RNS Number:6601G

GruppeM Investments PLC

31 October 2007

31 October 2007

GruppeM Investments PLC

(LSE: GRP, 'GruppeM' or the 'Company')

Interim results for the six months ended 30 June 2007

GruppeM, the Aston Martin Importer for China and retailer of Porsche cars in the

country's Shandong region, today announces its interim results for the six

months ended 30 June 2007 which have been reviewed by the Company's auditors but

are unaudited.

Overview:

* 203 cars ordered and 191 cars delivered by the Porsche Qingdao dealership

in the six-month period;

* Revenues of #11.6 million (2006: #5.3 million);

* Profit before tax of #57,993 (2006: #252,918 loss);

* Earnings per share 0.05p (2006: 1.27p loss).

Significant post balance sheet events:

* CLB Littlejohn Frazer, a top 30 firm of chartered accountants and business

advisors, appointed as auditors;

* Stephanie Wong taking up appointment as Finance Director on 1 November

2007;

* GruppeM to launch Aston Martin brand into China at the end of November

2007, following agreement to import and distribute the brand to China retail

dealerships.

Commenting on the results and related developments, Kenny Chen, Chief Executive

Officer, said:

"This has been a great six months for GruppeM as it develops its luxury sports

cars portfolio. Demand for Porsche cars is continuing unabated with 203 cars

being ordered in the period from our Qingdao dealership. We have been granted

the right to retail Porsche cars within Shandong and are convinced that there is

much greater demand for the brand within the region. The opening of our second

Porsche dealership in the region's capital Jinan, (delayed to the first quarter

of 2008 due to the building work overrunning), will enable us to begin meeting

this demand and increasing sales volume going forward.

Our high reputation, allied with our deep understanding of the Chinese luxury

car market, has yielded an agreement with Aston Martin to import and distribute

the marque to retail dealerships within China. We are confident that the Aston

Martin brand, like other luxury brands before it, will be hugely popular within

the Chinese marketplace.

We are delighted to welcome Stephanie Wong as Finance Director to the Group.

Stephanie is Chinese, qualified as a CPA and practised within the US, and has

extensive experience of the Asia Pacific Region. We look forward to her

starting on 1 November 2007."

Enquiries:

GruppeM Investments PLC Shore Capital and Corporate Limited

Kenny Chen Alex Borrelli

Tel: +44 (0) 207 233 2952 Tel: +44 (0) 207 408 4090

CHAIRMAN'S STATEMENT

Background

GruppeM's most recent audited annual report covered the 17-month period to 31

December 2006. The interim financial statements below, for the six months ended

30 June 2007, have been reviewed by the Company's auditors but are unaudited.

The comparative period is from 1 January 2006 to 30 June 2006.

Board changes

We are delighted to welcome Stephanie Wong to the board as Finance Director from

1 November 2007. Originally from Hong Kong, Stephanie qualified as a CPA in

Texas in 1996, going on to complete an MBA at the University of Houston the

following year. She has held various senior finance roles, latterly as the Asia

Pacific Director of Finance and Operations for Fortinet Inc. - a leading

provider of multi-threat security systems in relation electronic communications.

The directors are confident that Stephanie's arrival will be a powerful

addition to the management team based in China.

Financial timetable and auditors

GruppeM's annual report for the 17-month period ended 31 December 2006 was

posted to shareholders today. Therefore, the directors anticipate that the

share suspension will be lifted, and that trading in the Company's shares will

resume, in the near future. The interim report, containing the unaudited

results below, will also be posted to shareholders today.

The release of our audited results for the 17 months ended 31 December 2006, and

unaudited interim results for the six months ended 30 June 2007, has been

delayed due to the audit of our Chinese subsidiaries being interrupted by a

routine audit by the Chinese tax authority from which no material issues arose.

The board is delighted to announce the appointment of CLB Littlejohn Frazer ("

CLBLF") as our new auditor. CLBLF is an independent 'top 30' firm of chartered

accountants and business advisers based in Canary Wharf in London.

Results and business review

The Group continues to grow rapidly thanks to the increasing volume of sales of

Porsche cars. Turnover increased significantly to #11.6 million (period to 30

June 2006: #5.3 million). The pre-tax profit from operations for the period was

#57,993 against a loss of #252,918 for the period to 30 June 2006. Earnings per

share were 0.05 pence (2006: 1.27 pence loss). The directors will not be

recommending the payment of an interim dividend.

The Porsche Qingdao dealership performed strongly with 203 cars ordered and 191

cars delivered in the period. Demand for the brand remains strong with customers

currently waiting approximately six months for their new car.

