TIDMHUW

RNS Number : 0628A

Helios Underwriting Plc

25 September 2020

25 September 2020

Helios Underwriting plc

( ' Helios ' or ' the Company ' )

Interim Results for the Six Months Ended 30 June 2020

Helios Underwriting plc, the unique investment vehicle which

acquires and consolidates underwriting capacity at Lloyd's,

announces its unaudited results for the six months ended 30 June

2020.

Nigel Hanbury, Chief Executive, provides the following

overview:

"These interim results reflect syndicate Covid losses recognised

during the period, but our exposure on the 2020 open underwriting

year has been greatly reduced through quota share reinsurance.

"Our pro-forma Adjusted NAV per share remains robust, reflecting

the quality of our portfolio and has increased to GBP2.07 per

share.

"Current market conditions have opened up an exciting window of

opportunity for Helios: the opportunity to increase our retained

exposure by reducing the quota share cession and through targeted

acquisitions of LLV's. We have an attractive pipeline of these,

which we are actively evaluating. We also continue to explore

options to finance the additional capital required, including a

potential fundraising."

SUMMARY FINANCIAL INFORMATION

6 months to 30th Year to

June 31 (st) December

2020 2019 2019

GBP000's GBP000's GBP000's

Underwriting profits 154 1,610 3,261

Other income 850 469 2,557

Costs (1,112) (1,326) (3,391)

---------- ---------- ------------------

Operating profit for the period

before impairment (108) 753 2,427

---------- ---------- ------------------

Profit after tax (96) 648 4,054

Earnings per share -0.55p 4.51p 25.64p

Adjusted Net Asset Value per GBP2.07 GBP1.91 GBP2.06

Share

-- Operating loss before impairment is GBP108,000 (30 June 2019 - a profit of GBP753,000)

-- Reduction in underwriting profits from the syndicate

participations reflects the losses recognised from the Covid-19

pandemic in this period

-- The cumulative premium rate increase achieved by underwriters

since 1 (st) January 2018 is 28%, which together with greater

discipline encouraged by the Franchise Board at Lloyd's, has

improved the prospects for profitable underwriting

-- The Adjusted Net Asset Value per share is GBP2.07 per share

(31 (st) December 2019 - GBP2.06 per share)

The underwriting result has been impacted by the losses arising

from the Covid-19 coronavirus pandemic. Losses of GBP5m (7% of

capacity) have been reserved for Covid-19 by the supported

syndicates as at 30th June 2020, of which 85% attaches to the 2019

year. The quota share reinsurers share GBP3.5m of this loss so the

impact on the underwriting profits was GBP1.5m. The disputes over

business interruption coverage are largely outside Lloyds and are

not expected to impact the portfolio. The mid point forecast for

the 2019 year of account as at 30 (th) June 2020 is a loss of 1.6%,

having reserved the Covid 19 losses that have been incurred. We

have a stop loss reinsurance protection for the 2019 year on which

we do not expect to have to make a claim.

The current turmoil is taking place against the backdrop of the

greatest positive momentum the Directors have seen in both

insurance and reinsurance pricing for many years. The improvement

in underwriting conditions is now accelerating on top of an

aggregate rate increase during 2019 of 5.4% (2018: 3.5%) following

catastrophe losses in 2017, 2018 and 2019. Cumulative rate

increases since 1 (st) January 2018 are 28%. We have been advised

of further pre-emptions of approximately GBP9.5m from our supported

syndicates to take advantage of improved market conditions.

Underwriting Profits and Window of Market Opportunity

The underwriting profits generated from the proportion of the

capacity portfolio retained by Helios reflects the results of the

underlying syndicates. The profitability of the syndicates has been

affected by the following:

-- The losses from Covid-19 have been recognised during the period.

-- The premium rate increases that have been achieved are being

reflected in the underlying results as reported in the Lloyds

market results.

A window of opportunity has been opened which is exciting for

Helios:

-- Our strategy of building a portfolio of syndicate capacity

continues to rely on the flow of LLVs for sale at reasonable

prices.

-- The pre-emptions, if fully taken up will increase the portfolio by approximately 13%.

-- There is an opportunity to increase the capacity retained by

Helios shareholders by reducing the quota share cession.

The exposure on the 2020 open underwriting year has been reduced

by 70% through quota share reinsurance. The quota share reinsurers

fund their share of the capital requirements and pay Helios a fee

and a profit commission. Stop loss reinsurance is bought for the

remaining 30% to limit the Group's exposure in the event of large

underwriting losses. Our costs should not increase at the same

pace.

The Pro-forma Adjusted Net Asset Value per share is GBP2.07p per

share (Dec 2019 - GBP2.06p per share). It is expected that there

will continue to be demand for the top syndicates that make up a

significant proportion of the Helios Capacity Fund at the Lloyds

Capacity Auctions that take place later this year.

For further information, please contact:

Helios Underwriting plc

Nigel Hanbury - Chief Executive 07787 530 404 /

nigel.hanbury@huwplc.com

Arthur Manners - Chief Financial Officer 07754 965 917

Shore Capital

Robert Finlay 020 7408 4080

David Coaten

Buchanan

Helen Tarbet / Henry Wilson / George Beale 07872 604 453

020 7466 5111

About Helios

Helios provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). Helios trades within the

Lloyd's insurance market writing approximately GBP70m of capacity

for the 2020 account. The portfolio provides a good spread of

business being concentrated in property insurance and reinsurance.

For further information please visit www.huwplc.com.

Financial results summary

Six months ended 30 June 2020

6 months 6 months Year to 31

to 30 June to 30 June December

2020 2019 2019

Underwriting profits 154 1,610 3,261

Other Income

Fees from reinsurers 400 249 235

Corporate reinsurance

recoveries 202 (205) (358)

Goodwill on bargain purchase 172 285 1,707

Investment income 76 140 972

Total Other Income 850 469 2,557

Costs

Pre - acquisition (9) (2) (859)

Stop loss costs (181) (182) (200)

Operating costs (922) (1,142) (2,332)

Total Costs (1,112) (1,326) (3,391)

Operating profit before

impairments of goodwill

and capacity (108) 753 2,427

Impairment charge for

capacity - - 1,860

Tax 12 (105) (233)

Profit for the period/year (96) 648 4,054

============ ============ ===========

Period to 30 (th) June 2020

Helios retained Total profit/(loss)

capacity at currently Helios

30 June 2020 Portfolio mid estimated Profits

Underwriting Year GBPm point forecasts GBP'000 GBP'000

2018 27.6 -3.1% (856) 439

2019 23.3 -1.6% (373) 101

2020 21.1 - - (386)

------------------ --------------- ---------------- ------------------- --------

154

------------------ --------------- ---------------- ------------------- --------

Period to 30 (th) June 2019

Helios retained Total profit/(loss)

capacity at currently Helios

30 June 2018 Portfolio mid estimated Profits

Underwriting Year GBPm point forecasts GBP'000 GBP'000

------------------ --------------- ---------------- ------------------- --------

2017 28.9 -7.4% (2,139) 1,048

2018 18.7 -3.6% (673) 681

2019 16.1 - - (119)

------------------ --------------- ---------------- ------------------- --------

1,610

------------------ --------------- ---------------- ------------------- --------

Year to 31 December 2019

Helios retained

capacity at Total profit/(loss)

31 December currently Helios

2018 Portfolio mid estimated Profits

Underwriting Year GBPm point forecasts GBP'000 GBP'000

------------------ --------------- ---------------- ------------------- --------

2017 36.2 -4.8% (1,748) 2,725

2018 21 -3.6% (758) 1,349

2019 18.3 - - (814)

------------------ --------------- ---------------- ------------------- --------

3,261

------------------ --------------- ---------------- ------------------- --------

Summary Balance Sheet

The summary Group balance sheet excludes items relating to

syndicate participations. See Note 15 for further information.

