RNS Number : 8215X

GruppeM Investments PLC

30 June 2008

Embargoed until 9.00 a.m.

30 June 2008

GruppeM Investments PLC

(LSE: GRP, 'GruppeM' or the 'Company')

Final results for the year ended 31 December 2007

GruppeM Investments PLC, the Aston Martin importer for the People's Republic of China and retailer of Porsche cars in the country's

Shandong region, announces its final results for the year ended 31 December 2007.

Operational highlights:

* 419 Porsche cars ordered (17 months to 31 December 2006: 278) and 392 cars delivered (17 months to 31 December 2006: 222) by the

Qingdao dealership in the year

* Second Porsche dealership planned to open in August in Jinan - the capital of the Shandong region

* Strong demand for Aston Martin cars in China

Financial highlights:

* Revenues of �23.6 million (17 months to 31 December 2006: �12.1 million)

* Profit before tax of �0.46 million (17 months to 31 December 2006: �0.95 million loss)

* Basic earnings per share 0.5p (2006: 3.27p loss per share)

Commenting on the results, Kenny Chen, Chief Executive Officer, said:

"These results demonstrate that the Company's strategy is proving successful. We have consolidated our position and the Company has

moved into profit. The significant investment that has been made is now providing the firm foundation on which the business will grow. The

market is continuing to expand at a fast rate and the Company is now in a position to gain maximum benefit from the opportunities that are

being presented. The only limiting factor will be the Company's ability to rapidly raise sufficient funds to take advantage of those

opportunities. Demand for luxury cars is still very strong despite some downturn in markets elsewhere in the world. The downturn is an

advantage for Chinese based businesses as manufacturers are supporting them with more cars to satisfy the growing demand. We intend to add

an additional dealership with the opening of the Jinan Porsche Centre in August 2008 which will enable the Company to reach further into the

Shandong Province. The relationship with Aston Martin is very strong both on a business and a personal level. The Company represented Aston Martin at the Beijing and Qingdao auto shows with great

success and it will continue to work very closely with them at future events. Demand for Aston Martin cars is increasing and we are

confident of satisfying that demand as soon as official type approval is granted by the Chinese authorities."

Enquiries:

GruppeM Investments PLC Shore Capital and Corporate Limited

Kenny Chen Alex Borrelli

Tel: +44 (0) 207 233 2952 Tel: +44 (0) 207 408 4090

CHIEF EXECUTIVE OFFICER'S STATEMENT

Results

The Group continued to grow strongly in the year to 31 December 2007. Turnover increased to �23.6 million (17 month period to 31

December 2006: �12.1 million). The pre-tax profit from operations for the year was �0.46 million against a loss of �0.95 million for the 17

month period to 31 December 2006. Basic earnings per share were 0.5p (17 month period to 31 December 2006: 3.27p loss).

The directors will not be recommending the payment of a dividend.

Porsche car sales, from our Qingdao dealership in the Shandong province in East China, remained strong with 419 cars ordered and 392

cars delivered in the year with healthy margins earned. We are experiencing continuing demand for the larger model, the Porsche Cayenne,

with sales of this product accounting for 85% of total sales, a trend repeated for Porsche throughout China where Porsche delivered 4,119

cars in the year to 31 July 2007 and stated that demand is continuing to outstrip supply. There has been an increase in demand for sports

cars with the percentage of total sales rising from 9% in the previous period to 15% in the current year, while the average waiting period

is between six and nine months, depending upon the model.

Board Changes

There have been several Board changes in the year. As previously announced, Don McCrickard and Stephanie Wong both left the Company and

Paul McIlwaine assumed the role of Company Secretary.

Peter Kent has resigned as non-executive director of the Company. We would like to thank Peter for the guidance and support he has

provided to the Company, and give him our very best wishes in the future.

Market Prospects

China's economy continues to grow with an increase in GDP of 11.4% in 2007. In 2007 China's automobile sales increased to 8.79 million

units - an increase of 21.8% over the previous year. This consolidates China's position as the second largest car market in the world and it

is predicted to surpass the USA to become number one. According to the Xinhua News Agency "Vehicle ownership in China is currently 44 cars

per 1000 people whereas the world average is 120 cars per 1000 and in the USA there are 750 cars per 1000 people". Despite a worldwide slow

down in car sales in the first half of 2008, China sales have continued to increase with a year-on-year increase of 25.3% in the first five

months.

Current trading

Trading in the first half of 2008 remains strong and our additional Porsche dealership in Jinan, the capital city of the Shandong

Province, is due for completion in August 2008 and will provide further growth opportunities. It has received a quota allocation from

Porsche of 198 cars for the period between August 2008 and the end of July 2009 which should provide a good platform to grow the business.

The relationship with Aston Martin Lagonda Ltd, ("Aston Martin"), continues to strengthen with several jointly organised events being

hosted by the manufacturer in China, following the Company being appointed as the importer for Aston Martin in China.

