Half Yearly Report

July 20 2009 - 11:30AM

UK Regulatory

TIDMHVT

RNS Number : 8189V

Heavitree Brewery PLC

20 July 2009

The Heavitree Brewery PLC

Trood Lane

Matford

Exeter EX2 8YP

Date:20 July 2009

Contact:Graham Crocker - Managing Director - 01392 217733

Rod Glanville - Director and Company Secretary - 01392 217733

Pascal Keane - Shore Capital - 0207 468 7995

Following a meeting by a duly authorised committee of the Board of Directors

held today, 20 July 2009, the Directors announce the interim results for the six

months ended 30 April 2009.

Chairman's statement

I reported at this year's Annual General Meeting that following our decision to

restructure the business and to close our Managed House operation (Heavitree

Inns), the challenge was then to return the pubs operated by Heavitree Inns to

tenancy or leasehold as efficiently as possible. I am pleased to report that at

the time of writing only one of these houses remains under the Heavitree Inns

umbrella and a lease contract has now been agreed. Completion is expected to be

imminent. This in the present climate is an excellent achievement by the

Managing Director and the operational team and we look forward to a long and

mutually beneficial relationship with the new operators of these houses.

RESULTS.

Turnover for the Group decreased against last year by 18% to GBP4,944,000. This

was expected because as the number of Managed Houses has reduced so the

associated retail sales have been lost to turnover. Group Operating Profit is

GBP269,000 (2008: GBP130,000 loss). Profit before taxation for the six month

period was GBP387,000 after restructuring costs of GBP256,000 to date, finance

costs and the sale of three properties and a small piece of land (2008 :

GBP185,000).

DIVIDEND.

The Directors recommend an interim dividend of 3.5p per Ordinary and 'A' Limited

Voting Ordinary Share (2008 - Nil).

PROPERTIES.

The King's Arms in South Zeal, The Old Rydon in Kingsteignton, and The Heavitree

Arms in Bideford were sold. Also a small piece of land at Sandford was sold.

These transactions realised a book profit before tax totalling GBP503,000.

Since 30 April 2009 the Company has accepted an offer on, and completed the sale

of The Hub in Exeter.

PENSION SCHEME.

The triennial actuarial funding review has been completed and the deficit for

the closed final salary Pension Scheme stands at GBP4.5 m at the 1 May 2009.

This is not a fixed figure as every 3 years further valuations will be required.

However, it is a lesser figure than previously feared and I can confirm that the

Directors have informed the Trustees that the Company will meet its funding

obligations through annualised deficit correction payments.

AUDITORS

It was resolved at the Annual General Meeting to re-elect Messrs Ernst and Young

LLP to serve as the Company's auditors. Following a restructure of their

business Messrs Ernst and Young LLP have resigned and Messrs Francis Clark

Chartered Accountants have been appointed as the Company's auditors in their

place.

BOARD CHANGES.

Matthew Pease-Watkin resigned from the Board of Directors on 8 May 2009 owing to

external commitments. Matthew joined the Board in June 1999 and his dedication

and contribution to the Company will be missed. The Board would like to extend

its gratitude for his 10 years of service.

Katherine Pease-Watkin has been appointed as a non-executive director as of 1

July 2009 and will stand for election at the next Annual General Meeting.

PROSPECTS.

The decisions that the Company made after last year's strategic review have

resulted in a steady performance for the half-year. The interim dividend

reflects this whilst recognising that caution is still needed at a time when the

winds of uncertainty continue to buffet our industry as a whole.

