TIDMHUW

RNS Number : 3105M

Hampden Underwriting Plc

21 May 2010

21 May 2010

Hampden Underwriting PLC

("Hampden Underwriting" or the "Company")

Preliminary results for the year ended 31 December 2009

Hampden Underwriting, which provides investors with a limited liability direct

investment into the Lloyd's insurance market, announces its preliminary results

for the year ended 31 December 2009.

Highlights

· Group's second acquisition of a Lloyd's corporate member during the year

· Premium written during the year totalled GBP8.6m (an increase of 64% over

the same period last year)

· Net profit attributable to equity shareholders of GBP724,000

· Earnings per share of 9.77p

· Net assets increase to GBP7.7m

Commenting upon these results Chairman, Sir Michael Oliver said:

"I am delighted with the results this year, particularly when one remembers that

the first year of account in which Hampden Corporate Member participated was the

2008 year which will not close until the end of 2010. The increase in net asset

value and the achievement of a pre-tax profit of GBP985,000, compared to a loss

last year of GBP85,000, is testament to the quality of our underwriting

portfolio constructed by Hampden Agencies and of our policy of acquiring other

corporate members which enabled us to have exposure to the excellent 2007 year.

The current outlook appears promising with the prospect of attractive returns

resulting from the 2008 and 2009 years of account but it is important to realise

that insurance has, is, and will continue to be a cyclical business."

Enquiries

+-------------------+--------------------+-----------------+

| Hampden | Jeremy Evans | 020 7863 6567 |

| Underwriting | | |

| | | |

+-------------------+--------------------+-----------------+

| Smith & | David Jones | 020 7131 4000 |

| Williamson | Barrie Newton | |

| Corporate Finance | | |

+-------------------+--------------------+-----------------+

Chairman's Statement

Hampden Agencies, our Lloyd's adviser, start their report with the statement:

"what a difference a year makes", and it is difficult to think of a better way

to begin my statement than to agree with them - what a difference a year makes,

albeit for different reasons.

I am delighted with the results this year, particularly when one remembers that

the first year of account in which Hampden Corporate Member participated was the

2008 year which will not close until the end of 2010. The increase in net asset

value and the achievement of a pre-tax profit of GBP985,000, compared to a loss

last year of GBP85,000, is testament to the quality of our underwriting

portfolio constructed by Hampden Agencies and of our policy of acquiring other

corporate members which enabled us to have exposure to the excellent 2007 year.

We continue to look at opportunities to make similar acquisitions but not at any

price. Unless our valuation criteria are met we are happy to walk away from the

transaction; if capital with excessive zeal is willing to pay a higher price

than that which we are prepared to pay then so be it. As and when the timing is

right, we will be seeking to raise further capital from both existing

shareholders and new investors to enable us to continue with our acquisition

policy.

You will recall that as well as underwriting in our own right and acquiring

other corporate members, the third element of our strategy was to look at other

Lloyd's opportunities. We have seen several during the course of the year but

they were not of sufficient interest to persuade us to utilise our capital to

support them as opposed to increasing our exposure to underwriting.

The current outlook appears promising with the prospect of attractive returns

resulting from the 2008 and 2009 years of account but it is important to realise

that insurance has, is, and will continue to be a cyclical business. However it

is encouraging that Hampden Agencies report that, despite the current

challenging conditions, they see no evidence of a dangerous lack of discipline

in the market which characterised previous loss making years. With lower

investment returns maintaining pressure on underwriters to generate underwriting

profits coupled with a disciplined approach and lack of complacency, we remain

confident of our ability to generate attractive returns for shareholders.

Sir Michael Oliver

Non-executive Chairman

20 May 2010

Lloyd's Adviser's Report

Market outlook

What a difference a year makes. A year ago, 2008 had marked the steepest fall in

the benchmark Standard & Poor's 500 Index since 1931, with a fall of 38.5%. At

the end of the first quarter of 2009, just after the stock market had bottomed,

the financial crisis of 2008 ranked as the largest "capital event" over the past

20 years for the US property and casualty industry. Losses on investments, both

realised and unrealised, had eroded 16.2% of the industry's surplus, exceeding

the previous record for an insured loss of 13.8% for Hurricane Katrina. Against

this background, we were optimistic that 2009 would prove to be a year of

transition with the market moving from a softening/soft market (falling rates)

to a hardening market (rising rates) in 2010.

The turnaround in the asset markets has been in complete contrast to the

position a year ago. The Standard & Poor's 500 Index at the end of April 2010

was up 76% from the March 2009 lows, which is the sharpest rise since 1932/1933.

Credit spreads have narrowed and with it the value of assets on insurers' and

reinsurers' balance sheets has increased. Combined with a benign year for

natural catastrophes in 2009, policyholder surplus, (a measure of its capital

base) in the United States is now within 2% of its pre-financial crisis peak and

softening market conditions have reasserted themselves other than in loss

affected lines such as aviation and UK motor.

Today, the one constant is that the National Bureau for Economic Research has

not yet called the end of the "great recession" in the United States, although

most economists consider the likely end was in June 2009, which would make the

recession at 19 months the longest since 1929 and almost twice the length of the

average recession. The impact of reduced demand for insurance due to the

recession and rate competition has resulted in net written premiums in the US

property/casualty market falling in each of the years 2007 through to 2009,

marking the first three year decline since 1930 to 1933.

