RNS Number:4820B

Eleco PLC

23 September 2002

23 September 2002

ELECO PLC

The Building Systems and Software Group

PRELIMINARY RESULTS FOR THE YEAR ENDED 30 JUNE 2002

Enquiries to:

John Ketteley, Executive Chairman Tel: 01920 443 830

Eleco plc mail@elecoplc.co.uk

David Dannhauser, Finance Director Tel: 01920 443 830

Eleco plc mail@elecoplc.co.uk

Tarquin Edwards/Simon Rothschild Tel: 020 7929 5599

Holborn tarquin.edwards@holbornpr.co.uk

simon.rothschild@holbornpr.co.uk

"Eleco Confirms Potential"

"Strong Recovery in Difficult Markets"

Change Year ended 30 June 2002 Year ended 30 June 2001

(restated)*

#m #m

Turnover UP 22 % 32.9 26.8

Profit Before Tax UP 176 % 1.74 0.63

Profit After Tax UP 175 % 1.24 0.45

Dividend per Share UP 15 % 1.15p 1.00p

Earnings per Share UP 169% 3.01p 1.12p

*Restated to reflect the adoption of FRS 19 Deferred Tax

* Eleco delivering significant further growth and profitability.

* Combination with Consultec, a leading Swedish construction industry

software developer, will provide Eleco with critical mass in the

construction industry software market.

John Ketteley, Executive Chairman of Eleco plc, commented:

"Eleco has now been transformed into a company with a strong financial base and

with the capability of offering high quality, innovative products for the

building industry. Therefore, and despite the current political and economic

uncertainties, I have every confidence in our strategy for growing the business

and in our employees' skills and will to deliver."

Chairman's Statement

I am pleased to report that the Group has recovered well from the weather

related difficulties experienced last year. A strong performance in the second

half of the year resulted in higher turnover, profits before and after tax and

cash generation for the full year. As a consequence we ended the financial year

in a strong financial position and our cash balances exceeded our bank

borrowings at 30 June 2002.

The improvement was achieved by greatly improved contributions from Bell &

Webster Concrete, SpeedDeck Building Systems, and Gang-Nail Systems. Bell &

Webster Concrete produced record numbers of its FastBuild flat pack rooms for

hotels and university student accommodation and SpeedDeck Building Systems

carried out its largest single order. Both companies achieved record turnover

and operating profits. Gang-Nail Systems launched the latest version of its

Gang-Nail Roof and Truss software and a new Ecojoist(R) software program. The

success of these programs undoubtedly contributed to its best performance in the

past five years. Forma Communications had another year of excellent progress.

In July 2002, we signed a software licensing agreement with Consultec Group AB

of Sweden covering its range of construction software programs. At the same

time, we signed an option agreement to purchase the entire issued share capital

of Consultec at an exercise price of SEK 28,500,000 payable in cash and the

allotment credited as fully paid of 8,405,660 new ordinary shares of Eleco -

equivalent in aggregate to approximately #3,785,000. Consultec is a leading

Swedish construction industry software developer, commanding approximately 25

per cent of the Swedish construction industry software market. Consultec has a

comprehensive portfolio of construction industry software programs and an

outstanding and experienced software development team.

The exercise of the option is subject to shareholder approval and subject to

completion of satisfactory due diligence, shareholders will be sent a circular

setting out details of the proposals and a Notice convening an Extraordinary

General Meeting to consider them. The bringing together of Consultec with Eleco

would give the enlarged Eleco Group critical mass in the developing market for

design and procurement software for the construction industry. Following the

proposed merger of Consultec with Eleco, Mats Lovgren, the President and Chief

Executive of Consultec will be invited to join the Board of Eleco as Chief

Executive of our combined software interests.

Results

The trading results for the year are summarised below.

Group turnover for the year ended 30 June 2002 was #32.9 million (2001: #26.8

million), an increase of 27.4 per cent. after eliminating turnover of operations

discontinued in the prior year.

Group operating profit was #1,878,000 (2001: #1,055,000), an increase of 78.0

per cent.

