TIDMGYM

RNS Number : 0635S

The Gym Group plc

15 March 2016

15 March 2016

The Gym Group Plc

('the Company' or 'The Gym')

Full Year Results

Strong revenue and profit growth and record number of new site

openings underpinning future growth

The Gym Group Plc, the fast growing, nationwide operator of 75

low cost gyms branded 'The Gym', announces its full year results

for the year ended 31 December 2015.

Financial Highlights

-- Revenue of GBP60.0 million, an increase of 31.9% (2014: GBP45.5 million)

-- Group Adjusted EBITDA(1) of GBP17.0 million, an increase of 15.9% (2014: GBP14.7 million)

-- Group Operating Cash Flow(2) of GBP18.6 million, an increase

of 12.7% (2014: GBP16.5 million)

-- Loss before tax of GBP12.4 million (2014: GBP9.4 million) as

a result of pre IPO finance costs and exceptional costs

-- Proforma adjusted profit before tax(3) of GBP5.3 million with

proforma Adjusted EPS(4) of 3.07p

Operational Progress

-- Successful IPO on the London Stock Exchange and refinancing in November 2015

-- 19 new gyms opened in 2015 increasing the total estate to 74,

with a further site opening this week

-- Total year end members at 376,000, an increase of 28.3% versus prior year (2014: 293,000)

Outlook

-- A strong start to 2016 with performance in line with the Board's expectations

-- Strong pipeline with 6 new sites expected to be open by the

end of H1 2016; a further 4 locations where contractors are on

site

John Treharne, CEO of The Gym Group, commented:

"2015 was a landmark year for The Gym Group with an acceleration

in roll out and strong results, culminating in a successful IPO.

Our low cost, affordable and disruptive model, which we

relentlessly strive to improve, resonates with consumers as

demonstrated by the near 30% increase in membership in 2015. In

January 2016 we moved through the 400,000 member mark. A strong

site pipeline for 2016 will see us continue to expand at a fast

rate to take advantage of our considerable opportunity. We have a

proven model, strong market fundamentals and financial strength to

continue to prosper and deliver value for shareholders both in 2016

and much further beyond."

An audio webcast of the analyst presentation will be available

from 13:00 today via our website www.tggplc.com

For further information, please contact

The Gym Group via Instinctif Partners

John Treharne, CEO

Richard Darwin, CFO

Numis

Oliver Cardigan

Oliver Hardy

Toby Adcock 020 7260 1000

Instinctif Partners

Matthew Smallwood

Justine Warren 0207 457 2020

(1) Group Adjusted EBITDA is calculated as operating profit

before depreciation, amortisation, exceptional items and other

income.

(2) Group Operating Cash Flow is calculated as Group Adjusted

EBITDA less working capital less maintenance capital

expenditures.

(3) Proforma adjusted profit before tax is calculated as Group

Adjusted EBITDA less depreciation and proforma interest.

(4) Proforma Adjusted EPS is calculated as proforma adjusted

profit before tax less proforma tax divided by the number of shares

at the year end.

Chairwoman's statement

2015 was an excellent year for The Gym. Revenue increased by

31.9% to GBP60.0 million, Group Adjusted EBITDA increased by 15.9%

to GBP17.0 million and 19 new gyms were opened during the year.

This demonstrates the ability of the business to drive top and

bottom line growth by growing the estate efficiently and meeting

the needs of our members. We are delighted to have listed on the

Full List of the London Stock Exchange and welcome our new

shareholders to this exciting business. The business has a

well-defined operating and financial model and has further

strengthened its balance sheet to support future growth. We are

well positioned to take advantage of the substantial opportunity in

the market.

My first impressions

I joined The Gym shortly before the IPO of the Company. I am

pleased to share with you my first impressions. This is a business

which has pioneered the low cost gym model. It has a clear strategy

and a passionate culture with the aim of providing every member the

very best experience. Supported by a knowledgeable and experienced

property team, it selects excellent sites that meet strict criteria

and deliver high returns in a reassuringly predictable way.

Operating a flexible, low cost, disruptive, technology led model,

The Gym operates efficiently and is now driving further benefits

from its increased scale.

The fact that The Gym has all these attributes as a relatively

young business with much potential is testament to an experienced,

talented and driven management team led by the Company's founder,

John Treharne.

Future growth will enable the Company to further its vision to

provide affordable exercise facilities to every person who wants to

improve their wellbeing; a very positive purpose for a company.

Strong governance

Strong governance is about putting in place a system and an

openness to challenge in order to make good decisions. At IPO we

strengthened our Board processes and committee structures, and we

expect to appoint an additional Non-Executive Director in the

coming months to complete this process. There is a strong

commitment to a well organised and efficient Board to support the

Executive team, and to enable swift and confident decision

making.

Looking ahead

The Gym has extensive opportunities to grow in the years ahead.

Our low cost, no contract, high quality, 24 hour gym membership is

highly attractive in today's fast moving, value conscious society.

Our proposition is extremely competitive within the wider gym

market and we are evidencing new members joining us from

traditional higher cost gyms and other health and fitness

operators. Importantly, more than a third of our new members are

experiencing gym membership for the first time. We look forward to

reaching more communities as we open more gyms to provide them with

the same encouragement to enhance their wellbeing.

Our people are vital in delivering an outstanding service to our

members. I am pleased to announce that in the coming weeks we plan

to introduce a scheme where all of our staff will have the

opportunity to become shareholders in the business.

