TIDMHUW

RNS Number : 5492T

Hampden Underwriting Plc

30 September 2010

30 September 2010

Hampden Underwriting PLC

"Hampden Underwriting" or the "Company")

Interim results for the six months ended 30 June 2010

Hampden Underwriting, which provides investors with a limited liability direct

investment into the Lloyd's insurance market, announces its unaudited results

for the six months ended 30 June 2010.

Highlights

- Premium written during the period totalled GBP5.7m (an increase of 7% over the

same period last year).

- Net loss of GBP58,000 (compared to a profit of GBP138,000 over the same period

last year).

- Earnings per share of (0.78)p (compared to 1.86p over the same period last

year).

- Net assets remain at GBP7.7m.

For further information please contact:

+-------------------+--------------------+-----------------+

| Hampden | Jeremy Evans | 020 7863 6567 |

| Underwriting | | |

| | | |

+-------------------+--------------------+-----------------+

| Smith & | David Jones | 020 7131 4000 |

| Williamson | Barrie Newton | |

| Corporate Finance | | |

| Limited | | |

+-------------------+--------------------+-----------------+

Chairman's Statement

Our result at mid-year has been adversely affected by both the catastrophe

losses in the first six months and by the much publicised deterioration in the

operating performance of UK motor business which has impacted the 2008, 2009 and

2010 years of account reducing our result for the period by some GBP350,000. It

is important to remember however, that the full year results normally tell a

different story to the half year, as indeed was the case last year and in the

absence of an abnormal loss pattern in the remaining months of the year, we

fully expect a satisfactory outcome for 2010. On a three year account basis,

the portfolio of syndicates supported by Hampden Underwriting continues to

outperform Lloyd's on both the 2008 and 2009 accounts with Hampden Agencies (our

Lloyd's adviser) estimating profits of 6.11% on capacity for 2008 and 12.68% for

2009. They are currently targeting a profit of 5% on capacity for the 2010 year

of account although it must be borne in mind that the hurricane season usually

continues until the end of November. In this respect the current year is still

very much on risk.

Whilst current prospects are undoubtedly more challenging, we remain confident

of the resilience of the syndicates in our portfolio.

I said in my statement in 2009 that our policy of expansion through the

acquisition of Namecos remained an important part of our strategy and therefore

I am delighted to report that in August this year we were able to buy Nameco (No

321) Ltd., thereby increasing our underwriting by a further GBP800,000. It is

also gratifying that despite the mid-year result, the cash balance, held by the

Group, has increased by GBP571,000.

Sir Michael Oliver

Chairman

29 September 2010

Condensed Group Income Statement

Six months ended 30 June 2010

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | 6 | | 6 | | 12 |

| | | months | | months | | months |

| | | ended | | ended | | ended |

| | | 30 | | 30 | | 31 |

| | | June | | June | | December |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | 2010 | | 2009 | | 2009 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| |Note | GBP'000 | | GBP'000 | | GBP'000 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Gross premium written | | 5,723 | | 5,344 | | 8,610 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Reinsurance premium ceded | | (1,127) | | (1,255) | | (1,753) |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Net premiums written | | 4,596 | | 4,089 | | 6,857 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Change in unearned gross premium | | (1,776) | | (1,554) | | (8) |

| provision | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Change in unearned reinsurance | | 373 | | 649 | | 116 |

| premium provision | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | (1,403) | | (905) | | 108 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Net earned premium | 2 | 3,193 | | 3,184 | | 6,965 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Net investment income | 4 | 201 | | 140 | | 375 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Other underwriting income | | 4 | | 9 | | 24 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Other income | 2 | 3 | | 173 | | 337 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | 208 | | 322 | | 736 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Revenue | | 3,401 | | 3,506 | | 7,701 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Gross claims paid | | (2,058) | | (1,184) | | (2,836) |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Reinsurance share of gross claims | | 344 | | 176 | | 472 |

| paid | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Claims paid, net of reinsurance | | (1,714) | | (1,008) | | (2,364) |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Change in provision for gross | | (657) | | (1,013) | | (1,457) |

| claims | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Reinsurance share of change in | | (46) | | 123 | | 170 |

| provision for gross claims | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Net change in provision for claims | | (703) | | (890) | | (1,287) |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Net insurance claims and loss | 2 | (2,417) | | (1,898) | | (3,651) |

| adjustment expenses | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Expenses incurred in insurance | 2 | (812) | | (1,175) | | (2,513) |

| activities | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Other operating expenses | 2 | (252) | | (307) | | (552) |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Operating expenses | | (1,064) | | (1,482) | | (3,065) |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Operating (loss)/profit before tax | 2 | (80) | | 126 | | 985 |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Income tax credit/(expense) | 5 | 22 | | 12 | | (261) |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| (Loss)/profit attributable to | 9 | (58) | | 138 | | 724 |

| equity shareholders | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Earnings per share attributable to | | | | | | |

| equity shareholders | | | | | | |

+-------------------------------------+------+---------+----------+---------+----------+----------+

| Basic and diluted | 6 | (0.78)p | | 1.86p | | 9.77p |

+-------------------------------------+------+---------+----------+---------+----------+----------+

