TIDMHOC

RNS Number : 8109E

Hochschild Mining PLC

15 April 2014

15 April 2014

Production Report and Interim Management Statement

for the 3 months ended 31 March 2014

Highlights

-- Q1 2014 production of 5.9 million attributable silver

equivalent ounces

-- On track to achieve 2014 production target of 21.0 million

attributable silver equivalent ounces

-- Key Inmaculada Advanced Project set to begin commissioning in

Q4 2014

-- Cashflow optimisation programme on track to deliver

approximately $200 million of savings

o Over $145 million of savings already achieved

o Further initiatives targeted

-- Corporate refinancing completed in January 2014

o 7.75% $350 million Senior Notes issued due 2021

-- Total cash of approximately $274 million as at 31 March 2013;

short term borrowings reduced to $11 million

-- Minority investments valued at $55 million as at 31 March

2013

Ignacio Bustamante, Chief Executive Officer commented:

"Hochschild has started the year well with the first quarter

production performance placing the Company in a solid position to

reach our 21.0 million ounce target for 2014. We are also

continuing to move forward with our cashflow optimisation programme

which has already delivered more than $145 million of savings and

are currently targeting further initiatives in all areas of the

Company including operations, administration and exploration.

Strong developmental progress has also been made during the

quarter at our now 100% owned flagship Inmaculada project and I am

also pleased that we were able to complete our corporate

refinancing process in the first few weeks of the year."

__________________________________________________________________________________

A conference call will be held at 3pm (London time) on Tuesday

15 April 2014 for analysts and investors.

Dial in details as follows:

UK: +44 (0) 20 3003 2666

Password: Hochschild

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

UK: +44 (0) 20 8196 1998

Access code: 7871054

__________________________________________________________________________________

Overview

In Q1 2014, the Company delivered attributable production of 5.9

million silver equivalent ounces, comprised of 4.3 million ounces

of silver and 27.5 thousand ounces of gold, and is on track to meet

its full year production target of 21.0 million attributable silver

equivalent ounces.

Production

Main operations

At Arcata, total silver equivalent production in Q1 2014 rose to

1.9 million ounces (Q1 2013: 1.4 million ounces) driven by

increased material from stopes and developments (resulting in

higher grades and recoveries) partially replacing, as expected,

volumes processed from the low-grade Macarena Waste Dam Deposit.

Arcata also benefited from the processing of stock mined in

2013.

Table Showing Contribution From Macarena Waste Dam Deposit

Q1 2014 Q1 2013

------------------------- -------- --------

Total

Tonnage 194,239 203,888

Average head grade

gold (g/t) 0.78 0.73

Average head grade

silver (g/t) 248 202

------------------------- -------- --------

Macarena

Tonnage 32,166 63,743

Average head grade

gold (g/t) 0.26 0.28

Average head grade

silver (g/t) 66 98

Stopes and Developments

Tonnage 162,073 140,145

Average head grade

gold (g/t) 0.89 0.93

Average head grade

silver (g/t) 285 249

------------------------- -------- --------

At the now 100% owned Pallancata operation, production was in

line with Q1 2013 with total silver equivalent production of 2.1

million ounces (Q1 2013: 2.0 million ounces).

At the San Jose operation, total silver equivalent production

was 2.8 million ounces (Q1 2013: 2.6 million ounces). Higher

production versus Q1 2013 was mainly due to higher tonnage

resulting from the increase in throughput capacity from 1,500 to

1,650 tonnes per day partially offset by lower grades.

Other operations

The Company's ageing Ares mine in Peru continued to operate in

Q1 2014, delivering total silver equivalent production of 588

thousand ounces (Q1 2013: 527 thousand ounces) driven by consistent

grades and the processing of stock from 2013. Ares is currently

expected to cease production towards the end of H1 2014.

Average realisable prices and sales

Average realisable precious metal prices in Q1 2014 (which are

reported before the deduction of commercial discounts) were

$1,347/ounce for gold and $20.7/ounce for silver (Q1 2013:

$1,600/ounce for gold and $29.6/ounce for silver).

In March, the Group signed agreements to hedge the sale of

2,000,000 ounces of silver at $22/ounce and 33,000 ounces of gold

at $1,338.45/ounce, during the period from March to December

2014.

Project pipeline & exploration

The Company has an exploration budget of almost $30 million for

2014, representing 63,500 metres. This will be split between

exploration work at the Company's existing operations, the

Inmaculada Advanced Project and greenfield opportunities in Peru

and Mexico. The main focus will continue to be on brownfield

exploration.

In 2014, exploration work at the core operations is principally

focused on identifying new potential and near-mine high grade areas

to further improve the resource quality whilst at the Inmaculada

Advanced Project, efforts are focused on identifying new potential

high grade areas.

Hochschild's greenfield strategy for 2014 is in line with

changes outlined as part of the Company's cashflow optimisation

programme with the focus remaining only on the most promising

prospects, specifically in Peru and Mexico.

