TIDMHEIT

RNS Number : 6759W

Harmony Energy Income Trust PLC

22 August 2022

22 August 2022

Harmony Energy Income Trust plc

("HEIT" or the "Company")

Net Asset Value and Portfolio Update

Harmony Energy Income Trust plc, an externally managed company

that invests in energy storage assets in Great Britain, today

announces that its Net Asset Value ("NAV") as at 31 July 2022 was

116.21p per share.

Highlights

-- NAV increased by 6.72% to GBP244.05 million, or 116.21 pence

per share, up 7.32 pence per share over the three months from 30

April 2022;

-- NAV increase for this quarter is primarily driven by:

a) the acquisition on 29 July 2022 by the Company of the first

pipeline project from Harmony Energy Limited: Bumpers (99 MW / 198

MWh) at a discount to fair market value; and

b) the revaluation of both the Bumpers and Little Raith (49.5 MW

/ 99 MWh) projects to reflect lower risk as these projects are now

categorised as "under construction". Contracts with Tesla were

signed on 30 June 2022 (Little Raith) and 29 July 2022 (Bumpers),

with target commercial operations dates of September 2023 (Bumpers)

and October 2023 (Little Raith);

-- Revenue projections have not been revised since 30 April

2022. Next revision due 31 October 2022;

-- 1 pence per Ordinary Share dividend paid on 29 July 2022, as

per the timetable forecast at IPO, taking NAV Total Return in the

period to 7.64%. The Company remains on track to meet its target

returns of paying a 2 pence per Ordinary Share dividend in 2022,

increasing to 8 pence per Ordinary Share in 2023;

-- Target commercial operations date of Pillswood project remains on track for November 2022;

-- GBP60 million debt facility with NatWest agreed on 21 June

2022, which will facilitate the construction of the Bumpers

project; and

-- Company expects pipeline of c.500 MW "shovel ready" projects

ready for acquisition (subject to financing and due diligence) by

the end of 2022, with some projects capable of acquisition during

Q4.

Portfolio Update

The construction of the Portfolio continues to progress well and

the company is on track to deliver target returns in 2022 and 2023.

All projects within the Portfolio are now categorised as "under

construction" and targeting to commence operations in accordance

with the table below (which, other than the change in status in

relation to Little Raith and Bumpers, remain unchanged from 30

April 2022).

Project MW / MWh Location Target Commercial Status

Operations Date

Pillswood 98 / 196 Yorkshire November 2022 Under Construction

----------- --------- ----------------- ------------------

Broadditch 11 / 22 Kent December 2022 Under Construction

----------- --------- ----------------- ------------------

Farnham 20 / 40 Surrey March 2023 Under Construction

----------- --------- ----------------- ------------------

Rusholme 35 / 70 Yorkshire March 2023 Under Construction

----------- --------- ----------------- ------------------

Bumpers 99 / 198 Bucks. September 2023 Under Construction

----------- --------- ----------------- ------------------

Little Raith 49.5 / 99 Fife October 2023 Under Construction

----------- --------- ----------------- ------------------

Total 312.5 / 625

----------- --------- ----------------- ------------------

On the Company's Pillswood project, steel platforms are being

made ready to receive the first batch of Tesla Megapacks which are

expected to arrive on site by the end of August.

By end of 2022, the Company expects to have 109 MW of operating

projects, 203.5 MW "under construction" and a pipeline of c.500 MW

"shovel ready" projects ready for acquisition (subject to financing

and due diligence), with a number of these being capable of

acquisition during Q4. These pipeline projects benefit (or will

benefit) from near-term grid energisation dates ranging from Q3

2023 to Q4 2024. All pipeline projects are expected to be at least

2-hour duration battery systems.

Market Commentary

The strong revenue performance of battery storage assets in

Great Britain has continued through the quarter, with average

monthly revenues hitting record levels in June and July 2022.

Ancillary Service pricing has remained strong, and the 2-hour

duration batteries continue to benefit from strong pricing in the

Dynamic Regulation service. Wholesale trading volumes remained low

compared to winter months, but some batteries (especially those

with more than 1-hour duration) still benefited from some large

wholesale spread opportunities: On 18th July 2022, the unusually

hot weather and low levels of forecast wind generation prompted

National Grid ESO to issue Capacity Market Notices (later

cancelled), and this pushed the GB evening wholesale peak price as

high as GBP647/MWh. The overall market outlook remains strong with

high gas prices forecast to continue until 2026.

NAV Update for the period ended 31 July 2022

The Company's NAV as at 30 April 2022 was GBP228.69 million

(108.90 pence per share). As at 31 July 2022, the unaudited NAV is

calculated to have increased by 6.72% to GBP244.05 million (116.21

pence per share), up 7.32 pence per share over the three months

from 30 April 2022.

This increase was largely driven by (a) the acquisition of the

Bumpers project (99 MW / 198 MWh) at a discount to fair market

value (as supported by the independent valuer's opinion); and (b)

the revaluation of both the Little Raith and Bumpers projects by

virtue of the Company executing EPC, O&M and revenue

optimisation contracts with Tesla during the period, thereby

allowing the projects to be categorised as "under construction".

The payment of the 1 pence per Ordinary Share dividend on 29 July

2022 offset some of these increases.

Revenue projections have not been revised since 30 April 2022,

with the next revision due in the coming quarter.

Max Slade, Commercial Director of Harmony Energy Advisors

Limited, commented: "This announcement reiterates the positive news

previously announced by the Company during the quarter, including

the interim results published on 28 June. The Company has achieved

so much during 2022 and we are pleased to continue meeting our

targets and delivering positive NAV growth for the shareholders. We

now look forward to completing construction and commencing

operations on the Pillswood project in the coming months. We will

provide further updates in due course."

The Company's factsheet for 31 July 2022 is available on the

Company's website at:

https://www.heitp.co.uk/sites/camarcoir/files/2022-08/heit-plc-fact-sheet-q3-2022.pdf

END

For further information, please contact:

Harmony Energy Advisors Limited

Paul Mason

Max Slade

Peter Kavanagh

James Ritchie

info@harmonyenergy.co.uk

Berenberg

Gillian Martin

Ben Wright

Ciaran Walsh

Dan Gee-Summons +44 (0)20 3207 7800

Camarco

Eddie Livingstone-Learmonth

Georgia Edmonds +44 (0)20 3757 4980

JTC (UK) Limited

Uloma Adighibe

Harmony.CoSec@jtcgroup.com +44 (0)20 3832 3877

LEI: 254900O3XI3CJNTKR453

About Harmony Energy Advisors Limited (the "Investment

Adviser")

The Investment Adviser is a wholly owned subsidiary of Harmony

Energy Limited. The Investment Adviser is an appointed

representative of Laven Advisors LLP, which is authorised and

regulated by the Financial Conduct Authority.

The management team of the Investment Adviser have been

exclusively focussed on the energy storage sector (across multiple

projects) in Great Britain for over six years, both from the point

of view of asset owner/developer and in a third-party advisory

capacity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVQKLFFLVLFBBV

(END) Dow Jones Newswires

August 22, 2022 02:00 ET (06:00 GMT)

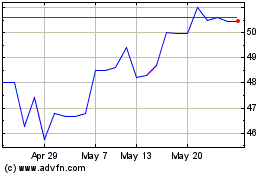

Harmony Energy Income (LSE:HEIT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Harmony Energy Income (LSE:HEIT)

Historical Stock Chart

From Jul 2023 to Jul 2024