TIDMHEIQ

RNS Number : 6244R

HeiQ PLC

30 October 2023

30 October 2023

HeiQ Plc

("HeiQ" or "the Company")

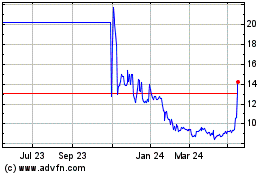

Results for year ended 31 December 2022

Cutting through the headwinds & setting the course for what

comes next

HeiQ Plc (LSE:HEIQ), a leading company in materials innovation

and hygiene technologies, announces its final results for the full

year ended 31 December 2022 ("FY 2022"). These results are

published concurrently with the Company's Interim Results for the

period ending 30 June 2023.

Annual Report and Restoration of Trading:

The Company's Annual Report and Accounts for the year ended 31

December 2022 will shortly be available to view on HeiQ's website,

www.heiq.com/investors . A copy of the Annual Report will also be

submitted to the Financial Conduct Authority in the United Kingdom

via the National Storage Mechanism ("NSM"), available for

inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . Copies

will be posted to shareholders in the coming days.

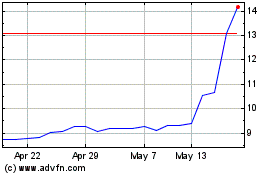

Upon uploading the Annual Report to the NSM, expected to be

completed today, the Company will make an immediate request to the

FCA for the Company's Ordinary Shares to be restored to trading on

the Main Market of the London Stock Exchange as soon as practicable

thereafter. A further announcement will be made confirming the

exact time and date of resumption of trading.

Financial Overview:

-- Revenue reduced 14.8% to US$47.2 million (FY 2021 restated: US$55.4 million*)

-- Gross profit margin down 17.3% to 28.5% (FY 2021 restated: 45.8%*)

-- Adjusted EBITDA decreased to US-$12.2 million (FY 2021 restated: US$4.5 million*)

-- Operating loss of US-$29.2 million (FY 2021 restated: US$-1.4 million*)

-- Loss after taxation of US$-29.8 million (FY 2021 restated: US$-1.4 million*)

-- Cash at year-end of $8.5m with net debt (including lease liabilities) of US$3.7 million

* Details on restatements of prior year financial information

are disclosed in Note 2 of the Company's Financial Statements.

Operational Overview:

-- Despite a robust first-half performance, the second half of

FY 2022 was characterized by a sudden weakening of the markets in

which HeiQ operates leading to a decrease in sales and related

contribution margin, which impacted financial performance.

-- Unprecedented macroeconomic pressures converged, creating a

challenging trading environment not only for HeiQ but also for our

competitors and the textile industry at large.

Post Period:

In response to ongoing market challenges, HeiQ has taken rapid,

decisive action to enhance resilience and reduce its cost base. The

Company has reviewed and prioritized its activities to navigate

these turbulent market conditions. Actions taken include:

-- Strategic Reorganization: Business was restructured into

three commercial units, each with dedicated leadership and P&L

responsibility, being Textiles & Flooring, Antimicrobials and

Life Sciences.

-- Relocated various support functions to the lower-cost location Portugal.

-- Applied a strong focus on commercialization teams and

prioritised high-value opportunities in high-growth markets.

-- Focused on commercialized innovations and mature, sustainable

and future-proof products such as HeiQ Allergen Tech and HeiQ

Synbio, HeiQ Mint and HeiQ Smart Temp.

-- These initiatives have reduced overheads by 15%, becoming

mainly effective from H2 2023 onwards.

While the Board considers the Company has adequate resources, it

is in discussions with financial institutions to replace the

currently uncommitted credit facilities by committed, long-term

facilities.

Carlo Centonze, co-founder and CEO, HeiQ plc, said:

"I would like to first acknowledge the understandable

frustration felt by our valued shareholders in regard to the

delayed publication of FY 2022 accounts following our 10-month

audit and the corresponding 6 month suspension from trading. As the

largest shareholder, I share this burden and as Group CEO I have

addressed the commercial difficulties it generated for us.

"FY 2022 was a challenging year for our industry and our

business, as we faced sudden and dramatic market disruptions in H2

2022, caused by large inventory de-stocking by brands and retailers

following reduced consumer demand, high inflation, and rising

interest rates globally.

"Since the start of 2023, we have taken focused steps to reduce

our cost base and reorganize the business. We have not seen the

challenges abate, but actions taken since the start of the year

mean we will be in a better position going forward to manage the

challenging macro-economic environment, continue building value in

our core innovations and preserve our ability to deliver when the

market demand turns.

"These post-period initiatives, which are set out in detail in

our annual report and interim results reported concurrently with

these full-year results, are already having an impact and have

delivered an annualized 15% reduction in overheads, becoming

effective mainly from H2 2023 onwards. Looking forward we are

seeing increasingly positive trends within our markets and consumer

preferences quickly adapting to more sustainable solutions, opening

up opportunities for growth for HeiQ and its innovative portfolio

of sustainable products. With this in mind, we will continue to

prioritise innovations close to positive cash flow generation,

putting appropriate emphasis on operational excellence and our high

potential key innovation initiatives with superior sustainability

and profitability profiles."

Equity analyst and shareholder presentations:

Following the resumption of trading in its ordinary shares the

Company will announce registration details for two live

presentations. These presentations will cover today's results and

will be held separately for both equity analysts and investors.

For further information, please contact:

HeiQ Plc

Carlo Centonze (CEO) +41 56 250 68 50

Cavendish Securities Plc (Broker) +44 (0) 207 397

Stephen Keys / Callum Davidson 8900

------------------

SEC Newgate (Media Enquiries) +44 (0) 20 3757

Elisabeth Cowell / Tom Carnegie / Molly 6882

Gretton HeiQ@s ecnewgate

.co.uk

------------------

CHAIR'S STATEMENT

Setting the course for what comes next

FY 2022 was an extraordinarily challenging year for HeiQ. Whilst

trading performance in the first half remained robust given the

circumstances, the markets we operate in became significantly

weaker in the second half. An array of macroeconomic pressures

converged, creating a very challenging trading environment for

HeiQ, its competitors and the textile industry at large.

The sudden decrease in sales and related contribution margin

impacted on our performance. In addition, we had to defer

previously recognised revenue from partnership agreements and

therefore, our financial performance fell short of expectations in

FY 2022.

Further, the Board of HeiQ Plc had to announce that the Company

could not publish its audited FY 2022 Accounts by 30 April 2023,

which regrettably led to the shares being suspended. HeiQ appointed

Deloitte as its new auditor in November 2022, to reflect the

international expansion and increased complexity of the Group since

listing. Following several acquisitions, the Group has grown

significantly in terms of capabilities, technology platforms and

growth potential, but also in terms of organizational complexity.

We have seen a number of businesses with different systems,

processes and cultures joining the Group since 2017 and in

particular in 2021. In order to integrate these different

businesses, the Group started the harmonization of processes,

systems and ways of working across the organization in 2022. While

this is a challenging project for any organization, the changes in

market conditions made this process even more challenging given our

lean set-up across the Group, including in support functions. All

these factors contributed to a significantly extended year end

reporting timetable for 2022 with a related impact on the timing of

the external audit work. Further, while reviewing our processes,

the Board has also challenged key estimates and judgments in

relation to previous reporting periods. This has led to the

restatement of prior year financial statements as disclosed in the

notes to the financial statements within this Annual Report*.

We understand the frustration of our stakeholders - in

particular shareholders - about the delay in reporting audited FY

2022 Accounts and the related suspension of shares from trading on

the London Stock Exchange.

With market conditions remaining very challenging during 2023,

we have taken rapid, decisive action to build additional resilience

and to reduce our cost base, reviewing and prioritizing our

activities rigorously, including our innovation pipeline. These

activities have allowed us to navigate through 2023 during which

time cash management is key given the fragile market conditions and

uncommitted nature of the Group's current financing facilities as

further discussed in the Financial Review.