Profit on ordinary activities before tax was #1,736,000 (2001: #629,000), an

increase of 176.0 per cent. Earnings per share were 3.0p (2001: 1.1p restated),

an increase of 170.5 per cent..

Net bank balances at 30 June 2002 amounted to #772,000 (Net bank borrowings at

30 June 2001 - #1,818,000).

Comparative figures have been restated to reflect the implementation of FRS 19

Deferred Tax, the impact of which has been to increase the previous year's tax

charge by #235,000 and reduce opening reserves by #237,000.

Dividend

The Board has proposed a final dividend of 0.80p per share (2001: 0.65p) payable

on 13 December 2002 to Shareholders on the Register on 29 November 2002. The

final dividend, if approved by shareholders, would result in the payment of

dividends for the year totalling 1.15p per share (2001: 1.00p), an increase of

15 per cent, which would be covered 2.6 times by earnings (2001: 1.1 times

restated).

OPERATING REVIEW

Building Systems

Turnover in the year under review was #31.52 million (2001: #24.96 million), an

increase of 26.3 per cent and operating profits were #2,610,000 (2000:

#1,726,000), an increase of 51.2 per cent.

Structural Precast Concrete Systems

Bell & Webster Concrete

Bell & Webster Concrete continued the progress made in the first six months. The

#5.5 million order from Carillion plc for 1601 FastBuild rooms for The

University of Hertfordshire has gone well. Production of the #2.7 million order

for 750 FastBuild rooms for Essex University at Colchester, to which I also

referred in my Interim Statement, was delayed until this current financial year.

In the meantime, other FastBuild room orders for hotel projects have ensured

that our Grantham plant has continued to operate at high levels of capacity

utilisation.

Ground beams and retaining walls also enjoyed a satisfactory year and further

progress was made on the design and development of precast railway platform

products. The provision of fast, reliable and accurate quotations has also been

facilitated by the introduction of new software developed for Bell & Webster

Concrete by MBA Computing.

Roof, Cladding and Panel Systems

SpeedDeck Building Systems

SpeedDeck Building Systems completed the largest single order in its history for

the Prologis warehousing complex at Brackmills, Northampton in April 2002. We

very much value our relationship with Prologis and the Brackmills Project is the

latest of a number of Prologis warehousing projects with which we have been

associated.

The Vitesse(R) composite wall panel is now well established in its market. I am

pleased to report that SpeedDeck Building Systems is working with Porsche and

its advisers on a programme to install Vitesse(R) on all 28 Porsche franchise

garages in the UK and has completed five so far.

Downer Cladding Systems

In May 2002, we completed the purchase of Downer Cladding Systems, the

specialist supplier of fixing and support systems for rainscreen cladding, and

the company made a positive contribution in the period up to our year-end.

The cladding market continues to see an increased interest in the use of modern

ventilated rainscreen systems. Downer Cladding Systems is acknowledged to be a

leading provider of technical assistance and supplier of fixing systems,

including its proprietary, rapid-fix HELPING HAND(R) aluminium system, which is

particularly well suited to ceramic, terracotta and non-ferrous metal cladding.

Stramit Industries

Last year proved to be a difficult one for Stramit Industries following the loss

of a major customer in the early part of the year. This necessitated a

restructuring of its business in the second half-year to reduce the cost base of

the company, the benefit of which is now starting to feed through.

Stramit has a reputation for manufacturing quality and the technical capability

to meet customers' non-standard panel requirements at a competitive price.

Management are focussing on these strengths with a view to increasing the volume

of panel products manufactured at the factory at Eye in Suffolk.

Timber Engineering Systems

Gang-Nail Systems

Gang-Nail Systems had an excellent year, assisted by a substantial increase in

orders from Eleco Bauprodukte in Germany. The results were helped by favourable

raw material prices and by a significant increase in sales of new machinery. The

number of Ecojoist(R) licensed fabricators increased to eight during the year as

the product increased its market share, gaining technical approval from a number

of national house builders.

The latest version of the Gang-Nail Truss and Roof software produced during the

year by Gang-Nail Systems' technical team is now acknowledged as being as good

as if not better than any in the market.

