TIDMINSG

RNS Number : 4161W

Insig AI Plc

22 December 2021

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. It forms part of United Kingdom

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement, this inside information

is now considered to be in the public domain.

22 December 2021

Insig AI plc

("Insig AI" or the "Company")

Interim Results

Insig AI plc the data science and machine learning group, is

pleased to announce its interim results for the six months ended 30

September 2021.

Highlights:

-- Company transformed by reverse takeover of AI/machine

learning business Insight Capital Limited. Repositioned as a SaaS

product business model from a pure technology consulting solutions

provider

-- Secured contract with Carval Investors L.P ("Carval") to

support its ESG Collateralised Loan Obligations fund launch

-- Group revenue of GBP0.9 million (H1 2020: GBP0.2 million)

-- Group operating loss pre-exceptional items of GBP0.5 million (H1 2020: GBP0.3 million loss)

-- Net cash at 30 September 2021 of GBP2.3 million, excluding

GBP0.7 million R&D tax credit received post period end

Post period-end:

-- Three contract wins, added further capability and data to

assist Royal London Asset Management

-- Appointment of Colm McVeigh as Chief Commercial Officer

-- Successful completion of acquisition of FDB Systems Limited

Commenting, Insig AI's Chief Executive Steve Cracknell said:

"Each month continues to be busier than the last and I fully expect

this to continue. Since 1 October, we have released Insig Portfolio

2, delivered our ESG scoring solution to Carval, appointed Colm

McVeigh as Chief Commercial Officer, completed the acquisition of

FDB and closed three new contract wins, two of which we have

already announced.

"I am pleased to report that both in the coming quarter and

beyond, I expect this momentum to build very significantly. We have

multiple opportunities: within the asset management industry, most

notably for our ESG data scoring, bespoke ESG solutions, corporate

sales and our data sourcing and machine learning analytics. Our

Portfolio Insights tool can now be incorporated into our ESG

solutions. We are also excited to progress our partnership revenue

share opportunities, where the scale of revenue streams can be a

multiple of a Software as a Service sale. Beyond the asset

management industry, the 4Bio contract win has shown that we are

able to apply our machine learning capabilities to other sectors.

In the New Year, I hope to be able to provide further evidence of

our ability to sell to another vertical. The coming quarter and

2022 should demonstrate our ability to secure multiple contract

wins, as we successfully leverage our machine learning technology

and exploit it, so it fuels fast growing and increasingly higher

margin revenues. I look forward to a very exciting 2022."

For further information, please visit www.insg.ai , or

contact:

Insig AI Plc Via SEC Newgate

Steve Cracknell, CEO

Zeus Capital Limited (Nominated Adviser

& Broker)

David Foreman / James Hornigold +44 (0) 203 829 5000

SEC Newgate (Financial PR) +44 (0) 7540 106

Robin Tozer / Tom Carnegie / Richard Bicknell 366

insigai@secnewgate.co.uk

Chairman's Statement

The period under review includes the new strategic focus on

artificial intelligence and machine learning, culminating with the

acquisition on 10 May 2021 of the entire issued share capital of

Insight Capital Partners Limited ("Insight").

Since becoming interim Chairman in mid-August, my immediate task

was to take stock of the business and to objectively assess its

strengths, opportunities, weaknesses, and threats. Very quickly, a

key priority emerged: to better commercialise the business. Insig

AI has a clear focus in terms of technology: data science and

machine learning. Its technology is strong and impressive. This is

a necessary condition for commercial success. However, without good

commercial structure and discipline, it is not a sufficient

condition. That is why the appointment in November of Colm McVeigh

as Chief Commercial Officer is so important. The business is

already benefiting from his experience, structure, and

professionalism.

Recently, Insig AI has demonstrated the quality of its client

base with important business wins including from global alternative

investment manager CarVal Investors L.P. ("CarVal") and Royal

London Asset Management. I believe that some context is important.

Insig AI is a relatively small team: the data science machine

learning is a team of just 32, with 23 focussed on product

delivery. Last year's pivot from consulting to developing product

led solutions with a robust technical infrastructure was essential.

The priority has now switched to converting this data

infrastructure into scalable revenues.

Since May, the business has been very largely focused on

delivering ESG scoring tools to support CarVal's risk scoring

methodology. Significant resources were deployed to ensure delivery

was achieved on time. CarVal's Clean Collateralised Loan Obligation

Product Line is a ground-breaking product. Insig AI can be proud

that it has a client of the calibre of CarVal.

