TIDMENET

RNS Number : 9804M

Ethernity Networks Ltd

20 September 2023

20 September 2023

ETHERNITY NETWORKS LTD

("Ethernity" or the "Company" or the "Group")

Interim results for the six months ended 30 June 2023

Ethernity Networks Ltd (AIM: ENET.L; OTCMKTS: ENETF), a leading

supplier of networking processing semiconductor technology ported

on field programmable gate arrays ("FPGAs") for virtualised

networking appliances, announces its interim results for the six

months ended 30 June 2023.

Financial summary

-- Revenues increased by 98% to $1,398,871 (H1 2022: $704,853).

-- Gross profit increased by 87% to $802,494 over the comparable

period (H1 2022: $428,761), and an underlying gross profit of

$996,031 without the non-recurring IFRS impairment which reflects

an increase of 132% vs H1 2022.

-- Gross margin of 57.37% (H1 2022 60.83%) and an underlying

gross margin of 71.2% without the non-recurring IFRS

impairment.

-- Net comprehensive loss for the period increased by $111,716

to $3,614,449 (H1 2022: $3,502,733). This is due to IFRS finance

income recognized in H1 2022 in respect of the fundraising

undertaken in that period.

-- Research and Development, General and Administrative, and

Marketing expenses (before amortisation, depreciation and IFRS

adjustments) decreased overall by 3%.

-- Adjusted EBITDA loss decreased by 19% to $3,045,037 (H1 2022: $3,782,342).

Current trading

The Company is targeting the achievement of positive cash flow

generation from operations during the second half of 2023 by

continuing to fulfill customers' orders and from anticipated

revenue from new contracts, in combination with a reduction in

expenses. The Company anticipates that revenue growth will be

achieved as a result of the modified business model which focuses

on the licensing of data processing, passive optical network

("PON") and software technology.

As of today, 950,000 platforms have been deployed with the ENET

data processing technology, in various types of platforms including

Carrier Ethernet Demarcation devices, wireless backhaul, cellular

base stations, Broadband fiber and DSL platform, Broadband fix

wireless platforms and aerospace aviation platforms. The Company

continues to generate steady revenue from existing customers in all

the above fields.

Recently, after immense efforts and logistics, the Company's

U.S. based Tier 1 Aerospace client received U.S. Government

approval to work with the Company on a military project that is

based on the ENET Data processor adapted for the aviation

market.

Additionally, the Company has expanded the offering of its

standard ENET data processing solution with a network operating

system that delivers a complete software stack for system

operation. This expansion provides an opportunity for revenue

growth and an increase in gross margin for each delivery of an ENET

Flow processor. It also allows the Company to expand its customer

base among those that do not obtain the complete software

capabilities for networking functions to deliver customized FPGAs,

customized FPGA based systems, or customized eASIC for medium

volume platforms.

Company Strategy

Ethernity's data processing and PON firmware and software can be

ported into AMD's low-cost FPGA, Microchip's FPGAs, Intel's FPGAs

or Intel's eASIC, dependent on the application, the platform and

the volume of the business, for use in mass production with

customized features. The ASIC process requires large investment,

however the same Firmware that runs on a FPGA can be repurposed for

a reduced cost through an eASIC, which requires c. 20% of the

investment needed for fabricating a pure ASIC and has a

significantly shorter time to market. Therefore, the eASIC can be

used for medium volume markets, such as telecom equipment, and

provides a considerably lower cost and lower power option than an

FPGA. Furthermore, for large volume markets such as Residential

Gateways Customer Premises Equipment ("CPE") devices that

represents a market of tens of millions of units a year, the ENET

Data processing and PON firmware can be utilized on pure ASIC to

capture the right price for customer located devices.

The Company's PON technology spans into different market

segments including Fiber-To-The-Room, PON Optical Line Terminal

("OLT") Sticks that utilize PON OLT MAC within optical transceiver,

remote OLTs with main requirements to support Combo PON, that

essentially runs 10G PON and legacy Giga Bit PON ("GPON") over

single fibre, and traditional OLTs with multiple PON ports that

will be severed by an eASIC process. Furthermore, the Company plans

further PON business expansion with 25Gbps PON and 50Gbps PON.

The business model for both the PON and the ENET Flow processor

is based on licensing the technology to be implemented on FPGA or

eASIC, along with an associated software package, which lowers the

time to market for the customers and reduces the time it takes for

Ethernity to earn revenue.

The combination of this model of delivering our solution on FPGA

for unique and customized platform or an eASIC offering for larger

volume markets, should allow the Company to generate cash with

higher profit margins, and position the Company as a semiconductor

and software provider, offering customized semiconductor solution

ported on FPGA/eASIC based devices or a complete system for the

telecom access market that will utilize the Company's intellectual

property and software framework, to secure the future growth of the

Company focusing on its strengths.

Half Year Review

Operational highlights

During the first six months of 2023, development was completed

on several critical products and solutions including the XGS-PON,

GPON and UEP2025 with wireless link bonding. These products and

solutions are currently in discussion, testing and evaluation with

customers and are targeted to generate licensing revenues and NRE

for customised product developments.

