TIDMHUW

RNS Number : 7375F

Hampden Underwriting Plc

29 May 2013

Hampden Underwriting plc

("Hampden Underwriting" or the "Company")

Preliminary results for the year ended 31 December 2012

Hampden Underwriting, which provides investors with a limited

liability direct investment into the Lloyd's insurance market,

announces its preliminary results for the year ended 31 December

2012.

Highlights

-- Premium written during the period totalled GBP9.1m

-- Net profit of GBP763,000

-- Earnings per share 9.92p

-- Net assets increased to GBP9.1m

-- Net assets per share of GBP1.07

Commenting upon these results Chairman, Sir Michael Oliver

said:

"The profit after tax for the year ended 31 December 2012 shows

a marked improvement on 2011. In last year's report I mentioned

that the time was now right for expansion. This we have done with a

35% increase in underwriting. Plans continue to develop and we look

forward to informing shareholders as and when they reach

fruition."

Enquiries:

Hampden Underwriting Nigel Hanbury nigel.hanbury@hampdenplc.com

------------------------------ --------------- -----------------------------

Smith & Williamson Corporate

Finance David Jones 020 7131 4000

------------------------------ --------------- -----------------------------

Chairman's Statement

During the year the Board was pleased to welcome Nigel Hanbury

in the role of Chief executive. Nigel brings a wealth of experience

in underwriting at Lloyd's, and we now look forward to a period of

increased activity.

The profit after tax of GBP763k for the year ended 31 December

2012 compares with a loss after taxation of GBP387k for 2011. This

result includes a net credit of GBP487k in respect of goodwill

arising on the three acquisitions made in the year. Excluding this

the profit after tax for the year of GBP276k still shows a marked

improvement on 2011.

The 2010 underwriting year of account closed at 31 December 2012

with a profit of GBP459k, compared to a profit of GBP831k for the

2009 year of account at 31 December 2011. This represents a profit

of 2.55% on capacity (Lloyd's overall market result was 2.49%)

compared to a profit of 18.27% for the 2009 account which was a

percentage point above the Lloyd's market average result for

2009.

Net assets have increased to 107p per share and when the

unamortised value of capacity is added back it shows a value of

119p.

In last year's report I mentioned that the time was now right

for expansion. This we have done with a 35% increase in

underwriting between the 2012 and 2013 underwriting years of

account. This growth has been achieved through the acquisition of

three Namecos at what we believe to be acceptable prices in a

market that continues to offer profitable opportunities. This

brings the total number of Namecos under 100% ownership to

seven.

A by product of purchasing Namecos is not only to enable

increased underwriting in 2013 but also to increase exposure to

their open years of 2010 (now closed), 2011 and 2012 which are at

varying degrees of maturity at the time of purchase. Of course a

price is paid for these open years but the company benefits from

any improvements between the acquisition date and closure. The

total amount of premium limit purchased last year over the three

open years is in excess of GBP13m.

Furthermore all of the underwriting vehicles own significant

Funds at Lloyd's. Following a beauty parade of various asset

managers this cash has now been invested through two fund managers:

the Trojan Fund managed by Troy and the Ruffer Total and Absolute

Return Funds managed by Ruffer. The Trojan Fund's investment

objective is to achieve growth in capital and income in real terms

over the long term through substantially investing in UK and

Overseas equities and fixed interest securities but it has the

ability/is authorized to invest in all asset classes. The Ruffer

funds aim to preserve capital and achieve low volatility with

positive returns from an actively managed portfolio of different

asset classes including equities bonds and currencies. The

investment of these assets gives the shareholder the ability to

obtain an investment return as well as a return from taking

underwriting risk. Over many years this double use of assets has

been one of the attractions of investing at Lloyd's. The total

amount of the investments in these funds at HUW Plc. and its

subsidiaries, at the time of going to press, is approximately

GBP8.1m or about 95p per share. There are additional cash amounts

yet to be invested or earmarked for day to day cash requirements

amounting to 7p per share.

Plans continue to develop and we look forward to informing

shareholders as and when they reach fruition. However we are

pleased our Lloyd's advisor is seeing clear signs of an improvement

in property and casualty insurance rates which is offsetting, to

some degree, the new competition from the capital markets which are

competing for reinsurance business such as through the issuance of

Catastrophe Bonds and other structures which is likely to have an

adverse effect on reinsurance rates for the June and July

renewals.

Finally, in last year's report we mentioned the possibility of

paying a dividend. The Board has concluded that in the current

climate our resources are better deployed within our core business.

However, we have agreed to buy back some of our shares each year

where the Board feels it is prudent to do so.

Sir Michael Oliver

Non-executive Chairman

28 May 2013

Lloyd's Advisers' Report

2012 review and outlook for 2013

Total insured losses for the global insurance industry from

natural catastrophes in 2012 totalled $71bn, with man-made

disasters costing an additional $6bn. Overall insured losses were

still above the average of recent years but at $77bn declined

significantly from the total of $126bn in 2011. Most of the losses

in 2012 arose from Hurricane Sandy, which made landfall in Atlantic

City, New Jersey on 29 October 2012. The Insurance Information

Institute estimates that insurance companies will pay $18.8bn in

claims from Sandy, making it the third costliest storm in US

history, after Hurricane Katrina in 2005 ($48.7bn) and Hurricane

Andrew in 1992 ($25.6bn).