In the short term, market conditions overall can best be described as

challenging. The Lloyd's market continues to benefit from improved discipline

and controls both at Managing Agency level and Franchise Board level. We do not

anticipate a return to the aggressive market conditions of the late 1980s and

late 1990s, characterised by under-reserving and broad terms and conditions. In

particular, we continue to see the reinsurance marketplace as being disciplined

with no sign of the naïve reinsurance capacity which has been associated with

previous soft insurance markets.

Our conclusion is that now is the time to be cautious in view of constrained

demand and ample supply of capital. With Lloyd's setting the business planning

exchange rate for 2011 at $1.50:GBP1, the same rate as for this year, we expect

many syndicates to reduce their capacity for 2011 in the face of a general

downward pressure on rates.

Encouragingly, we do not see evidence of the lack of discipline which

characterised the loss making years at the end of the 1980s and 1990s. We expect

the pressure for rate rises to build over the next two years due to a

combination of reserve releases tapering off and continued low investment

returns. While our current message is one of caution, investors in Hampden

Underwriting can be reassured by our view that Lloyd's is currently better

positioned relative to its peers than at any time over the past ten years.

Our investment thesis for Lloyd's remains that in an era of low investment

returns there is greater pressure to generate an underwriting profit in order to

provide an acceptable return on equity for providers of risk capital, although

current market conditions are such that some insurers have yet to fully

appreciate this pressure. It is no coincidence that during this era of low

investment returns, Lloyd's has been consistently profitable for each of the

closed 2002 through to 2007 accounts (on a three year account basis). We expect

Lloyd's to continue to perform well, relative to the industry, and the

syndicates supported by Hampden Underwriting to outperform Lloyd's.

Lloyd's competitive position continues to strengthen

As the world's leading subscription market for insurance and reinsurance risk,

Lloyd's ended 2009 with its reputation and market position enhanced. Since 2001

Lloyd's has been one of only three major reinsurers whose Standard & Poor's

credit rating is currently unchanged compared with the position before the World

Trade Centre losses in 2001. The Lloyd's subscription model backed by a layer of

mutual security continues to prove its worth to clients as many large insureds

and reinsurers seek to diversify their counterparty risk. As a platform there

has been continued strong investor interest in Lloyd's with eight new syndicates

being established in 2009/2010.

Importantly, Lloyd's operating results continue to be excellent using both the

three year and annual reporting measures. The 2007 three year account result

announced by Lloyd's on 24 March 2010 was a 17% return on capacity while, in

spite of catastrophe losses from Hurricane Ike, an improved forecast of 4% was

reported for the 2008 account. Lloyd's annually accounted results for 2009 were

a record pre-tax profit of GBP3.9bn.

The traditional method for performance comparisons of competing insurance

businesses is an analysis of the combined ratio, which is the ratio of net

incurred claims plus net operating expenses to net earned premiums. In 2009,

Lloyd's combined ratio was the second best in its peer group at 86%, with

Lloyd's outperforming its nearest competitor, Bermudian reinsurers, by an

aggregate of 7% over the period 2005 to 2009.

Lloyd's operating results have outperformed its main peer groups, while HAL's

managed portfolios continue to outperform Lloyd's on a three year account basis

with a result of 19.7% for the closed 2007 account compared with the Lloyd's

average of 17.0%.

Hampden underwriting's performance

Hampden Underwriting's first underwriting year through Hampden Corporate Member

is the 2008 account with underwriting capacity of GBP5.1m and a further GBP2.8m

from the two Nameco acquisitions (Nameco 365 and Nameco 605). Both Nameco

acquisitions have also given exposure to the profitable 2006 and 2007 accounts.

During 2008 and 2009 Hampden Underwriting added four smaller individual

participations on MAP Syndicate 6103, Hiscox Syndicate 6104, Amlin Syndicate

6106 and ICAT Syndicate 4242, all of which give additional exposure to US

catastrophe business which remains well rated.

2008 Account

The latest mid-point estimate after eight quarters is a profit of 7.06% of

capacity. On this estimate the portfolio is outperforming the Lloyd's market

average of 4.00% of capacity. This estimated result is an excellent performance

given that 2008 marked the third worst year on record for insured catastrophe

losses.

Top 10 Syndicate Holdings

+-----------+---------------------+-------------+-----------+-----------+----------------+

| Syndicate | Managing Agent | 2010 | 2010 | 2010 | Class |

| | | Syndicate | HCM | HCM | |

| | | capacity | portfolio | portfolio | |

| | | GBP'000 | capacity | % of | |

| | | | GBP'000 | total | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 2791 | Managing Agency | 500,000.0 | 1,450.2 | 16.5 | Reinsurance |

| | Partners Ltd | | | | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 510 | R.J. Kiln & Co. Ltd | 920,000.0 | 1,267.6 | 14.5 | US$ Property |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 623 | Beazley Furlonge | 222,300.0 | 903.5 | 10.3 | US$ Non-Marine |

| | Ltd | | | | Liability |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 609 | Atrium Underwriters | 275,000.0 | 634.8 | 7.2 | Energy |

| | Ltd | | | | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 958 | Omega Underwriting | 280,000.0 | 573.7 | 6.5 | Reinsurance |

