RNS Number:6588G

GruppeM Investments PLC

31 October 2007

31 October 2007

GruppeM Investments PLC

(LSE: GRP, 'GruppeM' or the 'Company')

Final results for the 17 months ended 31 December 2006

GruppeM, the Aston Martin Importer for China and retailer of Porsche cars in the

country's Shandong region, today announces its audited final results for the 17

months ended 31 December 2006. GruppeM previously reported its unaudited

preliminary results for the 17 months ended 31 December 2006 on 15 August 2007.

The Chairman's Statement and financial information below has been extracted from

the report and accounts of the Company for the 17 months ended 31 December 2006

which are being despatched to shareholders today: these will be available to the

public from the Company's registered office at GruppeM Investments PLC, Suite

1.3 Buckingham Court, 78 Buckingham Gate, London, SW1E 6PD.

Enquiries:

GruppeM Investments PLC Shore Capital and Corporate Limited

Kenny Chen Alex Borrelli

Tel: +44 (0) 207 233 2952 Tel: +44 (0) 207 408 4090

Further information on GruppeM Investments PLC can be found on the Company's

website: www.gruppemplc.com.

CHAIRMAN'S STATEMENT

Background

GruppeM Investments PLC's initial annual report covered the period from its

incorporation on 16 July 2004 to 31 July 2005. The comparative period shown in

the Financial Statements below is therefore from 16 July 2004 to 31 July 2005.

We have since changed our accounting reference date from 31 July to 31 December,

to bring it into line with our Chinese trading operations. This means that the

results below are for a 17-month accounting period from 1 August 2005 to 31

December 2006.

GruppeM Investments PLC was floated on the Alternative Investment Market of the

London Stock Exchange ("AIM") market in February 2005 and remained a cash shell

until the reverse takeover of GruppeM Hong Kong Limited in October 2006.

GruppeM Hong Kong Limited is a Hong Kong based holding company with two Chinese

based subsidiaries operating a Porsche franchise in the Shandong region of

China. It was incorporated on 1 February 2005 and was wholly owned and

controlled by Pinocelle S.A. - a nominee company of Kenny Chen. Therefore, the

reverse acquisition was deemed a related-party transaction as both GruppeM

Investments PLC and GruppeM Hong Kong Limited were under the common control of

Kenny Chen. Accordingly, the consolidated figures presented below have been

prepared under merger accounting rules, i.e., the Financial Statements of

GruppeM Investments PLC and GruppeM Hong Kong Limited have been aggregated and

presented as if the two companies had been part of the same group since

incorporation.

Financial Timetable

Further to our announcement on 15 August 2007, the audited results for the

17-month period to 31 December 2006 have been delayed due to a combination of

the Company changing auditors and the audit of our Chinese subsidiaries being

interrupted by a routine audit by the Chinese tax authority from which no

material issues arose. The delay in the completion of the statutory Financial

Statements has had the knock-on effect of delaying the announcement of the

interim results for the six months to 30 June 2007. However, the interim

results have been released today.

Results

The Group has grown rapidly in the 17-month start-up period to 31 December 2006.

Turnover increased significantly to #12.1 million (period to 31 July 2005:

#0.12 million). The pre-tax loss from operations for the period was #0.95

million against a loss of #0.56 million for the period to 31 July 2005. Losses

per share were 3.27 pence (2005: 5.70 pence). The Directors will not be

recommending the payment of a dividend until such time as the Group reaches an

appropriate level of profitability.

Porsche car sales from our Qingdao dealership were strong with 278 cars ordered

and 222 cars delivered in the period. Of the 222 cars delivered, 91% were the

large four-wheel-drive Cayenne model, however, demand for the sports cars range

is strengthening as the market becomes more aware of the Porsche brand and

heritage. Sales of Porsche cars remain strong with no signs of slowing. Demand

continues to outstrip supply, with a waiting time of approximately 6 months from

the customer placing the order to receiving the car.

We are delighted that GruppeM Hong Kong Limited has now signed a formal

dealership agreement with Porsche China. This replaces the letter of intent

under which the Qingdao dealership was operating until March 2007.

Trading in the first half of 2007 has been brisk with the strong demand seen at

the end of 2006 continuing into this period.