Since the end of September, there have been further customer

wins. Last month, the business signed a proof-of-concept exercise

with a European asset manager with assets under management ("AUM")

of several billion Euros. Insig AI is using its machine learning

data and expertise to analyse and categorise the client's

portfolio. The objective is to use a combination of linear and

non-linear analysis methods to surface and understand relationships

within the client's investment datasets comprising approximately

2,000 companies.

Earlier this month, the business secured a five year "software

as a service" ("SaaS") agreement with 4BIO Partners LLP ("4BIO"), a

leading international venture capital fund targeting advanced

disease therapies. Using Insig AI's proprietary machine learning

classifiers, and its deep domain expertise, 4BIO will be able to

quickly analyse up to 32 million medical publications that contain

disease research to identify patterns and trends to inform future

investment decisions and venture creation. This contract win

demonstrates the scalability of our AI data solutions beyond the

asset management industry. The business is currently in discussions

with another vertical, which it is hoped will lead to a contract

win prior to our March year end.

I'm also pleased to report that recently, Insig AI has

successfully added further capability and data to assist Royal

London Asset Management, which has resulted in an expansion of our

hosted financial analysis solution with associated recurring

revenues.

Whilst it is widely accepted that contract wins of significant

size are rarely quick, it was apparent that in order to accelerate

that cycle, eliminating the wait to obtain a potential client's

portfolio associated data needed to be addressed. That is why the

FDB Systems Limited ("FDB") acquisition is important. FDB

specialises in structuring data, which is the process of

transforming raw data so that it can be more easily and effectively

used as an input to machine learning, data science and AI

processes. Combining FDB's technology with our machine learning and

analysis tools creates a world-leading aggregator of ESG

information. Providing prospective customers with ESG tagged

structured data makes it more attractive and valuable, which we

believe will result in accelerated sales. With a fast-growing

client list, as well as cross-selling opportunities, we're excited

that FDB is now part of Insig AI. The integration of both the

business and the team is proceeding well.

Richard Bernstein

21 December 2021

Chief Executive's Review

During the period under review, we invested heavily in our data

infrastructure and product platform. This was to enable us to

produce and sell quality, scalable software solutions aimed at the

asset management industry. This was the basis of the reverse

takeover back in May and was consistent with our long-term strategy

to shift away from undertaking only high value technology solution

consulting engagements so that we could pivot to become a product

focussed business.

Historically, the business delivered strong and growing

consulting revenues. When clients buy consultancy services, they

are effectively buying into the people delivering the solution.

Software as a Service (SaaS) product sales however have a

completely different sales process. We have been building the

different skill sets and processes within the business which are

required to secure this stickier and more valuable revenue. These

include customer workshops, pre-proposals and proposals. Having

scalable offerings enables us to accelerate sales growth. This is

the right approach to build shareholder value.

The transition from providing pure technology consulting

solutions to becoming a SaaS product business model required a

strong technical infrastructure and sticky product offering to

underpin our future sales growth. As expected, this impacted short

term revenues, with during the period, core machine learning

business generating revenues of GBP0.2 million. Since the start of

our second half, in line with management expectations, we have

already seen much improved revenue, with the emphasis on SaaS

product sales. Securing SaaS contracts can take time, for a host of

reasons, but given tangible progress on several pipeline contracts

in recent weeks, I am confident that these will be secured early in

the New Year, as we see increasing interest in our ESG scoring and

data screening capabilities.

I am pleased to report that our projections for the coming

quarter and beyond, see a significant ramp up in revenues.

Recognising that our shareholders would like greater clarity on

Insig's penetration of and growth trajectory in our target markets,

as soon as the Company has secured some of these near-term

opportunities and has as expected, increased its base of run-rate

revenues and demonstrated a track record in converting

opportunities from initial conversations, through trials to initial

commercial agreements, we will be in a position to communicate the

size and value of our near term and longer term pipeline as well as

other related financial KPIs.

It is the Board's intention to release a year-end trading update

in April 2022 outlining what we believe to be the relevant KPIs for

Insig AI and how we aim to address each of them.

Including our Sport in Schools business, Group revenue was

GBP0.9 million and the operating loss for the period before

exceptional items which related to the cost of the reverse takeover

was GBP0.3 million. Whilst our core focus is on the machine

learning business, it is encouraging to note the resilience of the

Sports in Schools business and its operating profitability.

At 30 September 2021, net cash was GBP2.3 million. This excluded

a receipt of GBP0.7 million in relation to our R&D tax credit.