6 Months to June 2020 6 Months to June 2019 Year to 31 December 2019

GBP'000 GBP'000 GBP'000

------------------ --------------------- ----------------------- ------------------------

Intangible assets 21,655 16,490 21,178

Funds at Lloyd's 8,989 10,850 13,520

Other cash 1,156 2,018 3,013

Other assets 8,179 8,391 10,120

------------------ --------------------- ----------------------- ------------------------

Total assets 39,979 37,749 47,831

------------------ --------------------- ----------------------- ------------------------

Deferred tax 3,686 2,134 3,292

Borrowings- 2,000 1,034 2,001

------------------ --------------------- ----------------------- ------------------------

Other liabilities 1,118 4,865 6,144

------------------ --------------------- ----------------------- ------------------------

Total liabilities 6,804 8,033 11,437

------------------ --------------------- ----------------------- ------------------------

Syndicate equity (5,123) (8,648) (8,244)

------------------ --------------------- ----------------------- ------------------------

Total equity 28,052 21,068 28,150

------------------ --------------------- ----------------------- ------------------------

Summary Group Cash Flow

The summary group cash flow sheet excludes items relating to

syndicate participations. See Note 15 for further information.

6 months 6 months Year to 31

to 30 June to 30 June December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Opening Balance (free cash) 3,028 9,717 9,717

Income

Acquired on acquisition 280 119 2,045

Distribution of profits (net

of tax retentions) 54 1,165 1,724

Transfers from Funds at Lloyds' 4,252 1,512 4,178

Investment income 28 43 178

Other income - - 911

Sale of investments - - 2,014

Borrowings 2,000 (8,162) 2,000

Expenditure

Operating costs (inc Hampden

/ Nomina fees) (406) (469) (2,392)

Reinsurance Cost (353) (531) -

Payable funds for acquisitions - - -

Payments to QS reinsurers - - (465)

Acquisition of LLV's (4,875) (428) (4,897)

Transfers to Funds at Lloyds' (750) (778) (1,137)

Tax (102) (36) (833)

Dividends paid - - (529)

Revolving credit facility

repayment (2,000) - (9,214)

Share buy backs - (133) (287)

Closing balance 1,156 2,019 3,013

------------ ------------ -----------

Adjusted NAV

6 months 6 months Year to 31

to 30 June to 30 June December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Net tangible assets 6,397 4,578 6,970

Group letters of

credit 2,916 1,762 2,850

Value of capacity

(WAV) 26,827 21,077 26,350

------------ ------------ -----------

36,140 27,417 36,170

------------ ------------ -----------

Share in issue

- on the market 17,478 14,348 17,489

Shares in issue

- total of on the

market and JSOP

shares 17,978 14,848 17,989

Adjusted net asset

value per share

GBP - on the market 2.07 1.91 2.07

Adjusted net asset

value per share

GBP - on the market

and JSOP shares 2.01 1.85 2.01

Interim condensed consolidated statement of comprehensive

income

Six months ended 30 June 2020

6 months

ended 6 months 12 months

30 June ended 30 ended

2020 June 2019 31 December

Unaudited Unaudited 2019 Audited

Note GBP'000 GBP'000 GBP'000

------------------------------------------- ------ ---------- ---------- -------------

Gross premium written 4 36,950 29,552 55,470

Reinsurance premium ceded (11,575) (9,380) (13,210)

------------------------------------------- ------ ---------- ---------- -------------

Net premium written 4 25,375 20,172 42,260

------------------------------------------- ------ ---------- ---------- -------------

Change in unearned gross premium provision 5 (7,700) (4,625) (60)

Change in unearned reinsurance premium

provision 5 3,837 2,767 488

------------------------------------------- ------ ---------- ---------- -------------

5 (3,863) (1,858) 428

------------------------------------------- ------ ---------- ---------- -------------

Net earned premium 3,4 21,512 18,314 42,688

Net investment income 6 1,174 1,491 2,335

Other underwriting income 400 252 417

Gain on bargain purchase 12 172 285 1,707

Other income - 13 432

------------------------------------------- ------ ---------- ---------- -------------

Revenue 23,258 20,355 47,579

------------------------------------------- ------ ---------- ---------- -------------

Gross claims paid (16,380) (17,242) (34,107)

Reinsurers' share of gross claims

paid 3,784 3,890 8,237

------------------------------------------- ------ ---------- ---------- -------------

Claims paid, net of reinsurance (12,596) (13,352) (25,870)

------------------------------------------- ------ ---------- ---------- -------------

Change in provision for gross claims 5 (5,927) 1,337 (3,758)

Reinsurers' share of change in provision

for gross claims 5 2,162 (1,036) 2,004

------------------------------------------- ------ ---------- ---------- -------------

Net change in provision for claims 5 (3,765) 301 (1,754)

------------------------------------------- ------ ---------- ---------- -------------

Net insurance claims and loss adjustment

expenses 4 (16,361) (13,051) (27,624)

------------------------------------------- ------ ---------- ---------- -------------

Expenses incurred in insurance activities (6,166) (5,786) (15,764)

Other operating expenses (839) (765) (1,764)

------------------------------------------- ------ ---------- ---------- -------------

Operating expenses (7,005) (6,551) (17,528)

------------------------------------------- ------ ---------- ---------- -------------

Operating profit before impairments

of goodwill and capacity 4 (108) 753 2,427

Impairment of goodwill - - -

Impairment of syndicate capacity - - -

------------------------------------------- ------ ---------- ---------- -------------

Profit before tax (108) 753 4,287

Income tax charge 7 12 (105) (233)

------------------------------------------- ------ ---------- ---------- -------------

Profit for the period (96) 648 4,054

------------------------------------------- ------ ---------- ---------- -------------

Other comprehensive income

Foreign currency translation differences - - -

Income tax relating to the components

of other comprehensive income - - -

------------------------------------------- ------ ---------- ---------- -------------

Other comprehensive income for the

period, net of tax - - -

------------------------------------------- ------ ---------- ---------- -------------

Total other comprehensive income for

the period (96) 648 4,054

------------------------------------------- ------ ---------- ---------- -------------

Profit for the period attributable

to owners of the Parent (96) 648 4,054

------------------------------------------- ------ ---------- ---------- -------------

Total comprehensive income for the

period attributable to owners of the

Parent (96) 648 4,054

------------------------------------------- ------ ---------- ---------- -------------

Earnings per share attributable to

owners of the Parent

Basic 8 -0.55p 4.51p 25.64p

Diluted 8 -0.52p 4.36p 24.86p

------------------------------------------- ------ ---------- ---------- -------------

The profit attributable to owners of the Parent and earnings per

share set out above are in respect of continuing operations.