De-Listing

The Chinese auto market is expanding at such a fast rate that many excellent business opportunities exist. In order to take advantage of

these opportunities, it is necessary to raise funds very quickly to avoid losing out to competitors. However, with the prevailing conditions

within the financial markets, the Board believes it is not practicable for the Company to raise the funds required while maintaining trading

on AIM within the desired time frame and in the light of the limited trading liquidity in the Company's shares. Therefore, the Directors

have concluded that it is no longer in the best interests of the Company, or its Shareholders as a whole, to maintain its AIM listing.

Annual General Meeting and General Meeting

The report and accounts will be sent to shareholders today. A circular containing the notice of AGM and a notice for a general meeting

with a resolution to de-list the Company's shares from AIM will be sent to shareholders within the next few weeks.

I would like to thank all our employees and advisers for their hard work and contribution to the continued success of the Company.

Kenny Chen

Chief Executive Officer

30 June 2008

GRUPPEM INVESTMENTS PLC

Consolidated income statement for the YEAR ended

31 December 2007

Year ended 17 months ended

31 December 31 December

2007 2006

(Audited) (Audited)

Note � �

Revenue 23,634,551 12,099,616

Cost of sales (21,069,615) (11,239,678)

Gross Profit 2,564,936 859,938

Administrative expenses (2,087,631) (1,823,174)

Operating Profit/(Loss) 477,305 (963,236)

Finance income and expense (net) (18,552) 13,628

Profit/(Loss) for the Period 458,753 (949,608)

before Taxation

Taxation 41,480 (13,172)

Profit/(Loss) for the Period 4 500,233 (962,780)

Profit/(Loss) per share expressed

in pence per share

- Basic 2 0.50p (3.27)p

- Diluted 2 0.50p n/a

Statement of recognised income and expense for the YEAR ended 31 December 2007

Year ended 17 months ended

31 December 31 December 2006

2007 (Audited)

(Audited)

� �

Profit/(Loss) for the financial period 500,233 (962,780)

Exchange adjustments (16,005) 46,650

Total Recognised Income and Expense for 484,228 (916,130)

the Period

All amounts relate to continuing activities.

GRUPPEM INVESTMENTS PLC

Consolidated balance sheet as at 31 December 2007

As at

As at 31 December

31 December 2006

2007 (Audited)

(Audited)

� �

Assets

Non-Current Assets

Property, plant and equipment 3,199,022 499,850

Deferred taxation 41,480 -

3,240,502 499,850

Current Assets

Inventories 970,447 836,672

Trade and other receivables 2,161,373 2,791,348

Cash and cash equivalents 92,838 126,556

3,224,658 3,754,576

Total Assets 6,465,160 4,254,426

Liabilities

Current Liabilities

Trade and other payables 2,292,684 2,433,149

2,292,684 2,433,149

Non-Current Liabilities

Director's loan account 5,280,018 3,414,011

Convertible loan 100,366 99,402

Related party loan 182,000 182,000

5,562,384 3,695,413

Total Liabilities 7,855,068 6,128,562

Capital and Reserves

Share capital 1,000,000 1,000,000

Merger reserve (1,392,156) (1,392,156)

Foreign operation translation reserve 28,710 44,715

Retained deficit (1,026,462) (1,526,695)

(1,389,908) (1,874,136)

Total Equity and Liabilities 6,465,160 4,254,426

GRUPPEM INVESTMENTS PLC

Consolidated cash flow statement for the YEAR ended

31 December 2007

Year ended 17 months ended

31 December 31 December 2006

2007 (Audited)

(Audited)

� �

Cash flow from operating activities

Profit/(Loss) from operating activities 477,305 (963,236)

Adjustments for:

Depreciation 163,054 176,334

Exchange adjustment on property, plant (18,358) 6,616

and equipment

Net cash flow from operating activities 622,001 (780,286)

before changes in working capital

Increase in inventories (133,775) (836,672)

(Decrease)/Increase in payables (129,113) 2,045,882

Decrease/(Increase) in receivables 629,975 (2,496,638)

Net cash flow from operating activities 989,088 (2,067,714)

before interest and taxation paid

Interest paid (9,327) (2,046)

Taxation paid (11,352) (1,820)

Net cash flow from operating activities 968,409 (2,071,580)

Investing activities

Purchase of property, plant and (92,918) (598,863)

equipment

Sale of property, plant and equipment - 24,555

Assets under construction (2,750,950) -

Interest received 388 76

Net cash flow from investing activities (2,843,480) (574,232)

Financing activities

Cost of share issue - (592,156)

Issue of convertible loan notes - 115,000

Director's loan 1,857,358 3,067,141

Net cash flow from financing activities 1,857,358 2,589,985

Net decrease in cash and cash equivalents (17,713) (55,827)

in the period

Cash and cash equivalents at the 126,556 135,733

beginning of the period

Effect of foreign exchange rate changes (16,005) 46,650

Cash and cash equivalents at the end of 92,838 126,556

the period

NOTES TO THE ANNOUNCEMENT

1. Basis of preparation

The Financial Statements have been prepared in accordance with EU Endorsed International Financial Reporting Standards ("IFRS"),