Condensed Group Balance Sheet

At 30 June 2010

+-----------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| | | 30 | | 30 | | 31 |

| | | June | | June | | December |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| | | 2010 | | 2009 | | 2009 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| |Note | GBP'000 | | GBP'000 | | GBP'000 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Assets | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Intangible assets | | 1,101 | | 1,241 | | 1,216 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Financial investments | | 13,025 | | 10,578 | | 10,441 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Reinsurance share of insurance | | | | | | |

| liabilities | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| - Reinsurers' share of | | 2,383 | | 1,726 | | 1,581 |

| outstanding claims | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| - Reinsurers' share of unearned | | 935 | | 775 | | 349 |

| premiums | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Other receivables, including | | 7,982 | | 4,915 | | 4,910 |

| insurance receivables | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Prepayments and accrued income | | 1,086 | | 879 | | 873 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Deferred income tax assets | | - | | - | | 12 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Cash and cash equivalents | | 3,408 | | 2,656 | | 2,111 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Total assets | | 29,920 | | 22,770 | | 21,493 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| | | | | | | |

| Liabilities | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Insurance liabilities | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| - Claims outstanding | | 11,988 | | 8,610 | | 7,301 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| - Unearned premiums | | 5,557 | | 3,796 | | 3,402 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Other payables, including | | 3,513 | | 2,651 | | 2,215 |

| insurance payables | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Accruals and deferred income | | 603 | | 233 | | 226 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Current income tax liabilities | | 108 | | 5 | | 106 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Deferred income tax liabilities | | 469 | | 321 | | 503 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Total liabilities | | 22,238 | | 15,616 | | 13,753 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Shareholders' equity | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Share capital | 8 | 741 | | 741 | | 741 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Share premium | 8 | 6,261 | | 6,261 | | 6,261 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Retained earnings | 9 | 680 | | 152 | | 738 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Total shareholders' equity | | 7,682 | | 7,154 | | 7,740 |

+-----------------------------------+------+---------+----------+---------+----------+----------+

| Total liabilities and | | 29,920 | | 22,770 | | 21,493 |

| shareholders' equity | | | | | | |

+-----------------------------------+------+---------+----------+---------+----------+----------+

Condensed Group Cash Flow Statement

Six months ended 30 June 2010

+------------------------------------------+---------+----------+---------+----------+----------+

| | | | |

+------------------------------------------+---------+-------------------------------+----------+

| | 6 | | 6 | | 12 |

| | months | | months | | months |

| | ended | | ended | | ended |

| | 30 | | 30 | | 31 |

| | June | | June | | December |

+------------------------------------------+---------+----------+---------+----------+----------+

| Cash flow from operating activities | 2010 | | 2009 | | 2009 |

+------------------------------------------+---------+----------+---------+----------+----------+

| | GBP'000 | | GBP'000 | | GBP'000 |

+------------------------------------------+---------+----------+---------+----------+----------+

| | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Results of operating activities | (80) | | 126 | | 985 |

+------------------------------------------+---------+----------+---------+----------+----------+

| Interest received | (9) | | (21) | | (47) |

+------------------------------------------+---------+----------+---------+----------+----------+

| Investment income | (159) | | (119) | | (179) |

+------------------------------------------+---------+----------+---------+----------+----------+

| Dividend received | - | | - | | - |

+------------------------------------------+---------+----------+---------+----------+----------+

| Income tax paid | (1) | | (26) | | 159 |

+------------------------------------------+---------+----------+---------+----------+----------+

| Recognition of negative goodwill | - | | (173) | | (206) |

+------------------------------------------+---------+----------+---------+----------+----------+

| Amortisation of intangible assets | 118 | | 104 | | 217 |

+------------------------------------------+---------+----------+---------+----------+----------+

| Profit on sale of intangible assets | - | - | - | | (133) |

+------------------------------------------+---------+----------+---------+----------+----------+

| Change in fair value of investments | - | | 112 | | (88) |

| recognised in the income statement | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Changes in working capital: | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Increase in other receivables | (3,285) | | (2,625) | | (2,616) |

+------------------------------------------+---------+----------+---------+----------+----------+

| Increase in other payables | 1,675 | | 2,055 | | 1,613 |

+------------------------------------------+---------+----------+---------+----------+----------+

| Net increase in technical provisions | 5,454 | | 5,605 | | 4,472 |

+------------------------------------------+---------+----------+---------+----------+----------+

| Net cash inflow from operating | 3,713 | | 5,038 | | 4,177 |

| activities | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Cash flows from investing activities | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Interest received | 9 | | 21 | | 47 |

