Our team investing in markets linked to renewable power

generation made good progress with our third fund, Impax New Energy

Investors III ("NEF III"), committing capital in Spain, Italy,

Poland and the UK, as well as making two successful exits. In

October 2021 the team held the first close of Impax New Energy

Investors IV ("NEF IV"), with EUR238 million committed.

CLIENT SERVICE AND BUSINESS DEVELOPMENT

Asset growth was well diversified across our direct sales and

distribution partner channels, reflecting increased client demand

across Europe, Asia-Pacific, and North America.

Inflows over the Period were directed particularly into our

Global Opportunities and Leaders strategies (30.1% and 29.2% of net

inflows respectively) with strong investor interest in our Climate

and Asian Environmental strategies (10.0% and 8.7% of net inflows

respectively).

In the UK, we extended our relationship with wealth manager St

James's Place with a second mandate for our Global Opportunities

strategy, and we also won new segregated accounts based on the same

strategy.

Our FTSE 250 listed Environmental Markets investment trust

continued to attract considerable inflows and, at the Period end,

had approximately GBP1.4 billion in total net assets.

Our Ireland-domiciled UCITS funds enjoyed significant growth

over the Period, with aggregate AUM reaching GBP2.1 billion, up

from GBP806 million. Net inflows from European clients helped push

the AUM of the Global Opportunities fund in this range past GBP500

million for the first time.

We also continued to build our Dublin-based team, which is now

established post-Brexit as an important strategic centre for the

Company to access EU markets.

In October 2020, we developed further our relationship with BNP

Paribas Asset Management ("BNPP AM") by signing a new distribution

agreement on similar terms to the Memorandum of Understanding that

has been in place since 2007. This continues to be an important

strategic relationship across Europe and Asia. Since the new

agreement was signed we have won additional mandates and received

significant flows into the BNPP AM funds that we sub-advise,

including via global financial institutions.

In Japan, we worked with BNPP AM to secure the mandate for a

significant new fund launch by Nomura. This feeds into an existing

fund of the Leaders strategy.

In April we signed a new distribution agreement with Fidante

Partners Limited as our exclusive distribution partner in Australia

and New Zealand, markets that show strong potential. We also won

two significant Australian superannuation funds mandates, including

a segregated account using our Climate strategy. In the run-up to

COP26 we have received strong investor interest globally in this

strategy, which focuses on investing in companies providing

solutions to the challenges linked to climate change.

In the US, we secured several new mandates, including with

Jordan Park for the High Yield strategy, and saw notable flows into

the Leaders strategy, particularly via intermediaries, including JP

Morgan.

August 2021 marked 50 years since the launch of the Pax

Sustainable Allocation Fund, the first public mutual fund in the US

to use social and environmental criteria. And it was a significant

year for the Pax World Funds as a whole. By the end of the Period,

their aggregate AUM reached GBP6.1 billion, up from GBP4.1

billion.

In Canada, we secured a sub-advisory mandate for FÉRIQUE Fund

Management, gained investments from two foundations for our Global

Opportunities strategy, and launched new mandates through our

distribution partners.

In January 2021, we completed the integration of our New

Hampshire-based team, who joined us in 2018 following the

acquisition of Pax World Management LLC.

Combining the two businesses has already underpinned significant

growth for the Group, and we enjoyed continued momentum throughout

the Period, taking our North American AUM to GBP9.4 billion.

AUM movement Listed equities Fixed Private Total firm

12 months to 30 September income markets

2021

GBPm GBPm GBPm GBPm

---------------------------- -------------------------- -------- --------- -----------

Total AUM at 30 September

2020 18,865 947 371 20,183

Net flows 10,387 322 (34) 10,676

Market movement, FX and

performance 6,385 (12) (20) 6,353

---------------------------- -------------------------- -------- --------- -----------

Total AUM at 30 September

2021 35,636 1,257 318 37,211

BEYOND FINANCIAL RETURNS

Beyond delivering superior, risk-adjusted investment returns, we

focus on four broader areas. First, our corporate engagement and

stewardship activity aims to enhance our understanding of

investment risk. In 2020 we took part in over 230 engagements. We

were proud to be a successful applicant to be a signatory to the UK

Stewardship Code in 2021.

Second, we disclose through our annual impact report the

quantified environmental benefits linked to our clients'

investments in our portfolio companies. This year we have evolved

our reporting to include additional carbon emissions and water

data.

Third, we strive to influence policy outcomes that support

solutions to environmental and social challenges. We focused on

three areas during the Period: financing the transition to net-zero

emissions; greening the financial system, with a particular focus

on biodiversity; and human capital, including the response to

COVID-19. Through our policy and advocacy activities we collaborate

closely with a broad network, including the scientific community,

industry bodies, and not-for-profit organisations.

Finally, we publish thought leadership that provides value-added

insights to our clients and partners. This has included a series of

articles in the run-up to COP26, and, together with Swedish pension

fund, AP7, producing a report on how to measure water impact

effectively.

DEVELOPING OUR TALENT

We grew our headcount by 24% over the Period. 56% of those new

hires were women. Given this significant growth, we are acutely

aware of the need to nurture the collegial culture that has driven

our success over the last two decades.

Our People strategy seeks to future-proof our business with more

resilient HR systems, whilst offering a stimulating, collaborative,

and supportive workplace for our colleagues.

This year we launched a "behavioural competency" framework,

which sets out the standards we expect from colleagues on a

day-to-day basis. This has been woven into recruitment,

development, promotion, and rewards, to help reinforce our culture,

support our core values, and foster accountability.

As we began to emerge from lockdowns, we consulted with our

colleagues before updating our HR policies. Following that

consultation, we have decided to remain an office-based business,

but are committed to providing extra flexibility, for example for

those employees that wish to work from home more regularly.

We were pleased with the results of our employee engagement

survey, which revealed an 88% engagement score, notwithstanding the

challenges of working away from the office; this is 14 percentage

points ahead of the industry benchmark.

We continue to find that our clear mission as a specialist

focused on investing in the transition to a more sustainable

economy is a clear differentiator as we seek to hire, and then

retain, the very best talent in an increasingly competitive

market.

SYSTEMS AND INFRASTRUCTURE

As we grow, we are also investing in our corporate services

functions, including risk, compliance and IT. We are focusing in

particular on improving our data capabilities, managing cyber and

climate risk, and increasing our operational resilience.

Following the completion of the integration of our New

Hampshire-based team, we have sought to build global teams and

functions. This has included launching a single trading desk, which

serves our investment team across the US, the UK and Hong Kong.

