TIDMGWMO

RNS Number : 7888W

Great Western Mining Corp. plc

28 April 2021

GREAT WESTERN MINING CORPORATION PLC

("Great Western" or the "Company")

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2020

Great Western Mining Corporation PLC (AIM - GWMO, Euronext

Growth - 8GW), which is exploring and developing multiple

early-stage gold, silver and copper targets in Nevada, USA,

announces its results for the year ended 31 December 2020. The

Company is in the exploration, appraisal and development phase and

currently has no revenues.

Financial Highlights:

-- Loss for year EUR852,042 (2019: loss of EUR815,795)

-- Basic and diluted loss per share 0.001 (cent): (2019: 0.001)

-- Net assets at year-end: EUR7.9 million (2019: EUR6.2 million)

-- Cash at 31 December 2020: EUR2.2 million (2019: EUR0.3 million)

Operational Highlights

-- Precious metal poured at the year end proved the concept of

secondary recovery from multiple spoil heaps at Mineral Jackpot

-- 4-year option to acquire the Olympic Gold Project signed and

two geophysical surveys conducted to define drill locations for

2021

-- Soil sampling, rock sampling, trenching and geophysical

survey used to define drill locations at the previously unexploited

Rock House Group

-- Magnetometer survey over the Mineral Jackpot Group

-- Strengthened the Board with the addition of two experienced non-executive directors

Post Period End

-- Drilling programme on Olympic Gold Project commenced April 2021

-- Placing of new shares raised GBP1 million (EUR1.15 million) -

proceeds will be used to accelerate exploitation of gold prospects

and expand the Company's work programme for the current year

-- Independent test results indicated gravity separation as

viable production method for processing material from Mineral

Jackpot spoil heaps

-- Independent metallurgical consultant engaged to prepare

specifications and detailed costing for proposed processing

operations

-- Migration of share settlement system from CREST to Euroclear

Bank successfully completed

Brian Hall, Executive Chairman, commented: "During a difficult

year for everybody, we made strong progress on our projects and

successfully secured funds for our operations. The results of our

work in 2020 have enabled us to initiate a major drilling programme

across our three prime areas of interest, now under way, while

laboratory testing has shown the way forward for secondary recovery

of precious metals from numerous spoil heaps at the historic gold

and silver workings on our extensive inventory of claims, which we

are progressing with vigour.

"Importantly, we are well funded for the current year and are at

an inflexion point for the Company, with a growing portfolio, from

which we have already poured our first gold, and a clear line of

sight to long-term processing as well as the added value of our

copper assets. We have a busy year ahead, with our ongoing drilling

programme and we are extremely excited by our prospects."

For further information:

Great Western Mining Corporation PLC

Brian Hall, Chairman +44 207 933 8780

Max Williams, Finance Director +44 207 933 8780

Davy (NOMAD, Euronext Growth Adviser

& Joint Broker)

John Frain +353 1 679 6363

Novum Securities (Joint Broker)

Jon Belliss +44 207 399 9400

ETX Capital (Joint Broker)

Thomas Smith +44 207 392 1494

Walbrook PR (PR advisers)

Nick Rome/Nicholas Johnson +44 207 933 8783

Executive Chairman's Statement

For the year ended 31 December 2020

Dear Shareholder,

Herewith your Company's Annual Report and audited Financial

Statements for the year ended 31 December 2020. Great Western is an

exploration and development company which does not yet generate

commercial revenues and is reporting a loss for the year of

EUR852,042 (2019: EUR815,795), net assets of EUR7,919,625 (2019:

EUR6,234,087) and net cash of EUR2,287,172 (2019: EUR306,675). The

Company has no debt apart from current creditors arising in the

normal course of business and is not a party to any disputes.

Great Western explores for and exploits precious and base metals

in Mineral County, Nevada, USA where it operates multiple 100%

owned claims and has over 17,000 acres under licence.