Interim condensed consolidated statement of financial

position

Six months ended 30 June 2020

6 months

ended 6 months 12 months

30 June ended 30 ended

2020 June 2019 31 December

Unaudited Unaudited 2019 Audited

Note GBP'000 GBP'000 GBP'000

------------------------------------------ ------ ---------- ---------- -------------

Assets -

Intangible assets 21,655 16,490 21,178

Financial assets at fair value through

profit or loss 64,143 56,507 67,141

Reinsurance assets:

- reinsurers' share of claims outstanding 5 28,141 21,233 25,760

- reinsurers' share of unearned premium 5 9,195 7,163 5,023

Other receivables, including insurance

and reinsurance receivables 52,799 50,717 47,726

Deferred acquisition costs 6,853 6,228 6,641

Prepayments and accrued income 882 701 432

Cash and cash equivalents 8,501 6,997 6,037

------------------------------------------ ------ ---------- ---------- -------------

Total assets 192,169 166,036 179,938

------------------------------------------ ------ ---------- ---------- -------------

Liabilities

Insurance liabilities:

- claims outstanding 5 99,758 80,204 95,616

- unearned premium 5 35,961 30,631 26,522

Deferred income tax liabilities 3,686 2,134 3,292

Borrowings 2,000 1,034 2,000

Other payables, including insurance

and reinsurance payables 20,841 27,468 18,040

Accruals and deferred income 1,871 3,497 6,320

------------------------------------------ ------ ---------- ---------- -------------

Total liabilities 164,117 144,968 151,790

------------------------------------------ ------ ---------- ---------- -------------

Equity

Equity attributable to owners of the

Parent:

Share capital 11 1,839 1,510 1,839

Share premium 11 18,938 15,387 18,938

Other reserves - treasury shares 11 (50) (50) (50)

Retained earnings 7,325 4,221 7,421

------------------------------------------ ------ ---------- ---------- -------------

Total equity 28,052 21,068 28,148

------------------------------------------ ------ ---------- ---------- -------------

Total liabilities and equity 192,169 166,036 179,938

------------------------------------------ ------ ---------- ---------- -------------

The Financial Statements were approved and authorised for issue

by the Board of Directors on 24 September 2020, and were signed on

its behalf by:

Nigel Hanbury

Chief Executive

The notes are an integral part of these Financial

Statements.

Interim condensed consolidated statement of changes in

equity

Six months ended 30 June 2020

Attributable to owners

of the Parent

----------------------------------------------------

Share Share Other Retained

capital premium reserves earnings Total

Consolidated Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ------ -------- --------- ---------- --------- --------

At 1 January 2020 1,839 18,938 (50) 7,421 28,148

Total comprehensive income for -

the year: - - - -

Profit for the year - - - (96) (96)

Other comprehensive income, net -

of tax - - - -

-------------------------------- ------ -------- --------- ---------- --------- --------

Total comprehensive income for

the year - - - (96) (96)

-------------------------------- ------ -------- --------- ---------- --------- --------

Transactions with owners: - - - - -

Dividends paid 9 - - - - -

Company buy back of shares 11 - - - - -

-------------------------------- ------ -------- --------- ---------- --------- --------

Total transactions with owners - - - - -

At 30 June 2020 1,839 18,938 (50) 7,325 28,052

-------------------------------- ------ -------- --------- ---------- --------- --------

At 1 January 2019 1,510 15,387 (50) 4,198 21,045

Total comprehensive income for

the year:

Profit for the year - - - 648 648

Other comprehensive income, net

of tax - - - 39 39

-------------------------------- ------ -------- --------- ---------- --------- --------

Total comprehensive income for

the year - - - 687 687

-------------------------------- ------ -------- --------- ---------- --------- --------

Transactions with owners:

Dividends paid - - - (530) (530)

Share issue - - - (134) (134)

-------------------------------- ------ -------- --------- ---------- --------- --------

Total transactions with owners - - - (664) (664)

-------------------------------- ------ -------- --------- ---------- --------- --------

At 30 June 2019 1,510 15,387 (50) 4,221 21,068

-------------------------------- ------ -------- --------- ---------- --------- --------

At 1 January 2019 1,510 15,387 (50) 4,198 21,045

Total comprehensive income for

the year:

Profit for the year - - - 4,054 4,054

Other comprehensive income, net -

of tax - - - -

-------------------------------- ------ -------- --------- ---------- --------- --------

Total comprehensive income for

the year - - - 4,054 4,054

-------------------------------- ------ -------- --------- ---------- --------- --------

Transactions with owners:

Dividends paid - - - (529) (529)

Company buy back of shares 11 - - - (302) (302)

Share issue 11 329 3,551 - - 3,880

-------------------------------- ------ -------- --------- ---------- --------- --------

Total transactions with owners 329 3,551 - (831) 3,049

-------------------------------- ------ -------- --------- ---------- --------- --------

At 31 December 2019 1,839 18,938 (50) 7,421 28,148

-------------------------------- ------ -------- --------- ---------- --------- --------

Interim condensed consolidated statement of cash flows

Six months ended 30 June 2020

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Note 2020 2019 Unaudited 2019

Unaudited GBP'000 Audited

GBP'000 GBP'000

-------------------------------------------------------------- ------ ---------- --------------- ------------

Cash flows from operating activities

Profit before tax (108) 753 4,287

Adjustments for:

- Other comprehensive income, gross

of tax - - -

- Interest received (45) (39) (235)

- Investment income 6 (1,136) (1,416) (1,248)

- Recognition of negative goodwill (172) (285) (1,707)

- Goodwill on bargain purchase - - -

- Impairment of goodwill - - -

- (Profit)/loss on sale of intangible

assets - - (898)

- Impairment of intangible assets - - (1,860)

- Goodwill on acquisition - - -

Changes in working capital: -

* change in fair value of financial assets held at fair

value through profit or loss (79) 17 (659)

* decrease/(increase) in financial assets at fair value

through profit or loss 4,171 2,928 (3,010)

- (increase)/decrease in other receivables (3,863) 5,278 18,823

- (increase)/decrease in other payables - (1,193) 1,240 (6,783)

- net decrease/(increase) in technical

provisions 5,059 (5,504) (6,473)

-------------------------------------------------------------- ------ ---------- --------------- ------------

Cash generated/(utilised) from operations 2,634 2,972 237

-------------------------------------------------------------- ------ ---------- --------------- ------------

Income tax paid - - (1,119)

-------------------------------------------------------------- ------ ---------- --------------- ------------

Net cash inflow from operating activities 2,634 2,972 (882)

-------------------------------------------------------------- ------ ---------- --------------- ------------

Cash flows from investing activities

Interest received 45 39 235

Investment income 1,136 1,416 1,248

Purchase of intangible assets - - (22)

Proceeds from disposal of intangible

assets - - 932

Acquisition of subsidiaries, net of

cash acquired (1,218) (806) (1,493)

-------------------------------------------------------------- ------ ---------- --------------- ------------

Net cash (outflow)/inflow from investing

activities (37) 649 900

-------------------------------------------------------------- ------ ---------- --------------- ------------

Cash flows from financing activities

-------------------------------------------------------------- ------ ---------- --------------- ------------

Net proceeds from issue of ordinary

share capital - - 1,844

Buy back of ordinary share capital (133) (134) (302)

Payment for company buy back of shares - - 2,000

Proceeds from borrowings - (8,162) (9,196)

Repayment of borrowings - - -

Dividends paid to owners of the Parent - (530) (529)

-------------------------------------------------------------- ------ ---------- --------------- ------------

Net cash outflow from financing activities (133) (8,826) (6,183)

-------------------------------------------------------------- ------ ---------- --------------- ------------

Net (decrease)/increase in cash and

cash equivalents 2,464 (5,205) (6,165)

Cash and cash equivalents at beginning

of period 6,037 12,202 12,202

-------------------------------------------------------------- ------ ---------- --------------- ------------

Cash and cash equivalents at end of

period 8,501 6,997 6,037

-------------------------------------------------------------- ------ ---------- --------------- ------------

Cash held within the syndicates' accounts is GBP7,345,000 (2019:

GBP4,979,000) of the total cash and cash equivalents held at the

end of the period GBP8,501,000 (2019: GBP6,997,000). The cash held

within the syndicates' accounts is not available to the Group to

meet its day-to-day working capital requirements.

