TIDMHSL

RNS Number : 6169Z

Henderson Smaller Cos Inv Tst PLC

26 January 2022

THE HERSON SMALLER COMPANIES INVESTMENT TRUST PLC

HERSON INVESTMENT FUNDS LIMITED

LEGAL ENTITY IDENTIFIER: 213800NE2NCQ67M2M998

26 JANUARY 2022

THE HERSON SMALLER COMPANIES INVESTMENT TRUST PLC

Unaudited Results for the Half-Year Ended 30 November 2021

This announcement contains regulated information

"In the six months to 30 November 2021, smaller companies

underperformed larger companies; principally due to the rise in

bond yields and a gravitation towards value over growth stocks.

Your Company outperformed its benchmark, continuing what has been a

consistent strong long term track record."

Penny Freer

Chairman

INVESTMENT OBJECTIVE

The Company aims to maximise shareholders' total returns

(capital and income) by investing in smaller companies that are

quoted in the United Kingdom.

PERFORMANCE

-- Net asset value ('NAV') total return(1) of -2.1% compared to

a total return from the benchmark(2) of -2.8%

-- Share price(3) total return of -7.9%

-- Interim dividend(4) of 7.0p (30 November 2020: 7.0p)

TOTAL RETURN PERFORMANCE (including dividends reinvested)

6 Months 1 Year 3 Years 5 Years 10 Years

% % % % %

------------------------------- --------- ------- -------- -------- ---------

NAV(1) -2.1 28.7 57.0 96.9 372.6

Benchmark(2) -2.8 24.0 31.8 47.8 196.4

Share price(3) -7.9 22.0 62.5 112.8 476.6

Average sector NAV(5) 2.5 32.1 42.4 70.4 261.6

Average sector share price(6) 0.8 31.9 41.2 83.5 307.8

FTSE All-Share Index 1.9 17.4 16.9 30.6 103.0

Sources: Morningstar Direct, Janus Henderson, Refinitiv

Datastream

1 Net asset value ('NAV') per ordinary share total return with

income reinvested

2 Numis Smaller Companies Index (excluding investment companies)

total return

3 Share price total return using mid-market closing price

4 Interim dividend of 7.0p (30 November 2020: 7.0p) to be paid to shareholders on 7 March 2022

5 Average NAV total return of the AIC UK Smaller Companies

sector

6 Average share price total return of the AIC UK Smaller

Companies sector

FINANCIAL SUMMARY

(Unaudited) (Unaudited) (Audited)

30 November 30 November 31 May

2021 2020 2021

----------------------------- ------------- ------------- ----------

Net assets GBP960.8m GBP760.0m GBP992.9m

NAV per ordinary share 1,286.2p 1,017.4p 1,329.1p

Share price per ordinary

share 1,164.0p 972.0p 1,280.0p

Total return per ordinary

share (26.2p) 174.8p 493.5p

Revenue return per ordinary

share 9.30p 5.00p 13.86p

Dividend per ordinary

share 7.00p 7.00p 23.75p

Gearing 10.6% 9.9% 8.8%

CHAIRMAN'S STATEMENT

In my first statement as your Chairman, I would like to begin by

paying tribute to Jamie Cayzer-Colvin's decade of leadership. Jamie

stepped down as Chairman at our AGM on 1 October 2021 leaving your

Company well positioned for the future.

COVID-19 continues to impact businesses and individuals. After a

period of increasing positivity stemming from the vaccination

rollout we have, more recently, again been affected by rising cases

from new variants and a return to some measure of restrictions.

Clearly the crisis is not over, although with greater numbers

vaccinated and seemingly milder symptoms, we are gradually seeing a

return to some degree of normality.

Performance

During the six months to 30 November 2021, UK equity markets

were broadly flat, although smaller companies underperformed larger

stocks as investor sentiment shifted from growth-oriented companies

to those with more value type characteristics. Against this

backdrop, your Company's net asset value total return fell during

the period under review by 2.1%, outperforming the Numis Smaller

Companies Index by 0.7% over the period. However, it underperformed

the AIC UK Smaller Companies sector average, which rose by 2.5% and

the share price underperformed the NAV during the period,

delivering a total return of -7.9%, as the discount widened to 9.5%

(31 May 2021: 3.7%) reflecting weaker investor sentiment towards

smaller companies. Nevertheless, the longer-term performance record

of the Company remains consistently strong, reflecting an unchanged

strategy adopted by the Fund Manager and his team.