I am delighted to have been appointed Chairwoman. I believe The

Gym, with its attractive financial model and successful growth

strategy, is well positioned to continue to enhance and create

value for institutional and employee shareholders as we work every

day to provide our members with an excellent experience.

Penny Hughes

Chairwoman

14 March 2016

Chief Executive's Review

Introduction

The Gym is the original pioneer of low cost gyms in the UK that

are open 24/7. Underlying our disruptive concept is that we offer

the products that members want at market leading prices without

compromising on quality or fundamentals.

I am pleased to present my first Chief Executive's Review

following our listing on the Full List of the London Stock Exchange

in November 2015.

This has been a landmark year for our business with a record

number of new site openings, increasing our estate to 74 sites at

31 December 2015 from 55 in the prior year. Our financial metrics

reflect the rapid growth that we have delivered: Total year end

members increased by 28.3% to 376,000 (2014: 293,000); revenue of

GBP60.0 million (2014: GBP45.5 million), an increase of 31.9%, and

Group Adjusted EBITDA of GBP17.0 million, an increase of 15.9%

(2014: GBP14.7 million).

We are a market leader in the low cost sector, enabling us to

realise the benefits of increased scale to drive down operational

and capital costs and deliver higher returns. Low cost gyms are a

fast growing market, and we continue to drive the expansion of the

sector by attracting members that are new to the gym market and

also from more traditional gym operators. We constantly seek out

ways to improve our business model to capitalise on this market

opportunity. Equally, the strength of our financial covenant means

that we are offered the best sites by landlords which underpins the

growth of our estate and our pipeline.

Strategic progress

Delivering performance from gyms

Our business model is straightforward with new sites taking time

to reach maturity. Once mature they generate excellent levels of

cash and good returns. We have been accelerating our rollout

programme and so at the end of 2015, 34 of our 74 sites had been

open for less than two years. We can expect to benefit from the

growth of these sites as they mature during the current year and

beyond.

Improving operating efficiencies

Our business model strips out the elements of the more

traditional proposition that add unnecessary cost and are barely

used, enabling us to operate a low cost environment. As we grow we

will use the benefits of scale and operating expertise to continue

to take costs out of the way that we deliver the business model. We

deliver as low a cost base as possible. This enables us to pass on

these benefits to the members through charging some of the lowest

prices in the sector. The Gym charges an average fee of GBP16 per

month.

An exercise to renegotiate operating cost contracts has

identified GBP1 million of annualised savings on an ongoing basis

and was implemented during the year.

Achieving our rollout strategy

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

The Gym operates a flexible low cost model that can be used in

many different types of location. There remain substantial growth

opportunities to expand our footprint across the UK. In 2015, gyms

opened in sites previously used as retail space (Bedford and

Reading) and a gentlemen's club (Charing Cross). We also opened a

gym as part of a leisure park regeneration scheme (Hemel

Hempstead), as well as gym spaces vacated by other operators

(Eastbourne, Croydon Purley Way and Derby). Our new sites continue

to trade well, in line with our expectations. Our pipeline is

expanding rapidly. We are well positioned to open between 15 and 20

gyms in total in 2016 and per year thereafter over the medium term.

The pipeline is stronger than at any point in our history;

landlords are also recognising the strength of our covenant,

assisted further by our newly acquired status as a publicly listed

company.

We continue to refine and reduce the cost of building and

fitting out a new site where we are provided with a clean shell by

the landlord. Savings have been achieved on multiple stages of the

fit-out process, including build costs, gym equipment and fixtures

and fittings. This is demonstrated by the decrease in the initial

cost to fit out a new gym, from an average of GBP1.5 million for

the 2008 to 2014 portfolio to an average cost of approximately

GBP1.35 million for the 2015 gyms.

Developing the customer proposition

The low cost sector is still at an early stage of development in

the UK, particularly compared with older, low cost gym markets in

mainland Europe and the United States. We continue to evolve our

concept to address the needs of our members. This is achieved by

monitoring customer feedback closely to ensure that we provide what

members want at affordable prices. During 2015 we expanded group

exercise classes in response to feedback from members. Similarly,

scientific analysis of actual usage patterns indicated that members

wanted additional space allocated for lighter free weights. The Gym

also benefited from a brand relaunch to emphasise our brand

personality at our sites. We are applying this to the new sites as

we develop them, ensuring there is consistency across the sites as

well as in our marketing messaging. This new branding will be

rolled out into some of our earlier sites as they come up for

refurbishment.

Monitoring member feedback about our offer and the service that

we provide is a core component of the development of our business.

Examples of feedback include measuring the use of machines to

enable us to understand when to change the equipment in our gyms,

ensuring that what we provide is in line with what members want to

use. Equally we analyse our site openings to understand the

demographics of our membership base and aid our decision making for

future site acquisition. Member feedback about our operational

performance is measured through Net Promoter Score with a score of

60.2% achieved in 2015. Our online measure of customer

satisfaction, Feefo, score was 94% for the year. The business is

constantly evolving the way it collects this type of feedback.

Focussing on our people

Our people are instrumental to running a successful business.

The Gym is made up of 74 gyms that act as local businesses drawing

on a network of central head office support to fulfill their

operational goals. As we grow we continue to enhance the quality of

support to this network of sites. A regional operations structure

has been put in place, along with the expansion of our commercial

team to explore further revenue opportunities and enhance our

monitoring of suppliers. We operate an outsourced support model

where services are provided through a number of key suppliers.

Our people are highly engaged, passionate and committed. We have

achieved a 2 star 'Outstanding' award in the Best Companies

accreditation which measures workplace engagement. The Company

recently achieved the Investors in People Silver award and is

currently applying for the Gold award. The business continues to be

the only low cost fitness provider with such accreditation.

