TIDMHUW

RNS Number : 9269O

Hampden Underwriting Plc

26 September 2013

26 September 2013

Hampden Underwriting plc

("Hampden Underwriting" or the "Company")

Interim results for the six months ended 30 June 2013

Hampden Underwriting plc, which provides investors with a

limited liability direct investment into the Lloyd's insurance

market, announces its unaudited results for the six months ended 30

June 2013.

Highlights

-- Premium written during the period totalled GBP7.2m (an

increase of 42% over the same period last year).

-- Net profit of GBP462,000 (compared to a profit of GBP247,000

over the same period last year).

-- Earnings per share of 5.42p (compared to 3.33p over the same period last year).

-- Net assets increased to GBP9.6m from GBP9.1m at 31 December 2012.

Commenting upon these results Chairman, Sir Michael Oliver

said:

"The six months ended 30 June 2013 shows some significantly

improved figures. This has occurred both as a result of good

overall results in the Lloyd's market and the benefit of our

acquisitions of Lloyd's Limited Liability Vehicles, made over the

last few years, delivering a performance commensurate with the

Directors' expectations at the time of purchase."

For further information please contact:

Hampden Underwriting Nigel Hanbury nigel.hanbury@hampdenplc.com

Smith & Williamson Corporate

Finance David Jones 020 7131 4000

Chairman's Statement

The six months ended 30 June 2013 shows some significantly

improved figures. This has occurred both as a result of good

overall results in the Lloyd's market and the benefit of our

acquisitions of Lloyd's Limited Liability Vehicles (LLVs), made

over the last few years, delivering a performance commensurate with

the Directors' expectations at the time of purchase.

Over the comparable period last year, premium written is up 42%

and net profit is up from GBP247,000 to GBP462,000. Earnings per

share stand at 5.42p compared to 3.33p and net assets have

increased to GBP9.6m from GBP9.1m at 31 December 2012.

Our investment portfolio is now invested in long term low

volatility funds which have performed within expected parameters

and more details of this will be set out in our next annual

report.

In July we were able to announce the signing of a quota share

arrangement, in effect a reinsurance of half our 2013 year of

account portfolio in exchange for a fee and a ratcheted performance

based profit commission. This has released GBP4.1m of capital to

HUW which had previously been allocated as Funds at Lloyd's. The

plan is to put this capital back to work with new underwriting

capacity and we are currently negotiating on three possible

acquisitions. We will be actively seeking more should suitable

opportunities present themselves.

There are a number of potentially rewarding uses of our capital

but the acquisition of further LLVs would seem the most attractive

for the time being. As and when we are successful we will make the

appropriate announcements.

Sir Michael Oliver

Non-executive Chairman

25 September 2013

Condensed Consolidated Statement of Comprehensive Income

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2013 2012 2012

Unaudited Unaudited Audited

------------------------------------------------ ----- ---------- ---------- -------------

Note GBP'000 GBP'000 GBP'000

------------------------------------------------ ----- ---------- ---------- -------------

Gross premium written 7,158 5,043 9,141

Reinsurance premium ceded (1,634) (1,201) (1,820)

------------------------------------------------ ----- ---------- ---------- -------------

Net premiums written 5,524 3,842 7,321

Change in unearned gross premium

provision (1,626) (1,337) (405)

Change in unearned reinsurance premium

provision 689 565 52

------------------------------------------------ ----- ---------- ---------- -------------

(937) (772) (353)

Net earned premium 2 4,587 3,070 6,968

------------------------------------------------ ----- ---------- ---------- -------------

Net investment income 4 24 204 429

Other underwriting income 26 - -

Other income 110 - 568

------------------------------------------------ ----- ---------- ---------- -------------

160 204 997

------------------------------------------------ ----- ---------- ---------- -------------

Revenue 4,747 3,274 7,965

------------------------------------------------ ----- ---------- ---------- -------------

Gross claims paid (2,855) (2,133) (4,685)

Reinsurance share of gross claims

paid 549 416 930

------------------------------------------------ ----- ---------- ---------- -------------