The completion of the first release of the UEP-2025 product, the

XGS-PON OLT, and fiber-to-the-room ("FTTR") OLT development has

enabled the Company to maintain reduced R&D staff while still

pursuing future revenue opportunities with these products and

technologies.

During H1 2023, the Company's activities have progressed in

multiple domains:

-- First release of the UEP bonding product delivered to our

existing bonding OEM customer who intends to complete its product

for integration during Q4/23.

-- We completed development of the XGS-PON OLT firmware ported

onto our Asian vendor's XGS-PON OLT platform, which embeds

Ethernity's XGSPON MAC FPGA SoC.

-- Completion of the FTTR gateway - we expect delays in

deployment by the customer due to the customer's own constraints,

and therefore FTTR revenues for the current year from the customer

are uncertain.

-- Received a purchase order for $1.5 million from our existing

fixed wireless customer to supply the Company's data processing

system-on-chip (SoC) in staged deliveries during Q2 and Q3

2023.

Outlook

With the modified business model, the Company anticipates it

will be able to accelerate growth from its software operation

stack, FPGAs, and future eASIC based engagements. This, together

with and reduction in costs already implemented, will contribute

towards the Company's ability to generate cash for future

expansion.

In parallel to the Company's existing FPGA business and the

progress with existing customers, the Company is in discussions to

expand its UEP-2025 link bonding offering with potential new OEM

customers.

David Levi, Chief Executive Officer of Ethernity Networks

Limited, commented:

"While it is a challenging period due to the global financial

situation, I am encouraged by the fact that there is demand for our

PON offerings that have captured interest from larger corporations,

and I am hopeful that, with the cost reductions implemented and the

modified business plan, engagement in multiple design wins for our

PON technology will fulfil our further anticipated growth."

For further information, please contact:

Ethernity Networks Ltd Tel: +972 3 748 9846

David Levi, Chief Executive Officer

Allenby Capital Limited (Nominated Adviser and Tel: +44 (0)20 3328 5656

Joint Broker)

James Reeve / Piers Shimwell (Corporate Finance)

Amrit Nahal/ Stefano Aquilino (Sales and Corporate

Broking)

Peterhouse Capital Limited (Joint Broker) Tel: +44 (0)20 7562 0930

Lucy Williams/ Duncan Vasey/ Eran Zucker

MARKET ABUSE REGULATION

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse (amendment) (EU Exit) Regulations 2019/310

("MAR"). With the publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

OPERATIONAL and financial REVIEW

During the period under review, the Company delivered revenues

of $1,398,871 (H1 2022: $704,853), an increase of 98% over H1

2022.

The underlying gross profit increased to $996,031 (H1 2022:

$428,761), and the underlying gross margin increased to 71.2% (H1

2022: 60.83%). However, due to a non-recurring IFRS raw material

inventory impairment charge of $194K, which the Company recorded in

H1 2023, the gross profit and gross margin have been reduced to

$802,494 and 57.37% respectively.

EBITDA

The EBITDA for the six months ended 30 June 2023 is presented as

follows:

EBITDA US Dollar Increase %

For the 6 months ended 12 months (Decrease)

ended 31-Dec June

------------------------------ ----------------- -----------------

30-Jun

------------------------------ ----------------- -----------------

2023 2022 2022

----------- ----------------- ----------------- -----------------

Revenues 1,398,871 704,853 2,937,424 694,018 98%

----------- ----------------- ----------------- ----------------- -----

COGS 402,840 276,092 1,339,096 126,748 46%

----------- ----------------- ----------------- ----------------- -----

Inventory impairment 193,537 - - 193,537

----------- ----------------- ----------------- ----------------- -----

Gross Profit 802,494 428,761 1,598,328 373,733 87%

----------- ----------------- ----------------- ----------------- -----

Gross Margin % 57.37% 60.83% 54.41% -3pps

----------- ----------------- ----------------- ----------------- -----

Operating Loss -3,774,255 -4,478,031 -8,696,876 703,776 -16%

----------- ----------------- ----------------- ----------------- -----

Add back Amortisation

of Intangible Assets 480,690 480,690 961,380 -

----------- ----------------- ----------------- ----------------- -----

Add back depreciation

charges on fixed assets 67,614 53,052 108,673 14,562

----------- ----------------- ----------------- ----------------- -----

Add back IFRS 16 operating

leases depreciation

net of rent expenses -46,324 -501 -38,567 -45,823

----------- ----------------- ----------------- ----------------- -----

EBITDA -3,272,275 -3,944,790 -7,665,390 672,515 -17%

----------- ----------------- ----------------- ----------------- -----

Add back Share based

compensation charges 56,025 127,444 221,362 -71,419

----------- ----------------- ----------------- ----------------- -----

Add back impairments 193,537 20,200 599,200 173,337

----------- ----------------- ----------------- ----------------- -----

Add back vacation

accrual charges -22,324 22,782 35,646 -45,106

----------- ----------------- ----------------- ----------------- -----

Adjusted EBITDA -3,045,037 -3,774,364 -6,809,182 729,327 -19%

----------- ----------------- ----------------- ----------------- -----

Adjusted EBITDA loss in the first six months of the year

decreased by 19% to $3,045,037 (H1 2022: $3,774,364). This decrease

in adjusted EBITDA loss is attributed to the cost savings steps the

Company took in its efforts to control spending and to progress

towards generating positive cash flow. These steps, together with

the significant increase in reported revenues of $1,398,871 vs. H1

2022 revenues of $704,853, resulted in the above-mentioned decrease

in the EBITDA loss and adjusted EBITDA loss. The gross margin is a

direct result of the revenue mix and it is anticipated that the

current margin level will continue.

