TIDMHOTC

RNS Number : 6487A

Hotel Chocolat Group PLC

23 January 2024

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

23 January 2024

RECOMMED CASH ACQUISITION

of

HOTEL CHOCOLAT GROUP PLC ("HOTEL CHOCOLAT")

by

HIVE BIDCO, INC. ( " BIDCO ")

a wholly-owned indirect subsidiary of Mars, Incorporated

("Mars")

to be effected by means of a scheme of arrangement under Part 26

of the Companies Act 2006

COURT SANCTION OF SCHEME OF ARRANGEMENT

On 16 November 2023, the boards of directors of Hotel Chocolat

and Bidco, a wholly-owned indirect subsidiary of Mars,

Incorporated, announced that they had reached agreement on the

terms and conditions of a recommended cash acquisition, pursuant to

which Bidco will acquire the entire issued, and to be issued, share

capital of Hotel Chocolat (the "Acquisition"). The Acquisition is

being implemented by way of a Court-sanctioned scheme of

arrangement (the "Scheme") under Part 26 of the Companies Act 2006.

The scheme document in respect of the Acquisition (the " Scheme

Document ") was published and made available to Hotel Chocolat

Shareholders on 14 December 2023.

On 17 January 2024, Hotel Chocolat announced that the Scheme had

been approved by the requisite majority of Scheme Shareholders at

the Court Meeting held on 16 January 2024 and the Special

Resolution relating to the implementation of the Scheme had been

approved by the requisite majority of Hotel Chocolat Shareholders

at the General Meeting also held on 16 January 2024.

Hotel Chocolat is pleased to announce that the High Court of

Justice in England and Wales has today sanctioned the Scheme

pursuant to which the Acquisition is being implemented.

The Scheme remains conditional on the delivery to the Registrar

of Companies of the Court Order made at the Court Hearing to

sanction the Scheme. The Scheme is expected to become effective on

25 January 2024 (the "Effective Date") and a further announcement

will be made at that time.

The last day for dealings in, and for registrations of transfers

of, Hotel Chocolat Shares is expected to be 24 January 2024. The

Scheme Record Time is expected to be 6.00 p.m. on 24 January 2024,

at which time CREST will be disabled in respect of Hotel Chocolat

Shares. Trading in Hotel Chocolat Shares on AIM is expected to be

suspended with effect from 7.30 a.m. on 25 January 2024.

It is expected that, subject to the Scheme becoming effective,

the admission to trading of Hotel Chocolat Shares on AIM will be

cancelled and Hotel Chocolat Shares will cease to be admitted to

trading on AIM at 7.00 a.m. on 26 January 2024.

On the Effective Date, share certificates in respect of Hotel

Chocolat Shares will cease to be valid and entitlements to Hotel

Chocolat Shares held within the CREST system will be cancelled.

Capitalised terms used in this announcement (unless otherwise

defined) have the same meanings as set out in the Scheme Document.

All references to times in this announcement are to London, United

Kingdom times unless otherwise stated.

Full details of the Acquisition are set out in the Scheme

Document published on 14 December 2023.

Enquiries

Bidco and Mars +1 (312) 794 6200

Fabiano Lima, Global VP of Corporate Affairs,

Mars Snacking

Denise Young, Global VP of Corporate Communications,

Mars

Morgan Stanley (Financial Adviser to

Bidco and Mars) +44 (0)20 7425 8000

Laurence Hopkins

Imran Ansari

Mae Wang

Stuart Wright

Brunswick (Public Relations Adviser to

Bidco and Mars) +44 (0)20 7404 5959

Max McGahan

Rosie Oddy

James Baker

Hotel Chocolat +44 (0)1763 257 746

Stephen Alexander, Non-Executive Chairman

Angus Thirlwell, Co-Founder and CEO

Jonathan Akehurst, Chief Financial Officer

Lazard (Lead Financial Adviser and Rule

3 Adviser to Hotel Chocolat) +44 (0)20 7187 2000

William Lawes

Davin Staats

Fariza Steel

Adam Blin

Liberum (Co-Financial Adviser, Nominated

Adviser and Corporate Broker to Hotel

Chocolat) +44 (0)20 3100 2000

Dru Danford

Tim Medak

Ed Thomas

Matt Hogg

Citigate Dewe Rogerson (Financial Communications

Adviser to Hotel Chocolat) +44 (0)20 7638 9571

Angharad Couch

Ellen Wilton

Alex Winch

Freshfields Bruckhaus Deringer LLP is acting as legal adviser to

Bidco and Mars in connection with the Acquisition. Herbert Smith

Freehills LLP is acting as legal adviser to Hotel Chocolat in

connection with the Acquisition.

