TIDMCTG

RNS Number : 7956V

Christie Group PLC

19 April 2021

19 April 2021

Christie Group plc

Preliminary results for the 12 months ended 31 December 2020

Christie Group plc ('Christie Group' or the 'Group'), the

leading provider of Professional & Financial Services (PFS) and

Stock & Inventory Systems & Services (SISS) to the

hospitality, leisure, healthcare, medical, childcare &

education and retail sectors, is pleased to announce its audited

preliminary results for the 12 months ended 31 December 2020.

Key points:

-- Revenue of GBP42.2m (2019: GBP78.0m) impacted by the pandemic

-- Operating profit pre exceptionals for the 2(nd) HY GBP1.1m

-- Operating loss for the full year pre exceptionals contained

to GBP4.4m loss (2019: GBP5.8m profit)

-- Sectorisation of Christie & Co - more flexibility,

efficiency and lower cost base going forward

-- All our sectors remain in demand and pricing of businesses is robust

-- Retail stocktaking restructured

-- Prudently foregone a final dividend (2019 total dividend: 1.25p per share)

-- Ended year with a healthy cash balance of GBP10.3m (2019: GBP9.8m)

-- Earnings per share (19.32p) - 2019: 15.30p

-- 2021 has started positively and look forward to remainder of year with enthusiasm

Commenting on the results, David Rugg, Chairman and Chief

Executive of Christie Group said:

"2020 Group performance was impacted by the pandemic especially

in the 1(st) half year; however, we have already experienced a

recovery in performance in the 2(nd) half year. The business

reorganisations taken by the Group during this period, have created

the ability to generate higher levels of profitability. 2021 has

started positively in the PFS division and Retail stocktaking

businesses, and as our Hospitality stocktaking & visitor

attractions businesses reopen we shall be firing on all

cylinders."

Enquiries:

Christie Group plc

David Rugg

Chairman and Chief Executive 020 7227 0707

Daniel Prickett

Chief Operating Officer 020 7227 0700

Simon Hawkins

Group Finance Director 020 7227 0700

Shore Capital

Antonio Bossi / Patrick Castle

Nominated Adviser & Broker 020 7408 4090

Notes to Editors:

Christie Group plc (CTG.L), quoted on AIM, is a leading

professional business services group with 40 offices across the UK

and Europe, catering to its specialist markets in the hospitality,

leisure, healthcare, medical, childcare & education and retail

sectors.

Christie Group operates in two complementary business divisions:

Professional & Financial Services (PFS) and Stock &

Inventory Systems & Services (SISS). These divisions trade

under the brand names: PFS - Christie & Co, Pinders, Christie

Finance and Christie Insurance: SISS - Orridge, Venners and

Vennersys.

Tracing its origins back to 1846, the Group has a

long-established reputation for offering valued services to client

companies in agency, valuation services, investment, consultancy,

project management, multi-functional trading systems and online

ticketing services, stock audit and inventory management. The

diversity of these services provides a natural balance to the

Group's core agency business.

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

For more information, please go to www.christiegroup.com .

CHAIRMAN AND CHIEF EXECUTIVE'S REVIEW OF THE YEAR

Review of 2020 results and performance

Following an unprecedented first half to the year, we are

pleased to report the return to operating profit in the second half

of the year. Our operating loss before restructuring costs for the

year was contained to GBP4.4m (2019: GBP5.8m operating profit)

derived from decimated revenue of GBP42.2m (2019: GBP78.0m). We

have risen from an extraordinary year with transformed businesses,

tight-knit focused teams and a renewed sense of purpose.

Despite the considerable adverse financial impact and ongoing

effect of the Covid-19 pandemic, 2020 was a positive year for

Christie Group as we proved our resilience, adaptability and the

value of the roles we undertake for our clients across all our

businesses.

We experienced an encouraging first quarter, boosted by the

certainty of a decisive general election result. However, the

pandemic's arrival meant that business effectively stalled for

three months, with our physical offices closed and systems and

people adapting to the demands of remote working to the extent

required.

Professional & Financial Services

Our Professional & Financial Services ("PFS") Division

achieved revenue of GBP26.3m (2019: GBP46.0m). Despite a reduction

in revenue of GBP19.7m, through prompt and decisive action we

limited the derived operating loss to GBP1.9m, compared to an

operating profit of GBP6.2m in the prior year.

The outstanding attitude of our people drove a broadly positive

performance across the PFS division. For example, Christie &

Co, our business intelligence, valuation and consultancy firm,

following sectorisation focused more effectively than ever on

clients' key priorities, enabling it to make efficiency gains and

achieve better margins. Our brilliant Childcare & Education

team won the 'Broker - of Educational Institutions' award at the

Education Investor awards 2020. Our Christie Insurance brokerage

successfully placed business in a historically challenging market,

winning new business while also achieving its budgeted

client-retention figures.