International Financial Reporting Interpretations Committee ("IFRIC") interpretations and the Companies Act 1985 applicable to companies

reporting under IFRS. The Group has adopted all of the standards and interpretations issued by the International Accounting Standards Board

and the International Financial Reporting Interpretations Committee that are relevant to its operations. As at the date of approval of these

consolidated Financial Statements, the following standards and interpretations were in issue but not yet effective:

* IFRS 8, Operating Segments;

* IFRIC 11, IFRS 2: Group and Treasury share transactions;

* IFRIC 12, Service concession arrangements;

* IFRIC 13, Customer Loyalty Programmes; and

* IFRIC 14, IAS 19 The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction

The Directors do not anticipate that the adoption of these interpretations in future reporting periods will have a material impact on

the Group's results, except for additional disclosures on segregated results, when the relevant standards come into effect for periods

commencing on or after 1 January 2008.

Basis of Consolidation

The consolidated Financial Statements consist of GruppeM Investments PLC and its subsidiaries made up to 31 December 2007. The

consolidated Financial Statements of GruppeM Investments PLC have been prepared under merger accounting rules. This means that the Financial

Statements of GruppeM Investments PLC and its wholly owned subsidiary, GruppeM Hong Kong Limited have been aggregated and presented as if

the two companies have always formed a group.

Accordingly, although GruppeM Investments PLC acquired the entire share capital of GruppeM Hong Kong Limited on 31 October 2006, the

results for both companies are reflected in comparatives for the whole of the 17 month period ended 31 December 2006, the reason being that

due to common ownership and control of the respective entities both before and after the business combination, the business combination

falls outside the scope of IFRS 3.

2. Earnings per Ordinary Share

Basic earnings per share is calculated by dividing the earnings attributable to ordinary shareholders by the weighted average number of

ordinary shares outstanding during the period. Diluted earnings per share is calculated by adjusting the weighted average number of ordinary

shares outstanding to assume conversion of all dilutive potential ordinary shares. The Company has one category of dilutive potential

ordinary shares in the convertible loan notes. The convertible loan notes are assumed to have been converted into ordinary shares and the

net profit is adjusted to eliminate the interest expense.

As the Company was loss-making in the 17 months ended 31 December 2006, the convertible loan notes were anti-dilutive, and in

accordance with IAS 33 were ignored for the purposes of calculating diluted earnings per share.

2007 2006

Weighted average Per share amount Weighted average Per share amount

number of shares number of shares

Profit Loss

� pence � pence

Basic EPS

Profit/(Loss) attributable to 500,233 100,000,000 0.50 (962,780) 29,411,765 (3.27)

ordinary shareholders

500,233 100,000,000 0.50 (962,780) 29,411,765 (3.27)

2007

Weighted average Per share amount

number of shares

Profit

� pence

Diluted EPS

Profit attributable to 500,233 100,000,000

ordinary shareholders

Interest expense on 8,649 1,840,000

convertible loan notes and

assumed conversion of

convertible loan notes

Profit and weighted average 508,882 101,840,000 0.50

number of shares for diluted

EPS

3. Share capital

2007 2007 2006 2006

No. � No. �

Authorised:

Ordinary shares of 1p each 200,000,000 2,000,000 200,000,000 2,000,000

Issued and Fully Paid:

Ordinary shares of 1p each 100,000,000 1,000,000 100,000,000 1,000,000

4. Movement on reserves

The merger reserve represents a reserve arising on consolidation, being the share capital and share premium account balances of GruppeM

Hong Kong Limited at 16 July 2004 less the nominal value of the shares issued by the Company to acquire the shares, reflecting the position

as if the merger had occurred on 16 July 2004.

Group Merger reserve Foreign currency translation reserve

Retained losses

� � �

At 31 December 2006 (1,392,156) 44,715 (1,526,695)

Profit for the period - - 500,233

Foreign exchange loss on - (16,005) -

translation

At 31 December 2007 (1,392,156) 28,710 (1,026,462)

Circulation to shareholders

The annual report and accounts will be posted to shareholders today and will be available to the public from the Company's registered

office at GruppeM Investments PLC, Suite 1.3 Buckingham Court, 78 Buckingham Gate, London, SW1E 6PD and on the Company's website:

www.gruppemplc.com.

For more information please contact:

GruppeM Investments PLC

Kenny Chen

Tel: +44 (0) 207 233 2952

Shore Capital and Corporate Limited

Alex Borrelli

Tel: +44 (0) 207 408 4090

Further information on GruppeM Investments PLC can be found on the Company's website: www.gruppemplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FKKKBOBKKFAN

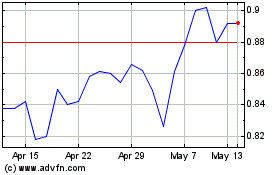

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

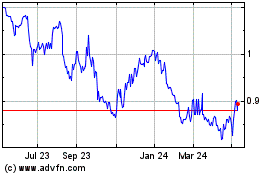

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jul 2023 to Jul 2024