AWARDS AND INDUSTRY RECOGNITION

The Company's expertise and success has been acknowledged

through numerous prestigious industry awards. After the Period end

this included: "AIM Company of the Year" (Shares); "AIM Growth

Business of the Year" (AIM Awards 2021), and Finncap's "Best

Performer, Financials" award. Highlights during the Period

included: Pensions Expert's "Active Equity Manager of the Year";

"Best Sustainability Reporting (large asset manager)" in

Environmental Finance's Sustainable Investment Awards; and both the

"Sustainable Reporting" and "Green Finance" categories at the

Better Society Awards.

OUTLOOK

We believe that the focus on climate change at COP26 and the

post-pandemic fiscal boost will help catalyse further investment in

companies benefitting from the transition to a more sustainable

economy.

In particular, we believe that infrastructure investment is set

to accelerate. Rapid expansion in decentralised renewable power

generation, zero-emissions transportation, resilient water supply

and climate resilience are positioned to provide significant

investment opportunities.

We also anticipate a number of supportive regulatory drivers.

The EU's wide-ranging Sustainable Finance Disclosure Regulation

("SFDR"), which attempts to counter "greenwashing", imposes

mandatory ESG disclosure obligations for asset managers and has

contributed to a marked increase in investment towards more

sustainable companies and issuers. This, together with the

equivalent UK green taxonomy, will contribute to a further shift in

capital flows across Europe throughout the current decade.

In the US, the Department of Labor announced in October 2021

that it was proposing to reverse the Trump Administration's ban on

considering ESG factors in retirement plans. This is also likely to

be positive for the markets in which Impax invests.

Our investment teams continue to manage a broad array of risks.

2021 laid bare the vulnerability of global supply chains and has

contributed to concerns about a potential looming energy crisis in

Europe and Asia. Meanwhile, high valuations in some areas and the

threat of persistent inflation continue to inform our portfolio

construction and trading decisions.

We believe that Impax continues to be well positioned to benefit

from the many regulatory, policy, market, and investor tailwinds.

There is growing evidence that asset owners are increasingly

attracted to our global reach, our authenticity, and our investment

philosophy focused on the transition to a more sustainable economy.

Against this backdrop, we are confident that Impax can continue to

deliver excellent value for all of our stakeholders.

Ian Simm

1 December 2021

1 Gross of fees.

2 GBP, gross of fees.

3 GBP, gross of fees. Benchmark: MSCI ACWI returned 22.2%.

FINANCIAL REVIEW

I am delighted to report another year of strong financial

results including more than doubling our adjusted operating profit

and profit before tax.

As in previous periods, in order to facilitate comparison of

performance with previous time periods and to provide an

appropriate comparison with our peers, the Board encourages

shareholders to focus on financial measures after adjustment for

accounting charges or credits arising from the acquisition

accounting from Impax NH, adjustments arising from the accounting

treatment of National Insurance costs on share-based payment awards

and significant tax credits related to prior periods.

Financial highlights for financial year 2021 versus financial

year 2020

2021 2020

GBP000 GBP000

------------------------------------ -------------- --------------

AUM GBP37.2bn GBP20.2bn

Revenue GBP143.1m GBP87.5m

Adjusted operating profit GBP55.8m GBP23.3m

Adjusted profit before tax GBP54.0m GBP22.2m

Adjusted diluted earnings per share 33.9p 14.5p

Cash reserves GBP70.1m GBP37.4m

Seed investments GBP7.5m GBP4.3m

3.6p interim + 1.8p interim +

Dividend per share 17.0p final 6.8p final

------------------------------------ -------------- --------------

2021 2020

------------------------------------ -------------- --------------

IFRS operating profit GBP47.4m GBP17.6m

IFRS profit before tax GBP45.7m GBP16.7m

IFRS diluted earnings per share 30.3p 10.5p

------------------------------------ -------------- --------------

Revenue

Revenue for the Period grew by GBP55.6 million to GBP143.1

million (2020: GBP87.5 million). Growth was driven by the

exceptionally strong net inflows across the business and very

positive fund performance.

Our run-rate revenue at the end of the Period was GBP173.8

million (2020: GBP96.5 million), giving a weighted average run rate

revenue margin1 of 47 basis points (2020: 48 basis points) on the

GBP37.2 billion of AUM.

Operating costs

Adjusted operating costs increased to GBP87.3 million (2020:

GBP64.3 million), mainly reflecting increases in headcount required

to service our significantly increased client base and higher

profit-related pay due to rising profitability. We expect higher

costs in the next financial year to reflect a full year of costs

from hires made in 2021, further hires in 2022 to support continued

growth opportunities and increased marketing and other costs as we

return to travelling.

IFRS operating costs include additional charges and credits,

principally the amortisation of intangible assets arising from the

Impax NH acquisition, National Insurance charges on share options

and restricted shares. Employer's National Insurance is payable

based on the share price when an option is exercised or restricted

shares vest, and accordingly the charge has increased significantly

as our share price has risen over the year. This charge is offset

by a tax credit which is recorded in equity.

Profits

Adjusted operating profit increased to GBP55.8 million (2020:

GBP23.3 million), driven by the revenue growth described above.

Run-rate adjusted operating profits at the end of the Period grew

further to GBP67.5 million (2020: GBP28.3 million), in line with

business expansion. IFRS operating profit in 2021 increased to

GBP47.4 million (2020: GBP17.6 million). Fair value gains and other

non-operating income offset interest expense and non-operating

costs to give adjusted profit before tax of GBP54.0 million (2020:

GBP22.2 million).

Tax

Tax rates were lower than the prior period as we benefited from

a GBP2.8 million credit in relation to taxation of prior year

private equity income (2020: GBP1.0 million).

Earnings per Share

Adjusted earnings per share grew to 33.9 pence (2020: 14.5

pence) as a result of the growth in profits, offset to a small

extent by increases in shares in issue as a result of restricted

share awards and option exercises. IFRS earnings per share

increased to 30.3 pence (2020: 10.5 pence).

Financial management

At the Period end the Company held GBP70.1 million of cash

resources, an increase of GBP32.8 million on 2020. The Company had

no debt (2020: no debt) but retains access to a US$13 million

revolving facility (the "RCF") (LIBOR plus 3.3%) which was put in

place at the time of the Impax NH acquisition.