In contrast to 2011, which was affected by international losses,

principally in Japan, New Zealand and Thailand, 2012 was much more

benign with the largest non-US insured loss being the earthquakes

in Italy costing $1.6bn in May 2012 and the January 2012 capsize of

the cruise liner, Costa Concordia, which is expected to cost

insurers more than $1bn. As a market, Lloyd's net ultimate claims

at 31 December 2012 for catastrophe losses during 2012 are

estimated at GBP1.8bn, which is just above the 15 year average of

GBP1.4bn but like the insurance industry as a whole a significant

reduction on the record claims suffered in 2011 of GBP4.7bn.

Despite Hurricane Sandy and claims from the summer drought in

the corn belt of the US, the underwriting results of the US

property/casualty insurance industry improved in 2012 with net

losses from underwriting reducing to $16.7bn from $36.2bn in 2011.

Net investment gains (income and realised capital gains) enabled an

improved overall net profit after tax of $33.5bn compared with

$19.5bn in 2011.

Capital remains strong for both insurers and reinsurers. At

Lloyd's total net resources increased by 6% in 2012 to a record

GBP20.2bn with the solvency surplus improving by 4%, also to a

record GBP3.1bn. The policyholders' surplus of the US

property/casualty industry, a proxy for underwriting capacity, grew

by $33.1bn in 2012 to a record $586.9bn. Reinsurance capital also

grew to a record $505bn at year end 2012, an increase of 11% or

$50bn since the end of 2011, according to reinsurance broker, Aon

Benfield.

Demand measured by premium has grown over the long term, being

linked to growth in GDP and levels of insurance penetration. During

the Great Recession of 2007-2009 US net written insurance premiums

fell by an aggregate 6.8%, the first three year decline since

1930-1933. Growth in overall net written premiums, a proxy for

demand, accelerated to 4.3% in 2012 from 3.4% in 2011 with insurers

writing predominantly commercial lines showing greater increases of

5.7%. The demand component has been boosted by a combination of

increasing premium rates and a recovering US economy contributing

to organic growth. Encouragingly, net written premium has now

overtaken its previous peak set in 2006.

The insurance pricing cycle is typically supply led with demand

playing a limited role. However, in this cycle deficient demand has

had a greater impact than normal since 2007 as organic growth

opportunities have largely not been available to use up surplus

capital. The strength of the economic recovery remains uncertain in

Lloyd's principal market, the US.

Sluggish economic conditions are expected to continue to have an

impact on the demand for insurance and therefore organic growth

opportunities. However, it is encouraging that US real GDP growth

accelerated to 2.5% in the first quarter of 2013 compared with 0.4%

in the final quarter of 2012.

It is possible that we may have seen the bottom of the cycle in

2011 when the US property/casualty industry reported a combined

ratio of 106.3%, the worst ratio since 2002 with the bottom of the

previous cycle having been in 2001 when the combined ratio was

115.8%. US property/casualty industry net written premium growth in

2013 is expected to be the strongest since 2004 driven by a mixture

of organic growth and a broad and sustained increase in pricing. A

M Best is projecting net written premium growth of 4.5% for

2013.

Insurers and reinsurers have three main sources of earnings.

These are the potential for underwriting profit on earned income

from the current year, the potential for releases from reserves on

business written in prior years and finally investment income and

realised gains. In our view, the principal reason why pricing is

recovering on US insurance business is the investment environment.

The Federal Reserve is actively signalling that it is determined to

keep interest rates low until unemployment drops below 6.5% or

until inflation expectations exceed 2.5%.

The treasury yield curve remains close to its most depressed

level in at least 45 years. Investment income has further reduced

due to a combination of lower yields and a reduction in the average

maturity of insurers' bond portfolios which, according to the

Insurance Information Institute based on A M Best data, has fallen

from 7.32 years in 2006 to 6.45 years in 2011. The duration of bond

investments for Lloyd's syndicates is even lower at 1.7 years.

The significance of the fall in bond years can be seen from the

fact that a US five year treasury bond could have been bought with

a yield of 5% in July 2007, yet when that bond matured in July 2012

the reinvestment yield available was only 0.6%.

The trend in declining yields from 2007 can be seen in the chart

below which shows both the two year and five year US treasury from

2005 to May 2013. At the time of writing the two year is yielding

0.23% and the five year 0.79%.

US treasury bond yields

The investment component of the return on equity by line of

business is particularly important in capital intensive lines such

as reinsurance, or casualty business where claims may not be paid

out for a number of years. Apart from controlling expenses, the

main way for insurance company managements to compensate for this

"lost investment income" is to encourage their underwriters to put

rates up.

At previous cycle turning points, reserve deteriorations have

followed periods of reserve releases. Currently reserve releases

continue to be made, although they have been reducing since 2008

for US insurers and are expected to taper off in 2013 and 2014.

Global reinsurance rates were stable at 1 January 2013 despite

the losses from Hurricane Sandy. The reinsurance broker, Guy

Carpenter, reported that renewals for loss free accounts varied

between down by 2.5% to up by 2.5% for US property catastrophe

reinsurance with loss impacted catastrophe programmes experiencing

increases, although the level of these increases varied widely.

Reinsurance pricing at 1 April 2013 Asian renewals were stable to

falling marginally.

The most significant issue affecting the reinsurance industry in

2013 is the convergence of traditional and alternative sources of

reinsurance capital with Guy Carpenter calculating that

non-traditional capacity now makes up an estimated 14% of global

property catastrophe limit. Alternative capital/reinsurance

structures typically offer a collateralised quota share reinsurance

through a variety of mechanisms designed for investors seeking

catastrophe risk. At the time of writing the market is in a state

of flux in advance of the 1 June and 1 July renewal seasons for

reinsurance business. However, early indications are that there

will be rate reductions of 10% or more, which will have a

particular impact on what have been attractive margins for Florida

reinsurance business, for example.