+------------------------------------------+---------+----------+---------+----------+----------+

| Investment income | 159 | | 119 | | 179 |

+------------------------------------------+---------+----------+---------+----------+----------+

| Dividend received | - | | - | | - |

+------------------------------------------+---------+----------+---------+----------+----------+

| Purchase of intangible assets | - | | - | | (67) |

+------------------------------------------+---------+----------+---------+----------+----------+

| Proceeds from disposal of intangible | - | | 28 | | 135 |

| assets | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Purchase of financial investments | (2,584) | | (6,447) | | (6,310) |

+------------------------------------------+---------+----------+---------+----------+----------+

| Acquisition of subsidiary, net of cash | - | | (34) | | 19 |

| acquired | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Net cash used in investing activities | (2,416) | | (6,313) | | (5,997) |

+------------------------------------------+---------+----------+---------+----------+----------+

| | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Cash flows from financing activities | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Net proceeds from issue of ordinary | - | | - | | - |

| share capital | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Net cash used in financing activities | - | | - | | - |

+------------------------------------------+---------+----------+---------+----------+----------+

| | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Net increase/(decrease) in cash and cash | 1,297 | | (1,275) | | (1,820) |

| equivalents | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Cash and cash equivalents at beginning | 2,111 | | 3,931 | | 3,931 |

| of period | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

| Cash, cash equivalents and bank | 3,408 | | 2,656 | | 2,111 |

| overdrafts at end of period | | | | | |

+------------------------------------------+---------+----------+---------+----------+----------+

Condensed Group Statement of Changes in Shareholders' Equity

Six months ended 30 June 2010

+----------------------------+----------+------------+---------+----------+---------+

| | Ordinary | Preference | Share | Retained | Total |

| | Share | share | Premium | Earnings | |

| | Capital | capital | | | |

+----------------------------+----------+------------+---------+----------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+----------------------------+----------+------------+---------+----------+---------+

| At 1 January 2009 | 741 | - | 6,261 | 14 | 7,016 |

+----------------------------+----------+------------+---------+----------+---------+

| Profit for the year | - | - | - | 724 | 724 |

| attributable to equity | | | | | |

| shareholders | | | | | |

+----------------------------+----------+------------+---------+----------+---------+

| At 31 December 2009 | 741 | - | 6,261 | 738 | 7,740 |

+----------------------------+----------+------------+---------+----------+---------+

| At 1 January 2010 | 741 | - | 6,261 | 738 | 7,740 |

+----------------------------+----------+------------+---------+----------+---------+

| Loss for the period | - | - | - | (58) | (58) |

| attributable to equity | | | | | |

| shareholders | | | | | |

+----------------------------+----------+------------+---------+----------+---------+

| At 30 June 2010 | 741 | - | 6,261 | 680 | 7,682 |

+----------------------------+----------+------------+---------+----------+---------+

Notes to the Interim Financial Statements

Six months ended 30 June 2010

1. Accounting policies

Basis of preparation

The Interim Financial Statements have been prepared using accounting policies

consistent with International Financial Reporting Standards (IFRSs) and in

accordance with International Accounting Standard (IAS) 34 Interim Financial

Reporting.

The Interim Financial Statements are prepared for the six months ended 30 June

2010.

The Interim Financial Statements incorporate the results of Hampden Underwriting

plc, Hampden Corporate Member Limited, Nameco (No. 365) Limited and Nameco (No.

605) Limited.

The Interim Financial Statements are unaudited, but have been subject to review

by the Group's auditors. The Interim Financial Statements have been prepared in

accordance with the accounting policies adopted for the period ended 31 December

2009.

The comparative figures are based upon the Group Financial Statements for the

period ended 31 December 2009, and have been reported on by the Group's auditors

and were delivered to the Registrar of Companies on 22 June 2010.

The underwriting data on which these Interim Financial Statements are based upon

has been supplied by the managing agents of those syndicates which the Group

supports. The data supplied is the 100% figures for each syndicate. The Group

has applied its share of the syndicate participations to the gross figures to

derive its share of the syndicates transactions, assets and liabilities.

Significant accounting policies

The Interim Financial Statements have been prepared under the historical cost

convention. The same accounting policies, presentation and methods of

computation are followed in these Interim Financial Statements as were applied

in the preparation of the Group Financial Statements for the period ended 31

December 2009.

2.Segmental information

Primary segment information

The Group has three primary segments which represent the primary way in which

the Group is managed:

· Syndicate participation;

· Investment management;

· Other corporate activities.