Market Prospects

China's economy continues to grow strongly - recording annual double digit

growth (11.9%) for the fifth year in a row: it is poised to overtake Germany as

the third largest economy in the world within the next year.

In 2006 the Chinese automobile market became the second largest in the world

with sales of 7.2 million. Sales of luxury cars increased by 25.1% over the

previous year to 320,000 (China Association of Auto Manufacturers). According

to China View, "sales of luxury cars are booming and top luxury automakers see

China as an increasingly important market".

The latest statistics released by the Chinese Ministry of Public Security on 4

June 2007 show that, in the first 5 months of 2007, the number of private cars

increased by 16 per cent to 13.4 million. It is anticipated that sales volume

in the Chinese market will overtake the USA by 2010.

Board Changes

There have been several Board changes in the period. I took over from Lord

Marsh as Chairman, following the reverse acquisition of GruppeM Hong Kong

Limited in October 2006 and Peter Kent joined the Board shortly afterwards.

Julian Hardy also joined us as sales director at the time of the acquisition.

Marvin Tien resigned during the period. In June this year we were all saddened

by the news that Stephen Chen had passed away after a long illness. We send our

condolences to his wife and family.

Strategy

The Board is aiming to expand the business both organically, by increasing our

Porsche retailing footprint in the Shandong region, and by partnering other

premium brand manufacturers in order to distribute luxury cars throughout China.

The Shandong region, with a population of approximately 92 million, is located

on the burgeoning east coast of China between Beijing and Shanghai. In Q1 2008

the Company is planning to open a further Porsche dealership in the region's

capital Jinan. Jinan has a population of 5.9 million, compared to Qingdao with

7.2 million, and its information technology related economic output ranks number

4 in China.

As far as other partnerships are concerned, the Group is also in high-level

discussions with other luxury car manufacturers with a view to diversifying our

geographical market (to include the whole of China); our operations (to include

luxury car importation and distribution as well as retail); and our brand

offering.

Indeed, I am delighted to confirm the recent appointment of the Group as the

only importer and distributor of Aston Martin motor cars to dealerships in

China. This represents a fantastic opportunity for both parties to take full

advantage of this exciting marketplace. We are confident that the combination

of Britain's finest luxury sporting cars manufacturer, and our expertise in the

Chinese car market, will pay great dividends and we look forward to a long and

successful future together.

The Board believes that the Group is in a position of strength to capitalise on

the current opportunities within the Chinese luxury car market in order to grow

the business and shareholder value.

I would like to thank all our employees for their support and contribution to

our success during the Group's early high-growth stage.

Don McCrickard

Chairman

30 October 2007

GRUPPEM INVESTMENTS PLC

Consolidated income statement for the 17 months ended 31 December 2006

17 months ended Period from 16

31 December July 2004 to

2006 31 July 2005

(Restated)

Note # #

Revenue 12,099,616 121,130

Cost of sales (11,239,678) (193,425)

Gross Profit/(Loss) 859,938 (72,295)

Administrative expenses (1,823,174) (349,102)

Exceptional item - (142,512)

Operating Loss (963,236) (563,909)

Finance income and expense (net) 13,628 (6)

Loss for the Period before Taxation (949,608) (563,915)

Taxation (13,172) -

Loss for the Period (962,780) (563,915)

Loss per share expressed in pence per share

- Basic and diluted 3 (3.27)p (5.70)p

Statement of recognised income and expense for the 17 months ended 31 December

2006

17 months ended Period from 16

31 December 2006 July 2004 to 31

July 2005

(Restated)

# #

Loss for the financial period (962,780) (563,915)

Exchange adjustments (46,650) 1,935

Total Recognised Income and Expense for the Period (1,009,430) (561,980)

All amounts relate to continuing activities.