An encouraging first quarter was progressively curtailed by

Covid-19. Our last major pre-Covid event was the successful

Healthcare Design Awards held on 11(th) March run by Pinders, our

business appraisal practice.

Our continuing teams assumed the transactions and assignments of

their furloughed colleagues. With their on-site management duties

largely in abeyance we enjoyed a period of great productivity.

Our agency business adopted a sector focus. This proved the

sectorised model with which we reorganised the business.

The continued stamp duty holiday should ensure a vibrant

residential market releasing capital for first-time business

buyers.

Our FCA-authorised Christie Finance operation saw increased

demand for the services of all its divisions, benefiting from its

positive relationships with a very wide array of niche lenders at a

time of reduced appetite from the big banks. In addition, the

availability of the UK government's Coronavirus Business

Interruption Loan Scheme ("CBILS") and bounce-back loans

effectively created a new marketplace for the firm which was busily

engaged throughout arranging loans predominantly through challenger

banks.

Pinders, our specialist business appraisal, valuation and

consultancy company, continued to build a solid platform for

growth, ending 2020 with a stronger new business pipeline than the

previous year.

Our territories in Europe were the most affected by the pandemic

in view of their focus on the hotel industry. Hotels coming to the

market are now generating strong interest, where appropriately

priced. As recently announced, Christie & Co have been ranked

as the most active agent in the hotel sector across Europe for 2020

based on the number of hotels sold, according to Real Capital

Analytics.

Stock & Inventory Systems & Services

Our Stock & Inventory Systems & Services ("SISS")

division achieved revenue of GBP16.0m for 2020 (2019: GBP32.1m).

Taking into consideration, our constrained trading periods, we

showed a marked improvement to the rate of loss, when the trading

result is compared on a pro rata basis to the prior year.

There were encouraging developments for our SISS division too.

The services of our Venners hospitality stocktaking business, for

example, were in considerable demand prior to lockdowns, as

business success and even survival for many players depends on

understanding stock levels and eliminating waste.

With our Retail stocktaking business closed in the UK, we took

the opportunity to plan a new start. We focused upon developing

tight-knit teams, with flexible but client-focused skills and

efficiencies. These teams comprised a smaller number of empowered

cross-function management.

From January 2021 we are seeing the benefit of our new approach

with increased efficiency and high accuracy of counts. The

extension of flexible furlough has given us the ability to recall

stocktakers into operations in line with our hospitality clients'

resumption of trade.

Vennersys, meanwhile, continued to prove it is positioned at the

forefront of providing advanced online ticketing solutions for the

UK leisure industry. Additionally, demand grew for Orridge's

retail, pharmacy and supply-chain stocktaking services in the UK

and Europe. You can read in more detail about the performance of

our subsidiaries elsewhere in this report.

The Government's culture grant to museums and heritage

attractions was augmented in the recent Budget. This funding is

enabling new Vennersys SAAS clients to open in a Covid-19-secure

manner through joining our online timed ticketing facility.

The advent of Brexit has made no discernible impact to our

businesses performance to date.

The impact of Covid-19

Despite such reasons for encouragement, we cannot ignore the

fact that our business environment overall was extremely

challenging during the year, and our revenues for the first half of

the year were only approximately half of those we generated in

2019. We therefore undertook a number of actions to minimise the

long-term impact on our business. These are set out in our Finance

Director's review. For example, as previously reported we availed

ourselves of a GBP6 million loan from the CLBILS.

In addition, we took action across the organisation to reduce

our running costs and reduced permanent employee numbers by 7.5%,

in line with our new ways of working. I am also extremely grateful

to our staff and directors who willingly accepted a reduction in

their remuneration while trading was either stalled or interrupted.

I must also thank and congratulate our many colleagues who during

this difficult time continued to support their communities, often

through charitable activities. We continue to admire, encourage and

support their selfless endeavours.

While at the time of writing we have been blessed in that none

of our employees have succumbed to the virus, many of us have lost

friends and relations during the pandemic. Several of our clients

have lost colleagues and other loved ones, as have many of the

businesses with which we partner to deliver our services. Our

thoughts and condolences are with all those affected.

None of the year's achievements would have been possible without

the ongoing diligence, energy and commitment of our extremely

hard-working management and staff. Their performance was exemplary

throughout the year, and I am enormously grateful to each and every

one of them.