| | Agents Ltd | | | | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 33 | Hiscox Syndicates | 1,000,000.0 | 548.7 | 6.3 | US$ Property |

| | Ltd | | | | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 218 | Equity Syndicate | 486,249.5 | 509.5 | 5.8 | Motor |

| | Mangement Ltd | | | | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 557 | R.J. Kiln & Co Ltd | 119,577.0 | 505.9 | 5.8 | Reinsurance |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 260 | KGM Underwriting | 72,499.8 | 353.7 | 4.0 | Motor |

| | Agencies Ltd | | | | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| 2121 | Argenta Syndicate | 175,000.0 | 288.8 | 3.3 | US$ Property |

| | Management Ltd | | | | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| Subtotal | | | 7,036.2 | 80.3 | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

| Portfolio Total | | 8,767.3 | 100.0 | |

+-----------+---------------------+-------------+-----------+-----------+----------------+

The two largest classes of business are reinsurance and US$ property insurance.

As the rating levels are more attractive in reinsurance than insurance, the

weighting of reinsurance relative to insurance has increased for 2010 compared

with 2009. These classes include business exposed to catastrophes and therefore

the next two largest classes, being motor and US casualty, provide balance to

these exposures.

2009 Account

Estimates for all syndicates on the 2009 account will not be available until the

end of May, reflecting data at the end of the first quarter of 2010. Forecasts

at the end of the fourth quarter of 2009 have been received for nine syndicates

in Hampden Underwriting's portfolio for the 2009 account representing 58% of

capacity with an average mid-point forecast of 11.2% on capacity. It is

encouraging that at this early stage, eight of these nine syndicates are

forecasting profits, the one exception being a motor syndicate which has been

affected by the difficult trading conditions in UK motor. However, the 2009

account is still on risk and at the time of writing two significant catastrophe

losses this year, the Chilean earthquake and the Deepwater Horizon rig

explosion, will impact the 2009 account and adversely affect some of the early

estimates. Also reinsurance business is exposed, in particular to earthquake,

until 30 June 2010 while many insurance policies will be on risk until 31

December 2010. Hampden maintains its profit target of 5% to 12.5% of capacity,

excluding prior year releases.

2010 Account

In contrast to the benign catastrophe year in 2009, 2010 has so far been above

average with record insured losses in the first quarter headed by the Chilean

earthquake, totalling $16bn, as estimated by Willis Re. Already, the second

quarter has started with a major loss in the energy market with the sinking of

the Deepwater Horizon oil rig following an explosion on 20 April 2010 with

estimated insured losses of up $1.5bn, though a significant portion of this loss

is expected to fall back to the 2009 account. While "market changing" for the

energy market this year, this loss is likely to be widely spread amongst

insurers and reinsurers and is not expected to have a broad based impact on

other classes of business. Likewise, it is unlikely that the Chilean earthquake,

which took place on 27 February 2010, with estimated insured losses of $10bn or

more, will on its own have an impact on market conditions. Losses from the

Chilean earthquake are likely to be split fairly evenly between the 2009 and

2010 accounts.

Catastrophe losses so far this year will have used up a material portion of many

underwriters' catastrophe margin for the full year so an active hurricane season

including a mega catastrophe like Hurricane Katrina or an accumulation of

smaller losses could be sufficient to turn the market.

Hampden's profit target for the year remains 5% to 10%, although a downwards

revision is possible due to the level of catastrophe losses and rating

conditions, which have been disappointing.

Apart from UK motor, aviation and loss affected business such as financial

institutions D&O, so far this year there has been a general softening of rates

and we expect this to continue into 2011. Reinsurance rates at 1 April 2010

continued the declining trend experienced at 1 January 2010 when rates were down

by 6% using Guy Carpenter's World Rate on Line Index. Similarly direct insurance

rates in the US, Lloyd's biggest market, are also down by an average of 5.3% in

the first quarter of this year according to a survey by the Council of Insurance

Agents and Brokers.

Hampden Underwriting's portfolio for 2010 provides a good spread of business

across managing agents and classes of business with motor and liability

providing a balance to the catastrophe exposed reinsurance and property

business, as well as contributing to lower capital requirements due to Lloyd's

credits for diversification.

26.9% of the capacity is in the three syndicates rated A by HAL, being

Syndicates 386, 609 and 2791 with Syndicate 2791 being the largest holding at

16.5% of capacity. 62.8% of the portfolio is in syndicates rated B, including

the Kiln Syndicate 510 which makes up 14.5% of the portfolio and has a good

track record of outperforming the market. 10.3% of the capacity is allocated to

C rated syndicates.

The ratings are intended to indicate HAL's view of expected performance of a

syndicate over a cycle, "A" being superior, "B" being above average and "C"

being average.

Portfolio risk management

HAL manages the portfolio risk by diversification across classes of business,

syndicates and managing agents as well as controlling the downside, in the event

of a major loss, by monitoring the aggregate losses estimated by managing agents

to Realistic Disaster Scenarios ("RDSs"). HAL considers risk

in the context of potential return and seeks to actively manage catastrophe

exposure,

dependent on market conditions.

Lloyd's first utilised RDSs in 1995 to evaluate exposure at both syndicate and

market level. These scenarios continue to be refined and updated to take account

of loss experience and exposure values. For 2010 the largest loss modelled is a

Florida windstorm totalling $125bn, which compares with only $60bn in 2005

indicating additional conservatism. Exposure management is a critical component

of being able to manage the insurance cycle.