Eleco Bauprodukte

Eleco Bauprodukte continues to be affected by highly competitive local pricing,

but nevertheless succeeded in increasing its market share in Germany.

International Truss Systems

Despite the sharp devaluation of the South African Rand, International Truss

Systems again made a useful contribution to Group profits, albeit lower than

last year. The move to its new office/warehousing facilities has improved

product flow and customer service.

Software and Internet Solutions

Turnover in the year under review was #1.35 million (2000: #0.84 million) and

operating profits were #12,000 (2000: #105,000). A record performance achieved

by Forma Communications was offset by disappointing results from MBA Computing.

Forma Communications

Forma Communications achieved a number of significant milestones during the past

year. Highlights included continued enhancement of the SpeedDeck Designer 2

roofing specification software; development of the British Cycling Federation

website, incorporating Forma Communications' successful league table technology;

and the continued development and hosting of promotional websites for Sony

Computer Entertainment Europe, following the successful launch in the early part

of the year of Playstation's World Rally Championship website which is Sony

Computer Entertainment Europe's most successful online promotion to date. In

addition, Muzantiks, the music teaching website for schools completed earlier

this year, has been nominated for a BAFTA award.

During the year Forma Communications continued to strengthen its technical team

and skill base and has improved its internal systems and methodologies in step

with the growth of the business.

MBA Computing

MBA Computing's contribution to the Group's turnover and operating profits were

significantly reduced from last year. However, its contribution to the success

of other parts of the Group was significant. Software to support Gang-Nail

Systems' highly successful Ecojoist(R) flooring system was rolled out during the

year and was well received by Ecojoist(R) fabricators. It also developed

estimating software for Bell and Webster Concrete for their FastBuild precast

concrete room system. Steps are being taken in the current year to improve

intra-group collaboration still further.

Employees

The Employee Home Computer Scheme continues to expand and has now been taken up

by over 80 per cent of all our employees. We have experienced less demand for

the Employee Further Education Scheme and will be introducing a programme of

learning incentives that I hope will encourage more employees to take advantage

of the Scheme.

The strength of our performance this year has meant that we have experienced a

near 15 per cent increase in the number of people we employ. I welcome those who

have joined us and, on your behalf, I would like to thank all our employees for

the contribution they have made towards achieving these excellent results.

Outlook

Trading for the first two months of the current year is ahead of last year.

Eleco has now been transformed into a company with a strong financial base and

with the capability of offering high quality, innovative products for the

building industry. Therefore, and despite the current political and economic

uncertainties, I have every confidence in our strategy for growing the business

and in our employees' skills and will to deliver.

John Ketteley

Executive Chairman

Eleco plc

Consolidated Profit and Loss Account (Unaudited)

For the year ended 30 June 2002

Notes 2002 2001

(Restated)

#'000 #'000

Turnover

Continuing operations 4 32,747 25,795

Acquisitions 4 126 -

32,873 25,795

Discontinued operations 4 - 1,044

32,873 26,839

Operating profit

Continuing operations 4 1,861 1,045

Acquisitions 4 17 -

1,878 1,045

Discontinued operations 4 - 10

1,878 1,055

Loss on disposal of discontinued operations - (177)

Profit on ordinary activities before interest and taxation 1,878 878

Net interest payable (142) (249)

Profit on ordinary activities before taxation 1,736 629

Taxation 3 (497) (176)

Profit for the financial year 1,239 453

Dividends 5 (477) (412)

Retained profit 762 41

Dividends per share 5 1.15p 1.00p

Basic earnings per ordinary 10p share 6 3.0p 1.1p

Diluted earnings per ordinary 10p share 7 3.0p 1.1p

Eleco plc

Statement of Total Recognised Gains and Losses (Unaudited)

for the year ended 30 June 2002

2002 2001

(Restated)

#'000 #'000

Profit for the financial year as reported 1,239 688

Less: effect of full provision for deferred tax - (235)

Profit for the financial year as restated 1,239 453

Translation differences on foreign currency net investments (115) (43)

Total recognised gains for the year 1,124 410

The cumulative effect of the prior period adjustment on the profit and loss

account brought forward at 1 July 2001, occasioned by the adoption of FRS 19,

was a reduction of #237,000.