Operating Costs

Operating expenses (before amortisation, depreciation and IFRS

adjustments) decreased by 4% from $4,203,125 to $4,041,068 during

the period against the same period in 2022.

Within the R&D division, the Company has cut operating

expenses with further cost cuts coming into effect during July and

August. The impact of the cost savings attributed to the above cuts

will be visible in the 2023 full year figures.

General and Administration costs (before amortisation,

depreciation and IFRS adjustments) have not materially changed,

however G&A cost will be reduced during second half of

2023.

The decrease in Marketing expenses (before amortisation,

depreciation and IFRS adjustments) is attributed to headcount cuts

in the department and further costs reduction will be visible

during H2 2023.

After adjusting for the amortisation costs of the Development

Intangible asset, Depreciation, Share Based Compensation

adjustments, and IFRS adjustments the resultant increases

(decreases) in Operating costs, as adjusted would have been:

US Dollar Increase

(Decrease)

June

For the 6 months 31-Dec

ended

---------------------- ----------

30-Jun

---------------------- ----------

Operating Costs 2023 2022 2022 %

---------- ---------- ----------

Research and Development

Costs net of amortisation,

Share Based Compensation,

IFRS adjustments and Vacation

accruals 2,727,389 2,689,191 5,475,581 38,198 1%

---------- ---------- ---------- ------------ -----

General and Administrative

expenses, net of depreciation,

Share Based Compensation,

IFRS adjustments, Vacation

accruals and impairments 895,691 901,286 1,799,794 -5,595 -1%

---------- ---------- ---------- ------------ -----

Marketing expenses, net

of Share Based Compensation

and Vacation accruals 417,988 612,648 1,147,176 -194,660 -32%

---------- ---------- ---------- ------------ -----

Total 4,041,068 4,203,125 8,422,551 -162,057 -4%

---------- ---------- ---------- ------------ -----

Summarised trading results

Summarised Trading Results US Dollar Increase %

(Decrease)

June

For the 6 months 31-Dec

ended

------------------------- -----------

30-Jun

------------------------- -----------

2023 2022 2022

------------ ----------- -----------

Revenues 1,398,871 704,853 2,937,424 -694,018 98%

------------ ----------- ----------- ------------ -----

Gross Profit 802,494 428,761 1,598,328 -373,733 87%

------------ ----------- ----------- ------------ -----

Gross Margin % 57.37% 60.83% 54.41% 3% -6%

------------ ----------- ----------- ------------ -----

Operating Loss -3,774,255 -4,478,031 -8,696,876 -703,776 -16%

------------ ----------- ----------- ------------ -----

Financing costs -179,529 -274,565 -573,388 -95,036 -35%

------------ ----------- ----------- ------------ -----

Financing income (expenses) 339,335 1,249,863 1,267,652 910,528 -73%

------------ ----------- ----------- ------------ -----

Net comprehensive loss for

the year -3,614,449 -3,502,733 -8,002,612 111,716 3%

------------ ----------- ----------- ------------ -----

Basic and Diluted earnings

per ordinary share -0.03 -0.05 -0.11 -0.02 -33%

------------ ----------- ----------- ------------ -----

Weighted average number of

ordinary shares for basic

earnings per share 108,252,292 75,367,394 76,013,296

------------ ----------- ----------- -------------------

Revenue Analysis

Revenues for the six months ended 30 June 2023 of $1,398,871

(2022: $704,853) are influenced by the timing of deliveries which

is dependent on the terms of the various contracts and orders.

The revenue mix will continue to evolve as the Company

progresses, however with the new business model based on licensing

of FPGA and ASICs, and projects involved in delivering systems

which are based on the Company's IP, the Board anticipates that

gross margin should improve.

Segment Reporting

The geographic mix is represented by the makeup of the products

supplied, and the main increase in revenues is attributed to sales

to the Company's U.S. based customers.

SEGMENT REPORT geographic

analysis

---------- ------- ----------- -------

Region Six months ended Six months ended Year ended

30 June 2023 30 June 2022 31 December 2022

------------------- ------------------- --------------------

US$ % US$ % US$ %

---------- ------- ---------- ------- ----------- -------

United States 1,193,868 85.3% 512,650 72.7% 2,085,670 71.0%

---------- ------- ---------- ------- ----------- -------

Israel 137,912 9.9% 149,403 21.2% 429,954 14.6%

---------- ------- ---------- ------- ----------- -------

Asia 54,700 3.9% 42,800 6.1% 290,800 9.9%

---------- ------- ---------- ------- ----------- -------

Europe 12,390 0.9% 0 0.0% 131,000 4.5%

---------- ------- ---------- ------- ----------- -------

Total 1,398,870 100.0% 704,853 100.0% 2,937,424 100.0%

---------- ------- ---------- ------- ----------- -------

Financing Costs

As noted in the Annual Results for the year ended 31 December

2022, the majority of the financing expenses and income relate to

the various fundraise deals the Company has executed.