We saw some significant changes at the trading entity Board

level during the year. My congratulations go to Scott Hulme, who

was appointed to the role of Venners Managing Director. Likewise,

congratulations are deservedly due to Darren Flack, who has been

appointed as Managing Director of Orridge UK Retail and Pharmacy. I

am pleased to announce that Mr Simon Herrick will be joining the

Group Board as a Non-executive Director from the 1 May 2021. Simon

brings with him a wealth of experience in multinational FMCG,

property, consultancy, food, software, manufacturing and retail

sectors.

Strategy

During the year we continued our strategic objectives. We

accelerated our application of technology & used lockdown

periods to test solutions that best require systems shut down. Our

reorganisations reflected our strategic objective to increase

operating margins as revenue rebuilds.

Outlook

We have come into the year with a strong cash position, having

already repaid GBP1.0m of our CLBILS facility.

Your directors have prudently opted not to propose a dividend

for 2020. It is our intention to reconsider dividend payments once

supported by more normalised trading.

Following business reorganisations in 2020 we have created the

ability to generate higher levels of profitability from the levels

of revenue previously achieved. The year has started positively for

our Professional and Financial Services and Retail stocktaking

businesses. As these activities are joined by hospitality

stocktaking and visitor attractions are reopened we shall be firing

on all cylinders. After allowing for inevitable lead time and lags

associated with sector reopening, for each quarter that our Group

is permitted to trade unimpeded we expect to do so profitably.

David Rugg

Chairman and Chief Executive

16 April 2021

CHIEF OPERATING OFFICER'S REVIEW

The prevailing theme when looking back at 2020, across both our

PFS and SISS divisions, is of a year where the scale of what we

were able to offer was significantly disrupted by the pandemic, but

the flexibility, value and quality of our services when provided

were undiminished, if not enhanced.

While the headline financial results for the year - and

particularly the fall in revenue compared to 2019 - illustrate the

impact of that reduction in activity, within that - for those

periods where each of our businesses and the sectors they serve

were able to trade - there was much to be encouraged by. We saw

enough from each of our businesses during a profitable second half

of the year for the Group as a whole, to be confident that all of

our trading brands can be profitable contributors to the Group in

future.

Professional & Financial Services Division

Our agency and advisory business, Christie & Co, remained

active across all of its sectors throughout the year, and continued

to serve clients in both the UK and internationally from its

European network.

While brokerage activity in terms of the number of businesses

sold in the year was 45% lower than achieved a year earlier,

average commissions received held up well. Indeed, the average fee

per business sold was up 29% on a year earlier, although it should

be noted this was partly a reversal of the mix of types of

businesses sold which last year explained a 21% fall. A comparison

across a slightly longer period of reflection shows average

brokerage fees per business sold were at a level broadly consistent

with 2018 and 2017.

There were several notable transactions across our sectors. In

Hotels, highlights included the sale of the Grade II-listed Warren

House in Surrey to Sun Hotel Limited, with Christie & Co acting

for the private vendors as well as advising Peel Hotels on their

sale of The Cosmopolitan Hotel in Leeds to the newly-formed Belfont

Hotels. Internationally the second half brought more success than a

very subdued H1, with the sale of the Schlosshotel Klink in Germany

reflective of a more active summer.

In Care, where once again Christie & Co was the most active

broker in the UK, we successfully supported the retiring directors

of Waverley Care Centre Limited in their sale of the leading South

Wales care home to Bellavista Care Homes in one of the largest

single-asset care home transactions in Wales.

Our Medical teams were busy throughout the year in both the

Dental and Pharmacy markets. In the latter, we continued to support

Boots and Rowlands on their respective multi-site disposal projects

while also seeing a 17% increase in independent pharmacy

instructions. In the former, it was a year where brokerage activity

gathered momentum, with the value of offers received in the second

half of 2020 being a 300% increase on that received in the first

six months.

Our award-winning Childcare & Education team were somewhat

stopped in their tracks by the impact of Covid on the sector after

an initially buoyant level of activity at the beginning of the

year. Values in the sector have nonetheless held up and activity

began to pick up again from Easter. Highlights in a very

challenging year included the sale of Heathfield Knoll School to

KSI Education, and the sale of Futurepath Childcare to Grandir UK,

the expanding French childcare operator.

Our Retail team were able to support a buoyant level of demand

for convenience stores and forecourts. Our appointment by Bestway

Retail Ltd to market 37 stores across the UK illustrated our

standing in the sector.

For the pub sector, we saw very little in the year in terms of

large-scale portfolio transactions, although the volume of

single-asset transactions rose, partly as a reflection of

first-time buyer appetite.

For Pinders, their decentralised national team of business

appraisers were already 'Covid ready' in their working practices.

They were therefore very quickly able to transition to undertaking

inspections in a Covid-secure manner.

