TIDMINV

RNS Number : 5084B

Investment Company PLC

14 February 2022

The Investment Company plc

Half Year Report Announcement (Unaudited) for the six months

ended 31 December 2021

Summary of Results

At 31 December At 30 June

2021

(unaudited) 2021

(audited) Change %

----------------------------- --------------- ----------- ----------

Equity Shareholders' funds

(GBP) 16,666,708 16,281,804 2.36

Number of ordinary shares

in issue 4,772,049 4,772,049 -

Net asset value ("NAV") per

ordinary share 349.26p 341.19p 2.36

Ordinary share price (mid) 308.00p 309.00p (0.32)

Discount to NAV 11.81% 9.43% (2.38)

----------------------------- --------------- ----------- ----------

6 months to Year ended

31 December 30 June

2021

(unaudited) 2021

(audited)

----------------------------- --------------- ----------- ----------

Total return per ordinary

share * 8.07p (29.08)p

Dividends paid per ordinary

share nil 3.00 p

* The total return per ordinary share is based on total income

after taxation as detailed in the Condensed consolidated income

statement and in note 3.

Investment Objective

At the Annual General Meeting on 4 November 2020, Shareholders

voted to amend the Company's Investment Objective and Policy to

that shown below.

The Company's investment objective is to protect the purchasing

power of its capital in real terms, and to participate in enduring

economic activities which lend themselves to genuine capital

accumulation and wealth creation.

Investment Policy

The Company will seek to acquire and hold, with no predetermined

investment time horizon, a collection of assets which, in the

Directors' judgement, are well-suited to the avoidance of a

permanent loss of capital. These assets will be comprised of

minority participations in the equity, debt or convertible

securities of quoted businesses which the Directors believe are led

by responsible and like-minded managers and suitable for the

long-term compounding of earnings. In addition, to protect its

capital as well as to maintain liquidity for future investments,

the Company will keep reserves in (a) liquid debt instruments such

as cash in banks or securities issued by governments and/or (b)

liquid, non-debt, tangible assets such as gold bullion, whether

held indirectly or in physical form.

The Company has no predetermined maximum or minimum levels of

exposure to asset classes, currencies or geographies, and has the

ability to invest globally. These exposures will be monitored by

the Board in order to ensure an adequate spreading of risks. No

holding in an individual company or debt instrument will represent

more than 15 per cent. by value of the Company's total assets at

the time of acquisition (such restriction does not, however, apply

to gold bullion or cash balances). The Company's holdings of gold

bullion may be as high as 35 per cent. of total assets at the time

of investment.

Given the Company's investment objective, asset mix and time

horizon, the portfolio will not seek to track any benchmark or

index. The Company will not invest more than 10 per cent. of its

total assets in other listed closed-ended investment funds. The

Company will not use derivative instruments for speculative

purposes, nor will it use currency hedges to manage returns in any

currency.

The Company's gearing will not exceed 20 per cent. of net assets

at the time of drawdown.

No material change will be made to the investment policy without

the approval of Shareholders by ordinary resolution.

Chairman's Statement

Dear fellow shareholders,

Results

During the six-month period ended 31 December 2021, the Group's

net assets increased by 8.07 pence per share to 349.26 pence per

share. This represents a total return of 2.36%. The details of this

return are outlined in the table below.

6 months to Year ended

31 December 2021 30 June 2021

Pence per Pence per

share % share %

------------------------------ ----------- ------- ---------- -------

Opening net assets 341.19 100.00 315.11 100.00

Gain on portfolio valuations 8.62 2.53 27.57 8.75

Investment income 3.12 0.91 14.75 4.68

Expenses (3.67) (1.08) (13.24) (4.20)

Dividends paid - - (3.00) (0.95)

------------------------------ ----------- ------- ---------- -------

Closing net assets 349.26 2.36 341.19 8.28

------------------------------ ----------- ------- ---------- -------

Equity Participations

During the half year we sold in aggregate shares worth GBP1.7

million realising a gain of GBP0.4 million (+28%), and we purchased

shares worth GBP2.6 million. This increased our equity

participations from 66.7% to 72.1% of net assets. We are looking

forward to further opportunities to add to our existing

holdings.