+--------------------------------+---------------+------------+------------+---------+

| 6 months ended 30 June 2010 | Syndicate | Investment | Other | Total |

| | participation | management | corporate | |

| | | | activities | |

+--------------------------------+---------------+------------+------------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+--------------------------------+---------------+------------+------------+---------+

| Net earned premium | 3,193 | - | - | 3,193 |

+--------------------------------+---------------+------------+------------+---------+

| Net investment income | 140 | 61 | - | 201 |

+--------------------------------+---------------+------------+------------+---------+

| Other underwriting income | 4 | - | - | 4 |

+--------------------------------+---------------+------------+------------+---------+

| Other income | - | - | 3 | 3 |

+--------------------------------+---------------+------------+------------+---------+

| Net insurance claims and loss | (2,417) | - | - | (2,417) |

| adjustment expenses | | | | |

+--------------------------------+---------------+------------+------------+---------+

| Expenses incurred in insurance | (812) | - | - | (812) |

| activities | | | | |

+--------------------------------+---------------+------------+------------+---------+

| Amortisation of syndicate | - | - | (76) | (76) |

| capacity | | | | |

+--------------------------------+---------------+------------+------------+---------+

| Other operating expenses | - | - | (176) | (176) |

+--------------------------------+---------------+------------+------------+---------+

| Results of operating | 108 | 61 | (249) | (80) |

| activities | | | | |

+--------------------------------+---------------+------------+------------+---------+

+---------------------------------+---------------+------------+------------+---------+

| 6 months ended 30 June 2009 | Syndicate | Investment | Other | Total |

| | participation | management | corporate | |

| | | | activities | |

+---------------------------------+---------------+------------+------------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+---------------------------------+---------------+------------+------------+---------+

| Net earned premium | 3,184 | - | - | 3,184 |

+---------------------------------+---------------+------------+------------+---------+

| Net investment income | 108 | 32 | - | 140 |

+---------------------------------+---------------+------------+------------+---------+

| Other underwriting income | 9 | - | - | 9 |

+---------------------------------+---------------+------------+------------+---------+

| Other income | - | - | 173 | 173 |

+---------------------------------+---------------+------------+------------+---------+

| Net insurance claims and loss | (1,898) | - | - | (1,898) |

| adjustment expenses | | | | |

+---------------------------------+---------------+------------+------------+---------+

| Expenses incurred in insurance | (1,175) | - | - | (1,175) |

| activities | | | | |

+---------------------------------+---------------+------------+------------+---------+

| Amortisation of syndicate | - | - | (76) | (76) |

| capacity | | | | |

+---------------------------------+---------------+------------+------------+---------+

| Other operating expenses | (6) | - | (225) | (231) |

+---------------------------------+---------------+------------+------------+---------+

| Results of operating activities | 222 | 32 | (128) | 126 |

+---------------------------------+---------------+------------+------------+---------+

+--------------------------------+---------------+------------+------------+---------+

| 12 months ended 31 December | Syndicate | Investment | Other | Total |

| 2009 | participation | management | corporate | |

| | | | activities | |

+--------------------------------+---------------+------------+------------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+--------------------------------+---------------+------------+------------+---------+

| Net earned premium | 6,965 | - | - | 6,965 |

+--------------------------------+---------------+------------+------------+---------+

| Net investment income | 228 | 147 | - | 375 |

+--------------------------------+---------------+------------+------------+---------+

| Other underwriting income | 24 | - | - | 24 |

+--------------------------------+---------------+------------+------------+---------+

| Other income | - | - | 337 | 337 |

+--------------------------------+---------------+------------+------------+---------+

| Net insurance claims and loss | (3,651) | - | - | (3,651) |

| adjustment expenses | | | | |

+--------------------------------+---------------+------------+------------+---------+

| Expenses incurred in insurance | (2,513) | - | - | (2,513) |

| activities | | | | |

+--------------------------------+---------------+------------+------------+---------+

| Amortisation of syndicate | - | - | (217) | (217) |

| capacity | | | | |

+--------------------------------+---------------+------------+------------+---------+

| Other operating expenses | (57) | - | (278) | (335) |

+--------------------------------+---------------+------------+------------+---------+

| Results of operating | 996 | 147 | (158) | 985 |

| activities | | | | |

+--------------------------------+---------------+------------+------------+---------+

Secondary segment information

The Group does not have any secondary segments as it considers all of its

activities to arise from trading within the UK.