Dividend

Your Board has decided to maintain the interim dividend at 7.0p

per ordinary share (30 November 2020: 7.0p).This will be paid on 7

March 2022 to shareholders on the register on 11 February 2022. The

shares will be marked ex-dividend on 10 February 2022. This

dividend is to be paid from the Company's revenue account.

Additional Loan Notes

I am pleased to announce that the Board has agreed to issue a

further GBP20 million of fixed-rate 30-year unsecured private

placement notes (the "Notes") at an annualised coupon of 2.77%.

These Notes will be in addition to the GBP30 million unsecured

notes currently in issue. This transaction will obtain fixed-rate

long-dated sterling-denominated financing at pricing that the Board

and Manager consider attractive and is expected to enhance long

term investment performance.

The funding date is expected to be 2 February 2022, subject to

customary closing conditions, with interest payable semi-annually.

The Notes are due to be repaid on 2 February 2052. The Notes will

be unsecured, which gives the Company increased flexibility to

manage its borrowings in the future. There has been no change in

the Company's policy on gearing, as set out on page 17 of the 2021

Annual Report. Gearing ended the period under review at 10.6% (31

May 2021: 8.8%).

Outlook

The economic background remains uncertain and changeable in the

face of new COVID-19 variants, but corporate earnings continue to

recover from the lows of 2020 and the health of the corporate

sector is much better than during the 2008-9 financial crisis.

Strong balance sheets and better than expected earnings recoveries

post the initial impact of COVID-19 give cause for optimism.

Corporate activity is high with M&A opportunities arising from

the impact of the pandemic. Tempering this is the prospect of

tightening monetary policy to counter higher inflation. Against

this background, your fund management team maintains a disciplined,

long term approach to investment and is focused on selecting the

companies which will emerge stronger from this period. I have

confidence that your Company can continue to deliver successful

outcomes for its investors in the years ahead.

Penny Freer

Chairman

FUND MANAGER'S REPORT

Market Review - Six Months to 30 November 2021

UK equity markets were broadly flat over the period. In the UK,

whilst most COVID-19 restrictions were relaxed on "freedom day",

rhetoric from the government remained cautious as the Delta variant

continued to spread. Towards the end of the period, discovery of

the new Omicron variant raised fears that restrictions would have

to be re-introduced. Global bond yields oscillated during the

period which resulted in a change of factor leadership in equity

markets. In the US, the Federal Reserve stepped away from its

initial view that inflation was transitory and became increasingly

hawkish. In September it announced that asset purchase tapering

would begin soon and by November the market was projecting three

interest rate rises in 2022. In the UK, the Bank of England decided

not to raise rates in November. Oil rallied initially but fell

sharply in November while sterling depreciated against the

dollar.

Smaller companies underperformed larger companies over the

period. This was driven principally by a rise in bond yields and a

gravitation towards value over growth stocks.

Fund Performance

The Company outperformed its benchmark during the period. The

net asset value fell by 2.1% on a total return basis. This compares

with a decline of 2.8% (total return) in the Numis Smaller

Companies Index (excluding investment companies).

Gearing

Gearing started the period at 8.8% and ended it at 10.6%. Debt

facilities are a combination of GBP30 million 20-year unsecured

loan notes at an interest rate of 3.33% and GBP85 million of short

term bank borrowings.

Attribution Analysis

The following tables show the top five contributors to, and

detractors from, the Company's relative performance. Some of the

stocks are included in the benchmark index but not held by the

Company. These have an effect on relative performance.

Top five contributors 6-month return Relative contribution

% %

Future +26.2 +0.8

--------------- ----------------------

Impax Asset Management +18.7 +0.7

--------------- ----------------------

Marshall Motors Holdings +121.3 +0.5

--------------- ----------------------

Watches of Switzerland +72.1 +0.5

--------------- ----------------------

CMC Markets* -49.2 +0.4

--------------- ----------------------

Top five detractors 6-month return Relative contribution

% %

--------------- ----------------------

Playtech* +62.2 -0.6

--------------- ----------------------

Clinigen -29.5 -0.6

--------------- ----------------------

Investec* +24.5 -0.4

--------------- ----------------------

Indivior* +46.9 -0.3

--------------- ----------------------

Drax Group* +28.5 -0.3

--------------- ----------------------

* In benchmark index but not

held by the Company.

Principal Contributors

Future is a special interest media group; Impax Asset Management

is a specialist fund manager; Marshall Motors Holdings is an

automotive retailer; Watches of Switzerland is a luxury watch

retailer; and CMC Markets is a financial derivatives dealer.

Principal Detractors

Playtech is a provider of technology and services to the

gambling industry; Clinigen is a pharmaceutical services and

products group; Investec is an international specialist bank and

asset manager; Indivior is a pharmaceutical group; and Drax Group

is a renewable power generation company.