In January 2021 we completed the integration of our New

Hampshire-based team ("Impax NH"), who joined us in 2018 following

the acquisition of Pax World Management LLC. As agreed in the terms

of the acquisition announced on 18 September 2017, we acquired the

remaining 16.7% of the business held by management for a total

consideration, net of loans, of US$3.0 million, paid in cash and

shares. In addition, contingent consideration payments of

US$270,000 were made in cash to the previous shareholders and

management as relevant assets under management of the Pax World

funds reached an average of US$5.5 billion over the final six

months of the 2020 calendar year, growing to US$6.6 billion at 31

December 2020, up from US$4.9 billion in January 2018.

The Company continues to make seed investments and to invest in

our private equity funds. These investments were valued at GBP7.5

million at the Period end. During the Period we invested into a

segregated account investing in our new Asian Opportunities

strategy and made further investments into our private equity

funds.

Share management

During the Period the Company issued 2.0 million new ordinary

shares to the Company's Employee Benefit Trust (the "EBT"). The EBT

holds shares for Restricted Share awards until they vest or to

satisfy share option exercises. The Company also issued a further

181,467 shares to part fund the acquisition of the remaining

interest in Impax NH.

Going forward, the Board intends that the Company will satisfy

obligations linked to share incentive awards for employees either

through purchase of its own shares or if there are attractive

alternatives for the use of the Company's cash resources, via

issuance of new shares. Share purchases are usually made by funding

the EBT which will then settle option exercises or hold shares for

Restricted Share awards until they vest. No share purchases were

made during the year.

Dividends

The Company paid an interim dividend of 3.6 pence per share in

July 2021. Our dividend policy is to pay, in normal circumstances,

an annual dividend within a range of 55% and 80% of adjusted profit

after tax. Impax has reported exceptionally strong growth in

revenue and profits and is in good financial health. The Board has

therefore decided to recommend a final dividend of 17.0 pence. This

would be an increase in the total dividend for the year of 12.0

pence or 140%. The annual dividend for the year represents 60% of

adjusted operating profit after tax which is still at the lower end

of our stated range.

This dividend proposal will be submitted for formal approval by

shareholders at the Annual General Meeting on 29 March 2022. If

approved, the dividend will be paid on or around 31 March 2022. The

record date for the payment of the proposed dividend will be 11

February 2022 and the ex-dividend date will be 10 February

2022.

The Company operates a dividend reinvestment plan ("DRIP"). The

final date for receipt of elections under the DRIP will be 28

February 2022. For further information and to register and elect

for this facility, please visit www.signalshares.com and search for

information related to the Company.

Going concern

The Financial Reporting Council requires all companies to

perform a rigorous assessment of all the factors affecting the

business when deciding to adopt a "going concern" basis for the

preparation of the accounts.

The Board has made an assessment covering a period of at least

12 months from the date of approval of this report which indicates

that, taking account of a reasonably possible downside in relation

to asset inflows, market performance and costs, the Group will have

sufficient funds to meet its liabilities as they fall due for that

period. In making this assessment the Board has considered the

potential evolving impacts of COVID-19.The Group has high cash

balances and no debt and, at the Period end market levels, is

profitable. A significant part of the Group's cost basis is

variable as bonuses are linked to profitability. The Group can also

preserve cash through dividend reduction and through issuance of

shares to cover share option exercises/restricted share awards

(rather than purchasing shares). The Directors therefore have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future and

have continued to adopt the going concern basis in preparing the

financial statements.

Charles Ridge

1 December 2021

Consolidated Income Statement

For the year ended 30 September 2021

2021 2020

Note GBP000 GBP000

-------------------------------------------------- ---- -------- --------

Revenue 143,056 87,511

Operating costs 6 (95,622) (69,928)

Finance income 9 286 1,020

Finance expense 10 (1,971) (1,921)

Profit before taxation 45,749 16,682

Taxation 11 (5,504) (2,944)

-------------------------------------------------- ---- -------- --------

Profit after taxation 40,245 13,738

-------------------------------------------------- ---- -------- --------

Earnings per share

Basic 12 31.5p 10.6p

Diluted 12 30.3p 10.5p

-------------------------------------------------- ---- -------- --------

Dividends per share

-------------------------------------------------- ---- -------- --------

Interim dividend paid and final dividend declared

for the year 13 20.6p 8.6p

-------------------------------------------------- ---- -------- --------

Adjusted results are provided in note 4.

Consolidated Statement Of Comprehensive Income

For the year ended 30 September 2021

2021 2020

Note GBP000 GBP000

---------------------------------------------------- ----- ------- -------

Profit for the year 40,245 13,738

Change in value of cash flow hedges 137 (70)

Tax on change in value of cash flow hedges (26) 13

Exchange differences on translation of foreign

operations (1,075) (487)

----------------------------------------------------------- ------- -------

Total other comprehensive income (964) (544)

----------------------------------------------------------- ------- -------

Total comprehensive income for the year attributable to

equity holders of the Parent 39,281 13,194

----------------------------------------------------------- ------- -------

All amounts in other comprehensive income may be reclassified to

income in the future.

The statement has been prepared on the basis that all operations

are continuing operations.

Consolidated Statement of Financial Position

2021 2020

------------------------------------ ----- --------------- ---------------

As at 30 September 2021 Notes GBP000 GBP000 GBP000 GBP000

------------------------------------ ----- ------ ------- ------ -------

Assets

Goodwill 14 11,816 12,306

Intangible assets 15 17,473 20,871

Property, plant and equipment 16 9,435 10,857

Deferred tax assets 11 11,895 5,492

------------------------------------ ----- ------ ------- ------ -------

Total non-current assets 50,619 49,526

Trade and other receivables 17 39,800 20,735

Investments 18 7,564 4,387

Current tax asset 134 224

Cash invested in money market funds

and long-term deposit accounts 19 38,066 18,516

Cash and cash equivalents 19 36,172 20,245

------------------------------------ ----- ------ ------- ------ -------

Total current assets 121,736 64,107

------------------------------------ ----- ------ ------- ------ -------

Total assets 172,355 113,633

------------------------------------ ----- ------ ------- ------ -------

Equity and liabilities

Ordinary shares 22 1,326 1,304

Share premium and merger reserve 10,824 9,291

Exchange translation reserve 374 1,449

Hedging reserve - (111)