Nonetheless, the first lockdown brought a sharp decline in new

instructions for a short period. The subsequent recovery in

activity levels represented an almost-symmetrical reversal of the

second-quarter decline, so that by the end of the year weekly

activity levels and volumes were back to levels comparable with the

last quarter of 2019. Indeed, in the final month of 2020, the

number of valuation reports issued was actually 14% higher than the

same period a year before, boding well for 2021 demand.

With Christie & Co's own valuation teams experiencing a

similar trend in the year, the number of valuations carried out in

the division for the year as a whole fell to 42% of the previous

year's volume. Despite this, fee levels held up well with a small

increase in the average fee per valuation, reversing an almost

equivalent fall seen in 2019.

PFS divisional KPIs 2020 2019

Total businesses sold 624 1,127

------ --------

% Increase / (decrease) in average fee

per business sold 29.3% (21.4%)

------ --------

Total value of businesses sold (GBPm) 823 1,444

------ --------

Total valuations carried out 2,642 6,346

------ --------

% increase / (decrease) in average fee

per valuation 0.8% (0.7%)

------ --------

Value of businesses valued (GBPm) 3,889 9,532

------ --------

% increase in number of loan offers secured 2.3% 13.9%

------ --------

Average loan size (GBP'000) 413 481

------ --------

Within the PFS division, our financial services businesses,

Christie Finance and Christie Insurance, were well placed to

support clients throughout the pandemic with little or no

disruption to their services. As owners and operators sought ways

to access both traditional funding and the attractively-priced

government funding schemes, Christie Finance were expertly

positioned to support clients in securing it for them.

A 2% increase in the number of loan offers secured illustrates

that borrower demand remained strong throughout the year, despite

the disruption to the level of transactionally-led referral volumes

that would normally come across from Christie & Co's agency

teams. Indeed, Christie Finance experienced increased demand in its

Core, Corporate and Unsecured divisions as businesses were able to

access commercial mortgages through CBILS.

For our insurance intermediary business, securing new business

was challenging in sectors where, due to the impacts of Covid and

insurers' own caution regarding their own business interruption

liabilities, appetite for taking on new client risk among

underwriters was severely limited, particularly in the Care

sector.

Nonetheless, Christie Insurance were able to support clients

across our chosen sectors in understanding the insurance market as

it applied to them. As the ability to shift insurers became more

challenging, premiums hardened and retention rates improved.

Stock & Inventory Systems & Services Division

The impact on our ability to carry out stocktakes during the

year as lockdown restrictions were applied to the retail and

hospitality sectors in particular, is starkly illustrated by the

fact that we were only able to complete 57% of the volume of jobs

we achieved in 2019. Our hospitality stock audit business, Venners,

bore the heaviest burden in that regard, with only 48% of the

previous year's volume of work possible.

Covid-secure operating requirements dictated that where it was

possible to carry out stocktaking, it was necessary to undertake

smaller assignments with reduced team sizes to limit people

interactions. That dynamic is reflected by a 12.5% fall in the

average income we earned per job, but the productivity improvements

achieved in Orridge in the UK meant that the profitability per job

was increased, despite the lower per-event income.

Positively - and demonstrating the value that independent

stocktaking has to our clients - we saw demand return quickly when

allowed. For Orridge, trading in both the UK and Europe was

encouraging through much of the second half of 2020, before the

onset of winter lockdowns and traditional seasonal demand effects

in the UK combined to curtail activity in the final few weeks of

the year.

SISS divisional KPIs 2020 2019

Total stocktakes & audits carried out (number

of jobs) 38,930 68,055

-------- -------

% increase / (decrease) in average income

per job (12.5%) 1.5%

-------- -------

For the traditionally-profitable Venners, from a complete

lockdown through April and May we then saw revenues recover

steadily through the third quarter to levels which, while still

significantly lower than normalised pre-Covid invoicing, were

sufficient for the business to return to trading profitably in the

month of September.

No sooner had we reached this point of recovery, it was then

immediately followed by the introduction of tier-based restrictions

on hospitality in October before the further national lockdowns

that followed thereafter, and which have remained in place

throughout the first quarter of 2021.

Nonetheless, this demonstrated how swiftly the business can

expect to scale back up and return to profit. We have retained a

nationwide team of over 150 BII-accredited licensed-trade

stocktakers who will be key to our future success and we have been

grateful for their support and endurance through an exceptionally

difficult period for the hospitality sector.

Despite these frustrations, Venners were still able to secure

new business with a number of clients including Alton Towers Group,

the Savini Group and HF Holidays, all of which we look forward to

working with when restrictions come to an end.

For Vennersys, our visitor attraction software provider, it was

a not-dissimilar story of continued progress offset by the

frustration of our clients being unable to trade for large periods

of the year.