GRUPPEM INVESTMENTS PLC

Consolidated balance sheet as at 31 December 2006

Note As at As at

31 31 July

December 2005

2006 (Restated)

# #

Assets

Non-Current Assets

Property, plant and equipment 499,850 108,492

499,850 108,492

Current Assets

Inventories 836,672 -

Trade and other receivables 2,791,348 294,710

Cash and cash equivalents 126,556 135,733

3,754,576 430,443

Total Assets 4,254,426 538,935

Liabilities

Current Liabilities

Trade and other payables 2,433,149 375,915

2,433,149 375,915

Non-Current Liabilities

Director's loan account 3,414,011 346,870

Convertible loan 99,402 -

Related party loan 182,000 182,000

3,695,413 528,870

Total Liabilities 6,128,562 904,785

Capital and Reserves

Share capital 1 1,000,000 200,000

Merger reserve 2 (1,392,156) -

Foreign operation translation reserve 2 44,715 (1,935)

Retained deficit 2 (1,526,695) (563,915)

(1,874,136) (365,850)

Total Equity and Liabilities 4,254,426 538,935

GRUPPEM INVESTMENTS PLC

Consolidated cash flow statement for the 17 months ended 31 December 2006

17 months Period from

ended 16 July 2004

31 December to 31 July

2006 2005

(Restated)

# #

Cash flow from operating activities

Loss from operating activities (963,236) (563,909)

Adjustments for:

Depreciation 176,334 125

Exchange adjustment on property, plant and equipment 6,616 -

Net cash flow from operating activities before changes in working (780,286) (563,784)

capital

Increase in inventories (836,672) -

Increase in payables 2,045,882 375,915

Increase in receivables (2,496,638) (294,710)

Net cash flow from operating activities before interest and taxation (2.067,714) (482,579)

paid

Interest paid (2,046) (6)

Taxation paid (1,820) -

Net cash flow from operating activities (2,071,580) (482,585)

Investing activities

Purchase of property, plant and equipment (598,863) (7,834)

Sale of property, plant and equipment 24,555 -

Assets under construction - (100,783)

Interest received 76 -

Net cash flow from investing activities (574,232) (108,617)

Financing activities

Proceeds from issue of ordinary shares - 200,000

Cost of share issue (592,156) -

Issue of convertible loan notes 115,000 -

Director's loan 3,067,141 346,870

Related party loan - 182,000

Net cash flow from financing activities 2,589,985 728,870

Net (decrease) / increase in cash and cash equivalents in the period (55,827) 137,668

Cash and cash equivalents at the beginning of the period 135,733 -

Effect of foreign exchange rate changes 46,650 (1,935)

Cash and cash equivalents at the end of the period 126,556 135,733

NOTES TO THE FINAL RESULTS ANNOUNCEMENT

GruppeM Investments PLC is a limited liability company incorporated and

domiciled in England and Wales. The address of the registered office is Suite

1.3 Buckingham Court, 78 Buckingham Gate, London, SW1E 6PD.

The principal accounting policies applied in the preparation of these Financial

Statements are set out below. These policies have been consistently applied to

all the periods presented, unless otherwise stated.

Adoption of IFRS for the 17 months ended 31 December 2006

The Company and Group have adopted IFRS for the first time in their respective

Financial Statements. The date of transition to IFRS was 16 July 2004 and all

comparative information in these Financial Statements has been restated where

applicable to reflect the Company's and Group's adoption of IFRS.

Going Concern

United Kingdom company law requires the Directors to consider whether it is

appropriate to prepare the Financial Statements on the basis that the Company

and Group is a going concern. In considering this matter, the Directors have

reviewed the Group's budget and working capital requirements for 2008 which

included consideration of the cash flow implications of the operating plan. In

addition, Kenny Chen has given a letter of support to the Group stating that he

will provide the necessary capital to make up any shortfall in funding over the

next 12 months, if required. The Directors see no reason why the Company and the

Group should not continue in operational existence for the foreseeable future.

For this reason they have adopted the going concern basis in preparing these

Financial Statements.

Basis of Preparation

The Financial Statements have been prepared in accordance with EU Endorsed

International Financial Reporting Standards ("IFRS"), International Financial

Reporting Interpretations Committee ("IFRIC") interpretations and the Companies

Act 1985 applicable to companies reporting under IFRS. The Group has adopted

all of the standards and interpretations issued by the International Accounting

Standards Board and the International Financial Reporting Interpretations

Committee that are relevant to its operations. As at the date of approval of

these consolidated Financial Statements, the following standards and

interpretations were in issue but not yet effective:

* IFRS 7, Financial Instruments: Disclosures and the complementary amendments

to IAS 1: Presentation of Financial Statements;

* IFRS 8, Operating Segments;

* IFRIC 8, Scope of IFRS 2;

* IFRIC 9, Reassessment of embedded derivatives;

* IFRIC 10, Interim Financial Reporting and Impairment;

* IFRIC 11, IFRS 2: Group and Treasury share transactions;

* IFRIC 12, Service concession arrangements;

* IFRIC 13, Customer Loyalty Programmes; and

* IFRIC 14, The Limit on a Defined Benefit Asset, Minimum Funding Requirements

and their Interaction

The Directors do not anticipate that the adoption of these interpretations in

future reporting periods will have a material impact on the Group's results.