Brownfield exploration[1]

Arcata

In Q1 2014, 729 metres of drilling were carried out at Arcata. A

detailed surface mapping and sampling campaign was conducted

between Tunel 3 and Tunel 4 areas where north east structures have

been identified. A drilling campaign with the aim of adding new

resources will begin in early May with five drill holes planned.

Significant intercepts during the quarter included:

Vein Results

----------- ------------------------------------

DDH587-LM14: 1.43m at 6.75 g/t Au &

Paralela 1 985 g/t Ag

----------- ------------------------------------

DDH587-LM14: 1.02m at 2.93 g/t Au &

Paralela 2 465 g/t Ag

----------- ------------------------------------

DDH587-LM14: 1.00m at 4.02 g/t Au &

Paralela 3 374 g/t Ag

----------- ------------------------------------

Pallancata

In Q1 2014, 1,297 metres of drilling were carried out at

Pallancata. The programme, which focused on mapping and sampling a

total of 1,200 ha, was concentrated on the Yurika, Jakeline, Pilar,

Jessica, Emilia, Tatiana, Vianka, Isis and Huararani vein

systems.

San Jose

In 2014, the 2,000 metre potential drilling campaign is focused

on the definition of the new Ayelen, Nuevo 1 and Karina veins as

well as drilling in the Los Pinos area. The team has already

completed detailed surface mapping and sampling over the Los Pinos

vein and identified another structure, Los Pinitos.

Ares

In 2014, exploration work is focused on generating targets

within the Ares-Arcata corridor and a 2,000 metre drilling campaign

is underway. A detailed surface mapping and sampling campaign has

also been conducted at Ares North West covering an area of 55 ha

which brings the total mapped area at the deposit to date to 3,731

ha.

Advanced Projects

Inmaculada

Work continued on the Immaculada project throughout the first

quarter with plant construction commencing, as scheduled, in March

following the end of the rainy season. Procurement of all the key

main equipment for the plant is now complete and will be

transported to site in April and May.

A further 1,925 metres of tunnelling and 421 metres of raise

boring has been carried out in the first quarter bringing the total

to 12,779 metres achieved since the project's commencement.

Engineering for the paste backfill has also continued with the main

required equipment including filters, pumps and thickeners

purchased in the period. In addition, construction of the project's

camp has now been completed as well as the 180km main access

road.

The 5,000 metre exploration programme consists of potential

drilling in the Mayte vein corridor as well as near mine

exploration at selected targets, in order to expand the current

resources. A detailed mapping programme is also due to begin

shortly.

Greenfield pipeline

Highlights of the exploration programme during the period are

provided below.

Pachuca

At the Pachuca Company Maker project in Mexico, the JV with

Solitario Exploration & Royalty Corp has been focusing on the

northwestern extension of the historical vein mining district. The

2014 plan includes testing the actual extensions of prior

intercepts tested by the previous operator. A total 2,454 metres

have been drilled on 13 holes during the 2013 and 2014 campaigns

with significant results including:

Vein Results

--------- ---------------------------------

Sorpresa DDHPA-1302: 0.6m at 6.21 g/t Au

& 520 g/t Ag

DDHPA-1413: 0.8m at 6.57 g/t Au

& 392 g/t Ag

--------- ---------------------------------

Riverside Joint Venture

The exploration team has accepted two targets generated by

Riverside, the JV partners in the western Sonora in Mexico. The

projects are called Bohemia and Cajon and whereas Bohemia exhibits

mineralised veins, orogenic type mineralisation has been observed

at Cajon with highly frequent small mineralised veins off a

detachment fault. Target definition is ongoing.

Peru

During the first quarter, the Company's exploration efforts in

Peru focused on optimising the project portfolio and reviewing new

opportunities that are resulting from the current mining industry

downturn. So far this year, Hochschild geologists have been

actively reviewing property submittals and existing projects,

resulting in target areas being prioritised and streamlined.

Financial position

The Company's financial position remains strong, with total cash

of approximately $274 million with short term borrowings down to

approximately $11 million and minority investments valued at

approximately $55 million.[2]

On 23 January 2014, Hochschild completed an offering of $350

million of Senior Notes with a coupon rate of 7.750% due for

repayment in 2021 via its wholly owned subsidiary, Compañía Minera

Ares S.A.C.

Outlook

The Company is on track to achieve its full year production

target of 21.0 million attributable silver equivalent ounces in

2014. Having already achieved over $145 million of savings to date,

Hochschild remains focused on delivering the full benefits of its

cashflow optimisation programme and is continuing in its efforts to

identify further savings throughout the Company.

