RNS Number:1084C

GruppeM Investments PLC

15 August 2007

15 August 2007

GruppeM Investments PLC

(LSE: GRP, 'GruppeM' or the 'Company')

Preliminary results for the 17 months ended 31 December 2006

GruppeM Investments PLC, the retailer of luxury motor cars in China, announces

its unaudited preliminary results for the 17 months ended 31 December 2006.

Operational highlights:

* 4th largest Porsche dealer in the Chinese market by volume

* 278 Porsche cars ordered and 222 cars delivered by the Qingdao dealership

in the period

* Second Porsche dealership planned to open in September in Jinan - the

capital of Shandong region

* Increasing consumer demand for luxury sports cars

* Significant post-balance sheet event: appointed as the only distributor of

Aston Martin motor cars for Mainland China in August 2007

Financial highlights:

* Revenues of #12.3 million (2005 restated: #0.12 million)

* Loss before tax of #0.84 million (2005 restated: #0.56 million)

* Loss per share 2.87p (2005 restated: 5.70p)

Commenting on the results, Kenny Chen, Chief Executive Officer, said:

"These results reflect our first significant period of trading and therefore

take into account the substantial set-up costs associated with the formation of

a luxury motor car retailing operation in China. The high quality of the

investment we have made, both in terms of premises and personnel, will enable

the Company to take full advantage of the exciting opportunities which exist

within this fast-growing market. Demand for Porsche cars throughout the

Shandong region remains very strong and believe we are now in a sound position

to replicate the success of our Qingdao dealership in the region's capital

Jinan. The appointment of GruppeM Investments PLC as the only distributor of

Aston Martin motor cars in Mainland China will diversify our brand offering as

well as our revenue generating operations. We are looking forward to partnering

the premier British luxury motor manufacturer in one of the world's fastest

growing luxury car markets. This will assist in our goal to become the leading

supplier of luxury motor cars in China and ensure the Company is in an excellent

position to capture a greater share of a large market."

Enquiries:

GruppeM Investments PLC Shore Capital and Corporate Limited

Kenny Chen Alex Borrelli/Pascal Keane

Tel: +44 (0) 207 233 2952 Tel: +44 (0) 207 408 4090

CHAIRMAN'S STATEMENT

Background

GruppeM Investments PLC's initial annual report covered the period from its

incorporation on 16 July 2004 to 31 July 2005. The comparative period shown in

the financial statements below is therefore from 16 July 2004 to 31 July 2005.

We have since changed our accounting reference date from 31 July to 31 December,

to bring it into line with our Chinese trading operations. This means that the

results below are for a 17-month accounting period from 1 August 2005 to 31

December 2006.

GruppeM Investments PLC was floated on the AIM market in February 2005 and

remained a cash shell until the reverse takeover of GruppeM Hong Kong Limited in

October 2006. GruppeM Hong Kong Limited is a Hong Kong based holding company

with two Chinese based subsidiaries operating a Porsche franchise in the

Shandong region of China. It was incorporated on 1 February 2005 and was wholly

owned and controlled by Pinocelle S.A. - a nominee company of Kenny Chen.

Therefore, the reverse acquisition was deemed a related-party transaction as

both GruppeM Investments PLC and GruppeM Hong Kong Limited were under the common

control of Kenny Chen. Accordingly, the consolidated figures presented below

have been prepared under merger accounting rules, i.e., the financial statements

of GruppeM Investments PLC and GruppeM Hong Kong Limited have been aggregated

and presented as if the two companies had been part of the same group since

incorporation.

Financial timetable

Further to our announcement on 13 June 2007, the results for the 17-month period

to 31 December 2006 have been delayed due to the audit of our Chinese

subsidiaries being interrupted by a routine but random audit by the Chinese tax

authority. Also, further to our announcement on 13 June 2007 following the

engagement of PricewaterhouseCoopers China to perform the audit of our

subsidiaries in China, PricewaterhouseCoopers UK has advised us that, it is

unable to accept the appointment in the UK (for the Group as a whole) due to

certain client acceptance procedures. Therefore, the results below are

unaudited. Following this major setback to our timetable we are currently in

discussions with several other audit firms with a view to releasing the annual

report and accounts by the end of October 2007. Our unaudited interim

statements for the 6 months ended 30 June 2007 will be released by the end of

September 2007. It is expected that the share suspension will be lifted, and

trading in the Company's shares will resume, following the posting of the annual

report and accounts at the end of October 2007.

Results

The Group has grown rapidly in the 17-month start-up period to 31 December 2006.