Group income statement

Year ended 31 December 2009

+---------------------------------------+------+----------+----------+

| | | | |

+---------------------------------------+------+----------+----------+

| | | Year | Year |

| | | ended | ended |

+---------------------------------------+------+----------+----------+

| | | 31 | 31 |

| | | December | December |

+---------------------------------------+------+----------+----------+

| | | 2009 | 2008 |

+---------------------------------------+------+----------+----------+

| | Note | GBP'000 | GBP'000 |

+---------------------------------------+------+----------+----------+

| Gross premium written | | 8,610 | 5,245 |

+---------------------------------------+------+----------+----------+

| Reinsurance premium ceded | | (1,753) | (854) |

+---------------------------------------+------+----------+----------+

| Net premiums written | | 6,857 | 4,391 |

+---------------------------------------+------+----------+----------+

| Change in unearned gross premium | | (8) | (1,982) |

| provision | | | |

+---------------------------------------+------+----------+----------+

| Change in unearned reinsurance | | 116 | 218 |

| premium provision | | | |

+---------------------------------------+------+----------+----------+

| | | 108 | (1,764) |

+---------------------------------------+------+----------+----------+

| Net earned premium | | 6,965 | 2,627 |

+---------------------------------------+------+----------+----------+

| Net investment income | 3 | 375 | 358 |

+---------------------------------------+------+----------+----------+

| Other underwriting income | | 24 | (1) |

+---------------------------------------+------+----------+----------+

| Other income | | 337 | 25 |

+---------------------------------------+------+----------+----------+

| | | 736 | 382 |

+---------------------------------------+------+----------+----------+

| Revenue | | 7,701 | 3,009 |

+---------------------------------------+------+----------+----------+

| Gross claims paid | | (2,836) | (670) |

+---------------------------------------+------+----------+----------+

| Reinsurance share of gross claims | | 472 | 108 |

| paid | | | |

+---------------------------------------+------+----------+----------+

| Claims paid, net of reinsurance | | (2,364) | (562) |

+---------------------------------------+------+----------+----------+

| Change in provision for gross claims | | (1,457) | (1,740) |

+---------------------------------------+------+----------+----------+

| Reinsurance share of change in | | 170 | 378 |

| provision for gross claims | | | |

+---------------------------------------+------+----------+----------+

| Net change in provision for claims | | (1,287) | (1,362) |

+---------------------------------------+------+----------+----------+

| Net insurance claims | | (3,651) | (1,924) |

+---------------------------------------+------+----------+----------+

| Expenses incurred in insurance | | (2,513) | (720) |

| activities | | | |

+---------------------------------------+------+----------+----------+

| Other operating expenses | | (552) | (450) |

+---------------------------------------+------+----------+----------+

| Operating expenses | | (3,065) | (1,170) |

+---------------------------------------+------+----------+----------+

| Operating profit/(loss) before tax | 4 | 985 | (85) |

+---------------------------------------+------+----------+----------+

| Income tax (expense)/credit | | (261) | 37 |

+---------------------------------------+------+----------+----------+

| Profit/(loss) attributable to equity | | 724 | (48) |

| shareholders | | | |

+---------------------------------------+------+----------+----------+

| Earnings per share attributable to | | | |

| equity shareholders | | | |

+---------------------------------------+------+----------+----------+

| Basic and diluted | 5 | 9.77p | (0.65)p |

+---------------------------------------+------+----------+----------+

The profit/(loss) attributable to equity shareholders and earnings per share set

out above are in respect of continuing operations.

The accounting policies and notes are an integral part of these financial

statements.