3. Insurance liabilities and reinsurance balances

Movement in claims outstanding

+---------------+---------+--------+-------------+--------+---------+

| | |

+---------------+---------------------------------------------------+

| | Gross | | Reinsurance | | Net |

+---------------+---------+--------+-------------+--------+---------+

| | GBP'000 | | GBP'000 | | GBP'000 |

+---------------+---------+--------+-------------+--------+---------+

| At 1 | 7,301 | | 1,581 | | 5,720 |

| January | | | | | |

| 2010 | | | | | |

+---------------+---------+--------+-------------+--------+---------+

| Movement | 657 | | (46) | | 703 |

| of | | | | | |

| reserves | | | | | |

+---------------+---------+--------+-------------+--------+---------+

| Net | 4,030 | | 848 | | 3,182 |

| exchange | | | | | |

| differences | | | | | |

| and changes | | | | | |

| in | | | | | |

| syndicate | | | | | |

| participation | | | | | |

+---------------+---------+--------+-------------+--------+---------+

| At 30 | 11,988 | | 2,383 | | 9,605 |

| June | | | | | |

| 2010 | | | | | |

+---------------+---------+--------+-------------+--------+---------+

Movement in unearned premium

+---------------+---------+--------+-------------+--------+---------+

| | |

+---------------+---------------------------------------------------+

| | Gross | | Reinsurance | | Net |

+---------------+---------+--------+-------------+--------+---------+

| | GBP'000 | | GBP'000 | | GBP'000 |

+---------------+---------+--------+-------------+--------+---------+

| At 1 | 3,402 | | 349 | | 3,053 |

| January | | | | | |

| 2010 | | | | | |

+---------------+---------+--------+-------------+--------+---------+

| Movement | 1,776 | | 373 | | 1,403 |

| in | | | | | |

| premiums | | | | | |

| earned | | | | | |

| in the | | | | | |

| year | | | | | |

+---------------+---------+--------+-------------+--------+---------+

| Net | 379 | | 213 | | 166 |

| exchange | | | | | |

| difference | | | | | |

| and | | | | | |

| changes in | | | | | |

| syndicate | | | | | |

| participation | | | | | |

+---------------+---------+--------+-------------+--------+---------+

| At 30 | 5,557 | | 935 | | 4,622 |

| June | | | | | |

| 2010 | | | | | |

+---------------+---------+--------+-------------+--------+---------+

4. Net investment income

+---------------------------------------+---------+----------+---------+----------+----------+

| | 6 | | 6 | | 12 |

| | months | | months | | months |

| | ended | | ended | | ended |

| | 30 | | 30 June | | 31 |

| | June | | | | December |

+---------------------------------------+---------+----------+---------+----------+----------+

| | 2010 | | 2009 | | 2009 |

+---------------------------------------+---------+----------+---------+----------+----------+

| | GBP'000 | | GBP'000 | | GBP'000 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Investment income at fair value | 159 | | 119 | | 179 |

| through income statement | | | | | |

+---------------------------------------+---------+----------+---------+----------+----------+

| Realised gains on financial | - | | - | | 169 |

| investments at fair value through | | | | | |

| income statement | | | | | |

+---------------------------------------+---------+----------+---------+----------+----------+

| Unrealised gains/(losses) on | 33 | | - | | 88 |

| financial investments at fair value | | | | | |

| through income statement | | | | | |

+---------------------------------------+---------+----------+---------+----------+----------+

| Investment management expenses | - | | - | | (108) |

+---------------------------------------+---------+----------+---------+----------+----------+

| Bank interest | 9 | | 21 | | 47 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Net investment income | 201 | | 140 | | 375 |

+---------------------------------------+---------+----------+---------+----------+----------+

5. Income tax expense

+---------------------------------------+---------+----------+---------+----------+----------+

| | 6 | | 6 | | 12 |

| | months | | months | | months |

| | ended | | ended | | ended |

| | 30 | | 30 June | | 31 |

| | June | | | | December |

+---------------------------------------+---------+----------+---------+----------+----------+

| | 2010 | | 2009 | | 2009 |

+---------------------------------------+---------+----------+---------+----------+----------+

| | GBP'000 | | GBP'000 | | GBP'000 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Income tax credit/(expense) | 22 | | 12 | | (261) |

+---------------------------------------+---------+----------+---------+----------+----------+

The income tax credit/(expense) is recognised based on management's best

estimate of the weighted average annual income tax rate expected for the full

financial year. The estimated average annual tax rate used is 28% (2009: 28%).

Material disallowed items have been adjusted for in the income tax calculation.

6. Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the period.

The Group has no dilutive potential ordinary shares.

Earnings per share have been calculated in accordance with IAS 33.

Reconciliation of the earnings and weighted average number of shares used in the

calculation is set out below.

+---------------------------------------+---------+----------+---------+----------+----------+

| | 6 | | 6 | | 12 |

| | months | | months | | months |

| | ended | | ended | | ended |

| | 30 | | 30 | | 31 |

| | June | | June | | December |

+---------------------------------------+---------+----------+---------+----------+----------+

| | 2010 | | 2009 | | 2009 |

+---------------------------------------+---------+----------+---------+----------+----------+

| | GBP'000 | | GBP'000 | | GBP'000 |

+---------------------------------------+---------+----------+---------+----------+----------+

| (Loss)/profit for the period | (58) | | 138 | | 724 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Weighted average number of shares in | 7,413 | | 7,413 | | 7,413 |

| issue | | | | | |

+---------------------------------------+---------+----------+---------+----------+----------+

| Basic and diluted earnings per share | (0.78)p | | 1.86p | | 9.77p |

| (p) | | | | | |

+---------------------------------------+---------+----------+---------+----------+----------+

7. Dividends

No equity dividends were proposed, declared or paid in the period (2009 -

GBPNil).