We are pleased to give our people the opportunity to share in

the success of the Group. In the coming weeks we will introduce an

all-staff share scheme where all of our people will be granted an

award of GBP1,000 free shares and also have the opportunity to

invest in additional shares.

Our use of technology

Technology and systems are at the heart of our business and

facilitate the low cost environment that we operate. A simple

online joining process is critical to our model. We are exploring

ways to upgrade our capability in this area with the development of

a new member management system. Our goal is for members to access

their data in a more efficient way and for the business to

communicate with members more effectively.

The business moved to a new email sales platform during the year

that will enable us to reach new and lapsed members more

effectively. More of our marketing is now online as we expand the

scope of Pay per Click and Search Engine Optimisation. At the heart

of our marketing effort is our ability to drive potential members

in a local catchment to our website to join up. This critical

difference in operation to the traditional health club market helps

us to attract over 35% first time gym users. Our 24/7, CCTV

controlled environment attracts a wider cross section of people who

wish to exercise outside traditional gym opening hours when it

suits them. As a result, over a third of the membership base are

shift workers such as doctors, nurses, bus drivers, taxi drivers,

hotel and restaurant workers, who find traditional opening hours

too restrictive.

Outlook

The new financial year has started well and in line with the

Board's expectations. January and February are the two most

significant trading months of the year for any gym business.

Membership numbers at the end of February had increased to 418,000,

a record level with an 11.2% increase since December 2015. This

level of member growth will help to underpin our performance for

the rest of the year. The pipeline continues to be strong and we

expect to open 15 to 20 sites in the current year. As in 2015 these

site openings will be weighted to the second half of the year, with

6 sites expected to be open in the first half of the year and a

further 4 locations where contractors are on site.

Five months into our life as a public company, our strategic

priorities and financial results are progressing well. Our focus is

on creating value for both our members and our shareholders.

John Treharne

Chief Executive Officer

14 March 2016

Financial Review

Summary

2015 2014

GBP'000 GBP'000

Total number of gyms 74 55

Number of year end members ('000) 376 293

Revenue 59,979 45,480

Group Adjusted EBITDA(1) 17,016 14,688

Group Adjusted EBITDA before Pre-Opening

Costs(2) 19,681 16,668

Adjusted Earnings(3) (1,107) (4,452)

Group Operating Cash Flow(4) 18,616 16,514

------------------------------------------ -------- --------

The Group delivered another excellent performance in 2015, with

revenue growth of 31.9% and Group Adjusted EBITDA growth of 15.9%,

with strong performances from both mature and new gyms.

Our Group Adjusted EBITDA growth has been achieved despite the

substantial pre-opening costs of GBP2.7 million incurred with the

opening of 19 new gyms, and additional investment in our key

central functions.

Group Operating Cash Flow increased by 12.7%, as a result of the

conversion of Group Adjusted EBITDA offset by increases in

maintenance capital expenditure as our estate increases in

size.

Result for the year

2015 2014

GBP'000 GBP'000

Revenue 59,979 45,480

Cost of sales (1,073) (1,040)

--------- ---------

Gross profit 58,906 44,440

Administration expenses (55,105) (39,452)

Exceptional costs (7,607) (2,653)

Other income 1,105 -

--------- ---------

Operating (loss) / profit (2,701) 2,335

Finance income 265 20

Finance costs (9,946) (11,797)

--------- ---------

Loss before tax (12,382) (9,442)

Tax credit 909 659

--------- ---------

Loss for the year (11,473) (8,783)

--------- ---------

Revenue

The strength of The Gym's member proposition has continued to be

reflected in our membership performance. Year end membership

numbers increased significantly in 2015, with 376,000 members at 31

December 2015 compared to 293,000 at 31 December 2014.

The average number of members increased by 31.0% during the year

to 355,000 (2014: 271,000), primarily due to the opening of 19 new

gyms. Average member numbers were split between mature sites of

234,000 and new sites of 121,000(5) . Average revenue per member

per month increased from GBP13.98 in 2014 to GBP14.08.

As a result Group revenue increased by 31.9% to GBP60.0 million

in the year ended 31 December 2015, from GBP45.5 million in the

year ended 31 December 2014.

(1) Group Adjusted EBITDA is calculated as operating profit

before depreciation, amortisation, exceptional items and other

income.

(2) Group Adjusted EBITDA before Pre-Opening Costs is defined as

Group Adjusted EBITDA excluding the costs associated with new site

openings.

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

(3) Adjusted Earnings is calculated as the Group's loss for the

year before amortisation, exceptional items, other income and the

related tax effect.

(4) Group Operating Cash Flow is calculated as Group Adjusted

EBITDA less working capital less maintenance capital

expenditures.

(5) Mature sites are defined as gyms that have been open for 24

months or more measured at the end of the year. New sites are

defined as gyms that have been open for less than 24 months at

the end of the year.

Administration expenses

Administration expenses increased by 39.7%, driven primarily by

an increase in the total number of gyms from 55 as at 31 December

2014 to 74 as at 31 December 2015. Due to the higher number of site

openings in 2015, pre-opening costs associated with new site

openings increased from GBP2.0 million to GBP2.7 million.

Property lease rentals and staff costs form a significant part

of our administration expenses. Property lease rentals increased

from GBP7.8 million in 2014 to GBP11.2 million in 2015 due to a

larger portfolio of gyms. Staff costs increased from GBP5.5 million

to GBP8.4 million. This was driven by both gym openings and head

office support staff costs.