Retained earnings 97,998 59,515

------------------------------------ ----- ------ ------- ------ -------

Total equity 110,522 71,448

Trade and other payables 20 50,107 27,984

Lease liabilities 16 1,330 1,410

Current tax liability 1,923 190

------------------------------------ ----- ------ ------- ------ -------

Total current liabilities 53,360 29,584

Lease liabilities 16 8,102 9,261

Deferred tax liability 371 3,340

------------------------------------ ----- ------ ------- ------ -------

Total non-current liabilities 8,473 12,601

Total equity and liabilities 172,355 113,633

------------------------------------ ----- ------ ------- ------ -------

Consolidated Statement of Changes In Equity

For the year ended 30 September 2021

Share

premium Exchange

Share and merger translation Hedging Retained Total

capital reserve* reserve reserve earnings Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------ -------- ----------- ------------ -------- --------- --------

1 October 2019 1,304 9,291 1,936 (54) 50,504 62,981

Transactions with owners of

the Company:

Dividends paid - - - - (7,442) (7,442)

Acquisition of own shares - - - - (4,223) (4,223)

Cash received on option exercises - - - - 489 489

Tax credit on long-term incentive

schemes - - - - 4,636 4,636

Share based payment charges - - - - 1,813 1,813

------------------------------------- -------- ----------- ------------ -------- --------- --------

Total transactions with owners

of the Company - - - - (4,727) (4,727)

Profit for the year - - - - 13,738 13,738

Other comprehensive income:

Change in value of cashflow

hedge - - - (70) - (70)

Tax on change in value of cashflow

hedges - - - 13 - 13

Exchange differences on translation

of foreign operations - - (487) - - (487)

------------------------------------- -------- ----------- ------------ -------- --------- --------

Total other comprehensive Income - - (487) (57) - (544)

------------------------------------- -------- ----------- ------------ -------- --------- --------

30 September 2020 1,304 9,291 1,449 (111) 59,515 71,448

Transactions with owners of

the Company:

New shares issued 22 1,533 - - (20) 1,535

Dividends paid - - - - (13,616) (13,616)

Cash received on option exercises - - - - 597 597

Purchase of Impax NH shares - - - - (2,239) (2,239)

Tax credit on long-term incentive

schemes - - - - 8,634 8,634

Share based payment charges - - - - 4,882 4,882

------------------------------------- -------- ----------- ------------ -------- --------- --------

Total transactions with owners

of the Company 22 1,533 - - (1,762) (207)

Profit for the year - - - - 40,245 40,245

Other comprehensive income:

Change in value of cash flow

hedge - - - 137 - 137

Tax on change in value of cashflow

hedges - - - (26) - (26)

Exchange differences on translation

of foreign operations - - (1,075) - - (1,075)

------------------------------------- -------- ----------- ------------ -------- --------- --------

Total other comprehensive Income - - (1,075) 111 - (964)

------------------------------------- -------- ----------- ------------ -------- --------- --------

30 September 2021 1,326 10,824 374 - 97,998 110,522

------------------------------------- -------- ----------- ------------ -------- --------- --------

* Includes merger reserve of GBP1,533,000.

Consolidated Cash Flow Statement

For the year ended 30 September 2021

2021 2020

Notes GBP000 GBP000

------------------------------------------------------- ----- -------- --------

Operating activities

Cash generated from operations 25 59,812 24,382

Corporation tax paid (4,445) (607)

------------------------------------------------------- ----- -------- --------

Net cash generated from operating activities 55,367 23,775

------------------------------------------------------- ----- -------- --------

Investing activities

Net acquisition of property plant & equipment and

intangible assets (257) (182)

Net (investments into)/redemptions from unconsolidated

Impax funds (2,529) 1,191

Settlement of investment related hedges (455) (156)

Purchase of Impax NH shares (704) -

Investment income received 93 222

Increase in cash held in money market funds and

long-term deposit accounts (19,550) (3,281)

------------------------------------------------------- ----- -------- --------

Net cash used by investing activities (23,402) (2,206)

------------------------------------------------------- ----- -------- --------

Financing activities

Acquisition of non-controlling interest (191) (201)

Interest paid on bank borrowings (129) (136)

Payment of lease liabilities (1,691) (1,699)

Acquisition of own shares - (4,223)

Cash received on exercise of Impax staff share

options 597 489

Dividends paid 13 (13,616) (7,442)

------------------------------------------------------- ----- -------- --------

Net cash used by financing activities (15,030) (13,212)

------------------------------------------------------- ----- -------- --------

Net increase in cash and cash equivalents 16,935 8,357

Cash and cash equivalents at beginning of year 20,245 11,939

Effect of foreign exchange rate changes (1,008) (51)

------------------------------------------------------- ----- -------- --------

Cash and cash equivalents at end of year 19 36,172 20,245

------------------------------------------------------- ----- -------- --------

Cash and cash equivalents under IFRS does not include deposits

in money market funds and cash held in deposits with more than an

original maturity of three months. The Group however considers its

total cash reserves to include these amounts. Cash held in RPA

accounts are not included in cash reserves.

Movements on cash reserves are shown in the table below:

At the

beginning At the

of the Foreign end of

year Cashflow exchange the year

GBP000 GBP000 GBP000 GBP000

---------------------------------------- ---------- -------- --------- ---------

Cash and cash equivalents 20,245 16,935 (1,008) 36,172

Cash invested in money market funds and

long-term deposit accounts 18,516 19,550 - 38,066

Cash in RPAs (1,363) (2,726) - (4,089)

---------------------------------------- ---------- -------- --------- ---------

Total Group cash reserves 37,398 33,759 (1,008) 70,149

---------------------------------------- ---------- -------- --------- ---------

1 REPORTING ENTITY

Impax Asset Management Group plc (the "Company") is incorporated

and domiciled in the UK and is listed on the Alternative Investment

Market ("AIM"). These consolidated financial statements comprise

the Company and its subsidiaries (together referred to as the

"Group").

2 BASIS OF PREPARATION

These financial statements have been prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 ("Adopted IFRS") and

applicable law.

The financial statements have been prepared under the historical

cost convention, with the exception of the revaluation of certain

investments and derivatives being measured at fair value.

The financial statements are presented in Sterling. All amounts

have been rounded to the nearest thousand unless otherwise

indicated.

Going concern

The Board has made an assessment covering a period of 12 months

from the date of approval of these financial statements which

indicates that, taking account of reasonably possible downside

assumptions in relation to asset inflows, market performance and

costs, the Group will have sufficient funds to meet its liabilities

as they fall due and regulatory capital requirements for that

period. In making this assessment the Board has considered the

potential ongoing impact of COVID-19. The Group has sufficient cash

balances and no debt and, at the year-end market levels, is

profitable. A significant part of the Group's cost basis is

variable as bonuses are linked to profitability. The Group can also

preserve cash through dividend reduction and through issuance of

shares to cover share option exercises/restricted share awards

(rather than purchasing shares). The Group has operated without

disruption during the lockdown periods to date and expects to

continue to do so. Consequently, the Directors are confident that

the Group will have sufficient funds to continue to meet its

liabilities as they fall due for at least 12 months from the date

of approval of the financial statements and therefore have prepared

the financial statements on a going concern basis.