In contrast we are now seeing a sustained upturn in property and

casualty insurance rates in the US, which does not suffer from the

ease of entry from alternative sources of capital seen in the

reinsurance sector. After nearly eight years of decreases the first

increase we saw was in the third quarter of 2011 and by the fourth

quarter of 2012 rates were up by an average of 5% using data

supplied by the Council of Insurance Agents and Brokers, the

largest increase since late 2003. Rate rises continued in the first

quarter of 2013, averaging 5.2%. The President/CEO, Ken Crerar,

commented, "Carriers backed off risky business, tightened

underwriting and pressed for higher pricing and deductibles on

renewal." Lloyd's received 41% of its income from US and Canada in

2012 and as the market leader in excess and surplus (the "E&S")

lines business is expected to be a major beneficiary from a

hardening US insurance market leading to business migrating back to

the E&S market from the US admitted market.

Following Hurricanes Katrina, Rita and Wilma in 2005, US

reinsurance rates have been among the most attractive of any class

of business. What we are seeing now in the current market place is

potentially a healthy rebalancing in the relative attractiveness of

writing insurance business compared to reinsurance business which,

if sustained, would suggest that overall, the insurance cycle has

turned the corner. However, from a reinsurance perspective,

reducing reinsurance rates should improve the margins of insurers

but reduce the attractiveness of writing reinsurance business. Time

will tell whether the alternative sources of capital which have

entered the industry will sustain their provision of capital post a

major loss and prove dependable for insurers.

Hampden Underwriting's 2012 results

The traditional method for comparing the performance of

competing insurance businesses is an analysis of the combined

ratio, which is the sum of net claims and expenses divided by net

earned premium. The combined ratio of Hampden Underwriting's

portfolio for 2012 was 93% which compares favourably with industry

peer groups, outperforming the 2012 results of the US

property/casualty industry, US reinsurers and European

reinsurers.

Syndicate profit distributions

Profit distributions from Hampden Underwriting's portfolio of

syndicates continue to be made by reference to the traditional

three year accounts. Using this measure of performance Hampden

Underwriting's portfolio marginally outperformed the Lloyd's result

as a percentage of capacity on the 2010 account at 31 December 2012

with a profit of 2.55% (Lloyd's 2.49%) and is estimated to

outperform Lloyd's on the 2011 account with a profit of 5.08% at

the mid-point estimate (Lloyd's 0.96%). At this early stage of

development of the 2012 account the mid-point estimate is a profit

of 4.75% (Lloyd's 4.2%).

Hampden Underwriting's capital position

Net tangible assets per share fell marginally by 1.4% during

2012, principally as a result of the three acquisitions made in the

year. Including the acquisitions, net tangible assets increased

from GBP6.43m at year end 2011 to GBP7.3m at year end 2012 and

continue to provide a capital surplus compared with the Lloyd's

minimum capital requirement as at November 2012, which was

GBP6.99m.

Hampden Underwriting's portfolio for 2013

Hampden Underwriting's portfolio for 2013 continues to provide a

good spread of business across managing agents and classes of

business with motor and liability providing a balance to the

catastrophe exposed reinsurance and property business, as well as

contributing through diversification to lower capital requirements.

28.2% of the capacity is in the three syndicates rated "A" by

Hampden Agencies, being Syndicates 386, 609 and 2791, with

Syndicate 2791 being the largest holding at 15.1% of capacity. The

top ten syndicates comprise 82.2% of the portfolio. No new

syndicates were joined for 2013.

Top ten syndicates for 2013

2013 2013 HCM

---------- ---------------------------- ------------ ---------- ---------- ---------------

Syndicate Portfolio 2013 HCM

---------- ---------------------------- ------------ ---------- ---------- ---------------

Capacity Capacity Portfolio

%

---------- ---------------------------- ------------ ---------- ---------- ---------------

Syndicate Managing Agent GBP'000s GBP'000s of Total Largest Class

---------- ---------------------------- ------------ ---------- ---------- ---------------

Managing Agency Partners

2791 Ltd 511,018.4 1,942.5 15.1 Reinsurance

---------- ---------------------------- ------------ ---------- ---------- ---------------

510 RJ Kiln & Co Ltd 1,063,790.9 1,815.6 14.1 US$ Property

---------- ---------------------------- ------------ ---------- ---------- ---------------

US$ Non-Marine

623 Beazley Furlonge Ltd 224,998.6 1,428.2 11.1 Liability

---------- ---------------------------- ------------ ---------- ---------- ---------------

Atrium Underwriters

609 Ltd 419,734.3 1,292.8 10.0 Energy

---------- ---------------------------- ------------ ---------- ---------- ---------------

33 Hiscox Syndicate Ltd 950,000.0 10,42.6 8.1 Reinsurance

---------- ---------------------------- ------------ ---------- ---------- ---------------

Pembroke Managing Agency

6110 Ltd 45,000.0 724.5 5.6 Reinsurance

---------- ---------------------------- ------------ ---------- ---------- ---------------

Equity Syndicate Management

218 Ltd 437,624.0 715.3 5.6 Motor

---------- ---------------------------- ------------ ---------- ---------- ---------------

