RNS Number:7559J

GruppeM Investments PLC

02 October 2006

2 October 2006

GruppeM Investments PLC

(the "Company")

Proposed acquisition of GruppeM Hong Kong Limited

("GruppeM Hong Kong")

Highlights

* Proposed acquisition of GruppeM Hong Kong which operates a Porsche

dealership in Qingdao, Shandong Province, East China for #4 million from

Pinocelle SA, nominee company of Kenny Chen, Managing Director

* GruppeM Hong Kong, established in 2005, has pre-sold all its 2006 calendar

year quota amounting to 250 Porsche vehicles; plans to open two further

Porsche dealerships in Shandong Province

* Acquisition in line with the investing strategy at the time of the

flotation on AIM in February 2005 and constitutes a reverse takeover under

the AIM Rules

* Consideration to be satisfied by the issue of 80 million new ordinary

shares at 5p per share and subject to shareholders' approval at an

Extraordinary General Meeting to be held on 25 October 2006

* Pinocelle has committed to the Company a convertible loan of #650,000,

full amount payable on or before 31 October 2006, for working capital

purposes

* Appointment of two additional directors - Paul McIlwaine who has joined as

finance director; and Julian Hardy as sales director with effect from

completion of the acquisition

* Second interim results for the six months ended 31 July 2006 also

announced

Kenny Chen, Managing Director, commented: "We believe that there are significant

opportunities for the selling and servicing of Porsche cars in China. GruppeM

Hong Kong has a well-established relationship with Porsche China and we look

forward to developing the business further through the opening of additional

dealerships in Shandong, China's third largest province."

Press enquiries:

GruppeM Investments PLC

Kenny Chen (Managing Director) 020 7233 2952

Paul McIlwaine (Finance Director) 020 7233 2952

Shore Capital

Alex Borrelli 020 7468 7932

GruppeM Investments PLC

(the "Company")

Proposed acquisition of GruppeM Hong Kong Limited

("GruppeM Hong Kong")

Introduction

The Company announces today that agreement had been reached, subject, inter

alia, to Shareholders' approval, to acquire from Pinocelle SA, a nominee company

of Kenny Chen, the entire issued share capital of GruppeM Hong Kong, the holding

company of a group operating a Porsche dealership in Qingdao, Shandong Province,

China. The Acquisition represents the first step in the implementation of the

Company's strategy of making investments in, inter alia, motor retailing in

China and the Far East, as envisaged at the time of the Company's flotation on

AIM in February 2005.

The consideration for the Acquisition is to be satisfied by the issue of

80,000,000 new Ordinary Shares on Completion, which will represent 80 per cent

of the Enlarged Share Capital. On 29 September 2006 in order to satisfy the

working capital requirements of the Company, and irrespective of whether

Completion occurs, Pinocelle has committed the Loan to the Company, being a loan

amounting to #650,000 in consideration for the issue to Pinocelle of the

Convertible Loan Notes, such issue being subject to the passing of certain

Resolutions at the Extraordinary General Meeting of the Company to be held on 25

October 2006.

In addition, Kenny Chen and the Company have agreed that the Director's Loan,

which was due to be repaid on or after 17 August 2006, should remain in place in

return for the issue by the Company to Kenny Chen of a Convertible Loan Note in

the sum of #115,000. The Director's Loan is now therefore subject to the terms

and conditions of the Convertible Loan Notes.

The Company is also pleased to announce today the appointment of two additional

Directors. Paul McIlwaine was appointed Finance Director on 29 September 2006.

Julian Hardy has been appointed Sales Director with effect from Completion,

responsible for the retail sales and service operations of GruppeM Hong Kong.

In view of its size, the Acquisition constitutes a reverse takeover under the

AIM Rules and is therefore conditional, inter alia, upon the approval of

Shareholders at the EGM. The Acquisition, the issue of the Convertible Loan

Notes to Pinocelle (in respect of the Loan) and the issue of Convertible Loan

Notes to Kenny Chen (in respect of the Director's Loan) also represent related

party transactions under the AIM Rules. If the Resolutions are passed at the

EGM, the Company's existing quotation on AIM will be cancelled and the Company

will apply for the Enlarged Share Capital to be admitted immediately to trading

on AIM.

Background to and reasons for the Acquisition

The Company was established for the purpose of making investments in the

property sector and motor retailing in China and the Far East. In addition to

the purchase of direct interests in land for the purposes of property

development, the Company may make investments in quoted or unquoted companies,

partnerships or joint ventures, which have direct or indirect interests in

property.

The Directors believe that, given the current market conditions in China, good

opportunities exist for investment in motor retailing high value European sports

cars. The trend is demonstrated by the number of marques entering China, which

is now the world's third-largest car market.

Following the Company's admission to AIM, which was effective on 18 February

2005, the Directors have evaluated various opportunities in China in conjunction

with Kenny Chen whose connected companies, trading under the 'GruppeM' name,

have existing business interests in China and the Far East. In particular,

GruppeM Hong Kong, owned by Pinocelle, has recently established a motor

retailing business operating in Qingdao, Shandong Province in China, trading in

Porsche cars.

The Independent Directors believe that GruppeM Hong Kong represents a

significant acquisition opportunity for the Company in line with its stated

strategy and have reached agreement with Kenny Chen, subject to Shareholders'

approval, to acquire GruppeM Hong Kong from Pinocelle for an aggregate

consideration of #4 million to be satisfied by the issue of 80 million new

Ordinary Shares at 5p per share. GruppeM Hong Kong has secured the distribution

rights for trading Porsche cars within Shandong Province and the Directors

believe that the trading of Porsche cars, including used Porsche cars, has

significant potential for growth within China.

Information on GruppeM Hong Kong

GruppeM Hong Kong was incorporated in Hong Kong on 1 February 2005 and is a

non-trading holding company. It is a wholly-owned subsidiary of Pinocelle, the

issued share capital of which is held beneficially by Kenny Chen.