We sold out of three holdings entirely. We sold our small

position in Fromageries Bel for a 23% gain because the founding

family is taking the business private and delisting the shares. We

sold the rest of our Rio Tinto shares for a 14% gain. Our existing

interest in oil and precious metals producers is already

substantial and having a few firms like this in our collection will

go a long way toward preparing us from any inflationary storms

ahead, whether transitory or not. We also sold out of Unilever

realising a 6% loss. The brand strength and their entrenched

position in so many countries remain a wonderful asset, and the

shares undervalued, but an undue focus on managing to a sterile ESG

mandate and institutional expectations doesn't sit well with us.

Whenever our priorities differ from the managers the decision to

sell becomes an easy one.

We sold part of our stake in Safilo realising a 95% gain.

Despite operating during two difficult years the turnaround under

their new CEO has gone exceptionally well. Later in the year,

Safilo also conducted a rights offering which eliminated most of

their debt burden and enables them to embark on an investment

program after a period of downsizing. We also bought shares in the

offering on very attractive terms.

We reduced our holding in Strix after a period of substantial

price appreciation, realising a 172% gain. Credit goes to our prior

investment manager for buying the shares well. Holding great

businesses at high prices is not a problem for us - we expect most

of our holdings to meet these criteria eventually - but it demands

a conviction which for us has to come from a proven capacity to

execute within their specialty for many years. The promise of

future growth in new product categories, though welcome, is not

something our objective places a premium on.

We added four new holdings during the half year: Robertet, the

world's pre-eminent producers of all-natural flavours and

fragrances; Kri Kri Milk, a premium Greek dairy company

specialising in exporting ice cream and yogurt; Crete Plastics, a

European producer of masterbatches for plastics manufacturing and

specialty agricultural films; and Karelia Tobacco, a family-owned

Greek cigarette producer serving markets in Southeast Europe and

across the Mediterranean. These are all multi-generational,

family-owned businesses with decades of deep experience in

relatively narrow markets. They have demonstrated a constant drive

to reinvest in new capacities and add to their business strengths,

show a history of operating with care and we think they can develop

their markets for decades to come. Though Robertet is 'a great

business at a high price', the other three are smaller companies,

completely unknown outside of their local markets and, fortunately

for us, priced to reflect their relative obscurity. Though not

small in any business sense, these companies are controlled by the

founding families and a fairly small group of other real, long-term

owners. We count ourselves among them.

For our existing holdings, we continued to add to Cembre, Lucas

Bols, Hal Trust and Nedap.

Legacy Assets

We sold out of our three largest legacy fixed income holdings,

generating GBP629k in proceeds and realising a 3% gain. This

reduced the legacy holdings down to 0.4% of net assets and marks

the end of the transition from the prior portfolio. The fixed 5% to

6% yields on these instruments were once alluring, but in the

present inflationary environment they look for our purposes like

wasting assets. It's better that the proceeds be invested in

business where time is our ally rather than having it count down

the erosion of our capital.

Precious Metals

With consumer price inflation finally arriving in the UK our

reasons for holding gold are unchanged - they form a liquid reserve

that we believe will retain its purchasing power across periods of

inflation and monetary disorder. As with our stakes in businesses,

the intended time horizon of our holding matters a great deal. Gold

is not suitable as a short-term hedge against rising consumer

prices, and though one could speculate on its price that is not our

reason for holding it. Gold has the curious property that as we

extend our gaze further into the future, and as we broaden our

understanding of the myriad effects of monetary debasement, the

more suitable it appears.

There were no changes to our gold holdings in the period, as new

equity purchases were largely offset against the sales of other

shares and our remaining legacy assets.

Income and costs

Total income for the first six months came to GBP162k, while

expenses totalled GBP175k. There were no extraordinary expenses in

the period, and we believe current expenses are indicative of

ongoing expenses for the Group. At our present size, we expect

investment income to largely - but not completely - offset expenses

for the full year.

Foreign Exchange

The Group reports its results in Sterling, but as of 31 December

2021 91.0% of our portfolio was invested in companies, securities

and reserve assets denominated in other currencies and we expect

this to continue in the future. Because of this shift any

strengthening or weakening of Sterling against these currencies

will now have a direct impact on our financial results in future

periods. We will not employ any currency hedging to manage the

returns as expressed in Sterling as we believe the exercise would

be both costly and counter to our purpose.

