Europa Oil & Gas (Holdings) PLC USD7 billion NPV for Offshore Ireland Prospects

October 26 2015 - 3:00AM

UK Regulatory

TIDMEOG

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG / Sector: Oil & Gas

26 October 2015

Europa Oil & Gas (Holdings) plc ('Europa' or 'the Company')

USD 7 billion Net Mean Un-risked NPV10 for Offshore Ireland Prospects

Europa Oil & Gas (Holdings) plc, the AIM quoted oil and gas company with both

producing and exploration assets in Europe, is pleased to announce that an

independent assessment undertaken by ERC Equipoise ('ERCE') estimates a mean

Un-risked Net Present Value ('NPV') of approximately US$7 billion to a 100%

working interest (subject to government approval) in three prospects on

Frontier Exploration Licence ('FEL') 3/13 in the Porcupine Basin, offshore

Ireland. On a Risked NPV basis the study estimates a 100% working interest

(subject to government approval) at US$1.1 billion. As announced on 12 May

2015, a Competent Persons Report ('CPR') prepared by ERCE detailed total Gross

mean Un-risked Prospective Resources of 1.5 billion barrels of oil equivalent

('bboe') across the three prospects in FEL 3/13.

On 16 June 2015, Europa advised the market of an independent assessment by ERCE

of the NPV of its then 15% carried interest in FEL 3/13. Following the

announcement of 22 September 2015 that Kosmos Energy Ireland ('Kosmos') intends

to withdraw from Ireland, Europa instructed ERCE to revise the NPV to reflect a

100% working interest in the permit and without the benefit of a carried work

programme. The estimate of NPV provided today also incorporates an updated oil

price assumption and cost deck.

CEO Hugh Mackay said "The CPR summary issued on 12 May 2015 identified

significant potential volumes of hydrocarbons: Gross mean Un-risked Prospective

Resources of approximately 1.5 billion barrels of oil equivalent across three

prospects in FEL 3/13. With the imminent departure of Kosmos from the licence

our net interest will revert to 100%, subject to government approval, with a

potential Net mean Un-risked NPV10 of approximately US$7 billion and a Net mean

Risked NPV10 of US$1.1 billion estimated by ERCE. We believe this is a very

strong indication of the commercial potential in our licences in offshore

Ireland.

"To realise this potential we need to drill exploration wells and find oil.

Our mission is to land a farm-in partner to share the costs of drilling and

the target audience is major and mid-cap oil companies. As a consequence of

the drop in oil prices day rates for state of the art harsh-environment

deepwater drilling rigs have halved. The next few years offer an opportunity to

drill offshore Ireland at the lowest rig costs in over a decade. We are

encouraged by the high levels of participation in the 2015 Atlantic Margin

Licensing Round, particularly given the low oil price. It would appear that

many other companies share our belief in the technical and commercial case for

exploration offshore Ireland. I look forward to updating the market in due

course as we focus on securing a farm-in partner with whom we can work to

unlock the potential value of these prospects."

Further Information

ERCE's independent assessment of NPV follows their CPR on the Prospective

Resources associated with the Wilde, Beckett and Shaw prospects on FEL 3/13

based on 3-D seismic data acquired in 2013 by the operator, Kosmos. These

prospects are at the pre-drill stage and realisation of this potential value

will require the drilling of exploration wells. ERCE estimates Un-risked and

Risked NPV at a 10% discount rate (NPV10) for an uncarried 100% working

interest as at 1 January 2015 for the Low, Best and High estimates of

Prospective Resources as tabulated below:

Prospect Gross Oil & Gas Net Un-risked NPV10 Chance Net Risked

Un-Risked Prospective (US$ Million) of NPV10 (US$

Resources MMboe Success Million)

(%)

Low Best High Low Best High Mean Mean

Wilde 61 239 952 -170 122 5,595 1,676 19 318

Beckett 109 424 1,661 -170 1,692 11,628 4,114 15 617

Shaw 57 198 681 -170 110 4,631 1,302 13 169

Total 7,092 1,105

Notes:

1. The discounted cash flow analysis has been carried out assuming exploration

drilling results in discovery of oil. However, due to the significant

uncertainties in the available geological information, there is a possibility

that exploration drilling, if successful, will result in the discovery of gas.

2. MMboe means millions of barrels of oil plus gas converted to oil using a

conversion rate of six thousand cubic feet of gas for each barrel of oil.