Portfolio Activity

Our approach is to consider our investments as long term in

nature and to avoid unnecessary turnover. The focus has been on

adding stocks to the portfolio that have good growth prospects,

sound financial characteristics and strong management, at a

valuation level that does not reflect these strengths. Likewise, we

have been employing strong sell disciplines to dispose of stocks

that fail to meet these criteria.

During the period, we have added to a number of positions in our

portfolio and increased exposure to those stocks which we feel have

further catalysts to drive strong performance.

New additions to the portfolio include: Access Intelligence, a

software provider for the public relations and marketing services

industries; Bridgepoint, a private equity manager; Devolver

Digital, a video game publisher; RPS, an engineering consultancy

group; Sigmaroc, an aggregates and construction materials group;

Stelrad, a steel radiator manufacturer; and Wickes, a home

improvement retailer.

To balance the additions to our portfolio, we have disposed of

positions in companies which we felt were set for poor price

performance or where the valuation had become extended, including

the holdings in Coats, Go-Ahead Group, Johnson Service Group and

Rotork. Additionally we sold our holdings in Sanne, St Modwen and

Vectura, after these companies received agreed takeover bids.

Market Outlook

The COVID-19 outbreak dramatically changed expectations for

global economic growth. The lockdown measures we have seen across

the globe have had a profound effect on economic activity.

Government actions to protect consumers and businesses from the

worst impact of the shock softened the blow but ultimately can only

be short term in nature given the scale of the bail-out

required.

The positive vaccine news announced in November 2020 and the

subsequent successful vaccination programme has meant life has

returned to some sort of normality with a consequent rebound in

economic activity. Conditions remain fragile though and subsequent

'waves' of COVID-19 and new variants of the virus serve as

reminders that the crisis is not over.

One of the major concerns facing the equity market is the threat

of higher inflation and the need for central banks to start

tightening monetary policy. There is much debate as to whether

current indications of inflation, led by commodity, energy and

logistic costs, are temporary or are of a more permanent nature. A

sustained pick up in wage inflation will probably force monetary

authorities to act more quickly. The recent increase in UK base

interest rates and indications from the Federal Reserve of higher

rates gives a good indication as to the likely direction of central

bank policy in 2022.

In the corporate sector, conditions are intrinsically stronger

than they were during the financial crisis of 2008-9. Balance

sheets, in particular, are more robust. On the whole, so far, the

UK corporate sector has performed well during the crisis and most

companies are beating their initial post COVID-19 earnings and cash

expectations.

We are seeing a noticeable pickup in corporate activity. The IPO

market, after a quiet 2020, has exploded into life in recent

months. Given the amount of companies looking to float onto public

markets it is important to remain disciplined when sifting through

the multitude of new investment opportunities we have in front of

us. Likewise, we are also seeing a significant increase in M&A

activity as private equity, in particular, looks to exploit

opportunities thrown up by COVID-19. We expect this upsurge to

continue in the coming months as UK equity market valuations remain

markedly depressed versus other developed markets.

In terms of valuations, the equity market is now trading in line

with long term averages if we apply pre COVID-19 earnings.

Corporate earnings were sharply down in 2020 although we have seen

a sharp recovery in 2021 which is likely to continue into 2022.

Although uncertainty remains around short term economic

conditions, the virus will pass and corporate profitability and

economies are recovering. The movements in equity markets have

thrown up some fantastic buying opportunities and we expect many

listed companies to emerge stronger from the downturn. However, it

is important to be selective as any recovery will be uneven and

strength of franchise, market positioning and balance sheet will

determine the winners from the losers in a post COVID-19 world.

Neil Hermon

Fund Manager

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties associated with the

Company's business fall broadly under the following categories:

-- investment activity and strategy;

-- legal and regulatory;

-- operational; and

-- financial instruments and the management of risk.

Detailed information on these risks is given in the Strategic

Report and in the Notes to the Financial Statements in the

Company's Annual Report for the year ended 31 May 2021.

In the view of the Board these principal risks and uncertainties

are as applicable to the remaining six months of the financial year

as they were to the six months under review.

DIRECTORS' RESPONSIBILITY STATEMENT

The directors confirm that, to the best of their knowledge:

-- the condensed set of financial statements has been prepared

in accordance with International Accounting Standard 34 Interim

Financial Reporting;

-- the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (indication of important events during the first six months

and description of the principal risks and uncertainties for the

remaining six months of the year); and

-- the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.8R (disclosure of related-party transactions and changes

therein).