The Company has recently opened a Porsche sales office in Jinan, the capital of

the Shandong region, and has already made several sales. The new Porsche Jinan

dealership and workshop is now planned to open in Q1 of 2008.

We are pleased that GruppeM has been appointed as the only importer and

distributor of Aston Martin motor cars to retail dealerships within China.

Initially GruppeM will be supplying the brand to third-party dealers, rather

than retailing the brand through its own dealerships.

GruppeM is excited at the prospect of launching the Aston Martin brand into

China at the end of November 2007. We are delighted to announce that the launch

will be attended and supported by the Aston Martin board.

Our success in regard to the appointment of GruppeM as sole importer and

distributor of Aston Martin in China is consistent with HMG's clearly stated

business strategy for the Chinese market, both in terms of exports and the need

to strengthen the growth of City of London listed companies in the rapid growing

economy of China. The British Embassy and other regional offices are supporting

this initiative to the fullest.

Market prospects

According to the Xinhua News Agency's recent report, the world's luxury car

makers are very enthusiastic about the great growth potential in China's auto

industry. Porsche China's Managing Director was quoted as saying that he

expects the growth in sales of the marque to increase beyond the doubling of

volume seen last year. Also, the general manager of Bentley in China (which

occupies a similar market position to Aston Martin) outlined that the sales to

the end of September 2007 outstripped the total sales for 2006, and that he

fully expects sales volume to reach 300 units by the end of this year. He

commented that the fast expanding economy, and rising income, will inevitably

boost consumer demand for luxury cars.

We appreciate your continuing support in our efforts to increase our share of

the burgeoning luxury car market in China. Finally, I would also like to thank

all our employees and advisors for their contribution to our success.

Don McCrickard

Chairman

30 October 2007

GRUPPEM INVESTMENTS PLC

CONSOLIDATED INCOME STATEMENT

FOR THE 6 MONTHS ENDED 30 JUNE 2007

6 months ended 6 months 17 months

30 June ended ended 31

2007 30 June December 2006

2006

(unaudited) (unaudited) (audited)

Note # # #

Revenue 11,551,698 5,258,243 12,099,616

Cost of sales (10,644,692) (4,876,656) (11,239,678)

Gross Profit 907,006 381,587 859,938

Administrative expenses (839,768) (541,465) (1,823,174)

Exceptional items - (88,125) -

Operating Profit/(Loss) 67,238 (248,033) (963,236)

Finance income and expense (net) (9,305) (4,915) 13,628

Profit/(Loss) for the Period before Taxation 57,993 (252,918) (949,608)

Taxation (9,919) (163) (13,172)

Profit/(Loss) for the Period 48,014 (253,081) (962,780)

Earnings/(loss) per share expressed in pence

per share

- Basic 2 0.05p (1.27)p (3.27)p

- Diluted 2 0.05p - -

All amounts relate to continuing activities.

CONSOLIDATED STATEMENT OF RECOGNISED INCOME AND EXPENSE

FOR THE 6 MONTHS ENDED 30 JUNE 2007

6 months 6 months 17 months

ended ended ended 31

30 June 30 June December 2006

2007 2006

(unaudited) (unaudited) (audited)

# # #

Profit/(loss) for the financial period 48,014 (253,081) (962,780)

Exchange adjustments 6,611 (22,700) (46,650)

Total Recognised Income and Expense 54,625 (275,781) (1,009,430)

for the Period

GRUPPEM INVESTMENTS PLC

CONSOLIDATED BALANCE SHEET AS AT 30 JUNE 2007

Notes As at As at As at

30 June 30 June 31 December

2007 2006 2006

(unaudited) (unaudited) (audited)

# # #

Assets

Non-Current Assets

Property, plant and equipment 456,029 509,322 499,850

456,029 509,322 499,850

Current Assets

Inventory 152,894 62,585 836,672

Trade and other receivables 3,964,353 1,354,307 2,791,348

Cash and cash equivalents 139,729 45,652 126,556

4,256,976 1,462,544 3,754,576

Total Assets 4,713,005 1,971,866 4,254,426

Liabilities

Current Liabilities

Trade and other payables 2,692,856 2,276,518 2,433,149

2,692,856 2,276,518 2,433,149

Non-Current Liabilities

Director's loan account 3,570,516 454,624 3,414,011

Convertible loan 100,366 - 99,402

Related party loan 182,000 182,000 182,000

3,852,882 636,624 3,695,413

Total Liabilities 6,545,738 2,913,142 6,128,562

Capital and Reserves

Share capital 3 1,000,000 200,000 1,000,000

Merger reserve 4 (1,392,156) - (1,392,156)