This was received after the period end.

It is rare for a business to be in the right place at the right

time. We are at the intersection of ESG and the AI market. The

demand for data driven tools has been further amplified by the

global focus on ESG investing and regulation.

As a tech company, we are well set up to enable our team to work

remotely. When Covid hit and lockdown was enforced, the transition

to home working appeared seamless. Whilst our machine learning

tools do not require personal interaction, when it comes to

creativity, we all benefit from not being confined to a virtual

means of communication. Whilst this is of course beyond our

control, I hope that 2022 will see a return to normality.

Having the necessary skills to take advantage of what the market

opportunity has to offer is essential. I am therefore delighted

that Colm is now our Chief Commercial Officer. He has already

demonstrated his worth, using techniques to better showcase our

technology, but crucially, other steps to both accelerate as well

as improve the likelihood of moving from product trials to

contracted revenues.

I am proud of the work that we have delivered to CarVal and I'm

hugely excited about supporting its business in 2022. This is a

huge and important opportunity for Insig AI. Whilst CarVal is

clearly a market leader, when it comes to ESG, the US market lacks

the appetite that we have seen in the UK, France and Germany.

Therefore, for 2022, these markets will be our geographical

focus.

In terms of personnel, we have a rich source of talent. However,

at 32, numerically, our team is small. In recent months, much work

has been done to focus our team and allocate our resources

efficiently. We have been putting the tools and people in place to

do so. I fully expect further hires will be required in due course

but will be muted in the second half of the year, whilst we focus

on converting the current pipeline. However, by the summer, we will

likely continue to expand assuming the business case supports

this.

Our objective and focus is clear. Revenue that is scalable,

repeatable, and growing aggressively. We are now well positioned to

deliver on this objective.

Current trading and outlook

Each month continues to be busier than the last and I fully

expect this to continue. Since 1 October, we have released Insig

Portfolio 2, delivered our ESG scoring solution to Carval,

appointed Colm McVeigh as Chief Commercial Officer, completed the

acquisition of FDB and closed three new contract wins, two of which

we have already announced.

I am pleased to report that both in the coming quarter and

beyond, I expect this momentum to build very significantly. We have

multiple opportunities: within the asset management industry, most

notably for our ESG data scoring, bespoke ESG solutions, corporate

sales and our data sourcing and machine learning analytics. Our

Portfolio Insights tool can now be incorporated into our ESG

solutions. We are also excited to progress our partnership revenue

share opportunities, where the scale of revenue streams can be a

multiple of a SaaS sale. Beyond the asset management industry, the

4Bio contract win has shown that we are able to apply our machine

learning capabilities to other sectors. In the New Year, I hope to

be able to provide further evidence of our ability to sell to

another vertical. The coming quarter and 2022 should demonstrate

our ability to secure multiple contract wins, as we successfully

leverage our machine learning technology and exploit it, so it

fuels fast growing and increasingly higher margin revenues. I look

forward to a very exciting 2022.

Steven Cracknell

21 December 2021

Consolidated statement of comprehensive income for the 6 months

ended 30 September 2021

Unaudited Unaudited

6 months 6 months

ended 30 ended 30

September September

2021 2020

GBP000 GBP000

Revenues from trading activity 896 196

Cost of revenues (477) (281)

419 (85)

Administrative expenses (2,215) (567)

Amortisation of intangible assets (204) -

Other operating income:

Realised gain on share investment 1,436 -

Coronavirus Job Retention Scheme and

local government grants 106 364

Operating loss from continuing activities (458) (288)

Finance income 4 1

Finance costs (15) -

Loss before exceptional item (469) (287)

Exceptional items - non- recurring

costs (375) -

----------- -----------

Loss before taxation (844) (287)

Taxation 194 -

----------- -----------

Loss after taxation from continuing

activities (650) (287)

Other comprehensive income - -

Total comprehensive loss (650) (287)

=========== ===========

Attributable to:

Owners of the company (663) (277)

Non-controlling interests 13 (10)

--------------------- ----------

(650) (287)

===================== ==========

Loss per share (basic and diluted)