3 USE OF JUDGEMENTS AND ESTIMATES

In preparing these financial statements management has made

estimates that affect the reported amounts of assets, liabilities,

income and expenses. Actual results may differ from estimates.

Revisions to estimates are recognised prospectively.

The Group has not identified any significant judgements and

estimates at the end of the reporting period.

4 ADJUSTED PROFITS AND EARNINGS

The reported operating earnings, profit before tax and earnings

per share are substantially affected by business combination

effects and other items. The Directors have therefore decided to

report an adjusted operating profit, adjusted profit before tax and

adjusted earnings per share which exclude these items in order to

enable comparison with peers and provide consistent measures of

performance over time. A reconciliation of the adjusted amounts to

the IFRS reported amounts is shown below.

Year ended 30 September 2021

-------------------------------------------- -----------------------------------------

Adjustments

-------- --------------------- --------

Business

Reported combination

- IFRS effects Other Adjusted

GBP000 GBP000 GBP000 GBP000

-------------------------------------------- -------- ------------ ------- --------

Revenue 143,056 143,056

Operating costs (95,622) (87,272)

Amortisation of intangibles arising on

acquisition 2,358

Credit from contingent consideration

adjustment 1,649

Acquisition equity incentive scheme charges 167

Mark to market charge on equity awards 4,176

-------------------------------------------- -------- ------------ ------- --------

Operating profit 47,434 4,174 4,176 55,784

Finance income 286 (89) 197

Finance costs (1,971) (1,971)

Profit before taxation 45,749 4,174 4,087 54,010

Taxation (5,504) (9,084)

Adjustment re historical tax charges (2,803)

Tax credit on adjustments (777)

-------------------------------------------- -------- ------------ ------- --------

Profit after taxation 40,245 4,174 507 44,926

-------------------------------------------- -------- ------------ ------- --------

Diluted earnings per share 30.3p 3.2p 0.4p 33.9p

-------------------------------------------- -------- ------------ ------- --------

* The charge is offset by GBP8,634,000 of tax credits shown in

the statement of changes in equity.

Year ended 30 September 2020

-------------------------------------------- -----------------------------------------

Adjustments

-------- --------------------- --------

Business

Reported combination

- IFRS effects Other Adjusted

GBP000 GBP000 GBP000 GBP000

-------------------------------------------- -------- ------------ ------- --------

Revenue 87,511 87,511

Operating costs (69,928) (64,261)

Amortisation of intangibles arising on

acquisition 2,535

Acquisition equity incentive scheme charges 135

Mark to market charge on equity awards* 2,997

-------------------------------------------- -------- ------------ ------- --------

Operating profit 17,583 2,670 2,997 23,250

Finance income 1,020 (124) 896

Finance costs (1,921) (1,921)

-------------------------------------------- -------- ------------ ------- --------

Profit before taxation 16,682 2,670 2,873 22,225

Taxation (2,944) (3,490)

Tax credit on adjustments (546)

-------------------------------------------- -------- ------------ ------- --------

Profit after taxation 13,738 2,670 2,327 18,735

-------------------------------------------- -------- ------------ ------- --------

Diluted earnings per share 10.5p 2.1p 1.8p 14.5p

-------------------------------------------- -------- ------------ ------- --------

* The charge is offset by GBP4,636,000 of tax credits shown in

the statement of changes in equity.

The diluted number of shares is the same as used for the IFRS

calculation of earnings per share.

Amortisation of intangibles

Management contracts, which are classified as intangible assets,

were acquired as part of the acquisition of Impax NH, the New

Hampshire based company acquired in January 2018, and are amortised

over their 11 year life. This charge is not linked to the operating

performance of the Impax NH business so is excluded from adjusted

profit.

Acquisition equity incentive scheme charges

Impax NH staff have been awarded share-based payments in respect

of the acquisition of Impax NH. Charges in respect of these relate

to the acquisition rather than the operating performance of the

Group and are therefore excluded from adjusted profit.

Contingent consideration adjustment

Until the time it was settled, the Group was required to review

and adjust our estimate of the contingent consideration payable in

respect of the Impax NH acquisition. Adjustments were recorded

through income but excluded from adjusted profit. These adjustments

are not linked to the operating performance of the Impax NH

business and are therefore eliminated from operating costs.

Mark to market charge on equity incentive awards

The Group has in prior years and the current period awarded

employees options over the Group's shares, some of which are either

unvested or unexercised at the balance sheet date. The Group has

also made awards of restricted shares ("RSS awards") some of which

have not vested at the balance sheet date. Employers National

Insurance Contributions ("NIC") are payable on the option awards

when they are exercised and on the RSS awards when they vest, based

on the valuation of the underlying shares at that point. The Group

does however receive a corporation tax credit equal to the value of

the awards at the date they are exercised (options) or vest (RSS

awards). A charge is accrued for the NIC within IFRS operating

profit based on the share price at the balance sheet date.

Similarly a credit for the corporation tax is accrued within

equity.

These charges vary based on the Group's share price (together

referred to as "mark to market charge on equity incentive schemes")

and are not linked to the operating performance of the Group. They

are therefore eliminated when reporting adjusted profit.

Taxation

The IFRS tax charge for 2021 includes a credit in respect of

historical tax charges related to private equity income. This does

not reflect the current year performance of the Group and is

therefore excluded from adjusted profit.

5 SEGMENTAL REPORTING

(a) Operating segments

For the year ended 30 September 2020 and prior years, the Group

had two reportable segments being Impax LN, the primarily London

based manager of listed equity and real asset funds and accounts,

and Impax NH. For the current year the Group is managed on an

integrated basis and there are no reportable segments. Financial

information is therefore reported for Impax LN and Impax NH for the

prior year only in the following table.

The segment information presented is on the same basis as that

provided for internal reporting purposes to the Group's chief

operating decision maker, the Chief Executive.