GruppeM Hong Kong has two subsidiary companies:

* GruppeM Services whose principal activity is the provision of after

sales service and a service centre/workshop for Porsche cars; and

* GruppeM Sales whose principal activity is the retail of Porsche motor

vehicles.

GruppeM Services is a wholly owned foreign entreprise ("WOFE"), some of the main

advantages of which include:

* independence and freedom to implement the strategies of its parent

company;

* the ability to issue invoices to customers in RMB and receive revenues

in RMB;

* the ability to convert Renminbi ("RMB") profits to other currencies

for remittance to a parent company outside China up to the amount of the

invested capital; and

* not being subject to certain local taxes such as education and city

maintenance taxes.

The Directors believe that there is a considerable and fast-growing market in

China for foreign cars, particularly at the high-end, luxury level. Furthermore,

they are encouraged by the prospects for the Enlarged Group within Shandong

Province, China's third largest province.

Porsche retailing and servicing

GruppeM Sales was initially granted the Porsche dealership rights for Shandong

Province in China by way of a letter of intent ("LOI") from Porsche China.

GruppeM Sales and GruppeM Services have recently reviewed a draft dealership

agreement which the Directors expect will be entered into with Porsche China in

the near future. The Directors believe that trading between GruppeM Sales,

GruppeM Services and Porsche China will continue on a satisfactory basis until

such time as the new dealership agreement has been entered into.

GruppeM Sales currently operates from a showroom in the Shinan District of

Qingdao close to the service centre/workshop which together trade as the "

Porsche Centre Qingdao".

Porsche China runs a quota system for its dealers. Quotas are agreed yearly and

reviewed half yearly. Since the showroom opened on 11 June 2005, GruppeM Sales

has pre-sold all of its 2006 calendar year quota amounting to 250 Porsche

vehicles. Porsche models sold are the Boxster, Carrera 911, Cayman and Cayenne,

a multi-purpose sports utility vehicle which is currently the most popular

choice amongst Chinese buyers and which comprises approximately 87.5 per cent of

GruppeM Sales' committed sales to date.

GruppeM Sales receives a dealer margin of 15.0 per cent, calculated on the

dealer price plus import duty and shipping charges. The Directors believe that

the margin is one of the highest in the motor retail industry in China. Chinese

sales VAT of 17 per cent is payable by the customer who bears all costs in

relation to the importation of the car to China.

Since 1 April 2005 China has allowed manufacturer-approved retailers, such as

GruppeM Sales, to sell used cars of that manufacturer's brand. GruppeM Sales is

therefore able to accept used Porsche cars in part exchange on the sale of new

Porsche cars and this will facilitate trade in the second hand car market.

The Directors believe that there is considerable opportunity for the marketing

of Porsche cars in Shandong Province and are planning for two other Porsche

dealerships in Jinan and Yantai.

Foreign currency exposure

Turnover from the retailing and service activities of GruppeM Hong Kong is

generated in RMB which is pegged against a basket of currencies including the US

dollar. Payments to Porsche China are made in RMB. The only significant foreign

currency exposure that arises is on the repatriation of funds to the UK although

the Directors do not believe that this represents a material risk to the

Company.

Financial information on GruppeM Hong Kong Group

For the fourteen month period ended 31 March 2006, GruppeM Hong Kong Group

generated a loss before taxation of #309,211 on revenue of #2,051,981. Net

liabilities at that date amounted to #315,531.

The Directors are confident of GruppeM Hong Kong Group achieving significant

progress as the business continues to develop.

Current trading and prospects

The Company announces today second interim results for the six months ended 31

July 2006. The Company made a loss for the period of #208,154. Net liabilities

at 31 July 2006 amounted to #604,160.

The Directors believe that the Acquisition represents a substantial opportunity

for the Company and are confident of generating increased shareholder value as

the retailing and service activities of GruppeM Hong Kong Group expand.

Financial statements for the Enlarged Group prepared under IFRS will be reported

in Sterling.

Principal terms of the Acquisition Agreement

On 29 September 2006, the Company entered into an agreement (the "Acquisition

Agreement") with Pinocelle and Kenny Chen to acquire (conditional upon

Shareholders' approval) from Pinocelle the entire issued share capital of

GruppeM Hong Kong for a total consideration of #4 million.

Under the terms of the Acquisition Agreement, the consideration is to be

satisfied by the allotment and issue of 80,000,000 new Ordinary Shares (the "

Consideration Shares") upon Completion, of which 60,500,000 new Ordinary Shares

are to be allotted to Pinocelle and the balance of 19,500,000 new Ordinary

Shares to the Initial Subscribers. Kenny Chen and Pinocelle have given

warranties and indemnities regarding GruppeM Hong Kong under the Acquisition

Agreement.

The Consideration Shares will rank pari passu in all respects with the existing

Ordinary Shares, including the right to receive all dividends and other

distributions declared, made or paid after the applicable dates of allotment.

Application will be made for the Enlarged Share Capital to be admitted to

trading on AIM. It is expected that Admission will be effective and that

dealings will commence on AIM on 30 October 2006. The Consideration Shares will

represent 80 per cent of the Enlarged Share Capital.

It is expected that the relevant Consideration Shares will be delivered into

CREST on 30 October 2006 and that share certificates for the Consideration

Shares will be despatched by 3 November 2006.

Following Admission, the Directors will be interested in 85,500,000 Ordinary

Shares representing 85.5 per cent of the Enlarged Share Capital.

