Helios Underwriting Plc Acquisition (9342E)

February 16 2015 - 2:00AM

UK Regulatory

TIDMHUW

RNS Number : 9342E

Helios Underwriting Plc

16 February 2015

16 February 2015

Helios Underwriting plc

("HUW" or the "Company")

Acquisition of Lloyd's Limited Liability Vehicle

HUW is pleased to announce that, in line with its strategy of

increasing underwriting capacity through acquisition, it has agreed

to acquire Updown Underwriting Limited, a limited liability member

of Lloyd's ("LLV") for a total consideration of GBP0.6 million in

cash and 429,839 new ordinary shares in the Company. The 2015

underwriting capacity of the LLV is GBP0.9 million; this compares

with HUW's 2015 capacity of GBP21.4 million prior to this

acquisition. Completion is subject to change of control consent

from Lloyd's. The LLV participates in a spread of Lloyd's

syndicates broadly similar to HUW's own participation.

Commenting upon the acquisition, Nigel Hanbury, the Company's

Chief Executive Officer, said:

"We are delighted to have agreed a further LLV acquisition which

will further increase our underwriting capacity. This is in line

with our stated strategy of acquiring corporate members as suitable

opportunities arise. We continue to believe that there remain

significant opportunities for further growth available to the

Company."

For further information please contact:

HUW 020 7863 6655 / nigel.hanbury@huwplc.com

Nigel Hanbury - Chief Executive

Smith & Williamson Corporate

Finance

David Jones 020 7131 4000

Westhouse Securities

Robert Finlay 020 7601 6100

About HUW

HUW provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). HUW's subsidiary underwriting

vehicles trade within the Lloyd's insurance market as corporate

members of Lloyd's writing approximately GBP21 million of capacity

for the 2015 account. The portfolio provides a good spread of

classes of business being concentrated in property insurance and

reinsurance. For further information please visit

www.huwplc.com.

Additional information

Updown Underwriting Limited ("Updown") is a limited liability

member of Lloyd's which HUW has agreed to acquire from Nicholas

Wentworth Stanley; in the year ended 31 December 2013, Updown made

a profit before tax of GBP0.2 million on gross premiums written of

GBP0.8 million. Updown's expected net asset value at completion is

approximately GBP1.3 million, including underwriting capacity with

an estimated market value of GBP0.4 million.

Set out below are Updown's 2012 and 2013 open years of account

forecasts:

YOA Updown Forecast of syndicate profit

syndicate (30 September 2014)

capacity

(GBP'000)

------ ----------- -------------------------------------

Mid point Mid point Range

(GBP'000) (%) (%)

------ ----------- ----------- --------- -------------

2012 902 114 12.63% 9.38 - 15.87%

------ ----------- ----------- --------- -------------

2013 927 87 9.40% 5.09 - 13.70%

------ ----------- ----------- --------- -------------

Source: Syndicate data and HUW analysis (before early

release)

Set out below are details of Updown's syndicate participations

for the 2012 to 2015 years of account:

YOA 2012 2013 2014 2015

---------- ------------------- --------------------- ------------------- -------------------

Syndicate (GBP'000) (%)* (GBP'000) (%)* (GBP'000) (%)* (GBP'000) (%)*

---------- ---------- ------- ---------- --------- ---------- ------- ---------- -------

33 88 9.7% 88 9.5% 92 10.0% 92 10.7%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

218 52 5.8% 52 5.6% 52 5.6% 42 4.8%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

386 24 2.7% 24 2.6% 24 2.6% 21 2.4%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

510 137 15.2% 137 14.8% 137 14.8% 137 15.9%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

609 41 4.6% 41 4.4% 41 4.4% 41 4.8%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

623 111 12.3% 117 12.6% 126 13.6% 117 13.6%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

727 63 7.0% 63 6.8% 63 6.8% 63 7.3%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

958 50 5.5% 39 4.2% 31 3.4% 33 3.8%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

1176 38 4.2% 38 4.1% 38 4.1% 38 4.4%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

2010 105 11.6% 105 11.3% 105 11.3% 92 10.6%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

2014 - - - - 46 5.0% 40 4.6%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

2791 108 11.9% 108 11.6% 95 10.2% 84 9.7%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

6103 21 2.3% 26 2.8% 19 2.1% 8 0.9%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

6104 28 3.1% 36 3.9% 36 3.9% 36 4.1%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

6106 18 2.0% 21 3.5% - - - -

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

6110 18 2.0% 33 3.5% - - - -

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

6111 - - - - 20 2.2% 19 2.2%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

Total 902 100.0% 927 100.0% 927 100.0% 863 100.0%

---------- ---------- ------- ---------- ------- ------------ ------- ---------- -------

* Percentage of total syndicate portfolio

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQTJMRTMBIBBBA

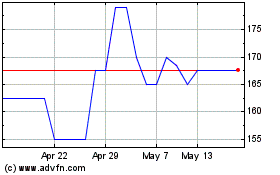

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2024 to Aug 2024

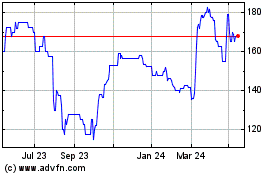

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Aug 2023 to Aug 2024