Catlin Underwriting

6111 Agencies Ltd 85,694.1 680.5 5.3 Reinsurance

---------- ---------------------------- ------------ ---------- ---------- ---------------

Canopius Managing Agents

958 Ltd 220,000.0 523.3 4.1 Reinsurance

---------- ---------------------------- ------------ ---------- ---------- ---------------

Cathedral Underwriting

2010 Ltd 350,015.9 423.5 3.3 Reinsurance

---------- ---------------------------- ------------ ---------- ---------- ---------------

Subtotal 10,588.8 82.2

---------- ---------------------------- ------------ ---------- ---------- ---------------

Total 12,882.3 100.00

---------- ---------------------------- ------------ ---------- ---------- ---------------

The two largest classes of business remain reinsurance and US

dollar property insurance. Casualty and UK motor exposures provide

balance against the more volatile property catastrophe

exposures.

Risk management

The two major risks faced by insurers and reinsurers are

deficient loss reserves and inadequate pricing, which, taken

together, account for over 40% of insurer impairments according to

A M Best. The pricing cycle is easier to identify in real time. The

reserving cycle is more difficult to identify in real time as

typically reserving standards slip after a period of reserve

releases and there is a lag before this is recognised. Hampden

Agencies approaches the management of portfolio risk by

diversifying across classes of business, syndicates and managing

agents and importantly understanding the cycle management and

reserving strategy of each syndicate as well as the rate

environment.

We also assess the downside in the event of a major loss through

monitoring the aggregate losses estimated by managing agents to

realistic disaster scenarios. Risk is assessed in the context of

potential return with catastrophe exposure being actively managed

dependent on market conditions.

Hampden Underwriting's largest modelled exposures net of

reinsurance as a percentage of gross premiums are similar for 2013

compared with 2012. The largest remains a major windstorm in the

north-east of the US at 29.7% of gross premium, net of reinsurance.

The next highest is the Gulf of Mexico windstorm at 28.9% net.

Consolidated statement of comprehensive income

Year ended 31 December 2012

Year ended Year ended

31 December 31 December

2012 2011

Note GBP'000 GBP'000

--------------------------------------------- ----- ------------ ------------

Gross premium written 9,141 7,715

Reinsurance premium ceded (1,820) (1,445)

--------------------------------------------- ----- ------------ ------------

Net premiums written 7,321 6,270

Change in unearned gross premium provision (405) 238

Change in unearned reinsurance premium

provision 52 (17)

--------------------------------------------- ----- ------------ ------------

(353) 221

--------------------------------------------- ----- ------------ ------------

Net earned premium 6,968 6,491

Net investment income 3 429 247

Other income - 22

Goodwill on bargain purchase 568 -

--------------------------------------------- ----- ------------ ------------

997 269

--------------------------------------------- ----- ------------ ------------

Revenue 7,965 6,760

--------------------------------------------- ----- ------------ ------------

Gross claims paid (4,685) (4,726)

Reinsurers' share of gross claims paid 930 842

--------------------------------------------- ----- ------------ ------------

Claims paid, net of reinsurance (3,755) (3,884)

--------------------------------------------- ----- ------------ ------------

Change in provision for gross claims 229 (1,115)

Reinsurers' share of change in provision

for gross claims 24 486

--------------------------------------------- ----- ------------ ------------

Net change in provision for claims 253 (629)

--------------------------------------------- ----- ------------ ------------

Net insurance claims and loss adjustment

expenses (3,502) (4,513)

Expenses incurred in insurance activities (2,743) (2,277)

Other operating expenses (866) (574)

--------------------------------------------- ----- ------------ ------------

Operating expenses (3,609) (2,851)

--------------------------------------------- ----- ------------ ------------

Operating profit/(loss) before tax 4 854 (604)

Income tax (charge)/credit (91) 217

--------------------------------------------- ----- ------------ ------------

Profit/(loss) and total comprehensive

income attributable to equity shareholders 763 (387)

--------------------------------------------- ----- ------------ ------------

Earnings/(loss) per share attributable

to equity shareholders

Basic and diluted 5 9.92p (5.22)p

--------------------------------------------- ----- ------------ ------------

The profit/(loss) attributable to equity shareholders and

earnings/(loss) per share set out above are in respect of

continuing operations.

The accounting policies and notes are an integral part of these

Financial Statements.

Consolidated statement of financial position

At 31 December 2012

31 December 31 December

2012 2011

Note GBP'000 GBP'000

------------------------------------------- ----- ------------ ------------

Assets

Intangible assets 6 1,797 1,052

Deferred income tax assets - -

Reinsurance assets:

- reinsurers' share of claims outstanding 4,323 3,044

- reinsurers' share of unearned premium 590 409

Other receivables, including insurance

receivables 9,343 6,628

Prepayments and accrued income 1,216 842

Financial assets at fair value 7 20,978 13,675

Cash and cash equivalents 1,444 3,020

------------------------------------------- ----- ------------ ------------

Total assets 39,691 28,670

------------------------------------------- ----- ------------ ------------

Liabilities

Insurance liabilities:

- claims outstanding 19,814 14,234

- unearned premium 4,624 3,137

Deferred income tax liabilities 938 415

Other payables, including insurance

payables 4,589 2,911

Accruals and deferred income 631 488

------------------------------------------- ----- ------------ ------------

Total liabilities 30,596 21,185

------------------------------------------- ----- ------------ ------------

Shareholders' equity

Share capital 8 853 741

Share premium 8 6,996 6,261

Retained earnings 1,246 483

------------------------------------------- ----- ------------ ------------

Total shareholders' equity 9,095 7,485

------------------------------------------- ----- ------------ ------------

Total liabilities and shareholders'

equity 39,691 28,670

------------------------------------------- ----- ------------ ------------

Consolidated statement of cash flows

Year ended 31 December 2012

Year ended Year ended

31 December 31 December

2012 2011

GBP'000 GBP'000

--------------------------------------------- ------------------- ------------

Cash flows from operating activities

Results of operating activities 854 (604)

Interest received (27) (4)

Investment income (320) (275)

Goodwill on bargain purchase (568) -

Impairment of goodwill 81 -

Loss on sale of intangible assets 1 11

Amortisation of intangible assets 314 270

Income tax paid (179) (16)

Change in fair value of investments (128) (5)

Changes in working capital:

- decrease/(increase) in other receivables 2,225 (530)

- (decrease)/increase in other payables (1,046) 3

- net (decrease)/increase in technical

provisions (2,991) 454

--------------------------------------------- ------------------- ------------

Net cash outflow from operating activities (1,784) (696)

--------------------------------------------- ------------------- ------------

Cash flows from investing activities

Interest received 27 4

Investment income 321 275

Purchase of intangible assets (217) (49)

Proceeds from disposal of intangible assets 51 -

Purchase of financial assets at fair value 854 166

Acquisition of subsidiaries, net of cash (828) -

acquired

--------------------------------------------- ------------------- ------------

Net cash inflow from investing activities 208 396

--------------------------------------------- ------------------- ------------

Net decrease in cash and cash equivalents (1,576) (300)

Cash and cash equivalents at beginning

of year 3,020 3,320

--------------------------------------------- ------------------- ------------

Cash and cash equivalents at end of year 1,444 3,020

--------------------------------------------- ------------------- ------------

Statements of changes in shareholders' equity

Year ended 31 December 2012

Attributable to owners of the parent

---------------------------------------------------------

Ordinary Preference Share Retained

share share capital premium earnings Total

capital

Consolidated GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- -------------- --------- --------- --------

At 1 January 2011 741 - 6,261 870 7,872

Loss and total comprehensive

income for the year - - - (387) (387)

-------------------------------- --------- -------------- --------- --------- --------

At 31 December 2011 741 - 6,261 483 7,485

-------------------------------- --------- -------------- --------- --------- --------

At 1 January 2012 741 - 6,261 483 7,485

Share issue 112 - 735 - 847

Profit and total comprehensive

income for the year - - - 763 763

-------------------------------- --------- -------------- --------- --------- --------

At 31 December 2012 853 - 6,996 1,246 9,095

-------------------------------- --------- -------------- --------- --------- --------

Notes to the financial statements

Year ended 31 December 2012

1. Accounting policies

The principal accounting policies adopted in the preparation of

the financial information set out in this announcement are set out

in the full financial statements for the year ended 31 December

2012 (the "Financial Statements").

Basis of preparation

The Financial Statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") endorsed by

the European Union ("EU"), IFRIC interpretations and those parts of

the Companies Act 2006 applicable to companies reporting under

IFRS.

The Financial Statements have been prepared under the historical

cost convention as modified by the revaluation of financial assets

at fair value through profit or loss. A summary of the more

important Group accounting policies is set out below.

The preparation of Financial Statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

Financial Statements and the reported amounts of revenues and

expenses during the reporting year. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual results ultimately may differ from these

estimates.

The Group participates in insurance business through its Lloyd's

corporate member subsidiaries. Accounting information in respect of

syndicate participations is provided by the syndicate managing

agents and is reported upon by the syndicate auditors.

International Financial Reporting Standards

There are no IFRS or IFRIC interpretations that are effective

for the first time for the financial year beginning on or after 1

January 2012 that had a material impact on the Group's Financial

Statements.

A number of new standards and amendments to standards and

interpretations are effective for annual periods beginning after 1

January 2012 and have not been applied in preparing these Financial

Statements. None of these is expected to have a significant effect

on the financial statements of the Group:

-- Amendment to IAS 1 "Financial Statement Presentation"

regarding other comprehensive income. The main change resulting

from these amendments is a requirement for entities to group items

presented in "other comprehensive income" ("OCI") on the basis of

whether they are potentially reclassifiable to profit or loss

subsequently (reclassification adjustments). The amendments do not

address which items are presented in OCI.

-- IAS 19 "Employee Benefits" was amended in June 2011. The

amendments eliminate the option to defer the recognition of gains

and losses, known as the "corridor method"; streamline the

presentation of changes in assets and liabilities arising from

defined benefit plans, including requiring re-measurements to be

presented in other comprehensive income; and enhance the disclosure

requirements for defined benefit plans, providing better

information about the characteristics of defined benefit plans and

the risks that entities are exposed to through participation in

those plans.

-- IFRS 7 "Financial Instruments: Disclosures" was amended for

asset and liability offsetting. This amendment requires disclosure

of information that will enable users of financial statements to

evaluate the effect or potential effect of netting arrangements,

including rights of set-off associated with the entity's recognised

financial assets and recognised financial liabilities, on the

entity's financial position. The amendment is effective for the

accounting period beginning on or after 1 January 2013, subject to

endorsement by the EU.