Reconciliation of Movement in Equity Shareholders' Funds (Unaudited)

for the year ended 30 June 2002

2002 2001

(Restated)

#'000 #'000

Profit for the financial year 1,239 688

Less: effect of full provision for deferred tax - (235)

Profit for the financial year as restated 1,239 453

Other recognised losses relating to the year (115) (43)

Dividends (477) (412)

Proceeds from issue of ordinary shares 55 362

Issue of ordinary shares on acquisition of subsidiaries - 646

Net increase in equity shareholders funds 702 1,007

Opening equity shareholders' funds 8,545 7,539

Closing equity shareholders' funds 9,247 8,545

Opening equity shareholders' funds at 1 July 2000 were previously #7,541,000

before restating for the effect of the full provision of deferred taxation.

Eleco plc

Summarised Consolidated Balance Sheet (Unaudited)

at 30 June 2002

2002 2001

(Restated)

#'000 #'000

Fixed assets 8,851 8,777

Current assets

Stocks 1,838 1,825

Debtors 7,026 6,450

Cash at bank and in hand 3,333 482

12,197 8,757

Creditors: amounts falling due within one year (9,917) (7,222)

Net current assets 2,280 1,535

Total assets less current liabilities 11,131 10,312

Creditors: amounts falling due after more than one year (1,601) (1,397)

Provisions for liabilities and charges (283) (370)

Net assets 9,247 8,545

Capital and reserves

Called up share capital 4,282 4,259

Share premium account 5,080 5,048

Merger reserve 367 367

Profit and loss account (482) (1,129)

Equity shareholders' funds 9,247 8,545

Eleco plc

Consolidated Cash Flow Statement (Unaudited)

for the year ended 30 June 2002

Notes 2002 2001

#'000 #'000

Net cash inflow from operating activities - continuing operations 9 4,152 1,913

Net cash inflow from operating activities - discontinued operations 9 - 228

Net cash inflow from operating activities 4,152 2,141

Returns on investment and servicing of finance

Interest received 31 42

Interest paid (142) (247)

Interest element of finance lease rentals (31) (44)

Net cash outflow from returns on investment and servicing of finance (142) (249)

Net cash outflow from taxation (5) (132)

Capital expenditure and financial investment

Increase in loans to Employee Share Ownership Trust (19) (352)

Purchase of fixed assets (914) (634)

Sale of tangible fixed assets 63 10

Net cash outflow from capital expenditure and financial investment (870) (976)

Acquisitions and disposals

Purchase of subsidiary undertakings net of cash acquired 8 (537) (713)

Sale of subsidiary undertakings' operations 770 (64)

Net cash inflow/(outflow) from acquisitions and disposals 233 (777)

Equity dividends paid (412) (395)

Net cash inflow/(outflow) before financing 2,956 (388)

Financing

New bank loans 750 500

Repayment of principal under finance leases (282) (250)

Repayment of bank loans (301) (273)

Issue of ordinary shares 5 362

Net cash inflow from financing 172 339

Increase/(decrease) in cash in the year 10 3,128 (49)

Eleco plc

Notes

1. The financial information in this announcement does not constitute statutory accounts within the meaning of

section 240 of the Companies Act 1985. Statutory accounts of the Company, on which the Auditors will report,

will be delivered to the Registrar of Companies and posted to shareholders on 10 October 2002. The

comparative figures for the year to 30 June 2001 have been taken from, but do not constitute, the Company's

statutory financial statements for that financial year. Those financial statements have been reported on by

the Auditors and delivered to the Registrar of Companies. The Report of the Auditors was unqualified and did

not contain a statement under s237(2) or (3) of the Companies Act 1985.

2. The information herein has been prepared on the basis of the accounting policies adopted for the year ended

30 June 2001, as set out in the Company's Annual Report and Accounts, except as modified by the adoption of

certain Financial Reporting Standards. The Group has adopted the provisions of "FRS 19 - Deferred Tax" and

continues to adopt "FRS 17 - Retirement Benefits" in accordance with its transitional provisions. The effect

of the adoption of FRS19 on the results reported in the current and previous periods are explained in note 3

below.