The focus of the Company's brownfield exploration programme will

remain on further improving and optimising the Company's resource

base to ensure the continued addition of high quality resources in

the future.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 7907 2934

Head of Investor Relations

RLM Finsbury

Charles Chichester +44 (0)20 7251 3801

Public Relations

____________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has almost fifty years' experience in

the mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

PRODUCTION & SALES INFORMATION*

TOTAL GROUP PRODUCTION

Q1 Q4 Q1 12 mths

2014 2013 2013 2013

------------------------- ------- ------- ------- --------

Silver production

(koz) 4,992 5,475 4,328 19,754

Gold production (koz) 38.30 43.80 41.64 175.22

Total silver equivalent

(koz) 7,290 8,103 6,827 30,267

Total gold equivalent

(koz) 121.50 135.05 113.78 504.45

Silver sold (koz) 5,112 5,742 3,502 19,555

Gold sold (koz) 38.11 43.56 29.53 168.56

------------------------- ------- ------- ------- --------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose as well as production in 2013 from the recently-sold Moris

operation.

ATTRIBUTABLE GROUP PRODUCTION

Q1 Q4 Q1 12 mths

2014 2013 2013 2013

----------------------- ------- ------- ------- --------

Silver production

(koz) 4,271 4,622 3,666 16,639

Gold production (koz) 27.53 30.80 31.31 126.8

Silver equivalent

(koz) 5,923 6,470 5,545 24,247

Gold equivalent (koz) 98.72 107.83 92.42 404.11

----------------------- ------- ------- ------- --------

Attributable production for Q1 2014 includes 100% of all

production from Arcata, Pallancata and Ares and 51% from San Jose.

Comparatives from 2013 for Pallancata have been restated to 100% of

production and also include production from the recently-sold Moris

operation.

QUARTERLY PRODUCTION BY MINE

ARCATA

Product Q1 Q4 Q1 12 mths

2014 2013 2013 2013

---------------------------- -------- -------- -------- --------

Ore production (tonnes

treated) 194,239 244,125 203,888 900,861

Average grade silver

(g/t) 248 242 202 217

Average grade gold

(g/t) 0.78 0.81 0.73 0.74

Silver produced (koz) 1,574 1,337 1,190 4,984

Gold produced (koz) 4.80 4.32 4.16 16.83

Silver equivalent produced

(koz) 1,862 1,597 1,440 5,994

Silver sold (koz) 1,654 1,404 931 4,924

Gold sold (koz) 4.91 4.42 3.10 15.95

---------------------------- -------- -------- -------- --------

ARES

Product Q1 Q4 Q1 12 mths

2014 2013 2013 2013

---------------------------- ------- ------- ------- --------

Ore production (tonnes

treated) 77,479 91,602 77,359 329,095

Average grade silver

(g/t) 105 86 65 82

Average grade gold

(g/t) 2.43 2.00 2.36 2.39

Silver produced (koz) 244 195 166 757

Gold produced (koz) 5.73 4.90 6.02 23.40

Silver equivalent produced

(koz) 588 489 527 2,162

Silver sold (koz) 193 214 132 761

Gold sold (koz) 4.32 5.27 4.71 23.25

---------------------------- ------- ------- ------- --------

PALLANCATA

Product Q1 Q4 Q1 12 mths

2014 2013 2013 2013

---------------------------- -------- -------- -------- ----------

Ore production (tonnes

treated) 254,483 291,740 251,702 1,088,712

Average grade silver

(g/t) 259 285 239 264

Average grade gold

(g/t) 1.04 1.14 1.08 1.13

Silver produced (koz) 1,703 2,198 1,608 7,628

Gold produced (koz) 5.79 6.97 6.53 27.83

Silver equivalent produced

(koz) 2,051 2,616 2,000 9,298

Silver sold (koz) 1,771 2,378 1,539 7,567

Gold sold (koz) 6.23 7.51 5.93 26.67

---------------------------- -------- -------- -------- ----------

Comparatives from 2013 for Pallancata have been restated to 100%

of production.

SAN JOSE

Product Q1 Q4 Q1 12 mths

2014 2013 2013 2013

---------------------------- -------- -------- -------- --------

Ore production (tonnes

treated) 134,589 156,150 108,379 536,937

Average grade silver

(g/t) 391 399 459 425

Average grade gold

(g/t) 5.77 6.03 6.87 6.42

Silver produced (koz) 1,471 1,741 1,351 6,357

Gold produced (koz) 21.97 26.53 21.08 98.83

Silver equivalent produced

(koz) 2,790 3,333 2,616 12,286

Silver sold (koz) 1,493 1,742 889 6,278

Gold sold (koz) 22.30 25.25 12.80 94.76

---------------------------- -------- -------- -------- --------

The Company has a 51% interest in San Jose.

*Silver equivalent production assumes a gold/silver ratio of

60:1

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

- ends -

[1]Please note that in line with industry-wide standards, all

mineralised intersections in this release are quoted as calculated

true widths.

[2] All figures as at 31 March 2014

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSFWFWLFLSEEL

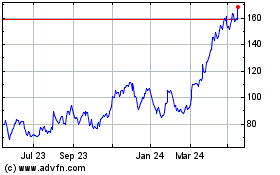

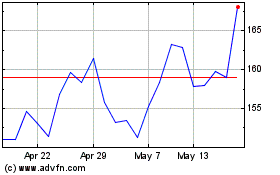

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Jul 2023 to Jul 2024