Depreciation charges increased from GBP7.6 million in 2014 to

GBP10.9 million in 2015, largely as a result of the increased

number of sites. The Group's depreciation charges appear high in

relation to operating loss / profit as leasehold improvements and

fit-out costs start to be depreciated as soon as a gym is opened,

whereas it takes time for a gym to reach mature profit levels.

Head office costs increased from GBP4.0 million to GBP6.3

million. This is due to investments in key business functions,

including property, commercial and finance. We believe that our

core functions are now well-placed to support the growth of the

business in the foreseeable future.

Other income

Other income of GBP1.1 million relates to proceeds received in

relation to a lease surrender for one of the Group's sites that did

not reach opening.

Group Adjusted EBITDA

2015 2014

GBP'000 GBP'000

Operating (loss) / profit (2,701) 2,335

Exceptional items 7,607 2,653

Other income (1,105) -

Depreciation of property, plant and equipment 10,907 7,600

Amortisation of intangible assets 2,308 2,100

-------- ------------------

Group Adjusted EBITDA 17,016 14,688

-------- ------------------

Group Adjusted EBITDA increased during the year mainly due to

the increase in the number of gyms in operation resulting from the

Group's ongoing rollout strategy, and from gyms reaching maturity

in member numbers and revenue.

Group Adjusted EBITDA was adversely affected by pre-opening

costs, with gym openings being weighted towards the second half of

the year. Group Adjusted EBITDA before Pre-Opening Costs increased

by 18.1% to GBP19.7 million (2014: GBP16.6 million).

As a result of the ongoing rollout strategy Site EBITDA

contributed by the 40 mature sites demonstrated strong growth,

increasing by 15.9% to GBP18.8 million (2014: GBP16.2 million from

32 sites).

EBITDA from the 34 new sites performed strongly and increased by

81.2% to GBP4.5 million (2014: GBP2.5 million from 23 new sites).

Growth was driven by an increased number of new gyms and the

strength of gyms opened during 2014 and early 2015 as they mature.

This strong performance has offset losses associated with gyms

opening later in 2015 which are in the process of growing their

membership numbers. The impact of gym openings was magnified as a

result of 11 out of the 19 total openings occurring in the second

half of 2015.

Exceptional items

In the year ended 31 December 2015 exceptional costs of GBP7.6

million were incurred (2014: GBP2.7 million).

This includes GBP5.7 million of costs in relation to the Group's

IPO. An additional GBP2.6 million of costs associated with the

issue of new shares have been recognised within share premium.

In accordance with IFRS 2, a non-cash charge of GBP1.0m (2014:

GBPnil) has been recognised in respect of share options granted to

staff and senior managers in connection with the capital

restructuring on the date of the IPO.

Additionally GBP0.9 million was incurred in relation to the

exploration of strategic options prior to the IPO.

Finance costs

Finance costs decreased by 15.7% to GBP9.9 million in the year

ended 31 December 2015, from GBP11.8 million in the year ended 31

December 2014.

This included GBP1.6 million (2014: GBPnil) of exceptional

finance items relating to the write off of capitalised financing

fees and interest on finance lease creditors, which occurred as

part of the refinancing activity in November 2015. Excluding

exceptional items, finance costs decreased by 30.0%, driven

primarily by a decrease in preference share interest of GBP2.5

million following a change in the Company's Articles of Association

in 2014, and fair value gains on interest rate derivatives.

Finance costs will decrease in 2016 due to the refinancing

carried out in 2015. Based on the December 2015 interest charge,

the proforma annualised interest charge for 2015 was GBP0.8

million.

Taxation

The Group has incurred an income tax credit for the year ended

2015 of GBP0.2 million (2014: GBPnil) due to the trading loss

position and adjustments in respect of prior years. Trading losses

were offset by disallowable exceptional costs and disallowable

interest charges arising under the previous private equity funding

structure. A deferred tax credit of GBP0.7 million (2014: GBP0.7

million) has arisen in relation to the reversal of temporary

differences.

Earnings

The loss for the year increased from GBP8.8 million for the year

ended 31 December 2014 to GBP11.5 million for the year ended 31

December 2015 as a result of the factors discussed above.

Basic earnings per share ('EPS') was a loss of GBP0.19 (2014:

loss of GBP0.18).

Adjusted EPS was a loss of GBP0.02 (2014: loss of GBP0.09).

Adjusted EPS is calculated by excluding amortisation, exceptional

items, other income and the resultant tax effect from basic

earnings. The improvement in Adjusted EPS results from both an

increase in Adjusted Earnings and the dilution arising on the issue

of shares on IPO.

Dividend

Due to the short period of time between the IPO and the year

end, the Board has not recommended a final dividend for 2015.

The Directors intend to declare an interim dividend in respect

of the first half of 2016. The total dividend for 2016 is expected

to be 10% to 20% of Adjusted Earnings.

Cash Flow

2015 2014

GBP'000 GBP'000

Group Adjusted EBITDA 17,016 14,688

Movement in working capital 4,348 3,407

Maintenance capital expenditure(1) (2,748) (1,581)

--------- ---------

Group Operating Cash Flow 18,616 16,514

Expansionary capital expenditure(2) (28,230) (20,335)

Other income 1,105 -

Exceptional items (7,001) (2,653)

Taxation (73) (244)

Finance costs (4,108) (5,726)

IPO proceeds 89,931 -

Repayment of debt (89,842) (2,617)

Other net cash flows from financing activity 16,886 16,546

--------- ---------

Net cash flow (2,716) 1,485

--------- ---------

The Group continues to deliver strong cash generation with Group

Operating Cash Flow 12.7% higher at GBP18.6 million (2014: GBP16.5

million) due to an increase in EBITDA resulting from a greater

number of gyms and efficient use of working capital, offset by

increased investment in maintenance capital expenditure as the

estate grows. These factors result in a small decrease in Group

Operating Cash Flow Conversion(3) to 109.4% (2014: 112.4%).

