TIDMIHP

RNS Number : 8862S

IntegraFin Holdings plc

19 July 2022

LEI Number: 213800CYIZKXK9PQYE87

IHP Group quarterly update - Q3 of financial year 2022

19 July 2022

Headlines

-- Our gross inflows for the quarter were GBP1.7bn and our net

inflows over the same period were GBP1.0bn. Furthermore, our gross

inflows and net inflows for the financial year to date remain ahead

of the prior year comparative. This is a solid performance,

considering the economic and market headwinds in 2022.

-- The average daily funds under direction ('FUD') for the

quarter was GBP51.9bn, this was lower than both Q1 and Q2 of

financial year 2022, due to the adverse impact of market

movements.

-- The rate at which new clients and advisers are joining the

platform remains consistently strong and provides a solid basis for

ongoing platform growth.

-- In this quarterly update we also provide cost guidance,

including further information on the phasing of the investment in

additional IT and software development staff that we announced at

our FY22 half year reporting.

Quarter ended Quarter ended Financial Financial

year year

to date to date

--------------------

30 June 2022 30 June 2021 30 June 2022 30 June 2021

GBPm GBPm GBPm GBPm

Opening FUD 53,500 46,929 52,112 41,093

Inflows 1,703 1,994 5,770 5,728

Outflows -703 -657 -2,089 -2,084

Net Flows 1,000 1,337 3,681 3,644

Market movements -4,152 2,112 -5,321 5,744

Other movements(1) -48 -68 -172 -171

Closing FUD 50,300 50,310 50,300 50,310

Average daily

FUD for the

period 51,889 48,677 52,655 45,698

Notes:

(1) Includes fees, taxes and investment income.

Alex Scott, Chief Executive Officer, commented:

I am pleased to report a robust quarter of inflows on to our

platform. Net inflows were GBP1.0bn in spite of a difficult

economic and market environment. Outflows remained broadly in line

with previous quarters.

The net inflows on to the platform, together with strong and

consistent rates of new clients joining the platform (17,949 added

to date in FY22, compared to 17,942 for the comparative period in

FY21), and newly registered advisers (546 added to date in FY22,

compared to 522 for the comparative period in FY21), is testament

to the strength of the investment platform offering.

Platform FUD at the end of the third quarter had reduced to

GBP50.3bn as a result of continuing macro-economic and

geo-political events impacting both stock and bond markets. This

has had a corresponding impact on our core platform revenue.

We announced in our HY22 reporting that we would be increasing

investment in IT and software development. We now provide guidance

on the previously announced 50 IT and software development staff to

be recruited in FY22 and FY23 mainly in relation to the Transact

platform.

-- This investment in IT and software development will deliver

enhancements to our proprietary investment platform and back office

software - with enhanced functionality for UK clients and their

advisers. Furthermore, this investment will enable us to implement

enhanced straight through processing of our operational activities,

meaning that we improve our operational efficiencies and the cost

effective scalability of our investment platform. This will reduce

the additional operational staff required to service additional

clients and advisers from FY25.

-- With recruitment made to date we expect a total Group staff

cost increase of 16% for the full financial year 2022 (excluding

T4A post combination remuneration), compared to the prior year

(FY21 total Group staff costs: GBP41.6m). We expect a similar level

of percentage increase of total Group staff costs for financial

year 2023. Total Group staff costs are then expected to increase by

9% in FY24. This guidance includes the expected impact of

continuing higher wage inflation.

-- We confirm that after these IT and software development staff

have been recruited, we then do not expect any material levels of

recruitment in these areas in the period to end of FY27.

We also provide guidance on the other key areas of Group

costs:

-- We received a significant one-off business rate rebate in

FY21. Allowing additionally for a significant increase in energy

costs we expect occupancy costs to increase by 72% for the full

financial year 2022 compared to the prior year (FY21: GBP1.4m). In

FY23 we expect occupancy costs to increase by 5%.

-- Regulatory and professional fees are expected to increase by

28% for the full financial year 2022, compared to the prior year

(FY21: GBP7.6m). This is driven by an increase in regulatory fees,

and an increase in professional fees to support our ongoing

regulatory requirements as a growing business. We then expect these

costs to increase by a single digit percentage in FY23.

-- Other costs are expected to increase by 24% for the full

financial year 2022 compared to the prior year (FY21: GBP3.9m).

This is driven by an increase of sales and marketing activity in

the period since lockdown restrictions were significantly reduced,

and due to an increase in IT equipment that has been expensed. We

then expect these costs to increase by 14% in FY23.

The Transact platform rate of net inflows, and the rate of

addition of new clients and advisers, gives me every confidence

that there is a strong pipeline for future platform growth.

Additionally, the software and system enhancements that we are

making to the Transact platform mean that we will continue to

provide the premier advised platform service in the UK.

T4A's development of the new CURO 365 software is progressing

well, and remains on target to be released for beta testing with a

major adviser firm client later this year.

The demand for financial advice is as strong as ever. There are

significant opportunities for the IHP Group in the growing advised

market in which we operate. Therefore, as we have done for over 20

years, we will continue to support UK clients and their financial

advisers. I believe it is our combination of in-house proprietary

technology, best in class service standards, and resilient and

efficient infrastructure, which makes our business model unique and

means we are well placed to lead in this sector. I look forward to

delivering value for our key stakeholders through the enhancements

that we will implement.

Historical flow and FUD data by quarter

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

FY20 FY21 FY21 FY21 FY21 FY22 FY22 FY22

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Opening FUD 39,711 41,093 44,824 46,929 50,310 52,112 54,539 53,500

Inflows 1,291 1,581 2,153 1,994 1,967 1,976 2,092 1,703

Outflows -560 -741 -686 -657 -660 -688 -697 -703

Net Flows 731 840 1,467 1,337 1,307 1,288 1,395 1,000

Market movements 690 2,938 694 2,112 553 1,207 -2,376 -4,152

Other movements

(1) -39 -47 -56 -68 -59 -68 -58 -48

Closing FUD 41,093 44,824 46,929 50,310 52,112 54,539 53,500 50,300

Average daily

FUD for the

period 40,607 42,905 45,873 48,677 51,647 53,514 52,551 51,889

Notes:

(1) Includes fees, taxes and investment income.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 ("EUWA")) (" UK MAR")

Enquiries

Investors

Luke Carrivick, Head of Investor

Relations +44 020 7608 5463

Media

Lansons: Tony Langham +44 (0)7979692287

Lansons: Maddy Morgan-Williams +44 (0)7947364578

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBKFBQFBKDKOD

(END) Dow Jones Newswires

July 19, 2022 02:00 ET (06:00 GMT)

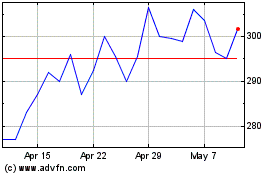

Integrafin (LSE:IHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

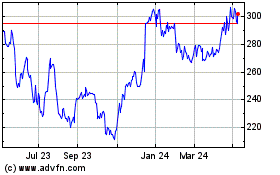

Integrafin (LSE:IHP)

Historical Stock Chart

From Jul 2023 to Jul 2024