Although we have had a total return of some GBP385k in the half

year, this arises from our capital rather than income and the

Directors do not propose to pay an interim dividend.

Outlook

The Board welcomes dialogue with our Shareholders who will find

details of how to contact us at the Company's website,

www.theinvestmentcompanyplc.co.uk.

In these uncertain and volatile times, we believe the Company is

well positioned to provide Shareholders with capital preservation

and wealth creation over the long-term. Furthermore, we continue to

evaluate opportunities to grow the capital base.

I. R. Dighé

Chairman

14 February 2022

Portfolio Summary

Asset Exposure by Trading Currency

At 31 December 2021

% of net

Currency assets

---------------- --------

GBP 9%

EUR 41%

CAD 8%

CHF 6%

NOK 3%

USD 7%

Precious Metals 26%

--------

Total 100%

--------

Equity Participations - Regional Economic Exposure*

At 31 December 2021

% of equity

Region participations

-------------------- ---------------

Europe 51%

North America 25%

South America 7%

Asia, Africa, Other 17%

---------------

Total 100%

---------------

Equity Participations - By Sector *

At 31 December 2021

% of equity

Sector participations

---------------- ---------------

Consumer Goods 46%

Industrials 34%

Basic Materials 10%

Oil & Gas 10%

---------------

Total 100%

---------------

*Director estimates. Regional Economic Exposure represents where

in the world the underlying business activity of the equity

participations takes place.

Portfolio and Asset s

At 31 December 2021

Fair Value % of net

Security Country Holding GBP assets

------------------------------- --------------- --------- ------------ ----------

Hal Trust Netherlands 12,000 1,469,388 8.8%

Karelia Tobacco Greece 3,250 758,797 4.6%

Tonnellerie François

Frères Group France 32,000 752,499 4.5%

British American Tobacco UK 27,000 738,046 4.4%

Cembre Italy 24,500 703,705 4.2%

Lucas Bols Netherlands 70,731 696,202 4.2%

Imperial Oil Canada 26,000 690,969 4.2%

Barrick Gold Canada 45,000 634,413 3.8%

Emmi Switzerland 700 612,109 3.7%

Crete Plastics Greece 39,461 589,909 3.5%

Bakkafrost Faroe Islands 12,000 588,861 3.5%

Lukoil ADR Russia 7,500 498,071 3.0%

Nedap Netherlands 9,000 473,167 2.8%

Bucher Industries Switzerland 1,200 439,822 2.6%

Safilo Group Italy 300,000 396,573 2.4%

Robertet France 460 376,669 2.3%

Franco-Nevada Canada 3,600 366,879 2.2%

Strix Group UK 120,000 364,200 2.2%

Kri-Kri Milk Industries Greece 38,929 277,901 1.7%

ForFarmers Netherlands 80,000 271,101 1.6%

Alamos Gold Canada 43,000 243,732 1.5%

Legacy holdings Various 67,407 0.4%

------------ ----------

Total equity participations 12,010,420 72.1%

------------ ----------

Invesco Physical Gold ETC UK 15,000 1,958,560 11.7%

WisdomTree Physical Gold ETC UK 9,500 1,210,956 7.3%

WisdomTree Physical Swiss

Gold ETC Switzerland 9,000 1,169,325 7.0%

------------ ----------

Total gold 4,338,841 26.0%

------------ ----------

Sterling cash 363,908 2.2%

Other liabilities net of other

assets (46,461) (0.3)%

------------ ----------

Total cash less other net

current liabilities 317,447 1.9%

------------ ----------

Total net assets 16,666,708 100.0%

------------ ----------

Interim management report and Directors' responsibility

statement

Interim management report

The important events that have occurred during the period under

review and their impact on the financial statements are set out in

the Chairman's Statement above.

In the view of the Board, the principal risks facing the Group

are substantially unchanged since the date of the Report and

Accounts for the year ended 30 June 2021 and continue to be as set

out in that report. Risks faced by the Group include, but are not

limited to, market risk (which comprises market price risk,

interest rate risk and liquidity risk). Details of the Group's

management of these risks and exposure to them is set out in the

Group's Report and Accounts for the year ended 30 June 2021.

There have been no significant changes in the related party

disclosures set out in the Annual Report.