For and on behalf of the Board

Penny Freer

Chairman

INVESTMENT PORTFOLIO

at 30 November 2021

Valuation Portfolio Valuation Portfolio

Company GBP'000 % Company GBP'000 %

----------------------------- ---------- ---------- ------------------------- ------------ ----------

Impax Asset Management* 38,568 3.63 Cairn Energy 11,466 1.08

Future 37,411 3.52 Brewin Dolphin 11,371 1.07

Watches Of Switzerland 32,042 3.01 Alpha Financial Markets* 11,175 1.05

Bellway 25,256 2.38 Bodycote 10,992 1.03

Oxford Instruments 23,575 2.22 XP Power 10,928 1.03

RWS* 22,344 2.10 Midwich* 10,868 1.02

Synthomer 19,874 1.87 Victrex 10,858 1.02

Learning Technologies* 19,741 1.86 Vitec 10,513 0.99

Ultra Electronics 19,596 1.84 Bytes Technology 10,369 0.98

Team17* 19,520 1.84 Foresight Group 10,297 0.97

---------- ---------- ---------- ----------

10 largest 257,927 24.27 40 largest 679,416 63.94

OneSavings Bank 19,038 1.79 Just Group 10,257 0.97

Euromoney Institutional

Paragon 18,759 1.76 Investor 10,245 0.96

GB Group* 18,408 1.73 DFS 9,984 0.94

Gamma Communications* 17,955 1.69 Spectris 9,983 0.94

Dechra Pharmaceuticals 17,388 1.64 Inspecs* 9,927 0.94

Clinigen* 17,342 1.63 Chemring 9,384 0.88

Savills 17,009 1.60 Redde Northgate 9,271 0.87

Mitchells & Butlers 16,541 1.56 Serco 9,212 0.87

Softcat 15,801 1.49 Restore* 9,168 0.86

Ascential 15,588 1.47 Wickes 9,016 0.85

---------- ---------- ---------- ----------

20 largest 431,756 40.63 50 largest 775,863 73.02

Next Fifteen

IntegraFin 15,448 1.45 Communications* 8,690 0.82

Computacenter 14,689 1.38 CLS 8,526 0.80

Luceco 14,629 1.38 Serica Energy* 8,443 0.79

Liontrust Asset Management 14,076 1.33 Crest Nicholson 8,261 0.78

Volution 14,069 1.32 Auction Technology 8,143 0.76

Vesuvius 13,952 1.31 Countryside 7,509 0.71

Renishaw 13,847 1.30 Moneysupermarket.com 7,344 0.69

TI Fluid Systems 13,750 1.30 SThree 7,202 0.68

Tyman 12,518 1.18 Gym Group 7,198 0.68

Balfour Beatty 11,845 1.12 Moonpig 7,118 0.67

---------- ---------- ---------- ----------

30 largest 570,579 53.70 60 largest 854,297 80.40

Remaining 47 208,301 19.60

------------ ----------

Total 1,062,598 100.00

======= ======

* Quoted on the Alternative Investment Market ('AIM')

STATEMENT OF COMPREHENSIVE INCOME

(Unaudited) (Unaudited) (Audited)

Half-year ended Half-year ended Year ended

30 November 2021 30 November 2020 31 May 2021

Revenue Capital Total Revenue Capital Total Revenue Capital Total

return return return return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ----------- ---------- --------- --------- --------- --------- ---------- ----------

Investment

income 8,088 - 8,088 4,555 - 4,555 12,269 - 12,269

(Losses)/gains

on

investments

held at

fair value

through

profit or loss - (24,756) (24,756) - 128,062 128,062 - 365,577 365,577

--------- ----------- ---------- --------- --------- --------- --------- ---------- ----------

Total income 8,088 (24,756) (16,668) 4,555 128,062 132,617 12,269 365,577 377,846

Expenses

Management and

performance

fees (note 3) (506) (1,182) (1,688) (323) (754) (1,077) (749) (6,284) (7,033)

Other expenses (366) - (366) (299) - (299) (726) - (726)

--------- --------- --------- --------- --------- --------- --------- ---------- ----------

Profit/(loss)

before

finance

costs and

taxation 7,216 (25,938) (18,722) 3,933 127,308 131,241 10,794 359,293 370,087

Finance costs (249) (579) (828) (200) (465) (665) (427) (995) (1,422)

--------- --------- --------- --------- --------- --------- --------- ---------- ----------

Profit/(loss)

before

taxation 6,967 (26,517) (19,550) 3,733 126,843 130,576 10,367 358,298 368,665

Taxation (1) - (1) - - - (14) - (14)

--------- --------- --------- --------- --------- --------- --------- ---------- ----------

Profit/(loss)

for

the period and

total

comprehensive

income 6,966 (26,517) (19,551) 3,733 126,843 130,576 10,353 358,298 368,651

===== ====== ====== ===== ====== ====== ===== ====== ======

Earnings per

ordinary

share (note 4) 9.33p (35.50p) (26.17p) 5.00p 169.80p 174.80p 13.86p 479.64p 493.50p

===== ====== ====== ===== ====== ====== ===== ====== ======

The total column of this statement represents the Statement of

Comprehensive Income, prepared in accordance with UK adopted

international accounting standards.

