RNS Number : 4394I

Derwent London PLC

19 November 2008

19 November 2008

Derwent London plc ("Derwent London" / "group")

Interim Management Statement for the NINE months

endED 30 SEPTEMBER 2008

Highlights

* Ongoing letting success:

* Lettings for the year to date totalled 408,000 sq ft (37,900 sq m), which will generate income of �14.7 million per annum

* A further 35,500 sq ft (3,300 sq m) of floorspace currently under offer, which will produce rental income of �1.0 million per

annum when completed

* Current vacancy rate of only 3.3% of ERV, down from 4.5% at December 2007

* Strong finances:

* Unutilised, committed bank facilities of �290 million - nearly �200 million more than the forecast cash requirement through to

December 2010

* Low gearing

* Group loan to value ratio at June 2008 of only 32.6%

* Realigned capital expenditure programme:

* Reduced commitment to developments with only three projects under way which require approximately �100 million to complete, of

which 57% of the floorspace is pre-let.

Commenting on the period under review, John Burns, chief executive of Derwent London, said:

"In the current business environment, central London occupier demand has inevitably weakened, causing rent free incentives to increase

and rental levels to decline. However, as demonstrated by our letting activity, our well designed space, at mid market rents, remains

attractive to cost conscious, yet discerning, occupiers.

"Whilst activity in the property investment market remains scarce, the recent substantial reduction in the base rate should be a

positive step towards improving liquidity as the gap between interest rates and increasing property yields widens. Hopefully, this will

start to re-establish the market.

"We have a strong balance sheet which puts us in a good position to ride out the current challenging conditions. During these times, we

will concentrate on maintaining income, minimising vacancies and managing our capital expenditure programme, to ensure that we benefit from

the recovery when it arrives."

For further information, please contact:

John Burns, Chief Executive Officer Chris Odom, Finance Director

Derwent London Derwent London

Tel: +44 (0)20 7659 3000 Tel: +44 (0)20 7659 3000

Stephanie Highett / Dido Laurimore

Financial Dynamics

Tel: +44 (0)20 7831 3113

Overview

Derwent London is a real estate investment trust with a commercial property portfolio focussed on central London, predominantly its West

End. The group's half-year statement highlighted the difficult economic conditions that the UK was facing and the impact this was having on

investment activity and tenant demand. During the third quarter, the outlook deteriorated further with the UK economy contracting for the

first time in 16 years. Despite this, we have continued to make good progress with our lettings and, in the year to date, these have

totalled �14.7 million by rental income on an annualised basis.

Measures taken by the board have ensured that the group is well positioned to face the current extraordinary economic climate. The

portfolio is let off low average rents (passing rent of �24.78 psf / �267 psm), has an unexpired average lease length of 8.2 years and a

reduced commitment to speculative developments. Our finances continue to be in good shape. The group possesses a strong balance sheet with

low gearing and considerable committed, unutilised bank facilities.

Asset values

Our portfolio is valued externally every six months, the last valuation being 30 June 2008. At this time, the portfolio was valued at

�2.5 billion, and showed an underlying decline of 6.1% since the beginning of the year. This compared favourably to the IPD quarterly index

which showed a capital value decline of 8.2% for offices in central London over for the same period.

As an indication of the movement in capital values over the third quarter of the year, the IPD and CBRE central London office indices

showed declines of 6.8% and 7.2% respectively. This further fall in capital values was driven by an increase in yields and concern over the

performance of the occupational market. Although the portfolio has not been revalued this quarter, after consulting CBRE, our main external

valuers, we believe the value of our central London portfolio would have broadly tracked these indices.

Portfolio management

The �14.7 million of letting activity this year comprised �3.7 million in the first half, �8.9 million in the third quarter and a

further �2.1 million since that quarter-end. In total, this represents 408,000 sq ft (37,900 sq m) of space, some 7.3% of the group's total

floor area.