Important notices

This announcement is for information purposes only and is not

intended to, and does not, constitute, or form part of, an offer,

invitation or the solicitation of an offer to purchase, otherwise

acquire, subscribe for, sell or otherwise dispose of, any

securities or the solicitation of any vote or approval in any

jurisdiction pursuant to the Acquisition or otherwise, nor shall

there be any sale, issuance or transfer of securities of Hotel

Chocolat in any jurisdiction in contravention of applicable law.

The Acquisition will be implemented solely pursuant to the terms of

the Scheme Document (or, if the Acquisition is implemented by way

of a Takeover Offer, the offer document), which will contain the

full terms and conditions of the Acquisition, including details of

how to vote in respect of the Acquisition. Any vote in respect of

the Scheme or other response in relation to the Acquisition should

be made only on the basis of the information contained in the

Scheme Document (or, if the Acquisition is implemented by way of a

Takeover Offer, the offer document).

This announcement does not constitute a prospectus or a

prospectus-equivalent document.

If you are in any doubt about the contents of this announcement

or the action you should take, you are recommended to seek your own

financial advice immediately from your stockbroker, bank manager,

solicitor, accountant or other independent financial adviser duly

authorised under the Financial Services and Markets Act 2000 (as

amended) if you are resident in the United Kingdom or from another

appropriately authorised independent financial adviser if you are

taking advice in a territory outside the United Kingdom.

Notices related to financial advisers

Morgan Stanley, which is authorised by the Prudential Regulation

Authority and regulated in the United Kingdom by the Financial

Conduct Authority and the Prudential Regulation Authority, is

acting exclusively as financial adviser to Bidco and Mars and no

one else in connection with the matters contained in this

announcement and Morgan Stanley, its affiliates and their

respective directors, officers, employees and agents will not

regard any other person as their client, nor will they be

responsible to anyone other than Bidco and Mars for providing the

protections afforded to clients of Morgan Stanley nor for providing

advice in connection with the matters contained in this

announcement or any other matter referred to herein.

Lazard & Co., Limited, which is authorised and regulated in

the United Kingdom by the Financial Conduct Authority ("FCA"), is

acting exclusively as lead financial adviser and Rule 3 adviser to

Hotel Chocolat and no one else in connection with the matters

described in this announcement and will not be responsible to

anyone other than Hotel Chocolat for providing the protections

afforded to clients of Lazard nor for providing advice in relation

to the contents of this announcement or any other matter or

arrangement referred to herein. Neither Lazard nor any of its

affiliates (nor their respective directors, officers, employees or

agents) owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Lazard in connection with this announcement, any matter,

arrangement or statement contained or referred to herein or

otherwise.

Liberum, which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting exclusively for

Hotel Chocolat and for no one else in connection with the subject

matter of this announcement and will not be responsible to anyone

other than Hotel Chocolat for providing the protections afforded to

its clients or for providing advice in connection with the subject

matter of this announcement. Neither Liberum nor any of its

affiliates (nor their respective directors, officers, employees or

agents) owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Liberum in connection with the Acquisition, this announcement,

any statement contained herein or otherwise. No representation or

warranty, express or implied, is made by Liberum as to the contents

of this announcement.

Overseas shareholders

The release, publication or distribution of this announcement in

or into jurisdictions other than the UK may be restricted by law

and therefore any persons who are subject to the law of any

jurisdiction other than the UK should inform themselves of, and

observe, any applicable legal or regulatory requirements. Any

failure to comply with such requirements may constitute a violation

of the securities laws of any such jurisdiction. To the fullest

extent permitted by applicable law, the companies and persons

involved in the Acquisition disclaim any responsibility or

liability for the violation of such restrictions by any person.

This announcement has been prepared for the purposes of complying

with English law, the AIM Rules and the Code and the information

disclosed may not be the same as that which would have been

disclosed if this announcement had been prepared in accordance with

the laws of jurisdictions outside of England.

The availability of the Acquisition to Hotel Chocolat

Shareholders who are not resident in and citizens of the UK may be

affected by the laws of the relevant jurisdictions in which they

are located or of which they are citizens. Persons who are not

resident in the UK should inform themselves of, and observe, any

applicable legal or regulatory requirements of their jurisdictions.