During the reporting year we strengthened our cash position

through four placings of new shares; acquired an option to purchase

the Olympic Gold Project in Nevada where we have since carried out

two separate geophysical surveys; evaluated spoil heaps at the

Mineral Jackpot property and, at the very end of the year, poured a

trial quantity of gold and silver as a pilot scheme for processing

operations; doubled the mineralisation footprint at Mineral

Jackpot; and established the potential for gold and silver at the

Rock House ('RH') group of claims which have never before been

explored or exploited.

At the Annual General Meeting in 2020 we were pleased to welcome

two experienced Non-Executive Directors to the Board who have now

been elected by shareholders. Andrew Hay has spent a long career in

banking and finance and is former head of corporate finance at the

Edmond de Rothschild in London. He is now a Senior Adviser at Smith

Square Partners, a leading UK corporate finance advisory firm.

Alastair Ford has spent his entire career in or associated with the

mining industry, at different times as an analyst, journalist and

asset manager. These two appointees have both previously been

directors of listed companies and are making a strong

contribution.

During 2020 our focus was almost entirely on gold and silver.

Our target for gold is a resource of 1.5 million ounces but this is

of course subject to the success of our ongoing exploration

efforts. We have already established an inferred and indicated

copper resource of 4.28 million tonnes of 0.45% copper for 19,000

tonnes of contained copper metal at a 0.2% cut-off grade, which

represents considerable progress but still falls far short of an

economic resource and requires further capital expenditure. The

Company's current policy is to accelerate its numerous and more

accessible gold and silver prospects, while seeking a strong joint

venture partner for development of the copper potential. We have

had two separate approaches from third parties but neither has met

our criteria and we actively continue to seek an appropriate

partner. In the meantime, there are no outstanding work commitments

beyond manageable annual lease rentals.

Our three primary gold and silver prospects are (1) the Mineral

Jackpot claims on the Black Mountain group, consisting of five

historic mines, which we have managed to link together through

mapping and thereby double the area of potential mineralisation;

(2) the RH (Rock House) Group which has never previously been

explored but where we have identified strong indications of gold

and silver, carried out trenching, a geophysical survey and

processed small quantities of gold and silver from float material;

and (3) the Olympic Gold Project where we acquired a 4 year

purchase option in May 2020 and have since carried out two

geophysical surveys which have allowed us to plan a drilling

programme for 2021. More detailed information on all these

prospects is to be found in the operations section of the Annual

Report.

New gold mines are not developed overnight and, as an interim

measure, we are assessing how to exploit the numerous spoil heaps

from past mine workings at Mineral Jackpot and elsewhere for

secondary recovery of precious metals. At Mineral Jackpot alone

there are approximately 38 spoil heaps, estimated to aggregate up

to 12,000 tonnes of material. We set ourselves a challenging target

of pouring first precious metal from a pilot scheme by the end of

2020. This was a difficult exercise, not helped by the

pandemic-related trans-Atlantic travel ban, but at the very end of

the year we achieved this objective with only a day or two to

spare. We therefore proved the concept by producing a single small

doré bar comprising a mix of gold, silver and some other minerals

and we still have a lot of material left to be processed, as our

small team on site is currently multi- tasking over all our

projects and our team members in the UK and Ireland continue to

face travel restrictions at the time of writing. A balancing act

and careful planning is constantly needed to prioritise the tasks

in hand among only a very few people and to make sure we keep our

projects moving ahead. Processing the remaining material together

with additional material from our trenching exercise at RH is

work-in-progress.

During the first quarter of 2021 a metallurgical laboratory in

the UK carried out a full analysis of a sample load of spoil heap

material from Mineral Jackpot, with an initial calculated grade of

1.26 g/t gold and 434 g/t silver, and the results of this were

announced at the beginning of April. This analysis concluded that

gravity separation of the material will be a viable production

method and that a much more complex and expensive cyanide leaching

project, requiring a high level of environmental approvals, would

not significantly increase recovery of precious metals. Under test

conditions at the laboratory, material ground to a diameter of

0.35mm liberated 50% of available gold and 40% of available silver.