A number of the early third quarter transactions were announced with the interim results. Highlights of these included: a pre-let at the

Angel Building to Cancer Research UK (�5.6 million per annum), a pre-let at Gordon House to The Benefit Express (�0.9 million per annum) and

a letting at Qube to Geronimo Communications (�0.7 million per annum). More recent transactions concluded are:

* Qube, Fitzrovia - 27,300 sq ft (2,500 sq m) of office space let to HOK International at a rent of �1.3 million per annum. The

tenant is paying a rent of �56 psf (�603 psm) on the third floor and �50 psf (�538 psm) on the first floor offices.

* Tea Building, Shoreditch - Following the granting of planning permission to transform a redundant element of this building into a

25-bedroom boutique hotel, we have pre-let the space to Soho House at a rent of �0.3 million per annum. This marks a further stage in the

phased refurbishment of the successful Tea Building.

In addition to the lettings made in the period, the group has 35,500 sq ft (3,300 sq m) of floorspace under offer which will produce

further rental income of �1.0 million per annum when completed.

This activity has reduced the amount of available space in our portfolio to 3.3% by estimated rental value and 3.5% by floor area. These

compare favourably to the levels of 4.5% and 4.0% respectively at the start of the year. The vacancy rate for London as a whole reported

by CBRE is 4.2%.

Since we reported at the half-year, 16 lease renewals have been concluded at a rent of over �1.3 million per annum which is marginally

below the rental values underlying the June 2008 valuation. This takes activity for the year to 31 lease transactions equating to an annual

rent of �2.8 million.

Collection of the group's rent for the September quarter was in line with our previous experience with 98% being collected within two

weeks. The number of tenants defaulting continues to be de minimis.

Project update

During the third quarter, we completed the 15,900 sq ft (1,500 sq m) refurbishment and extension of the third to fifth floors at Gordon

House, Victoria (fully pre-let) and the 25,000 sq ft (2,300 sq m) refurbishment of 151 Rosebery Avenue, Clerkenwell (81% pre-let).

Current schemes under construction are:

* Angel Building, Islington/Clerkenwell - 263,000 sq ft (24,400 sq m) with 53% of the space pre-let. Completion due in Summer 2010.

* Arup Phase III, Fitzrovia - 85,000 sq ft (7,900 sq m). Fully pre-let. Completion due in Autumn 2009.

* 16-19 Gresse Street, Noho - 47,000 sq ft (4,400 sq m). Completion due Summer 2009.

In total, the cost to complete these schemes is approximately �100 million.

Whilst we continue to appraise our longer term projects, which will incur some planning costs, our priority in the current economic

conditions is for income retention. Our pipeline of future projects is comprised of income producing properties where the leases give us

flexibility to control scheme timing. An example of this is our City Road Estate where we have recently been successful in obtaining

planning consent, on appeal, to increase the existing net floor area by 147% to 251,000 sq ft (23,300 sq m). This is a valuable consent to

have secured for the future. In the meantime, the existing buildings are being managed to maximise the income.

Acquisitions and disposals

During the quarter, the group made two small acquisitions. Firstly, 12,000 sq ft (1,100 sq m) of vacant offices at 9 and 10 Rathbone

Place, Noho as part of a lease re-gear and property exchange. This expands our ownership around our Gresse Street development and enables us

to improve the local environment. Secondly, 232-242 Vauxhall Bridge Road, Victoria was acquired for �11.0 million, excluding costs. The

23,000 sq ft (2,100 sq m) office building is multi-let and offers potential solutions to planning issues on our other properties in the

locality.

In addition, the group disposed of �18.1 million of non-core assets in the quarter. This predominantly comprised the �10.6 million sale

of our retail holdings in Bournemouth. Overall, the disposals were made in line with the June valuations.

Finance

There has been little change in the group's net debt position since the half year with only a small rise in borrowings. The conservative

debt ratios, with which the group entered 2008, have stood it in good stead. At 30 September 2008, the group had �290 million of unutilised,

committed bank facilities available which exceeded the group's 2009 and 2010 cash requirements by nearly �200 million based on current

forecasts.

