FBD Holdings PLC ?70 million Capital Investment (2935Z)

September 16 2015 - 11:00AM

UK Regulatory

TIDMFBH

RNS Number : 2935Z

FBD Holdings PLC

16 September 2015

FBD Holdings plc

16 September 2015

EUR70 million Capital Investment

FBD Holdings plc ("FBD" or the "Company" or with its

subsidiaries the "Group") is pleased to announce that it has

entered into an agreement pursuant to which Fairfax Financial

Holdings Limited ("Fairfax") will invest EUR70 million in FBD

through a private placement of a convertible bond instrument (the

"Convertible Bond"). The transaction will be subject to FBD

shareholder approval.

The Convertible Bond will be a 10 year Solvency II compliant

instrument and it will carry a coupon of 7.0% per annum which will

be payable semi-annually. The conversion price has been set at

EUR8.50, a 37% premium over the closing share price on 15 September

2015. Unless previously redeemed, the Convertible Bond will be

exercisable from year 3 to year 10 and, in the event that the 30

day volume weighted average share price exceeds the conversion

price for a period of 180 days, the Convertible Bond will

automatically convert into ordinary shares in FBD at the conversion

price.

The issue of the Convertible Bond to Fairfax is subject to the

execution of a final, definitive agreement between the parties and

shareholder approval. As an interim stage in this transaction,

agreement has also been reached with Fairfax, that FBD Insurance

plc will today issue at 12% per annum, EUR70 million, 10 year, tier

2 instrument to Fairfax (the "Tier 2 Debt Instrument"). The Tier 2

Debt Instrument will be exchanged for the Convertible Bond within 7

days of Group shareholders approving the issue of Convertible

Bond.

Commenting, Interim Chief Executive, Fiona Muldoon, said:

"This is a significant vote of confidence in FBD and in our

future success. I am confident that the completion of this

transaction helps our business plan with our core farming and small

business customers and with our consumer customers also. It

underpins the Board's strong commitment to maintain healthy capital

buffers as we prepare for the implementation of Solvency II."

Mr. Michael Berkery, Group Chairman added:

"I welcome Fairfax as a key additional investor in FBD. I am

confident that Fairfax will be a good strategic partner for the

Group as we advance our plans to return to profitability. The Board

will strongly recommend this transaction to shareholders for

approval given the clear benefits accruing to the Group and our

shareholders."

Commenting, Prem Watsa, Chairman and CEO of Fairfax said:

"Fairfax is delighted to become an investor in and partner to

FBD. We have been a long-standing follower of FBD and its deserved

reputation as a leader in the farm insurance sector in Ireland.

This investment underlines our belief in the strength of Ireland's

on-going economic recovery and in FBD's core franchise in the

farming and agri-business sectors."

ENDS

For Reference:

FBD Holdings plc Telephone

Fiona Muldoon, Interim Chief Executive +353 1 409 3208

Peter Jackson, Head of Investor Relations

Conor Gouldson, Company Secretary

About FBD Holdings plc ("FBD")

The FBD Group was established in the 1960s is one of Ireland's

largest property and casualty insurers looking after the insurance

needs of farmers, private individuals and business owners.

About Fairfax Financial Holdings Limited ("Fairfax")

Fairfax is a holding company which, through its subsidiaries, is

engaged in property and casualty insurance and reinsurance and

investment management. Fairfax's corporate objective is to achieve

a high rate of return on invested capital and build long-term

shareholder value. Fairfax seeks to differentiate itself by

combining disciplined underwriting with the investment of its

assets on a total return basis, which Fairfax believes provides

above-average returns over the long-term.

Fairfax was founded in 1985 by the present Chairman and Chief

Executive Officer, V. Prem Watsa. The company has been under

present management since 1985 and is headquartered in Toronto,

Canada. Its common shares are listed on the Toronto Stock Exchange

under the symbol FFH and in U.S. dollars under the symbol

FFH.U.

Fairfax's insurance and reinsurance companies operate on a

decentralized basis, with autonomous management teams applying a

focused underwriting strategy to their markets. Fairfax

subsidiaries provide a full range of property and casualty

products, maintaining a diversified portfolio of risks across all

classes of business, geographic regions, and types of insureds.

The following details relate to FBD's ordinary shares of EUR0.60

each which are publicly traded:

Listing Irish Stock Exchange UK Listing Authority

Listing Category Dual Premium (Equity)

Trading Venue Irish Stock Exchange London Stock Exchange

Market Main Securities Main Market

Market

ISIN IE0003290289 IE0003290289

Ticker EG7.IR FBH.L

FBD Holdings plc FBD House, Bluebell, Dublin 12

Registered in Dublin, Ireland Registered Number 135882

This information is provided by RNS

The company news service from the London Stock Exchange

END

IODBSGDCIUBBGUL

(END) Dow Jones Newswires

September 16, 2015 11:00 ET (15:00 GMT)

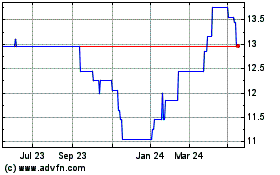

Fbd (LSE:FBH)

Historical Stock Chart

From Jun 2024 to Jul 2024

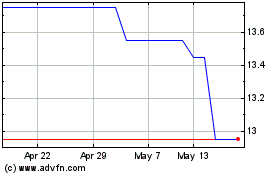

Fbd (LSE:FBH)

Historical Stock Chart

From Jul 2023 to Jul 2024