Directors

The Directors (including the Proposed Director) are as follows:

The Rt. Hon. The Lord Marsh of Mannington Kt., aged 78, Non-Executive Chairman

Lord Marsh was the Member of Parliament for Greenwich from 1959 to 1970 and was

the Parliamentary Secretary for the Ministry of Labour (1964-65) and the

Ministry of Technology (1965-66). He was a Cabinet Minister from 1966 to 1970,

having been first Minister of Energy and then Minister of Transport. Among the

many chairmanships and directorships previously held by Lord Marsh, he has been

the Chairman of the British Railways Board (1971-75), Chairman of the British

Iron & Steel Consumers' Council (1975-81), Chairman of the Newspaper Publishers'

Association (1975-90) and Vice-Chairman then Chairman of TV-am Plc (1980-84).

Since 1982 to date, Lord Marsh has been adviser to various companies including

the Nissan Motor Company, Tokyo, Fujitec Co Ltd, Osaka and Taisei Europe Ltd. Of

particular relevance to the Company is Lord Marsh's experience in his

directorships of Charles Church Group Ltd (1987-96), China & Eastern Investment

Company Ltd (Hong Kong) (1987-96) and Chairman and Founder of Income Growth

Trust plc (1996-2005).

Kenny Chen, aged 29, Managing Director

Kenny Chen is a professionally qualified architect with experience of

substantial property development projects. Having obtained an MA & Diploma in

Architecture from The Architectural Association School of Architects in London,

Kenny Chen worked for architects in both the UK and Taiwan.

Kenny Chen has worked on many high-profile projects, including the #70 million

Fulham Football Club Redevelopment, the proposed #150 million New Residential

Tower at Millbank in London and the ADC Theatre, University of Cambridge. Kenny

Chen is the founder and owner of GruppeM Europe Limited, which distributes high

performance car parts and accessories, including specialist racing air filter

intake systems for GT racing and road cars. Kenny Chen also owns and manages

GruppeM Racing which won the 2003/2004 British GT Championship. It was the

approved Porsche factory works team for Porsche Germany in 2005. In September

2005, GruppeM Racing won the FIA GT Championship. Kenny Chen is Stephen Chen's

son.

Paul McIlwaine, aged 34, Finance Director

Paul McIlwaine ACA Cert PFS qualified as a chartered accountant with

PricewaterhouseCoopers where he spent 10 years latterly leading change

management projects for The Royal Bank of Scotland Group plc, Barclays plc and

The Office of the Deputy Prime Minister. He was previously finance director of

AIM-listed Camaxys Group plc.

Julian Hardy, aged 47, Proposed Director

Julian Hardy holds a Masters degree in Retail Automotive Management from

Loughborough University. He has spent his career within the automotive sector

since 1975 latterly holding senior management roles. From April 2002 to February

2003 he was general manager of Brunel Ford in Bristol responsible for three Ford

main dealerships and part of Ford Retail Europe. Since that time he has been

general manager of Porsche Centre Reading, responsible for the budgeting,

performance and profitability of the largest Porsche retail operation in Europe.

Raymond Man, aged 30, Executive Director

Raymond Man graduated in 2000 with a BA(Hons) in Hospitality Management from the

University of Central England, Birmingham. He has been with GruppeM Europe

Limited since December 2001 as Operations Manager. Prior to that, Raymond was an

administrator at Donaldson, Lufkin & Jenrette (an affiliate of Credit Suisse

First Boston).

Stephen Chen, aged 57, Non-Executive Director

Stephen Chen holds a Masters degree in law from National Chung Hsing University

in Taiwan. He was general manager for Hsing Ya Steel Mill Co. Ltd in Taiwan,

specialising in waste metal purchasing and new steel production for export,

between 1971 and 1981. In 1981, Stephen established Hwa Chung Construction Co.

Ltd. The main focus of the business has been the master planning and development

of the Chung Hwa village, an area of approximately 150 acres owned by the Chen

family, with a current estimated value of #100 million. He has also been

responsible for the development of other substantial residential and commercial

developments in Taiwan and Japan. In 2002, Stephen set up Ching Chen Investments

Co. Ltd for the acquisition and management of commercial properties in Tokyo.

Investments to date include two commercial and retail buildings in Harajuku (#35

million) and a commercial and retail building in Ginza (#6 million). Stephen is

Kenny Chen's father.

Lock-in arrangements

The Directors (other than Lord Marsh, Paul McIlwaine and Julian Hardy), whose

interests in the Company will amount to 85,500,000 Ordinary Shares representing

85.5 per cent of the issued Ordinary Shares on Completion, have undertaken not

to dispose of any interest in their Ordinary Shares for a minimum period of 12

months following Completion, except in the very limited circumstances allowed by

the AIM Rules.

The terms of the lock-ins enable the parties to accept an offer for the Company,

to give irrevocable undertakings to accept an offer for the Company, and to sell

their Ordinary Shares to potential offerors for the Company.

Initial Subscribers

Prior to June 2005, Pinocelle entered into a verbal arrangement with the Initial

Subscribers for the allocation of part of any new Ordinary Shares that may be

issued by the Company to Pinocelle as consideration for the first acquisition

effected by the Company. As a result, of the Consideration Shares to be issued

in respect of the Acquisition, the allocation will be as follows:

Proportion of the Consideration

Shares

Pinocelle (connected with Kenny Chen, Director) 75.625%

Michael Beckman 1.50%

Barry Carpenter 2.00%

Stephen Chen, Director 5.00%

Howard Freeman 1.50%

Raymond Man, Director 5.00%

Noble Hill Overseas Holdings Limited 4.75%

Marvin Tien 2.00%

Annie Tsang 0.50%

Dominic Tsang 0.50%

Varudh Varavan 0.625%

David Yuen 1.00%

100%

Messrs Beckman, Carpenter, Freeman and Varavan and Noble Hill Overseas Holdings

(a company registered in the British Virgin Islands) are unrelated investors; Mr

and Mrs Tsang and Mr Yuen are individual investors in the Company, but have a

commercial relationship as investors with each other in other businesses wholly

unrelated to the Company; and Mr Tien was a director of the Company.