Loss per share from continuing activities (0.0074)p (0.0069)p

Consolidated statement of financial position as at 30 September

2021

Unaudited Audited

At 30 September At 31 March

2021 2021

GBP000 GBP000

Non- current assets

Unlisted investments - 1,500

Goodwill and patents 26,677 60

Development costs 5,035 -

Property, plant and equipment 347 54

Total non-current assets 32,059 1,614

------------------ -------------

Current assets

Trade and other receivables 1,595 397

Cash and cash equivalents 2,274 935

------------------ -------------

Total current assets 3,869 1,332

------------------ -------------

Total assets 35,928 2,946

Current liabilities - due within 12

months

Trade and other payables 524 566

Leasing commitments 8 8

Convertible unsecured loan notes - 414

Bank loan - (unsecured) 36 36

------------------ -------------

Total current liabilities 568 1,024

------------------ -------------

Non-current liabilities - due after

12 months

Leasing commitments 296 38

Bank loan - (unsecured) 195 204

Deferred taxation 617 -

------------------ -------------

Total non-current liabilities 1,108 242

------------------ -------------

Total liabilities 1,676 1,266

NET ASSETS 34,252 1,680

================== =============

Equity

Share capital 3,040 2,480

Share premium 35,154 3,040

Merger reserve 976 326

Other reserves - 102

Retained earnings (4,865) (4,202)

Equity attributable to owners of the

company 34,305 1,746

Non-controlling interest (53) (66)

TOTAL EQUITY 34,252 1,680

================== =============

Consolidated statement of changes in equity for the 6 months

ended 30 September 2021

Unaudited Audited

6 months 15- month

ended period ended

30 September 31 March

2021 2021

GBP000 GBP000

Total equity at the beginning of the period 1,680 554

Issue of shares 33,131 2,063

Share issue costs (435) (22)

Share based payments - 23

Merger reserve on acquisition of Insig

Partners Limited 650 -

Equity component of convertible loan notes (124) 124

Loss for the period (650) (1,062)

Total equity at end of the period 34,252 1,680

============== ==============

Consolidated statement of cash flows for the 6 months ended 30

September 2021

Unaudited Unaudited

6 months 6 months

ended 30 ended 30

September September

2021 2020

GBP000 GBP000

Operating cash flow

Loss from continuing activities (844) (287)

Adjustments for:

Finance income (4) (1)

Finance expense 15 -

Share based payments -

Depreciation and amortisation 1,178 3

Working capital on susidiary acquisition (410) -

Realised gain on share investment (1,436) -

Operating cash flow before working capital

movements (1,501) (285)

Increase in receivables (105) (31)

Decrease in payables (42) (21)

Net cash absorbed by operations (1,648) (337)

-----------

Cash flow from investing activities

Development expenditure (1,182) -

Property, plant and equipment acquired (6) -

Finance income 4 1

Net cash used in investing activities (1,184) 1

----------- ------------

Financing activities

Funds from share issues 6,145 -

Cash consideration to shareholders of the (1,442) -

acquired company

Share issue costs paid (435) -

Funds from bank loan - 240

Finance expense (10) -

Repayment of leasing liabilities and bank (87) -

borrowings

Net cash from financing activities 4,171 240

----------- ------------

Net increase/(decrease) in cash and cash

equivalents 1,339 (96)

Cash and cash equivalents at the beginning

of the period 935 461

Cash and cash equivalents at the end of the

year 2,274 365

=========== ============

Notes to the financial statements for the 6 months ended 30

September 2021

1. General information

Insig AI Plc (the "Company") is a company domiciled in England

and its registered office address is 30 City Road, London EC1Y 2AB.

The condensed consolidated interim financial statements of the

Company for the 6 months ended 30 September 2021 comprise the

Company and its subsidiaries (together referred to as the

"Group").

The condensed consolidated interim financial statements do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006.

The consolidated financial position at 31 March 2021 has been

extracted from the statutory accounts and the auditors' report on

those statutory accounts was unqualified. A copy of those accounts

has been filed with the Registrar of Companies.

The Group has presented its results in accordance with the

measurement principles set out in International Financial Reporting

Standards as adopted by the EU ("IFRS") using the same accounting

policies and methods of computation as were used in the annual

financial statements for the 15 months ended 31 March 2021 with

exception of the application of new accounting standards. As

permitted, the interim report has been prepared in accordance with

the AIM rules for companies but is not compliant in all respects

with IAS34 'Interim Financial Statements'.

The condensed consolidated interim financial statements do not

include all the information required for full annual financial

statements and therefore cannot be construed to be in full

compliance with IFRS.

The condensed consolidated interim financial statements were

approved by the board and authorised for issue on 21 December

2021.

2. Acquisition of Insig Partners Limited (formerly Insight Capital Limited)

On 10 May 2021, the Company acquired the balance of shares in

Insig Partners Limited's not already owned and obtained

control.