Cash and cash equivalents comprise cash at bank and in hand.

The notes are an integral part of these Financial

Statements.

Notes to the financial statements

Six months ended 30 June 2020

1. General information

The Company is a public limited company quoted on AIM. The

Company was incorporated in England, is domiciled in the UK and its

registered office is 40 Gracechurch Street, London EC3V 0BT. The

Company participates in insurance business as an underwriting

member at Lloyd's through its subsidiary undertakings.

2. Accounting policies

Basis of preparation

The Condensed Consolidated Interim Financial Statements have

been prepared using accounting policies consistent with

International Financial Reporting Standards (IFRSs) and in

accordance with International Accounting Standard (IAS) 34 Interim

Financial Reporting, as adopted by the European Union.

The Condensed Consolidated Interim Financial Statements are

prepared for the six months ended 30 June 2020.

The Condensed Consolidated Interim Financial Statements for the

six months ended 30 June 2020 and 2019 are unaudited, but have been

subject to review by the Group's auditors. The Condensed

Consolidated Interim Financial Statements have been prepared in

accordance with the accounting policies adopted for the year ended

31 December 2019, and the adoption of new and amended standards as

set out further below.

The Condensed Consolidated Interim incorporate the Financial

Statements of Helios Underwriting plc, the Parent Company, and its

directly and indirectly held subsidiaries being Hampden Corporate

Member Limited, Nameco (No. 917) Limited, Nameco (No. 229) Limited,

Nameco (No. 518) Limited, Nameco (No. 804) Limited, Halperin

Underwriting Limited, Bernul Limited, Nameco (No. 311) Limited,

Nameco (No. 402) Limited, Updown Underwriting Limited, Nameco (No.

507) Limited, Nameco (No. 76) Limited, Kempton Underwriting

Limited, Devon Underwriting Limited, Nameco (No. 346) Limited,

Pooks Limited, Charmac Underwriting Limited, Nottus (No 51)

Limited, Chapman Underwriting Limited, Llewellyn House Underwriting

Limited, Advantage DCP Limited, Romsey Underwriting Limited, Nameco

(No 409) Limited, Nameco (No 1113) Limited, Catbang 926 Limited,

Whittle Martin Underwriting, Nameco (No 408) Limited, RBC CEES

Trustee Limited, Helios UTG Partner Limited, Nomina No 035 LLP,

Nomina No 342 LLP, Nomina No 372 LLP, Salviscount LLP, Inversanda

LLP, Fyshe Underwriting LLP, Nomina No 505 LLP and Nomina No 321

LLP. (Note 10).

The underwriting data on which these Condensed Consolidated

Interim Financial Statements are based upon has been supplied by

the managing agents of those syndicates which the Group supports.

The data supplied is the 100% figures for each syndicate. The Group

has applied its share of the syndicate participations to the gross

figures to derive its share of the syndicates transactions, assets

and liabilities.

Significant accounting policies

The Condensed Consolidated Interim Financial Statements have

been prepared under the historical cost convention as modified by

the revaluation of the financial assets at fair value through the

profit and loss. The same accounting policies, presentation and

methods of computation are followed in these Condensed Consolidated

Interim Financial Statements as were applied in the preparation of

the Group Financial Statements for the year ended 31 December

2020.

During the current year, the Group and the Company adopted all

the new and revised IFRS, amendments and interpretations that are

relevant to its operations and are effective for accounting periods

beginning on 1 January 2019. Except for IFRS 9 "Financial

Instruments" effective from 1 January 2018, for which a temporary

exemption has been applied by the Group, as explained further

below. These are set out below and did not have a material impact

on the accounting policies of the Group and the Company:

-- IFRS 16 "Leases", issued on 13 January 2016 (effective 1

January 2019).

-- Amendments to IFRS 9: Prepayment Features with Negative

Compensation, issued on 12 October 2017, (effective date 1 January

2019).

-- Amendments to IAS 28: Long-term Interests in Associates and

Joint Ventures, issued on 12 December 2017, (effective date 1

January 2019).

-- IFRS 23 "Uncertainty over Income Tax Treatments", issued on 7

June 2017, (effective date 1 January 2019).

-- Annual improvements to IFRS 2015-2017 Cycle, issued on 12

December 2017, (effective date 1 January 2019).

-- Amendments to IAS 19: Plan Amendment, Curtailment or

Settlement, issued on 7 February 2017, (effective date 1 January

2019).

Temporary exemptions from IFRS 9 "Financial Instruments",

(effective 1 January 2018)

The effective date of IFRS 9 Financial Instruments is January

2018. An insurer that has not previously adopted any version of

IFRS 9, including the requirements for the presentation of gains

and losses on financial liabilities designated as at fair value

through profit or loss and whose activities are predominantly

connected with insurance as its annual reporting date that

immediately precedes 1 April 2016 (or a later date as specified in

paragraph 20G of IFRS 4), may apply IAS 39 - Financial Instruments:

Recognition and Measurement, rather than IFRS 17 - Insurance

Contracts.

The Group has applied the temporary exemption from IFRS 9 as its

activities are predominately connected with insurance and it has

not previously adopted any version of IFRS 9, including the

requirements for the presentation of gains and losses on financial

liabilities designated at fair value through profit or loss, for

annual period beginning before 1 January 2023. Consequently, the

Group has a single date of initial application for IFRS 9 in it's

entirely, being 1 January 2023.

New standards, amendments and interpretations not yet

adopted.

At the date of authorisation of these Financial Statements, the

following standards, amendments and interpretations were in issue

but not yet effective:

(i) Adopted by the EU

Amendments:

-- Amendments to IAS 1 and IAS 8: Definition of Material, issued

on 31 October 2018, (effective 1 January 2020).

-- Amendments to References to the Conceptual Framework in IFRS,

issued on 29 March 2017, (effective date 1 January 2020).

(ii) Not adopted by the EU

Standards:

-- IFRS 17 "Insurance Contracts", issued on 18 May 2017,

(effective date 1 January 2023).

Amendments:

-- Amendment to IFRS 3 Business Combinations, issued on 22

October 2018, (effective 1 January 2020).

-- Amendment to IAS 1 Presentation of Financial Statements:

Classification of Liabilities as Current or Non- Current, issued on

23 January 2020, (effective date 1 January 2022)

3. Segmental information

Nigel Hanbury is the Group's chief operating decision-maker. He

has determined its operating segments based on the way the Group is

managed, for the purpose of allocating resources and assessing

performance.

The Group has three segments that represent the primary way in

which the Group is managed, as follows:

-- syndicate participation;

-- investment management; and

-- other corporate activities.