Claims paid, net of reinsurance (2,306) (1,717) (3,755)

Change in provision for gross claims 4 193 229

Reinsurance share of change in provision

for gross claims (95) (179) 24

------------------------------------------------ ----- ---------- ---------- -------------

Net change in provision for claims (91) 14 253

Net insurance claims and loss adjustment

expenses 2 (2,397) (1,703) (3,502)

------------------------------------------------ ----- ---------- ---------- -------------

Expenses incurred in insurance activities 2 (1,300) (916) (2,743)

Other operating expenses 2 (448) (321) (866)

------------------------------------------------ ----- ---------- ---------- -------------

Operating expenses (1,748) (1,237) (3,609)

Operating profit before tax 2 602 334 854

------------------------------------------------ ----- ---------- ---------- -------------

Income tax expense 5 (140) (87) (91)

Profit attributable to equity shareholders 10 462 247 763

------------------------------------------------ ----- ---------- ---------- -------------

Earnings per share attributable to

equity shareholders

Basic and diluted 6 5.42p 3.33p 9.92p

------------------------------------------------ ----- ---------- ---------- -------------

Condensed Consolidated Statement of Financial Position

At 30 June 2013

30 June 30 June 31 December

2013 2012 2012

Unaudited Unaudited Audited

-------------------------------------------- ----- ---------- ---------- --------------

Note GBP'000 GBP'000 GBP'000

-------------------------------------------- ----- ---------- ---------- --------------

Assets

Intangible assets 1,571 909 1,797

Deferred income tax assets - - -

Reinsurance share of insurance

liabilities

- Reinsurers' share of outstanding

claims 3 3,658 2,702 4,323

- Reinsurers' share of unearned

premiums 3 1,379 992 590

Other receivables, including insurance

receivables 9,285 6,598 9,343

Prepayments and accrued income 1,577 1,045 1,216

Financial assets at fair value 8 19,817 14,091 20,978

Cash and cash equivalents 2,270 3,526 1,444

Total assets 39,557 29,863 39,691

-------------------------------------------- ----- ---------- ---------- --------------

Liabilities

Insurance liabilities

- Claims outstanding 3 17,487 12,853 19,814

- Unearned premiums 3 6,694 4,603 4,624

Deferred income tax liabilities 978 417 938

Other payables, including insurance

payables 4,108 3,814 4,589

Accruals and deferred income 733 444 631

Total liabilities 30,000 22,131 30,596

-------------------------------------------- ----- ---------- ---------- --------------

Shareholders' equity

Share capital 9 853 741 853

Share premium 9 6,996 6,261 6,996

Retained earnings 10 1,708 730 1,246

-------------------------------------------- ----- ---------- ---------- --------------

Total shareholders' equity 9,557 7,732 9,095

-------------------------------------------- ----- ---------- ---------- --------------

Total liabilities and shareholders'

equity 39,557 29,863 39,691

-------------------------------------------- ----- ---------- ---------- --------------

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2013

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2013 2012 2012

Cash flow from operating activities Unaudited Unaudited Audited

-------------------------------------------------- ------------ ------------ -------------

GBP'000 GBP'000 GBP'000

-------------------------------------------------- ------------ ------------ -------------

Results of operating activities 602 334 854

Interest received - (15) (27)

Investment income (49) (177) (320)

Goodwill on bargain purchase - - (568)

Impairment of goodwill - - 81

Profit on sale of intangible assets - - 1

Amortisation of intangible assets 226 143 314

Change in fair value of investments 93 2 (128)

Changes in working capital:

(Increase)/decrease in other receivables (303) (173) 2,225

(Decrease)/increase in other payables (479) 772 (1,046)

Net increase in technical provisions (381) (156) (2,991)

Income tax paid (93) - (179)

Net cash (outflow)/inflow from operating

activities (384) 730 (1,784)

-------------------------------------------------- ------------ ------------ -------------

Cash flows from investing activities

Interest received - 15 27

Investment income 49 177 321

Purchase of intangible assets - - (217)