The revenue return and capital return columns are supplementary

to this and are prepared under guidance published by the

Association of Investment Companies.

The accompanying notes are an integral part of these financial

statements.

STATEMENT OF CHANGES IN EQUITY

Half-year ended Share Capital redemption Capital Revenue Total

30 November 2021 capital reserve reserves reserve equity

(unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------------- --------------------- ------------ ----------- -----------------

Total equity at

1 June 2021 18,676 26,745 935,307 12,170 992,898

Total comprehensive

income:

(Loss)/profit for

the

period - - (26,517) 6,966 (19,551)

Transactions with

owners,

recorded directly to

equity:

Ordinary dividend

paid - - (343) (12,170) (12,513)

---------- ---------- ---------- ---------- -----------

Total equity at

30 November 2021 18,676 26,745 908,447 6,966 960,834

====== ====== ====== ====== ======

Half-year ended Share Capital redemption Capital Revenue

30 November 2020 capital reserve reserves reserve Total equity

(unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------------- --------------------- ------------ ----------- -----------------

Total equity at

1 June 2020 18,676 26,745 577,009 19,366 641,796

Total comprehensive

income:

Profit for the

period - - 126,843 3,733 130,576

Transactions with

owners,

recorded directly to

equity:

Ordinary dividend

paid - - - (12,326) (12,326)

---------- ---------- ---------- ---------- -----------

Total equity at

30 November 2020 18,676 26,745 703,852 10,773 760,046

====== ====== ====== ====== ======

Capital

Share redemption Capital Revenue Total

capital reserve reserves reserve equity

Year ended 31 May

2021

(audited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------------- --------------------- ------------ ----------- -----------------

Total equity at

1 June 2020 18,676 26,745 577,009 19,366 641,796

Total comprehensive

income:

Profit for the year - - 358,298 10,353 368,651

Transactions with

owners,

recorded directly to

equity:

Ordinary dividend

paid - - - (17,549) (17,549)

---------- ---------- ----------- ---------- -----------

Total equity at

31 May 2021 18,676 26,745 935,307 12,170 992,898

====== ====== ======= ====== ======

The accompanying notes are an integral part of these financial statements.

BALANCE SHEET

(Unaudited)

Half-year (Unaudited) (Audited)

ended Half-year Year ended

30 November ended 30 November 31 May

2021 2020 2021

GBP'000 GBP'000 GBP'000

--------------------------------------- --------------- ------------------- ---------------

Non current assets

Investments held at fair value

through

profit or loss 1,062,598 834,939 1,080,358

------------- ----------- --------------

Current assets

Securities sold for future settlement 4,730 - 3,079

Taxation recoverable - 16 9

Prepayments and accrued income 1,340 1,060 1,908

Cash and cash equivalents 5,262 5,331 2,962

----------- ----------- ----------

11,332 6,407 7,958

-------------- ----------- --------------

Total assets 1,073,930 841,346 1,088,316

-------------- ----------- --------------

Current liabilities

Securities purchased for future

settlement (2,221) (1,159) (474)

Accruals and deferred income (876) (1,154) (715)

Performance fee - - (4,537)

Bank loans (80,162) (49,159) (59,860)

----------- ----------- ------------

(83,259) (51,472) (65,586)

----------- ----------- ------------

Total assets less current liabilities 990,671 789,874 1,022,730

Non current liabilities (29,837) (29,828) (29,832)

----------- ----------- -----------

Net assets 960,834 760,046 992,898

====== ====== ======

Equity attributable to equity

shareholders

Called up share capital (note

6) 18,676 18,676 18,676

Capital redemption reserve 26,745 26,745 26,745

Retained earnings:

Capital reserves (note 7) 908,447 703,852 935,307

Revenue reserve 6,966 10,773 12,170

----------- ----------- -----------

Total equity 960,834 760,046 992,898

====== ====== ======

Net asset value per ordinary

share (note 8) 1,286.2p 1,017.4p 1,329.1p

======= ======= =======

The accompanying notes are an integral part of these financial

statements.