Outlook

While we expect the trading conditions for our commercialized

product range to continue to be challenging into 2024, we have

significantly reduced our cost base and will implement further

measures if needed. The Board is also re-assessing the overall

strategy and resource allocation of the Group as well as its debt

structure to address the uncertainty in relation to financing

arising from the uncommitted nature of credit facilities, as

disclosed in the notes to our financial statements. This is to

ensure a healthy balance between maintaining the long-term growth

potential of our key innovation projects, the constraints of the

current market conditions for our commercial business activities as

well as being prepared to capture opportunities to gain market

share once market conditions improve.

We are facing uncertain times, both politically and economically

on a global scale, which has impacted many key regions of HeiQ's

operation. At the same time, we are seeing increasingly positive

trends within our markets and consumer preferences quickly adapting

to more sustainable solutions, opening up opportunities for growth

for HeiQ and its innovative portfolio of sustainable products.

We thank our stakeholders for their continuing support. We as a

Board as well as the whole management team of HeiQ remain committed

and motivated to deliver long-term growth and value for our

shareholders and all other stakeholders by bringing sustainable

technologies to market. With an aggregate holding of approximately

24%, the Board and extended management team continues to be well

aligned with the interest of shareholders.

Esther Dale-Kolb

Chair

(R) Details on restatements of prior year financial information

are disclosed in Note 2 of the Company's Financial Statements.

CHIEF EXECUTIVE OFFICER'S REVIEW

Cutting through the headwinds: a year in review

I would like to first acknowledge the understandable frustration

felt by our valued shareholders in regards to the delayed

publication of FY 2022 accounts and the corresponding suspension

from trading at LSE. As the largest shareholder I share this burden

and as CEO I have addressed the commercial difficulties it

generated for us.

The macro picture and FY 2022 performance

FY 2022 was a challenging year for our industry and our

business, as we faced sudden and dramatic market disruptions in H2,

caused by large inventory de-stocking by brands and retailers

following reduced consumer demand, high inflation, and rising

interest rates globally. These factors were exacerbated by the war

in Ukraine and the resulting energy crisis in Europe has hamstrung

the entire European chemical industry. Our business was further

exposed to prolonged Covid-19 restrictions in China in H1, and the

downturn was protracted by a sectoral recession in our customer

segment following the lifting of restrictions and value chain

shifts by US brands and retailers out of China. Given that we were

investing in scaling up our four ventures with game-changing

innovation technologies, the sudden decrease in sales and the

related innovation financing by the profits from our commercial

businesses not only impacted top line performance, but also Group

profitability.

The dramatic disruption in market demand across our value chains

also impaired the ability of our recently acquired businesses to

achieve their business plans. The Directors therefore have

concluded that an impairment of goodwill recognized upon

acquisition of some of these businesses is appropriate.

Further, we had to partly defer revenues (and corresponding

profits) in respect of certain partnership agreements originally

recognized in H1 2022 and H2 2022 to future periods. Previously, we

had recognized revenue from these contracts at the point in time of

achieving certain technical development milestones. However, upon

further review, we concluded that it is appropriate to recognize

such revenues over time to coincide with specific exclusivity

rights being granted by HeiQ to the partners. Consequently, total

revenue of US$4.0 million has been deferred over a period of four

years with initial revenues being recognized in H2 2022.

Total revenue for the year amounts to US$47.2 million (2021(R) :

US$55.4 million) and the operating loss for the year was US$-29.2

million (2021(R) : US$-1.4 million) after goodwill impairments

(aggregated goodwill impairments in 2021 and 2022 amount to US$13

million). The cash balance as of December 31, 2022 was US$8.5

million.

2023 Trading Update

Since the start of 2023, we have taken focused steps to reduce

our cost base and reorganize the business. We have not seen the

challenges abate in 2023 but actions taken since the start of the

year mean we are to be in a better position going forward to manage

the challenging macro-economic environment, continue building value

in our core innovations and preserve our ability to deliver when

the market demand turns.

I am pleased to report that the initiatives set out below have

delivered an annualized 15% reduction in overheads, becoming

effective mainly from H2 2023 onwards. As set out in our separately

reported interim results, for H1 2023, we achieved sales of US$20.5

million (H1 2022(R) : US$27.6 million) with a slight decrease in

margins in a buyers-market driven by current overcapacity (H1

2023:40.9% vs. 41.5% for FY 2022). I want to point out that while

we have curtailed our investments in our four ventures, we have

maintained their value creating momentum and thus face the

corresponding costs. The benefits of the reduced cost base will

only be felt in H2 2023, so our operating loss for H1 2023 amounts

to US$-6.0 million (H1 2022(R) : US$-1.6 million). The cash balance

as of June 30, 2023 amounts to US$7.3 million. Our credit

facilities have historically and continue to be uncommitted in

nature, which casts a material uncertainty on the going concern

assessment until appropriate longer-term funding is in place, as

disclosed in the Notes to the financial statements. However, the

Board considers that the Group has adequate resources and

accordingly, the financial statements continue to be prepared on

the going concern basis. T he Board is in discussions with

financial institutions to replace the currently uncommitted credit

facilities by committed, long-term facilities, but the outcome of

these discussions cannot be guaranteed.

Reorganizing, right-sizing and re-focusing

At the beginning of the year we reorganized our activities into

three commercial business units and one "Other" segment

encompassing four innovation ventures with no commercial activities

yet, Innovation Services provided internally and externally to a

broad range of customers, as well as group functions. The three

distinct business units each have their dedicated team leader,

management team, and P&L responsibility:

-- Textiles & Flooring, under the leadership of Mr. Mike Abbott, headquartered out of the US

-- Life Sciences, led by Dr. Robin Temmerman, headquartered out of Belgium

-- Antimicrobials, led by Mr. Tom Ellefsen, headquartered out of Thailand

I will give you an update for each of these shortly, but before

I do so, it is worth touching on how we have built resilience into

the service offerings - Innovation, Differentiation and Regulatory

- which are delivered through each business unit as well as

internal services like Finance.

Besides streamlining and relocating various support functions

out of Switzerland to lower-cost locations, we have created clear

goals and responsibilities for all our business and service

organizations to optimize operations and to focus resource

allocation rigorously. In Innovation, we have focused our R&D

investment on innovation technologies which are closest to

cash-flow generation or are already being financed by brand

partners or through grants. In Differentiation we are leveraging

our brand customers to promote HeiQ to a broader (consumer)

audience thereby reducing our costs. We have expanded our internal

service organization particularly in Finance by implementing a

centralized accounting function and will continue to do so to

strengthen our financial reporting processes.

In addition, we are applying a strong focus on our

commercialization teams, aligning our efforts with our mission to

improve the lives of billions through our products. We are

prioritizing high value opportunities in high growth markets, where

we can leverage competitive advantages and deliver sustainable

value for our customers and shareholders. We are focusing on our

commercialized innovations and mature, sustainable and future-proof

products such as HeiQ Allergen Tech and HeiQ Synbio, HeiQ Mint and

HeiQ Smart Temp and are also actively challenging competitors'

positions with a better quality-price-terms ratio offering with our

HeiQ Pure range.

Textiles & Flooring

We have taken decisive steps to strengthen our position as the

market leader for branded, nominated textile innovation. In order

to maintain capabilities at a lower cost, we have accelerated the

reallocation of our innovation, testing, and product management

operations to Portugal, which is a lower-cost country with high

education in which to undertake these labor-intensive workstreams.

Our production has been moved largely to the US from Switzerland

due to lower energy costs and chemical raw material availability.