Save as mentioned above, the Initial Subscribers have no relationship with

Pinocelle, Kenny Chen or the Company.

The Concert Party

The members of the Concert Party are Kenny Chen, Pinocelle, a nominee company of

Kenny Chen, and Stephen Chen, Director.

Pinocelle was incorporated in the British Virgin Islands on 4 January 2005 as an

international business company under the International Business Companies Act

(Cap. 291) with registered number 634154. Its registered office is situated at

Mill Mall, Suite 6 Wickhams Cay 1, PO Box 3085, Road Town, Tortola, British

Virgin Islands. One share of $1 in the company is held in the name of Jen-Te

(Kenny) Chen. Pinocelle has one appointed director, Oaklawn Limited, and one

secretary, ILS Secretaries Limited. Pinocelle is a non- trading company with no

assets other than the shares in the Company shown in the table below and in

GruppeM Hong Kong. Pinocelle has not prepared any financial statements in

respect of the period since its incorporation.

The interests of the members of the Concert Party in the Company are, and will

be following Completion, as follows:

Number of Percentage of Number of Percentage

Ordinary issued share Ordinary of issued

Shares prior capital prior Shares after share

to Completion to Completion Completion capital

after

Completion

Directors

Kenny Chen (including Pinocelle) 15,000,000 75.0% 75,500,000 75.5%

Stephen Chen 1,000,000 5.0% 5,000,000 5.0%

16,000,000 80.0% 80,500,000 80.5%

The City Code

The City Code is issued on behalf of the Panel on Takeovers and Mergers (the "

Panel"). It is kept under review by the Code Committee of the Panel.

The City Code is designed principally to ensure that shareholders are treated

fairly and are not denied an opportunity to decide on the merits of a takeover.

It also provides an orderly framework within which takeovers are conducted.

The City Code has been developed since 1968 to reflect the collective opinion of

those professionally involved in the field of takeovers as to appropriate

business standards and as to how fairness to shareholders and an orderly

framework for takeovers can be achieved.

The City Code applies to all offers for, inter alia, companies and Societas

Europaea which have their registered offices in the United Kingdom, the Channel

Islands or the Isle of Man if any of their securities are admitted to trading on

a regulated market in the United Kingdom or on any stock exchange in the Channel

Islands or the Isle of Man. The City Code also applies to all offers for, inter

alia, public and certain categories of private companies and Societas Europaea

which have their registered offices in the United Kingdom, the Channel Islands

or the Isle of Man and which are considered by the Panel to have their place of

central management and control in the United Kingdom, the Channel Islands or the

Isle of Man.

Under the City Code, a concert party arises when persons who, pursuant to an

agreement or understanding (whether formal or informal), co-operate to obtain or

consolidate control of a company or to illustrate the successful outcome of an

offer for a company. Control means an interest, or interests, in shares carrying

in aggregate 30 per cent or more of the voting rights of a company, irrespective

of whether such interest or interests give de facto control. For the purposes of

the City Code, Kenny Chen, Pinocelle and Stephen Chen (Director), are deemed to

be acting in concert. Following Completion, the Concert Party's holding will

amount to 80,500,000 Ordinary Shares representing 80.5 per cent of the Enlarged

Share Capital.

Pursuant to Rule 9 of the City Code, when any person who acquires, whether by a

series of transactions over a period of time or not, an interest in shares which

(taken together with shares in which persons acting in concert with him are

interested) carry 30 per cent or more of the voting rights of a company such

person is normally required to make a general offer to all shareholders in that

company in cash to acquire the remaining shares in the company not already held

by them at the highest price paid for any shares in the company in the 12 months

prior to the announcement of the offer by the person required to make the offer

or any person acting in concert with him.

Where any person, together with persons acting in concert with him, is already

interested in shares which in the aggregate carry not less than 30 per cent, but

not hold shares carrying more than 50 per cent, of the voting rights of such a

company, a general offer will be required if he or any person acting in concert

with him, acquires an interest in any other shares which increases the

percentage of shares carrying voting rights in which he is interested.

Following Completion, the Concert Party will continue to hold more than 50 per

cent of the Company's voting share capital and (whilst the members of the

Concert Party continue to be treated as acting in concert) will be able to

increase its shareholding without being subject to the provisions of Rule 9 of

the City Code. However, individual members of the Concert Party should contact

the Panel before buying through a Rule 9 threshold.

Further details concerning Kenny Chen, Pinocelle and Stephen Chen are set out in

the sections headed 'Directors' and 'The Concert Party' above.

Related party transactions

The Acquisition, in view of Kenny Chen's position as a Director and also as the

beneficial owner of Pinocelle, which has agreed to sell GruppeM Hong Kong to the

Company, represents a related party transaction under the AIM Rules. The

Independent Directors, having consulted with the Company's nominated adviser,

Shore Capital, consider that the terms of the Acquisition are fair and

reasonable insofar as Shareholders are concerned.

On 29 September 2006, in order to satisfy the working capital requirements of

the Company, and irrespective of whether Completion occurs, Pinocelle committed

to the Company a loan (the "Loan") amounting to #650,000 in consideration for

which the Company would, subject to Shareholders' approval, issue the

Convertible Loan Notes, subject and pursuant to the Convertible Loan Note

Instrument. Of the Loan, the Company has received #260,000 and Pinocelle has

committed to pay to the Company the balance of the Loan amounting to #390,000 on

or before 31 October 2006 and, on receipt and subject to the passing of

Resolutions 2, 3 and 4, the Company will issue Convertible Loan Notes for the

full amount subject and pursuant to the Convertible Loan Note Instrument.

The proceeds of the Loan will be applied to satisfy the working capital

requirements of the Company.

In addition, Kenny Chen and the Company have agreed that the Director's Loan,

which was due to be repaid on or after 17 August 2006, should remain in place in

return for the issue by the Company to Kenny Chen of a Convertible Loan Note in

the sum of #115,000. The Director's Loan is now therefore subject to the terms

and conditions of the Convertible Loan Notes.