It is to be noted that these equity events, albeit in essence

based on raising funds via equity issues, are nonstandard equity

arrangements and have been dealt with in terms of the guidance in

IFRS9-Financial Instruments. This guidance, albeit that it is not

based on the actual cash cost of the financing arrangements to the

Company, is significantly complex in its application, forces the

recognition of the fair value of the equity issues, and essentially

creates a recognition in differences between the market price of

the shares issued at time of issue versus the actual price at which

the equity is allotted. It is not a reflection of the cash inflows

and outflows of the transactions. It is this differential or

"derivative style instrument" that needs to be subject to a fair

value analysis, and the instruments, the values received and

outstanding values due being separated into equity, assets, finance

income and finance charges in terms of the IFRS-9 guidance.

Referring to the two fundraise deals the Company completed

during the year of 2022 and the first half of 2023 being;

a. Share Subscription Agreement (5G Innovation Leaders Fund) in February 2022

b. Issuance of the Share and Warrants bundle in January 2023 and May 2023

It has been determined that in terms of IFRS-9, part of these

transactions is to be recognised as equity and part as a liability

of the Company and all adjustments to the liability value are to be

recognised through the Income Statement. In both cases the equity

differential based on allotment price and fair value at time of

allotment charges to the income statement.

The Financing Expenses and Finance Income in the Income

Statement that relate to the above-mentioned transactions are thus

summarised as follows:

Financing expenses for the period ended June 30 2023

01.2023 Placing warrants $10,096 Initial expense in respect of warrants

issued to broker

-------- ---------------------------------------

Total $10,096

-------- ---------------------------------------

Financing income for the period ended June 30 2023

01.2023 Placing warrants $105,329 Finance income in respect of 6p

warrants liability adjusted to fair

value as of June 30 2023

--------- ----------------------------------------

5G Innovation Leaders $80,034 Net adjustment to fair value of

Fund remaining unsettled share subscription

agreement as at June 30 2023

--------- ----------------------------------------

Total $185,363

-------------------------- ----------------------------------------

Going Concern

Based on the major cut in expenses and the modified business

model, licensing discussion and negotiations with major Telecom

manufacturers, and in the light of enquiries made by the Directors

as to business status of the Company, as well as bearing in mind

the ability and success of the Company to raise funds previously,

the Directors have a reasonable expectation that the Company will

have access to adequate resources to continue in operational

existence for the foreseeable future and therefore have adopted the

going concern basis of preparation in the financial statements.

Other than the points outlined above, there are no items on the

Balance Sheet that warrant further discussion outside of the

disclosures made in the Interim Unaudited Financial Statements

presented below.

FORWARD LOOKING STATEMENTS

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". By their nature,

forward-looking statements involve risk and uncertainty since they

relate to future events and circumstances. Actual results may, and

often do, differ materially from any forward-looking statements.

Any forward-looking statements in this announcement reflect

Ethernity's view with respect to future events as at the date of

this announcement. Save as required by law or by the AIM Rules for

Companies, Ethernity undertakes no obligation to publicly revise

any forward-looking statements in this announcement, following any

change in its expectations or to reflect events or circumstances

after the date of this announcement.

By order of the Board

Ayala Deutsch

VP Finance

20 September 2023

Interim Unaudited Financial Statements

as at 30 June 2023

STATEMENTS OF FINANCIAL POSITION

US dollars

----------------------------------------

30 June 31 December

2023 2022 2022

------------ ------------ ------------

Unaudited Audited

-------------------------- ------------

ASSETS

Current

Cash and cash equivalents 136,872 4,164,415 715,815

Trade receivables 1,465,637 1,273,328 1,299,072

Inventories 5 890,897 771,122 773,076

Other current assets 577,290 234,263 343,872

Current assets 3,070,696 6,443,128 3,131,835

Non-Current

Property and equipment 891,478 800,194 810,326

Intangible asset 4,982,110 5,943,490 5,462,800

Right-of-use asset 2,658,699 2,982,310 2,816,641

Other long term assets 34,524 35,767 35,689

Non-current assets 8,566,811 9,761,761 9,125,456

Total assets 11,637,507 16,204,889 12,257,291

============ ============ ============

LIABILITIES AND EQUITY

Current

Short Term Borrowings 403,492 74,286 428,935

Trade payables 1,010,240 739,258 785,583

Liability related to share subscription agreement 1,510,000 2,060,000 1,836,555

Warrants liability 27,215 5,033 -

Other current liabilities 1,247,660 1,100,706 1,121,909

Current liabilities 4,198,607 3,979,283 4,172,982

Non-Current

Lease liability 2,278,634 2,625,598 2,505,777

------------ ------------ ------------

Non-current liabilities 2,278,634 2,625,598 2,505,777

Total liabilities 6,477,241 6,604,881 6,678,759

Equity

Share capital 38,500 21,152 21,904

Share premium 43,873,332 40,402,890 40,786,623

Other components of equity 1,318,269 1,131,473 1,225,391

Accumulated deficit (40,069,835) (31,955,507) (36,455,386)

------------ ------------ ------------

Total equity 5,160,266 9,600,008 5,578,532

Total liabilities and equity 11,637,507 16,204,889 12,257,291

============ ============ ============

The accompanying notes are an integral part of the interim

financial statements.

