Helios Underwriting Plc 2023 Helios Retained Capacity Update (1574M)

January 10 2023 - 2:00AM

UK Regulatory

TIDMHUW

RNS Number : 1574M

Helios Underwriting Plc

10 January 2023

10th January 2023

Helios Underwriting plc

("Helios" or the "Company")

2023 Helios Retained Capacity Update

Portfolio increased by 27% year-on-year to GBP297 million

Helios, the unique investment vehicle that acquires and

consolidates underwriting capacity at Lloyds', announces an update

on the Company's capacity to be underwritten for 2023.

Nigel Hanbury, Chief Executive of Helios, commented:

"I am delighted that the retained capacity underwritten by

Helios shareholders will have significantly increased for another

successive underwriting year to GBP238m. Market discipline remains

strong and we are confident that 2023 will offer superior returns.

The Jan uary renewals supports this with significant pricing

improvement and market dislocation in the reinsurance and retro

markets respectively. Rating indices across most lines are at or

above our underwriting requirements and the Board is confident the

Company is well positioned to maximise market opportunities ."

Capacity Update

Helios announces that the retained underwriting capacity for the

2023 year of account will be GBP238m, a near 40% increase in the

capacity underwritten since the start of 2022. The overall

portfolio , including the capacity reinsured , has increased to

GBP297m, adding more than 27% to the size of the portfolio since

the 1 (st) January 2022.

Helios - 2023 Year of Account Capacity

GBPm Retained Reinsured Total

Capacity as at 1st January

2023 238.3 58.3 296.6

Capacity as at 1st January

2022 171.1 61.6 232.7

% change - Increase/(Decrease) 39% (5)% 27%

The prospects for underwriting profitability and higher

investment returns have improved considerably and the Board

believes this substantial increase in the retained capacity will

significantly benefit the Company's shareholders for 2023

onwards.

The analysis of this increase in the Helios portfolio is as

follows:

Capacity

GBPm

Capacity at 1(st) January

2021 for 2022 YOA 232.7

Capacity acquired in 2022 for 2023

YOA 5.7

Pre-emption capacity 36.0

Disposal of capacity in the capacity

auction (16.7)

Additions to Tenancy Capacity 38.9

Capacity as at 1(st) January

2023 for 2023 YOA 296.6

---------

Helios has and continues to support both new and well

established syndicates that offer capacity for a limited period

only, referred to as Tenancy Capacity, and Helios expects to

support these syndicates in the longer term.

Helios acquired three LLVs in 2022 adding GBP5.7m of capacity to

the 2022 year of account and increased the retained capacity for

all three open years of account.

The split of capacity between retained and reinsured for the

current open years of account is currently as follows:

Retained Capacity 2020 to 2023 Years of Account

2020 2021 2022 2023

GBPm GBPm GBPm GBPm

Capacity - Position as at

1st Jan uary 2022 66.5 93.4 171.1 -

Capacity acquired during 2022 5.6 5.8 5.7 -

Capacity - Expected at 1st

Jan uary 2023 72.1 99.2 176.8 238.3

The increased retained capacity on the 2020 to 2022 years of

account, substantially "off-risk" for the underwriting years, will

contribute to the recognised profits in the future.

Split of Freehold and Leasehold Capacity by Year of Account

As at 1 (st) January 2022 YOA 2023 YOA

- GBPm

Freehold capacity 144.8 147.3

Tenancy capacity 87.9 149.3

Total capacity 232.7 296.6

Value of capacity

Fund 59.8 60.0

For further information please contact:

Helios Underwriting plc

Nigel Hanbury - Chief Executive +44 (0)7787 530 404 /

nigel.hanbury@huwplc.com

Arthur Manners - Chief Financial Officer +44 (0)7754 965 917

Shore Capital (Nomad and Broker)

Robert Finlay +44 (0)20 7601 6100

David Coaten

Buchanan (PR)

Helen Tarbet / Henry Wilson / George Beale +44 (0)7872 604 453

+44 (0)20 7466 5111

About Helios

Helios provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). Helios trades within the

Lloyd's insurance market writing approximately GBP297m of capacity

for the 2023 account. The portfolio provides a good spread of

business being concentrated in property & casualty insurance

and reinsurance. For further information please visit

www.huwplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCVKLFBXFLFBBZ

(END) Dow Jones Newswires

January 10, 2023 02:00 ET (07:00 GMT)

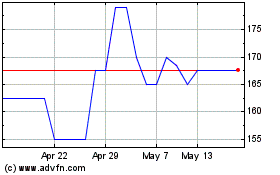

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024