-- IFRS 10 "Consolidated Financial Statements" builds on

existing principles by identifying the concept of control as the

determining factor in whether an entity should be included within

the consolidated financial statements of the Parent Company. The

standard provides additional guidance to assist in the

determination of control where this is difficult to assess. The

Group intends to adopt IFRS 10 no later than the accounting period

beginning on or after 1 January 2013.

-- IFRS 11 "Joint Arrangements" provides for a more realistic

reflection of joint arrangements by focusing on the rights and

obligations of the arrangement, rather than its legal form. There

are two types of joint arrangement; joint operations and joint

ventures. Joint operations arise where a joint operator has rights

to the assets and obligations relating to the arrangement and

therefore accounts for its share of assets, liabilities, revenue

and expenses. Joint ventures arise where the joint venture has

rights to the net assets of the arrangement and therefore equity

accounts for its interest. Proportional consolidation of joint

ventures is no longer allowed. The Group intends to adopt IFRS 11

no later than the accounting period beginning on or after 1 January

2013.

-- IFRS 12 "Disclosures of Interests in Other Entities" includes

the disclosure requirements for all forms of interests in entities,

including joint arrangements, associates, special purpose vehicles

and other off Statement of Financial Position vehicles. The Group

intends to adopt IFRS 12 no later than the accounting period

beginning on or after 1 January 2013.

-- Amendments to IFRS 10 "Consolidated Financial Statements",

IFRS 11 "Joint Arrangements" and IFRS 12 "Disclosure of Interests

in Other Entities" provide additional transition relief to IFRS

10,11 and 12 by limiting the requirement to provide adjusted

comparative information to only the preceding comparative period.

For disclosures related to unconsolidated structured entities, the

amendments will remove the requirement to present comparative

information for periods before IFRS 12 is first applied. The Group

intends to adopt the amended standards no later than the accounting

period beginning on or after 1 January 2013, subject to endorsement

by the EU.

-- IFRS 13 "Fair Value Measurement" aims to provide consistency

and reduce complexity by providing a precise definition of fair

value and a single source of fair value measurement and disclosure

requirements for use across IFRS. The requirements do not extend

the use of fair value accounting but provide guidance on how it

should be applied where its use is already required or permitted by

other IFRS.

-- IAS 27 "Separate Financial Statements" replaces the current

version of IAS 27 "Consolidated and Separate Financial Statements"

as a result of the issue of IFRS 10. The revised standard includes

the requirements relating to separate financial statements. The

Group intends to adopt IAS 27 (revised) no later than the

accounting period beginning on or after 1 January 2013.

-- IAS 28 "Investments in Associates and Joint Ventures"

replaces the current version of IAS 28 "Investments in Associates"

as a result of the issue of IFRS 11. The revised standard includes

the requirements for associates and joint ventures that have to be

equity accounted following the issue of IFRS 1. The Group intends

to adopt IAS 28 (revised) no later than the accounting period

beginning on or after 1 January 2013.

-- IFRS 9 "Financial Instruments" addresses the classification,

measurement and recognition of financial assets and financial

liabilities. It replaces parts of IAS 39 that relate to the

classification and measurement of financial instruments. IFRS 9

requires financial assets to be classified into two measurement

categories: those measured as at fair value and those measured at

amortised cost. The determination is made at initial recognition.

The classification depends on the entity's business model for

managing its financial instruments and the contractual cash flow

characteristics for the instrument. For financial liabilities, the

standard retains most of the IAS 39 requirements. The main change

is that, in cases where the fair value option is taken for

financial liabilities, the part of a fair value change due to an

entity's own credit risk is recorded in other comprehensive income

rather than the income statement, unless this creates an accounting

mismatch. The Group is yet to assess IFRS 9's full impact and

intends to adopt IFRS 9 no later than the accounting period

beginning on or after 1 January 2015, subject to endorsement by the

EU. The Group will also consider the impact of the remaining phases

of IFRS 9 when completed by the Board.

-- Amendments to IAS 32 "Financial Instruments: Presentation"

add application guidance to address inconsistencies identified in

applying some of the criteria when offsetting financial assets and

financial liabilities. This includes clarifying the meaning of

"currently has a legally enforceable right of set-off" and that

some gross settlement systems may be considered equivalent to net

settlement. The Group is yet to assess the full impact of the

amendments to IAS 32 and intends to adopt the amended standard no

later than the accounting period beginning on or after 1 January

2014.

"Annual Improvements 2009-2011 Cycle" sets out amendments to

various IFRS as follows:

-- An amendment to IFRS 1 "First-time Adoption" clarifies whether an entity may apply IFRS 1:

(a) if the entity meets the criteria for applying IFRS 1 and has

applied IFRS 1 in a previous reporting period; or

(b) if the entity meets the criteria for applying IFRS 1 and has

applied IFRS in a previous reporting period when IFRS 1 did not

exist.

-- The amendment to IFRS 1 also addresses the transitional

provisions for borrowing costs relating to qualifying assets for

which the commencement date for capitalisation was before the date

of transition to IFRS.

-- An amendment to IAS 1 "Presentation of Financial Statements"

clarifies the requirements for providing comparative

information:

(a) for the opening statement of financial position when an

entity changes accounting policies, or makes retrospective

restatements or reclassifications; and

(b) when an entity provides Financial Statements beyond the

minimum comparative information requirements.

-- An amendment to IAS 16 "Property, Plant and Equipment"

addresses a perceived inconsistency in the classification

requirements for servicing equipment.