Group balance sheet

At 31 December 2009

+----------------------------------------+------+-------------+------------+

| | | 31 December | 31 |

| | | | December |

+----------------------------------------+------+-------------+------------+

| | | 2009 | 2008 |

+----------------------------------------+------+-------------+------------+

| | Note | GBP'000 | GBP'000 |

+----------------------------------------+------+-------------+------------+

| Assets | | | |

+----------------------------------------+------+-------------+------------+

| Intangible assets | 6 | 1,216 | 920 |

+----------------------------------------+------+-------------+------------+

| Financial investments | 7 | 10,441 | 4,131 |

+----------------------------------------+------+-------------+------------+

| Reinsurance share of insurance | | | |

| liabilities | | | |

+----------------------------------------+------+-------------+------------+

| - Reinsurers' share of outstanding | | 1,581 | 678 |

| claims | | | |

+----------------------------------------+------+-------------+------------+

| - Reinsurers' share of unearned | | 349 | 266 |

| premiums | | | |

+----------------------------------------+------+-------------+------------+

| Other receivables, including insurance | | 4,910 | 2,557 |

| receivables | | | |

+----------------------------------------+------+-------------+------------+

| Prepayments and accrued income | | 873 | 612 |

+----------------------------------------+------+-------------+------------+

| Deferred income tax assets | | 12 | 16 |

+----------------------------------------+------+-------------+------------+

| Cash and cash equivalents | | 2,111 | 3,931 |

+----------------------------------------+------+-------------+------------+

| Total assets | | 21,493 | 13,111 |

+----------------------------------------+------+-------------+------------+

| Liabilities | | | |

+----------------------------------------+------+-------------+------------+

| Insurance liabilities | | | |

+----------------------------------------+------+-------------+------------+

| - Claims outstanding | | 7,301 | 2,879 |

+----------------------------------------+------+-------------+------------+

| - Unearned premiums | | 3,402 | 2,366 |

+----------------------------------------+------+-------------+------------+

| Other payables, including insurance | | 2,215 | 803 |

| payables | | | |

+----------------------------------------+------+-------------+------------+

| Accruals and deferred income | | 226 | 26 |

+----------------------------------------+------+-------------+------------+

| Current income tax liabilities | | 106 | - |

+----------------------------------------+------+-------------+------------+

| Deferred income tax liabilities | | 503 | 21 |

+----------------------------------------+------+-------------+------------+

| Total liabilities | | 13,753 | 6,095 |

+----------------------------------------+------+-------------+------------+

| Shareholders' equity | | | |

+----------------------------------------+------+-------------+------------+

| Share capital | 8 | 741 | 741 |

+----------------------------------------+------+-------------+------------+

| Share premium | 8 | 6,261 | 6,261 |

+----------------------------------------+------+-------------+------------+

| Retained earnings | 8 | 738 | 14 |

+----------------------------------------+------+-------------+------------+

| Total shareholders' equity | | 7,740 | 7,016 |

+----------------------------------------+------+-------------+------------+

| Total liabilities and shareholders' | | 21,493 | 13,111 |

| equity | | | |

+----------------------------------------+------+-------------+------------+

The accounting policies and notes are an integral part of these financial

statements.

Group cash flow statement

Year ended 31 December 2009

+-------------------------------------------+-----------+------------+

| | | |

+-------------------------------------------+-----------+------------+

| | Year | Year ended |

| | ended | |

+-------------------------------------------+-----------+------------+

| | 31 | 31 |

| | December | December |

+-------------------------------------------+-----------+------------+

| | 2009 | 2008 |

+-------------------------------------------+-----------+------------+

| Cash flow from operating activities | GBP'000 | GBP'000 |

+-------------------------------------------+-----------+------------+

| Results of operating activities | 985 | (85) |

+-------------------------------------------+-----------+------------+

| Interest received | (47) | (264) |

+-------------------------------------------+-----------+------------+

| Investment income | (179) | (49) |

+-------------------------------------------+-----------+------------+

| Dividend received | - | (18) |

+-------------------------------------------+-----------+------------+

| Income tax paid | 159 | 11 |

+-------------------------------------------+-----------+------------+

| Recognition of negative goodwill | (206) | (25) |

+-------------------------------------------+-----------+------------+

| Profit on sale of intangible assets | (133) | - |

+-------------------------------------------+-----------+------------+

| Amortisation of intangible assets | 217 | 150 |

+-------------------------------------------+-----------+------------+

| Change in fair value of investments | (88) | 17 |

| recognised in the income statement | | |

+-------------------------------------------+-----------+------------+

| Changes in working capital: | | |

+-------------------------------------------+-----------+------------+

| Increase in other receivables | (2,616) | (3,057) |

+-------------------------------------------+-----------+------------+

| Increase in other payables | 1,613 | 810 |

+-------------------------------------------+-----------+------------+

| Net increase in technical provisions | 4,472 | 4,301 |

+-------------------------------------------+-----------+------------+

| Net cash inflow from operating activities | 4,177 | 1,791 |

+-------------------------------------------+-----------+------------+

| Cash flows from investing activities | | |

+-------------------------------------------+-----------+------------+

| Interest received | 47 | 264 |

+-------------------------------------------+-----------+------------+

| Investment income | 179 | 49 |

+-------------------------------------------+-----------+------------+

| Dividend received | - | 18 |

+-------------------------------------------+-----------+------------+

| Purchase of intangible assets | (67) | (17) |

+-------------------------------------------+-----------+------------+

| Proceeds from disposal of intangible | 135 | 3 |

| assets | | |

+-------------------------------------------+-----------+------------+

| Purchase of financial investments | (6,310) | (1,645) |

+-------------------------------------------+-----------+------------+

| Acquisition of subsidiary, net of cash | 19 | (84) |

| acquired | | |

+-------------------------------------------+-----------+------------+

| Net cash outflow from investing | (5,997) | (1,412) |

| activities | | |

+-------------------------------------------+-----------+------------+

| Cash flows from financing activities | | |

+-------------------------------------------+-----------+------------+

| Net proceeds from issue of ordinary share | - | - |

| capital | | |

+-------------------------------------------+-----------+------------+

| Net cash inflow from financing activities | - | - |

+-------------------------------------------+-----------+------------+

| Net (decrease)/increase in cash, cash | (1,820) | 379 |

| equivalents and bank overdrafts | | |

+-------------------------------------------+-----------+------------+

| Cash, cash equivalents and bank | 3,931 | 3,552 |

| overdrafts at beginning of year | | |

+-------------------------------------------+-----------+------------+

| Cash, cash equivalents and bank | 2,111 | 3,931 |

| overdrafts at end of year | | |

+-------------------------------------------+-----------+------------+

The accounting policies and notes are an integral part of these financial

statements.