This was further improved when the material was ground to 0.25mm

diameter, yielding an enriched concentrate that assayed up to 140

grams gold and 20,000 grams silver per tonne processed. It is

important to stress that while these results are extremely

encouraging, they cannot be directly extrapolated over 38 widely

dispersed spoil heaps which may have varying characteristics.

However, we now have sufficient data from which to evaluate a

potential production project and have contracted an independent

metallurgical consultant who is

preparing specifications and detailed costings.

Looking ahead, with regulatory approvals now in place, we have

this month commenced a 10,000-foot drilling programme with a

Reverse Circulation rig which we have under contract. In addition,

we have contracted a much smaller and more easily transportable

coring rig for accessing difficult mountainous areas and with these

two units we shall be drilling at all three of our primary gold and

silver target areas. Although our main objective is precious

metals, we also aim to drill at least one hole on the M4 prospect

with the aim of defining a copper lead.

Away from field operations, we expect to formulate a workable

plan for exploitation of the spoil heaps in the near future. Our

basic 2021 programme was already funded but In March we undertook a

placing of new shares for cash and raised GBP1 million before

transaction expenses which will enable us to expand our programme

if our drilling yields promising results. In addition to our

existing assets and the recently acquired Olympic Gold Project

option, we are actively seeking further precious metals

opportunities for exploration, to spread our risk and maximise the

opportunity for a company-maker discovery.

Since the year end, we have successfully migrated our share

settlement operations from CREST in London to the Euroclear Bank in

Belgium, being a post-Brexit requirement for Irish public

companies. This was a complicated and lengthy exercise which we

have managed to achieve at minimum cost and which also required the

active voting participation of shareholders in order to succeed,

for whose support we are very grateful.

Details of the Annual General Meeting will be advised to

shareholders in the near future.

We have a very active ongoing programme and a number of

excellent prospects to work on. We cannot assure success on all of

them but believe we have a wide enough spread of really interesting

opportunities to be able to create real value for Great Western's

shareholders. On behalf of our small, dedicated team, I would like

to thank our wide base of nearly 4,000 underlying shareholders for

their continuing support. We will publish operational updates

whenever appropriate throughout the year.

Yours sincerely,

Brian Hall

Executive Chairman

Operations Report

For the year ended 31 December 2020

Principal activities, strategy and business model

The principal activity of the Group is to explore for and

develop gold, silver, copper and other minerals. The Board aims to

increase shareholder value by the systematic evaluation and

exploitation of its existing assets in Mineral County, Nevada, USA

and elsewhere as may become applicable.

Great Western's near-term objective is to develop small scale,

short lead-time gold and silver projects which can potentially be

brought into production under the control of the Group.

The Group's secondary objective is to progress the copper

projects which it has already identified and enhanced through

extensive drilling. Such projects have potential for the discovery

of large mineralised systems which can be monetised over the longer

term, possibly through joint ventures with third parties.

Business development and performance

During the twelve months ended 31 December 2020, Great Western

carried out exploration across its portfolio of six 100% owned

claims groups in Nevada and in May 2020 entered an option agreement

over the Olympic Gold group of claims, increasing the Group's claim

position by 48 claims.

In September 2020 as part of the annual claim renewal procedure,

the Group reduced its land position through the relinquishment of

119 claims in the JS, EM and BM Groups which were considered no

longer to have strategic value to the Group. Following renewal, the

land position held by Great Western in Mineral County consists of

728 full and fractional unpatented claims, covering a total land

area of approximately 58.9 km(2).

Review by Project

The Black Mountain Group of Claims

The Black Mountain Group ("BM") lies on a south-west trending

spur ridge of the Excelsior Range of mountains and comprises 249

full and fractional claims covering approximately 20.7 km(2).

During 2020, the Company conducted a magnetometer survey over

the northern apart of the prospect, around the former workings of

the Mineral Jackpot mine. Results were very encouraging - appearing

to show a strong correlation between magnetic signatures and known

vein structures. This should allow for expansion of the survey into

prospective areas where there are currently no known veins in the

search for new structures.