Other

Syndicate Investment corporate

participation management activities Total

6 months ended 30 June 2020 Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ----------- ----------- --------

Net earned premium 22,133 - (621) 21,512

Net investment income 1,171 3 - 1,174

Other income - - 400 400

Net insurance claims and loss adjustment

expenses (16,361) - - (16,361)

Expenses incurred in insurance activities (5,842) - (324) (6,166)

Other operating expenses - - (839) (839)

Goodwill on bargain purchase - - 172 172

Impairment of goodwill - - - -

Impairment of syndicate capacity - - - -

------------------------------------------ -------------- ----------- ----------- --------

Profit before tax 1,101 3 (1,212) (108)

------------------------------------------ -------------- ----------- ----------- --------

Other

Syndicate Investment corporate

participation management activities Total

6 months ended 30 June 2019 Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ----------- ----------- --------

Net earned premium 19,754 - (1,440) 18,314

Net investment income 1,491 - - 1,491

Other income - - 265 265

Net insurance claims and loss adjustment

expenses (13,051) - - (13,051)

Expenses incurred in insurance activities (5,472) - (314) (5,786)

Other operating expenses - - (765) (765)

Goodwill on bargain purchase - - 285 285

Impairment of goodwill - - - -

Impairment of syndicate capacity - - - -

------------------------------------------ -------------- ----------- ----------- --------

Profit before tax 2,722 - (1,969) 753

------------------------------------------ -------------- ----------- ----------- --------

Other

Syndicate Investment corporate

participation management activities Total

12 months ended 31 December 2019 Audited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ----------- ----------- --------

Net earned premium 42,688 - - 42,688

Net investment income 2,387 (52) - 2,335

Other income 254 - 595 849

Net insurance claims and loss adjustment

expenses (26,265) - (1,359) (27,624)

Expenses incurred in insurance activities (15,367) - (397) (15,764)

Other operating expenses (114) - (1,650) (1,764)

Gain on bargain purchase - - 1,707 1,707

Impairment of goodwill - - - -

Impairment of syndicate capacity - - 1,860 1,860

------------------------------------------ -------------- ----------- ----------- --------

Profit before tax 3,583 (52) 756 4,287

------------------------------------------ -------------- ----------- ----------- --------

The Group does not have any geographical segments as it

considers all of its activities to arise from trading within the

UK.

No major customers exceed 10% of revenue.

Net earned premium within 2020 other corporate activities

totalling GBP621,000 (2019: 1,440,000 - 2017, 2018 and 2019 years

of account) represents the 2018, 2019 and 2020 years of account net

Group quota share reinsurance premium payable to Hampden Insurance

Guernsey PCC Limited - Cell 6. This net quota share reinsurance

premium payable is included within "reinsurance premium ceded" in

the Consolidated Statement of Comprehensive Income of the

period.

4. Operating profit before impairments of goodwill and

capacity

Underwriting year of account*

-------------------------------------------

2018 and Pre- Corporate Other

6 months ended 30 prior 2019 2020 Sub-total acquisition reinsurance corporate Total

June 2020 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 115 4,439 32,491 37,045 (95) - - 36,950

Reinsurance ceded (131) (1,089) (9,578) (10,798) 24 (621) (181) (11,575)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written (16) 3,350 22,913 26,247 (70) (621) (181) 25,375

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 1,519 15,105 5,756 22,380 (66) (621) (181) 21,512

Other income 702 301 102 1,105 (7) 400 248 1,746

Net insurance claims

and loss adjustment

expenses (401) (10,523) (5,686) (16,610) 47 - 202 (16,361)

Operating expenses (581) (4,092) (1,427) (6,100) 17 - (922) (7,005)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 1,239 791 (1,255) 775 (9) (221) (653) (108)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share adjustment (800) (690) 869 (621) - 621 - -

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 439 101 (386) 154 (9) 400 (653) (108)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Underwriting year of account*

---------------------------------------------

2017 and Pre- Corporate Other

6 months ended 30 prior 2018 2019 Sub-total acquisition reinsurance corporate Total

June 2019 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 669 4,017 24,993 29,679 (127) - 29,552

Reinsurance ceded (132) (930) (6,731) (7,793) 36 (1,440) (182) (9,380)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written 536 3,088 18,262 21,886 (91) (1,440) (182) 20,172

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 2,103 12,936 4,987 20,026 (90) (1,440) (182) 18,314

Other income 934 319 130 1,383 (16) 249 425 2,042

Net insurance claims

and loss adjustment

expenses (656) (7,879) (4,369) (12,904) 58 - (205) (13,051)

Operating expenses (717) (3,605) (1,133) (5,455) 46 - (1,142) (6,551)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 1,664 1,771 (385) 3,050 (2) (1,191) (1,104) 753

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share

adjustment (616) (1,090) 266 (1,440) - 1,440 - -

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 1,048 681 (119) 1,610 (2) 249 (1,104) 753

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Underwriting year of account*

---------------------------------------------

2017 Pre- Corporate Other

12 months ended 31 and prior 2018 2019 Sub-total acquisition reinsurance corporate Total

December 2019 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 1,031 5,891 54,656 61,578 (6,108) - - 55,470

Reinsurance ceded (116) (1,443) (13,003) (14,563) 1,553 - (200) (13,210)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written 914 4,447 41,653 47,015 (4,555) - (200) 42,260

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 3,526 21,772 22,157 47,545 (4,566) - (200) 42,688

Other income 1,574 615 339 2,527 (551) 235 2,679 4,891

Net insurance claims

and loss adjustment

expenses 893 (12,854) (16,276) (28,237) 2,329 (1,359) (358) (27,624)

Operating expenses (1,535) (6,823) (8,768) (17,125) 1,929 - (2,332) (17,528)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 4,458 2,710 (2,548) 4,620 (859) (1,124) (221) 2,426

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share

adjustment (1,733) (1,361) 1,734 (1,359) - 1,359 - -

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 2,725 1,349 (814) 3,261 (859) 235 (211) 2,426

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Pre-acquisition relates to the element of results from the new

acquisitions before they were acquired by the Group.

* The underwriting year of account results represent the Group's

share of the syndicates' results by underwriting year of account

before corporate member level reinsurance and members' agents

charges.

5. Insurance liabilities and reinsurance balances

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2020 95,616 25,760 69,856

Increase in reserves arising from acquisition of

subsidiary undertakings 2,036 505 1,531

Movement of reserves 5,927 2,162 3,765

Other movements (3,821) (286) (3,535)

------------------------------------------------- -------- ----------- --------

At 30 June 2020 99,758 28,141 71,617

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2020 26,522 5,023 21,499

Increase in reserves arising from acquisition of

subsidiary undertakings 530 92 438

Movement of reserves 7,700 3,837 3,863

Other movements 1,209 243 966

------------------------------------------------- -------- ----------- --------

At 30 June 2020 35,961 9,195 26,766

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2017 and prior years'

claims reserves reinsured into the 2018 year of account on which

the Group does not participate and currency exchange

differences.

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2019 88,032 22,698 65,334

Increase in reserves arising from acquisition of

subsidiary undertakings 1,974 552 1,422

Movement of reserves (1,337) (1,036) (301)

Other movements (8,465) (981) (7,484)

------------------------------------------------- -------- ----------- --------

At 30 June 2019 80,204 21,233 58,971

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2019 24,772 4,057 20,715

Increase in reserves arising from acquisition of

subsidiary undertakings - - -

Movement of reserves 4,625 2,767 1,858

Other movements 1,234 339 895

------------------------------------------------- -------- ----------- --------

At 30 June 2019 30,631 7,163 23,468

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2016 and prior years'

claims reserves reinsured into the 2017 year of account on which

the Group does not participate and currency exchange

differences.