Directors' responsibility statement

The Directors confirm that to the best of their knowledge:

-- the condensed set of financial statements has been prepared

in accordance with International Accounting Standard 34, Interim

Financial Reporting, and gives a true and fair view of the assets,

liabilities, financial position and profit or loss of the Group;

and

-- this Half-Yearly Financial Report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that have taken place in the first

six months of the current financial year and that have materially

affected the financial position or performance of the Group during

that period; and any changes in the related party transactions that

could do so.

This Half-Yearly Financial Report was approved by the Board of

Directors on 14 February 2022 and the above responsibility

statement was signed on its behalf by I. R. Dighe , Chairman.

Condensed consolidated income statement

For the six months ended 31 December 2021 (unaudited)

6 months to 31 6 months to 31 Year ended 30 June

December 2021 December 2020 2021

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes GBP GBP GBP GBP GBP GBP GBP GBP GBP

--------- ------- --------- --------- ------- --------- --------- --------- ---------

Gains on

investments

at fair

value through

profit or

loss - 414,942 414,942 - 329,396 329,396 - 1,315,694 1,315,694

Exchange

(loss) on

capital

items - (3,515) (3,515) - (660) (660) - (88) (88)

Investment

income 2 161,894 - 161,894 502,481 - 502,481 724,585 - 724,585

Investment

management

fee 7 - - - (56,543) - (56,543) (96,825) - (96,825)

Other expenses (175,482) - (175,482) (328,551) (323) (328,874) (535,120) - (535,120)

--------- ------- --------- --------- ------- --------- --------- --------- ---------

Return before

taxation (13,588) 411,427 397,839 117,387 328,413 445,800 92,640 1,315,606 1,408,246

Taxation (12,935) - (12,935) (1,219) - (1,219) (20,338) - (20,338)

--------- ------- --------- --------- ------- --------- --------- --------- ---------

Total

(loss)/income

after taxation (26,523) 411,427 384,904 116,168 328,413 444,581 72,302 1,315,606 1,387,908

--------- ------- --------- --------- ------- --------- --------- --------- ---------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

pence pence pence pence pence pence pence pence pence

--------- ------- --------- --------- ------- --------- --------- --------- ---------

Return on

total income

after taxation

per 50p

ordinary

share -

basic &

diluted 3 (0.55) 8.62 8.07 2.43 6.88 9.31 1.51 27.57 29.08

--------- ------- --------- --------- ------- --------- --------- --------- ---------

The total column of this statement is the Income Statement of

the Group prepared in accordance with IFRS as adopted by the United

Kingdom. The supplementary revenue and capital columns are prepared

in accordance with the Statement of Recommended Practice ("AIC

SORP") issued in April 2021 by the Association of Investment

Companies.

The Group did not have any income or expenses that was not

included in total income for the period. Accordingly, total income

is also total comprehensive income for the period, as defined by

IAS 1 (revised) and no separate Statement of Comprehensive Income

has been presented.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

during the period.

The notes form part of these condensed financial statements.

Condensed consolidated statement of changes in equity

For the six months ended 31 December 2021 (unaudited)

Capital

Share Share redemption Capital Revenue

capital premium reserve reserve reserve Total

GBP GBP GBP GBP GBP GBP

------------------ --------------- ------------------ --------- ----------- ----------

Balance at 1 July

2021 2,386,025 4,453,903 2,408,820 8,410,600 (1,377,544) 16,281,804

Total comprehensive

income

Net return for

the period - - - 411,427 (26,523) 384,904

Transactions with

Shareholders recorded

directly to equity

Ordinary dividends

paid - (note 4) - - - - - -

------------------ --------------- ------------------ --------- ----------- ----------

Balance at 31 December

2021 2,386,025 4,453,903 2,408,820 8,822,027 (1,404,067) 16,666,708

------------------ --------------- ------------------ --------- ----------- ----------

Balance at 1 July

2020 2,386,025 4,453,903 2,408,820 7,094,994 (1,306,685) 15,037,057

Total comprehensive

income

Net return for

the period - - - 328,413 116,168 444,581

Transactions with

Shareholders recorded

directly to equity

Ordinary dividends

paid - (note 4) - - - - (95,441) (95,441)