N H P TUCKER

Chairman

Consolidated income statement (unaudited)

for the six months ended 30 April 2009

+----------------------------------------------+--------+---------+---+---------+

| | | 2009 | | 2008 |

+----------------------------------------------+--------+---------+---+---------+

| | Note | GBP | | GBP |

| | | '000 | | '000 |

+----------------------------------------------+--------+---------+---+---------+

| Revenue | | 4,944 | | 6,054 |

+----------------------------------------------+--------+---------+---+---------+

| Change in stocks | | (74) | | (14) |

+----------------------------------------------+--------+---------+---+---------+

| Other operating income | | 40 | | 25 |

+----------------------------------------------+--------+---------+---+---------+

| Purchase of inventories | | (1,866) | | (2,210) |

+----------------------------------------------+--------+---------+---+---------+

| Staff Costs | | (1,305) | | (1,893) |

+----------------------------------------------+--------+---------+---+---------+

| Depreciation of property, plant and | | (225) | | (278) |

| equipment | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Other operating charges | | (1,245) | | (1,814) |

+----------------------------------------------+--------+---------+---+---------+

| | | (4,675) | | (6,184) |

+----------------------------------------------+--------+---------+---+---------+

| Group operating profit/ (loss) | | 269 | | (130) |

+----------------------------------------------+--------+---------+---+---------+

| Profit on disposal of non-current assets | | 503 | | 566 |

+----------------------------------------------+--------+---------+---+---------+

| Group profit before finance costs, taxation | | 772 | | 436 |

| and restructuring costs | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Restructuring Costs | | (256) | | - |

+----------------------------------------------+--------+---------+---+---------+

| Group profit before finance costs and | | 516 | | 436 |

| taxation | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Finance income | | 10 | | 4 |

+----------------------------------------------+--------+---------+---+---------+

| Finance costs | | (81) | | (209) |

+----------------------------------------------+--------+---------+---+---------+

| Other finance costs-pensions | | (58) | | (46) |

+----------------------------------------------+--------+---------+---+---------+

| | | (129) | | (251) |

+----------------------------------------------+--------+---------+---+---------+

| Profit before taxation | | 387 | | 185 |

+----------------------------------------------+--------+---------+---+---------+

| Tax (expense) | | (55) | | (31) |

+----------------------------------------------+--------+---------+---+---------+

| Profit for the period | | 332 | | 154 |

+----------------------------------------------+--------+---------+---+---------+

| | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Earnings per share | 2 | 6.5p | | 2.94p |

| - basic | | 6.5p | | 2.94p |

| - diluted | | | | |

+----------------------------------------------+--------+---------+---+---------+

Group statement of total recognised income and expense (unaudited)

for the six months ended 30 April 2009

+----------------------------------------------+--------+--------+---+--------+

| | | 2009 | | 2008 |

| | | GBP | | GBP |

| | | '000 | | '000 |

+----------------------------------------------+--------+--------+---+--------+

| Income and expense recognised directly in | | | | |

| equity | | | | |

+----------------------------------------------+--------+--------+---+--------+

| Exchange differences on translation of | | - | | 1 |

| foreign operations | | | | |

+----------------------------------------------+--------+--------+---+--------+

| Actuarial (losses) on defined benefit | | (400) | | (147) |

| pension plans | | | | |

+----------------------------------------------+--------+--------+---+--------+

| | | (400) | | (146) |

+----------------------------------------------+--------+--------+---+--------+

| Tax on items taken directly to or | | 112 | | 41 |

| transferred from equity | | | | |

+----------------------------------------------+--------+--------+---+--------+

| Net (expense) recognised directly in equity | | (288) | | (105) |

+----------------------------------------------+--------+--------+---+--------+

| Profit for the period | | 332 | | 154 |

+----------------------------------------------+--------+--------+---+--------+

| Total recognised income and expense for the | | 44 | | 49 |

| period | | | | |

+----------------------------------------------+--------+--------+---+--------+

| | | | | |

+----------------------------------------------+--------+--------+---+--------+

Dividends

The Directors declare an interim dividend of 3.5p per share (2008 - Nil) on the

Ordinary and 'A' Limited Voting Ordinary Shares. This dividend will be paid on

21 August 2009 to shareholders on the register at 31 July 2009.

Consolidated balance sheet (unaudited)

at 30 April 2009

+----------------------------------------------+--------+---------+---+----------+

| | | 2009 | | 2008 |

| | | GBP | | GBP |

| | | '000 | | '000 |

+----------------------------------------------+--------+---------+---+----------+