Working from home presented no obstacles to the business in

itself, with staff and management able to transition quickly to

remote - but still collegiate and creative - working.

For the summer months of 2020, attractions saw strong consumer

demand return, particularly for those who were able to offer

outdoor experiences and events, and Vennersys's own revenues and

performance were strong through that period as a result, as

pre-booked ticketing became a 'must-have' even for many of those

clients who had previously opted for more reduced functionality

alongside their traditional ticketing processes.

Cross-selling initiatives have also gathered pace. Vennersys has

worked collaboratively with other group companies, such as Christie

Finance, enabling them to help their clients to access funding to

support their own investment plans.

Against this backdrop, growth continued. By the end of 2020, the

total number of sites using VenPos Cloud had increased by 31%

compared to a year earlier, and total new sales orders confirmed in

the year equated to 33% of 2019 revenues.

Summary

I wrote in early September when we released the then-delayed

2019 results, the events of 2020 have certainly not curtailed our

optimism or belief in what can be achieved by the Group in the

years ahead. 'Unprecedented' is a word which has been as overused

in the last twelve months as any, but our businesses and brands

have showed themselves to be resilient to the task.

If anything, 2020 has allowed us to review our operating models

and enhance efficiency and productivity where it was appropriate to

do so, while also re-confirming that the range of services we offer

our clients - underpinned by sector specialist knowledge and with

client relationships at the very heart of what we do - are as

valuable to them as they have ever been.

We look forward to the remainder of 2021 with enthusiasm.

Dan Prickett

Chief Operating Officer

16 April 2021

Consolidated Income Statement

For the year ended 31 December 2020

Note

2020 2019

GBP'000 GBP'000

---------------------------------------------- ----- ---------- ----------

Revenue 2 42,224 78,041

Other income - government grants 3 8,182 -

Employee benefit expenses (40,338) (53,754)

---------------------------------------------- ----- ---------- ----------

10,068 24,287

Impairment (charge)/reversal (120) 22

Gain on sale and leaseback of property - 1,531

Other operating expenses (14,303) (20,069)

---------------------------------------------- ----- ---------- ----------

Operating (loss)/profit before restructuring

costs (4,355) 5,771

Restructuring costs 4 (672) -

Operating (loss)/profit post restructuring

costs (5,027) 5,771

Finance costs (1,316) (1,351)

Finance income 4 2

Total finance costs (1,312) (1,349)

---------------------------------------------- ----- ---------- ----------

(Loss)/profit before tax (6,339) 4,422

Taxation 1,277 (409)

---------------------------------------------- ----- ---------- ----------

(Loss)/profit after tax (5,062) 4,013

---------------------------------------------- ----- ---------- ----------

Profit for the period after tax attributable

to:

Equity shareholders of the parent (5,062) 4,013

Earnings per share attributable to equity holders - pence

Profit attributable to the equity holders of the Company

Basic 6 (19.32) 15.30

Diluted 6 (19.32) 14.87

---------------------------------------------- ----- ---------- ----------

All amounts derive from continuing activities.

The accompanying notes are an integral part of these preliminary

results .

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2020

2020 2019

GBP'000 GBP'000

----------------------------------------------------- --------------- ----------

(Loss)/profit after tax (5,062) 4,013

---------------------------------------------------- ----- ---------- ----------

Other comprehensive income:

Items that may be reclassified subsequently

to profit or loss:

Exchange differences on translating foreign

operations (34) (145)

---------------------------------------------------- ----- ---------- ----------

Net other comprehensive losses to be reclassified

to profit or loss in subsequent years (34) (145)

---------------------------------------------------- ----- ---------- ----------

Items that will not be reclassified subsequently

to profit or loss:

Actuarial (losses)/gains on defined benefit

plans (8,052) 1,207

Income tax effect 1,770 (205)

---------------------------------------------------- ----- ---------- ----------

Net other comprehensive (losses)/income

not being reclassified to profit or loss

in subsequent years (6,282) 1,002

---------------------------------------------------- ----- ---------- ----------

Other comprehensive (losses)/income/ for

the year net of tax (6,316) 857

---------------------------------------------------- ----- ---------- ----------

Total comprehensive (losses)/income for

the year (11,378) 4,870

---------------------------------------------------- ----- ---------- ----------

Total comprehensive (losses)/income attributable to:

Equity shareholders of the parent (11,378) 4,870

------------------------------------ --------- ------

Consolidated Statement of Changes in Shareholders' Equity

As at 31 December 2020

Attributable to the Equity Holders of the Company

Other Cumulative

Share reserves translation Retained Total

capital GBP'000 reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- --------- ---------- ------------- ---------- ---------

