AIM Schedule One - DP Poland PLC (4199J)

December 22 2020 - 3:00AM

UK Regulatory

TIDMDPP

RNS Number : 4199J

AIM

22 December 2020

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

DP Poland plc ("DP Poland" or the "Company")

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

Registered Office:

Elder House St Georges Business Park 207 Brooklands Road

Weybridge

Surrey

United Kingdom

KT13 0TS

Company Trading Address:

ul S omińskiego 19

lok. 508

00-195 Warsaw

Poland

COUNTRY OF INCORPORATION:

United Kingdom

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

www.dppoland.com/2015/aim-26-data/

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

DP Poland proposes to acquire the entire issued of Dominium

S.A ("Dominium"), a Polish pizza restaurant group (the "Acquisition").

The Acquisition constitutes a reverse takeover under Rule 14

of the AIM Rules, and is conditional on approval by Shareholders

at a General Meeting.

On 19 October, DP Poland announced that approval had been received

from the Polish Office of Competition and Consumer Protection,

UoKIK, in respect of the Acquisition.

DP Poland

Domino's Pizza is operated in Poland by DP Polska S.A., a Polish

registered company which is wholly owned by DP Poland plc.

DP Polska holds the master franchise agreement to own, operate

and franchise Domino's stores in Poland.

The Company currently operates 69 stores, of which 50 are corporately

run and 19 under sub-franchise agreements. Stores are typically

located in high population density areas and offer a broad

range of pizza, freshly prepared in store that can be delivered

within 25 minutes of an order being received.

Dominium

Dominium operates a total of 57 pizza restaurants across Poland

with 698 employees. Restaurants offer eat-in and takeaway services,

and are categorised as standard (32), shopping mall (23), or

franchise (2).

More than one third of the restaurants are located in the capital,

and Dominium has a presence in other major cities in Poland:

21 in Warsaw, 5 in Krakow (with 4 in shopping malls), 2 in

each of Katowice, Lublin, Torun and Wroclaw, and a further

23 in other towns and cities in Poland. The majority of revenue

has historically been generated from eat-in business.

The Enlarged Group

The Acquisition will almost double the number of stores within

DP Poland's existing portfolio and provide a basis for further

expansion and market penetration in new cities and towns.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

Ordinary Shares of 0.5 pence each ("Ordinary Shares") for which

Admission will be sought: 581,485,754

Issue price per Ordinary Share: 8 pence

There are no restrictions as to the transfer of Ordinary Shares

No Ordinary Shares to be held in treasury

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

Total capital to be raised on Admission: GBP5.2 million

Primary funds raised: GBP3.5 million

Secondary sell down: GBP1.7 million

Anticipated market capitalisation on Admission: GBP46.5 million

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

47.5%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

N/A

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Current Directors:

To remain on the board in their current roles post Admission:

Nicholas John Donaldson Non-Executive Chairman

Robert Nicholas Lutwyche Morrish Non-Executive Director

To step down from the board prior to Admission:

Christopher Humphrey Robertson Non-Executive Director

Moore

Gerald William Ford Non-Executive Director

Proposed Directors:

Piotr Józef Dzier ek Chief Executive Officer

Przemys aw G bocki Non-Executive Director

Jakub Mi osz Chechelski Non-Executive Director

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Shareholder Interest prior Interest

to Acquisition Post Admission

(%) (%)

Malaccan Holdings Limited 0.0 45.0

---------------- ----------------

Pageant Holdings 17.7 9.4

---------------- ----------------

Fidelity Management & Research 9.8 8.4

---------------- ----------------

Canaccord Genuity Wealth

Management 12.2 6.2

---------------- ----------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

N/A

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 31 December

(ii) DP Poland: Unaudited interim accounts for the six months

ended 30 June 2020;

Dominium: Unaudited interim accounts for the six months ended

30 June 2020; and

(iii) 30 June 2021 (Audited annual accounts for the period

ended 31 December 2020);

30 September 2021 (unaudited interim accounts for the six months

ended 30 June 2021); and

30 June 2022 (audited annual accounts for the 12 months ended

31 December 2021)

EXPECTED ADMISSION DATE:

8 January 2020

NAME AND ADDRESS OF NOMINATED ADVISER:

N+1 Singer

1 Bartholomew Lane

London EC2N 2AX

NAME AND ADDRESS OF BROKER:

N+1 Singer

1 Bartholomew Lane

London EC2N 2AX

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

www.dppoland.com

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

QCA Corporate Governance Code

DATE OF NOTIFICATION:

21 December 2020

NEW/ UPDATE:

NEW

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAUAOVRROUUUAA

(END) Dow Jones Newswires

December 22, 2020 03:00 ET (08:00 GMT)

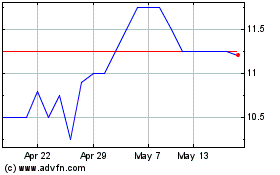

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jul 2023 to Jul 2024