STATEMENTS OF COMPREHENSIVE LOSS

US dollars

--------------------------------------

Six months ended For the

30 June year ended

31 December

2023 2022 2022

----------- ----------- ------------

Note Unaudited Audited

------------------------ ------------

Revenue 8 1,398,871 704,853 2,937,424

Cost of sales 596,377 276,092 1,339,096

Gross profit 802,494 428,761 1,598,328

Research and development expenses 3,241,579 3,276,067 6,618,795

General and administrative expenses 926,293 1,001,705 2,523,916

Marketing expenses 408,877 629,020 1,167,534

Other income - - (15,041)

Operating loss (3,774,255) (4,478,031) (8,696,876)

Financing costs 6 (163,008) (274,565) (573,388)

Financing income 7 322,814 1,249,863 1,267,652

Loss before tax (3,614,449) (3,502,733) (8,002,612)

Tax expense - - -

Net comprehensive loss for the period (3,614,449) (3,502,733) (8,002,612)

=========== =========== ============

Basic and diluted loss per ordinary

share (0.03) (0.05) (0.11)

=========== =========== ============

Weighted average number of ordinary

shares for basic and diluted loss

per share 108,252,292 75,367,394 76,013,296

=========== =========== ============

The accompanying notes are an integral part of the interim

financial statements.

STATEMENTS OF CHANGES IN EQUITY

US dollars

-----------------------------------------------------------------

Number Share Share Other components Accumulated Total

of shares capital premium of equity deficit equity

----------- -------- ---------- ---------------- ------------ -----------

Balance at 1 January 2023

(Audited) 78,084,437 21,904 40,786,623 1,225,391 (36,455,386) 5,578,532

Employee share-based

compensation - - - 56,025 - 56,025

Net proceeds allocated to

the issuance

of ordinary shares 49,688,097 14,073 2,638,711 - - 2,652,784

Shares issued pursuant to

share

subscription agreement 6,629,236 1,816 244,705 - - 246,521

Expenses paid in shares and

warrants 2,388,771 707 203,293 36,853 - 240,853

Net comprehensive loss for

the

period - - - - (3,614,449) (3,614,449)

----------- -------- ---------- ---------------- ------------ -----------

Balance at 30 June 2023

(Unaudited) 136,790,541 38,500 43,873,332 1,318,269 (40,069,835) 5,160,266

=========== ======== ========== ================ ============ ===========

Balance at 1 January 2022

(Audited) 75,351,738 21,140 40,382,744 1,004 ,029 (28,452,774) 12,955,139

Employee share-based

compensation - - - 127,444 - 127,444

Expenses paid in shares 37,106 12 20,146 - - 20,158

Net comprehensive loss for

the

period - - - - (3,502,733) (3,502,733)

----------- -------- ---------- ---------------- ------------ -----------

Balance at 30 June 2022

(Unaudited) 75,388,844 21,152 40,402,890 1,131,473 (31,955,507) 9,600,008

=========== ======== ========== ================ ============ ===========

Balance at 1 January 2022

(Audited) 75,351,738 21,140 40,382,744 1,004 ,029 (28,452,774) 12,955,139

Employee share-based

compensation - - - 221,362 - 221,362

Shares issued pursuant to

share

subscription agreement 2,695,593 752 383,733 - - 384,485

Expenses paid in shares and

warrants 37,106 12 20,146 - - 20,158

Net comprehensive loss for

the

year - - - - (8,002,612) (8,002,612)

----------- -------- ---------- ---------------- ------------ -----------

Balance at 31 December 2022

(Audited) 78,084,437 21,904 40,786,623 1,225,391 (36,455,386) 5,578,532

The accompanying notes are an integral part of the interim

financial statements.

STATEMENTS OF CASH FLOWS

US dollars

--------------------------------------

Six months ended Year ended

30 June 31 December

2023 2022 2022

----------- ----------- ------------

Unaudited Audited

------------------------ ------------

Operating activities

Net comprehensive loss for the period (3,614,449) (3,502,733) (8,002,612)

Non-cash adjustments

Inventory write off 193,537 - -

Depreciation of property and equipment 67,614 53,052 108,581

Depreciation of right of use asset 157,942 173,892 339,561

Share-based compensation 56,025 127,444 221,362

Amortisation of intangible assets 480,690 480,690 961,380

Amortisation of liabilities (140,693) (206,755) (396,434)

Foreign exchange losses on cash balances 17,328 369,053 381,480

Revaluation of financial instruments, net (212,120) (1,149,960) (984,001)

Expenses paid in shares and options 240,853 20,158 20,158

Net changes in working capital

(Increase) decrease in trade receivables (166,565) 272,270 246,526

(Increase) in inventories (311,358) (486,312) (488,266)