Expansionary capital expenditure of GBP28.2 million arises as a

result of the fit-out of new gyms.

(1) Maintenance capital expenditure comprises the replacement of

gym equipment and premises refurbishment.

(2) Expansionary capital expenditure relates to the Group's

investment in the fit-out of new gyms and central IT projects. It

is stated gross of amounts funded by finance leasing (GBP3.1

million, 2014: GBP4.7 million) and net of contributions towards

landlord building costs.

(3) Group Operating Cash Flow Conversion is calculated as Group

Operating Cash Flow as a percentage of Group Adjusted EBITDA

2015 2014

GBP'000 GBP'000

Net debt at 1 January 49,205 36,743

Group Operating Cash Flow (18,616) (16,514)

Expansionary capital expenditure 28,230 20,335

Other non-operating cash flow (4,275) 8,641

IPO proceeds (89,931) -

Drawdown of new bank facility 10,000 -

Financing fees and costs of IPO 9,828 -

Repayment of shareholder loans 22,699 -

--------- ---------

Net debt at 31 December 7,140 49,205

--------- ---------

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

Proceeds from the Group's IPO of GBP89.9 million and a new term

loan of GBP10.0 million were used to repay GBP53.9 million of

borrowings under the Group's previous bank loan facilities

(including accrued interest), GBP22.7 million of outstanding

shareholder loans, GBP10.0 million of outstanding finance leases

and GBP8.8 million of cash costs associated with the IPO.

As a result of the Group's IPO and refinancing, combined with

the strong operating performance, Net Debt : Group Adjusted EBITDA

decreased to 0.42x (2014: 3.35x).

Balance sheet

Our business model, strong conversion from revenue to cash and

debt restructuring during the year results in an uncomplicated

balance sheet.

2015 2014

GBP'000 GBP'000

------------------------------- -------- --------

Non-current assets

Property, plant and equipment 85,237 67,510

Intangible assets 49,137 50,870

Deferred tax asset 177 -

------------------------------- -------- --------

Total non-current assets 134,551 118,380

------------------------------- -------- --------

Current assets

Inventories 122 75

Trade and other receivables 5,654 4,282

Cash and cash equivalents 2,860 5,576

------------------------------- -------- --------

Total current assets 8,636 9,933

------------------------------- -------- --------

Total assets 143,187 128,313

------------------------------- -------- --------

Current liabilities

Trade and other payables 25,546 20,797

Income taxes payable - 246

Borrowings - 3,613

------------------------------- -------- --------

Total current liabilities 25,546 24,656

------------------------------- -------- --------

Non-current liabilities

Borrowings 8,966 70,253

Provisions 232 223

Financial instruments - 1,037

Deferred tax liabilities - 559

------------------------------- -------- --------

Total non-current liabilities 9,198 72,072

------------------------------- -------- --------

Total liabilities 34,744 96,728

------------------------------- -------- --------

Net assets 108,443 31,585

------------------------------- -------- --------

The non-current assets of the Group have increased by GBP16.0

million to GBP134.4 million. This is as a result of capital

expenditure in property, plant and equipment and computer software

totaling GBP29.2 million, offset by depreciation and amortisation

of GBP13.2 million.

Cash balances have decreased as a result of the net funding of

the capital expenditure program from operating cash flows.

Other current assets primarily relate to prepaid property costs

and have remained consistent year on year. Trade and other payables

have increased by GBP4.7 million largely as a result of lease

incentives associated with new gyms opening during the year.

The Group has drawn GBP10.0 million of its 5 year bullet

repayment facility. GBP25.0 million of the facility was undrawn at

31 December 2015 and will be utilised to fund new sites, working

capital and capital expenditure.

Richard Darwin

Chief Financial Officer

14 March 2016

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2015

Note 31 December 2015 31 December 2014

GBP'000 GBP'000

Revenue 59,979 45,480

Cost of sales (1,073) (1,040)

Gross profit 58,906 44,440

Administration expenses (62,712) (42,105)

Other income 1,105 -

Operating (loss) / profit 3 (2,701) 2,335

Being:

-------------------------------------------------------------- ----- ----------------- -----------------

- Group Adjusted EBITDA(1) 17,016 14,688

- Depreciation 9 (10,907) (7,600)

- Amortisation (2,308) (2,100)

- Exceptional items and other income 3, 4 (6,502) (2,653)

--------------------------------------------------------------- ----- ----------------- -----------------

Finance income 6 265 20

Finance costs 7 (9,946) (11,797)

Loss before tax (12,382) (9,442)

Tax credit 8 909 659

Loss for the year attributable to equity shareholders (11,473) (8,783)

----------------- -----------------

Other comprehensive income for the year - -

Total comprehensive loss attributable to equity shareholders (11,473) (8,783)

----------------- -----------------

Earnings per share GBP GBP

Basic and Diluted 5 (0.19) (0.18)

Adjusted 5 (0.02) (0.09)