Statement of changes in shareholders' equity

Year ended 31 December 2009

+------------------------------+----------+------------+---------+----------+---------+

| | Ordinary | Preference | Share | Retained | |

| | | | | | |

+------------------------------+----------+------------+---------+----------+---------+

| | share | share | premium | earnings | Total |

| | capital | capital | | | |

+------------------------------+----------+------------+---------+----------+---------+

| Group | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+------------------------------+----------+------------+---------+----------+---------+

| At 1 January 2008 | 741 | - | 6,261 | 62 | 7,064 |

+------------------------------+----------+------------+---------+----------+---------+

| Loss for the year | - | - | - | (48) | (48) |

+------------------------------+----------+------------+---------+----------+---------+

| At 31 December 2008 | 741 | - | 6,261 | 14 | 7,016 |

+------------------------------+----------+------------+---------+----------+---------+

| At 1 January 2009 | 741 | - | 6,261 | 14 | 7,016 |

+------------------------------+----------+------------+---------+----------+---------+

| Profit for the year | - | - | - | 724 | 724 |

+------------------------------+----------+------------+---------+----------+---------+

| At 31 December 2009 | 741 | - | 6,261 | 738 | 7,740 |

+------------------------------+----------+------------+---------+----------+---------+

| | | | | | |

+------------------------------+----------+------------+---------+----------+---------+

The accounting policies and notes are an integral part of these financial

statements.

Notes to the Financial Statements

1. Accounting policies

The principal accounting policies adopted in the preparation of the financial

information set out in the announcement are set out in the full financial

statements for the year ended 31 December 2009 (the "Financial Statements").

Basis of preparation

The Financial Statements have been prepared in accordance with International

Financial Reporting Standards ("IFRS"), incorporating International Financial

Reporting Interpretations Committee ("IFRIC") interpretations endorsed by the

European Union ("EU") and with those parts of the Companies Act 2006, applicable

to companies reporting under IFRS. The Financial Statements have been prepared

under the historical cost convention.

The preparation of Financial Statements in conformity with generally accepted

accounting principles requires the use of estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the Financial

Statements and the reported amounts of revenues and expenses during the

reporting period. Although these estimates are based on management's best

knowledge of the amount, event or actions, actual results ultimately may differ

from these estimates. The Group participates in insurance business through its

Lloyd's corporate members. Accounting information in respect of syndicate

participations is provided by the syndicate managing agents and is reported upon

by the syndicate auditors.

International Financial Reporting Standards

At the date of authorisation of these Financial Statements the following

standards and interpretations had been published by the International Accounting

Standards Board ("IASB") but were not yet effective and have therefore not been

adopted in these Financial Statements:

- IFRS 1 "First-time Adoption of International Financial Reporting Standards"

(Amended)

- IFRS 2 "Share-based Payment" (Amended)

- IFRS 3 "Business Combinations" (Revised)

- IFRS 9 "Financial Instruments"

- IAS 24 "Related Party Disclosures" (Revised)

- IAS 27 "Consolidated and Separate Financial Statements" (Amended)

- IAS 32 "Financial Instruments: Presentation" (Amended)

- IAS 39 "Financial Instruments: Recognition and Measurement" (Amended)

- IFRIC 14 "IAS 19 - The Limit on a Defined Benefit Asset, Minimum Funding

Requirements and their Interaction" (Amended)

- IFRIC 17 "Distribution of Non-cash Assets to Owners"

- IFRIC 18 "Transfers of Assets from Customers"

- IFRIC 19 "Extinguishing Financial Liabilities with Equity Instruments"

The Directors anticipate that the adoption of the above in future years will not

have a material impact on the Financial Statements except for additional

disclosures.

2. Segmental information

Primary segment information

The Group has three primary segments which represent the primary way in which

the Group is managed:

+---+-------------------------------------------------------------------------+

| - | Syndicate participation; |

+---+-------------------------------------------------------------------------+

| - | Investment management; and |

+---+-------------------------------------------------------------------------+

| - | Other corporate activities. |

+---+-------------------------------------------------------------------------+

+-------------------------------------+---------------+------------+------------+---------+

| | | | Other | |

+-------------------------------------+---------------+------------+------------+---------+

| | Syndicate | Investment | corporate | |

| | | | | |

+-------------------------------------+---------------+------------+------------+---------+

| | participation | management | activities | Total |

+-------------------------------------+---------------+------------+------------+---------+

| Year ended 31 December 2009 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------+---------------+------------+------------+---------+

| Net earned premium | 6,965 | - | - | 6,965 |

+-------------------------------------+---------------+------------+------------+---------+

| Net investment income | 228 | 147 | - | 375 |

+-------------------------------------+---------------+------------+------------+---------+

| Other underwriting income | 24 | - | - | 24 |

+-------------------------------------+---------------+------------+------------+---------+

| Other income | - | - | 337 | 337 |

+-------------------------------------+---------------+------------+------------+---------+

| Net insurance claims and loss | (3,651) | - | - | (3,651) |

| adjustment expenses | | | | |

+-------------------------------------+---------------+------------+------------+---------+

| Expenses incurred in insurance | (2,513) | - | - | (2,513) |

| activities | | | | |

+-------------------------------------+---------------+------------+------------+---------+

| Amortisation of syndicate capacity | - | - | (217) | (217) |

+-------------------------------------+---------------+------------+------------+---------+

| Other operating expenses | (57) | - | (278) | (335) |

+-------------------------------------+---------------+------------+------------+---------+

| Results of operating activities | 996 | 147 | (158) | 985 |

+-------------------------------------+---------------+------------+------------+---------+