Sale/(purchase) of financial assets

at fair value 1,161 (416) 854

Acquisition of subsidiary, net of cash

acquired - - (828)

Proceeds from disposal of intangible

assets - - 51

Net cash used in investing activities 1,210 (224) 208

-------------------------------------------------- ------------ ------------ -------------

Cash flows from financing activities

Net proceeds from issue of ordinary - - -

share capital

Net cash used in financing activities - - -

-------------------------------------------------- ------------ ------------ -------------

Net increase/(decrease) in cash and

cash equivalents 826 506 (1,576)

Cash and cash equivalents at beginning

of period 1,444 3,020 3,020

Cash, cash equivalents and bank overdrafts

at end of period 2,270 3,526 1,444

-------------------------------------------------- ------------ ------------ -------------

Condensed Statement of Changes in Shareholders' Equity

For the six months ended 30 June 2013

Ordinary Retained

share capital Share Premium Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- --------------- -------------- ---------- --------

At 1 January 2013 853 6,996 1,246 9,095

Profit for the period attributable

to equity shareholders - - 462 462

At 30 June 2013 853 6,996 1,708 9,557

---------------------------------------- --------------- -------------- ---------- --------

For the six months ended 30 June 2012

Ordinary Retained

share capital Share Premium Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- --------------- -------------- ---------- --------

At 1 January 2012 741 6,261 483 7,485

Profit for the period attributable

to equity shareholders - - 247 247

At 30 June 2012 741 6,261 730 7,732

---------------------------------------- --------------- -------------- ---------- --------

For the twelve months ended 31 December 2012

Ordinary Retained

share capital Share Premium Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- --------------- -------------- ---------- --------

At 1 January 2012 741 6,261 483 7,485

Share issue 112 735 - 847

Profit for the year attributable

to equity shareholders - - 763 763

-------------------------------------- --------------- -------------- ---------- --------

At 31 December 2012 853 6,996 1,246 9,095

-------------------------------------- --------------- -------------- ---------- --------

Notes to the Interim Financial Statements

Six months ended 30 June 2013

1. Accounting policies

Basis of preparation

The Condensed Consolidated Interim Financial Statements have

been prepared using accounting policies consistent with

International Financial Reporting Standards (IFRSs) and in

accordance with International Accounting Standard (IAS) 34 Interim

Financial Reporting.

The Condensed Consolidated Interim Financial Statements are

prepared for the six months ended 30 June 2013.

The Condensed Consolidated Interim Financial Statements

incorporate the results of Hampden Underwriting plc, Hampden

Corporate Member Limited, Nameco (No. 365) Limited, Nameco (No.

605) Limited, Nameco (No. 321) Limited, Nameco (No. 917) Limited,

Nameco (No. 229) Limited and Nameco (No. 518) Limited.

The Condensed Consolidated Interim Financial Statements are

unaudited, but have been subject to review by the Group's auditors.

The Interim Financial Statements have been prepared in accordance

with the accounting policies adopted for the year ended 31 December

2012.

The comparative figures are based upon the Group Financial

Statements for the year ended 31 December 2012, and have been

reported on by the Group's auditors and were delivered to the

Registrar of Companies on 27 June 2013.

The underwriting data on which these Condensed Consolidated

Interim Financial Statements are based upon has been supplied by

the managing agents of those syndicates which the Group supports.

The data supplied is the 100% figures for each syndicate. The Group

has applied its share of the syndicate participations to the gross

figures to derive its share of the syndicates transactions, assets

and liabilities.

Significant accounting policies

The Condensed Consolidated Interim Financial Statements have

been prepared under the historical cost convention. The same

accounting policies, presentation and methods of computation are

followed in these Condensed Consolidated Interim Financial

Statements as were applied in the preparation of the Group

Financial Statements for the year ended 31 December 2012. The new

standards and amendments to standards and interpretations effective

after 1 January 2013, as disclosed in the Annual Report for the

year ended 31 December 2012, have not had a significant impact on

the Condensed Consolidated Interim Financial Statements at 30 June

2013.