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2019 88,032 22,698 65,334

Increase in reserves arising from acquisition of

subsidiary undertakings 11,792 2,730 9,062

Movement of reserves 3,758 2,004 1,754

Other movements (7,966) (1,672) (6,294)

------------------------------------------------- -------- ----------- --------

At 31 December 2019 95,616 25,760 69,856

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2019 24,772 4,057 20,715

Increase in reserves arising from acquisition of

subsidiary undertakings 3,379 1,182 2,197

Movement of reserves 60 488 (428)

Other movements (1,689) (704) (985)

------------------------------------------------- -------- ----------- --------

At 31 December 2019 26,522 5,023 21,499

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2016 and prior years'

claims reserves reinsured into the 2017 year of account on which

the Group does not participate and currency exchange

differences.

6. Net investment income

6 months

ended 6 months 12 months

30 June ended ended 31

2020 Unaudited 30 June December

GBP'0 2019 Unaudited 2019 Audited

00 GBP'000 GBP'000

---------------------------------------------- --------------- ---------------- -------------

Investment income 1,136 1,416 1,248

Realised (losses)/gains on financial assets

at fair value through profit or loss 126 17 262

Unrealised (losses)/gains on financial assets

at fair value through profit or loss (133) 18 657

Investment management expenses - 1 (67)

Bank interest 45 39 235

---------------------------------------------- --------------- ---------------- -------------

Net investment income 1,174 1,491 2,335

---------------------------------------------- --------------- ---------------- -------------

7. Income tax charge

Analysis of tax charge/(credit) in the period

6 months 6 months 12 months

ended ended ended 31

30 June 30 June December

2020 Unaudited 2019 Unaudited 2019 Audited

GBP'000 GBP'000 GBP'000

------------------ --------------- ---------------- -------------

Income tax credit (12) 105 233

------------------ --------------- ---------------- -------------

The income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual tax rate

used is 19.00% (2019: 19.00%). Material disallowed terms have been

adjusted for in the income tax calculation.

8. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary shareholders after tax by the weighted

average number of ordinary shares outstanding during the

period.

Diluted earnings per share is calculated by dividing the net

profit attributable to ordinary equity holders of the Company by

the weighted average number of ordinary shares outstanding during

the period, plus the weighted average number of ordinary shares

that would be issued on the conversion of all the dilutive

potential ordinary shares into ordinary shares.

Earnings per share has been calculated in accordance with IAS 33

"Earnings per share".

The earnings per share and weighted average number of shares

used in the calculation are set out below:

6 months 6 months 12 months

ended 30 ended 30 ended 31

June 2020 June 2019 December

Unaudited Unaudited 2019 Audited

------------------------------------------------- ---------- ----------- -------------

Profit for the year after tax attributable

to ordinary equity holders of the parent (96,000) 648,000 4,054,000

------------------------------------------------- ---------- ----------- -------------

Basic - weighted average number of ordinary

shares* 17,978,841 14,356,224 15,809,376

------------------------------------------------- ---------- ----------- -------------

Adjustments for calculating the diluted earnings

per share: Treasury shares (JSOP scheme) 500,000 500,000 500,000

------------------------------------------------- ---------- ----------- -------------

Diluted - weighted average number of shares* 17,478,841 14,856,224 15,044,433

------------------------------------------------- ---------- ----------- -------------

Basic earnings per share (0.55p) 4.51p 3.14p

------------------------------------------------- ---------- ----------- -------------

Diluted earnings per share (0.52p) 4.36p 3.03p

------------------------------------------------- ---------- ----------- -------------

* Used as the denominator in calculating the basic earnings per

share, and diluted earnings per share, respectively.

9. Dividends paid or proposed

It was proposed and agreed at the AGM on 25 June 2020 that no

dividend will be payable in 2020 (2019: 3p).

10. Investments in subsidiaries

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

--------------------------------------------------------------------------------- -------- -------- -----------

Total 45,335 25,905 32,901

--------------------------------------------------------------------------------- -------- -------- -----------

30 June 30 June 31 December

Direct/indirect 2020 2019 2019

Company or partnership interest ownership ownership ownership Principal activity

---------------------- ---------------- ---------- ----------- ------------- -------------------------------

Hampden Corporate Lloyd's of London corporate

Member Limited Direct 100% 100% 100% vehicle

Nameco (No. 365) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 605) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 321) Lloyd's of London corporate

Limited Direct - 100% 100% vehicle

Nameco (No. 917) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 229) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 518) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 804) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Halperin Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Lloyd's of London corporate

Bernul Limited Direct 100% 100% 100% vehicle

Nameco (No. 311) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 402) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Updown Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 507) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 76) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Kempton Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Devon Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No. 346) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Lloyd's of London corporate

Pooks Limited Direct 100% 100% 100% vehicle

Charmac Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

RBC CEES Trustee Joint Share Ownership

Limited Direct 100% 100% 100% Plan

Lloyd's of London corporate

Nottus (No 51) Limited Direct 100% 100% 100% vehicle

Chapman Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Helios UTG Partner

Limited Direct 100% 100% 100% Corporate partner

Lloyd's of London corporate

Nomina No 035 LLP Indirect 100% 100% 100% vehicle

Lloyd's of London corporate

Nomina No 342 LLP Indirect 100% 100% 100% vehicle

Lloyd's of London corporate

Nomina No 372 LLP Indirect 100% 100% 100% vehicle

Lloyd's of London corporate

Salviscount LLP Indirect 100% 100% 100% vehicle

Lloyd's of London corporate

Inversanda LLP Indirect 100% 100% 100% vehicle

Fyshe Underwriting Lloyd's of London corporate

LLP Indirect 100% 100% 100% vehicle

Lloyd's of London corporate

Nomina No 505 LLP Indirect 100% 100% 100% vehicle

Lloyd's of London corporate

Nomina No 321 LLP Direct 100% 100% - vehicle

Llewellyn House

Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Lloyd's of London corporate

Advantage DCP Limited Direct 100% 100% 100% vehicle

Romsey Underwriting Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No 409) Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Nameco (No 1113 Lloyd's of London corporate

Limited Direct 100% 100% 100% vehicle

Lloyd's of London corporate

Catbang 926 Limited Direct 100% 100% 100% vehicle

Whittle Martin Lloyd's of London corporate

Underwriting Direct 100% 100% 100% vehicle

Nameco (No 408) Lloyd's of London corporate

Limited Direct 100% - - vehicle

Helios UTG Partner Limited, a subsidiary of the Company, owns

100% of Nomina No 035 LLP, Nomina No 342 LLP, Nomina No 372 LLP,

Salviscount LLP, Inversanda LLP, Fyshe Underwriting LLP, Nomina No

505 LLP and Nomina No 321 LLP. The cost of acquisition of these

LLPs is accounted for in Helios UTG Partner Limited, their

immediate Parent Company.

RBC CEES Trustee Limited is a newly incorporated entity in year

2017 to satisfy the requirements of the Joint Share Ownership

Plan.

For details of all new acquisitions in the 6 months to 30 June

2020, refer to note 12.