Balance at 1 January 2019 531 5,357 765 (10,853) (4,200)

------------------------------------- --------- ---------- ------------- ---------- ---------

Profit for the year after

tax - - - 4,013 4,013

Items that will not be reclassified

subsequently to profit or

loss - - - 1,002 1,002

Items that may be reclassified

subsequently to profit or

loss - - (145) - (145)

------------------------------------- --------- ---------- ------------- ---------- ---------

Total comprehensive income

for the year - - (145) 5,015 4,870

Movement in respect of employee

share scheme - 27 - - 27

Employee share option scheme

- value of services provided - 59 - - 59

Dividends paid - - - (790) (790)

------------------------------------- --------- ---------- ------------- ---------- ---------

Balance at 31 December 2019 531 5,443 620 (6,628) (34)

------------------------------------- --------- ---------- ------------- ---------- ---------

Loss for the year after tax - - - (5,062) (5,062)

Items that will not be reclassified

subsequently to profit or

loss - - - (6,282) (6,282)

Items that may be reclassified

subsequently to profit or

loss - - (34) - (34)

Total comprehensive losses

for the year - - (34) (11,344) (11,378)

Movement in respect of employee

share scheme - (27) - - (27)

Employee share option scheme

- value of services provided - 46 - - 46

Dividends paid - - - - -

Balance at 31 December 2020 531 5,462 586 (17,972) (11,393)

------------------------------------- --------- ---------- ------------- ---------- ---------

Consolidated Statement of Financial Position

At 31 December 2020

2020 2019

GBP'000 GBP'000

-------------------------------- ----------------- -----------------

Assets

Non-current assets

Intangible assets - Goodwill 1,855 1,810

Intangible assets - Other 1,038 1,243

Property, plant and equipment 1,819 1,557

Right of use assets 5,774 6,649

Deferred tax assets 5,114 2,649

Other receivables 2,263 1,901

----------------------------------- ----------------- -----------------

17,863 15,809

-------------------------------- ----------------- -----------------

Current assets

Inventories 24 35

Trade and other receivables 10,624 14,914

Current tax assets 976 240

Cash and cash equivalents 10,284 9,807

----------------------------------- ----------------- -----------------

21,908 24,996

-------------------------------- ----------------- -----------------

Total assets 39,771 40,805

----------------------------------- ----------------- -----------------

Equity

Share capital 531 531

Other reserves 5,462 5,443

Cumulative translation

reserve 586 620

Retained earnings (17,972) (6,628)

----------------------------------- ----------------- -----------------

Total equity (11,393) (34)

----------------------------------- ----------------- -----------------

Liabilities

Non-current liabilities

Trade and other payables 50 464

Retirement benefit obligations 20,136 12,011

Lease liabilities 7,999 8,737

Borrowings 3,000 -

Provisions 1,004 590

----------------------------------- ----------------- -----------------

32,189 21,802

-------------------------------- ----------------- -----------------

Current liabilities

Trade and other payables 13,316 11,574

Lease liabilities 1,296 1,122

Current tax liabilities - 43

Borrowings 3,206 5,055

Provisions 1,157 1,243

----------------------------------- ----------------- -----------------

18,975 19,037

-------------------------------- ----------------- -----------------

Total liabilities 51,164 40,839

----------------------------------- ----------------- -----------------

Total equity and liabilities 39,771 40,805

----------------------------------- ----------------- -----------------

Consolidated Statement of Cash Flows

For the year ended 31 December 2020

Note 2020 2019

GBP'000 GBP'000

---------------------------------------------- ------- ---------- ----------

Cash flow from operating activities

Cash generated from operations 7 2,503 6,535

Interest paid (1,081) (992)

Tax paid (197) (361)

---------------------------------------------- ------- ---------- ----------

Net cash generated from operating activities 1,225 5,182

---------------------------------------------- ------- ---------- ----------

Cash flow from investing activities

Purchase of property, plant and equipment (899) (540)

Proceeds from sale of property, plant

and equipment 15 5,082

Intangible asset expenditure (184) (326)

Interest received 4 2

Net cash generated (used in)/from investing

activities (1,064) 4,218

---------------------------------------------- ------- ---------- ----------

Cash flow from financing activities

Proceeds from bank loan 6,000 -

Repayment of bank loan (1,000) (653)

Repayment of other loan (910) -

(Repayment)/drawdown of invoice finance (476) 37

Repayment of lease liabilities (825) (1,596)

Dividends paid - (790)

Net cash generated/(used in) financing

activities 2,789 (3,002)

---------------------------------------------- ------- ---------- ----------

Net increase in cash 2,950 6,398

Cash and cash equivalents at beginning

of year 6,625 201

Exchange gains on euro bank accounts (10) 26

Cash and cash equivalents at end of

year 9,565 6,625

---------------------------------------------- ------- ---------- ----------

The accompanying notes are an integral part of these preliminary

results.