2. Segmental information

The Group has three primary segments which represent the primary

way in which the Group is managed:

-- Syndicate participation;

-- Investment management;

-- Other corporate activities.

6 months ended 30 June 2013 Syndicate Investment Other corporate

Unaudited participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------------- ------------ ---------------- -----------

Net earned premium 4,587 - - 4,587

Net investment income 21 3 - 24

Other income - - 136 136

Goodwill on bargain purchase - - - -

Net insurance claims and loss

adjustment expenses (2,397) - - (2,397)

Expenses incurred in insurance

activities (1,300) - - (1,300)

Amortisation of syndicate capacity - - (119) (119)

Other operating expenses (139) - (190) (329)

------------------------------------ --------------- ------------ ---------------- -----------

Results of operating activities 772 3 (173) 602

------------------------------------ --------------- ------------ ---------------- -----------

6 months ended 30 June 2012 Syndicate Investment Other corporate

Unaudited participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------------- ------------ ---------------- -----------

Net earned premium 3,070 - - 3,070

Net investment income 141 63 - 204

Other income - - - -

Goodwill on bargain purchase - - - -

Net insurance claims and loss

adjustment expenses (1,703) - - (1,703)

Expenses incurred in insurance

activities (916) - - (916)

Amortisation of syndicate capacity - - (87) (87)

Other operating expenses (114) - (120) (234)

------------------------------------ --------------- ------------ ---------------- -----------

Results of operating activities 478 63 (207) 334

------------------------------------ --------------- ------------ ---------------- -----------

12 months ended 31 December Syndicate Investment Other corporate

2012 Audited participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------------- ------------ ---------------- ------------

Net earned premium 6,968 - - 6,968

Net investment income 405 24 - 429

Other income - - - -

Goodwill on bargain purchase - - 568 568

Net insurance claims and loss

adjustment expenses (3,502) - - (3,502)

Expenses incurred in insurance

activities (2,743) - - (2,743)

Amortisation of syndicate capacity - - (192) (192)

Other operating expenses (303) - (371) (674)

------------------------------------ --------------- ------------ ---------------- ------------

Results of operating activities 825 24 5 854

------------------------------------ --------------- ------------ ---------------- ------------

The Group does not have any geographical segments as it

considers all of its activities to arise from trading within the

UK.

No major customers exceed 10% of revenue.

3. Insurance liabilities and reinsurance balances

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

---------------------- -------- ------------ --------

At 1 January 2013 19,814 4,323 15,491

Movement of reserves (4) (95) 91

Other movements (2,323) (570) (1,753)

---------------------- -------- ------------ --------

At 30 June 2013 17,487 3,658 13,829

---------------------- -------- ------------ --------

Included within other movements are the 2010 and prior years'

claims reserves reinsured into the 2011 year of account and

currency exchange differences.

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

---------------------- -------- ------------ --------

At 1 January 2013 4,624 590 4,034

Movement of reserves 1,626 689 937

Other movements 444 100 344

---------------------- -------- ------------ --------

At 30 June 2013 6,694 1,379 5,315

---------------------- -------- ------------ --------

4. Net investment income

6 months 6 months

ended ended 12 months ended

30 June 30 June 31 December

2013 2012 2012

Unaudited Unaudited Audited

----------------------------------------- ----------- ---------- ----------------

GBP'000 GBP'000 GBP'000

----------------------------------------- ----------- ---------- ----------------

Investment income 49 177 320

Realised gains on financial investments

at fair value through income statement 129 - 3

Unrealised (losses)/gains on financial

investments at fair value through

income statement (144) 20 128

Investment management expenses (10) (8) (49)

Bank interest - 15 27

----------------------------------------- ----------- ---------- ----------------

Net investment income 24 204 429

----------------------------------------- ----------- ---------- ----------------

5. Income tax expense

6 months 6 months

ended ended 12 months ended

30 June 30 June 31 December

2013 2012 2012

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------- ---------- ---------- ----------------

Income tax expense (140) (87) (91)

-------------------- ---------- ---------- ----------------

The income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual tax rate

used is 23.25% (2012: 24.50%). Material disallowed items have been

adjusted for in the income tax calculation.

6. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

The Group has no dilutive potential ordinary shares.

Earnings per share have been calculated in accordance with IAS

33.

Reconciliation of the earnings and weighted average number of

shares used in the calculation is set out below.

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2013 2012 2012

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------- ---------- ---------- -------------

Profit for the period 462,000 247,000 763,000

-------------------------------------- ---------- ---------- -------------

Weighted average number of shares

in issue 8,526,948 7,413,376 7,691,769

-------------------------------------- ---------- ---------- -------------

Basic and diluted earnings per share

(p) 5.42p 3.33p 9.92p

-------------------------------------- ---------- ---------- -------------

7. Dividends

No equity dividends were proposed, declared or paid in the

period (2012 - GBPNil).

8. Financial assets at fair value

The Group uses the following hierarchy for determining and

disclosing the fair value of financial instruments by valuation

technique:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities.

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly.

Level 3: techniques which use inputs that have a significant

effect on the recorded fair value that are not based on observable

market data.

As at 30 June 2013, the Group held GBP17,709,000 (31 December

2012: GBP19,275,000) Level 1 Financial Assets and GBP2,108,000 (31

December 2012: GBP1,703,000) Level 2 Financial Assets. The Group

has no level 3 investments (31 December 2012 GBPNil).

9. Share capital and share premium

Ordinary

Share

Capital Share Premium Total

Allotted, called up and fully paid GBP'000 GBP'000 GBP'000

------------------------------------------- --------- -------------- ---------

7,413,376 ordinary shares of 10p each and

share premium at 30 June 2012 741 6,261 7,002

8,526,948 ordinary shares of 10p each and

share premium at 31 December 2012 853 6,996 7,849

8,526,948 ordinary shares of 10p each and

share premium at 30 June 2013 853 6,996 7,849

------------------------------------------- --------- -------------- ---------

10. Retained earnings

30 June 30 June 31 December

2013 2012 2012

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Group

At 1 January 2013 1,246 483 483

Profit attributable to equity shareholders 462 247 763

---------- ---------- ------------

At 30 June 2013 1,708 730 1,246

---------- ---------- ------------

11. Related party transactions

Hampden Underwriting plc has provided inter-company loans to

Hampden Corporate Member Limited, Nameco (No. 365) Limited, Nameco

(No. 605) Limited, Nameco (No. 321) Limited, Nameco (No. 917)

Limited and Nameco (No. 229) Limited ("Corporate Members"), all

100% subsidiaries of the Company. Nameco (No. 518) Limited, a 100%

subsidiary of the Company, has provided inter-company loans to the

Company. Interest is charged on the loans at base rate plus 0.125%.

The loans are repayable on three months' notice provided it does

not jeopardise the ability of the Corporate Members to meet their

liabilities as they fall due. The amounts outstanding as at 30 June

2013 are set out below:

30 June 30 June 31 December

2013 2012 2012

Unaudited Unaudited Audited

Company GBP'000 GBP'000 GBP'000

---------------------------------------- ---------- ---------- ------------

Balances due from/(to) Group companies

at the period end:

Hampden Corporate Member Limited 3,109 3,111 3,537

Nameco (No. 365) Limited 330 346 350

Nameco (No. 605) Limited 1,092 1,100 1,306

Nameco (No. 321) Limited 321 319 350

Nameco (No. 917) Limited 1,449 - 1,431

Nameco (No. 229) Limited 355 - 358

Nameco (No. 518) Limited (163) - -

---------------------------------------- ---------- ---------- ------------

Total 6,493 4,876 7,332

---------------------------------------- ---------- ---------- ------------

The Corporate Members are 100% subsidiaries of the Company and

have entered into a management agreement with Nomina plc. Jeremy

Evans, a Director of Hampden Underwriting plc and the Corporate

Members is also a Director of Nomina plc. Under the agreement,

Nomina plc provides management and administration, financial tax

and accounting services to the Group for an annual fee of GBP2,750

(2012: GBP2,750) per Corporate Member.