The issue of the Convertible Loan Notes to Pinocelle (in respect of the Loan)

and to Kenny Chen (in respect of the Director's Loan) also represents related

party transactions under the AIM Rules. The Directors (other than Kenny Chen),

having consulted with the Company's nominated adviser, Shore Capital, consider

that the terms of the Convertible Loan Notes are fair and reasonable insofar as

Shareholders are concerned.

Working capital

The Directors are of the opinion that, having made due and careful enquiry, the

working capital available to the Company will be sufficient for its present

requirements, that is, for at least the next 12 months from Admission.

Dividend policy

The Directors believe the Company should seek to generate capital growth for its

Shareholders, but may recommend distributions at some future date, depending

upon the generation of sustainable profits and when it becomes commercially

prudent so to do.

Taxation

Investors in any doubt as to their tax position, or are subject to tax in a

jurisdiction other than the UK, should consult their professional advisers

Corporate governance

The Directors recognise the importance of sound corporate governance

commensurate with the size of the Company and the interests of Shareholders. As

the Company develops, the Directors intend that it should develop policies and

procedures, which reflect the Principles of Good Governance and Code of Best

Practice as published by the Committee on Corporate Governance (commonly known

as the "Combined Code"). So far as is practicable, taking into account the size

and nature of the Company, the Directors will take steps to comply with the

Combined Code.

The Directors have established an audit committee (comprising Lord Marsh and

Paul McIlwaine) to receive and review reports from management and from the

auditors relating to the interim and annual accounts and to the system of

internal financial control. The Directors have established a remuneration

committee (comprising Lord Marsh and Paul McIlwaine) which will, when

applicable, determine the terms and conditions of service of executive

directors.

The Company has adopted the Model Code for Directors' dealings as applicable to

AIM companies and will take all proper and reasonable steps to ensure compliance

by the Directors and relevant employees.

CREST

The Articles permit the Company to issue shares in uncertificated form in

accordance with the Regulations. The Directors have applied for the New Ordinary

Shares to be admitted to CREST with effect from Admission. Accordingly,

settlement of transactions in the Ordinary Shares following Admission may take

place in the CREST system if the relevant Shareholders wish.

CREST is a voluntary system and holders of Ordinary Shares who wish to receive

and retain certificates will be able to do so.

SECOND INTERIM RESULTS OF GRUPPEM INVESTMENTS PLC

CHAIRMAN'S STATEMENT

Overview

I am delighted to announce the proposed acquisition of GruppeM Hong Kong

Limited, subject to shareholders' approval. GruppeM Hong Kong Limited is a Hong

Kong based company with two Chinese subsidiaries operating a successful Porsche

dealership in Qingdao - an affluent city on the east coast of China. The Board

believes that the acquisition represents an excellent opportunity for future

growth in line with our investing strategy as outlined in the admission document

of February 2005.

Financial results

In the six months ended 31 July 2006, the Company made a loss of #208,154 after

exceptional costs of #97,323. This compares to a loss of #427,385, after

exceptional costs of #310,299, in the six month period ended 31 January 2006.

The exceptional costs are in relation to the legal and professional costs

billed, and accrued, in advance of the proposed transaction announced today.

Working capital

There has been a further injection of capital of #260,000 into the Company, in

the form of a convertible loan, in order to fulfil its ongoing working capital

requirements.

Strategy

The Board is aiming to expand the business both organically and by continuing to

seek high-quality acquisitions in line with the investing strategy. The Board

believes it can drive growth, and thereby shareholder value, by taking advantage

of the strong market conditions prevalent within the Chinese market at present.

Market prospects

According to the World Bank, the rapid growth of the Chinese economy is making

an increasingly important contribution to the growth rate worldwide. China has

made the largest contribution - 13 per cent - since joining the World Trade

Organisation (WTO) in 2001.

Since China implemented a policy of reform and opening-up to the outside world

in 1979, the economy has maintained robust growth, with the average annual

growth rate in GNP reaching 9.6 per cent 28 years in a row. It is predicted that

the Chinese economy will still be increasing by 7 per cent annually in 2020.

The continued strong growth of the economy as a whole has had a significant

impact on China's 'luxury' car market. A leading Chinese marketing company's

research has shown that the luxury market supplied by manufacturers such as

Audi, BMW, Cadillac, Mercedes-Benz, Lexus, Volvo and Porsche grew by more than

45 per cent in just one year from 2004 to 2005.

The Board believes that the overall growth in the Chinese economy, and the

specific market in which the proposed acquisition is operating, endorses our

investing strategy and represents an exciting backdrop for our proposed

operations in China going forward.

Once again, I would like to thank all our employees and professional advisors

for their hard work and support in facilitating the significant reverse takeover

transaction and we look forward to working with them again in the near future.

Lord Marsh

Chairman, on behalf of the Board

INCOME STATEMENT

For the six month period ended 31 July 2006

Notes Six months ended 31 July Six months ended 31 January Period ended 31 July

2006 (Unaudited) 2006 (Unaudited) 2005 (Audited)

# # #

Administrative expenses 3 (208,133) (426,902) (168,777)

Operating loss before (208,133) (426,902) (168,777)

financial income

Interest received 24 23 156

Interest paid (45) (506) -

Loss for the period 4 (208,154) (427,385) (168,621)

Loss per share

Basic 15 (1.04p) (2.14p) (1.70p)

BALANCE SHEET

As at 31 July 2006

Notes 31 July 2006 31 January 2006 31 July 2005

(Unaudited) (Unaudited) (Audited)