3. Deferred Tax unprovided as at 30 June 2001 has been provided for as required by FRS19 and included as a prior

period adjustment by the restatement of the results for the year ended 30 June 2001.

The current period effect of the adoption of FRS19 is to increases the tax charge by #25,000. The adoption of

FRS19 has increased the tax charge by #235,000 for the year ended 30 June 2001. The effect on reserves and

net assets at 30 June 2001 was a decrease of #237,000.

4. Turnover and Segmental analysis

Group turnover and profits were attributable as follows

Turnover Operating profit/(loss)

2002 2001 2002 2001

#'000 #'000 #'000 #'000

Continuing activities

Building systems 31,523 24,957 2,610 1,726

Software systems 1,350 838 12 105

Corporate - - (744) (786)

Total continuing operations 32,873 25,795 1,878 1,045

Discontinued activities

Rail and marine - 1,044 - 10

Total discontinued operations - 1,044 - 10

32,873 26,839 1,878 1,055

5. A dividend of #142,000 was declared at the interim stage. A final dividend representing 0.80p per

share is being proposed and, if approved at the Annual General Meeting, will be payable on 13 December

2002 to shareholders on the register on 29 November 2002.

6. The calculation of basic earnings per share is based on the profit attributable to equity shareholders

of #1,239,000 (2001(restated): #453,000) and on 41,195,519 ordinary shares (2001: 40,264,237), being

the weighted average number of ordinary shares in issue during the year.

7. The calculation of diluted earnings per share is based on the profit attributable to equity

shareholders of #1,239,000 (2001(restated): #453,000) and a diluted weighted average of 41,328,446

ordinary shares (2001: 40,722,060).

8. On 10 May 2002, the Group acquired the entire issued share capital of Downer Cladding Systems Limited

for a total initial consideration, including acquisition expenses, of #950,000. Provision has been

made for #20,000 deferred consideration payable. Goodwill on acquisition of #299,000 has been

capitalised and included within fixed assets. #900,000 of the total consideration was paid in cash and

#506,000 cash was acquired.

9. Reconciliation of operating profit to net cash flow from operating

activities

Continuing Discontinued

2002 2001 2002 2001

#'000 #'000 #'000 #'000

Operating profit 1,878 1,045 - 10

Depreciation charge 1,182 1,004 - 70

Amortisation of intangible assets 94 47 - -

(Profit)/loss on sale of fixed assets (7) 11 - -

Working capital decrease/(increase) 1,005 (194) - 148

4,152 1,913 - 228

10. Reconciliation of net cash flow to movement in net debt

2002 2001

#'000 #'000

Increase/(decrease) in cash in the year 3,128 (49)

Cash flow from movements in debt and lease financing (167) 23

Decrease/(increase) in net debt resulting from cash flows 2,961 (26)

Other non-cash items:

New finance leases (162) (368)

Finance lease obligations disposed of on sale of business - 47

Finance lease obligations acquired with subsidiaries - (10)

Effects of changes in foreign exchange rates (89) (32)

Decrease/(increase) in net debt in the year 2,710 (389)

Opening net debt (2,246) (1,857)

Closing net funds/(debt) 464 (2,246)

11. The Annual General Meeting of Eleco plc will be held at The Brewers Hall,

Aldermanbury Square, London EC2V 7HR at 12:00 noon on 20 November 2002.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BKKKQFBKDFCB

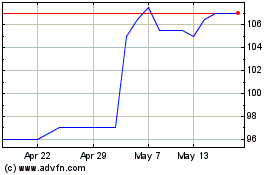

Eleco Public (LSE:ELCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

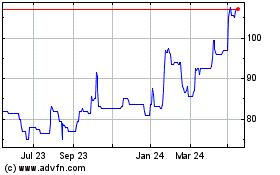

Eleco Public (LSE:ELCO)

Historical Stock Chart

From Jul 2023 to Jul 2024