| Non-current assets | | | | |

+----------------------------------------------+--------+---------+---+----------+

| Property, plant and equipment | | 14,521 | | 15,912 |

+----------------------------------------------+--------+---------+---+----------+

| Financial assets | | 46 | | 77 |

+----------------------------------------------+--------+---------+---+----------+

| Deferred tax asset | | 389 | | 429 |

+----------------------------------------------+--------+---------+---+----------+

| | | 14,956 | | 16,418 |

+----------------------------------------------+--------+---------+---+----------+

| Current assets | | | | |

+----------------------------------------------+--------+---------+---+----------+

| Trade and other receivables | | 1,901 | | 2,259 |

+----------------------------------------------+--------+---------+---+----------+

| Inventories | | 89 | | 196 |

+----------------------------------------------+--------+---------+---+----------+

| Cash and short-term deposits | | 574 | | 441 |

+----------------------------------------------+--------+---------+---+----------+

| Assets held for sale | | 285 | | 594 |

+----------------------------------------------+--------+---------+---+----------+

| Total assets | | 17,805 | | 19,908 |

+----------------------------------------------+--------+---------+---+----------+

| Current liabilities | | | | |

+----------------------------------------------+--------+---------+---+----------+

| Trade and other payables | | (1,430) | | (2,370) |

+----------------------------------------------+--------+---------+---+----------+

| Financial liabilities | | (6,181) | | (8,313) |

+----------------------------------------------+--------+---------+---+----------+

| Income tax payable | | (142) | | (210) |

+----------------------------------------------+--------+---------+---+----------+

| Provisions | | - | | - |

+----------------------------------------------+--------+---------+---+----------+

| | | (7753) | | (10,893) |

+----------------------------------------------+--------+---------+---+----------+

| Non-current liabilities | | | | |

+----------------------------------------------+--------+---------+---+----------+

| Other payables | | (265) | | (251) |

+----------------------------------------------+--------+---------+---+----------+

| Financial liabilities | | (11) | | (11) |

+----------------------------------------------+--------+---------+---+----------+

| Deferred tax liabilities | | (368) | | (263) |

+----------------------------------------------+--------+---------+---+----------+

| Defined benefit pension plan | | (1,343) | | (1,510) |

+----------------------------------------------+--------+---------+---+----------+

| | | (1,987) | | (2,035) |

+----------------------------------------------+--------+---------+---+----------+

| Total liabilities | | (9,740) | | (12,928) |

+----------------------------------------------+--------+---------+---+----------+

| Net assets | | 8,065 | | 6,980 |

+----------------------------------------------+--------+---------+---+----------+

| Capital and reserves | | | | |

+----------------------------------------------+--------+---------+---+----------+

| Equity share capital | | 264 | | 264 |

+----------------------------------------------+--------+---------+---+----------+

| Capital redemption reserve | | 673 | | 673 |

+----------------------------------------------+--------+---------+---+----------+

| Treasury shares | | (994) | | (1,227) |

+----------------------------------------------+--------+---------+---+----------+

| Fair value adjustments reserve | | 26 | | 57 |

+----------------------------------------------+--------+---------+---+----------+

| Currency translation | | 3 | | - |

+----------------------------------------------+--------+---------+---+----------+

| Retained earnings | | 8,093 | | 7,211 |

+----------------------------------------------+--------+---------+---+----------+

| Total equity | | 8,065 | | 6,980 |

+----------------------------------------------+--------+---------+---+----------+

Group statement of cash flows (unaudited)

for the six months ended 30 April 2009

+----------------------------------------------+--------+---------+---+---------+

| | | 2009 | | 2008 |

+----------------------------------------------+--------+---------+---+---------+

| | | GBP | | GBP |

| | | '000 | | '000 |

+----------------------------------------------+--------+---------+---+---------+

| Operating activities | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Profit/(loss) for the period | | 269 | | (130) |