# # #

ASSETS

Non-current assets

Property, plant and equipment 8 1,301 1,566 -

Current assets

Trade and other receivables 9 8,296 5,091 8,185

Cash and cash equivalents 10 - 145 94,746

TOTAL ASSETS 9,597 6,802 102,931

LIABILITIES

Current liabilities

Trade and other payables 11 613,757 402,808 71,552

NET CURRENT (LIABILITIES)/ASSETS (605,461) (397,572) 31,379

TOTAL LIABILITIES 613,757 402,808 71,552

EQUITY

Equity attributable to

shareholders

Share capital 12 200,000 200,000 200,000

Accumulated losses (804,160) (596,006) (168,621)

TOTAL EQUITY (604,160) (396,006) 31,379

TOTAL EQUITY AND LIABILITIES 9,597 6,802 102,931

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Accumulated Total

capital losses Equity

# # #

Balance as at 31 July 2005 200,000 (168,621) 31,379

Net loss for the period - (427,385) (427,385)

Balance as at 1 February 2006 200,000 (596,006) (396,006)

Net loss for the period - (208,154) (208,154)

Balance as at 31 July 2006 200,000 (804,160) (604,160)

CASH FLOW STATEMENT

For the six month period ended 31 July 2006

Six months ended 31 July Six months ended 31 January Period ended 31 July

2006 (Unaudited) 2006 (Unaudited) 2005 (Audited)

# # #

CASH FLOWS FROM OPERATING

ACTIVITIES

Loss from operations (208,133) (426,902) (168,777)

Depreciation 265 169

Decrease/(increase) in trade and (3,205) 3,094 (8,185)

other receivables

Increase in trade and other 135,590 307,235 66,704

payables

Interest paid (45) (506) -

CASH USED IN OPERATING ACTIVITIES (75,528) (116,910) (110,258)

CASH FLOWS FROM INVESTING

ACTIVITIES

Interest received 24 23 156

Purchases of property, plant and - (1,735) -

equipment

NET CASH RECEIVED/(USED IN) 24 (1,712) 156

INVESTING ACTIVITIES

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from issue of shares - - 200,000

Proceeds from short-term 243,717 189,372 509,468

borrowings

Repayment of short-term borrowings (168,378) (165,351) (504,620)

NET CASH FROM FINANCING ACTIVITIES 75,339 24,021 204,848

NET (DECREASE)/INCREASE IN CASH (165) (94,601) 94,746

AND CASH EQUIVALENTS

CASH AND CASH EQUIVALENTS AT 145 94,746 -

BEGINNING OF PERIOD

CASH AND CASH EQUIVALENTS AT END (20) 145 94,746

OF PERIOD

Bank balances and cash (20) 145 94,746

NOTES TO THE FINANCIAL STATEMENTS

For the six month period ended 31 July 2006

1. Group and Principal Activities

GruppeM Investments Plc ("Company") is a public limited company incorporated in

England and Wales on 16 July 2004 with company number 5181790.

The Company has not traded during the period.

2. Accounting Policies

The principal accounting policies, adopted in the preparation of the financial

information are set out below:

(a) Basis of presentation

The financial information has been prepared in accordance with International

Financial Reporting Standards ("IFRS"), including International Accounting

Standards ("IAS") and interpretations issued by the International Accounting

Standards Board.

The financial information has been prepared under the historical cost

convention.

(b) Receivables

Trade receivables are carried at original invoice amount less provision made for

impairment of these receivables.

(c) Cash and cash equivalents

Cash and cash equivalents are carried in the balance sheet at cost. Cash and

cash equivalents comprise cash on hand, deposits held at call with banks and

other short-term highly liquid investments with original maturities of three

months or less. Bank overdrafts are included within borrowings in current

liabilities on the balance sheet.

(d) Financial liabilities

The Company's financial liabilities include trade, payments in advance for

products and other payables. Financial liabilities are recognised when the

Company becomes a party to the contractual agreements of the instrument.

3. Expenses by Nature

Six months ended Six months ended Period ended

31 July 2006 31 January 2006 31 July 2005

# # #

Employee benefit costs 70,441 33,631 6,333

Flotation costs 97,323 310,299 133,950

Other expenses 40,369 82,972 28,494

208,133 426,902 168,777

4. Loss for the Period

Six months Six months Period

ended ended ended

31 July 2006 31 January 31 July

# 2006 2005

# #

Loss for the period has been stated after charging:

Depreciation 265 169 -

Auditors' remuneration - as auditors - 38,674 6,463

Auditors' remuneration - other services(i) 44,427 46,655 5,320

Directors' remuneration (note 6) 20,001 - 6,333

Staff costs - wages and salaries excluding directors' remuneration 50,440 33,631 -

(note 5)

(i) In connection with the Company's admission to the AIM Market and proposed

investment transaction.

5. Employee benefit expense

Six months ended Six months ended Period ended

31 July 2006 31 January 2006 31 July 2005

# # #

Wages and salaries 45,000 30,000 -

Social security costs 5,440 3,631 -

50,440 33,631 -

6. Directors' Remuneration

Six months Six months Period

ended ended ended

31 July 2006 31 January 31 July

# 2006 2005

# #

Directors' remuneration charged to the income statement for the period is

as follows:

Fees 18,000 - 6,000

Social security costs 2,001 - 333

20,001 - 6,333

7. Taxation

No provision for taxation has been made as the Company has made losses in the

period.

The tax assessed for the period differs from the loss before tax at the standard

rate of corporation tax in the UK (30 per cent).