----------------- -----------------

(1) Group Adjusted EBITDA is a non-GAAP metric used by

management and is not an IFRS disclosure

Consolidated Statements of Financial Position

As at 31 December 2015

Note 31 December 2015 31 December 2014 31 December 2013

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 9 85,237 67,510 51,418

Intangible assets 49,137 50,870 52,738

Deferred tax asset 177 - -

Total non-current assets 134,551 118,380 104,156

Current assets

Inventories 122 75 138

Trade and other receivables 5,654 4,282 3,060

Cash and cash equivalents 2,860 5,576 4,091

Total current assets 8,636 9,933 7,289

Total assets 143,187 128,313 111,445

---------------- ---------------- ----------------

Current liabilities

Trade and other payables 25,546 20,797 14,125

Income taxes payable - 246 -

Borrowings 10 - 3,613 2,363

Total current liabilities 25,546 24,656 16,488

Non-current liabilities

Borrowings 10 8,966 70,253 106,195

Provisions 232 223 131

Derivative financial instruments - 1,037 177

Deferred tax liabilities - 559 1,708

---------------- ---------------- ----------------

Total non-current liabilities 9,198 72,072 108,211

---------------- ---------------- ----------------

Total liabilities 34,744 96,728 124,699

---------------- ---------------- ----------------

Net assets / (liabilities) 108,443 31,585 (13,254)

---------------- ---------------- ----------------

Capital and reserves

Issued capital 12 9 8

Own shares held 48 - -

Capital redemption reserve 4 - -

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

Share premium 136,280 48,974 550

Retained deficit (27,901) (17,398) (13,812)

---------------- ---------------- ----------------

Total equity shareholders' funds / (deficit) 108,443 31,585 (13,254)

---------------- ---------------- ----------------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2015

Capital

Own shares redemption Retained

Issued Capital held reserve Share Premium deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2014 8 - - 550 (13,812) (13,254)

Loss for the year

and total

comprehensive

loss - - - - (8,783) (8,783)

Waiver of

preference share

interest - - - - 5,197 5,197

Issue of Ordinary

share capital 1 - - 29 - 30

Reclassification

of preference

shares - - - 48,395 - 48,395

At 31 December

2014 9 - - 48,974 (17,398) 31,585

Loss for the year

and total

comprehensive

loss - - - - (11,473) (11,473)

Share based

payments - - - - 1,018 1,018

Conversion of

Preference share

capital into

Ordinary share

capital 2 - - - - 2

Cancellation of

share capital (4) - 4 - - -

Issue and

repurchase of

share capital - 48 - - (48) -

Costs associated

with the issue of

share capital - - - (2,620) - (2,620)

Issue of Ordinary

share capital 5 - - 89,926 - 89,931

At 31 December

2015 12 48 4 136,280 (27,901) 108,443

-------------- -------------- ------------- ------------- -------------- --------

Consolidated Cash Flow Statement

For the year ended 31 December 2015

Note 31 December 2015 31 December 2014

GBP'000 GBP'000

Cash flows from operating activities

Operating (loss) / profit (2,701) 2,335

Adjustments for:

Other income (1,105) -

Exceptional items 4 7,607 2,653

Depreciation of property, plant and equipment 9 10,907 7,600

Amortisation of intangible assets 2,308 2,100

Loss on disposal of property, plant and equipment 98 39

(Increase) / decrease in inventories (47) 65

Increase in trade and other receivables (1,372) (1,223)

Increase in trade and other payables 5,669 4,526

----------------- -----------------

Cash generated from operations 21,364 18,095

Tax paid (73) (244)

Interest paid (4,124) (5,726)

----------------- -----------------

Net cash flows from operating activities before exceptional items

and other income 17,167 12,125

Other income 1,105 -

Exceptional items (7,001) (2,653)

----------------- -----------------

Net cash flow from operating activities 11,271 9,472

----------------- -----------------

Cash flows from investing activities

Proceeds from disposals of property, plant and equipment - 1,036

Purchase of property, plant and equipment (27,330) (17,785)

Purchase of intangible assets (575) (231)

Interest received 16 -

----------------- -----------------

Net cash flows used in investing activities (27,889) (16,980)

----------------- -----------------

Cash flows from financing activities

Proceeds of issue of Ordinary shares 89,931 30

Drawdown of bank loans 17,500 11,580

Payment of financing fees (1,067) -

Costs associated with IPO (2,620) -

Repayment of bank loans (53,902) -

Repayment of shareholder loans (22,699) -

Repayment of finance leases (13,241) (2,617)

----------------- -----------------

Net cash flows from financing activities 13,902 8,993

----------------- -----------------

Net (decrease) / increase in cash and cash equivalents (2,716) 1,485

Cash and cash equivalents at 1 January 5,576 4,091

----------------- -----------------

Cash and cash equivalents at 31 December 2,860 5,576

----------------- -----------------

Notes

1. General information

The financial information, comprising of the consolidated

statement of comprehensive income, consolidated statements of

financial position, consolidated statement of changes in equity,

consolidated cash flow statement and related notes, has been

extracted from the consolidated financial statements of The Gym

Group Plc ('the Company') for the year ended 31 December 2015,

which were approved by the Board of Directors on 14 March 2016.

The financial information does not constitute statutory accounts

within the meaning of sections 435(1) and (2) of the Companies Act

2006 or contain sufficient information to comply with the

disclosure requirements of International Financial Reporting

Standards ('IFRS'). An unqualified report on the consolidated

financial statements for the year ended 31 December 2015 has been

given by the auditors Ernst & Young LLP. It did not include

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report and did not contain

any statement under section 498 (2) or (3) of the Companies Act

2006.

The consolidated financial statements for the year ended 31

December 2015 will be filed with the Registrar of Companies,

subject to their approval by the Company's shareholders at the

Company's Annual General Meeting on 15 May 2016.