Net debt had risen to �879 million at 30 September 2008. Most of this increase can be attributed to capital expenditure and the cost of

acquisitions exceeding disposal proceeds by �24 million in the three months. The committed debt facilities of �1,135 million are unchanged

from the half year. The bank facilities are mainly revolving loans that can be used for "general corporate purposes" which gives the group a

high degree of flexibility in the management of its debt. All the facilities are secured for amounts beyond current drawings, and there

remains a substantial amount of unsecured property. In respect of debt, the strength of the group's balance sheet can be simply demonstrated

by looking at two numbers. First, to fully draw the group's committed facilities, which as noted above would comfortably exceed the group's

two year projected borrowings, would require �1.56 billion of security. This figure compares with a portfolio value at 30 June 2008 of �2.5

billion, so that values would have to fall by 38% before the group would not have access to its full facilities. The group's loan to value, reported at the half year as 32.6%,

encapsulates this. Secondly, based on forecast rental income and a LIBOR rate of 5%, rental income would need to fall by at least �24

million per annum to inhibit access to debt facilities. In our view, such a fall is unlikely, particularly given the low average passing

rent and tenant profile.

The group has no further refinancing requirements in 2008. At the end of 2009, it has a �125 million facility maturing which it expects

to renew. Thereafter, there are no maturing loans until December 2011.

At the September 2008 quarter end, 63% of the nominal value of net debt was either at fixed rates, or fixed using interest rate

derivative products. Interest on a further 18% was base rate related, thus avoiding the exceptionally high LIBOR rates prevailing for much

of the year on over 80% of debt. The group's current spot weighted cost of debt, which does not yet fully reflect the recent fall in

interest rates, is 5.5%.

Outlook

In the current business environment, central London occupier demand has inevitably weakened, causing rent free incentives to increase

and rental levels to decline. However, as demonstrated by our letting activity, our well designed space, at mid market rents, remains

attractive to cost conscious, yet discerning, occupiers.

Whilst activity in the property investment market remains scarce, the recent substantial reduction in the base rate should be a positive

step towards improving liquidity as the gap between interest rates and increasing property yields widens. Hopefully, this will start to

re-establish the market.

As a strategic capital city we believe that London, particularly the West End, will retain its long term importance to both occupiers

and global investors. However, in the prevalent economic climate we will concentrate on maintaining income, minimising vacancies and

managing our capital expenditure programme, to ensure that we benefit from the recovery when it arrives.

Disclaimer

This document includes statements that are forward-looking in nature. Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results, performance or achievements of Derwent London plc to be materially

different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Notes to editors

Derwent London plc

Derwent London plc was formed on 1 February 2007 following the merger of Derwent Valley Holdings and London Merchant Securities and

converted to REIT status on 1 July 2007. The group is one of London's most innovative office specialist property developers and investors

and is well known for its established design-led philosophy and creative management approach to development. Derwent London won the RIBA

Client of the Year Award 2007.

Derwent London's core strategy is to acquire and own a portfolio of central London property that has reversionary rents and significant

opportunities to enhance and extract value through refurbishment and redevelopment. The group owns and manages an investment portfolio of

over �2.5 billion, of which 94% is located in central London, with a specific focus on the West End and the areas bordering the City of

London. Landmark schemes by Derwent London include: Qube W1, Johnson Building EC1, Davidson Building WC2 and Tea Building E1.

Approximately 50% of the London portfolio is identified as having the opportunity, through development, to achieve significant gains in

floor area and, thereby, increases in value.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSBIBDBLXBGGII

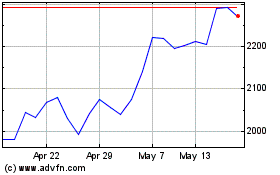

Derwent London (LSE:DLN)

Historical Stock Chart

From Jun 2024 to Jul 2024

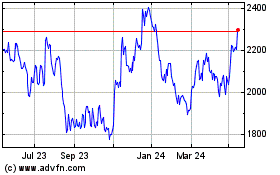

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2023 to Jul 2024