11. Share capital and share premium

Partly

Ordinary share paid ordinary Share

Number of capital share capital premium Total

shares (i) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----------- -------------- -------------- -------- --------

Ordinary shares of 10p each and share premium at 1

January 2019 15,104,240 1,460 50 15,387 16,897

Ordinary shares of 10p each and share premium at 31

December 2019 18,390,906 1,789 50 15,387 16,897

----------------------------------------------------- ----------- -------------- -------------- -------- --------

Ordinary shares of 10p each and share premium at 1

January 2020 18,390,906 1,789 50 15,387 16,897

Ordinary shares of 10p each and share premium at 30

June 2020 18,390,906 1,789 50 15,387 16,897

----------------------------------------------------- ----------- -------------- -------------- -------- --------

(i) Number of shares

30 June 2020 31 December 2019

------------------------------------------------------------------- ------------ ----------------

Allotted, called up and fully paid ordinary shares:

On the market 17,478,028 17,488,628

Company buy back of ordinary shares held in treasury 412,878 402,278

------------------------------------------------------------------- ------------ ----------------

17,890,906 17,890,906

------------------------------------------------------------------- ------------ ----------------

Uncalled and partly paid ordinary share under the JSOP scheme (ii) 500,000 500,000

------------------------------------------------------------------- ------------ ----------------

18,390,906 18,390,906

------------------------------------------------------------------- ------------ ----------------

(ii) The partly paid ordinary shares are not entitled to

dividend distribution rights during the year.

12. Acquisition of Limited Liability Vehicles

Nameco (No. 408) Limited

On 28 January 2020, Helios Underwriting plc acquired 100% of the

issued share capital of Nameco (No. 408) Limited for a total

consideration of GBP1,008,000. Nameco (No. 408) Limited is

incorporated in England and Wales and is a corporate member of

Lloyd's.

The acquisition has been accounted for using the acquisition

method of accounting. After the alignment of accounting policies

and other adjustments to the valuation of assets and liabilities to

reflect their fair value at acquisition, the fair value of the net

assets was GBP1,180,000. Negative goodwill of GBP172,000 arose on

acquisition which has been recognised as goodwill on bargain

purchase in the income statement. The following table explains the

fair value adjustments made to the carrying values of the major

categories of assets and liabilities at the date of

acquisition:

Carrying value Adjustments Fair value

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------- -------------- ----------- ----------

Intangible assets - 477 477

Financial assets at fair value through profit or loss 1,174 - 1,174

Reinsurance assets:

- reinsurers' share of claims outstanding 505 - 505

- reinsurers' share of unearned premium 92 - 92

Other receivables, including insurance and reinsurance receivables 1,418 - 1,418

Deferred acquisition cost 138 - 138

Prepayments and accrued income 10 - 10

Cash and cash equivalents 390 - 390

Insurance liabilities:

- claims outstanding (2,035) - (2,035)

- unearned premium (532) - (532)

Deferred income tax liabilities (1) (91) (92)

Other payables, including insurance and reinsurance payables (326) - (326)

Accruals and deferred income (39) - (39)

------------------------------------------------------------------- -------------- ----------- ----------

Net assets acquired 794 386 1,180

------------------------------------------------------------------- -------------- ----------- ----------

Satisfied by:

Cash and cash equivalents 1,008 - 1,008

Loan paid on acquisition - - -

------------------------------------------------------------------- -------------- ----------- ----------

Total consideration 1,008 - 1,008

------------------------------------------------------------------- -------------- ----------- ----------

Negative goodwill 214 386 (172)

------------------------------------------------------------------- -------------- ----------- ----------

2018 year 2019 year 2020 year

of account of account of account

------------------ ----------- ----------- -----------

Capacity acquired 1,304,321 1,142,830 1,086,270

------------------ ----------- ----------- -----------

The net earned premium and profit of Nameco (No. 408) Limited

for the period since the acquisition date to 30 June 2020 are

GBP356,000 and GBP33,000 respectively.

Negative goodwill has arisen on the acquisition of Nameco (No.

408) Limited as a result of the purchase consideration being at a

discount to the fair value of net assets acquired.

13. Related party transactions

Helios Underwriting plc and its subsidiaries have entered into a

management agreement with Nomina plc. Jeremy Evans, a Director of

Helios Underwriting plc and its subsidiary companies, is also a

Director of Nomina plc. Under the agreement, Nomina plc provides

management and administration, financial, tax and accounting

services to the Group for an annual fee of GBP152,000 (2019:

GBP180,000).

The Limited Liability Vehicles have entered into a members'

agent agreement with Hampden Agencies Limited. Jeremy Evans, a

Director of Helios Underwriting plc and its subsidiary companies,

is also a director of Hampden Capital plc, which controls Hampden

Agencies Limited. Under the agreement, the Limited Liability

Vehicles will pay Hampden Agencies Limited a fee based on a fixed

amount, which will vary depending upon the number of syndicates the

Limited Liability Vehicles underwrite on a bespoke basis, and a

variable amount depending on the level of underwriting through the

members' agent pooling arrangements. The total fees payable for

2020 are GBP135,000 (2019: GBP225,000).

A number of subsidiary companies have entered into quota share

reinsurance contracts for the 2018, 2019 and 2020 years of account

with protected cell companies of Hampden Insurance PCC (Guernsey)

Limited. The quota share percentages for the above years was

70%

Nigel Hanbury, a Director of Helios Underwriting plc and its

subsidiary companies, is also a director and majority shareholder

in Hampden Insurance Guernsey PCC Limited. Hampden Capital plc, a

substantial shareholder in Helios Underwriting plc, is also a

substantial shareholder in Hampden Insurance Guernsey PCC Limited -

Cell 6. Under quota share agreements between Cell 6 and certain

Helios subsidiaries, the Group accrued a net reinsurance premium

recovery of GBP4,453,000 (2019: GBP3,968,000) during the

period.

In addition, HIPCC provide stop loss, portfolio stop loss and

HASP reinforce policies for the company.

HIPCC Limited acts as an intermediary for the reinsurance

products purchased by Helios. An arrangement has been put in place

so that 51% of the profits generated by HIPCC (being Nigel Hanburys

share) in respect of the business relating to Helios will be repaid

to Helios for the business transacted for the 2020 and subsequent

underwriting years.

14. Ultimate controlling party

The Directors consider that the Group has no ultimate

controlling party.

15. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA")

in which the Company's subsidiaries participate as corporate

members of Lloyd's are as follows:

Allocated capacity per year of account

------------------------ -------------------------------------- ----------------------------------------------

2017 2018 (]) 2019 2020

Syndicate or MAPA number Managing or members' agent GBP GBP GBP GBP

------------------------ -------------------------------------- ---------- ---------- ---------- ----------