During the autumn, a team was organised to collect prospective

vein material from numerous spoil heaps that are scattered around

the former workings at Mineral Jackpot. Several tonnes of material

were collected and bought down to a small purpose-built gravity

pilot plant erected nearby. 130 kg of this material was split off

and shipped to a professional testing facility in the U.K., to

process in conjunction with the bulk of the material. The U.K.

testing facility was engaged to run leaching amenability tests, as

well as gravity amenability tests, with work ongoing at the year

end. Of the remaining material, the majority was successfully run

through the pilot gravity circuit, and a small doré bar of precious

metal produced with further processing planned for the current

year.

As well as precious metals, the copper potential at M2 is

significant and the M2 Deep Target is buried far beneath the

existing M2 copper oxide resource which was defined by an earlier

geophysical survey. This target could potentially extend the

current copper resource for a further 500m along strike. In 2019

two drill locations were permitted with the BLM in order to drill

test the target and they remain current and valid.

The Olympic Gold Group of Claims

In May, the Company acquired an option to purchase the Olympic

Gold Project, a group of 48 claims, located approximately 50 miles

from Great Western's original concessions but still within Mineral

County. The purchase consideration of $150,000 is spread over four

years during which time Great Western has full rights to all data

and to conduct exploration and appraisal work. Great Western may

elect to bring forward the closing of the purchase by early-paying

the schedule in full or it may exit the project at any time without

penalty and without completing the payment schedule. Work is in

progress on several potential prospects over this 800 acre

site.

The Olympic Gold Group of Claims (continued)

The Olympic Gold Project lies on the northern flanks of the

Cedar Mountain Range, on the eastern edge of Mineral County. It

lies within the Walker Lane Fault Belt, at the intersection of two

major mineral trends - the Rawhide-Paradise Peak trend, and the

Aurora-Round Mountain Trend. The mineral deposit type at Olympic is

of low sulphidation epithermal banded quartz-gold vein style.

Historic production from the former Olympic Gold Mine totalled

approximately 35,000 tonnes, at a grade of 25 g/t gold and 30 g/t

silver, in the interwar period of 1918 to 1939. Great Western

believes that faulted offsets of the high-grade Olympic Vein still

remain to be discovered in the area and this forms one of the

numerous target zones on the prospect.

During 2020 a rock sampling programme verified the historical

results provided as part of the option agreement package,

indicating mineralisation to be present across the claim block. A

magnetometer survey covering the sites of the mineralisation was

undertaken, leading to the discovery of a further buried target to

the east of the Trafalgar Hill prospect. The magnetics survey also

defined an anomaly to the east of the OMCO fault, the target area

containing a projected faulted slice of the Olympic vein.

The RH Group of Claims

The M7 gold-silver prospect lies within the Rock House ("RH")

group of claims. This area is accessible and lends itself to mining

operations but was never mined in the past, its potential having

only recently been identified through satellite imagery. It is a

circular structure associated with a magnetic low, adjacent to the

prolific Golconda thrust fault. The area is characterised by

intense argillic and sericitic alteration, along with

silicification and oxidation, within basement siltstones and

slates.