NOTES TO THE PRELIMINARY ANNOUNCEMENT

1. BASIS OF PREPARATION

The financial information set out in this announcement does not

comprise the Company's statutory accounts for the years ended 31

December 2020 or 31 December 2019.

The financial information has been extracted from the statutory

accounts of the Company for the years ended 31 December 2020 and 31

December 2019. The auditors reported on those accounts; their

reports were unqualified.

The statutory accounts for the year ended 31 December 2019 have

been delivered to the Registrar of Companies, whereas those for the

year ended 31 December 2020 will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRSs), this announcement does not itself contain

sufficient information to comply with IFRSs. The Company expects to

publish full financial statements that comply with IFRSs in June

2021.

These policies have been consistently applied to all years

presented, unless otherwise stated.

2. SEGMENT INFORMATION

The Group is organised into two main operating segments:

Professional & Financial Services (PFS) and Stock &

Inventory Systems & Services (SISS).

The segment results for the year ended 31 December 2020 are as

follows:

PFS SISS Other Group

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- ---------- ----------

Total gross segment sales 26,320 16,014 3,123 45,457

Inter-segment sales (110) - (3,123) (3,233)

----------------------------- ---------- ---------- ---------- ----------

Revenue 26,210 16,014 - 42,224

----------------------------- ---------- ---------- ---------- ----------

Operating loss (1,863) (3,164) - (5,027)

Finance costs (824) (227) (261) (1,312)

----------------------------- ---------- ---------- ---------- ----------

Loss before tax (2,687) (3,391) (261) (6,339)

----------------------------- ---------- ---------- ---------- ----------

Taxation 1,277

----------------------------- ---------- ---------- ---------- ----------

Loss for the year after tax (5,062)

----------------------------- ---------- ---------- ---------- ----------

The segment results for the year ended 31 December 2019 are as

follows:

PFS SISS Other Group

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ---------- ---------- ---------- ----------

Total gross segment sales 46,063 32,088 3,333 81,484

Inter-segment sales (110) - (3,333) (3,443)

------------------------------- ---------- ---------- ---------- ----------

Revenue 45,953 32,088 - 78,041

------------------------------- ---------- ---------- ---------- ----------

Operating profit/(loss) 6,224 (1,984) 1,531 5,771

Finance costs (915) (382) (52) (1,349)

------------------------------- ---------- ---------- ---------- ----------

Profit before tax 5,309 (2,366) 1,479 4,422

------------------------------- ---------- ---------- ---------- ----------

Taxation (409)

------------------------------- ---------- ---------- ---------- ----------

Profit for the year after tax 4,013

------------------------------- ---------- ---------- ---------- ----------

Revenue is allocated below based on the entity's country of

domicile.

2020 2019

GBP'000 GBP'000

------------------- ---------- ----------

Revenue

Europe 42,174 77,632

Rest of the World 50 409

------------------- ---------- ----------

42,224 78,041

------------------- ---------- ----------

3. OTHER INCOME - GOVERNMENT GRANTS

The Group has benefited from the Government support due to the

Covid-19 business disruption, utilising the furlough scheme from

its commencement which has provided financial assistance towards

employee salaries in 2020. During 2020, GBP8,182,000 (2019: GBPnil)

Government grants have been recognised in the Consolidated Income

Statement, under the category Other income - government grants.

4. RESTRUCTURING COSTS

2020 2019

GBP'000 GBP'000

-------------------- --------- ---------

Restructuring costs 672 -

672 -

-------------------- --------- ---------

During the year, the Group incurred restructuring costs of

GBP672,000, including GBP628,000 of employee related termination

costs.

5. DIVIDS

A dividend in respect of the year ended 31 December 2020 of

0.00p per share (2019: 0.00p), amounting to a total dividend of

GBPnil (2019: GBPnil) is to be proposed at the Annual General

Meeting on 16 June 2021.

In the year the Group paid an interim dividend of 0.00p per

share (2019: 1.25p) totalling GBPnil (2019: GBP326,000).

6. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year, which

excludes the shares held in the Employee Share Ownership Plan

(ESOP) trust.