Our top-selling products are being further integrated backwards to

improve our margin. Additionally, we are investing in Central

America, a region which is increasingly capturing supply from US

brand's reducing their exposure to China. We are exploring global

local manufacturing partnerships to lower the impact on margins of

short notice orders and resulting rapid delivery logistical

costs.

Antimicrobials

In our Antimicrobials business, we have reduced the commercial

team by focusing on selected markets and expanded our support to

our established large channel partners Americhem and Avient. We are

further reducing our overheads and divesting from our regional

sales hub HeiQ Brazil in order to build up this particular market

with a commercialization partner instead. We are focused on

strengthening our regulatory assets for inorganic, botanical and

natural antimicrobials to enhance our position within specialty

antimicrobials and are looking for opportunities to consolidate the

industry segment.

Life Sciences

In Life Sciences we have achieved a key milestone with the

publication of the study comparing Ecolab disinfectants with our

HeiQ Synbio probiotic cleaners at the University Hospital Charité

Berlin. The study, which was sponsored by the Melinda & Bill

Gates foundation and the German state confirmed that HeiQ's

probiotic cleaners are equally effective to Ecolab's disinfectants

while significantly reducing resistance gene developments. The

study led to a recommendation for probiotic cleaners by the German

Robert Koch institute and the finalization of the new European

Detergent Regulation, now including probiotic cleaners. With this

key regulatory milestone achieved, we are doubling down on securing

significant contracts for HeiQ Synbio in the healthcare cleaning

market and selecting the best channel partner for global

commercialization. We are in negotiations with leading channel

partners for an exclusive OEM (Original Equipment Manufacturer)

agreement for our probiotic healthcare cleaners. Additionally, we

are revisiting our medical device business strategy as closing of

an OEM agreement is not materializing.

Venture Innovations

Innovation remains the lifeblood of our business and future

value creation. I talked earlier about our focused strategy for

innovation, prioritizing core technologies which are close to

positive cash flows or are being funded by customers or grants in

order to alleviate the impact of their expensed R&D costs on

our net commercial revenues and accelerate their technology and

market readiness.

One of our most valuable innovation platforms is HeiQ AeoniQ ,

the world's first climate-positive fiber. HeiQ AeoniQ has had

significant industry support by Hugo Boss, The Lycra Company and

MAS Holdings and has been taken to customers as a HUGO BOSS Polo

Shirt on consumer shelves as early as January 2023, just 15 months

after launching it. Hugo Boss has recently captured global

attention for HeiQ AeoniQ with their "THE CHANGE" launch in high

fashion. Additionally, Beste, an Italian manufacturer, introduced

the first fabric collection featuring HeiQ AeoniQ to a range of

major Italian fashion brands.

HUGO BOSS has committed itself to replacing all use of polyester

and nylon by 2030 and made the achievement of the same a

fundamental part of leadership's remuneration. HeiQ AeoniQ has one

objective, to replace polyester, a US$135 billion market with a

compounding annual growth rate of 3.5%. Most recently, in July

2023, we secured a further US$2.5 million funding from MAS

Holdings, a premium leader in garment making headquartered in

Singapore. We have further secured US$1.2 million in grants for our

R&D work and up to US$ 8 million government grant contributions

over the next two years for our first 3 kilotons (kto) plant

scale-up in Portugal. We will continue our efforts to secure

funding and offtake agreements with leading brands in order to

finance and build our first 30kto capacity production plant

scheduled to operate in 2026.

HeiQ GrapheneX is a proprietary technology platform that enables

us to directly synthesize porous graphene materials with high

performance and versatility. This platform is strategically

positioned to capture the growing demand for advanced materials in

the batteries and electric vents sectors. We have recently sold our

first samples to a Fortune 500 Brand and top three leader in

handheld mobile devices. Over the next two years we aim to deliver

our first pilot commercialization plant and are currently

negotiating product development funding with a key OEM player in

the handheld mobile devices industry.

HeiQ ECOS is a transparent conductive coating technology that

enables low emissivity. HeiQ ECOS can also be used in defense, to

alter the electromagnetic signature of assets making them stealth.

We have two existing defense customers paying for the application

development for signature management. With the knowledge gained

from these projects, we have developed a strong proof of concept

for transparent window insulation and yield-enhancing greenhouse

films. Less energy is needed to cool down or warm buildings or

greenhouses and if utilized in the automotive window space

significantly more reach can be conferred on electric vehicles. We

are currently validating the technology in field trials with market

leading adopters and have been able to secure additional grants to

develop further technology applications.

HeiQ BacCell is centered around our precision fermentation

technology, utilizing bacteria to manufacture post-biotics (HeiQ

Synbio platform). Our aim is to use agricultural and food waste

available in large amounts and transform them into bacterial

cellulose. The latter is utilized as a feedstock for our HeiQ

AeoniQ climate positive fiber and promises additional market

application opportunities in packaging, food, cosmetics and medical

currently being explored with leading channel partners. By using

waste-based feedstock we prevent the burning or fouling of organic

waste and thereby contribute to reduce greenhouse gas emissions,

with a potential for carbon credits being awarded.

Sustainability

Our technologies are intrinsically built to bring sustainability

downstream to our customers and to consumers. Our biggest

contribution to science-based reduction goals is the continuous

substitution of hydrocarbon based raw materials in our products

with bio-based raw materials. With HeiQ AeoniQ we are bringing to

the market a game changing technology, capable of decarbonizing the

textile industry with one of the few climate-positive technologies

able to reduce the science-based footprint of brands and retailers,

contributing significantly to reaching a net zero target. At HeiQ,

we are committed to driving impactful game-changing sustainable

innovation technologies to market.

Outlook

Looking ahead, our vision remains firm: striving to improve the

lives of billions by bringing sustainable technology solutions to

market that can make an impact. To achieve this and to weather

current challenging market conditions and financial uncertainties,

we have taken and will take further actions as and when needed to

control our costs and sharpen our strategy. This includes

prioritizing innovations close to positive cash flow generation, to

put appropriate emphasis on operational excellence as well as to

drive our high potential key innovation initiatives with superior

sustainability profiles.

We expect the above-mentioned measures beginning to flow through

to our bottom line in H2 2023 with corresponding stabilization of

our financial performance. However, we remain alert to take

additional corrective actions should markets deteriorate

further.

As always, I would like to end my statement by thanking our

investors, team, advisors and customers for their support during

what has been a very challenging period for the market and the

company. As a significant shareholder and a founder of HeiQ, my

commitment to grow HeiQ and materialize its huge potential remains

unchanged.

Carlo Centonze

CEO

FINANCIAL REVIEW

2022 was a difficult year where our financial performance was

impacted by highly challenging market conditions and fell short of

expectations. Sales suffered from reduced market demand -

particularly in the last quarter of the year - while we continued

to invest into our key innovation initiatives to maintain the

long-term growth potential of the Group. After achieving a revenue

growth of 10.0%(R) in the previous year, revenues reduced by 14.8%

in 2022 to US$47.2 million (2021(R) : US$55.4 million).

Following several acquisitions, the Group has grown

significantly in terms of capabilities, technology platforms and

growth potential but also in terms of organizational complexity.

The Group has seen a number of businesses with different systems,

processes and cultures joining the Group since 2017 and in

particular during 2021. In order to integrate the different

businesses, the Group commenced the harmonization of processes,

systems and operating practices across the organization in 2022.

Furthermore, the significant drop in market demand required us to

review the valuation of intangible assets and our approach to

inventory valuation as we envisaged a short-term fall in demand for

certain of our technologies. Accordingly, despite our continued

confidence in the mid- to long-term value potential of our market

offerings, we have revised forecasts used in certain valuation

models related to intangible assets as well as inventory. As a

result, the Board has concluded that it is appropriate to impair

various goodwill positions as well as inventory positions where we

believe quantities on hand exceed demand for the next twelve

months. While preparing annual accounts 2022, including reviewing

aspects of accounting which rely on significant judgement, the

Company has also identified prior period errors that require

correction and thus lead to a restatement of prior period financial

statements. These factors have contributed to a significant delay

in the financial reporting process and the finalization of the work

by our auditors.