During 2020 a trenching programme was enacted over the Eastern

Shear Zone ("ESZ") and the Southern Alteration Zone ("SAZ"),

designed to target the anomalies detected in the earlier soil

programme. The trenches were designed to cross-cut the major

northwest to southeast structure mapped at the ESZ, and to better

expose the alteration assemblage at the SAZ. Best assays of 1.5m @

0.23 g/t Au and 1.5m @ 0.1 g/t Au from trench 5 in the SAZ, within

a sheared and altered carbonate unit, intruded by a felsic

intrusive, point to the promise of the area. Although no reportable

intercepts were encountered in the trenches excavated in the ESZ, a

10kg float sample was recovered from near the area of trench 2 and

assayed, producing a small prill of gold and silver. A magnetometer

survey was conducted over both the ESZ and the SAZ. Although the

survey did not pick up the main structure at the ESZ, a magnetic

high under the alluvium to the east and south of the zone was

defined, potentially indicating a buried intrusive body. The survey

over the SAZ showed a broad magnetic low to the east of the SAZ,

running north east to south west, which is likely related to a

buried fault structure underneath the alluvium. This fault may be a

range front fault, of which similar structures throughout Nevada

are known to host important gold deposits, or it may be related to

the Golconda fault system, an earlier thrust fault system that

hosts the prolific Candelaria silver deposit to the east.

The Huntoon Group of Claims

107 full and 12 fractional claims surround the workings of the

historic underground Huntoon gold mine and are prospective for

gold, silver and copper mineralisation. The claims are located on

the northwest side of the Huntoon Valley, covering approximately 10

km2. The Company is actively planning further exploration and in

parallel identifying opportunities for achieving near-term

production.

The JS Group of Claims

The M5 gold prospect lies within the JS Group in altered

siliceous host rock, exposed beneath Tertiary volcaniclastics for

1km. Gold, Arsenic and Antimony were all anomalous in samples taken

along a north-easterly crest of the central ridge at M5 and the

coincidence of anomalous pathfinder geochemistry and altered

sediments strongly suggests the presence of sediment hosted

disseminated gold mineralisation.

The M4 Copper-Gold project also lies within the JS Group. The M4

copper target was identified through geophysical surveys, soil

sampling and mapping of mineralised structures on surface. Great

Western believes that the breccia vein intercepted in hole M4_05,

along with other veins mapped at surface, could be offshoot

structures in the roof of a buried sulphide orebody. In 2019 the

Group received a drill permit application to follow up on the

exciting discovery in hole M4_05 and remains current.

The EM Group of Claims

The M8 copper prospect lies within the EM Group which contains

the historic Eastside Mine where high-grade copper-oxide ore was

mined from shallow underground workings during the First World War.

Conoco investigated Eastside as a copper porphyry prospect in the

early 1970's, identifying mineralisation consisting of substantial

copper and molybdenum values, within a north east trending graben

structure. Drilling by Conoco at the southern end of this structure

identified thick successions of alteration, and copper enrichment.

They did no further work to follow up on these results. The Company

regards the northerly continuation of this structure to be a strong

target for buried copper mineralisation, which remains

untested.

The Tun Group of Claims

The M6 gold-silver prospect lies within the TUN Group. The M6

prospect is a parallel system of multiple, oxide and sulphide,

gold-silver veins and veinlet stockworks. Supergene, high-grade

ores have been mined in the past at M6 and the potential remains

for deposits of shallow, oxidised stockworks in the immediate

vicinity of the historic workings.

Summary of 2020 Work Programme

-- Portfolio of claims reorganised by acquiring new claims with

precious metals potential and relinquishing old claims with no

remaining potential.

-- Collection of spoil heap material from the Mineral Jackpot

area, and production of a gold and silver bar.

-- Magnetometer survey over the Mineral Jackpot prospect.

-- Rock sampling over the Olympic Gold Project.

-- Magnetometer survey over the Olympic Gold Project.

-- Trenching and sampling at RH Group.

-- Magnetometer survey at RH Group.

Forward to 2021

2021 is scheduled to be a busy and exciting year for Great

Western, although the ongoing impact of Covid-19 may cause

continued challenges, given the overriding need to safeguard the

Company's employees and contractors and to comply fully with all

government directives. Numerous precious metal targets have been

identified from the 2020 field campaigns where drilling activities

will commence on the most promising of these as soon as

applications for surface disturbance works have been approved.