Basis of Consolidation

The consolidated Financial Statements consist of GruppeM Investments PLC and its

subsidiaries made up to 31 December 2006. The consolidated Financial Statements

of GruppeM Investments PLC have been prepared under merger accounting rules.

This means that the Financial Statements of GruppeM Investments PLC and its

wholly owned subsidiary, GruppeM Hong Kong Limited have been aggregated and

presented as if the two companies have always formed a group.

Accordingly, although GruppeM Investments PLC acquired the entire share capital

of GruppeM Hong Kong Limited on 31 October 2006, the results for both companies

are reflected in the consolidated Financial Statements for the whole of the 17

month period ended 31 December 2006 and the comparatives are presented on the

same basis, the reason being that due to common ownership and control of the

respective entities both before and after the business combination, the business

combination falls outside the scope of IFRS 3.

Where necessary, adjustments are made to the Financial Statements of

subsidiaries to bring their accounting policies into line with those used by

other members of the Group. All intra-group transactions, balances, income and

expenses are eliminated on consolidation.

The Company has taken advantage of the exemption provided under section 230 of

the Companies Act 1985 not to publish its individual income statement and

related notes.

1. Share Capital

2006 2006 2005 2005

No. # No. #

Authorised:

Ordinary shares of 1p each 200,000,000 2,000,000 100,000,000 1,000,000

Issued and Fully Paid:

Ordinary shares of 1p each 100,000,000 1,000,000 20,000,000 200,000

Shares issued during the Period

Ordinary Shares

No. Exercise/ #

share issue

price

At 31 July 2005 20,000,000 200,000

Acquisition of subsidiary 80,000,000 1p 800,000

At 31 December 2006 100,000,000 1,000,000

On 25 October 2006 the Company issued 80,000,000 new ordinary shares of 1p each

to Pinocelle S.A. for GruppeM Hong Kong Limited. The reverse acquisition has

been recognised under the principles of merger accounting.

2. Movement on Reserves

The merger reserve represents a reserve arising on consolidation, being the

share capital and share premium account balances of GruppeM Hong Kong Limited at

16 July 2004 less the nominal value of the shares issued by the Company to

acquire the shares, reflecting the position as if the merger had occurred on 16

July 2004.

Group Merger reserve Foreign currency

translation

reserve

Retained losses

# # #

At 16 July 2004 - - -

Loss for the period - - (563,915)

Foreign exchange loss on translation - (1,935) -

At 1 August 2005 - (1,935) (563,915)

Loss for the period - - (962,780)

Foreign exchange gain on translation - 46,650 -

Share issue expenses (592,156) - -

Arising on share issue 3,200,000 - -

Reversal of investment (4,000,000) - -

At 31 December 2006 (1,392,156) 44,715 (1,526,695)

3. Loss per Ordinary Share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the period.

As the Company is loss-making, the convertible loan notes are anti-dilutive, and

in accordance with IAS 33 have been ignored for the purposes of calculating

diluted earnings per share.

2006 2005

Weighted Per share Weighted Per share

average amount average amount

number of number of

shares shares

Loss Loss

# pence # Pence

Basic and diluted EPS

Loss attributable to ordinary (962,780) 29,411,765 (3.27) (563,915) 9,895,350 (5.70)

shareholders

(962,780) 29,411,765 (3.27) (563,915) 9,895,350 (5.70)

END

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DBLFXDBBXFBX

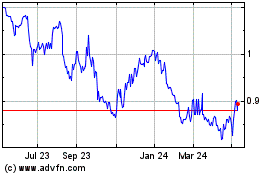

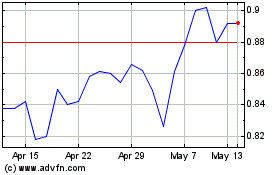

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jul 2023 to Jul 2024