+----------------------------------------------+--------+---------+---+---------+

| Adjustments to reconcile operating | | | | |

| profit/loss for the period to net cash | | | | |

| inflow/ outflow from operating activities | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Depreciation and impairment of property, | | 225 | | 278 |

| plant and equipment | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Restructuring Costs | | 256 | | - |

+----------------------------------------------+--------+---------+---+---------+

| Share based payments | | 7 | | - |

+----------------------------------------------+--------+---------+---+---------+

| Decrease in inventories | | 74 | | 14 |

+----------------------------------------------+--------+---------+---+---------+

| (Increase) in trade and other receivables | | (105) | | (762) |

+----------------------------------------------+--------+---------+---+---------+

| (Decrease)/Increase in trade and other | | (118) | | 694 |

| payables | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Net pension charge | | (120) | | (158) |

+----------------------------------------------+--------+---------+---+---------+

| Cash generated from operations | | 488 | | (64) |

+----------------------------------------------+--------+---------+---+---------+

| Income taxes paid | | - | | (311) |

+----------------------------------------------+--------+---------+---+---------+

| Net cash inflow/(outflow) from operating | | 488 | | (375) |

| activities | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Investing activities | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Interest received | | 10 | | 4 |

+----------------------------------------------+--------+---------+---+---------+

| Proceeds from sale of property, plant and | | 712 | | 801 |

| equipment | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Payments to acquire property, plant and | | (273) | | (986) |

| equipment | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Net cash inflow/ (outflow) from investing | | 449 | | (181) |

| activities | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Financing activities | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Interest paid | | (81) | | (208) |

+----------------------------------------------+--------+---------+---+---------+

| Preference dividend paid | | (1) | | (1) |

+----------------------------------------------+--------+---------+---+---------+

| Equity dividends paid | | (356) | | (370) |

+----------------------------------------------+--------+---------+---+---------+

| Consideration received by EBT on sale of | | 49 | | 145 |

| shares | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Consideration paid by EBT on purchase of | | - | | (345) |

| shares | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Repurchase of shares | | - | | (1,899) |

+----------------------------------------------+--------+---------+---+---------+

| Net cash (outflow) from financing activities | | (389) | | (2,678) |

+----------------------------------------------+--------+---------+---+---------+

| | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Increase/(decrease) in cash and cash | | 548 | | (3,234) |

| equivalents | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Cash and cash equivalents at the beginning | | (6,155) | | (4,638) |

| of the period | | | | |

+----------------------------------------------+--------+---------+---+---------+

| Cash and cash equivalents at the period end. | | (5,607) | | (7,872) |

+----------------------------------------------+--------+---------+---+---------+

Group reconciliation of movements in equity (unaudited)

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | Equity | Capital | | Fair | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | share | redemption | Treasury | value | Currency | Retained | Total |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | capital | reserve | shares | adjustment | translation | earnings | equity |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | GBP 000 | GBP '000 | 'GBP000 | GBP '000 | GBP '000 | GBP '000 | GBP '000 |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| At 31 | 264 | 673 | (1248) | 38 | 3 | 8,603 | 8,333 |

| October | | | | | | | |

| 2008 | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| Total | | | | | | | |

| recognised | | | | | | | |

| income and | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| expense for | - | - | - | - | - | 44 | 44 |

| the period | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| Consideration | | | | | | | |

| received | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| by EBT on | | | | | | | |

| sale of | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| shares | - | - | 49 | - | - | - | 49 |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| Gain by EBT | | | | | | | |

| on sale | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| of shares | - | - | 205 | - | - | (205) | - |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| Equity | - | - | - | - | - | (356) | (356) |

| dividend | | | | | | | |

| paid | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| Fair value | - | - | - | (12) | - | - | (12) |

| adjustment | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| Share based | | | | | | 7 | 7 |

| payment | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| At 30 April | 264 | 673 | (994) | 26 | 3 | 8,093 | 8,065 |

| 2009 | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

| | | | | | | | |

+---------------+-----------+------------+------------+------------+-------------+------------+------------+

Equity share capital

The balance classified as share capital includes the total net proceeds (both

nominal value and share premium) on issue of the Company's equity share capital,

comprising 5p ordinary and 'A' limited voting ordinary shares.