Approval for drilling at the Olympic project was granted in April

2021, with a drill rig mobilising shortly after. Drilling is also

taking place at the M4 copper project, with a light drill rig

currently set up on one of the eastern drill pads. At the other

prospects, rock and soil sampling will be continued to identify

future targets with a view to accelerating their exploitation. A

contract for a Reverse Circulation rig has been signed and a 10,000

feet (3,000 metre) programme is due to commence at the beginning of

the second quarter, starting at the Olympic property. A lighter,

easily deployable rig has also been identified and signed up with a

capability of drilling up to 90 feet and the Company is upgrading

this to increase its capability to 200 feet. On the processing

side, the Company will process more material through gravity

separation and work on developing a longer-term processing

facility, the specifications of which will be designed with the

help of specialist consultants once the laboratory analysis has

been definitively completed.

Consolidated Income Statement

For the year ended 31 December 2020

Notes 2020 2019

Continuing operations EUR EUR

Administrative expenses (852,270) (816,990)

Finance income 4 228 1,195

-------------------------------------- ------ ------------------ ------------------

Loss for the year before

tax 5 (852,042) (815,795)

Income tax expense 7 - -

--------------------------------------- ------ ------------------ ------------------

Loss for the financial

year (852,042) (815,795)

Loss attributable to:

Equity holders of the

Company (852,042) (815,795)

======================================= ====== ================== ==================

Loss per share from continuing

operations

Basic and diluted loss per share

(cent) 8 (0.001) (0.002)

======================================== ====== ================== ==================

Consolidated Statement of Other Comprehensive Income

For the year ended 31 December 2020

Notes 2020 2019

EUR EUR

Loss for the financial

year (852,042) (815,795)

Other comprehensive

income

Items that are or may be reclassified

to profit or loss:

Currency translation

differences (512,730) 87,052

--------------------------------------------- ------- ------------- --------------

(512,730) 87,052

Total comprehensive expense for the financial

year

attributable to equity holders of

the Company (1,364,772) (728,743)

=============================================== ======= ============= ==============

Consolidated Statement of Financial Position

For the year ended 31 December 2020

Notes 2020 2019

Assets EUR EUR

Non-current assets

Property, plant and

equipment 10 66,612 76,556

Intangible assets 11 5,898,940 6,106,347

---------------------------------- ------ ---------------- ----------------

Total non-current assets 5,965,552 6,182,903

Current assets

Trade and other receivables 12 99,904 94,943

Cash and cash equivalents 13 2,287,172 306,675

----------------------------------- ------ ---------------- ----------------

Total current assets 2,387,076 401,618

Total assets 8,352,628 6,584,521

================================== ====== ================ ================

Equity

Capital and reserves

Share capital 15 307,071 112,205

Share premium 15 12,543,606 9,687,151

Share based payment

reserve 16 559,420 435,962

Foreign currency translation

reserve 21,173 533,903

Retained earnings (5,511,645) (4,535,134)

---------------------------------- ------ ---------------- ----------------

Attributable to owners of the

Company 7,919,625 6,234,087

Total equity 7,919,625 6,234,087

Liabilities

Current liabilities

Trade and other payables 14 433,003 350,434

----------------------------------- ------ ---------------- ----------------

Total current liabilities 433,003 350,434

Total liabilities 433,003 350,434

Total equity and liabilities 8,352,628 6,584,521

=================================== ====== ================ ================

Consolidated Statement of Changes in Equity

For the year ended 31 December 2020

Share Foreign

based currency

Share Share payment translation Retained

capital premium reserve reserve earnings Total

EUR EUR EUR EUR EUR EUR

Balance at 1

January

2019 67,767 9,491,437 279,739 446,851 (3,707,653) 6,578,141

Comprehensive

income for

the year

Loss for the

year - - - - (815,795) (815,795)

Currency

translation

differences - - - 87,052 - 87,052

-------------------- ----------------- ----------------- ----------------- ----------------- ----------------- ------------

Total comprehensive

income

for the year - - - 87,052 (815,795) (728,743)

Transactions with

owners,

recorded

directly in equity

Shares issued 44,438 371,003 - - (11,686) 403,755

Share warrants

granted - (175,289) - - - (175,289)