Turnover increased significantly to #12.3 million (period to 31 July 2005:

#0.12 million). The pre-tax loss from operations for the period was #0.84

million against a loss of #0.56 million for the period to 31 July 2005. Losses

per share were 2.87 pence (2005: 5.70 pence). The directors will not be

recommending the payment of a dividend until such time as the Group reaches an

appropriate level of profitability.

Porsche car sales from our Qingdao dealership were strong with 278 cars ordered

and 222 cars delivered in the period with healthy margins earned. Of the 222

cars sold, 91% were the large four-wheel-drive Cayenne model, however, demand

for the sports cars range is strengthening as the market becomes more aware of

the Porsche brand and heritage. Sales of Porsche cars remain strong with no

signs of slowing. Demand continues to outstrip supply, with a waiting time of

approximately 6 months from the customer placing the order to receiving the car.

We are delighted that GruppeM Hong Kong Limited has now signed a formal

dealership agreement with Porsche China. This replaces the letter of intent

under which the Qingdao dealership was operating until March 2007.

Trading in the first half of 2007 has been brisk with the strong demand seen at

the end of 2006 continuing into this year. As a result, the board is confident

of delivering enhanced shareholder value for the financial year ending 31

December 2007 as the business expands with future dealerships.

Market prospects

China's economy continues to grow strongly - recording double digit growth

(11.9%) for the fifth year in a row - and is poised to overtake Germany as the

third largest economy in the world within the next year.

In 2006 the Chinese automobile market became the second largest in the world

with sales of 7.2 million. Sales of luxury cars increased by 25.1% over the

previous year to 320,000 (China Association of Auto Manufacturers). According

to China View, "sales of luxury cars are booming and top luxury automakers see

China as an increasingly important market".

The latest statistics released by the Chinese Ministry of Public Security on 4

June 2007 show that, in the first 5 months of 2007, the number of private cars

increased by 16 per cent. to 13.4 million. It is anticipated that sales volume

in the Chinese market will overtake the USA by 2010.

Board changes

There have been several board changes in the period. I took over from Lord

Marsh as Chairman, following the reverse acquisition of GruppeM Hong Kong

Limited in October 2006 and Peter Kent joined the board shortly afterwards.

Julian Hardy also joined us as sales director at the time of the acquisition.

Marvin Tien and Paul McIlwaine, our finance director, resigned during the

period. We are currently interviewing suitable candidates to replace Paul and

hope to make an announcement of his replacement in the near future. In June

this year we were all saddened by the news that Stephen Chen had passed away

after a long illness. We send our condolences to his wife and family.

Strategy

The board is aiming to expand the business both organically, by increasing our

Porsche retailing footprint in the Shandong region, and by partnering other

premium brand manufacturers in order to distribute luxury cars throughout

Mainland China.

The Shandong region, with a population of approximately 92 million, is located

on the burgeoning east coast of China between Beijing and Shanghai. In

September 2007 the Company is planning to open a further Porsche dealership in

the region's capital Jinan. Jinan has a population of 5.9 million, compared to

Qingdao with 7.2 million, and its information technology related economic output

ranks number 4 in China.

The Company is also in high-level discussions with other luxury car

manufacturers with a view to diversifying: our geographical market (to include

the whole of Mainland China); our operations (to include luxury car distribution

as well as retail); and our brand offering.

I am delighted to announce the recent appointment of GruppeM Investments PLC as

the only distributor of Aston Martin motor cars in Mainland China. This

represents a fantastic opportunity for both parties to take full advantage of

this exciting marketplace. We are confident that the combination of Britain's

finest luxury sporting cars manufacturer, and our expertise in the Chinese car

market, will pay great dividends and we look forward to a long and successful

future together.

The board believes that the Company is in a position of strength to capitalise

on the current opportunities within the Chinese luxury car market in order to

grow the business, and shareholder value, rapidly.

I would like to thank all our employees for their contribution to our success

and their support during the Company's early high-growth stage.

Don McCrickard

Chairman

15 August 2007

GRUPPEM INVESTMENTS PLC

Consolidated income statement for the 17 months ended 31 December 2006

17 months Period from

ended 31 16 July 2004

December 2006 to 31 July

2005

Unaudited

Restated

Unaudited

Note # #

Revenue 12,285,042 121,130

Cost of sales (11,647,383) (193,425)

Gross profit 637,659 (72,295)

Distribution expenses (212,940) (1,487)

Administrative expenses (1,314,707) (347,615)

Exceptional items 2 - (142,512)

(Loss) / profit from operations before interest (889,988) (563,909)

Finance income and expense (net) (920) (6)

(Loss) / profit for the period before taxation (890,908) (563,915)

Tax 46,058 -

(Loss) / profit for the period (844,850) (563,915)

(Loss ) / earnings per share expressed in pence per share 3

- Basic (2.87)p (5.70)p

- Diluted (2.83)p (5.70)p

Statement of recognised income and expense for the 17 months ended 31 December

2006

17 months Period from 16

ended 31 July 2004 to 31

December2006 July 2005

Unaudited Restated

Unaudited

# #

(Loss) / profit for the financial year (844,850) (563,915)

Exchange adjustments (40,712) 1,935

Total recognised income and expense for the year (885,562) (561,980)

All amounts relate to continuing activities.