The differences are explained below:

Six months Six months Period

ended ended ended

31 July 31 January 31 July

2006 2006 2005

# # #

Loss for the period before taxation (208,154) (427,385) (168,121)

Loss for the period at the standard rate of taxation of 30% (62,447) (128,216) (50,586)

Addition to tax loss 62,447 128,216 50,586

- - -

8. Property, Plant and Equipment

Office equipment Total

# #

Cost

At 31 July 2005 - -

Additions at cost 1,735 1,735

At 31 January 2006 1,735 1,735

Additions at cost - -

At 31 July 2006 1,735 1,735

At 31 July 2005 - -

Charge for the period 169 169

Accumulated depreciation

At 31 January 2006 169 169

Charge for the period 265 265

At 31 July 2006 434 434

Net book value at 31 July 2006 1,301 1,301

Net book value at 31 January 2006 1,566 1,566

9. Trade and Other Receivables

31 July 2006 31 January 2006 31 July 2005

# # #

Prepaid expenses 8,296 5,091 8,185

10. Cash and Cash Equivalents

31 July 2006 31 January 2006 31 July 2005

# # #

Cash at bank - 145 94,746

11. Trade and Other Payables

31 July 2006 31 January 2006 31 July 2005

# # #

Bank overdraft 20 - -

Trade payables 119,463 122,014 54,366

Other payables (see note 14) 104,208 28,869 4,848

Accrued expenses 390,066 251,925 12,338

613,757 402,808 71,552

12. Share Capital

31 July 2006 31 January 2006 31 July 2005

# # #

AUTHORISED

100,000,000 ordinary shares of 1p each 1,000,000 1,000,000 1,000,000

ALLOTTED, CALLED UP AND FULLY PAID

20,000,000 ordinary shares of 1p each 200,000 200,000 200,000

13. Post balance sheet events

On 29 September 2006, in order to satisfy the working capital requirements of

the Company, and irrespective of whether Completion occurs, Pinocelle committed

to the Company the Loan amounting to #650,000 in consideration for which the

Company would, subject to the passing of Resolutions, issue the Convertible Loan

Notes, subject and pursuant to the Convertible Loan Note Instrument. Of the

Loan, the Company has received #260,000, and Pinocelle has committed to pay to

the Company the balance of the Loan amounting to #390,000 on or before 31

October 2006 and, on receipt and subject to the passing of Resolutions 2, 3 and

4 as set out in the EGM Notice, the Company will issue Convertible Loan Notes

for the full amount subject and pursuant to the Convertible Loan Note

Instrument.

The Convertible Loan Note is convertible to shares at the conversion price which

is the average closing price for an Ordinary Share for the ten consecutive

trading days ending on the trading day preceding the redemption date. The

Convertible Loan Note is repayable in full at par on the earlier of (a) five

business days after the service of a redemption notice such service to be on or

after the second anniversary of the date of the Convertible Loan Note Instrument

and (b) the third anniversary of the date of the Convertible Loan Note

Instrument. The Convertible Loan Notes bear interest at the rate of 2 per cent

per annum above the base rate from time to time of HSBC Bank PLC.

On 29 September 2006, the Company entered into an agreement with Pinocelle SA,

conditional upon admission to acquire the whole of the issued share capital of

GruppeM Hong Kong Limited and all its directly and indirectly wholly-owned

subsidiary undertakings. The consideration is to be satisfied by the allotment

and issue of 80,000,000 Ordinary Shares of 1p each, credited as fully paid, in

the Company.

On 29 September 2006, Kenny Chen and the Company agreed that the Director's

Loan, which was due to be repaid on or after 17 August 2006, should remain in

place in return for the issue by the Company to Kenny Chen of a Convertible Loan

Note in the sum of #115,000. The terms of this Convertible Loan Note are the

same as those set out above.

14. Related party transactions

During the period, the Company paid expenses on behalf of companies under the

control of Kenny Jen-Te Chen, a director of the Company. Similarly, these

companies paid expenses on behalf of GruppeM Investments PLC. At 31 July 2006,

#104,208 (31 January 2006: #28,869; 31 July 2005: #4,848) was payable by GruppeM

Investments PLC to these companies, and is included in other creditors.

15. Earnings per share

The calculation of loss per share is based upon the loss of #208,154 (31 January

2006: #427,385; 31 July 2005: #168,621) and on 20,000,000 (31 January 2006:

20,000,000; 31 July 2005: 9,895,350) being the weighted average number of shares

in issue during the period.

There were no share options in issue during the period.

16. Contingent liabilities

At 31 July 2006, there were two separate claims against the Company from third

parties, both for services rendered in relation to a property development in

Qingdao, China. The property development is being managed by GruppeM Qingdao

Developments Company Limited ('GruppeM Developments'), which is a Hong Kong

company ultimately owned by Pinocelle S.A., a vehicle of Kenny Chen, but which

is otherwise totally unconnected with GruppeM Investments PLC. GruppeM

Developments has assumed responsibility for all invoices in relation to the

services provided and has accounted fully for the liabilities in its financial

statements for the period ended 30 June 2005. On the basis of legal advice

received, the directors believe that any liability in relation to the invoices

rests with GruppeM Developments and, as a result, believe it extremely unlikely

that the outcome of the disputes will have a material effect on the Company's

financial position.

NEW ISSUE STATISTICS

Number of Ordinary Shares in issue 20,000,000

Number of Consideration Shares to be issued in respect of the Acquisition 80,000,000

Number of Ordinary Shares in issue following the Acquisition 100,000,000

Percentage of Enlarged Share Capital represented by the Consideration Shares 80.0%

Market capitalisation at the Issue Price #5.0 million

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2006

Latest time and date for receipt of completed Forms of Proxy for the EGM 10.30 a.m. on 23 October

Extraordinary General Meeting 10.30 a.m. on 25 October

Completion of the Acquisition, subject to Admission 25 October

Commencement of dealings on AIM in the Enlarged Share Capital 8.00 a.m. on 30 October

CREST accounts credited 8.00 a.m. on 30 October

Despatch of definitive share certificates (if applicable) by 3 November

Press enquiries:

GruppeM Investments PLC

Kenny Chen (Managing Director) 020 7233 2952

Paul McIlwaine (Finance Director) 020 7233 2952

Shore Capital

Alex Borrelli 020 7468 7932

APPENDIX

Paul McIlwaine - previous directorships

Camaxys Group plc

Camaxys Limited

Camhealth Limited

No further information is required to be disclosed under the AIM Rules.