To facilitate the acquisition of Insig Partners Limited, in May

2021 the Group raised GBP6.1 million (before expenses) via a

placing of 9,172,375 new ordinary shares of 1 pence each of the

Company ("Ordinary Shares") at 67 pence per share, a 14 per cent.

premium to the closing share price of the Ordinary Shares which was

59 pence per share on 3 September 2020, being the last business day

before the Ordinary Shares were suspended from trading.

The funds were used to pay the cash element of the consideration

paid to acquire the Insig Partners Limited shares of GBP1,442,000,

to settle in cash professional costs relating to the acquisition

and issue of the shares of GBP1,006,000 of which GBP670,000 was

incurred in the six month period ended 30 September 2021 and for

general working capital purposes, namely investing in the enlarged

Group's team of developers, engineers and sales and marketing

employees to accelerate product growth and business development

activities.

In addition to the cash consideration, 44,819,161 new Ordinary

Shares were issued at 59 pence per share, the closing middle market

price of 59 pence per Ordinary Share on 3 September 2020 (being the

last business day before the Ordinary Shares were suspended) as

consideration shares to the former owners of Insig Partners

Limited.

The convertible loan notes issued by the Company were converted

in May 2021 into 2,000,000 new Ordinary Shares issued at 25 pence

per share.

The following number of Ordinary Shares were admitted to trading

on AIM on 10 May 2021:

No.

Placing Shares 9,172,375

Consideration Shares 44,819,161

Convertible Loan Note Shares 2,000,000

Following the issue of the new Ordinary Shares, the Company has

98,653,174 Ordinary Shares in issue with full voting rights.

Total transaction costs are summarised below as follows:

Transaction costs Charged

against Share premium

comprehensive issue costs

income Total costs

GBP000 GBP000 GBP000

Costs recognised to 31 March 2021 314 22 336

Costs incurred and paid to 30 September 235 435 670

Total 549 457 1,006

--------------- --------------- ------------

The acquisition was classified as a reverse takeover under the

AIM rules. The directors have given consideration to the method of

accounting to be applied and concluded that it meets the definition

of a business combination under IFRS 3 and Insig AI Plc has been

identified as the accounting acquirer for these purposes. The Group

has accounted for the acquisition by applying the acquisition

method of accounting, rather than applying reverse accounting under

IFRS 3.

The investment in Insig Partners Limited will be recognised at

the fair value of the consideration given:

GBP000

Consideration shares issued - 44,819,161 shares 30,029

Cash consideration 1,442

---------

Total consideration 31,471

Fair value of net assets on acquisition (see below) (4,650)

---------

Goodwill recognised on acquisition 26,821

---------

The value of the consideration shares has been determined in

accordance with IFRS 3 applying the acquisition-date fair values of

the equity interests issued by the acquirer. The fair value on the

acquisition date is considered to be 67 pence per share, being the

price at which the placing shares were issued on the same day.

Goodwill referred to above forms part of the total goodwill

included in non- current assets before amortisation.

As the Company held an interest in Insig Partners Limited prior

to the acquisition in May 2021, the fair value of which amounted to

GBP2,936,000, the Group has therefore recognised a gain of

GBP1,436,000 over the original cost of investment because of

measuring at fair value its 9.4 per cent. equity interest in Insig

Partners Limited held before the business combination. This gain

has been included in other income in the Company's statement of

comprehensive income.

The identifiable assets and liabilities on acquisition

comprised:

GBP000

Cash 180

Financial assets 1,084

Property, plant and equipment 345

Identifiable Intangibles 4,749

Financial liabilities (1,708)

-------

Total consideration 4,650

=======

No fair value adjustments are considered necessary at the date

of these financial statements other than in relation to

identifiable intangible assets as referred to below.

Goodwill of GBP26,821,000 from this acquisition is based on the

book values of Insig Partners Limited as set out above and arises

largely from the expected growth in the AI and machine learning

industry and collective expertise of the workforce in developing

and delivering the business's product range. The allocation between

amounts recognised as goodwill includes the fair value on

acquisition of customer lists of GBP5,200,000 which is subject to

amortisation over 10 years. The amortisation recognised in these

financial statements is GBP204,000. The remaining goodwill on

acquisition of GBP21,621,000 representing the valuation of

intellectual property has not yet been assessed for any fair value

adjustments and will be subject to an annual impairment review at

the Group's year end 31 March 2022.