STATEMENT OF CASH FLOWS

(Unaudited) (Unaudited)

Half-year Half-year (Audited)

ended ended Year ended

30 November 30 November 31 May

2021 2020 2021

GBP'000 GBP'000 GBP'000

------------------------------------------ ------------- ------------- ------------

(Loss)/gain before taxation (19,550) 130,576 368,665

Add back interest payable 828 665 1,422

Gains/(losses) on investments held

at fair value through profit or loss 24,756 (128,062) (365,577)

Purchases of investments (79,124) (54,357) (157,850)

Sales of investments 72,129 59,810 155,399

Decrease in receivables 3 14 20

(Increase)/decrease in amounts due

from brokers (1,651) 2,740 (340)

Decrease/(increase) in accrued income 573 (692) (1,546)

(Decrease)/increase in payables (4,402) 671 4,743

Increase/(decrease) in amounts due

to brokers 1,747 (1,842) (2,527)

----------- ----------- -----------

Net cash (outflow)/inflow from operating

activities before interest (4,691) 9,523 2,409

----------- ----------- -----------

Interest paid (798) (659) (1,392)

----------- ----------- -----------

Net cash (outflow)/inflow from operating

activities (5,489) 8,864 1,017

====== ====== ======

Financing activities

Equity dividends paid (12,513) (12,326) (17,549)

Drawdown of bank loans 20,302 4,052 14,753

----------- ----------- -----------

Net cash inflow/(outflow) from financing

activities 7,789 (8,274) (2,796)

Increase/(decrease) in cash and cash

equivalents 2,300 590 (1,779)

Cash and cash equivalents at the start

of the period 2,962 4,741 4,741

---------- ---------- ----------

Cash and cash equivalents at the period

end 5,262 5,331 2,962

====== ====== ======

The accompanying notes are an integral part of these financial statements.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

1. Accounting Policies - Basis of Preparation

The Henderson Smaller Companies Investment Trust plc (the 'Company')

is a company incorporated and domiciled in the United Kingdom

under the Companies Act 2006.

These condensed financial statements comprise the unaudited results

of the Company for the half-year ended 30 November 2021. They

have been prepared on a going concern basis and in accordance

with UK adopted international accounting standards and with the

Statement of Recommended Practice for Investment Trusts ('SORP')

dated April 2021, where the SORP is consistent with the requirements

of UK adopted international accounting standards.

For the period under review the Company's accounting policies

have not varied from those described in the Annual Report for

the year ended 31 May 2021.

These financial statements have been neither audited nor reviewed

by the Company's auditor.

2. Going Concern

The assets of the Company consist of securities that are readily

realisable and, accordingly, the directors believe that the Company

has adequate resources to continue in operational existence for

at least twelve months from the date of approval of the financial

statements. The directors have also considered the impact of

COVID-19, including cash flow forecasting, a review of covenant

compliance including the headroom above the most restrictive

covenants and an assessment of the liquidity of the portfolio.

They have concluded that they are able to meet their financial

obligations, including the repayment of the bank loan, as they

fall due for a period of at least twelve months from the date

of issuance. Having assessed these factors, the principal risks

and other matters discussed in connection with the Viability

Statement in the Annual Report for the year ended 31 May 2021,

the directors confirm that the financial statements have been

prepared on a going concern basis. The Company's shareholders

are asked every three years to vote for the continuation of the

Company. The next continuation vote will take place at the AGM

in 2022.

3. Expenses

Expenses, finance costs and taxation include provision for a

performance fee when the relevant criteria have been met. There

was no performance fee provision for the six months to 30 November

2021 (30 November 2020 GBPnil; 31 May 2021: GBP4,537,000). Any

provision for a performance fee is charged 100% to capital. The

actual performance fee, if any, payable to Janus Henderson for

the year to 31 May 2022 will depend on outperformance over the

full financial year, subject to a cap on the total fees paid

to Janus Henderson of 0.9% of the average value of the net assets

of the Company during the year. No performance fee is payable

if on the last day of the accounting year the Company's share

price or net asset value ('NAV') is lower than the share price

and NAV at the preceding year end. Details of the performance

fee arrangements are set out in the Annual Report for the year

ended 31 May 2021.

4. Earnings per Ordinary Share

The earnings per ordinary share figure is based on the net loss for

the half-year ended 30 November 2021 of GBP19,551,000 (half-year ended

30 November 2020: net profit of GBP130,576,000; year ended 31 May

2021: net profit of GBP368,651,000) and on 74,701,796 (half-year ended

30 November 2020: 74,701,796; year ended 31 May 2021: 74,701,796)

ordinary shares, being the weighted average number of ordinary shares

in issue during the period.

