Final Results

November 18 2005 - 9:06AM

UK Regulatory

RNS Number:3687U

GruppeM Investments PLC

18 November 2005

18 November 2005

For Immediate Release

GRUPPEM INVESTMENTS PLC

(LSE: GRP, 'GruppeM' or the 'Company')

Final results for the period ended 31 July 2005

GruppeM Investments PLC today announces its unaudited final results for the

financial period ended 31 July 2005.

For more information please contact:

GruppeM Investments Plc

Kenny Chen/Paul McIlwaine

Tel: +44 (0) 207 233 2952

Shore Capital and Corporate Limited

Alex Borrelli

Tel: +44 (0) 207 408 4090

Further information on GruppeM Investments Plc can be found on the Company's

website: www.gruppemplc.com

CHAIRMAN'S STATEMENT

Following the Company's successful flotation on the AIM Market in February 2005,

the investment policy of the Company continues to aim to exploit growth

opportunities in the property sector and motor retailing within China. The

market for high specification commercial property is growing rapidly whilst

demand for high value European sports cars continues to outstrip supply.

For the period ended 31 July 2005, the Company made a loss of #168,621, with

general and administrative expenses amounting to #168,777, and a small amount of

interest income. Included within expenses were #41,942 of legal fees and

#109,971 of professional fees. At the year end the Company had net assets of

#31,379 and cash of #94,746.

In line with the amended AIM rules, a resolution will be proposed at the AGM to

gain shareholder approval for the Company's investment strategy. The directors

are confident that a suitable investment opportunity, in line with the Company's

stated strategy, will be identified in the near future in order to generate

increased shareholder value.

Lord Marsh

PROFIT AND LOSS ACCOUNT

FOR THE PERIOD ENDED 31 JULY 2005

Period ended

31 July 2005

(unaudited)

#

Administrative expenses

- exceptional items 142,512

- other 26,265

________

OPERATING LOSS (168,777)

Interest received 156

________

LOSS FOR THE PERIOD (168,621)

--------

Loss per share

Basic and fully diluted (0.17p)

--------

All activities are classed as continuing.

There are no recognised gains or losses other than the loss for the financial

period.

BALANCE SHEET

AS AT 31 JULY 2005

31 July 2005

(unaudited)

#

Current assets

Debtors 8,185

Cash at bank 94,746

________

102,931

Creditors

Amounts falling due within one year 71,552

________

NET ASSETS 31,379

--------

EQUITY AND LIABILITIES

Capital and Reserves

Share Capital 200,000

Profit and loss account (168,621)

________

Equity shareholders' funds 31,379

--------

CASH FLOW STATEMENT

FOR THE PERIOD ENDED 31 JULY 2005

Period ended

31 July 2005

(unaudited)

#

Operating loss (168,777)

Increase in debtors (8,185)

Increase in creditors 71,552

________

Cash outflow from operating activities (105,410)

Return on investment and servicing of finance 156

Financing

Proceeds on issue of shares 200,000

________

NET INCREASE IN CASH FOR THE PERIOD 94,746

--------

RECONCILIATION OF NET CASH INFLOW TO MOVEMENT IN NET FUNDS

Increase in cash for the period 94,746

________

Net funds as at 31 July 2005 94,746

--------

ANALYSIS OF NET FUNDS

Cash at bank 94,746

--------

NOTES

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been prepared in accordance with applicable

accounting standards.

The financial statements have been prepared under the historical cost convention

and the principal accounting policies adopted are set out below.

These period end statements do not constitute statutory financial statements

within the meaning of Section 240 of the Companies Act 1985. Results for the

period ended 31 July 2005 have not been audited.

Foreign currency translations

Foreign currency transactions are translated into sterling using the exchange

rates prevailing at the dates of the transactions. Foreign exchange gains and

losses resulting from the settlement of such transactions are recognised in the

income statement.

Financial instruments

The company's financial instruments comprise only cash at bank. Trade debtors

and trade creditors have been excluded from the following disclosure, as

permitted by Financial Reporting Standard 13.

The company's policy is to obtain the highest possible rate of return on its

cash balances, subject to having sufficient resources to manage the business on

a day to day basis and not exposing the company to unnecessary risk of default.

The company had no undrawn borrowing facilities at 31 July 2005.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PKFKKQBDDBDD

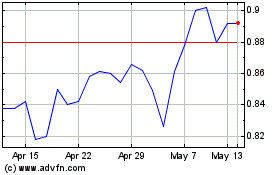

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

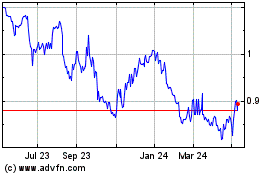

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jul 2023 to Jul 2024