33 Hiscox Syndicates Limited 5,764,233 8,019,797 7,031,021 8,339,667

218 ERS Syndicate Management Limited 3,620,739 5,104,083 5,108,619 5,108,619

308 Tokio Marine Kiln Syndicates Limited 132,000 - - -

318 Beaufort Underwriting Agency Limited 866,250 866,250 836,250 -

386 QBE Underwriting Limited 1,322,097 1,291,391 1,295,773 1,295,772

510 Tokio Marine Kiln Syndicates Limited 11,843,732 11,850,400 11,865,468 13,051,289

557 Tokio Marine Kiln Syndicates Limited 1,844,203 1,526,776 1,512,922 2,269,384

609 Atrium Underwriters Limited 4,722,562 5,058,275 5,069,124 5,700,796

623 Beazley Furlonge Limited 6,951,965 8,057,318 8,428,557 9,544,350

727 S A Meacock & Company Limited 1,586,583 1,586,582 1,586,582 1,436,179

1176 Chaucer Syndicates Limited 1,168,400 1,448,810 1,449,906 1,419,908

1200 Argo Managing Agency Limited 136,305 57,857 57,143 -

1729 Asta Managing Agency Limited 329,996 324,634 55,810 2,867

1884 Charles Taylor Managing Agency Limited 217,500 - - -

1969 Apollo Syndicate Management Limited 616,462 131,082 - -

1991 R&O Managing Agency Limited 222,228 - - -

2010 Cathedral Underwriting Limited 2,127,335 2,127,332 2,130,071 2,129,005

2014 Pembroke Managing Agency Limited 2,279,023 547,449 92,192 -

2121 Argenta Syndicate Management Limited 885,082 1,003,093 1,003,093 1,253,868

2525 Asta Managing Agency Limited 332,794 432,632 467,270 535,460

2689 Asta Managing Agency Limited 1,537,499 398,045 32,192 2,377

2791 Managing Agency Partners Limited 6,468,698 6,468,694 6,480,967 6,282,966

2988 Brit Syndicates Limited 225,687 227,127 2,740 -

4242 Asta Managing Agency Limited 288,521 348,378 253,299 3,299

4444 Canopius Managing Agents Limited 757,008 1,177,416 - -

5623 Beazley Furlonge Limited 2,250,000 - - 2,250,000

5820 ANV Syndicates Limited - - - -

5886 Asta Managing Agency Limited 5,623,852 453,254 536,512 5,623,852

6103 Managing Agency Partners Limited 1,349,391 1,287,333 1,292,210 1,349,391

6104 Hiscox Syndicates Limited 1,047,395 1,112,543 1,137,541 1,047,395

6107 Beazley Furlonge Limited 1,026,295 1,014,510 1,263,800 1,026,295

6111 Catlin Underwriting Agencies Limited 278,279 249,065 - -

6117 Argo Managing Agency Limited 3,302,839 3,472,410 3,095,553 397,574

6123 Asta Managing Agency Limited 8,440 8,708 -

7211 Members' agent pooling arrangement 11,553 121,828 120,610 130,401

7217 Members' agent pooling arrangement 18,107 19,917 29,875 -

7227 Members' agent pooling arrangement 2,746 3,661 6,406 -

Total 62,710,376 65,796,650 62,241,506 70,200,714

------------------------ -------------------------------------- ---------- ---------- ---------- ----------

16. Group-owned net assets

The Group statement of financial position includes the following

assets and liabilities held by the syndicates on which the Group

participates. These assets are subject to trust deeds for the

benefit of the relevant syndicates' insurance creditors. The table

below shows the split of the statement of financial position

between Group and syndicate assets and liabilities:

30 June 2020 30 June 2019 31 December 2019

------------------------- ----------------------------- ----------------------------- -----------------------------

Group Syndicate Total Group Syndicate Total Group Syndicate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Assets

Intangible assets 21,655 - 21,655 16,490 - 16,490 21,178 - 21,178

Financial assets at fair

value through profit or

loss 8,989 55,154 64,143 10,850 45,657 56,507 13,520 53,621 67,141

Reinsurance assets: - - - - - - - -

- reinsurers' share of

claims outstanding 61 28,080 28,141 61 21,172 21,233 61 25,699 25,760

- reinsurers' share of

unearned premium - 9,195 9,195 - 7,163 7,163 - 5,023 5,023

Other receivables,

including

insurance and

reinsurance

receivables 7,837 44,962 52,799 8,151 42,566 50,717 10,044 37,682 47,726

Deferred acquisition

costs - 6,853 6,853 - 6,228 6,228 - 6,641 6,641

Prepayments and accrued

income 281 601 882 179 522 701 - 432 432

Cash and cash equivalents 1,156 7,345 8,501 2,018 4,979 6,997 3,028 3,009 6,037

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total assets 39,979 152,190 192,169 37,749 128,287 166,036 47,831 132,107 179,938

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Liabilities

Insurance liabilities:

- claims outstanding - 99,758 99,758 - 80,204 80,204 - 95,616 95,616

- unearned premium - 35,961 35,961 - 30,631 30,631 - 26,522 26,522

Deferred income tax

liabilities 3,686 - 3,686 2,134 - 2,134 3,292 - 3,292

Borrowings 2,000 - 2,000 1,034 - 1,034 2,000 - 2,001

Other payables, including

insurance and

reinsurance

payables 10 20,831 20,841 1,694 25,774 27,468 1,051 16,989 18,040

Accruals and deferred

income 1,108 763 1,871 3,171 326 3,497 5,094 1,226 6,320

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total liabilities 6,804 157,313 164,117 8,033 136,935 144,968 11,437 140,353 151,790

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Equity attributable to

owners of the Parent

Share capital 1,839 - 1,839 1,510 - 1,510 1,839 - 1,839

Share premium 18,938 - 18,938 15,387 - 15,387 18,938 - 18,938

Other reserves (50) - (50) (50) - (50) (50) - (50)

Retained earnings 12,448 (5,123) 7,325 12,869 (8,648) 4,221 15,667 (8,246) 7,421

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total equity 33,175 (5,123) 28,052 29,716 (8,648) 21,068 36,394 (8,246) 28,148

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total liabilities and

equity 39,979 152,190 192,169 37,749 128,287 166,036 47,831 132,108 179,938

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

17. COVID-19

The COVID-19 pandemic has created turbulence in financial

markets and economic uncertainty which will impact individuals and

businesses. The full impact of this on the insurance industry,

including the Lloyd's market, is uncertain. The initial assessment

by supported syndicates has identified those lines of business most

likely to be impacted, however the full extent of the losses and

the impact upon pricing will become clearer as the year progresses.

We will regularly monitor developments in this area and take

appropriate actions as needed.

The COVID-19 coronavirus pandemic will be a manageable loss for

the property and casualty insurance and reinsurance industry,

unless there is some kind of structural change to drive the cost to

the sector much higher.

It should not be forgotten that the current turmoil is happening

against the backdrop of the greatest momentum we have seen in

(re)insurance pricing for many years. Recent events are

accelerating the premium rate rises.

The importance of having sufficient diversification within the

portfolio to absorb shock losses is critical to the success of the

portfolio. We do this by being partnered with the highest quality

underwriting businesses at Lloyd's

It is expected that that a significant proportion of the losses

arising from COVID-19 will attach to the 2019 underwriting year and

therefore there remains considerable uncertainty regarding the

eventual outcome for this underwriting year.

The Directors are confident that the business continues to be a

going concern as in addition to the current funds lodged at

Lloyd's, Helios has available the following facilities to provide

additional resources to fund the necessary capital

requirements:

-- A bank revolving credit bank facility of GBP4m of which GBP2.0m has been utilised, and

-- The stop loss reinsurance contracts for the 2019 and 2020

years of account could provide additional underwriting capital of

approximately GBP5m.

The Board considers that the dividend policy should reflect the

requirement to maintain its available cash resources given the

uncertainty for the potential funding of the COVID-19 and other

losses in the immediate future and therefore no dividend will be

payable.

The Interim Report will be made available in electronic format

on the Company's website, www.huwplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QZLFLBKLFBBE

(END) Dow Jones Newswires

September 25, 2020 02:00 ET (06:00 GMT)

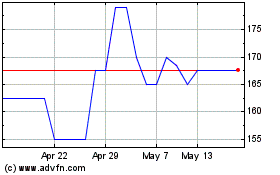

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024