-- An amendment to IAS 32 "Financial Instruments: Presentation"

addresses perceived inconsistencies between IAS 12 "Income Taxes"

and IAS 32 with regard to recognising the consequences of income

tax relating to distributions to holders of an equity instrument

and to transaction costs of an equity transaction.

-- An amendment to IAS 34 "Interim Financial Reporting"

clarifies the requirements on segment information for total assets

and liabilities for each reportable segment.

The Group is yet to assess the full impact of these amendments

and intends to adopt the amended standards no later than the

accounting period beginning on or after 1 January 2013, subject to

endorsement by the EU.

Amendments to IFRS 10 "Consolidated Financial Statements", IFRS

12 "Disclosure of Interests in Other Entities" and IAS 27 "Separate

Financial Statements" define an investment entity and introduce an

exception to consolidating particular subsidiaries for investment

entities. These amendments require an investment entity to measure

those subsidiaries at fair value through profit or loss in

accordance with IFRS 9 "Financial Instruments" in its consolidated

and separate Financial Statements. The amendments also introduce

new disclosure requirements for investment entities in IFRS 12 and

IAS 27. The Company is yet to assess the full impact of these

amendments and intends to adopt the amended standards no later than

the accounting period beginning on or after 1 January 2014, subject

to endorsement by the EU.

There are no other IFRSs or IFRIC interpretations that are not

yet effective that would be expected to have a material impact on

the Company.

2. Segmental information

The Group has three segments that represent the primary way in

which the Group is managed:

-- syndicate participation;

-- investment management; and

-- other corporate activities.

Other corporate

Syndicate Investment

participation management activities Total

Year ended 31 December 2012 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------------- ------------- ---------------- --------

Net earned premium 6,968 - - 6,968

Net investment income 405 24 - 429

Other income - - 568 568

Net incurred insurance claims

and loss adjustment expenses (3,502) - - (3,502)

Expenses incurred in insurance

activities (2,743) - - (2,743)

Amortisation of syndicate capacity - - (192) (192)

Other operating expenses (303) - (371) (674)

------------------------------------ -------------- ------------- ---------------- --------

Results of operating activities 825 24 5 854

------------------------------------ -------------- ------------- ---------------- --------

Other corporate

Syndicate Investment

participation management activities Total

Year ended 31 December 2011 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------------- ------------- ---------------- --------

Net earned premium 6,491 - - 6,491

Net investment income 245 2 - 247

Other income 22 - - 22

Net incurred insurance claims

and loss adjustment expenses (4,513) - - (4,513)

Expenses incurred in insurance

activities (2,277) - - (2,277)

Amortisation of syndicate capacity - - (158) (158)

Other operating expenses (192) - (224) (416)

------------------------------------ -------------- ------------- ---------------- --------

Results of operating activities (224) 2 (382) (604)

------------------------------------ -------------- ------------- ---------------- --------

The Group does not have any geographical segments as it

considers all of its activities to arise from trading within the

UK.

No major customers exceed 10% of revenue.

3. Net investment income

Year ended Year ended

31 December 31 December

2012 2011

GBP'000 GBP'000

-------------------------------------------------- ------------ ------------

Investment income 320 275

Realised gains on financial assets at fair value

through profit or loss 3 74

Unrealised gains on financial assets at fair

value through profit or loss 128 5

Investment management expenses (49) (111)

Bank interest 27 4

-------------------------------------------------- ------------ ------------

Net investment income 429 247

-------------------------------------------------- ------------ ------------

4. Operating profit/(loss) before tax

Year ended Year ended

31 December 31 December

2012 2011

GBP'000 GBP'000

---------------------------------------------------- ------------ ------------

Operating profit/(loss) before tax is stated

after charging/(crediting):

Directors' remuneration 84 65

Exchange differences 125 (19)

Amortisation of intangible assets 314 270

Acquisition costs in connection with the new 45 -

subsidiaries acquired in the year

Impairment of goodwill 81 -

Goodwill on bargain purchase (568) -

Auditors' remuneration:

- audit of the Parent Company and Group Financial

Statements 25 25

- audit of subsidiary company Financial Statements 14 8

- services relating to taxation - -

- other services pursuant to legislation - -

- other services - -

---------------------------------------------------- ------------ ------------

The Group has no employees other than the Directors of the

Company.

Year ended Year ended

31 December 31 December

2012 2011

Directors' remuneration GBP GBP

------------------------- ------------ ------------

Sir Michael Oliver 20,000 20,000

Andrew Leslie 15,000 15,000

Jeremy Evans 15,000 15,000

Michael Cunningham 15,000 15,000

Nigel Hanbury 18,750 -

------------------------- ------------ ------------

Total 83,750 65,000

------------------------- ------------ ------------

Directors' remuneration comprises only Directors' fees. The

Chief Executive, Nigel Hanbury, has a bonus incentive scheme. No

bonus has been paid during the year. No other Directors derive

other benefits, pension contributions or incentives from the Group.

At 31 December 2012 no share options were held by the Directors

(2011: nil).

The Company did not have a Remuneration Committee during the

year.

5. Earnings/(loss) per share

Basic earnings/(loss) per share is calculated by dividing the

earnings/(loss) attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period.

The Group has no dilutive potential ordinary shares.

Earnings per share has been calculated in accordance with IAS

33.