The Group deemed it appropriate to defer the recognition of

revenues (and profits) from certain partnership agreements related

to HeiQ AeoniQ to future periods. It was concluded that it is more

appropriate to recognize the milestone-payments over time during

the agreed exclusivity period rather than at a point in time upon

achieving the agreed technical development milestones. Accordingly,

US$2.0 million recognized in H1 2022 has been deferred and will be

recognized over a 4-year period commencing in H2 2022 and an

additional US$2.0 million previously expected to be recognized in

H2 2022 has also been deferred.

Accounting aspects relying on significant judgment and

estimations that materially affected our 2022 financial

performance

Impairment of Goodwill

Considering the challenging trading conditions, we have

determined a cumulative impairment charge of US$13 million to be

appropriate as of December 31, 2022. As we have corrected the

underlying framework for modelling valuation assumptions, we have

also applied the same approach retrospectively to the FY 2021

accounts and have concluded that of the cumulative impairment

charge of US$13 million, US$2.4 million should be charged against

income in 2021 instead of 2022. Further details on the impairment

charge can be found in Note 18 and Note 2 (restatement of 2021) to

the financial statements.

Allowance on inventory

Due to the deterioration in market conditions, the Group has

limited the demand forecast period to assess whether a good is

sellable or not to twelve months. Previously, the Group applied a

longer period of up to three years. However, the Board concluded

that this practice is no longer appropriate given the deterioration

in market conditions. This has resulted in recording a significant

allowance on inventory of US$4.9 million in 2022. This non-cash

expense has a significant impact on the gross margin for 2022 and

relates mainly to the raw materials for a limited number of

finished products.

Accounting for take-or-pay contracts

Certain customers have agreed, under a "take or pay" contract,

to purchase a specified minimum quantity of particular products

over a specified period of time, usually in exchange for a

specified exclusivity during the same period. However, the customer

must pay for the full quantity stated in the contract, irrespective

of whether the customer takes delivery of the minimum quantity to

which they are committed. Upon payment of the full amount, the

contract allows customers to defer their unexercised rights and to

consume the remaining units within a twelve-month period, although

there is no compulsion to do so. Revenue recognition for the

shortfall items is deferred until the customer consumes the units,

or, in case of expiry of the rights, typically twelve months after

payment by the customer. This represents an amendment to the

accounting policy for such contracts as disclosed in Note 2 and has

led to prior year restatements as discussed further below.

Consequently, the Directors have also concluded that no revenue

should be recognized for a long-term customer contract that the

Group is enforcing by way of legal claim in court as the customer

has not shown a willingness to execute any business as stipulated

in the signed agreement. This has led to a de-recognition of

revenue and profits in 2021 (US$0.6 million) and H1 2022 (US$0.7

million).

Financial Performance

Year

ended Year ended

December December

31, 31,

2022 2021

US$'000 US$'000

(restated)

-------------------------- ---------- ------------

Revenue 47,202 55,419

Gross profit 13,457 25,397

-------------------------- ---------- ------------

Gross profit margin 28.5% 45.8%

-------------------------- ---------- ------------

Selling and general

administrative expenses (30,969) (24,680)

Impairment losses (12,381) (2,454)

Net other income/expenses 648 383

-------------------------- ---------- ------------

Operating loss (29,245) (1,354)

-------------------------- ---------- ------------

Operating margin (62.0%) (2.4%)

-------------------------- ---------- ------------

Loss after taxation (29,814) (1,373)

-------------------------- ---------- ------------

Adjusted EBITDA (12,174) 4,545

-------------------------- ---------- ------------

EBITDA margin (adjusted) (25.8%) 8.2%

-------------------------- ---------- ------------

Revenues

Market demand for most of our businesses, with the exception of

the Chinese market due to lockdowns imposed by the government, was

not significantly impacted by geo-political developments, inflation

and rising interest rates until late in the year on the back of

consumer demand and inventory build-up across the value chain.

After the COVID-19 pandemic and supply-chain disruptions in the

previous years, industry players have been building up much higher

inventory levels than in the past to mitigate possible supply

issues which has supported demand. As such, in the first half of

the year, HeiQ was able to deliver a revenue growth of 6.8% (H1

2022(R) vs. H1 2021) despite an extremely low level of business

activity in China (lockdowns). As inflation continued to increase

rapidly in H2 2022, market sentiment weakened based on increasing

global recession concerns. Late in the year, this led to a sudden

halt in business along the entire supply chain, particularly in the

textile industry which, in terms of revenue, is still the most

important industry segment for HeiQ. Brands started to cancel

orders as they faced uncertain consumer demand coupled with very

high levels of inventory. This caused a sudden and severe decrease

in manufacturing activity across the value chain. Consequently,

revenues for H2 2022 were down 33.7% compared to H2 2021(R) and

down 28.7% compared to H1 2022(R) . Given the high inventory levels

seen in Q3 2022, we expect demand for our functional ingredients to

remain subdued for 2023.

Gross margin

Gross margins were 28.5% for the full year (2021(R) : 45.8%). In

H1 2022(R) margin was stable compared to H2 2021(R) (41.5% vs.

42.7%). The increased inventory allowance due to the change in the

valuation approach had a negative impact on the gross margin in H2

2022 which stood at 10.3%. Excluding the US$4.9 million allowance

on inventory recorded in 2022, the gross profit for FY 2022 would

have been US$18.4 million and the corresponding gross margin would

have been 38.9% vs. 45.8% for the full year 2021(R) .

Sales and General Administration Expenses

As we have disruptive technologies with high value and market

potential in our innovation pipeline, we continued to invest during

2022 in our future and in value creation although we have both

prioritized and adjusted the scope of projects as revenues and

related cash generation have suffered. Our Sales and General

Administration expenses ("SG&A") have grown in 2022 to US$31.0

million, an increase of US$6.3 million or 25.5% (2021(R) : US$24.7

million).

SG&A in H1 2022(R) was US$ 14.0 million, stable compared to

H2 2021(R) (US$ 14.0 million) but significantly higher than in H1

2021 (US$10.7 million). Approximately US$1.9 million of this

increase in H1 2022 (vs H1 2021) relates to the full year inclusion

of acquired companies. Further, in the course of 2021 we invested

in our skilled workforce, including the build-up of the HeiQ

AeoniQ(TM) fiber team which increased the general cost base for H1

2022 by another US$1.4 million compared to H1 2021.

In H2 2022, SG&A amounted to US$17.0 million which

represents an increase of US$3.0 million against H1 2022(R) and

US$3.0 million against H2 2021(R) . Audit costs for FY 2022

increased by about US$1.0 million compared to FY 2021.

Impairment losses

Impairment losses have been recorded both on intangible assets

(US$11.7 million) - mainly related to goodwill impairments as

explained above - as well as on property, plant & equipment

(US$0.7 million) as hygiene mask production equipment has been

impaired due to a significant decline in demand.

Other Income / Expenses

Other income and other expenses predominantly relate to foreign

exchange gains on working capital (other income) and foreign

exchange losses (other expenses). Other expenses further include a

write-off of intangible assets.

Overall, and including goodwill impairments, HeiQ reports an

operating loss of US$-29.2 million for the year 2022 compared to an

operating loss of US$-1.4 million in 2021(R) .

Reporting as per new Business Unit structure

As explained in the Chair and CEO statement, the Group has

re-organized its management structure into distinct Business Units

and therefore has also amended its disclosures on reported

segments.