The earnings per ordinary share figure detailed above can be further

analysed between revenue and capital, as below.

(Unaudited) (Audited)

30 November (Unaudited) 31 May

30 November

2021 2020 2021

GBP'000 GBP'000 GBP'000

--------------------------------------- --------------- -------------- --------------

Net revenue profit 6,966 3,733 10,353

Net capital (loss)/gain (26,517) 126,843 358,298

---------- ---------- ------------

Net total (loss)/profit (19,551) 130,576 368,651

====== ====== =======

Weighted average number of

ordinary shares in issue

during the period 74,701,796 74,701,796 74,701,796

Pence Pence Pence

--------------------------------------- --------------- -------------- --------------

Revenue earnings per ordinary

share 9.33 5.00 13.86

Capital (loss)/earnings per

ordinary share (35.50) 169.80 479.64

--------- --------- ----------

Total (loss)/earnings per

ordinary share (26.17) 174.80 493.50

===== ===== ======

5. Dividends

The Board has declared an interim dividend of 7.0p (30 November 2020:

7.0p) to be paid on 7 March 2022 to shareholders on the register

at the close of business on 11 February 2022. The ex-dividend date

will be 10 February 2022. This dividend is to be paid from the Company's

revenue account. No provision has been made for the interim dividend

in these condensed financial statements.

The final dividend of 16.75p per ordinary share, paid on 11 October

2021, in respect of the year ended 31 May 2021, has been recognised

as a distribution in the period.

6. Share Capital

At 30 November 2021 there were 74,701,796 ordinary shares in issue

(30 November 2020: 74,701,796; 31 May 2021: 74,701,796). During the

half-year ended 30 November 2021 the Company did not buy back or

issue any shares (half-year ended 30 November 2020: nil; year ended

31 May 2021: nil). No shares have been bought back or issued since

the period end.

7. Capital Reserves

The capital reserve includes the capital reserve arising on investments

sold of GBP515,498,000 (30 November 2020: GBP461,076,000; 31 May 2021:

GBP482,446,000) and the capital reserve arising on revaluation of

investments held of GBP392,949,000 (30 November 2020: GBP242,776,000;

31 May 2021: GBP452,861,000).

The Company's capital reserve arising on investments sold (i.e. realised

capital profits) and revenue reserve may be distributed by way of

a dividend.

8. Net Asset Value ('NAV') per Ordinary Share

The NAV per ordinary share is based on the net assets attributable

to the equity shareholders of GBP960,834,000 (30 November 2020: GBP760,046,000;

31 May 2021: GBP992,898,000) and on 74,701,796

(30 November 2020: 74,701,796; 31 May 2021: 74,701,796) ordinary shares,

being the number of ordinary shares in issue at the period end.

9. Transaction Costs

Purchase transaction costs for the half-year ended 30 November 2021

were GBP204,000 (half-year ended 30 November 2020: GBP202,000; year

ended 31 May 2021: GBP487,000). These comprise mainly stamp duty

and commission. Sale transaction costs for the half-year ended 30

November 2021 were GBP34,000 (half-year ended 30 November 2020: GBP26,000;

year ended 31 May 2021: GBP68,000).

10. Financial Instruments

The investments are held at fair value through profit or loss. All

the net current liabilities are held in the Balance Sheet at a reasonable

approximation of fair value. At 30 November 2021 the fair value of

the Preference Stock was GBP4,000 (30 November 2020: GBP4,000; 31

May 2021: GBP4,000). The fair value of the Preference Stock is estimated

using the prices quoted on the exchange on which the investment trades.

The Preference Stock is carried in the Balance Sheet at par.

The unsecured loan notes are carried in the Balance Sheet at par

less the issue costs which are amortised over the life of the notes.

In order to comply with fair value accounting disclosures only, the

fair value of the unsecured loan notes has been estimated to be GBP34,681,000

(30 November 2020: GBP36,719,000; 31 May 2021: GBP34,035,000) and

is categorised as Level 3 in the fair value hierarchy as described

below. However, for the purpose of the daily NAV announcements, the

unsecured loan notes are valued at par in the fair value NAV because

they are not traded and the directors have assessed that par value

is the most appropriate value to be applied for this purpose.

The fair value of the unsecured loan notes is calculated using a

discount rate which reflects the yield of a UK Gilt of similar maturity

plus a suitable credit spread.