Foreign operation translation reserve 4 38,104 33,009 44,715

Retained deficit 4 (1,478,681) (1,174,285) (1,526,695)

(1,832,733) (941,276) (1,874,136)

Total Equity and Liabilities 4,713,005 1,971,866 4,254,426

GRUPPEM INVESTMENTS PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE 6 MONTHS ENDED 30 JUNE 2007

6 months 6 months 17 months ended

ended ended

30 June 30 June 31 December

2007 2006 2006

(unaudited) (unaudited) (audited)

# # #

Cash Flow from Operating Activities

Profit/(loss) from operating activities 67,238 (248,003) (963,236)

Adjustments for:

Depreciation 86,430 51,370 176,334

Exchange adjustment on property, plant and (2,569) 656 6,616

equipment

Net Cash Flow from Operating Activities before 151,099 (195,977) (780,286)

Changes in Working Capital

Decrease/(increase) in inventories 683,778 92,022 (836,672)

Increase in payables 490,648 417,488 2,045,882

(Increase)/decrease in receivables (1,403,946) 160,605 (2,496,638)

Net Cash Flow from Operating Activities before (78,421) 474,138 (2,067,714)

Interest and Taxation Paid

Interest paid (8,365) (4,940) (2,046)

Taxation (9,919) (163) (1,820)

Net Cash Flow from Operating Activities (96,705) 469,035 (2,071,580)

Investing Activities

Purchase of property, plant and equipment (40,040) (550,703) (598,863)

Sale of property, plant and equipment - - 24,555

Interest received 24 25 76

Net Cash Flow from Investing Activities (40,016) (550,678) (574,232)

Financing Activities

Cost of share issue - - (592,156)

Issue of convertible loan notes - - 115,000

Director's loan 156,505 71,167 3,076,141

Net Cash Flow from Financing Activities 156,505 71,167 2,589,985

Net Increase/(Decrease) in Cash and Cash 19,784 (10,476) (55,827)

Equivalents in the Period

Cash and cash equivalents at the beginning of 126,556 43,081 135,733

the period

Effect of foreign exchange rate changes on cash (6,611) 13,047 46,650

and cash equivalents

Cash and Cash Equivalents at the end of the 139,729 45,652 126,556

Period

NOTES TO THE INTERIM ANNOUNCEMENT

1. Basis of Preparation

These interim statements have been prepared on a consistent basis with the

Financial Statements for the period ended 31 December 2006.

These interim statements do not constitute statutory Financial Statements within

the meaning of Section 240(5) of the Companies Act 1985. Neither the results

for the six months ended 30 June 2007, nor the comparatives for the six months

ended 30 June 2006, have been audited. The statutory Financial Statements for

the 17 months ended 31 December 2006 contained an unqualified auditors' report

in accordance with Section 235 of the Companies Act 1985.

This financial information has been prepared in accordance with International

Financial Reporting Standards (IFRSs) as adopted by the European Union (EU) and

IFRIC interpretations that are relevant to its operations. The financial

information has been prepared under the historical cost convention.

The preparation of this financial information in conformity with generally

accepted accounting principles requires the use of estimates and assumptions

that affect the reported amounts of assets and liabilities at the date of the

financial information and the reported amounts of revenues and expenses during

the reporting period. Although these estimates are based on management's best

knowledge of the amount, event or actions, actual results ultimately may differ

from those estimates.

Basis of Consolidation

The consolidated Financial Statements consist of GruppeM Investments PLC and its

subsidiaries. The consolidated Financial Statements of GruppeM Investments PLC

have been prepared under merger accounting rules. This means that the Financial

Statements of GruppeM Investments PLC, and its wholly owned subsidiary GruppeM

Hong Kong Limited, have been aggregated and presented as if the two companies

have always formed a group.

Where necessary, adjustments are made to the Financial Statements of the

subsidiaries to bring their accounting policies into line with those used by

other members of the Group. All intra-group transactions, balances, income and

expenses are eliminated on consolidation.

2. Profit/(Loss) per Ordinary Share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the period.

In order to calculate diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all dilutive

potential ordinary shares according to IAS 33. Dilutive potential ordinary

shares include convertible loan notes and are assumed to have been converted

into ordinary shares.