HeiQ reports four segments: the three Business Units as well as

"Other activities". Other activities include the Innovation Service

function, Business Development initiatives ("Ventures" as well as

costs not allocated to one of the three Business Units, including

goodwill impairments. In 2022 and 2021, SG&A expenses have been

allocated to Business Units only to a limited extent with focus on

commercial activities. For 2023 and going forward, the Group

intends to allocate costs more extensively to the three Business

Units.

Textiles & Life Other Total

Flooring Sciences Antimicrobials activities

US$'000 2022 2021* 2022 2021* 2022 2021* 2022 2021* 2022 2021*

------------------ ------ ------ ------- ------ ------- ------- -------- -------- -------- -------

Revenue 33,870 39,773 6,894 10,115 3,577 3,379 2,861 1,792 47,202 55,419

Operating profits

(loss) 979 14,196 (1,078) 1,438 53 1,106 (29,199) (18,096) (29,245) (1,354)

Finance result (590) (35)

Loss before

taxation (29,835) (1,389)

Taxation 21 16

------------------ ------ ------ ------- ------ ------- ------- -------- -------- -------- -------

Loss after

taxation (29,814) (1,373)

------------------ ------ ------ ------- ------ ------- ------- -------- -------- -------- -------

*as restated

Revenues within the Textiles & Flooring business unit

decreased by US$5.9 million (-15%) to $33.9 million in 2022. This

was driven by two previously mentioned main contributors: COVID-19

related lockdowns in one of our main markets, China, as well as the

unprecedented, industry wide decrease in demand along the entire

value chain towards the end of the year.

Revenues within the Life Sciences business unit decreased by

US$3.2 million (-32%) to $6.9 million in 2022 compared to 2021(R) .

This decrease reflects the significantly lower sales of hygiene

masks in 2022 which was partly offset by an increase in sales of

HeiQ Synbio products.

Revenues within the Antimicrobials business unit increased by

US$0.2 million (+5.9%) to US$3.6 million.

Revenues allocated to other activities encompass mainly

Innovation Services provided to 3(rd) party customers.

Adjusted EBITDA

Reported adjusted EBITDA loss was US$-12.2 million for 2022

compared to a positive EBITDA of US$4.5 million in 2021(R) .

EBITDA is a way of measuring cash generation. HeiQ therefore

adjusts EBITDA for share options and rights granted to Directors

and employees and significant non-cash items being impairments of

goodwill and intangible assets.

Adjusted EBITDA 2021

US$'000 2022 (restated)

------------------------- -------- ------------

Operating loss (29,245) (1,354)

Depreciation 2,220 1,971

Amortization 1,435 976

Impairment losses

and write-offs 13,278 2,454

Share options and

rights granted to

Directors and employees 138 498

------------------------- -------- ------------

Adjusted EBITDA (12,174) 4,545

------------------------- -------- ------------

Statement of Financial Position

Total assets were US$71.1 million as of December 31, 2022

(December 31, 2021(R) : US$94.1 million) with equity amounting to

US$40.3 million and liabilities of US$30.8 million as of December

31, 2022 (December 31, 2021(R) : US$59.5 million equity and US$34.6

million of liabilities). This corresponds to an equity ratio of 57%

( 2021(R) : 63%).

Non-current assets decreased from US$47.3 million (December 31,

2021(R) ) to US$38.7 million as of December 31, 2022, mainly driven

by the impairment of intangible assets.

Current assets decreased by 30.9% to US$32.4 million as of

December 31, 2022 (US$46.9m as of December 31, 2021(R) ). Trade

receivables reduced by US$8.2 million to US$6.5 million as of

December 31, 2022 (2021(R) : US$14.7 million). The cash balance

decreased by US$6.1 million year-on-year and was US$8.5 million as

of December 31, 2022 (2021: US$14.6 million).

The decrease in total liabilities was mainly driven by the

settlement of deferred consideration related to the acquisitions

made in 2021. Total liabilities decreased by US$3.8 million (11.0%)

from US$34.6 million as of December 31, 2021(R) to US$30.8 million

as of December 31, 2022. Net debts (including lease liabilities)

amount to US$3.7 million as of December 31, 2022 (December 31,

2021(R) : net cash position of US$3.7 million).

Cash Flow Statement

As a result of sales below expectation coupled with the

(budgeted) increase in our cost base, net cash generated from

operating activities in the year 2022 was negative and amounted to

US$-2.5 million (2021: US$3.4 million).

Cash used in investing activities amounts to US$8.8 million in

2022 (2021: US$12.7 million) and reflects the continued investment

in building long-term value. With US$3.9 million the development

and acquisition of intangible assets accounts for the largest share

of investment activities. This includes internal R&D activities

qualifying for capitalization but also the acquisition of

intellectual property rights to further complement the hygiene

range of our Antimicrobial business. We also invested US$3.4

million of cash in plant and equipment, predominantly related to

the HeiQ AeoniQ(TM) pilot plant located in Austria. Consideration

paid for acquisitions (US$1.6 million) relate to earn-out and

instalment payments for acquisitions executed in previous

periods.

Net cash from financing activities amounted to US$5.9 million

(2021: US$-1.3 million net cash used). The largest portion of

proceeds is related to the sale of a 2.5% equity stake in HeiQ

AeoniQ GmbH to Hugo Boss in H1 2022 (US$4.8 million). Proceeds from

borrowings (net) amount to US$2.6 million and relate mainly to

fixed advances with a duration of up to 3 months.

The Group reports a cash balance of US$8.5 million as of

December 31, 2022 (December 31, 2021: US$14.6 million).

Prior Period Adjustments

As describe further above, the Directors have concluded that

certain adjustments to prior period financial statements should be

recorded. The cumulative impact on the prior period financial

statements (FY 2021) is as follows.

In US$ As published Total restatements As restated

previously

Revenue for FY 2021 57.9 million (2.5 million) 55.4 million

Income (loss) after taxation 2.5 million (3.9 million) (1.4 million)

for FY 2021

-------------- ------------------- --------------

Total assets as at December

31, 2021 101.8 million (7.7 million) 94.1 million

Total equity as at December

31, 2021 64.6 million (5.1 million) 59.5 million

Total liabilities as at December

31, 2021 37.2 million (2.6 million) 34.6 million

-------------- ------------------- --------------

These corrections resulted in a significant restatement of the

income after taxation. Further details of these corrections as well

as additional corrections that did not result in material

restatement of the income after taxation are disclosed in Note 2 to

the financial statements.

Restatement in respect of a significant take-or-pay

contracts

As disclosed in Note 2 to the financial statements, the Group

has renegotiated a significant take-or-pay contract after the

balance sheet date. As a result of renegotiations, the Group has

effectively waived unpaid accounts receivable in exchange for a

right of first refusal on supply of a wide product range to a large

industry player with the expectation to grow this multiple million

US$ account significantly over the coming years. The company has

reviewed its historic accounting for this contract. The conclusion

of this review is that amounts recognized as revenue in 2021 and

accounts receivable as at December 31, 2020 and 2021 were

overstated as the criteria for revenue recognition under IFRS 15

had not been met. There are also associated impacts on costs of

sales, accrued liabilities and tax. The Group has determined that

revenues of US$1.8 million and profits of US$0.7 million recognised

in 2021 required reversal. Additional revenues and profits of

US$0.7 million have been derecognized in relation to another

take-or-pay contract in relation to which the Group has filed a

claim against the customer in court.

Restatement in regards of goodwill impairments

As highlighted further above and discussed in more detail in

Note 2 to the financial statements, the Directors concluded that a

portion of the goodwill impairments identified in preparation of

the 2022 Annual Accounts should have been identified during the

preparation of the 2021 financials, if all available information at

the point of publishing the annual report 2021 had been taken into

consideration. Consequently, a retrospective review of the 2021

goodwill impairment tests was performed. It was concluded that a

portion of the identified impairment amounting to US$2.3 million is

to be allocated to the 2021 financial statements.

