AIM Schedule One - Catena Group PLC (0859W)

April 21 2021 - 3:00AM

UK Regulatory

TIDMCTNA

RNS Number : 0859W

AIM

21 April 2021

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

Catena Group plc - to be renamed Insig AI plc from Admission

(subject to shareholder approval)

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES):

30 City Road, London, EC1Y 2AB

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

Current: www.catenagroup.co.uk

From Admission: www.insg.ai 10 May 2021

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

Catena Group plc ("Catena") is a UK-based AIM-listed holding

company, which is focused on acquiring and growing businesses

operating in high performing industries.

In line with this strategy, on 4 March 2020, Catena acquired

a 9.1 per cent. interest in the ordinary share capital of Insight

Capital Partners Limited ("Insight"). On 3 September 2020,

the Company announced that discussions had commenced with respect

to Catena potentially acquiring the balance of the issued share

capital of Insight (the "Proposed Acquisition").

Insight, which is based in the UK, is a data science and machine

learning solutions company that provides bespoke web-based

applications, advanced analytical tools and modern technology

infrastructure to make machine learning accessible to investment

professionals. Insight has developed five products specifically

aimed at accelerating an asset manager's data science and machine

learning strategy.

Pursuant to Rule 14 of the AIM Rules for Companies, the Proposed

Acquisition constitutes a reverse takeover. Shareholder approval

for the Proposed Acquisition is being sought at a general meeting

convened for 7 May 2021.

In conjunction with the Proposed Acquisition, a resolution

will be put to shareholders at the general meeting to approve

a change in the Company's name to Insig AI plc.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

Between 92,023,423 and 99,145,399 ordinary shares of 1 pence

each ("Ordinary Shares"), comprising:

* 42,661,638 existing Ordinary Shares

* 9,172,375 Ordinary Shares to be issued at 67p per

share pursuant to the placing

* Between 38,189,410 and 45,311,386 Ordinary Shares to

be issued at 59p per share pursuant to the Proposed

Acquisition (the "Consideration Shares")

* 2,000,000 Ordinary Shares to be issued in respect of

a convertible loan note on completion of the Proposed

Acquisition

The actual number of Consideration Shares will only become

known once the Insight option holders exercise their rights

to receive between 6,611,179 Consideration Shares and GBP301,370

cash, and 7,121,976 and GBPnil cash. To the extent that any

of the Insight option holders do not exercise their rights,

then they will not receive any Consideration Shares This will

be confirmed by close of business on 7 May 2021

No shares are held in treasury

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

Capital to be raised on Admission approximately GBP6.1 million

pursuant to the placing

Anticipated market capitalisation on admission to AIM: approximately

GBP66.4 million (based on the placing price and assuming the

Insight option holders exercise their rights to receive the

maximum entitlement to Consideration Shares and GBPnil cash)

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

Between 49.4% and 51.8% depending on the extent to which any

Insight option holders (i) allow their options to lapse or

(ii) exercise their rights to receive the maximum entitlement

to Consideration Shares and GBPnil cash

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Matthew Todd Farnum-Schneider (Executive Chairman)

Steven (Steve) Wallace Cracknell (Chief Executive Officer)

Warren Paul Pearson (Chief Technical Officer)

John Christopher Murray (Independent Non-Executive Director

)

Peter Lee Rutter (Independent Non-Executive Director)

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Before Admission Following Admission

Shares held % Shares held %(1) %(2)

------------ ----- ------------ ----- -----

Richard Bernstein 11,721,000 27.5 11,821,000 11.9 12.8

------------ ----- ------------ ----- -----

David Kyte 2,567,547 6.0 2,900,880 2.9 3.2

------------ ----- ------------ ----- -----

Richard Owen 2,694,672 6.3 2,694,672 2.7 2.9

------------ ----- ------------ ----- -----

Carole Rowan 2,000,000 4.7 2,000,000 2.0 2.2

------------ ----- ------------ ----- -----

Schroders & Co Bank

AG 2,000,000 4.7 2,000,000 2.0 2.2

------------ ----- ------------ ----- -----

Steven (Steve) Cracknell - - 10,818,293 10.9 11.8

------------ ----- ------------ ----- -----

Nikhil Srinivasan - - 7,599,936 7.7 8.3

------------ ----- ------------ ----- -----

Mark Woodhouse - - 5,048,537 5.1 5.5

------------ ----- ------------ ----- -----

Anna Mann - - 5,438,600 5.5 5.9

------------ ----- ------------ ----- -----

Warren Pearson - - 4,808,131 4.8 5.2

------------ ----- ------------ ----- -----

(1.) Assuming the Insight option holders exercise their rights

to receive the maximum entitlement to Consideration Shares

(2.) Assuming the Insight option holders allow their options

to lapse and therefore receive no Consideration Shares

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

None

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 31 March

(ii) With respect to Insight Capital Partners Limited, 30 September

2020 (audited interim information)

With respect to Catena Group plc, in accordance with AIM Rule

28, no historical financial information is provided in the

admission document

(iii) 30 September 2021 (audited financial information for

the year ending 31 March 2021)

31 December 2021 (unaudited interims for the six months ending

30 September 2021)

30 September 2022 (audited financial information for the year

ending 31 March 2022)

EXPECTED ADMISSION DATE:

10 May 2021

NAME AND ADDRESS OF NOMINATED ADVISER:

Zeus Capital Ltd

82 King Street

Manchester

M2 4WQ

10 Old Burlington Street

London

W1S 3AG

NAME AND ADDRESS OF BROKER:

Zeus Capital Ltd

10 Old Burlington Street

London

W1S 3AG

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

A copy of the admission document containing full details about

Catena Group plc and Insight Capital Partners Limited and the

admission of Catena Group plc's securities will be available

on the Company's website www.catenagroup.co.uk

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

QCA Corporate Governance Code

DATE OF NOTIFICATION:

21 April 2021

NEW/ UPDATE:

New

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAFLFFRSLIIFIL

(END) Dow Jones Newswires

April 21, 2021 03:00 ET (07:00 GMT)

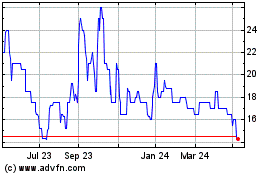

Insig Ai (LSE:INSG)

Historical Stock Chart

From Jun 2024 to Jul 2024

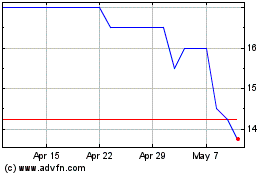

Insig Ai (LSE:INSG)

Historical Stock Chart

From Jul 2023 to Jul 2024