8. Share capital and share premium

+------------------------------------------------+----------+-+----------+-------+---------+---------+

| Allotted, called up and fully paid | | Ordinary Share | Share | Total |

| | | Capital | Premium | GBP'000 |

| | | GBP'000 | GBP'000 | |

+------------------------------------------------+----------+--------------------+---------+---------+

| 7,413,376 ordinary shares of 10p each and share premium | | 741 | 6,261 | 7,002 |

| at 1 January 2010 | | | | |

+-----------------------------------------------------------+------------+-------+---------+---------+

| 7,413,376 ordinary shares of 10p each and share premium at | | 741 | 6,261 | 7,002 |

| 30 June 2010 | | | | |

+-------------------------------------------------------------+----------+-------+---------+---------+

| | | | | | | |

+------------------------------------------------+----------+-+----------+-------+---------+---------+

9 Retained earnings

+---------------------------------------+---------+----------+---------+----------+----------+

| | 30 | | 30 | | 31 |

| | June | | June | | December |

+---------------------------------------+---------+----------+---------+----------+----------+

| | 2010 | | 2009 | | 2009 |

+---------------------------------------+---------+----------+---------+----------+----------+

| | GBP'000 | | GBP'000 | | GBP'000 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Group | | | | | |

+---------------------------------------+---------+----------+---------+----------+----------+

| At 1 January 2010 | 738 | | 14 | | 14 |

+---------------------------------------+---------+----------+---------+----------+----------+

| (Loss)/profit attributable to equity | (58) | | 138 | | 724 |

| shareholders | | | | | |

+---------------------------------------+---------+----------+---------+----------+----------+

| At 30 June 2010 | 680 | | 152 | | 738 |

+---------------------------------------+---------+----------+---------+----------+----------+

10. Related party transactions

The table set out below illustrates the Parent Company inter-company balances

at the period end.

+---------------------------------------+---------+----------+---------+----------+----------+

| | 30 June | | 30 | | 31 |

| | | | June | | December |

+---------------------------------------+---------+----------+---------+----------+----------+

| | 2010 | | 2009 | | 2009 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Company | GBP'000 | | GBP'000 | | GBP'000 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Balances due from Group companies at | | | | | |

| the period end: | | | | | |

+---------------------------------------+---------+----------+---------+----------+----------+

| Hampden Corporate Member Limited | 3,693 | | 3,671 | | 3,682 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Nameco (No. 365) Limited | 133 | | 125 | | 133 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Nameco (No. 605) Limited | 960 | | 900 | | 957 |

+---------------------------------------+---------+----------+---------+----------+----------+

| Total | 4,786 | | 4,696 | | 4,772 |

+---------------------------------------+---------+----------+---------+----------+----------+

Hampden Underwriting plc has provided an inter-company loan to Hampden Corporate

Member Limited, a 100% subsidiary of the company. The amount outstanding as at

30 June 2010 is GBP3,693,000 (2009: GBP3,671,000). Interest is charged on the

loan at base rate plus 0.125%. The loan is repayable on three months notice

provided it does not jeopardise the ability of Hampden Corporate Member Limited

to meet its liabilities as they fall due.

Hampden Underwriting plc has provided an intercompany loan to Nameco (No.365)

Limited, a 100% subsidiary of the Company. The amount outstanding as at 30 June

2010 is GBP133,000 (2009: GBP125,000). Interest is charged on the loan at base

rate plus 0.125%. The loan is repayable on three months notice provided it does

not jeopardise the ability of Nameco (No.365) Limited to meet its liabilities as

they fall due.

Hampden Underwriting plc has provided an intercompany loan to Nameco (No.605)

Limited, a 100% subsidiary of the Company. The amount outstanding as at 30 June

2010 is GBP960,000 (2009: GBP900,000). Interest is charged on the loan at base

rate plus 0.125%. The loan is repayable on three months notice provided it does

not jeopardise the ability of Nameco (No.605) Limited to meet its liabilities as

they fall due.

Hampden Underwriting plc and Hampden Corporate Member Limited, a 100% subsidiary

of the company, have entered into a management agreement with Nomina plc. Jeremy

Richard Holt Evans, a Director of Hampden Underwriting plc and Hampden Corporate

Member Limited is also a Director of Nomina plc. Under the agreement, Nomina plc

provides management and administration, financial tax and accounting services to

the Group for an annual fee of GBP2,625 (2009: GBP10,000). No fees have been

paid by the Group in the period.

Hampden Corporate Member Limited, a 100% subsidiary of the company, has entered

into a member's agent agreement with Hampden Agencies Limited. Jeremy Richard

Holt Evans, a Director of Hampden Underwriting plc and Hampden Corporate Member

Limited, and Sir James Michael Yorrick Oliver, a Director of Hampden

Underwriting plc, are also a Directors of Hampden Capital plc which controls

Hampden Agencies Limited. Under the agreement, Hampden Corporate Member Limited

will pay Hampden Agencies Limited a fee based on a fixed amount, which will vary

depending upon the number of syndicates the company underwrites on a bespoke

basis, and a variable amount depending on the level of underwriting through the

members' agent pooling arrangements. In addition, the Company will pay profit

commission on a sliding scale from 1% of the net profit up to a maximum of 10%.

The total fee payable for 2010 will be GBP16,964 (2009: GBP16,694).