In particular, the ability of persons who are not resident in the

UK to vote their Scheme Shares with respect to the Scheme at the

Court Meeting, or to appoint another person as proxy to vote at the

Court Meeting on their behalf, may be affected by the laws of the

relevant jurisdictions in which they are located. Any failure to

comply with the applicable restrictions may constitute a violation

of the securities laws of any such jurisdiction. To the fullest

extent permitted by applicable law, the companies and persons

involved in the Acquisition disclaim any responsibility or

liability for the violation of such restrictions by any person.

Unless otherwise determined by Bidco or required by the Code,

and permitted by applicable law and regulation, the Acquisition

will not be made available, directly or indirectly, in, into or

from a Restricted Jurisdiction where to do so would violate the

laws in that jurisdiction and no person may vote in favour of the

Scheme by any such use, means, instrumentality or from within a

Restricted Jurisdiction or any other jurisdiction if to do so would

constitute a violation of the laws of that jurisdiction. Copies of

this announcement and any formal documentation relating to the

Acquisition are not being, and must not be, directly or indirectly,

mailed or otherwise forwarded, distributed or sent in or into or

from any Restricted Jurisdiction and persons receiving such

documents relating to the Acquisition (including, without

limitation, agents, custodians, nominees and trustees) must not

mail or otherwise forward, distribute or send it in or into or from

any Restricted Jurisdiction. Doing so may render invalid any

related purported vote in respect of the Acquisition. If the

Acquisition is implemented by way of an Takeover Offer (unless

otherwise permitted by applicable law and regulation), the Takeover

Offer may not be made directly or indirectly, in or into, or by the

use of mails or any means or instrumentality (including, but not

limited to, facsimile, e-mail or other electronic transmission,

telex or telephone) of interstate or foreign commerce of, or of any

facility of a national, state or other securities exchange of any

Restricted Jurisdiction and the Takeover Offer may not be capable

of acceptance by any such use, means, instrumentality or facilities

or from or within any Restricted Jurisdiction.

The availability of the Acquisition (including the Partial Share

Alternative) to Hotel Chocolat Shareholders who are not resident in

the UK may be affected by the laws of the relevant jurisdictions in

which they are resident. Persons who are not resident in the UK

should inform themselves of, and observe, any applicable

requirements.

The Acquisition shall be subject to the applicable requirements

of the Code, the Panel, the London Stock Exchange, the FCA and the

AIM Rules.

Additional information for US investors

The Acquisition is being made to acquire the shares of an

English company by means of a scheme of arrangement provided for

under English law. A transaction effected by means of a scheme of

arrangement is not subject to the tender offer rules or the proxy

solicitation rules under the US Exchange Act. Accordingly, the

Scheme will be subject to disclosure requirements and practices

applicable in the UK to schemes of arrangement, which are different

from the disclosure requirements of the US tender offer and proxy

solicitation rules. The financial information included in this

announcement and the Scheme documentation has been or will have

been prepared in accordance with accounting standards applicable in

the United Kingdom and thus may not be comparable to financial

information of US companies or companies whose financial statements

are prepared in accordance with generally accepted accounting

principles in the US. If Bidco exercises its right to implement the

acquisition of the Hotel Chocolat Shares by way of a Takeover

Offer, such offer will be made in compliance with applicable US

laws and regulations.

The receipt of cash pursuant to the Acquisition by a US holder

as consideration for the transfer of its Hotel Chocolat Shares

pursuant to the Scheme will likely be a taxable transaction for

United States federal income tax purposes and under applicable

United States state and local, as well as foreign and other, tax

laws. Each Hotel Chocolat Shareholder is urged to consult their

independent professional adviser immediately regarding the tax

consequences of the Acquisition applicable to them.

The Rollover Shares issued under the Partial Share Alternative

have not been and will not be registered under the US Securities

Act of 1933 (the "Securities Act") or under the relevant securities

laws of any state or territory or other jurisdiction of the US and

will not be listed on any stock exchange. Accordingly, the Rollover

Shares may not be offered or sold in the US, except in a

transaction not subject to, or in reliance on an applicable

exemption from, the registration requirements of the Securities Act

and any applicable state securities laws. Bidco expects to issue

the Rollover Shares in reliance upon the exemption from the

registration requirements of the Securities Act provided by Section

3(a)(10) thereof ("Section 3(a)(10)"). Section 3(a)(10) exempts

securities issued in specified exchange transactions from the

registration requirement under the Securities Act where, among

other things, the fairness of the terms and conditions of the

issuance and exchange of such securities have been approved by a

court or governmental authority expressly authorised by law to

grant such approval, after a hearing upon the fairness of the terms

and conditions of the exchange at which all persons to whom the

Rollover Shares are proposed to be issued have the right to appear

and receive adequate and timely notice thereof. If Bidco exercises

its right to implement the acquisition of the Hotel Chocolat Shares

by way of a Takeover Offer, the Rollover Shares will not be offered

in the United States except pursuant to an exemption from or in a

transaction not subject to registration under the Securities

Act.