(Increase) decrease in other current assets (233,418) 6,701 (102,908)

Decrease in other long-term assets 1,165 3,189 3,267

Increase in trade payables 224,657 87,500 133,825

Increase (decrease) in other liabilities 127,872 (17,733) (12,261)

Net cash used in operating activities (3,110,920) (3,769,544) (7,570,342)

Investing activities

Purchase of property and equipment (148,766) (193,177) (258,838)

Net cash used in investing activities (148,766) (193,177) (258,838)

Financing activities

Proceeds from share subscription agreement - 2,000,000 2,000,000

Proceeds allocated to ordinary shares 2,864,790 - -

Proceeds allocated to warrants 132,544 - -

Issuance costs (185,249) - (9,952)

Proceeds from short term borrowings 956,382 100,283 527,790

Repayment of short-term borrowings (970,872) (448,630) (493,338)

Repayment of lease liability (99,524) (216,288) (158,849)

Net cash provided by financing activities 2,698,071 1,435,365 1,865,651

Net change in cash and cash equivalents (561,615) (2,527,356) (5,963,529)

Cash and cash equivalents, beginning of year 715,815 7,060,824 7,060,824

Exchange differences on cash and cash equivalents (17,328) (369,053) (381,480)

Cash and cash equivalents, end of period 136,872 4,164,415 715,815

=========== =========== ============

Supplementary information:

Interest paid during the period 38,499 6,049 13,321

----------- ----------- ------------

Interest received during the period 76 1,418 1,507

----------- ----------- ------------

Supplementary information on non-cash activities:

Shares issued pursuant to share subscription agreement 246,521 - 384,485

----------- ----------- ------------

Expenses paid in shares and warrants 240,853 20,158 20,158

----------- ----------- ------------

The accompanying notes are an integral part of the interim

financial statements.

NOTES TO THE FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS

ETHERNITY NETWORKS LTD. (hereinafter: the "Company"), was

incorporated in Israel on the 15th of December 2003 as Neracore

Ltd. The Company changed its name to ETHERNITY NETWORKS LTD. on the

10th of August 2004.

The Company provides innovative, comprehensive networking and

security solutions on programmable hardware for accelerating

telco/cloud networks performance. Ethernity's FPGA logic offers

complete Carrier Ethernet Switch Router data plane processing

firmware, PON MAC firmware and control software with a rich set of

networking features, robust security, and a wide range of virtual

function accelerations to optimise telecommunications networks.

Ethernity's complete solutions quickly adapt to customers' changing

needs, improving time-to-market and facilitating the deployment of

5G, edge computing, and different NFV appliances including wireless

backhaul with wireless link bonding, 5G UPF, 5G CU and vRouter

offload with the current focus on 5G emerging appliances. The

Company's customers are situated worldwide.

NOTE 2 - SUMMARY OF ACCOUNTING POLICIES

Basis of presentation of the financial statements and statement

of compliance with IFRS

The interim condensed financial statements for the six months

ended 30 June 2023 have been prepared in accordance with IAS 34,

Interim Financial Reporting. The interim condensed financial

statements do not include all the information and disclosures

required in the annual financial statements in accordance with IFRS

and should be read in conjunction with the Company's annual

financial statements as at 31 December 2022. The accounting

policies applied in the preparation of the interim condensed

financial statements are consistent with those followed in the

preparation of the Company's annual financial statements for the

year ended 31 December 2022.

The interim condensed financial statements for the half-year

ended 30 June 2023 (including comparative amounts) were approved

and authorized for issue by the board of directors on 19 September

2023.

NOTE 3 - GOING CONCERN

The financial statements have been prepared assuming that the

Company will continue as a going concern. Under this assumption, an

entity is ordinarily viewed as continuing in business for the

foreseeable future unless management intends or has no realistic

alternative other than to liquidate the entity or to stop trading

for at least, but not limited to, 12 months from the reporting

date. The assessment has been made of the Company's prospects,

considering all available information about the future, which have

been included in the financial budget, from managing working

capital and among other factors such as debt repayment schedules.

Consideration has been given inter alia to the significant values

of funds raised during the year ended 31 December 2022 and to date,

the current stage of the Company's life cycle, its losses and cash

outflows, including with respect to the development of the

Company's products, the expected timing and amounts of future

revenues.

As set out in the Company's annual report and the results for

the year ended 31 December 2022, the Company is taking careful

steps towards generating positive cash flow from its operations

during FY2023, which includes a combination of the modified

business model to focus on licensing and a reduction in costs. The

delays in existing customer contracts, combined with the extended

sales cycles being experienced by the Company place significant

uncertainty over the Company's ability to achieve the revenues

previously targeted for FY2023. Whilst revenue is therefore

expected to be lower than previously anticipated, the focus on the

higher margin licensing contracts is expected to contribute to an

improved gross margin once licensing sales commence and combined

with the cost savings, an improved EBITDA.