Going Concern Assessment

To manage its cash balance, the Group has access to credit

facilities totalling CHF9.0 million (approximately US$9.8 million

as of September 30, 2023). The credit facilities are in place with

two different banks and both contracts have materially the same

conditions. The facilities are not limited in time, can be

terminated by either party at any time and allow overdrafts and

fixed cash advances with a duration of up to twelve months.

As of September 30, 2023, the Group has drawn CHF6.3 million of

the facilities (CHF2.4 million as December 31, 2022) as

follows:

Maturity dates of used credit Amount

facilities:

November 27, 2023 CHF 4.5 million

----------------

June 17, 2024 CHF 0.8 million

----------------

September 30, 2024 CHF 1.0 million

----------------

Total CHF 6.3 million

----------------

The facilities are not committed, but the Board has not received

any indication from financing partners that facilities are at risk

of being terminated. Furthermore, the Board is in discussions with

financial institutions to replace the currently uncommitted credit

facilities by committed, long-term facilities, but the outcome of

these discussions remain uncertain.

The Group's directors have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future and operate within its credit facilities

for a period of 12 months from date of approval of these financial

statements. Nevertheless, the Board acknowledges the uncommitted

status of the facilities which could be terminated without notice

during the forecast period requiring the refinancing of debts as

per above maturity dates, indicates that a material uncertainty

exists that may cast significant doubt on the Group's ability to

continue as a going concern . Further disclosure on the going

concern assessment are made in Note 3b to the financial

statements.

Xaver Hangartner

Chief Financial Officer

(R) Details on restatements of prior year financial information

are disclosed in Note 2 of the Company's Financial Statements.

Consolidated statement of profit and loss and other

comprehensive income

For the year ended December 31, 2022

Year ended Year ended

December

31, December 31,

2022 2021

Note US$'000 US$'000

(restated*)

---------------------------------------- ---- ---------- --------------------

Revenue 7 47,202 55,419

Cost of sales 9 (33,745) (30,022)

Gross profit 13,457 25,397

Other income 10 4,832 6,625

Selling and general administrative

expenses 11 (30,969) (24,680)

Impairment loss on intangible

assets 18 (11,651) (2,454)

Impairment loss on property,

plant & equipment 19 (730) -

Other expenses 13 (4,184) (6,242)

---------------------------------------- ---- ---------- --------------------

Operating loss (29,245) (1,354)

---------------------------------------- ---- ---------- --------------------

Finance income 14 683 534

Finance costs 15 (1,273) (569)

Loss before taxation (29,835) (1,389)

Income tax 16 21 16

---------------------------------------- ---- ---------- --------------------

Loss after taxation (29,814) (1,373)

---------------------------------------- ---- ---------- --------------------

Other comprehensive income:

Exchange differences on translation

of foreign operations (1,914) (2,550)

---------------------------------------- ---- ---------- --------------------

Items that may be reclassified

to profit or loss in subsequent

periods (1,914) (2,550)

Actuarial gains/(losses) from

defined benefit pension plans 1,380 1,124

Income tax relating to items

that will not be reclassified

subsequently to profit or loss (276) (225)

---------------------------------------- ---- ---------- --------------------

Items that will not be reclassified

to profit or loss in subsequent

periods 1,104 899

---------------------------------------- ---- ---------- --------------------

Other comprehensive loss for

the year (810) (1,651)

---------------------------------------- ---- ---------- --------------------

Total comprehensive loss for

the year (30,624) (3,024)

---------------------------------------- ---- ---------- --------------------

Loss attributable to:

Equity holders of HeiQ (29,251) (1,177)

Non-controlling interests (563) (196)

---------------------------------------- ---- ---------- --------------------

(29,814) (1,373)

---------------------------------------- ---- ---------- --------------------

Total Comprehensive loss attributable

to:

Equity holders of the Company (30,061) (2,828)

Non-controlling interests (563) (196)

---------------------------------------- ---- ---------- --------------------

(30,624) (3,024)

---------------------------------------- ---- ---------- --------------------

Loss per share:

Basic (cents)** 17 (21.92) (0.91)

---------------------------------------- ---- ---------- ---------- ---------

*The consolidated statement of profit and loss and other

comprehensive income has been restated in the comparative period as

described in Note 2.

**The effect of share options is anti-dilutive and therefore not

disclosed.

Consolidated statement of financial position

As at December 31, 2022

As at As at As at

December December December

31, 31, 31,

2022 2021 2020

Note US$'000 US$'000 US$'000

(restated*) (restated*)

----------------------------------- ----- ---------- ------------ ------------

ASSETS

Intangible assets 18 20,442 30,773 5,264

Property, plant and equipment 19 9,802 6,865 5,467

Right-of-use assets 20 7,819 7,974 2,564

Deferred tax assets 32 538 1,337 1,288

Other non-current assets 21 137 333 206

----------------------------------- ----- ---------- ------------ ------------

Non-current assets 38,738 47,282 14,789

----------------------------------- ----- ---------- ------------ ------------

Inventories 22 13,168 13,770 13,540

Trade receivables 23 6,487 14,656 10,080

Other receivables and prepayments 24 4,262 3,876 2,609

Cash and cash equivalents 8,488 14,560 25,695

----------------------------------- ----- ---------- ------------ ------------

Current assets 32,405 46,862 51,924

----------------------------------- ----- ---------- ------------ ------------

Total assets 71,143 94,144 66,713

----------------------------------- ----- ---------- ------------ ------------

EQUITY AND LIABILITIES

Issued share capital and

share premium 26 205,874 195,714 184,096

Other reserves 28 (128,017) (127,195) (125,968)

Retained deficit 28 (39,466) (11,525) (10,348)

----------------------------------- ----- ---------- ------------ ------------

Equity attributable to

HeiQ shareholders 38,391 56,994 47,780

Non-controlling interests 1,948 2,541 (20)

----------------------------------- ----- ---------- ------------ ------------

Total equity 40,339 59,535 47,760

----------------------------------- ----- ---------- ------------ ------------

Lease liabilities 30 6,558 7,209 2,304

Long-term borrowings 31 1,445 1,605 1,400

Deferred tax liability 32 1,253 2,333 857

Other non-current liabilities 33 4,714 2,619 3,425

----------------------------------- ----- ---------- ------------ ------------

Total non-current liabilities 13,970 13,766 7,986

----------------------------------- ----- ---------- ------------ ------------

Trade and other payables 34 5,322 8,271 5,815

Accrued liabilities 35 4,978 3,386 2,168

Income tax liability 16 314 51 1,495

Deferred revenue 36 1,285 1,004 -

Short-term borrowings 31 2,893 1,157 173

Lease liabilities 30 1,264 905 349

Other current liabilities 38 778 6,069 967

----------------------------------- ----- ---------- ------------ ------------

Total current liabilities 16,834 20,843 10,967

----------------------------------- ----- ---------- ------------ ------------

Total liabilities 30,804 34,609 18,953

----------------------------------- ----- ---------- ------------ ------------

Total equity and liabilities 71,143 94,144 66,713

----------------------------------- ----- ---------- ------------ ------------

*The consolidated statement of financial position has been

restated for the comparative periods as described in Note 2.