2. Basis of preparation

The consolidated financial statements have been prepared on a

going concern basis under the historical cost convention as

modified by the recognition of financial liabilities (including

derivative instruments) at fair value through the profit and

loss.

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

This is the Group's first set of financial statements prepared

in accordance with IFRS. The Group previously prepared its

financial statements under UK Generally Accepted Accounting

Practice. The Group's deemed transition date to IFRS is 1 January

2014, the beginning of the first period presented, and the

requirements of IFRS 1 First-time Adoption of International

Financial Reporting Standards ('IFRS 1') have been applied as of

that date.

The Directors have made appropriate enquiries and formed a

judgement at the time of approving the financial statements that

there is a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. For this reason the Directors continue to adopt the going

concern basis in preparing the financial statements.

3. Operating loss / profit

Operating loss / profit is stated after charging / (crediting): 2015 2014

GBP'000 GBP'000

Other income (1,105) -

Depreciation of property, plant and equipment 10,907 7,600

Amortisation of intangible assets (included in administration expenses) 2,308 2,100

Operating lease rentals 11,186 7,781

Loss on disposal of property, plant and equipment 98 39

Cost of inventory recognised as an expense 197 225

-------- --------

Auditors' remuneration

Fees payable for the audit of the Company's annual accounts 40 6

Fees payable for other services

Audit of the Company's subsidiaries pursuant to legislation 50 37

Tax compliance services - 25

Tax advisory services 3 -

Reporting accountant services in relation to IPO 883 -

Other non-audit services in relation to IPO 42 -

Corporate finance services 126 -

-------- --------

1,144 68

-------- --------

The amounts above for 2015 relate to Ernst & Young LLP, with

the comparative figures in 2014 relating to Grant Thornton UK

LLP.

Other income received in the year of GBP1,105,000 (2014: GBPnil)

relates to a payment received on the surrender of a lease.

4. Exceptional items

2015 2014

GBP'000 GBP'000

Costs in relation to IPO 5,731 -

Share based payment costs associated with IPO 1,018 -

Exploration of strategic options 809 -

Costs in relation to aborted merger with Pure Gym 49 1,950

Gym relocation - 703

-------- --------

7,607 2,653

-------- --------

An additional GBP2,620,000 of exceptional costs associated with

the issue of share capital as part of the IPO have been recognised

directly in reserves.

5. Earnings per share

Basic earnings per share is calculated by dividing the profit or

loss attributable to equity shareholders by the weighted average

number of Ordinary shares outstanding during the year.

As the Company issued shares and changed its capital structure

on IPO, the number of shares in the prior period has been adjusted

to match the post restructuring position such that the figures

remain comparable.

Diluted earnings per share is calculated by adjusting the

weighted average number of Ordinary shares outstanding to assume

conversion of all dilutive potential Ordinary shares. During the

current and prior year the Group had no convertible financial

instruments, options or other dilutive instruments.

The following reflects the income and share data used in the

basic earnings per share calculation:

2015 2014

Loss for the year GBP'000 (11,473) (8,783)

Basic and diluted weighted average number of shares 60,485,605 48,802,414

Basic and diluted earnings per share GBP (0.19) (0.18)

----------- -----------

Adjusted earnings per share is based on profit for the year

before exceptional items, amortisation and their associated tax

effect.

2015 2014

GBP'000 GBP'000

Loss for the year (11,473) (8,783)

Amortisation of intangible assets 2,308 2,100

Other income (1,105) -

Exceptional administration expenses 7,607 2,653

Exceptional finance costs 1,623 -

Tax effect of amortisation and exceptional items (67) (422)

----------- -----------

Adjusted earnings (1,107) (4,452)

----------- -----------

Basic weighted average number of shares 60,485,605 48,802,414

Adjusted earnings per share GBP (0.02) (0.09)

----------- -----------

6. Finance income

2015 2014

GBP'000 GBP'000

Bank interest receivable 16 20

Fair value gains on derivative financial instruments 249 -

-------- --------

265 20

-------- --------

7. Finance costs

2015 2014

GBP'000 GBP'000

Bank loans and overdrafts 4,950 4,937

Shareholder loans 1,809 1,899

Preference share interest - 2,533

Finance leases and hire purchase contracts 1,112 1,073

Unwinding of discount 9 3

Amortisation of financing fees 443 492

Exceptional finance costs 1,623 -

Fair value losses on derivative financial instruments - 860

-------- --------

9,946 11,797

-------- --------

Exceptional finance costs comprise the write-off of GBP1,290,000

of outstanding capitalised financing fees and interest incurred on

the repayment of finance lease creditors of GBP333,000.

8. Taxation

The major components of taxation are:

(a) Tax on profit

2015 2014

GBP'000 GBP'000

Current income tax

Current tax on profits for the year - 246

Adjustments in respect of prior years (173) 244

-------- --------

Total current income tax (173) 490

Deferred tax

Origination and reversal of temporary differences (700) (628)

Change in tax rates (91) 44

Adjustments in respect of prior years 55 (565)

-------- --------

Total deferred tax (736) (1,149)

Tax credit in the Income Statement (909) (659)

-------- --------

(b) Reconciliation of tax credit

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

The tax on the Group's loss before tax differs from the

theoretical amount that would arise using the weighted average rate

applicable to losses of the Group as follows:

2015 2014

GBP'000 GBP'000

Loss before tax (12,382) (9,442)

Tax calculation at standard rate of corporation tax of 20.25% (2014: 21.49%) (2,507) (2,029)