+------------------------------------+---------------+------------+------------+---------+

| | | | Other | |

+------------------------------------+---------------+------------+------------+---------+

| | Syndicate | Investment | corporate | |

| | | | | |

+------------------------------------+---------------+------------+------------+---------+

| | participation | management | activities | Total |

+------------------------------------+---------------+------------+------------+---------+

| Year ended 31 December 2008 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+------------------------------------+---------------+------------+------------+---------+

| Net earned premium | 2,627 | - | - | 2,627 |

+------------------------------------+---------------+------------+------------+---------+

| Net investment income | 134 | 224 | - | 358 |

+------------------------------------+---------------+------------+------------+---------+

| Other underwriting income | (1) | - | - | (1) |

+------------------------------------+---------------+------------+------------+---------+

| Other income | - | - | 25 | 25 |

+------------------------------------+---------------+------------+------------+---------+

| Net insurance claims and loss | (1,924) | - | - | (1,924) |

| adjustment expenses | | | | |

+------------------------------------+---------------+------------+------------+---------+

| Expenses incurred in insurance | (720) | - | - | (720) |

| activities | | | | |

+------------------------------------+---------------+------------+------------+---------+

| Amortisation of syndicate capacity | - | - | (150) | (150) |

+------------------------------------+---------------+------------+------------+---------+

| Other operating expenses | - | - | (300) | (300) |

+------------------------------------+---------------+------------+------------+---------+

| Results of operating activities | 116 | 224 | (425) | (85) |

+------------------------------------+---------------+------------+------------+---------+

Secondary segment information

The Group does not have any secondary segments as it considers all of its

activities to arise from trading within the UK.

3. Net investment income

+------------------------------------------------+-------------+-------------+

| | | |

+------------------------------------------------+-------------+-------------+

| | Year ended | Year ended |

+------------------------------------------------+-------------+-------------+

| | 31 December | 31 December |

+------------------------------------------------+-------------+-------------+

| | 2009 | 2008 |

+------------------------------------------------+-------------+-------------+

| | GBP'000 | GBP'000 |

+------------------------------------------------+-------------+-------------+

| Investment income at fair value through income | 179 | 67 |

| statement | | |

+------------------------------------------------+-------------+-------------+

| Realised gains on financial investments at | 169 | 92 |

| fair value through income statement | | |

+------------------------------------------------+-------------+-------------+

| Unrealised gains/(losses) on financial | 88 | (17) |

| investments at fair value through income | | |

| statement | | |

+------------------------------------------------+-------------+-------------+

| Investment management expenses | (108) | (48) |

+------------------------------------------------+-------------+-------------+

| Bank interest | 47 | 264 |

+------------------------------------------------+-------------+-------------+

| Net investment income | 375 | 358 |

+------------------------------------------------+-------------+-------------+

4. Operating profit/(loss) before tax

+--------------------------------------------------+------------+------------+

| | | |

+--------------------------------------------------+------------+------------+

| | Year ended | Year ended |

+--------------------------------------------------+------------+------------+

| | 31 | 31 |

| | December | December |

+--------------------------------------------------+------------+------------+

| | 2009 | 2008 |

+--------------------------------------------------+------------+------------+

| | GBP'000 | GBP'000 |

+--------------------------------------------------+------------+------------+

| Operating profit/(loss) before tax is stated | | |

| after charging: | | |

+--------------------------------------------------+------------+------------+

| Directors' remuneration | 65 | 74 |

+--------------------------------------------------+------------+------------+

| Amortisation of intangible assets | 217 | 150 |

+--------------------------------------------------+------------+------------+

| Auditors' remuneration: | | |

+--------------------------------------------------+------------+------------+

| - audit of the Parent Company and Group | 31 | 12 |

| Financial Statements | | |

+--------------------------------------------------+------------+------------+

| - audit of subsidiary company Financial | 3 | 2 |

| Statements | | |

+--------------------------------------------------+------------+------------+

| - services relating to taxation | 5 | 2 |

+--------------------------------------------------+------------+------------+

| - other services pursuant to legislation | - | 15 |

+--------------------------------------------------+------------+------------+

5. Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the period. The Group has no dilutive potential ordinary

shares.

The Group has no dilutive potential ordinary shares.

Earnings per share have been calculated in accordance with IAS 33.

Reconciliation of the earnings and weighted average number of shares used in the

calculation is set out below.