Share options

charge - - 156,223 - - 156,223

-------------------- ----------------- ----------------- ----------------- ----------------- ----------------- ------------

Total transactions

with owners,

recorded directly

in equity 44,438 195,714 156,223 - (11,686) 384,689

Balance at 31

December 2019 112,205 9,687,151 435,962 533,903 (4,535,134) 6,234,087

==================== ================= ================= ================= ================= ================= ============

Consolidated Statement of Changes in Equity (continued)

For the year ended 31 December 2020

Share Foreign

based currency

Share Share payment translation Retained

capital premium reserve reserve earnings Total

EUR EUR EUR EUR EUR EUR

Balance at 1

January

2020 112,205 9,687,151 435,962 533,903 (4,535,134) 6,234,087

Comprehensive

income for

the year

Loss for the

year - - - - (852,042) (852,042)

Currency

translation

differences - - - (512,730) - (512,730)

-------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -------------

Total comprehensive

income

for the year - - - (512,730) (852,042) (1,364,772)

Transactions with

owners,

recorded

directly in equity

Shares issued 194,866 2,680,921 - - (140,490) 2,735,297

Share warrants

granted - - 25,521 - (25,521) -

Share warrants

exercised - 175,534 (11,815) - - 163,719

Share warrants

terminated - - (41,542) - 41,542 -

Share options

charge - - 151,294 - - 151,294

------------------- ----------------- ----------------- ----------------- ----------------- ----------------- -------------

Total transactions

with owners,

recorded directly

in equity 194,866 2,865,455 123,458 - (124,469) 3,050,310

Balance at 31

December 2020 307,071 12,543,606 559,420 21,173 (5,511,645) 7,919,625

==================== ================= ================= ================= ================= ================= =============

Consolidated Statement of Cash Flows

For the year ended 31 December 2020

Notes 2020 2019

EUR EUR

Cash flows from operating activities

Loss for the

year (852,042) (815,795)

Adjustments

for:

Depreciation 10 3,733 7,216

Interest receivable and similar

income 4 (228) (1,195)

(Increase)/Decrease in trade and

other receivables (4,961) 28,231

(Decrease)/Increase in trade and

other payables (72,067) 32,784

Equity settled share-based

payment 16 151,294 156,223

-------------------------------------------- ------ ----------------- -----------------

Net cash flows from operating

activities (774,271) (592,536)

Cash flow from investing activities

Expenditure on intangible

assets 11 (196,982) (206,736)

Interest received 4 228 1,195

------------------------------------------- ------ ----------------- -----------------

Net cash from investing

activities (196,754) (205,541)

Cash flow from financing activities

Proceeds from the issue of new

shares 15 3,130,705 415,441

Share warrants granted 15 - (175,289)

Commission paid from the issue

of new shares 15 (140,490) (11,686)

--------------------------------------------- ------ ----------------- -----------------

Net cash from financing

activities 2,990,215 228,466

Decrease in cash and cash equivalents 2,019,190 (569,611)

Exchange rate adjustment on cash and

cash equivalents (38,693) (8,166)

Cash and cash equivalents at beginning

of the year 13 306,675 884,452

Cash and cash equivalents at end

of the year 13 2,287,172 306,675

============================================== ====== ================= =================

Notes to the Financial Statements PDF link:

http://www.rns-pdf.londonstockexchange.com/rns/7888W_1-2021-4-27.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SEIFUWEFSESL

(END) Dow Jones Newswires

April 28, 2021 02:00 ET (06:00 GMT)

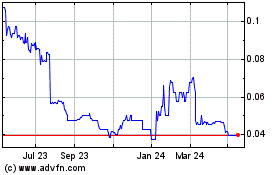

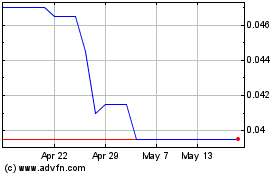

Great Western Mining (LSE:GWMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Great Western Mining (LSE:GWMO)

Historical Stock Chart

From Jul 2023 to Jul 2024