Treasury shares

Treasury shares represents the cost of The Heavitree Brewery PLC shares

purchased in the market and held by The Heavitree Brewery PLC Employee Benefit

Trust ('EBT').

Notes to the interim results

1.Basis of preparation

These interim condensed and consolidated financial statements do not

constitute statutory accounts within the meaning of section 435 of the Companies

Act 2006.They have been prepared on the basis of the accounting policies that

will be complied with in the annual financial statements. The

accounting policies are drawn up in accordance with International Accounting

Standards (IAS) and International Financial Reporting Standards (IFRS) as issued

by the International Accounting Standards Board.These unaudited financial

statements were approved and authorised for issue by a duly appointed and

authorised committee of the Board of Directors on 20 July 2009.

2. Basic and diluted earnings per share

The calculation of basic earnings per ordinary share is based on earnings of

GBP332,000 (2008 :GBP154,000), being profit after taxation for the period, and

on 5,102,365 (2008 : 5,232,443) shares being the weighted average number of

Ordinary and 'A' Limited Voting Ordinary Shares in issue during the year after

excluding the shares owned by The Heavitree Brewery PLC Employee Benefits Trust

and those shares under option pursuant to the Employee Share Option Scheme.

Employee share options could potentially dilute basic earnings per share in the

future but are not included in the interim calculation of dilutive earnings per

share because they are antidilutive for the period presented. The Ordinary

Shares and the 'A' Limited Voting Ordinary Shares have equal dividend rights and

therefore no separate calculation of earnings per share for the different

classes has been given.

3. Segment information

Primary reporting format - Business segments

The primary segmental reporting format is determined to be business segments as

the Group's risks and rates of return are affected predominantly by differences

in the products and services provided.

The Group operates in two business segments; leased estate and managed estate.

Leased estate represents properties which are leased to tenants to operate

independently from the Group. Managed estate represents properties which are

owned, operated and maintained by the Group.

+-------------+------------+----------------+-------------------+-------------------+

| | 30 April 2009 | 30 April 2008 |

| | | |

+-------------+-----------------------------+---------------------------------------+

| | Revenue | Profit/(loss) | Revenue | Profit/(loss) |

| | GBP '000 | GBP '000 | GBP '000 | GBP '000 |

+-------------+------------+----------------+-------------------+-------------------+

| Leased | 3,448 | 163 | 3,585 | (31) |

+-------------+------------+----------------+-------------------+-------------------+

| Managed | 1,806 | (150) | 3,062 | (99) |

+-------------+------------+----------------+-------------------+-------------------+

| Intra group | (310) | - | (593) | - |

| sales | | | | |

+-------------+------------+----------------+-------------------+-------------------+

| Common | - | (129) | - | (251) |

| Costs | | | | |

+-------------+------------+----------------+-------------------+-------------------+

| Sale of | - | 503 | - | 566 |

| non-current | | | | |

| assets | | | | |

+-------------+------------+----------------+-------------------+-------------------+

| | 4,944 | 387 | 6,054 | 185 |

+-------------+------------+----------------+-------------------+-------------------+

4. Interim report

Copies of this announcement are available from the Company at Trood Lane,

Matford, Exeter EX2 8YP. The Company's interim report for the six months ended

30 April 2009 has been posted to shareholders today and will be available on our

website at www.heavitreebrewery.co.uk.

Ends.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZQLFFKDBZBBX

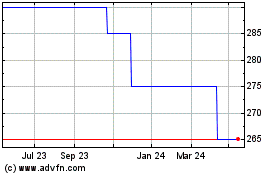

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

From Jun 2024 to Jul 2024

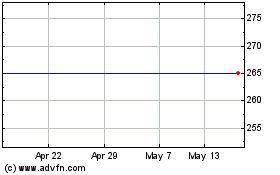

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

From Jul 2023 to Jul 2024