2020 2019

GBP'000 GBP'000

--------------------------------------------------------------------------- ------------ ------------

(Loss)/profit attributable to equity holders of the Company (5,062) 4,013

--------------------------------------------------------------------------- ------------ ------------

Thousands Thousands

--------------------------------------------------------------------------- ------------ ------------

Weighted average number of ordinary shares in issue 26,220 26,220

843 755

Adjustment for share options

---------------------------------------------------------------------------

Weighted average number of ordinary shares for diluted earnings per share 27,063 26,975

--------------------------------------------------------------------------- ------------ ------------

Pence Pence

--------------------------------------------------------------------------- ------------ ------------

Basic earnings per share (19.32) 15.30

Diluted earnings per share (19.32) 14.87

--------------------------------------------------------------------------- ------------ ------------

7. NOTES TO THE CASH FLOW STATEMENT

Cash generated from operations

2020 2019

GBP'000 GBP'000

-------------------------------------- --------- ---------

(Loss)/profit for the year after

tax (5,062) 4,013

Adjustments for:

Taxation (1,277) 409

Finance costs 1,096 1,000

Depreciation 1,818 1,936

Amortisation of intangible assets 390 469

Profit on sale of property, plant

and equipment (5) (1,531)

Increase in provisions 328 504

Foreign currency translation 45 12

Share option charge 46 59

Movement in retirement benefit

obligation (143) (900)

Movement in non-current other

receivables (362) 12

Movement in working capital:

Decrease/(increase) in inventories 11 (6)

Decrease/(increase) in trade and

other receivables 4,290 (54)

Increase in trade and other payables 1,328 612

Cash generated from operations 2,503 6,535

-------------------------------------- --------- ---------

Report and Accounts

Copies of the 2020 Annual Report and Accounts will be posted to

shareholders in May. Further copies may be obtained by contacting

the Company Secretary at the registered office. Alternatively, the

2020 Annual Report and Accounts will be available to download from

the investors section on the Company's website

www.christiegroup.com

Key dates

The Annual General Meeting of the Company is scheduled to take

place at 10.00am on Wednesday 16(th) June 2021 as a closed virtual

meeting.

Group Companies

Professional & Financial Services

Christie & Co

Christie & Co is the leading specialist firm providing

business intelligence in the hospitality, leisure, healthcare,

medical, childcare & education and retail sectors. A leader in

its specialist markets, it employs the largest team of sector

experts in the UK & Europe providing professional agency,

valuation and consultancy services.

www.christie.com

Christie Finance

Christie Finance has 40 years' experience in financing

businesses in the hospitality, leisure, healthcare, medical,

childcare & education, retail and medical sectors. Christie

Finance prides itself on its speed of response to client

opportunities and its strong relationships with finance

providers.

www.christiefinance.com

Christie Insurance

Christie Insurance has over 40 years' experience arranging

business insurance in the hospitality, leisure, healthcare,

medical, childcare & education and retail sectors. It delivers

and exceeds clients' expectations in terms of the cost of their

insurance and the breadth of its cover.

www.christieinsurance.com

Pinders

Pinders is the UK's leading specialist business appraisal,

valuation and consultancy company, providing professional services

to the licensed, leisure, retail and care sectors, and also the

commercial and corporate business sectors. Its Building Consultancy

Division offers a full range of project management, building

monitoring and building surveying services. Pinders staff use

business analysis and surveying skills to look at the detail of the

businesses to arrive at accurate assessments of their trading

potential and value.

www.pinders.co.uk

Stock & Inventory Systems & Services

Orridge

Orridge is Europe's longest established stocktaking business

specialising in all fields of retail stocktaking including high

street, warehousing and factory operations, pharmacy and supply

chain services. It also has a specialised pharmacy division

providing valuation and stocktaking services. Orridge prides itself

in its ability to deliver high-quality management information to

its clients effectively and conveniently.

www.orridge.eu

Venners

Venners is the leading supplier of stocktaking, inventory,

consultancy and compliance services and related stock management

systems to the hospitality sector. Consultancy and compliance

services include control audits and live event stock taking.

Bespoke software and systems enable real-time management reporting

to customers using the best available technologies. Venners is the

largest and longest established stock audit company in the sector

in the UK.

www.venners.com

Vennersys

Vennersys operates in the UK and deliveries online Cloud-based

ticketing sales and admission Systems to visitor attractions such

as historic houses and estates, museums, zoos, safari parks,

aquaria and cinemas. It has over 25 years' experience delivering

purpose-designed solutions for clients' ticketing, admissions, EPoS

and food and beverages sales requirements.

www.vennersys.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UNANRAKUSAAR

(END) Dow Jones Newswires

April 19, 2021 02:00 ET (06:00 GMT)

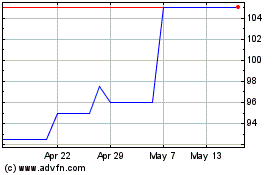

Christie (LSE:CTG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Christie (LSE:CTG)

Historical Stock Chart

From Jul 2023 to Jul 2024