------------------ --------------- ------------------ --------- ----------- ----------

Balance at 31 December

2020 2,386,025 4,453,903 2,408,820 7,423,407 (1,285,958) 15,386,197

------------------ --------------- ------------------ --------- ----------- ----------

Balance at 1 July

2020 2,386,025 4,453,903 2,408,820 7,094,994 (1,306,685) 15,037,057

Total comprehensive

income

Net return for

the year - - - 1,315,606 72,302 1,387,908

Transactions with

Shareholders recorded

directly to equity

Ordinary dividends

paid - (note 4) - - - - (143,161) (143,161)

------------------ --------------- ------------------ --------- ----------- ----------

Balance at 30 June

2021 2,386,025 4,453,903 2,408,820 8,410,600 (1,377,544) 16,281,804

------------------ --------------- ------------------ --------- ----------- ----------

The notes form part of these condensed financial statements.

Condensed consolidated balance sheet

At 31 December 2021 (unaudited)

31 December 31 December 30 June

2021 2020 2021

Notes GBP GBP GBP

----------- ----------- -----------

Non-current assets

Investments held at fair value through

profit or loss 8 16,349,261 14,224,363 15,618,864

----------- ----------- -----------

Current assets

Trade and other receivables 51,961 67,268 389,029

Cash and cash equivalents 363,908 1,221,865 540,800

----------- ----------- -----------

415,869 1,289,133 929,829

----------- ----------- -----------

Current liabilities

Trade and other payables (98,422) (127,299) (266,889)

----------- ----------- -----------

(98,422) (127,299) (266,889)

----------- ----------- -----------

Net current assets 317,447 1,161,834 662,940

----------- ----------- -----------

Net assets 16,666,708 15,386,197 16,281,804

----------- ----------- -----------

Capital and reserves

Ordinary share capital 5 2,386,025 2,386,025 2,386,025

Share premium 4,453,903 4,453,903 4,453,903

Capital redemption reserve 2,408,820 2,408,820 2,408,820

Capital reserve 8,822,027 7,423,407 8,410,600

Revenue reserve (1,404,067) (1,285,958) (1,377,544)

----------- ----------- -----------

Shareholders' funds 16,666,708 15,386,197 16,281,804

----------- ----------- -----------

NAV per ordinary share of 50p 6 349.26p 322.42p 341.19p

----------- ----------- -----------

The notes form part of these condensed financial statements.

Condensed consolidated cash flow statement

For the six months ended 31 December 2021 (unaudited)

31 December 31 December 30 June

2021 2020 2021

GBP GBP GBP

----------- ------------ ------------

Cash flows (used in)/generated from

operating activities

Income received from investments 131,236 517,128 777,299

Interest received 38 9,792 9,792

Overseas taxation paid (747) - (19,195)

Investment management fees paid (1,678) (56,323) (104,544)

Other cash payments (200,847) (341,076) (564,381)

----------- ------------ ------------

Net cash (used in)/generated from

operating activities (71,998) 129,521 98,971

----------- ------------ ------------

Cash flows used in financing activities

Dividends paid on ordinary shares - (95,441) (143,161)

----------- ------------ ------------

Net cash used in financing activities - (95,441) (143,161)

----------- ------------ ------------

Cash flows (used in)/generated from

investing activities

Purchase of investments (2,775,667) (10,953,343) (13,442,242)

Sale of investments 2,674,274 11,876,736 13,762,164

----------- ------------ ------------

Net cash (used in)/generated from

investing activities (101,393) 923,393 319,922

----------- ------------ ------------

Net ( decrease)/increase in cash

and cash equivalents (173,391) 957,473 275,732

----------- ------------ ------------

Reconciliation of net cash flow

to movement in net cash

(Decrease)/increase in cash (173,391) 957,473 275,732

Exchange rate movements (3,501) (660) 16

----------- ------------ ------------

(Decrease)/increase in net cash (176,892) 956,813 275,748

Net cash at start of period 540,800 265,052 265,052

----------- ------------ ------------

Net cash at end of period 363,908 1,221,865 540,800

----------- ------------ ------------

Analysis of net cash

Cash and cash equivalents 363,908 1,221,865 540,800

----------- ------------ ------------

363,908 1,221,865 540,800

----------- ------------ ------------

Condensed notes to the consolidated financial statements

At 31 December 2021 (unaudited)