GRUPPEM INVESTMENTS PLC

Consolidated balance sheet as at 31 December 2006

Notes As at As at

31 December 31 July

2006 2005

Unaudited Restated

Unaudited

# #

Assets

Non-current assets

Property, plant and equipment 345,795 108,492

Deferred tax asset 56,246 -

402,041 108,492

Current assets

Inventory 886,825 -

Trade and other receivables 2,969,120 294,710

Cash and cash equivalents 132,350 135,733

3,988,295 430,443

Total assets 4,390,336 538,935

Liabilities

Current liabilities

Current tax payable (11,640) -

Trade and other payables (5,262,005) (722,785)

(5,273,645) (722,785)

Non-current liabilities

Director's loan account (577,556) -

Other loan (19,877) -

Related party loan (182,000) (182,000)

(779,433) (182,000)

Total liabilities (6,053,078) (904,785)

Capital and reserves

Share capital 4 (1,000,000) (200,000)

Merger reserve 5 1,392,156 -

Foreign operation translation reserve (38,777) 1,935

Convertible loan (99,402) -

Retained loss 5 1,408,765 563,915

1,662,742 365,850

Total equity and liabilities (4,390,336) (538,935)

GRUPPEM INVESTMENTS PLC

Consolidated cash flow statement for the 17 months ended 31 December 2006

17 months Period from 16

ended 31 July 2004 to 31

December 2006 July 2005

Unaudited Restated

Unaudited

# #

Cash flow from operating activities

(Loss) / profit from operating activities (889,988) (563,909)

Adjustments for:

Depreciation 36,710 125

Forex adjustment on property, plant and equipment 6,622 -

Net cash flow from operating activities before changes in working (846,656) (563,784)

capital

Increase in inventories (886,825) -

Increase in payables 4,539,220 722,785

Increase in receivables (2,674,410) (294,710)

Net cash flow from operating activities before interest and 131,329 (135,709)

taxation paid

Interest paid (16,594) (6)

Taxation received 1,452 -

Net cash flow from operating activities 116,187 (135,715)

Investing activities

Purchase of property, plant and equipment (280,635) (7,834)

Assets under construction - (100,783)

Interest received 76 -

Net cash flow from investing activities (280,559) (108,617)

Financing activities

Proceeds from issue of ordinary shares - 200,000

Cost of share issue (592,156) -

Issue of convertible loan notes 115,000 -

Director's loan 577,556 -

Other loan 19,877 -

Related party loan - 182,000

Net cash flow from financing activities 120,277 382,000

Net (decrease) / increase in cash and cash equivalents in the (44,095) 137,668

period

Cash and cash equivalents at the beginning of the year 135,733 -

Effect of foreign exchange rate changes on cash and cash 40,712 (1,935)

equivalents

Cash and cash equivalents at the end of the year 132,350 135,733

NOTES TO THE PRELIMINARY ANNOUNCEMENT

1. Basis of preparation

The financial information set out in this announcement does not constitute

Statutory Accounts within the meaning of Section 240(5) of the Companies Act

1985. The statutory accounts have not been delivered to the Registrar of

Companies but will be delivered in due course.

Adoption of IFRS for the 17 months ended 31 December 2006

The financial statements have been prepared in accordance with EU Endorsed

International Financial Reporting Standards ("IFRS") and the Companies Act 1985

applicable to companies reporting under IFRS. In the current period GruppeM

Investments PLC and its subsidiaries ("the Group") has adopted all of the

standards and interpretations issued by the International Accounting Standards

Board and the International Financial Reporting Interpretations Committee that

are relevant to its operations and effective for the Group's financial period

beginning on 1 August 2005.

As at the date of approval of these consolidated financial statements, the

following interpretations were in issue but not yet effective:

* IFRS 7, Financial Instruments: Disclosures;

* IFRS 8, Operating Segments;

* IFRIC 8, Scope of IFRS 2;

* IFRIC 9, Reassessment of embedded derivatives;

* IFRIC 10, Interim Financial Reporting and Impairment;

* IFRIC 11, IFRS 2: Group and Treasury share transactions; and

* IFRIC 12, Service concession arrangements.