Based on the above-mentioned description, and in the light of

enquiries made by the Directors as to the current liquidity

position of the Company, as well as bearing in mind the ability and

success of the Company to raise funds previously, the Directors

have a reasonable expectation that the Company will have access to

adequate resources to continue in operational existence for the

foreseeable future and therefore have adopted the going concern

basis of preparation in the financial statements. The directors

recognize that their expectations are based on the success of the

new business model as well as the Company succeeding to raise

funds, however should events occur that could materially impact the

forecasts and cashflows of the Company, a material uncertainty

remains that may cast a significant doubt on the Company's ability

to continue as a going concern and fulfil its obligations and

liabilities in the normal course of business in the future.

NOTE 4 - SIGNIFICANT EVENTS

EQUITY RELATED TRANSACTIONS DURING THE ACCOUNTING PERIOD

During the 6 month period ended 30 June 2023, ordinary shares of

the Company were issued, as follows:

Number of

ordinary

Note shares

------ -----------

Issuance of ordinary shares (issued

together with warrants) [1] 49,688,097

Shares issued pursuant to share subscription

agreement [2] 6,629,236

Expenses paid for in shares and warrants 2,388,771

-----------

58,706,104

===========

[1] Details of the equity raises are as follows:

January 2023 equity raise

In January 2023 the Company issued 23,571,430 shares with

23,571,430 warrants attached. Each share and attached warrant were

issued for GBP0.07, realising gross proceeds of $2.02 million

(GBP1.65 million) and net proceeds after issuance expenses of

approximately $1.89 million (GBP1.54 million).

Each warrant was initially exercisable at GBP0.15 with a life

term of approximately 24 months. The warrants are not transferable,

are not traded on an exchange and have an accelerator clause,

whereby these warrants may be called by the Company if the closing

mid-market share price of the Company exceeded GBP0.20 over a

5-consecutive day period. If such 5-consecutive day period

condition is met, the Company may serve notice on the warrant

holders to exercise their relevant warrants within 7 calendar days,

failing which, such remaining unexercised warrants shall be

cancelled.

As the exercise price of the warrants is denominated in GBP and

not in the Company's functional currency, it was determined that

the Company's obligation under such warrants cannot be considered

as an obligation to issue a fixed number of equity instruments in

exchange for a fixed amount of cash. Accordingly, it was determined

that such warrants represent a derivative financial liability

required to be accounted for at fair value through the profit or

loss category. Upon initial recognition the Company allocated the

gross proceeds as follows: an amount of approximately $133,000 was

allocated as a derivative warrants liability with the remainder of

the proceeds amounting to $1.75 million (after deduction of the

allocated issuance costs of $0.14 million) being allocated to share

capital and share premium. The issuance expenses were allocated in

a consistent manner to the above allocation. The expenses related

to the warrant component were carried to profit or loss as an

immediate expense while the expenses related to the share capital

component were netted against the amount carried to equity. In

subsequent periods the company measures the derivative financial

liability at fair value and the periodic changes in fair value are

carried to profit or loss under financing costs or financing

income, as applicable. The fair value of the derivative warrant

liability is categorized as level 3 of the fair value

hierarchy.

The fair value valuation of the warrants was based on the

Black-Scholes option pricing model, calculated in two stages.

Initially, the fair value of these call warrants issued to

investors were calculated, assuming no restrictions applied to such

call warrants. As the Company, under certain circumstances, has a

right to force the investors to either exercise their warrants or

have them cancelled, the second calculation calculates the value of

the warrants as call warrants that were issued by the investor to

the company. The net fair value results from reducing the call

investor warrants fair value from the call warrants fair value, as

long as the intrinsic value of the call warrants (share price at

the period end less exercise price of the warrants) is not greater

than such value. Should the intrinsic value of the warrants be

higher than the Black-Scholes two stage method described above,

then the intrinsic value of the warrants is considered to be a more

accurate measure to use in determining the fair value. The

following factors were used in calculating the fair value of the

warrants at their issuance:

Risk free rate 4.2%

Volatility 82.3%

In May 2023, the Company changed the terms of the warrants as

follows:

Changed: From To

Exercise price of warrants GBP 0.15 GBP 0.060

Share price at which accelerator clause GBP 0.20 GBP 0.075

may be activated

Of the 23,571,430 shares and 23,571,430 warrants subscribed for,

the director's participation in this issuance was 3,697,342 shares

and 3,697,342 warrants, on the same terms that outside investors

participated.

None of these warrants had been exercised by 30 June 2023 and

their fair value of approximately $27,000 at such date is disclosed

as a warrants liability in the statement of financial position,

Upon this successful equity raise being concluded, the brokers

for this transaction received 573,429 two year warrants exercisable

at GBP0.07 per warrant. The fair-value of these warrants at the

time of issuance was approximately $23,000. As at 30 June 2023,

none of these warrants have been exercised.

May 2023 equity raise

In May 2023 the Company issued 26,116,667 shares at GBP0.03 per

share, realising gross proceeds of $0.98 million (GBP0.78 million)

and net cash proceeds after issuance expenses paid out of $0.92

million (GBP0.74 million).

Of the 26,116,667 shares subscribed for, the director's

participation in this issuance was 916,668 shares, on the same

terms that outside investors participated.

The gross proceeds, after deduction of the issuance costs of

$54,000, were allocated to share capital and share premium.