1. Significant accounting policies

Basis of Preparation

The condensed consolidated financial statements, which comprise

the unaudited results of the Company and its wholly owned

subsidiaries, Abport Limited and New Centurion Trust Limited,

together referred to as the "Group", have been prepared in

accordance with IFRS, as adopted by the United Kingdom, and as

applied in accordance with the provisions of the Companies Act

2006. The financial statements have been prepared in accordance

with the AIC SORP, except to any extent where it is not consistent

with the requirements of IFRS. The accounting policies are as set

out in the Report and Accounts for the year ended 30 June 2021.

The half-year financial statements have been prepared in

accordance with IAS 34 "Interim Financial Reporting".

The financial information contained in this half year financial

report does not constitute statutory accounts as defined by the

Companies Act 2006. The financial information for the periods ended

31 December 2021 and 31 December 2020 have not been audited or

reviewed by the Company's Auditor. The figures and financial

information for the year ended 30 June 2021 are an extract from the

latest published audited statements, and do not constitute the

statutory accounts for that year. Those accounts have been

delivered to the Registrar of Companies and include a report of the

Auditor, which was unqualified and did not contain a statement

under either Section 498(2) or 498(3) of the Companies Act

2006.

Going Concern

The Directors have made an assessment of the Group's ability to

continue as a going concern. This has included consideration of

portfolio liquidity, the Group's financial position in respect of

its cash flows and investment commitments (of which there are none

of significance), the working arrangements of the key service

providers, continued eligibility to be approved as an investment

trust company and the continued impact of the Covid-19 pandemic. In

addition, the Directors are not aware of any material uncertainties

that may cast significant doubt upon the Group's ability to

continue as a going concern.

The Directors are satisfied that the Group has the resources to

continue in business for the foreseeable future being a period of

at least 12 months from the date that these financial statements

were approved. Therefore, the financial statements have been

prepared on the going concern basis.

Segmental Reporting

The Directors are of the opinion that the Group is engaged in a

single segment of business, being investment business.

2. Income

6 months 6 months

to to Year ended

31 December 31 December 30 June

2021 2020 2021

GBP GBP GBP

------------ ------------ ----------

Income from investments:

UK dividends 103,326 354,598 438,996

Unfranked dividend income 67,344 5,051 132,143

UK fixed interest (8,814) 133,040 143,654

------------ ------------ ----------

161,856 492,689 714,793

Other income

Bank deposit and other interest 38 9,792 9,792

Total income 161,894 502,481 724,585

------------ ------------ ----------

3. Return per Ordinary Share

Returns per share are based on the weighted average number of

shares in issue during the period. Normal and diluted returns per

share are the same as there are no dilutive elements on share

capital.

6 months to 6 months to Year ended

31 December 2021 31 December 2020 30 June 2021

Net return Pence Net return Pence Net return Pence

GBP per share GBP per share GBP per share

---------- ---------- ---------- ---------- ----------- ----------

Return after taxation

attributable to

ordinary Shareholders

Revenue (26,523) (0.55) 116,168 2.43 72,302 1.51

Capital 411,427 8.62 328,413 6.88 1,315,606 27.57

---------- ---------- ---------- ---------- ----------- ----------

Total comprehensive

income 384,904 8.07 444,581 9.31 1,387,908 29.08

---------- ---------- ---------- ---------- ----------- ----------

Weighted average

number of ordinary

shares 4,772,049 4,772,049 4,772,049

---------- ---------- ---------- ---------- ----------- ----------

4. Dividends per Ordinary Share

Amounts recognised as distributions to equity holders in the

period.

6 months 6 months

to 31 to 31 Year ended

December December 30 June

2021 2020 2021

GBP GBP GBP

--------- --------- ----------

Ordinary shares

Interim dividend of 1.00p paid on

7 September 2020 - 47,720 47,720

Interim dividend of 1.00p paid on

4 December 2020 - 47,721 47,720

Interim dividend of 1.00p paid on

26 February 2021 - - 47,721

Total - 95,441 143,161

--------- --------- ----------

5. Ordinary Share Capital

31 December 2021 31 December 2020 30 June 2021

Number GBP Number GBP Number GBP

--------- --------- --------- --------- --------- ---------

Ordinary shares

of 50p each 4,772,049 2,386,025 4,772,049 2,386,025 4,772,049 2,386,025

--------- --------- --------- --------- --------- ---------

The Company does not hold any shares in treasury as at 31

December 2021 (31 December 2020: Nil and 30 June 2021: Nil).