The directors do not anticipate that the adoption of these interpretations in

future reporting periods will have a material impact on the Group's results.

Basis of consolidation

The consolidated financial statements consist of GruppeM Investments PLC and its

subsidiaries. All intra-group transactions have been excluded. The

consolidated financial statements of GruppeM Investments PLC have been prepared

under merger accounting rules. This means that the financial statements of

GruppeM Investments PLC, and its wholly owned subsidiary GruppeM Hong Kong

Limited, have been aggregated and presented as if the two companies have always

formed a group.

Accordingly, although GruppeM Investments PLC acquired the entire share capital

of GruppeM Hong Kong Limited on 25 October 2006, the results for both companies

are reflected in the Group financial statements for the whole of the 17-month

period ended 31 December 2006 and the comparatives are presented on the same

basis. The reason being that due to common ownership of the respective entities,

the business combination falls outside the scope of IFRS 3.

Where necessary, adjustments are made to the financial statements of the

subsidiaries to bring their accounting policies into line with those used by

other members of the Group. All intra-group transactions, balances, income and

expenses are eliminated on consolidation.

2. Exceptional expenses

These expenses, in the prior year, relate to legal and professional expenses

arising through the listing on AIM in February 2005, including the preparation

of an AIM admission document.

3. Loss per ordinary share

Basic earnings per share is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary shares

outstanding during the year.

In order to calculate diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all dilutive

potential ordinary shares according to IAS 33. Dilutive potential ordinary

shares include convertible loan notes.

2006 2005

Weighted Per share Weighted Per share

average amount average amount

number of number of

shares shares

Loss Loss

# pence # pence

Basic EPS

Loss attributable to ordinary (844,850) 29,411,765 (2.87) (563,915) 9,895,350 (5.70)

shareholders

Convertible loan note - 405,882 - - - -

Diluted EPS (844,850) 29,817,647 (2.83) (563,915) 9,895,350 (5.70)

4. Share capital

2006 2006 2005 2005

No. # No. #

Authorised:

Ordinary shares of 1p each 200,000,000 2,000,000 100,000,000 1,000,000

Issued and fully paid:

Ordinary shares of 1p each 100,000,000 1,000,000 20,000,000 200,000

Shares issued during the year

Ordinary shares

No. Exercise / share #

issue price

At 31 July 2005 20,000,000 200,000

Acquisition of subsidiary 80,000,000 1p 800,000

At 31 December 2006 100,000,000 1,000,000

On 25 October 2006 the Company issued 80,000,000 new ordinary shares of 1p each

to Pinocelle S.A. for GruppeM Hong Kong. The reverse acquisition has been

recognised under the principles of merger accounting.

5. Movement on reserves

The merger reserve represents a reserve arising on consolidation, being the

share capital and share premium account balances of GruppeM Hong Kong Limited at

1 Februay 2005, i.e., its date of incorporation less the nominal value of the

shares issued by the Company to acquire the shares, reflecting the position as

if the merger had occurred on 1 February 2005.

Group Foreign currency

translation

reserve

Merger reserve Retained

earnings

# # #

At 16 July 2004 - - -

Loss for the year (563,915)

Foreign exchange loss on translation 1,935

Share issue expenses -

Elimination of share capital -

At 31 July 2005 - 1,935 (563,915)

Loss for the year (844,850)

Foreign exchange gain on translation (40,712)

Share issue expenses 592,156

Arising on share issue (3,200,000)

Reversal of investment 4,000,000

At 31 December 2006 1,392,156 (38,777) (1,408,765)

Circulation to shareholders

The annual report and accounts will be posted to shareholders in due course and

will be available to the public from the Company's registered office at GruppeM

Investments PLC, Suite 1.3 Buckingham Court, 78 Buckingham Gate, London, SW1E

6PD.

For more information please contact:

GruppeM Investments PLC

Kenny Chen

Tel: +44 (0) 207 233 2952

Shore Capital and Corporate Limited

Alex Borrelli

Pascal Keane

Tel: +44 (0) 207 408 4090

Further information on GruppeM Investments PLC can be found on the Company's

website: www.gruppemplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR OKQKQOBKDAFD

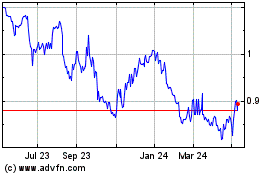

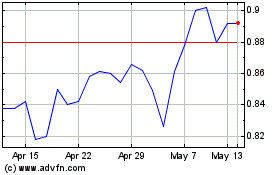

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jul 2023 to Jul 2024