Reconciliation of the earnings/(loss) and weighted average

number of shares used in the calculation is set out below:

Year ended Year ended

31 December 31 December

2012 2011

--------------------------------------------- ------------ -------------

Profit/(loss) for the year GBP763,000 GBP(387,000)

--------------------------------------------- ------------ -------------

Weighted average number of shares in issue 7,691,769 7,413,376

--------------------------------------------- ------------ -------------

Basic and diluted earnings/(loss) per share 9.92p (5.22)p

--------------------------------------------- ------------ -------------

6. Intangible assets

Syndicate

Goodwill capacity Total

GBP'000 GBP'000 GBP'000

--------------------------------------- --------- ---------- --------

Cost

At 1 January 2011 - 1,979 1,979

Additions - 49 49

Disposals - (1) (1)

--------------------------------------- --------- ---------- --------

At 31 December 2011 - 2,027 2,027

--------------------------------------- --------- ---------- --------

At 1 January 2012 - 2,027 2,027

Additions 81 218 299

Disposals - (56) (56)

Impairment (81) - (81)

Acquired with subsidiary undertakings - 1,032 1,032

--------------------------------------- --------- ---------- --------

At 31 December 2012 - 3,221 3,221

--------------------------------------- --------- ---------- --------

Amortisation

At 1 January 2011 - 705 705

Charge for the year - 270 270

--------------------------------------- --------- ---------- --------

At 31 December 2011 - 975 975

--------------------------------------- --------- ---------- --------

At 1 January 2012 - 975 975

Charge for the year - 314 314

Disposals - (4) (4)

Acquired with subsidiary undertakings - 139 139

--------------------------------------- --------- ---------- --------

At 31 December 2012 - 1,424 1,424

--------------------------------------- --------- ---------- --------

Net book value

As at 31 December 2011 - 1,052 1,052

--------------------------------------- --------- ---------- --------

As at 31 December 2012 - 1,797 1,797

--------------------------------------- --------- ---------- --------

7. Financial assets at fair value through profit or loss

The Group uses the following hierarchy for determining and

disclosing the fair value of financial instruments by valuation

technique:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities.

Level 2: other techniques for which all inputs which have a

significant effect on the recorded fair value are observable,

either directly or indirectly.

Level 3: techniques which use inputs that have a significant

effect on the recorded fair value that are not based on observable

market data.

The Group has no level 3 investments.

As at 31 December 2012, the Group held the following financial

assets carried at fair value on the statement of financial

position:

Assets measured at fair value

2012 Level 1 Level 2

GBP000 GBP000 GBP000

-------------------------------------------- ------- -------- --------

Shares and other variable yield securities 391 391 -

Debt securities and other fixed income

securities 10,864 10,864 -

Participation in investment pools 847 847 -

Loans guaranteed by mortgage 91 - 91

Holdings in collective investment

schemes 1,211 - 1,211

Deposits with credit institutions 22 - 22

Funds held at Lloyd's 7,173 7,173 -

Other 379 - 379

-------------------------------------------- ------- -------- --------

Total - market value 20,978 19,275 1,703

-------------------------------------------- ------- -------- --------

2011 Level 1 Level 2

GBP000 GBP000 GBP000

-------------------------------------------- ------- -------- --------

Shares and other variable yield securities 202 202 -

Debt securities and other fixed income

securities 7,821 7,821 -

Participation in investment pools 484 484 -

Loans guaranteed by mortgage 81 - 81

Holdings in collective investment

schemes 869 - 869

Deposits with credit institutions 43 - 43

Funds held at Lloyd's 4,090 4,090 -

Other 85 - 85

-------------------------------------------- ------- -------- --------

Total - market value 13,675 12,597 1,078

-------------------------------------------- ------- -------- --------

Funds at Lloyd's represents assets deposited with the

Corporation of Lloyd's ("Lloyd's") to support the Group's

underwriting activities as described in the accounting policies.

The Group has entered into a Lloyd's Deposit Trust Deed which gives

the Corporation the right to apply these monies in settlement of

any claims arising from the participation on the syndicates. These

monies can only be released from the provision of this Deed with

Lloyd's express permission and only in circumstances where the

amounts are either replaced by an equivalent asset, or after the

expiration of the Group's liabilities in respect of its

underwriting.

The Directors consider any credit risk or liquidity risk not to

be material.

The comparative figures have been reclassified to show 'holdings

in collective investment schemes' separately from 'shares and other

variable' yield securities.

8. Share capital and share premium

Ordinary

share Share

capital premium Total

Allotted, called up and fully paid GBP'000 GBP'000 GBP'000

7,413,376 ordinary shares of 10p each

and share premium at 1 January 2012 741 6,261 7,002

Share issue 112 735 847

---------------------------------------- --------- -------- --------

8,526,948 ordinary shares of 10p each

and share premium at 31 December 2012 853 6,996 7,849

---------------------------------------- --------- -------- --------

During the year 1,113,572 ordinary shares of 10p each were

issued for a total consideration of GBP847,000 as part of the

acquisition of Nameco (No. 917) Limited.

9. Financial statements

The financial information set out in this announcement does not

constitute statutory accounts but has been extracted from the

Group's Financial Statements which have not yet been delivered to

the Registrar. The Group's annual report and Financial Statements

will be posted to shareholders shortly. Further copies will be

available from the Company's registered office: Hampden House,

Great Hampden, Great Missenden, Buckinghamshire HP16 9RD and on the

Company's website www.hampdenplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SEUFWAFDSEFI

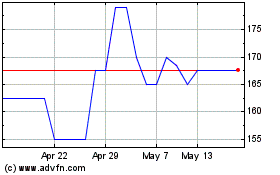

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2024 to Aug 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Aug 2023 to Aug 2024