3. Basic and diluted loss per share

Comprehensive loss per share for the six months ended 30

September 2021 has been calculated on the comprehensive loss

attributable to owners of the Company of GBP663,000 and on the

weighted average number of shares in issue during the period of

89,182,000.

Comprehensive loss per share for the 6 months ended 30 September

2020 has been calculated on the comprehensive loss attributable to

owners of the Company of GBP277,000 and on the weighted average

number of shares in issue during the period of 39,702,000.

In view of Group losses for all periods, share options and

warrants to subscribe for ordinary shares in the Company are

anti-dilutive and therefore diluted earnings per share information

is not presented.

4. Impact of the Covid-19 pandemic

As indicated in our most recent annual report for the 15 months

ended 31 March 2021, Sport in Schools (SSL) have continued their

recovery and have returned to trading profitably following cost

cutting and other operating efficiencies implemented during the

periods of lockdown in 2020 as well as having taken full advantage

of the Government's extended Covid-19 business support schemes

which continued into 2021 and mitigated the adverse financial

impact of renewed school closures earlier in 2021.

With schools having re-opened and many activities continuing at

broadly pre-pandemic levels, the directors are hopeful that SSL

revenue and profitability will continue. However, as we have seen

previously, the ongoing impact of the global pandemic continues to

evolve and it is difficult for the directors to predict with

certainty whether there will be further restrictions to school

operations and sporting activities that would once again affect SSL

operations.

The pandemic has had little financial impact on the Group's

machine learning activities following its acquisition of Insig

Partners Limited in May 2021.

5. Business segment analysis

Machine

learning Sports

Technology & Leisure Total

GBP000 GBP000 GBP000

Turnover 217 679 896

Costs attributable to segment (1,440) (578) (2,018)

Segmental operating profit/(loss) (1,223) 101 (1,122)

================ =================

Group operating expenses (568)

Amortisation of goodwill (204)

Gain on rebasing 9.4% initial investment

to fair value 1,436

Operating loss (458)

Non- recurring costs - see note below (375)

Finance income 4

Finance costs (15)

-----------------

(386)

--------------------

Loss before tax from all activities (844)

Taxation credit 194

Loss after tax from all activities (650)

====================

-- Non-recurring costs of GBP375,000 comprise fees paid

following the acquisition of Insig Partners Limited of GBP235,000

and share transaction stamp duty of GBP140,000 taken to the

comprehensive income statement.

-- The loss in the six months to 30 September 2020 set out in

the Consolidated Statement of Comprehensive Income arose from the

Group's sports and leisure activities.

6. Related party transactions.

The following related party transactions were recognised in the

six-month period to 30 September 2021:

On 20 April 2021 the Company entered into an acquisition

agreement with Steve Cracknell, Warren Pearson, Anna Mann and

Nikhil Srinivasa (the "Principal Insight Sellers") to acquire their

shareholdings in Insight Partners Limited. The consideration paid

by the Company to the Principal Insight Sellers was, in aggregate,

28,405,979 consideration shares at a price of 59 pence per Ordinary

Share and an aggregate cash payment of GBP812,329.

On 20 April 2021 the Company also entered into a minority

acquisition agreement with each of the other shareholders of

Insight Partners Limited (the "Minority Insight Sellers"). The

consideration paid by the Company to the Minority Insight Sellers

was, in aggregate, 9,783,431 consideration shares at a price of 59

pence per Ordinary Share and an aggregate cash payment of

GBP339,727.

Richard Bernstein

Following the completion of the Company's acquisition of Insig

Partners Limited in May 2021 and prior to his appointment as a

director in August 2021, a payment of GBP352,629 (including vat)

was paid to Mr Bernstein in accordance with an introduction

agreement made between himself and the Company in February 2018 in

which he as introducer would become entitled to a fee of 1% of the

value from this first acquisition by the Company.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGWPPUPGPUG

(END) Dow Jones Newswires

December 22, 2021 02:00 ET (07:00 GMT)

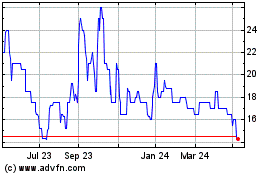

Insig Ai (LSE:INSG)

Historical Stock Chart

From Jun 2024 to Jul 2024

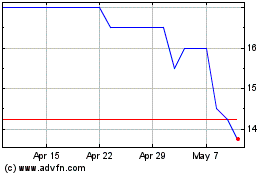

Insig Ai (LSE:INSG)

Historical Stock Chart

From Jul 2023 to Jul 2024