The Corporate Members are 100% subsidiaries of the Company and

have entered into a member's agent agreement with Hampden Agencies

Limited. Jeremy Evans, a Director of Hampden Underwriting plc and

the Corporate Members, is also Director of Hampden Capital plc

which controls Hampden Agencies Limited. Under the agreement the

Corporate Members will pay Hampden Agencies Limited a fee based on

a fixed amount, which will vary depending upon the number of

syndicates the Corporate Members underwrite on a bespoke basis, and

a variable amount depending on the level of underwriting through

the members' agent pooling arrangements. In addition, the Corporate

Members will pay profit commission on a sliding scale from 1% of

the net profit up to a maximum of 10%. The total fees payable for

2013 are set out below:

30 June 30 June 31 December

2013 2012 2012

Unaudited Unaudited Audited

Company GBP'000 GBP'000 GBP'000

---------------------------------- ---------- ---------- ------------

Hampden Corporate Member Limited 20 51 51

Nameco (No. 365) Limited 5 9 9

Nameco (No. 605) Limited 15 50 50

Nameco (No. 321) Limited 6 16 16

Nameco (No. 917) Limited 10 - 3

Nameco (No. 229) Limited 6 - 6

Nameco (No. 518) Limited 7 - 23

---------------------------------- ---------- ---------- ------------

Total 69 126 158

---------------------------------- ---------- ---------- ------------

Hampden Underwriting plc has entered into a company secretarial

agreement with Hampden Legal plc. Under the agreement, Hampden

Legal plc provides company secretarial services to the Group for an

annual fee of GBP38,000. During the period, company secretarial

fees of GBP17,500 (2012: GBP17,500) were charged to Hampden

Underwriting plc. Hampden Holdings Limited has a controlling

interest in both Hampden Legal plc and Hampden Capital plc.

The Corporate Members have entered into a quota share

reinsurance arrangement with Hampden Insurance PCC (Guernsey)

Limited - Cell 6. Under this the agreement, the Corporate members

have 50% quota share reinsurance. The Corporate Members in return

charge Hampden Insurance PCC (Guernsey) Limited - Cell 6 a profit

commission fee based on the group's aggregate underwriting profits.

A Fund fee of 1.5% of the security provided by the reinsurer (less

expenses) is also charged by the Corporate Members to Hampden

Insurance PCC (Guernsey) Limited - Cell 6.

12. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA")

in which the Company's subsidiaries participate as corporate

members of Lloyd's as are follows:

Allocated capacity

Year of account

Syndicate

or

MAPA Number Managing or Members' Agent 2011 2012 2013

------------- -------------------------------------- ----------- ----------- -----------