DEFINITIONS

Unless the context requires otherwise, the words and expressions set out below

shall bear the following meanings.

"Act" the Companies Act 1985, as amended

"Acquisition" the proposed acquisition by the Company of the entire issued share capital of

GruppeM Hong Kong pursuant to the Acquisition Agreement

"Acquisition Agreement" the conditional agreement dated 29 September 2006 between (1) the Company,

(2) Pinocelle and (3) Kenny Chen relating to the Acquisition, conditional,

inter alia, upon the passing of the Resolutions

"Admission" admission of the Enlarged Share Capital to trading on AIM becoming effective

in accordance with Rule 6 of the AIM Rules

"AIM" the AIM Market of the London Stock Exchange

"AIM Rules" the rules of AIM as published by the London Stock Exchange

"Articles" the articles of association of the Company

"Business Day" a day other than a Saturday or Sunday or a public holiday in England and

Wales

"China" the People's Republic of China

"City Code" the City Code on Takeovers and Mergers

"Combined Code" the Combined Code of Corporate Governance published by the Financial

Reporting Council in July 2003

"Company" or "GruppeM" GruppeM Investments PLC

"Completion" completion of the Acquisition

"Concert Party" Kenny Chen (Managing Director), Pinocelle, a nominee company of Kenny Chen,

and Stephen Chen (Director)

"Consideration Shares" 80,000,000 new Ordinary Shares to be allotted on Completion

"Convertible Loan Notes" the unsecured convertible loan notes issued, and to be issued, to Pinocelle

in respect of the Loan and/or pursuant to the Director's Loan in each case

pursuant to the terms and conditions of the Convertible Loan Note Instrument

and in respect of those to be issued to Pinocelle subject to the passing of

Resolutions 2, 3 and 4 as set out in the EGM Notice

"Convertible Loan Note the convertible loan note instrument dated 29 September 2006

Instrument"

"CREST" the relevant system (as defined in the Regulations) for the paperless

settlement of share transfers and the holding of shares in uncertificated

form in respect of which CRESTCo Limited is the operator (as defined in the

Regulations)

"CRESTCo" CRESTCo Limited, the operator of CREST

"Directors" the directors of the Company and the Proposed Director

"Director's Loan" the term loan of #115,000 made by Kenny Chen to the Company on 17 February

2005

"Document" the AIM admission document

"EGM" or "Extraordinary General the extraordinary meeting of the Company convened for 25 October 2006 at

Meeting" 10.30 a.m., or any adjournment thereof

"EGM Notice" the notice convening the EGM

"Enlarged Group" the Group following Completion

"Enlarged Share Capital" the Ordinary Shares in issue at Admission following the Acquisition

"Form of Proxy" the form of proxy for use by Shareholders, to enable Shareholders to appoint

one or more proxies to attend the EGM and, on a poll, to vote instead of that

Shareholder

"FSA" the Financial Services Authority

"Group" the Company and its subsidiary companies

"GruppeM Hong Kong" GruppeM Hong Kong Limited

"GruppeM Hong Kong Group" GruppeM Hong Kong and its subsidiaries

"GruppeM Sales" GruppeM (Qingdao) Automobile Sales Company Limited

"GruppeM Services" GruppeM (Qindgdao) Automobile Services Company Limited, a WOFE

"Independent Directors" Lord Marsh, Paul McIlwaine and Raymond Man

"Initial Subscribers" Michael Beckman, Barry Carpenter, Stephen Chen (Director), Howard Freeman,

Raymond Man (Director), Noble Hill Overseas Holdings Limited, Marvin Tien,

Annie Tsang, Dominic Tsang, Varudh Varavan and David Yuen

"Issue Price" 5p per Consideration Share

"Loan" a loan committed by Pinocelle to the Company amounting to, in aggregate,

#650,000

"London Stock Exchange" London Stock Exchange plc

"Official List" the Official List of the United Kingdom Listing Authority

"Ordinary Shares" ordinary shares of 1p each in the capital of the Company

"Panel" the Panel on Takeovers and Mergers

"Pinocelle" Pinocelle S.A., a nominee company of Kenny Chen

"Porsche China" Jebsen & Co. (China) Motors Ltd, controlled by Porsche AG, trading as Porsche

China

"Proposed Director" Julian Hardy

"Regulations" the Uncertificated Securities Regulations 2001 (SI 2001 No. 3755)

"Regulatory Information Service any of the regulatory information services operated by the London Stock

" Exchange

"Resolutions" the resolutions contained in the Notice of EGM

"RMB" or "Yuan" Renminbi, China's currency

"Shareholders" holders of Ordinary Shares

"Shore Capital" Shore Capital and Corporate Limited, nominated adviser to the Company,

authorised and regulated by the FSA

"United Kingdom" or "UK" United Kingdom of Great Britain and Northern Ireland

"VAT" value added tax

"Warrantors" Kenny Chen and Pinocelle who have agreed, pursuant to the Acquisition

Agreement, to give to the Company warranties and indemnities regarding

GruppeM Hong Kong

"WOFE" a 'Wholly Owned Foreign Enterprise' operating in China

Note: amounts in Renminbi (RMB) have been translated into Pounds Sterling (#) at

the rate of #1 = RMB15.0 unless otherwise stated.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DKLFLQKBEBBE

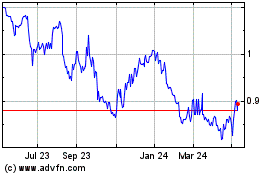

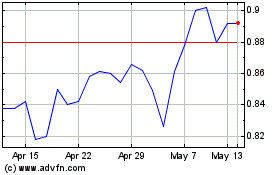

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jul 2023 to Jul 2024