Upon this successful equity raise being concluded, the brokers

for this transaction received 772,500 two year warrants exercisable

at GBP0.03 per warrant. The fair-value of these warrants at the

time of issuance was approximately $14,000. As at 30 June 2023,

none of these warrants have been exercised.

[2] Shares issued pursuant to the share subscription agreement

In February 2022, an institutional investor signed a follow-on

share subscription agreement with the Company, subscribing for a

further $2.0 million, with a total face value of $2,060,000. In

March 2022 the full $2.0 million was funded as a prepayment for the

subscription shares.

The number of subscription shares to be issued is determined by

dividing the face value of the subscription amount by the

Settlement Price.

The Settlement Price is equal to the sum of (i) the Reference

Price and (ii) the Additional Price.

The Reference Price is the average of the 3 daily

volume-weighted average prices ("VWAPs") of Shares selected by the

Investor during a 15 trading day period immediately prior to the

date of notice of their issue, rounded down to the next one tenth

of a penny. The Additional Price is equal to half of the excess of

85% of the average of the daily VWAPs of the Shares during the 3

consecutive trading days immediately prior to the date of notice of

their issue over the Reference Price.

The investor converted the following subscription amount during

the 6 month period ended 30 June 2023 as follows:

Amount converted Shares Issued

Notice date of conversion - USD

--------------------------- ----------------- --------------

21 May 2023 230,000 6,629,236

As described above, the investor converts subscription amounts

into shares of the Company at a discounted price. Upon each

conversion, the difference between the actual market value of

shares issued to the investor and the amount converted, is recorded

in finance costs, which in the 6 month period ended 30 June 2023

amounted to approximately $16,000.

NOTE 5 - INVENTORIES

US dollars

-----------------------------

30 June 31 December

2023 2022 2022

------- ------- -----------

Unaudited Audited

---------------- -----------

Components and raw materials 731,039 645,852 613,218

Finished cards 159,858 125,270 159,858

Total inventories 890,897 771,122 773,076

======= ======= ===========

NOTE 6 - FINANCING COSTS

US dollars

---------------------------------

Six months ended Year ended

30 June 31 December

2023 2022 2022

---------- ------- ------------

Unaudited Audited

------------------- ------------

Bank fees and interest 48,170 20,321 35,150

Lease liability financial expenses 104,742 114,244 227,246

Revaluation of liability related

to share subscription agreement

measured at FVTPL - 60,000 230,992

Expenses allocated to issuing

warrants 10,096 - -

Expenses allocated to share subscription

agreement - 80,000 80,000

---------- ------- ------------

Total financing costs 163,008 274,565 573,388

========== ======= ============

NOTE 7 - FINANCING INCOME

US dollars

--------------------------------------

Six months ended Year ended

30 June 31 December

2023 2022 2022

---------- ------------ ------------

Unaudited Audited

------------------------ ------------

Revaluation of proceeds due on

account of shares (financial

asset measured at FVTPL) 80,034 - -

Revaluation of warrant derivative

liability 105,329 1,209,960 1,214,993

Interest received 76 1,418 1,507

Exchange rate differences, net 137,375 38,485 51,152

---------- ------------ ------------

Total financing income 322,814 1,249,863 1,267,652

========== ============ ============

NOTE 8 - SEGMENT REPORTING

The Company has implemented the principles of IFRS 8, in respect

of reporting segmented activities. In terms of IFRS 8, the

management has determined that the Company has a single area of

business, being the development and delivery of high-end network

processing technology.

The Company's revenues are divided into the following

geographical areas:

US dollars

--------------------------------

Six months ended Year ended

30 June 31 December

2023 2022 2022

--------- ------- ------------

Unaudited Audited

------------------ ------------

Asia 54,700 42,800 290,800

Europe 12,390 - 131,000

Israel 137,912 149,403 429,954

United States 1,193,869 512,650 2,085,670

--------- ------- ------------

1,398,871 704,853 2,937,424

========= ======= ============

The Company's revenues are divided into the following

geographical areas:

%

--------------------------------

Six months ended Year ended

30 June 31 December

2023 2022 2022

-------- -------- ------------

Unaudited Audited

------------------ ------------

Asia 3.9% 6.1% 9.9%

Europe 0.9% - 4.5%

Israel 9.9% 21.2% 14.6%

United States 85.3% 72.7% 71.0%

-------- -------- ------------

100.0% 100.0% 100.0%

======== ======== ============

Revenue from customers in the company's domicile, Israel, as

well as its major market, the United States and Asia, have been

identified on the basis of the customer's geographical

locations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFMFWUEDSEFU

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

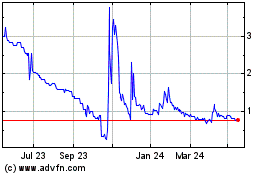

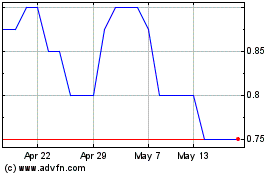

Ethernity Networks (LSE:ENET)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ethernity Networks (LSE:ENET)

Historical Stock Chart

From Jul 2023 to Jul 2024