Expenses not deductible for tax purposes 786 1,647

Exceptional IPO costs not deductible 1,023 -

Change in tax rates (93) 44

Adjustments in respect of prior years (118) (321)

--------- --------

(909) (659)

--------- --------

(c) Deferred tax

During the year the Group recognised the following deferred tax

assets and liabilities:

Accelerated capital

allowances Losses Intangible assets Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2013 (1,386) 1,683 - 125 422

Prior year adjustment (177) 213 - (30) 6

Acquisitions - - (1,898) - (1,898)

Recognised in income

statement (414) (315) 248 (29) (510)

Change in deferred tax rate 264 (198) 215 (9) 272

At 31 December 2013 (1,713) 1,383 (1,435) 57 (1,708)

Prior year adjustment 526 39 - - 565

Recognised in income

statement (581) 829 393 (57) 584

At 31 December 2014 (1,768) 2,251 (1,042) - (559)

Prior year adjustment (55) - - - (55)

Recognised in income

statement 1,545 (1,245) 400 - 700

Change in deferred tax rate 91 - - - 91

At 31 December 2015 (187) 1,006 (642) - 177

--------------------------- -------- ------------------ -------- --------

9. Property, plant and equipment

Fixtures,

Leasehold fittings and Gym and other Computer

improvements equipment equipment equipment Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2013 32,780 2,265 15,276 272 50,593

Additions 9,080 818 4,264 95 14,257

Disposals (19) - (280) (2) (301)

At 1 January 2014 41,841 3,083 19,260 365 64,549

Additions 15,978 1,054 7,526 178 24,736

Disposals (1,067) (104) (1,129) (10) (2,310)

At 31 December

2014 56,752 4,033 25,657 533 86,975

Additions 17,364 1,549 9,428 391 28,732

Disposals (89) (13) (298) - (400)

At 31 December

2015 74,027 5,569 34,787 924 115,307

------------------ ----------------- ------------------ ------------------ --------

Accumulated

depreciation

At 1 January 2013 2,276 523 4,496 137 7,432

Charge for the

year 1,961 524 3,411 83 5,979

Disposals - - (280) - (280)

At 1 January 2014 4,237 1,047 7,627 220 13,131

Charge for the

year 2,602 672 4,225 101 7,600

Disposals (233) (47) (980) (6) (1,266)

At 31 December

2014 6,606 1,672 10,872 315 19,465

Charge for the

year 5,745 656 4,329 177 10,907

Disposals (42) (7) (253) - (302)

At 31 December

2015 12,309 2,321 14,948 492 30,070

------------------ ----------------- ------------------ ------------------ --------

Net book value

At 31 December

2013 37,604 2,036 11,633 145 51,418

At 31 December

2014 50,146 2,361 14,785 218 67,510

At 31 December

2015 61,718 3,248 19,839 432 85,237

------------------ ----------------- ------------------ ------------------ --------

10. Borrowings

2015 2014 2013

GBP'000 GBP'000 GBP'000

Non-current

Bank facility A 10,000 - -

Former bank facility A (principal and PIK interest) - 34,813 31,786

Former bank facility B (principal and PIK interest) - 9,800 1,010

Finance leases - 6,555 5,675

Shareholder loans and accrued interest - 20,785 18,992

Preference share capital and accrued interest - - 50,924

Loan arrangement fees (1,034) (1,700) (2,192)

-------- -------- --------

8,966 70,253 106,195

-------- -------- --------

Current

Finance leases - 3,613 2,363

-------- -------- --------

The Group's bank borrowings are secured by way of fixed and

floating charges over the Group's assets.

On 12 November 2015 the Group refinanced its former bank

facilities and shareholder loans using the net proceeds of its

IPO.

HSBC and Barclays bank facility

On 12 November 2015 the Group entered into a new 5 year bullet

repayment facility with HSBC and Barclays. The facility comprises a

GBP10.0 million term loan ('facility A') for the purposes of

refinancing the Group's finance leases, a GBP25.0 million term loan

('facility B') to fund acquisitions and capital expenditure, and a

GBP5.0 million revolving credit facility. Interest is charged at

LIBOR plus a 2.5% margin.

At 31 December 2015, facility A was fully drawn and facility B

and the revolving credit facility were undrawn.

Four year record

2015 2014 2013(1) 2012(1)

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 59,979 45,480 35,734 22,264

Group Adjusted EBITDA 17,016 14,688 11,752 6,000

Group Adjusted EBITDA before Pre-Opening Costs 19,681 16,668 12,886 7,615

Group Operating Cash Flow 18,616 16,514 14,751 9,624

Operating Cash Flow Conversion 109.4% 112.4% 125.5% 160.4%

Expansionary Capital Expenditure 28,230 20,335 14,058 21,645

Net Debt 7,140 49,205 36,743 18,979

Net Debt to Adjusted EBITDA 0.42x 3.35x 3.11x 3.16x

Group Adjusted earnings (1,107) (4,452) (3,551) (958)

Adjusted earnings per share GBP (0.02) (0.09) (0.13) (0.04)

Total number of gyms (number) 74 55 40 32

Number of members ('000) 376 293 225 166

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

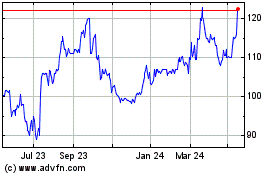

The Gym (LSE:GYM)

Historical Stock Chart

From Jun 2024 to Jul 2024

The Gym (LSE:GYM)

Historical Stock Chart

From Jul 2023 to Jul 2024