33 Hiscox Syndicates Limited 464,465 385,769 385,769

Equity Syndicates Management

218 Limited 363,431 229,285 329,285

386 QBE Underwriting Limited 76,108 86,117 86,117

510 RJ Kiln & Co. Limited 528,155 457,911 457,911

557 RJ Kiln & Co. Limited 327,725 523,590 102,868

570 Atrium Underwriters Limited 181,671 - -

609 Atrium Underwriters Limited 215,723 397,394 397,394

623 Beazley Furlonge Limited 452,631 324,688 340,269

727 S.A. Meacock & Company Limited 69,592 69,592 69,592

807 R.J. Kiln & Co Limited 120,587 - -

Canopius Managing Agency

958 Limited 260,508 335,508 263,615

1176 Chaucer Syndicates Limited - 101,818 201,818

1200 Argo Managing Agency Limited 217,465 197,466 28,551

2010 Cathedral Underwriting Limited 162,690 162,690 162,690

Argenta Syndicate Management

2121 Limited 156,969 156,969 11,691

Managing Agency Partners

2791 Limited 828,338 653,338 653,338

Managing Agency Partners

6103 Limited 110,000 310,000 363,956

6104 Hiscox Syndicates Limited 115,000 315,000 345,000

Ark Syndicate Management

6105 Limited 99,847 99,847 55,439

6106 Amlin Underwriting Limited 140,000 190,000 175,000

6107 Beazley Furlonge Limited 25,000 75,000 10,000

Pembroke Managing Agency

6110 Limited - 314,379 724,541

Catlin Underwriting Agencies

6111 Limited - 292,654 424,537

7200 Members' Agents Pooling Arrangement 295,221 303,635 303,613

7201 Members' Agents Pooling Arrangement 1,532,011 1,556,771 1,556,744

7202 Members' Agents Pooling Arrangement 542,140 552,653 552,629

7203 Members' Agents Pooling Arrangement 59,711 60,610 60,582

7211 Members' Agents Pooling Arrangement 4,627,855 4,751,602 4,751,588

7217 Members' Agents Pooling Arrangement 67,621 67,621 67,620

Total 12,040,464 12,971,907 12,882,157

------------- -------------------------------------- ----------- ----------- -----------

13. Group owned net assets

The Group balance sheet includes the following assets and

liabilities held by the syndicates on which the Group participates.

These assets are subject to trust deeds for the benefit of the

relevant syndicates' insurance creditors. The table below shows the

split of the Group balance sheet between Group and syndicate assets

and liabilities.

30 June 2013 30 June 2012 31 December 2012

Group Syndicate Total Group Syndicate Total Group Syndicate Total

Unaudited Unaudited Audited

--------------------- ------------------------------ ------------------------------ ------------------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Assets

Intangible

assets 1,571 - 1,571 909 - 909 1,797 - 1,797

Deferred - - - - - - - - -

income tax

assets

Reinsurance

share of

insurance

liabilities

- Reinsurers'

share of

outstanding

claims - 3,658 3,658 - 2,702 2,702 - 4,323 4,323

- Reinsurers'

share of

unearned

premiums - 1,379 1,379 - 992 992 - 590 590

Other receivables,

including

insurance

receivables 386 8,899 9,285 703 5,895 6,598 490 8,853 9,343

Prepayments

and accrued

income 34 1,543 1,577 27 1,018 1,045 62 1,154 1,216

Financial

assets at

fair value 7,881 11,936 19,817 5,562 8,529 14,091 7,354 13,624 20,978

Cash and

cash equivalents 296 1,974 2,270 2,080 1,446 3,526 697 747 1,444

Total assets 10,168 29,389 39,557 9,281 20,582 29,863 10,400 29,291 39,691

--------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Liabilities

Insurance

liabilities

- Claims

outstanding - 17,487 17,487 - 12,853 12,853 - 19,814 19,814

- Unearned

premiums - 6,694 6,694 - 4,603 4,603 - 4,624 4,624

Deferred

income tax

liabilities 978 - 978 417 - 417 938 - 938

Other payables,

including

insurance

payables 233 3,875 4,108 737 3,077 3,814 246 4,343 4,589

Accruals

and deferred

income 487 246 733 346 98 444 581 50 631

Current income - - - - - - - - -

tax liabilities

Total liabilities 1,698 28,302 30,000 1,500 20,631 22,131 1,765 28,831 30,596

--------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Shareholders'

equity

Share capital 853 - 853 741 - 741 853 - 853

Share premium 6,996 - 6,996 6,261 - 6,261 6,996 - 6,996

Retained

earnings 621 1,087 1,708 779 (49) 730 786 460 1,246

--------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Total shareholders'

equity 8,470 1,087 9,557 7,781 (49) 7,732 8,635 460 9,095

--------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Total liabilities

and shareholders'

equity 10,168 29,389 39,557 9,281 20,582 29,863 10,400 29,291 39,691

--------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

14. Announcement

A copy of this announcement will be available on the Company's

website, www.hampdenplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGURUBUPWGMA

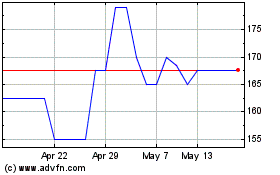

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024