6. Net Asset Value per Ordinary Share

The NAV per ordinary share is calculated as follows:

31 December 31 December

2021 2020 30 June 2021

GBP GBP GBP

----------- ----------- ------------

Net assets 16,666,708 15,386,197 16,281,804

----------- ----------- ------------

Ordinary shares in issue 4,772,049 4,772,049 4,772,049

----------- ----------- ------------

NAV per ordinary share 349.26p 322.42p 341.19p

----------- ----------- ------------

7. Investment Management fee

Pursuant to the changes to the Company's Investment Objective

and Policy, the Investment Manager, Fiske plc, was given notice to

terminate the investment management agreement as of 5 May 2021.

The management fee payable monthly in arrears by the Company to

the Investment Manager, was previously calculated at the rate of

one-twelfth of 0.75% of the NAV as at the last business day of each

calendar month.

At 31 December 2021, an amount of GBPnil (31 December 2020:

GBP9,675 and 30 June 2021: GBP1,678) was outstanding and due to the

Investment Manager.

8. Fair Value Hierarchy

The fair value is the amount at which an asset could be sold in

an ordinary transaction between market participants at the

measurement date, other than a forced or liquidation sale. The

Group measures fair values using the following hierarchy that

reflects the significance of the inputs used in making the

measurements.

Categorisation within the hierarchy has been determined on the

basis of the lowest level input that is significant to the fair

value measurement of the relevant asset as follows:

Level 1 - valued using quoted prices, unadjusted in active

markets for identical assets and liabilities.

Level 2 - valued by reference to valuation techniques using

observable inputs for the asset or liability other than quoted

prices included in Level 1.

Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data for the asset

or liability.

The table below sets out fair value measurement of financial

instruments as at 31 December 2021, by the level in the fair value

hierarchy into which the fair value measurement is categorised.

Level

1 Level 2 Level 3 Total

GBP GBP GBP GBP

---------- ------- ------- ----------

At 31 December 2021

Investments held at fair value

through profit or loss 16,282,652 - 66,609 16,349,261

---------- ------- ------- ----------

At 31 December 2020

Investments held at fair value

through profit or loss 13,241,128 - 983,235 14,224,363

---------- ------- ------- ----------

At 30 June 2021

Investments held at fair value

through profit or loss 15,024,544 - 594,320 15,618,864

---------- ------- ------- ----------

Reconciliation of Level 3 investments

The following table summarises Level 3 investments that were

accounted for at fair value.

31 December 31 December 30 June

2021 2020 2021

GBP GBP GBP

----------- ----------- -----------

Opening balance 594,320 2,030,066 2,030,066

Sales proceeds* (573,939) (1,095,168) (1,545,167)

Gains on investments 46,228 48,337 109,421

Closing balance 66,609 983,235 594,320

----------- ----------- -----------

* The Group and Company received GBP573,939 from investments

sold in the period. The book cost of these investments when they

were purchased was GBP518,840. These investments have been revalued

over time and until they were sold any unrealised gains/(losses)

were included in the fair value of investments.

9. Related party transactions

During the first six months of the financial year, no

transactions with related parties have taken place which have

materially affected the financial position or performance of the

Group.

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on this announcement (or

any other website) is incorporated into, or forms part of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFFFADEESELE

(END) Dow Jones Newswires

February 14, 2022 02:00 ET (07:00 GMT)

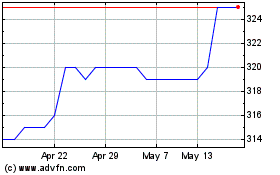

Investment (LSE:INV)

Historical Stock Chart

From Jun 2024 to Jul 2024

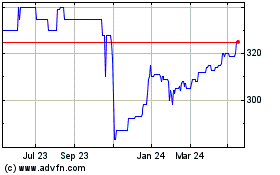

Investment (LSE:INV)

Historical Stock Chart

From Jul 2023 to Jul 2024