US holders who are or will be affiliates of Bidco Group or Hotel

Chocolat prior to, or of Bidco Group after, the Effective Date will

be subject to certain US transfer restrictions relating to the

Rollover Shares received pursuant to the Scheme.

For the purposes of qualifying for the exemption from the

registration requirements of the Securities Act in respect of the

Rollover Shares issued pursuant to the Partial Share Alternative

afforded by Section 3(a)(10), Bidco Group advised the Court that

its sanctioning of the Scheme will be relied upon by Bidco Group as

an approval of the Scheme following a hearing on its fairness to

Hotel Chocolat Shareholders.

Neither the US Securities and Exchange Commission nor any US

state securities commission has approved or disapproved of the

Partial Share Alternative nor the securities to which it relates or

determined if the Scheme Document is accurate or complete or

adequate. Any representation to the contrary is a criminal

offence.

In accordance with normal UK practice and pursuant to Rule

14e-5(b) of the US Exchange Act (to the extent applicable), Bidco

or its nominees, or its brokers (acting as agents), may from time

to time make certain purchases of, or arrangements to purchase,

Hotel Chocolat Shares outside of the US, other than pursuant to the

Acquisition, until the date on which the Acquisition and/or Scheme

becomes effective, lapses or is otherwise withdrawn. If such

purchases or arrangements to purchase were to be made, they would

be made outside of the US and would be in accordance with

applicable law, including the US Exchange Act and the Code. These

purchases may occur either in the open market at prevailing prices

or in private transactions at negotiated prices. Any information

about such purchases will be disclosed as required in the UK, will

be reported to a Regulatory Information Service and will be

available on the London Stock Exchange website at

www.londonstockexchange.com .

Cautionary note regarding forward-looking statements

This announcement (including information incorporated by

reference in this announcement), oral statements made regarding the

Acquisition, and other information published by Bidco, Mars and

Hotel Chocolat contain statements which are, or may be deemed to

be, "forward-looking statements". Forward-looking statements are

prospective in nature and are not based on historical facts, but

rather on current expectations and projections of the management of

Bidco, Mars and Hotel Chocolat about future events, and are

therefore subject to risks and uncertainties which could cause

actual results to differ materially from the future results

expressed or implied by the forward-looking statements.

The forward-looking statements contained in this announcement

include statements relating to the expected effects of the

Acquisition on Bidco, Mars and Hotel Chocolat (including their

future prospects, developments and strategies), the expected timing

and scope of the Acquisition and other statements other than

historical facts. Often, but not always, forward-looking statements

can be identified by the use of forward-looking words such as

"prepares", "plans", "expects" or "does not expect", "is expected",

"is subject to", "budget", "projects", "synergy", "strategy",

"scheduled", "goal", "estimates", "forecasts", "cost-saving",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or statements that certain

actions, events or results "may", "could", "should", "would",

"might" or "will" be taken, occur or be achieved. Forward looking

statements may include statements relating to the following: (i)

future capital expenditures, expenses, revenues, earnings,

synergies, economic performance, indebtedness, financial condition,

dividend policy, losses and future prospects; (ii) business and

management strategies and the expansion and growth of Bidco's,

Hotel Chocolat's, any member of the Bidco Group's or any member of

the Hotel Chocolat Group's operations and potential synergies

resulting from the Acquisition; and (iii) the effects of global

economic conditions and governmental regulation on Bidco's, Hotel

Chocolat's, any member of the Bidco Group's or any member of the

Hotel Chocolat Group's business.

Although Bidco, Mars and Hotel Chocolat believe that the

expectations reflected in such forward-looking statements are

reasonable, Bidco, Mars and Hotel Chocolat can give no assurance

that such expectations will prove to be correct. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements.

These factors include, but are not limited to: the ability to

complete the Acquisition; the ability to obtain requisite

regulatory and shareholder approvals and the satisfaction of other

Conditions on the proposed terms and schedule; changes in the

global political, economic, business and competitive environments

and in market and regulatory forces; changes in future exchange and

interest rates; changes in tax rates; future business combinations

or disposals; changes in general economic and business conditions;

changes in the behaviour of other market participants; and changes

in the anticipated benefits from the proposed transaction not being

realised as a result of: changes in general economic and market

conditions in the countries in which Bidco and Hotel Chocolat

operate, weak, volatile or illiquid capital and/or credit markets,

changes in tax rates, interest rate and currency value

fluctuations, the degree of competition in the geographic and

business areas in which Bidco and Hotel Chocolat operate and

changes in laws or in supervisory expectations or requirements.