Fair value hierarchy

The table below sets out the fair value measurements using the IFRS

13 fair value hierarchy. Categorisation within the hierarchy has

been determined on the basis of the lowest level of input that is

significant to the fair value measurement of the relevant asset,

as follows:

Level 1: valued using quoted prices in active markets for identical

assets.

Level 2: valued by reference to valuation techniques using observable

inputs other than quoted prices.

Level 3: valued by reference to valuation techniques using inputs

that are not based on observable market data.

Level 1 Level 2 Level 3 Total

As at 30 November 2021 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------------- ------------ ------------ --------------

Equity investments 1,062,598 - - 1,062,598

------------- ----------- ----------- -------------

1,062,598 - - 1,062,598

======== ====== ====== ========

Level 1 Level 2 Level 3 Total

--------------------------

As at 30 November 2020 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------------- ------------ ------------ --------------

Equity investments 834,939 - - 834,939

----------- ----------- ----------- -----------

834,939 - - 834,939

====== ====== ====== ======

Level 1 Level 2 Level 3 Total

--------------------------

As at 31 May 2021 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------------- ------------ ------------ --------------

Equity investments 1,080,358 - - 1,080,358

------------- ----------- ----------- -------------

1,080,358 - - 1,080,358

======== ====== ====== ========

The valuation techniques used by the Company are explained in

the accounting policies note 1(c) of the Annual Report for the

year ended 31 May 2021.

11. Related-Party Transactions

During the first six months of the current financial year, no

transactions with related parties have taken place which have

materially affected the financial position of the Company during

the period. Details of related-party transactions are contained

in the Annual Report for the year ended 31 May 2021.

12. Comparative Information

The financial information contained in this half-year financial

report does not constitute statutory accounts as defined in section

434 of the Companies Act 2006. The financial information for the

half-years ended

30 November 2021 and 30 November 2020 has not been audited.

The information for the year ended 31 May 2021 has been extracted

from the statutory accounts for that year, which have been filed

with the Registrar of Companies. The report of the auditor on

those accounts was unqualified and contained no statement under

either section 498(2) or section 498(3) of the Companies Act 2006.

13. General Information

The Henderson Smaller Companies Investment Trust plc is registered

in England and Wales.

Company Number: 00025526.

Registered Office: 201 Bishopsgate, London EC2M 3AE

London Stock Exchange (TIDM) Code: HSL

SEDOL Number: 0906506

Global Intermediary Identification Number (GIIN): WZD8S7.99999.SL.826

Legal Entity Identifier (LEI): 213800NE2NCQ67M2M998

Directors and Corporate Secretary

The directors of the Company are Penny Freer (Chairman of the

Board), Alexandra Mackesy (Chairman of the Audit and Risk Committee),

David Lamb (Senior Independent Director), Victoria Sant, Michael

Warren and Kevin Carter. The Corporate Secretary is Henderson

Secretarial Services Limited, represented by Johana Woodruff,

ACG.

Website

Details of the Company's share price and NAV, together with general

information about the Company, monthly factsheets and data, copies

of announcements, reports and details of general meetings can

be found at www.hendersonsmallercompanies.com .

14. Financial Report for the Half-Year Ended 30 November 2021

The half-year report will shortly be available on the Company's

website or from the Company's registered office. An abbreviated

version, the 'Update', will be circulated to shareholders in February

2022 and will be available from the Corporate Secretary at the

Company's registered office, 201 Bishopsgate, London EC2M 3AE.

For further information please contact:

Neil Hermon Nathan Brown

Fund Manager Corporate Broking

The Henderson Smaller Companies Investment Numis Securities

Trust plc Telephone: 020 7260 1426/1275

Telephone: 020 7818 4351

James de Sausmarez Harriet Hall

Director and Head of Investment Trusts PR Manager Investment Trusts

Janus Henderson Investors Janus Henderson Investors

Telephone: 020 7818 3349 Telephone: 020 7818 2919

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website), are incorporated into, or form part of,

this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DELFLLFLLBBE

(END) Dow Jones Newswires

January 26, 2022 02:00 ET (07:00 GMT)

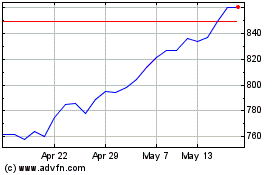

Henderson Smaller Compan... (LSE:HSL)

Historical Stock Chart

From Jun 2024 to Jul 2024

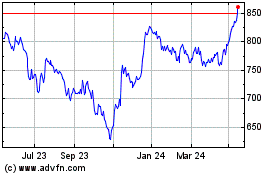

Henderson Smaller Compan... (LSE:HSL)

Historical Stock Chart

From Jul 2023 to Jul 2024