The Notes form an integral part of these Consolidated Financial

Statements. The Consolidated Financial Statements were approved and

authorized for issue by the Board of Directors on October 26, 2023

and signed on its behalf by:

Xaver Hangartner, Chief Financial Officer

Consolidated statement of changes in equity

For the year ended December 31, 2022

Issued Other reserves Retained Equity Non-controlling Total equity

share capital deficit attributable interests

and share to HeiQ

premium shareholders

Note US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------------- ---- -------------- -------------- ----------- ------------- --------------- ------------

(restated*) (restated*) (restated*) (restated*)

--------------------- ---- -------------- -------------- ----------- ------------- --------------- ------------

Balance at January

1, 2021 (as

presented) 184,096 (125,968) (8,499) 49,629 (20) 49,609

Prior year adjustment

in respect of

revenue

recognition - - (1,849) (1,849 - (1,849)

Balance at January

1, 2021 (as

restated) 184,096 (125,968) (10,348) 47,780 (20) 47,760

Loss after taxation - - (1,177) (1,177) (196) (1,373)

Other comprehensive

(loss)/income - (1,651) - (1,651) - (1,651)

Total comprehensive

(loss)/income for

the year - (1,651) (1,177) (2,828) (196) (3,024)

--------------------- ---- -------------- -------------- ----------- ------------- --------------- ------------

Issuance of shares 26 11,618 - - 11,618 - 11,618

Share-based payment

charges 27 - 424 - 424 - 424

Amounts arising

on business

combinations 5 - - - - 2,757 2,757

Transactions with

owners 11,618 424 - 12,042 2,757 14,799

--------------------- ----

Balance at December

31, 2021 195,714 (127,195) (11,525) 56,994 2,541 59,535

--------------------- ---- -------------- -------------- ----------- ------------- --------------- ------------

Loss after taxation - - (29,251) (29,251) (563) (29,814)

Other comprehensive

(loss)/income - (810) - (810) - (810)

Total comprehensive

(loss)/income for

the year - (810) (29,251) (30,061) (563) (30,624)

--------------------- ---- -------------- -------------- ----------- ------------- --------------- ------------

Issuance of shares 26 10,160 - - 10,160 - 10,160

Share-based payment

income 27 - (12) - (12) - (12)

Dividends paid

to minority

shareholders 28 - - - - (243) (243)

Capital contributions

from minority

shareholders - - - - 764 764

Adjustments arising

from change in

non-controlling

interests 5a - - (2,445) (2,445) (616) (3,061)

Transfer of shares

to non-controlling

interest 5b - - 3,755 3,755 65 3,820

Transactions with

owners 10,160 (12) 1,310 11,458 (30) 11,428

Balance at December

31, 2022 205,874 (128,017) (39,466) 38,391 1,948 40,339

--------------------- ---- -------------- -------------- ----------- ------------- --------------- ------------

*'The consolidated statement of changes in equity has been

restated for the comparative periods as described in Note 2.

Consolidated statement of cash flows

For the year ended December 31, 2022

Year ended Year ended

December December

31, 31,

2022 2021

Note US$'000 US$'000

Cash flows from operating (Restated*)

activities

----------------------------------- ------ ----------- ------------

Loss before taxation (29,835) (1,389)

Cash flow from operations

reconciliation:

Depreciation and amortization 9,11 3,655 2,947

Impairment expense 13 12,380 2,454

Net loss on disposal of assets 43 (5) (34)

Write-off of intangible assets 13 897 -

Fair value gain on derivative

liability 38 (371) -

Gain on earnout consideration 5g - (80)

Finance costs 273 225

Finance income (2) (18)

Pension expense 247 156

Non-cash equity compensation 12 138 498

Gain from lease modification 20 (68) -

Other costs paid in shares 26 235 -

Currency translation (61) (793)

Working capital adjustments:

Decrease in inventories 43 602 2,028

Decrease/(Increase) in trade

and other receivables 43 7,783 (2,305)

(Decrease)/Increase in trade

and other payables 43 2,543 2,181

------------------------------------ ------ ----------- ------------

Cash generated (used in)/from

operations (1,589) 5,870

Taxes paid 16 (870) (2,462)

------------------------------------ ------ ----------- ------------

Net cash generated (used in)/from

operating activities (2,459) 3,408

------------------------------------ ------ ----------- ------------

Cash flows from investing

activities

Consideration for acquisition

of businesses 43 (1,587) (8,857)

Cash assumed in asset acquisition 26 65 -

Purchase of property, plant

and equipment 19 (3,418) (994)

Proceeds from the disposal

of property, plant and equipment 53 138

Development and acquisition

of intangible assets 18 (3,865) (2,969)

Interest received 2 18

------------------------------------ ------ ----------- ------------

Net cash used in investing

activities (8,750) (12,664)

------------------------------------ ------ ----------- ------------

Cash flows from financing

activities

Interest paid on borrowings (110) (108)

Repayment of leases 20,43 (992) (662)

Interest paid on leases (163) (117)

Proceeds from disposals of

minority interests 5b 4,792 -

Proceeds from borrowings 43 3,465 546

Repayment of borrowings 43 (904) (928)

Dividends paid to minority

shareholders 28 (243) -

Net cash from/(used in) financing

activities 5,845 ( 1,269)

------------------------------------ ------ ----------- ------------

Net decrease in cash and cash

equivalents (5,364) (10,525)

------------------------------------ ------ ----------- ------------

Cash and cash equivalents

- beginning of the year 14,560 25,695

Effects of exchange rate changes

on the balance of cash held

in foreign currencies (708) (610)

------------------------------------ ------ ----------- ------------

Cash and cash equivalents

- end of the year 8,488 14,560

------------------------------------ ------ ----------- ------------

* The consolidated statement of cash flows has been restated for

the comparative period as described in Note 2.

Notes to the Consolidated Financial Statements for the year

ended December 31, 2022

1. General information

HeiQ Plc (the Company) is a company limited by shares

incorporated and registered in the United Kingdom. Its ultimate

controlling party is HeiQ Plc. The address of the Company's

registered office is 5th Floor, 15 Whitehall, London, SW1A 2DD.

The principal activities of the Company and its subsidiaries

(the Group) and the nature of the Group's operations are set out in

Note 6.

These financial statements are presented in United States

Dollars (US$) which is the presentation currency of the Group, and

all values are rounded to the nearest thousand dollars except where

otherwise indicated. Foreign operations are included in accordance

with the policies set out in Note 3.

2. Changes in accounting policies, prior period error correction

and adoption of new and revised standards

Change in accounting policy

Following the acquisitions in 2021, the Group had different

accounting policies for inventory in the subsidiaries and therefore

aligned the methodology during the financial year 2022 closing

process to apply solely a first-in-first-out basis. The Group has

assessed the impact on the valuation: the majority of inventory is

valued on an individual basis and the impact is limited to

functional consumer goods. It was therefore concluded that there

was no material impact from the change in policy. See Note 3s for a

description of the accounting policy.

Prior period error: Overstatement of lease assets and

liabilities and reclassifications

During the compilation of the financial statements for the year

ended December 31, 2022, the Group corrected an overstatement of

right-of-use assets and lease liabilities assumed in the

acquisition of HeiQ Chrisal N.V. It was determined that property

capitalized as a right-of-use asset was owned by HeiQ Chrisal N.V.

rather than leased - and the corresponding liability was that of a

loan rather than a lease in nature. The loan amount payable was

reported by Chrisal as short-term payables, and the assets were

recognized as property, plant and equipment. In addition, at Group

level, the same contracts were also recognized as right-of-use

asset and lease liabilities.

Further, certain liabilities arising from customer contracts

were incorrectly classified as deferred revenue rather than accrued

liabilities and certain other payables are reclassed to short- and

long-term borrowings.

The following table summarizes the impact of the prior period

error on the financial statements of the Group.

Year ended

December

31, 2021

Consolidated statement of profit

or loss US$'000

Selling and general administrative

expenses 16

Finance costs (27)

Decrease in profit for the financial

year (11)

Consolidated statement of financial position

Right-of-use assets (1,105)

Trade and other payables 1,088

Accrued liabilities (770)

Deferred revenue 770

Short-term borrowings (153)

Long-term borrowings (935)

Lease liabilities (current) 149

Lease liabilities (non-current) 967

Decrease in net assets and equity (11)

Prior period error: PPA Chrisal: Accounting for 51% of

intangible assets acquired instead of 100%

During the purchase price allocation of the Chrisal acquisition,

the Group identified and accounted for brand and customer

relationship as well as technologies. The Group correctly valued

the intangible assets at 51% in the purchase price allocation.