Nameco (No.365) Limited has entered into a management agreement with Nomina plc

and a members agent agreement with Hampden Agencies Limited. Under the

management agreement Nameco (No.365) Limited pays Nomina plc GBP2,625 (2009:

GBP2,625) for management, administration, financial, tax and accounting

services. Under the members agencies agreement Nameco (No.365) Limited will pay

Hampden Agencies Limited a fee based on a fixed amount, which will vary

depending upon the number of syndicates the company underwrites on a bespoke

basis, and a variable amount depending on the level of underwriting through the

members' agent pooling arrangements. In addition, the Company will pay profit

commission on a sliding scale from 1% of the net profit up to a maximum of 10%.

The total fee payable for 2010 will be GBP5,292 (2009: GBP4,802).

Nameco (No.605) Limited has entered into a management agreement with Nomina plc

and a member's agency agreement with Hampden Agencies Limited. Under the

management agreement Nameco (No.605) Limited pays Nomina plc GBP2,625 (2009:

GBP2,625) for management, administration, financial, tax and accountancy

services. Under the members' agency agreement Nameco (No.605) Limited will pay

Hampden Agencies Limited a fee based on a fixed amount, which will vary

depending upon the number of syndicates the company underwrites on a bespoke

basis, and a variable amount depending on the level of underwriting through the

members' agent pooling arrangements. In addition, the Company will pay profit

commission on a sliding scale from 1% of the net profit up to a maximum of 10%.

The total fee payable for 2010 will be GBP10,608 (2009: GBP10,006).

Hampden Underwriting plc has entered into a company secretarial agreement with

Hampden Legal plc. Under the agreement, Hampden Legal plc provides company

secretarial services to the Group for an annual fee of GBP35,000 (2009:

GBP38,000). Hampden Holdings Limited has a controlling interest in both Hampden

Legal plc and Hampden Capital plc.

The Group has entered into a reinsurance arrangement with an insurance company

owned by Hampden Capital plc. The total premium payable for 2010 will be GBP920

(2009: GBP35,239). The reinsurance arrangement was at market rates. Hampden

Capital plc is the holding company of Nomina plc.

11. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA") in which the

Company's subsidiaries participate as corporate members of Lloyd's as are

follows:

+-----------+-------------+-------+--+----------+--+-----------+----------+-----------+----------+----------------+

| | | | | Allocated capacity |

| | | | | Year of account |

+-----------+-------------+-------+-------------+ +

| | | | | |

+-----------+-------------+-------+-------------+-----------------------------------------------------------------+

| Syndicate | Managing or Members' | | | 2008 | | 2009 | | 2010 |

| or | Agent | | | | | | | |

| MAPA | | | | | | | | |

| Number | | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| | | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 218 | Equity Syndicates | | | 42,851 | | 43,851 | | 147,138 |

| | Management Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 318 | Beaufort Underwriting | | | 22,826 | | - | | - |

| | Agency Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 510 | RJ Kiln & Co. Limited | | | 38,572 | | 38,572 | | 56,328 |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 557 | RJ Kiln & Co. Limited | | | 175,000 | | 175,000 | | 195,000 |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 609 | Atrium Underwriters | | | 41,718 | | 41,718 | | 57,431 |

| | Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 623 | Beazley Furlonge | | | 37,960 | | 37,960 | | 57,081 |

| | Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 958 | Omega Underwriting | | | 55,500 | | 55,500 | | 62,301 |

| | Agency Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 1200 | Heritage Managing | | | 21,507 | | 21,507 | | 23,125 |

| | Agency Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 2121 | Argenta Syndicate | | | 349,999 | | 404,441 | | 100,000 |

| | Management Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 2791 | Managing Agency | | | 63,953 | | 62,953 | | 245,000 |

| | Partners Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 6103 | Managing Agency | | | 110,000 | | 282,028 | | 225,000 |

| | Partners Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 6104 | Hiscox Syndicates | | | 200,000 | | 200,000 | | 225,000 |

| | Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 6106 | Amlin Underwriting | | | - | | 104,334 | | 175,000 |

| | Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 6107 | Beazley Furlonge | | | - | | - | | 15,000 |

| | Limited | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 7200 | Members' Agents | | | 209,913 | | 194,532 | | 245,501 |

| | Pooling Arrangement | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 7201 | Members' Agents | | | 1,113,142 | | 1,028,781 | | 1,278,668 |

| | Pooling Arrangement | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 7202 | Members' Agents | | | 402,413 | | 373,051 | | 458,211 |

| | Pooling Arrangement | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 7203 | Members' Agents | | | 38,906 | | 35,673 | | 44,288 |

| | Pooling Arrangement | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 7208 | Members' Agents | | | 5,000,000 | | 4,416,400 | | 5,086,898 |

| | Pooling Arrangement | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| 7217 | Members' Agents | | | - | | 59,320 | | 70,235 |

| | Pooling Arrangement | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| | | | | | | | | |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| Total | | | |7,924,260 | | 7,575,621 | | 8,767,205 |

+-----------+------------------------+----------+--+-----------+----------+-----------+----------+----------------+

| | | | | | | | | | | |

+-----------+-------------+-------+--+----------+--+-----------+----------+-----------+----------+----------------+

12. Events after the balance sheet date

On 4 August 2010 Hampden Underwriting plc acquired 100% of the issued share

capital of GBP1 ordinary shares of Nameco (No. 321) Limited for GBP370,000.