+--------------------------------------------------+------------+-------------+

| | | |

+--------------------------------------------------+------------+-------------+

| | Year ended | Year ended |

+--------------------------------------------------+------------+-------------+

| | 31 | 31 |

| | December | December |

+--------------------------------------------------+------------+-------------+

| | 2009 | 2008 |

+--------------------------------------------------+------------+-------------+

| Profit/(loss) for the period | GBP724,000 | GBP(48,000) |

+--------------------------------------------------+------------+-------------+

| Weighted average number of shares in issue | 7,413,376 | 7,413,376 |

+--------------------------------------------------+------------+-------------+

| Basic and diluted earnings/(loss) per share | 9.77p | (0.65)p |

+--------------------------------------------------+------------+-------------+

6. Intangible assets

+--------------------------------------------------+--------------------------+

| | Syndicate |

+--------------------------------------------------+--------------------------+

| | capacity |

+--------------------------------------------------+--------------------------+

| | GBP'000 |

+--------------------------------------------------+--------------------------+

| Cost | |

+--------------------------------------------------+--------------------------+

| At 1 January 2009 | 1,081 |

+--------------------------------------------------+--------------------------+

| Additions | 67 |

+--------------------------------------------------+--------------------------+

| Disposals | (4) |

+--------------------------------------------------+--------------------------+

| Acquired with subsidiary undertaking | 505 |

+--------------------------------------------------+--------------------------+

| At 31 December 2009 | 1,649 |

+--------------------------------------------------+--------------------------+

| Amortisation | |

+--------------------------------------------------+--------------------------+

| At 1 January 2009 | 161 |

+--------------------------------------------------+--------------------------+

| Charge for the year | 217 |

+--------------------------------------------------+--------------------------+

| Disposals | (1) |

+--------------------------------------------------+--------------------------+

| Acquired with subsidiary undertaking | 56 |

+--------------------------------------------------+--------------------------+

| At 31 December 2009 | 433 |

+--------------------------------------------------+--------------------------+

| Net book value | |

+--------------------------------------------------+--------------------------+

| As at 31 December 2009 | 1,216 |

+--------------------------------------------------+--------------------------+

| As at 31 December 2008 | 920 |

+--------------------------------------------------+--------------------------+

7. Financial investments

+--------------------------------------------------+-------------+----------+

| | 31 December | 31 |

| | | December |

+--------------------------------------------------+-------------+----------+

| | 2009 | 2008 |

+--------------------------------------------------+-------------+----------+

| Group | GBP'000 | GBP'000 |

+--------------------------------------------------+-------------+----------+

| Shares and other variable yield securities | 583 | 124 |

+--------------------------------------------------+-------------+----------+

| Debt securities and other fixed income | 5,413 | 1,683 |

| securities | | |

+--------------------------------------------------+-------------+----------+

| Participation in investment pools | 201 | - |

+--------------------------------------------------+-------------+----------+

| Loans guaranteed by mortgage | 37 | - |

+--------------------------------------------------+-------------+----------+

| Holdings in collective investment schemes | - | 23 |

+--------------------------------------------------+-------------+----------+

| Deposits with credit institutions | 119 | 32 |

+--------------------------------------------------+-------------+----------+

| Funds held at Lloyd's | 4,088 | 2,258 |

+--------------------------------------------------+-------------+----------+

| Other | - | 11 |

+--------------------------------------------------+-------------+----------+

| Total - Market value | 10,441 | 4,131 |

+--------------------------------------------------+-------------+----------+

| Total - Cost | 10,205 | 4,155 |

+--------------------------------------------------+-------------+----------+

| Listed investments included in the above | 6,194 | 1,830 |

+--------------------------------------------------+-------------+----------+

8. Share capital and share premium

+-------------------------------------------------+----------+------------+---------+

| | Ordinary | Preference | |

| | | | |

+-------------------------------------------------+----------+------------+---------+

| | share | share | |

+-------------------------------------------------+----------+------------+---------+

| | capital | capital | Total |

+-------------------------------------------------+----------+------------+---------+

| Authorised | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------------------+----------+------------+---------+

| 29,500,000 ordinary shares of 10p each and | 2,950 | 50 | 3,000 |

| 100,000 preference shares of 50p each at 1 | | | |

| January 2009 | | | |

+-------------------------------------------------+----------+------------+---------+

| 29,500,000 ordinary shares of 10p each and | 2,950 | 50 | 3,000 |

| 100,000 preference shares of 50p each at 31 | | | |

| December 2009 | | | |

+-------------------------------------------------+----------+------------+---------+

| | | | |

+-------------------------------------------------+----------+------------+---------+

| | Ordinary | | |

| | | | |

+-------------------------------------------------+----------+------------+---------+

| | share | Share | |

+-------------------------------------------------+----------+------------+---------+

| | capital | premium | Total |

+-------------------------------------------------+----------+------------+---------+

| Allotted, called up and fully paid | GBP'000 | GBP'000 | GBP'000 |

+-------------------------------------------------+----------+------------+---------+

| 7,413,376 ordinary shares of 10p each and share | 741 | 6,261 | 7,002 |

| premium at 1 January 2009 | | | |

+-------------------------------------------------+----------+------------+---------+

| 7,413,376 ordinary shares of 10p each and share | 741 | 6,261 | 7,002 |

| premium at 31 December 2009 | | | |

+-------------------------------------------------+----------+------------+---------+

9.Financial statements

The financial information set out in this announcement does not constitute

statutory accounts but has been extracted from the Group's Financial Statements

which have not yet been delivered to the Registrar. The Group's annual report

and Financial Statements will be posted to shareholders shortly. Further copies

will be available from the Company's registered office: Hampden House, Great

Hampden, Great Missenden, Buckinghamshire, HP16 9RD and on the Company's website

www.hampden.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SEWFWSFSSELI

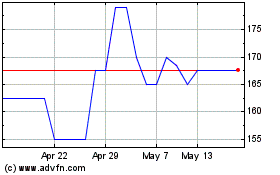

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024