3. "Gross Oil and Gas Un-risked Prospective Resources" are 100% of the volumes

estimated to be recoverable from an undrilled prospect before applying the

geological chance of success (COS)

4. The COS is an estimate of the probability that drilling the prospect would

result in a discovery

5. Prospective Resources are "Un-risked" in that the volumes have not been

multiplied by the COS

6. Net Un-risked NPV10 means the NPV10 at 10% discount rate as at 1 January

2015 attributable to Europa's 100% working interest in the Prospect before

multiplying by the COS

7. Net Risked NPV10 means the NPV10 at 10% discount rate as at 1 January 2015

attributable to Europa's 100% working interest in the Prospect after

multiplying by the COS.

8. The analysis for the Best and High cases assumes the successful drilling of

an exploration well on each prospect in 2017 followed in each case by appraisal

drilling and then development.

9. The Low estimates of NPV10 for each prospect comprise the Net cost to Europa

of an exploration and appraisal well, this is because discounted cash flow

modelling of each of the Low cases resulted in a more negative NPV10.

10. The Mean estimate of the NPV10 for each prospect has been calculated by

adding the Low, Best and High estimates of NPV10 weighted by 0.3, 0.4 and 0.3

respectively (the Swanson's Mean)

11. The NPV10 calculations presented in this report simply represent discounted

future cash flow values. Though NPV estimates form an integral part of fair

market value estimations; without consideration for the exploration risk factor

(COS) and other economic criteria, including market perception of risk, they

are not to be construed as opinions of fair market value.

12. The cash flows and NPV10 estimates have been calculated assuming a nominal

oil price of US$57 bbl in 2015 rising to US$87 bbl by 2019 and inflated at 2%

thereafter.

Europa notes that the drilling costs used in the NPV calculation are those

associated with the US$100/bbl oil price prevailing over much of the last five

years (i.e. rig rates of US$600,000 / day). The Company believes that a

continued period of lower oil prices will result in lower drilling costs.

Sensitivity analysis suggests that a 20% decrease in capital expenditure might

increase the Un-risked and Risked Mean NPV10 by approximately 20%.

The process for transfer of Kosmos' interest and operatorship of FEL 2/13 and 3

/13 to Europa is ongoing and is subject to obtaining relevant approval from the

Irish Authorities. On completion of this process and assuming a successful

outcome, Europa will seek to farm-out some of its interests in both licences.

Europa will be participating in the Atlantic Ireland conference in Dublin on 27

October. The Company encourages interested parties to visit its booth at the

conference or attend its presentation.

The process for marketing the farm-out has begun and the dataroom will open in

Q1 2016. Although the 2015 Atlantic Margin Licensing Round closed on 16

September awards have not been made yet and the award process remains live. For

reasons of confidentiality the full CPR and valuation reports will not be

issued into the public domain, they will be part of the farm-out dataroom.

Europa has previously confirmed that it participated in the Round and made

multiple applications.

Following the RNS issued on 12 May 2015 summarising the CPR on Prospective

Resources in FEL 3/13, Europa commissioned ERCE to prepare an independent

report on NPV for the FEL 3/13 prospects. Although it is comparatively unusual

for junior oil companies to commission such third party valuation work at this

early stage in the exploration cycle, the Company feels it is important that

investors and potential farm-in partners are provided with an independent and

credible valuation. As with the Prospective Resources CPR, the valuation has

been subjected to rigorous technical challenge and scrutiny by ERCE.

The Beckett, Wilde and Shaw prospects are located SW of Ireland, approximately

125 km from shore. ERCE has previously calculated a Low, Best and High

resource volume for these prospects. Due to water depths in excess of 1,000m

each prospect would be developed by a Floating, Production, Storage and

Offloading unit ('FPSO') in the event of successful exploration drilling. The

prospects are located in challenging environmental conditions, where high wave

heights must be accounted for in FPSO design. This in turn limits throughput

rates. Discovery size will also alter facility design, particularly with

respect to produced gas handling. ERCE has accounted for these aspects in its

forecasting work. ERCE conducted an independent review of the production,

operating expenditure, capital and abandonment expenditure and associated

discounted cash flow analysis of two Prospects; Beckett and Wilde and used that

analysis to derive value for the Shaw Prospect.

* * ENDS * *

For further information please visit http://www.europaoil.com/ or contact:

Hugh Mackay Europa + 44 (0) 20 7224

3770

(MORE TO FOLLOW) Dow Jones Newswires

October 26, 2015 03:00 ET (07:00 GMT)

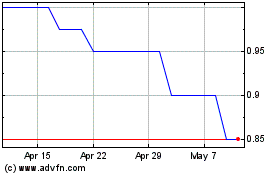

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Jul 2023 to Jul 2024