Nameco (No. 321) Limited is a corporate member at Lloyd's. It is not practicable

to disclose further details of the financial effect of this acquisition as the

financial statements of Nameco (No. 321) Limited are not yet available.

In order to support the underwriting of Nameco (No. 321) Limited, the

Group deposited Funds at Lloyd's of GBP12,568 and $157,000 on 13 September 2010.

13. Group owned net assets

The Group balance sheet includes the following assets and liabilities held by

the syndicates on which the Group participates. These assets are subject to

trust deeds for the benefit of the relevant syndicates' insurance creditors. The

table below shows the split of the Group balance sheet between Group and

syndicate assets and liabilities.

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| | 30 June 2010 | 30 June 2009 | 31 December 2009 |

+--------------------+-------------------------------+-------------------------------+-------------------------------+

| | Group | Syndicate | Total | Group | Syndicate | Total | Group | Syndicate | Total |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Assets | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Intangible assets | 1,101 | - | 1,101 | 1,241 | - | 1,241 | 1,216 | - | 1,216 |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Financial | 4,130 | 8,895 | 13,025 | 3,983 | 6,595 | 10,578 | 4,087 | 6,354 | 10,441 |

| investments | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Reinsurance share | | | | | | | | | |

| of insurance | | | | | | | | | |

| liabilities | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| - Reinsurers' | - | 2,383 | 2,383 | - | 1,726 | 1,726 | - | 1,581 | 1,581 |

| share of | | | | | | | | | |

| outstanding claims | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| - Reinsurers' | - | 935 | 935 | - | 775 | 775 | - | 349 | 349 |

| share of unearned | | | | | | | | | |

| premiums | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Other receivables, | 77 | 7,905 | 7,982 | 118 | 4,797 | 4,915 | 69 | 4,841 | 4,910 |

| including | | | | | | | | | |

| insurance | | | | | | | | | |

| receivables | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Prepayments and | 40 | 1,046 | 1,086 | 46 | 833 | 879 | 34 | 839 | 873 |

| accrued income | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Deferred income | - | - | - | - | - | - | 12 | - | 12 |

| tax assets | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Cash and cash | 2,347 | 1,061 | 3,408 | 1,801 | 855 | 2,656 | 1,776 | 335 | 2,111 |

| equivalents | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Total assets | 7,695 | 22,225 | 29,920 | 7,189 | 15,581 | 22,770 | 7,194 | 14,299 | 21,493 |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| | | | | | | | | | |

| Liabilities | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Insurance | | | | | | | | | |

| liabilities | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| - Claims | - | 11,988 | 11,988 | - | 8,610 | 8,610 | - | 7,301 | 7,301 |

| outstanding | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| - Unearned | - | 5,557 | 5,557 | - | 3,796 | 3,796 | - | 3,402 | 3,402 |

| premiums | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Other payables, | 118 | 3,395 | 3,513 | 117 | 2,534 | 2,651 | 120 | 2,095 | 2,215 |

| including | | | | | | | | | |

| insurance payables | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Accruals and | 507 | 96 | 603 | 191 | 42 | 233 | 233 | (7) | 226 |

| deferred income | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Current income tax | 108 | - | 108 | 5 | - | 5 | 106 | - | 106 |

| liabilities | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Deferred income | 469 | - | 469 | 321 | - | 321 | 503 | - | 503 |

| tax liabilities | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Total liabilities | 1,202 | 21,036 | 22,238 | 634 | 14,982 | 15,616 | 962 | 12,791 | 13,753 |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Shareholders' | | | | | | | | | |

| equity | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Share capital | 741 | - | 741 | 741 | - | 741 | 741 | - | 741 |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Share premium | 6,261 | - | 6,261 | 6,261 | - | 6,261 | 6,261 | - | 6,261 |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Retained earnings | (509) | 1,189 | 680 | (447) | 599 | 152 | (770) | 1,508 | 738 |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Total | 6,493 | 1,189 | 7,682 | 6,555 | 599 | 7,154 | 6,232 | 1,508 | 7,740 |

| shareholders' | | | | | | | | | |

| equity | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

| Total liabilities | 7,695 | 22,225 | 29,920 | 7,189 | 15,581 | 22,770 | 7,194 | 14,299 | 21,493 |

| and shareholders' | | | | | | | | | |

| equity | | | | | | | | | |

+--------------------+---------+-----------+---------+---------+-----------+---------+---------+-----------+---------+

14. Announcement

A copy of this announcement will be available on the Company's website:

www.hampdenplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGUUGBUPUGQB

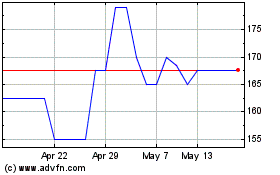

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024