However, the Group also consolidated the intangible assets at 51%

when it should have accounted for them at 100% with the difference

leading to an increase in non-controlling interests. The correction

of the error leads to an increase in intangible assets and a higher

amortization charge for the reporting period 2021.

The following table summarizes the impact of the prior period

error on the financial statements of the Group.

Year ended

December

31, 2021

Consolidated statement of profit

or loss US$'000

Selling and general administrative

expenses (218)

Income tax 55

Decrease in profit for the financial

year (163)

Consolidated statement of financial position

Intangible assets 1,759

Deferred tax liability (440)

Increase in net assets 1,319

Non-controlling interests (1,483)

Decrease in shareholders' equity (163)

Prior period error: Correcting revenue recognition of

take-or-pay contracts

A further restatement concerns two significant take-or-pay

contracts which have minimum guaranteed pricing irrespective of

amounts delivered to the customer. Following a renegotiation with

one customer post year-end, the company has reviewed its historic

accounting for this contract. The conclusion of this review is that

amounts recognized as revenue in 2021 and accounts receivable as at

December 31, 2020 and 2021 were overstated as the criteria for

revenue recognition under IFRS 15 had not been met. There are also

associated impacts on costs of sales, accrued liabilities and

tax.

As a further consequence, the accounting policy has been

amended. Revenue from take-or-pay contracts is recognized only upon

shipment of the products. See updated accounting policy and

additional background on take-or-pay contracts in note 3l. This has

led to a restatement for 2021 in relation to a second take-or-pay

contract.

The following table summarizes the impact of the prior period

error on the financial statements of the Group. The impact of the

prior period error on basic earnings per share is presented in Note

17.

Year ended

December

31, 2021

Consolidated statement of profit

or loss US$'000

Revenue (2,455)

Cost of sales 876

Selling and general administrative

expenses 19

Income tax 174

Decrease in profit for the financial

year (1,386)

Consolidated statement of financial

position

Trade receivables (37)

Other receivables and prepayments (2,399)

Deferred tax asset 174

Accrued liabilities 876

Decrease in net assets and equity (1,386)

Prior period error: Goodwill impairment and currency translation

Chrisal CGU and RAS CGU

In course of the preparation of the 2022 financial statements,

the Group identified a goodwill impairment in relation to three

CGUs (Chrisal, RAS, Life). It was found that a portion of the

goodwill impairment should have already been identified during the

preparation of the 2021 financials, if all available information at

the point of publishing the annual report 2021 had been taken into

consideration. Consequently, a retrospective review of the 2021

goodwill impairment tests was performed and the underlying

framework for modelling valuation assumptions was corrected. It was

concluded that a portion of the identified impairment amounting to

US$2.3 million is to be allocated to the 2021 financial statements

whereas US$1.3 million of the impairment charge relates to the

Chrisal CGU and US$1.0 million relates to the RAS CGU. No

correction to the 2021 impairment test was identified for Life

CGU.

IAS 21 - The Effects of Changes in Foreign Exchange Rates

requires that intangible assets including goodwill arising on the

acquisition shall be treated as assets of the foreign operation.

Chrisal CGU and RAS CGU both have a functional currency which is

different to the presentation currency of the Group. Consequently,

these intangible assets should be translated from the functional

currency of the CGU, Euro, to the presentation currency US$. The

company recalculated the US$ balances with the closing rate present

as at December 31, 2021. This led to a decrease of the intangible

asset balance as well as a charge to other comprehensive loss of

US$888,000.

See Note 18 for further details.

Year ended

December

31, 2021

Consolidated statement of profit

or loss US$'000

Impairment loss on intangible assets (2,310)

Decrease in profit for the financial

year (2,310)

Consolidated statement of financial position

Intangible assets (3,198)

Other reserves 888

Decrease in net assets and equity (2,310)

Prior period error: foreign currency risk note

The amounts in Note 42d foreign currency risk have been restated

as at December 31, 2021, as they contained intercompany balances,

related to long-term loans that form part of net investments in

foreign operations. Such balances are eliminated at Group level

while foreign currency differences that arise between the entities'

functional currencies only affect other comprehensive income. The

error has no impact on the consolidated financial statements.

Impact of error corrections on the Group's consolidated

statement of financial position

The effect of error corrections on the financial year ended

December 31, 2021 and the balance carried forward from December 31,

2020 is shown in the following tables:

Consolidated statement of financial position December 31,

2020

Restatement

US$'000 As presented revenue recognition As Restated

---------------------- ------------- --------------------- ------------

Assets

Deferred tax asset 826 462 1,288

Trade receivables 13,437 (3,357) 10,080

Total Assets 69,608 (2,895) 66,713

Capital and reserves

Retained deficit (8,499) (1,849) (10,348)

Total Equity 49,609 (1,849) 47,760

Liabilities

Accrued liabilities 3,214 (1,046) 2,168

Total Liabilities 19,999 (1,046) 18,953

Consolidated statement of financial position December 31,

2021

Restatement

Restatement revenue Restatement Restatement

US$'000 As presented Leasing recognition PPA Chrisal Goodwill As Restated

------------------------ ------------- ------------ ------------- ------------- ------------ ------------

Assets

Intangible assets 32,212 - - 1,759 (3,198) 30,773

Right-of-use assets 9,079 (1,105) - - - 7,974

Deferred tax assets 701 - 636 - - 1,337

Trade receivables 18,050 - (3,394) - - 14,656

Other receivables

and prepayments 6,275 - (2,399) - - 3,876

Total Assets 101,845 (1,105) (5,157) 1,759 (3,198) 94,144

Capital and reserves

Retained deficit (5,823) 6 (3,235) (164) (2,310) (11,526)

Other reserves (126,307) (888) (127,195)

Non-controlling

interests 1,053 5 - 1,483 - 2,541

Total Equity 64,637 11 (3,235) 1,319 (3,198) 59,535

Liabilities

Leases (non-current) 8,176 (967) - - - 7,209

Long-term borrowings 670 935 - - - 1,605

Deferred tax liability 1,894 - - 440 - 2,333

Trade and other

payables 9,359 (1,088) - - - 8,271

Accrued liabilities 4,538 770 (1,922) - - 3,386

Deferred revenue 1,774 (770) - - - 1,004

Short-term borrowings 1,004 153 - - - 1,157

Leases (current) 1,054 (149) - - - 905

Total Liabilities 37,208 (1,116) (1,922) 440 - 34,609

Impact of adjustment on the Group's statement of profit and loss

and other comprehensive income

December 31, 2021

US$'000 Restatement Restatement

Restatement revenue Restatement Goodwill

As presented Leasing recognition PPA Chrisal impairment As Restated

------------------------ ------------- ------------ ------------- ------------- ------------ ------------

Net result for

the year

Revenue 57,874 - (2,455) - - 55,419

Cost of sales (30,898) - 876 - - (30,022)

Selling and general

administration

expense (24,465) (16) 19 (218) - (24,680)

Impairment losses

on intangible assets (144) (2,310) (2,454)

Finance costs (597) 27 - - - (569)

Income tax (212) - 174 55 - (16)

Income (loss)

after taxation 2,474 11 (1,386) (163) (2,310) (1,373

Income (loss) after

taxation attributable

to HeiQ Stockholders 2,676 6 (1,386) (163) (2,310) (1,177)

Income after taxation

attributable to

non-controlling

interest (202) 5 - - - (196)

Income (loss) after

taxation 2,474 11 (1,386) (163) (2,310) (1,373)

Impact of adjustment on earnings per share

December 31, 2021

Restatement Restatement