Diageo to Launch New Irish Whiskey Brand as Sales of the Spirit Soar

January 31 2017 - 6:00AM

Dow Jones News

By Saabira Chaudhuri

Diageo PLC is getting back into the Irish whiskey business two

years after getting out of it.

The world's largest spirits maker in 2014 sold its Irish whiskey

brand Bushmills to Jose Cuervo in exchange for Don Julio

tequila.

Irish whiskey has been on a tear, growing 131% by volume

globally during the past decade, easily trumping rises of 13% for

Scotch whisky and 56% for bourbon during the same period, according

to industry tracker IWSR. Rising demand, especially from the U.S.,

has turned Irish whiskey into the world's fastest-growing major

spirit.

Diageo Chief Executive Ivan Menezes last year defended the

company's decision to sell Bushmills, saying, "It's not the Irish

whiskey sector that's hot, it's certain brands that are hot."

The Irish whiskey sector is dominated by Pernod Ricard SA's

Jameson brand, which makes up 67% of all global volumes and is

responsible for much of the category's growth.

Mr. Menezes said Diageo had "put in a lot of investment and a

lot of marketing, but we could not get Bushmills to

accelerate."

Now Diageo will invest 25 million euros ($26.77 million) in a

new distillery to create an Irish whiskey brand called Roe &

Co. at St James's Gate in Dublin, where it makes Guinness. The

upscale brand will compete with Pernod Ricard's roster of brands

like Redbreast and Midleton as well as brands from scrappy young

distillers like Teeling Whiskey Co., which opened in 2015.

Diageo said the first blend of Roe & Co. will be available

in Europe starting in March. As is common practice, the company

will start out by sourcing Irish whiskey from other distillers and

seasoning these in casks.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

January 31, 2017 05:45 ET (10:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

Diageo (LSE:DGE)

Historical Stock Chart

From May 2024 to Jun 2024

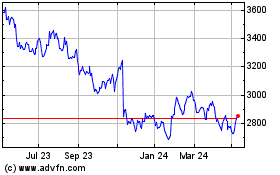

Diageo (LSE:DGE)

Historical Stock Chart

From Jun 2023 to Jun 2024