6 months to 30 June 2007 6 months to 30 June 2006

Weighted Per share Weighted Per share amount

average amount average

number of number of

Profit shares Loss shares

# pence # pence

Basic EPS

Profit/(loss) 48,014 100,000,000 0.05 (253,081) 20,000,000 (1.27)

attributable to

ordinary shareholders

Convertible loan note - 2,300,000 - - - -

Diluted EPS 48,014 102,300,000 0.05 (253,081) 20,000,000 (1.27)

3. Share Capital

30 June 2007 30 June 2007 30 June 2006 30 June 2006

No. # No. #

Authorised:

Ordinary shares of 1p each 200,000,000 2,000,000 100,000,000 1,000,000

Issued and fully paid:

Ordinary shares of 1p each 100,000,000 1,000,000 20,000,000 200,000

4. Movement on Reserves

The merger reserve represents a reserve arising on consolidation, being the

share capital and share premium account balances of GruppeM Hong Kong Limited at

1 February 2005, i.e., its date of incorporation less the nominal value of the

shares issued by the Company to acquire the shares, reflecting the position as

if the merger had occurred on 1 February 2005.

Group Share capital Merger Foreign Total

reserve currency

translation Retained

reserve earnings

# # # # #

At 1 January 2006 200,000 - 10,309 (921,204) (710,895)

Loss for the period - - - (253,081) (253,081)

Foreign exchange translation - - 22,700 - 22,700

At 30 June 2006 200,000 - 33,009 (1,174,285) (941,276)

Acquisition 800,000 - - - 800,000

Arising on share issue, less expenses - (1,392,156) - - (1,392,156)

Loss for the period - - - (352,410) (352,410)

Foreign exchange translation - - 11,706 - 11,706

At 31 December 2006 1,000,000 (1,392,156) 44,715 (1,526,695) (1,874,136)

Profit for the period - - - 48,014 48,014

Foreign exchange translation - - (6,611) - (6,611)

At 30 June 2007 1,000,000 (1,392,156) 38,104 (1,478,681) (1,832,733)

Independent Review Report to the Directors of GruppeM Investments PLC

Introduction

We have been instructed by the Company to review the financial information for

the six months ended 30 June 2007 which comprises the consolidated income

statement, the consolidated balance sheet, the consolidated statement of

recognised income and expense, the consolidated cash flow statement and the

related notes. We have read the other information contained in the interim

report and considered whether it contains any apparent misstatements or material

inconsistencies with the financial information.

This report, including the conclusion, has been prepared for and only for the

Company for the purpose of the AIM Rules of the London Stock Exchange and for no

other purpose. We do not, in producing this report, accept or assume

responsibility for any other purpose or to any other person to whom this report

is shown or into whose hands it may come save where expressly agreed by our

prior consent in writing.

Directors' Responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by the directors. The directors are

responsible for preparing the interim report in accordance with the AIM Rules of

the London Stock Exchange which require that the accounting policies and

presentation applied to the interim figures should be consistent with those

applied in preparing the annual accounts except where any changes, and the

reasons for them, are disclosed.

Review Work Performed

We conducted our review in accordance with the guidance contained in Bulletin

1999/4 issued by the Auditing Practices Board for use in the United Kingdom. A

review consists principally of making enquiries of management and applying

analytical procedures to the financial information and underlying financial data

and, based thereon, assessing whether the accounting policies and presentation

have been consistently applied unless otherwise disclosed. A review excludes

audit procedures such as tests of controls and verification of assets,

liabilities and transactions. It is substantially less in scope than an audit

performed in accordance with International Standards on Auditing (UK and

Ireland) and therefore provides a lower level of assurance than an audit.

Accordingly, we do not express an audit opinion on the financial information.

Review Conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30 June 2007.

CLB Littlejohn Frazer

Chartered Accountants and Registered Auditors

1 Park Place

Canary Wharf

London E14 4HJ

30 October 2007

Circulation to Shareholders

The interim report and accounts will be posted to shareholders in due course and

will be available to the public from the Company's registered office at GruppeM

Investments PLC, Suite 1.3 Buckingham Court, 78 Buckingham Gate, London, SW1E

6PD.

For more information please contact:

GruppeM Investments PLC

Kenny Chen

Tel: +44 (0) 207 233 2952

Shore Capital and Corporate Limited

Alex Borrelli

Tel: +44 (0) 207 408 4090

Further information on GruppeM Investments PLC can be found on the Company's

website: www.gruppemplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFSDIILIVID

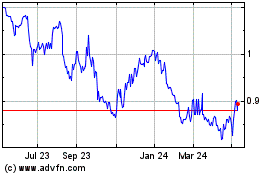

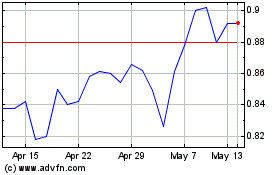

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jul 2023 to Jul 2024