Year ended 30 September 2020

Impax LN Impax NH Adjustments Total

GBP000 GBP000 GBP000 GBP000

Revenue

External customers 61,906 25,605 - 87,511

Inter-segment 3,147 - (3,147) -

------------------------------------------- -------- -------- ----------- -------

Total revenue 65,053 25,605 (3,147) 87,511

------------------------------------------- -------- -------- ----------- -------

Segment profit - adjusted operating profit 22,176 1,074 - 23,250

------------------------------------------- -------- -------- ----------- -------

(b) Geographical analysis

An analysis of revenue by the location of client is presented

below:

Revenue

----------------

2021 2020

GBP000 GBP000

-------------- ------- -------

UK 26,733 15,104

North America 50,608 34,705

France 12,680 9,478

Luxembourg 35,448 19,066

Netherlands 3,359 2,912

Ireland 9,412 3,553

Other 4,816 2,693

-------------- ------- -------

143,056 87,511

-------------- ------- -------

The following non-current assets: property plant and equipment,

goodwill and intangible assets, are located in the countries listed

below:

Non-current assets

--------------------

2021 2020

GBP000 GBP000

-------------- --------- ---------

UK 6,952 7,882

United States 31,594 36,131

Hong Kong 7 21

Ireland 171 -

-------------- --------- ---------

38,724 44,034

-------------- --------- ---------

(c) Non-cash items

Operating expenses include the following non-cash items:

Year ended 30 September 2020

Impax LN Impax NH Total

GBP000 GBP000 GBP000

------------------------------ -------- -------- -------

Share based payments 1,678 135 1,813

Depreciation and amortisation 1,221 3,039 4,260

------------------------------ -------- -------- -------

2,899 3,174 6,073

------------------------------ -------- -------- -------

6 OPERATING COSTS

The Group's largest operating cost is staff costs. Other

significant costs include direct fund costs, premises costs

(depreciation on office building leases, rates and service charge),

amortisation of intangible assets, mark to market charges on share

awards and IT and communication costs.

2021 2020

GBP000 GBP000

--------------------------------------- ------- -------

Staff costs (note 7) 66,215 44,728

Direct fund expenses 5,542 5,570

Premises costs 1,015 1,062

Research costs 780 570

Professional fees 3,321 2,555

IT and communications 4,457 4,017

Depreciation and amortisation 4,057 4,260

Mark to market charges on share awards 4,176 3,243

Other costs 5,892 3,923

--------------------------------------- ------- -------

Sub-total 95,455 69,928

--------------------------------------- ------- -------

Contingent Consideration 167 -

--------------------------------------- ------- -------

Total 95,622 69,928

--------------------------------------- ------- -------

Operating costs include GBP898,000 (2020: GBP774,000) in respect

of placing agent fees paid to related parties.

7 STAFF COSTS AND EMPLOYEES

Staff costs include salaries, a variable bonus, social security

cost (principally UK Employers' National Insurance on salary, bonus

and share awards), the cost of contributions made to employees'

pension schemes and share-based payment charges. Further details of

the Group's remuneration policies are provided in the Remuneration

Committee Report. Share-based payment charges are offset against

the total cash bonus pool paid to employees. NIC charges on

share-based payments are accrued based on the share price at the

balance sheet date.

2021 2020

GBP000 GBP000

---------------------------------------- ------- -------

Salaries and variable bonuses 51,510 34,081

Social security costs 5,181 3,702

Pensions 1,069 948

Share-based payment charge (see note 8) 4,882 1,813

Other staff costs 3,573 4,184

---------------------------------------- ------- -------

66,215 44,728

---------------------------------------- ------- -------

Employees

The average number of persons (excluding Non-Executive Directors

and including temporary staff), employed during the year was 195

(2020: 171).

2021 2020

No. No.

---------------------------------------- ---- ----

Portfolio Management 69 57

Private Equity 12 12

Client Service and Business Development 63 53

Group 51 49

---------------------------------------- ---- ----

195 171

---------------------------------------- ---- ----

8 SHARE-BASED PAYMENT CHARGES

The total expense recognised for the year arising from

share-based payment transactions was GBP4,882,000 (2020:

GBP1,813,000). The charges arose in respect of the Group's

Restricted Share Scheme ("RSS") and the Group's Employee Share

Option Plan ("ESOP") which are described below. Share based payment

charges also arose in respect of the Put and Call arrangement made

with Impax NH management to acquire their shares in Impax NH.

Details of all outstanding options are provided at the end of this

note. The charges for each scheme are:

2021 2020

GBP000 GBP000

------------- ------- -------

RSS 3,636 1,253

ESOP 1,003 426

Put and Call 243 134

------------- ------- -------

4,882 1,813

------------- ------- -------

Restricted Share Scheme

Restricted shares have been granted to employees in prior years

which are not wholly vested.

During the Period 361,500 restricted shares were granted under

the 2020 plan and post year end the Board approved the grant of a

further 389,750 restricted shares under the 2021 plan. Following

grant, the shares are held by a nominee for employees - who are

then immediately entitled to receive dividends. After a period of

three years' continuous employment, the employees will receive

unfettered access to one third of the shares, after four years a

further third and after five years the final third. The employees

are not required to make any payment for the shares on grant or

when the restrictions lapse.

A further 912,084 restricted shares were also granted to

employees of Impax NH following the acquisition of the remaining

shares held by management in that business. These have the same

conditions as described above except that unfettered access is

gained to all of the shares after a period of 3 years.

Full details of the awards granted along with their valuation

and the inputs used in the valuation are described in the tables

below. The valuation was determined using the Black-Scholes-Merton

model with an adjustment to reflect that dividends are received

during the vesting period.

2015 RSS 2017 RSS 2018 RSS 2019 RSS 2020 RSS 2021 RSS

-------------------------- ----------- -------------- ---------- ---------- ---------- ------------

2,550,000/

3,140,000/ 500,000/ 912,084/

Awards originally granted 1,000,000 675,000 478,250 67,250 361,500 389,750

In respect of services 1 Oct 2014/ 14 Dec 2016/ 1 Oct 2017 1 Oct 2018 1 Oct 2019 28 Oct 2020/

provided 9 Feb 2016 11 May 2017/ 24 Nov

for period from 1 Oct 2016 2020/

1 Oct 2020

497.98p/

42.1p/ 52.2p/87.7p/ 564.51p/

Award value 41.5p 161.6p 201.3p 236.8p 506.2p 1,144.7p

Weighted average share

price on grant 41.4p 77.4p 202.8p 239.0p 510.0p 709.1p

Expected volatility 32%/31% 29%/29%/29% 30% 31% 32% 32%

Weighted average award 4.9yrs 4.3yrs 5.3yrs 5.3yrs 5.3yrs 3.4yrs

life on grant

Expected dividend rate 3% 4%/2%/2% 1% 2% 1% 1%

Risk free interest rate 1.2%/0.8% 0.6%/0.6%/0.7% 1.2% 0.3% 0.0% 0.35%/0.67%

-------------------------- ----------- -------------- ---------- ---------- ---------- ------------

The expected volatility was determined by reviewing the

historical volatility of the Company and that of comparator

companies. The expected dividend rate is determined using the

Company share price and most recent full year dividend to grant

date.