Other unknown or unpredictable factors could cause actual results

to differ materially from those expected, estimated or projected in

the forward-looking statements. If any one or more of these risks

or uncertainties materialises or if any one or more of the

assumptions proves incorrect, actual results may differ materially

from those expected, estimated or projected. Such forward-looking

statements should therefore be construed in the light of such

factors. Neither Bidco, Mars nor Hotel Chocolat, nor any of their

respective associates or directors, members, managers, partners,

officers or advisers, provides any representation, assurance or

guarantee that the occurrence of the events expressed or implied in

any forward-looking statements in this announcement will actually

occur. You are cautioned not to place any reliance on these

forward-looking statements. The forward-looking statements speak

only at the date of this announcement.

Other than in accordance with their legal or regulatory

obligations, neither Bidco, Mars nor Hotel Chocolat is under any

obligation, and Bidco, Mars and Hotel Chocolat expressly disclaim

any intention or obligation, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Disclosure requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) of the Code applies must be made by no

later than 3.30 pm (London time) on the 10th business day following

the commencement of the offer period and, if appropriate, by no

later than 3.30 pm (London time) on the 10th business day following

the announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8 of the Code. A Dealing Disclosure by a person to whom Rule 8.3(b)

of the Code applies must be made by no later than 3.30 pm (London

time) on the business day following the date of the relevant

dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3 of the Code.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and 8.4 of

the Code).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Rule 26.1 disclosure

In accordance with Rule 26.1 of the Code, a copy of this

announcement will be available (subject to certain restrictions

relating to persons resident in Restricted Jurisdictions) on Hotel

Chocolat's website at

https://www.hotelchocolat.com/uk/investor-relations-offer.html ,

and Bidco's website, at

https://www.mars.com/news-and-stories/press-releases-statements/recommended-acquisition-of-hotel-chocolat-group-plc

by no later than 12 noon (London time) on the business day

following the date of this announcement. For the avoidance of

doubt, the contents of these websites are not incorporated by

reference and do not form part of this announcement.

No profit forecasts, estimates or quantified financial benefits

statements

No statement in this announcement is intended as a profit

forecast, profit estimate or quantified benefits statement for any

period and no statement in this announcement should be interpreted

to mean that earnings or earnings per share for Bidco or Hotel

Chocolat for the current or future financial years would

necessarily match or exceed the historical published earnings or

earnings per share for Bidco or Hotel Chocolat, as appropriate.

Requesting hard copy documents

In accordance with Rule 30.3 of the Code, Hotel Chocolat

Shareholders, persons with information rights and participants in

Hotel Chocolat Share Schemes may request a hard copy of this

announcement by: (i) telephoning Equiniti on +44 (0) 371 384 2030.

If calling from outside of the UK, please ensure the country code

is used. Lines will be open from 8.30 a.m. to 5.30 p.m., Monday to

Friday (excluding public holidays in England and Wales); or (ii)

submitting a request in writing to Equiniti Limited, Aspect House,

Spencer Road, Lancing, West Sussex BN99 6DA, United Kingdom. For

persons who receive a copy of this announcement in electronic form

or via a website notification, a hard copy of this announcement

will not be sent unless so requested.

Such persons may also request that all future documents,

announcements and information to be sent to you in relation to the

Acquisition should be in hard copy form.

Electronic Communications

Please be aware that addresses, electronic addresses and certain

other information provided by Hotel Chocolat Shareholders, persons

with information rights and other relevant persons for the receipt

of communications from Hotel Chocolat may be provided to Bidco

during the offer period as required under Section 4 of Appendix 4

of the Code to comply with Rule 2.11(c) of the Code.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

SOAUOUURSAUAUAR

(END) Dow Jones Newswires

January 23, 2024 07:54 ET (12:54 GMT)

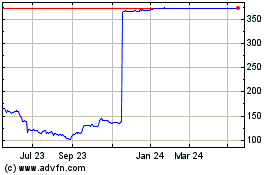

Hotel Chocolat (LSE:HOTC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Hotel Chocolat (LSE:HOTC)

Historical Stock Chart

From Jan 2024 to Jan 2025