Restricted shares outstanding

--------------------------------- -----------

Outstanding at 1 October 2020 4,747,722

Granted during the year 1,273,584

Vested during the year (2,683,473)

Forfeited during the year (15,000)

--------------------------------- -----------

Outstanding at 30 September 2021 3,322,833

--------------------------------- -----------

Employee share option plan ("ESOP")

Options granted in 2017

The strike price of these options was set at a 10% premium to

the average market price of the Company's shares for the five

business days following the announcement of the results for the

preceding financial year, which was GBP1.80. The 2017 options did

not have performance conditions but did have a time vesting

condition such that they vested subject to continued employment on

31 December 2020. Once vested, the options have an exercise period

of three years.

The valuation was determined using the Black-Scholes-Merton

model.

Options granted in 2018 and 2020

The strike price of the 2018 and 2019 options was set at GBP1.

The strike price of the 2020 options was set at GBP3. These options

do not have performance conditions but do have a time vesting

condition such that the options vest subject to continued

employment for five years following grant. Vested shares are

restricted from being sold until after a further five year period

(other than to settle any resulting tax liability and the strike

price).

Post year end the Board approved the grant of 378,475 options

under the 2021 plan with a GBP9 strike price and with the other

conditions the same as the 2018, 2019 and 2020 plans.

The valuation was determined using the binomial model.

Share options are equity settled.

Options outstanding

An analysis of the outstanding options arising from the

Company's ESOP is provided below:

Weighted

average

exercise

price

Number Pence

----------------------------------------- --------- ---------

Options outstanding at 1 October 2020 2,450,000 140.7

Options granted 610,000 300.0

Options exercised (400,000) 148.6

----------------------------------------- --------- ---------

Options outstanding at 30 September 2021 2,660,000 176.0

Options exercisable at 30 September 2021 1,000,000 180.2

----------------------------------------- --------- ---------

The weighted average remaining contractual life of options

outstanding at the end of the period was 6.0 years.

9 FINANCE INCOME

2021 2020

GBP000 GBP000

------------------------ ------- -------

Fair value gains 161 798

Interest income 36 98

Other investment income 89 124

------------------------ ------- -------

286 1,020

------------------------ ------- -------

Fair value gains represent those arising on the revaluation of

investments held by the Group and any gains or losses arising on

related hedge instruments held by the Group.

The fair value gain comprises realised losses of GBP487,000 and

unrealised gains of GBP648,000 (2020: GBP53,000 of realised losses

and GBP851,000 of unrealised gains).

10 FINANCE EXPENSE

2021 2020

GBP000 GBP000

------------------------------ ------- -------

Interest on lease liabilities 468 514

Finance costs on bank loans 85 295

Foreign exchange losses 1,418 1,112

------------------------------ ------- -------

1,971 1,921

------------------------------ ------- -------

Commitment fees are payable on the revolving credit facility

which the Group retains. Foreign exchange losses mainly arise on

the retranslation of intercompany loans.

11 TAXATION

The Group is subject to taxation in the countries in which it

operates (the UK, the US, Hong Kong and Ireland) at the rates

applicable in those countries. The total tax charge includes taxes

payable for the reporting period (current tax) and also charges

relating to taxes that will be payable in future years due to

income or expenses being recognised in different periods for tax

and accounting periods (deferred tax).

(a) Analysis of charge for the year

2021 2020

GBP000 GBP000

------------------------------------- ------- -------

Current tax expense:

UK corporation tax 5,960 124

Foreign taxes 235 219

Adjustment in respect of prior years 73 342

------------------------------------- ------- -------

Total current tax 6,268 685

------------------------------------- ------- -------

Deferred tax (credit)/expense:

Charge for the year 2,104 3,388

Adjustment in respect of prior years (2,868) (1,129)

------------------------------------- ------- -------

Total deferred tax (764) 2,259

------------------------------------- ------- -------

Total income tax expense 5,504 2,944

------------------------------------- ------- -------

Tax credits of GBP8,634,000 are also recorded in equity in

respect of tax deductions on share awards arising due to the share

price increase (2020: GBP4,636,000). Tax credits of GBP26,000 on

cash flow hedges have been reclassified from equity to the income

statement during the year on maturity of the hedges (2020: tax

credits recorded in equity of GBP13,000).

A tax credit of GBP713,000 has been recorded in respect of prior

year tax losses that previously had not been recognised.

The deferred tax adjustment in respect of prior years in 2020

and 2021 mainly reflects reductions in the tax expected to be

payable on private equity income, recorded in prior years, as

result of transactions which took place in the year.

Adjustments in 2020 also include a credit of GBP175,000 to

reflect the cancellation of the planned reduction in the UK tax

from 19% to 17% that was due to come in to effect from 1 April

2020.

An increase in the main rate of UK corporation tax from 19% to

25% with effect from 1 April 2023 was enacted in the Finance Act

2021. This rate increase has been taken into account in the

calculation of the Group's UK deferred tax assets and liabilities

as at 30 September 2021, to the extent that they are expected to

reverse after the rate increase comes into effect.

(b) Factors affecting the tax charge for the year

The UK tax rate for the year is 19%. The tax assessment for the

period is lower than this rate (2020: lower). The differences are

explained below:

2021 2020

GBP000 GBP000

---------------------------------------------------- ------- -------

Profit before tax 45,749 16,682

---------------------------------------------------- ------- -------

Tax charge at 19% (2020: 19%) 8,692 3,170

Effects of:

Non-taxable income (18) -

Non-deductible expenses and charges 316 13

Adjustment in respect of historical tax charges (2,795) (787)

Effect of higher tax rates in foreign jurisdictions 22 85

Tax losses not recognised - 463

Recognition of prior year tax losses (713) -

---------------------------------------------------- ------- -------

Total income tax expense 5,504 2,944

---------------------------------------------------- ------- -------

(c) Deferred tax

The deferred tax asset/(liability) included in the consolidated

statement of financial position is as follows:

Share-based Income

payment Total not yet

scheme Other assets assets taxable Other liabilities Total liabilities

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ----------- ------------ ------- -------- ----------------- -----------------

As at 1 October 2019 3,519 238 3,757 (3,833) (167) (4,000)

Credit to equity 4,636 13 4,649 - - -

Exchange differences on

consolidation - - - 6 - 6

Credit/(charge) to the income

statement (2,953) 40 (2,913) 697 (43) 654

------------------------------ ----------- ------------ ------- -------- ----------------- -----------------

As at 30 September 2020 5,202 291 5,493 (3,130) (210) (3,340)

Credit to equity 8,634 (26) 8,608 - - -

Exchange differences on

consolidation - - (1) - - -

Credit/(charge) to the income

statement (3,243) 1,038 (2,205) 2,969 - 2,969

------------------------------ ----------- ------------ ------- -------- ----------------- -----------------

As at 30 September 2021 10,593 1,303 11,895 (161) (210) (371)

------------------------------ ----------- ------------ ------- -------- ----------------- -----------------

Other assets include carried forward losses of GBP681,000 as at

30 September 2021 (2020: nil).

12 EARNINGS PER SHARE

Basic earnings per share ("EPS") is calculated by dividing the

profit for the year attributable to ordinary equity holders of the

Parent Company (the "Earnings") by the weighted average number of

ordinary shares outstanding during the year, less the weighted

average number of own shares held. Own shares are held in Employee

Benefit Trusts ("EBTs").

Diluted EPS includes an adjustment to reflect the dilutive

impact of share awards.

Earnings

for the

year Shares Earnings

GBP000 000s per share

-------- -------- ------- ----------

2021

Basic 40,245 127,644 31.5p

-------- -------- ------- ----------

Diluted 40,245 132,669 30.3p

-------- -------- ------- ----------

2020

-------- -------- ------- ----------

Basic 13,235 124,572 10.6p

-------- -------- ------- ----------

Diluted 13,235 125,825 10.5p

-------- -------- ------- ----------

The weighted average number of shares is calculated as shown in

the table below:

2021 2020

000's 000's

---------------------------------------------------------- ------- -------

Weighted average issued share capital 131,772 130,415

Less own shares held (4,128) (5,843)

---------------------------------------------------------- ------- -------

Weighted average number of ordinary shares used in the

calculation of basic EPS 127,644 124,572

Additional dilutive shares regarding share schemes 5,983 2,451

Adjustment to reflect option exercise proceeds and future

service from employees receiving share awards (958) (1,198)

---------------------------------------------------------- ------- -------

Weighted average number of ordinary shares used in the

calculation of diluted EPS 132,669 125,825

---------------------------------------------------------- ------- -------

13 DIVIDS

Dividends are recognised as a reduction in equity in the period

in which they are paid or in the case of final dividends when they

are approved by shareholders. The reduction in equity in the year

therefore comprises the prior year final dividend and the current

year interim dividend.

Dividends declared/proposed in respect of the year

2021 2020

pence pence

------------------------------------ ------ ------

Interim dividend declared per share 3.6 1.8

Final dividend proposed per share 17.0 6.8

------------------------------------ ------ ------

Total 20.6 8.6

------------------------------------ ------ ------

The proposed final dividend of 17.0p will be submitted for

formal approval at the Annual General Meeting to be held on 29

March 2022. Based on the number of shares in issue at the date of

this report and excluding own shares held the total amount payable

for the final dividend would be GBP22,409,000.

Dividends paid in the year

2021 2020

GBP000 GBP000

--------------------------------------- ------- -------

Prior year final dividend - 6.8p, 4.0p 8,871 5,140

Interim dividend - 3.6p, 1.8p 4,745 2,302

--------------------------------------- ------- -------

13,616 7,442

--------------------------------------- ------- -------

14 GOODWILL

The goodwill balance within the Group at 30 September 2021 arose

from the acquisition of Impax Capital Limited on 18 June 2001 and

the acquisition of Impax NH in January 2018.

Goodwill

GBP000

--------------------- --------

Cost

At 1 October 2019 12,804

Foreign exchange (498)

--------------------- --------

At 30 September 2020 12,306

--------------------- --------

Foreign exchange (490)

--------------------- --------

At 30 September 2021 11,816

--------------------- --------

Impax NH consists of only one cash-generating unit ("CGU").

Goodwill is allocated between CGUs at 30 September 2021 as follows

- GBP10,187,000 to Impax NH and GBP1,629,000 to the Listed Equity

and Private Equity CGUs.

The Group has determined the recoverable amount of its CGUs by

calculating their value in use using a discounted cash flow model.

The cash flow forecasts were derived taking into account the budget

for the year ended 30 September 2022, which was approved by the

Directors in October 2021.

The goodwill on the Listed Equity and Private Equity CGUs arose

over 15 years ago and the business has grown significantly in size

and profitability since that date. There is accordingly significant

headroom before an impairment is required. The main assumptions

used to calculate the cash flows in the impairment test for these

CGUs were that assets under management would continue at current

levels and margins would continue at current levels, that fund

performance for the Listed Equity business would be 5% per year

(2020: 5%) and a discount rate of 12.5% (2020: 12.5%). The discount

rate was derived from the Group's weighted average cost of capital.

There has been no impairment of goodwill related to these segments

to date and there would have to be significant asset outflows over

a sustained period before any impairment was required. If the

discount rate increased by 3% there would no impairment and if fund

performance reduced to zero there would be no impairment (2020: 3%

increase in discount rate, no impairment).

The impairment test for the Impax NH CGU showed no impairment

(2020: no impairment) was required and used the following key

assumptions - average fund inflows of $0.38 billion (2020: $0.57

billion), fund performance of 5% (2020: 5%), an average operating

margin of 17% (2020: 20%) and a discount rate of 12.5% (2020:

12.5%). The following plausible changes in assumptions would

individually not give rise to an impairment: a consistent 10%

decrease in inflows (2020: 10% decrease); a 100 basis point annual

reduction in performance each year (2020: 100 basis point

reduction); a 1% annual reduction in operating margin (2020: 1%

reduction), a 1% increase in discount rate (2020: 1% increase).

15 INTANGIBLE ASSETS

Intangible assets mainly represent the value of the management

contracts acquired as part of the acquisition of Impax NH.

Management

contracts Software Total

GBP000 GBP000 GBP000

------------------------- ---------- -------- -------

Cost

As at 1 October 2019 29,016 515 29,531

Additions - 14 14

Foreign exchange (1,309) - (1,309)

------------------------- ---------- -------- -------