RNS Number:2340R

Christie Group PLC

14 September 2005

CHRISTIE GROUP PLC

14th SEPTEMBER 2005

Interim Results for the six months ended 30 June 2005

Christie Group, a leading business services and software group, today announces

its interim results for the six months ended 30 June 2005.

Highlights

* Turnover up 9% to #38.9 million (2004: #35.7 million)

* Overall Group operating profit (stated under IFRS) up 5% to

#2.35 million (2004: #2.23 million), reflecting continued

investment in business development

* Strong performance at established operations with operating

profit of #4.4 million (2004: #3.1 million)

* West London Estates successfully integrated into Pinders

* Christie + Co advised "LRG Acquisition" on their #1 billion

purchase of 73 hotels from InterContinental Hotel Group, the

largest investment deal of its kind in UK Hotel Sector

* VcsTimeless and Wincor Nixdorf sign accord for development

of EPoS solution for non-food retailers

* Important business wins in stocktaking business including

Argos and Boots

* Interim dividend maintained at 1 pence per share

* Board announces intention to move listing to Alternative

Investment Market ("AIM"), subject to shareholder approval

Philip Gwyn, Chairman, commented:

"During the first half of this year, we have won important new business and

taken a number of steps to help ensure that we are well positioned for future

growth, including the acquisition and successful integration of West London

Estates into our Pinder business. These actions, combined with the continuing

investment we are making in software R&D and European expansion, will help us

ensure the sustainable long term development of Christie Group.

Despite a challenging trading environment, I believe that the diversity of our

income streams and the profitability of our established businesses mean we are

well positioned for further progress during 2005."

Enquiries:

Christie Group 020 7227 0707 Philip Gwyn, Chairman

David Rugg, Chief Executive

Robert Zenker, Finance Director

Brunswick 020 7404 5959 Michaela Hopkins or Ash Spiegelberg

Note to Editors

Christie Group (CTG.L) is listed on the London Stock Exchange. It is a leading

international professional services business with 32 offices throughout Europe

and Canada. Christie Group consists of three autonomously managed business

divisions: Professional Business Services, Software Solutions and Stock and

Inventory Services. The three complementary businesses are specifically focused

on the leisure, retail and care sectors.

For more information, please go to: www.christiegroup.com

CHAIRMAN'S STATEMENT

HALF YEAR TO 30 JUNE 2005

Christie Group's turnover for the half year to June 2005 increased 9% to #38.9

million (2004: #35.7 million). Overall Group operating profit (stated under

IFRS) increased by 5% to #2.35 million (2004: #2.23 million). These figures

mask sharply higher profits from established operations (#4.4 million against

#3.1 million in 2004), and more substantial losses from developing businesses,

details of which are given below. The Board remains confident that the

developing businesses will bring benefits to shareholders in future periods.

Dividend

The Board has declared an unchanged interim dividend of 1p per share.

Professional Business Services

Sales in our Professional Business Services division moved ahead by 10%. West

London Estates (acquired in January 2005), which has now been fully integrated

into our Pinder business, was profitable in the first half and provides a

nucleus for growth.

Christie + Co advised "LRG Acquisition" on their purchase of a #1 billion

portfolio of 73 hotels from InterContinental Hotel Group, with IHG retaining the

management of the hotels. This is the largest investment deal of its kind in

the UK Hotel Sector.

During the first half of 2005, Christie + Co incurred losses of #1.3 million

from continuing European and UK expansion and development. New operational

bases were opened in Epsom and Enfield in the UK and in May 2005 we opened a new

office in Madrid. We recognise that the gestation periods of these operations

and the speed at which they will reach profitability will vary. Christie +

Co's UK revenue rose 14% compared to the first half of 2004.

Turnover at Christie First Business Mortgages was flat during the first half of

2005. The Insurance Broking operation wrote 16% more policies than in the

corresponding period of 2004 but commission income rose 11%, reflecting reduced

premiums in a continuing "soft" market.

Software Solutions

Overall, turnover for the division increased by 19% including a contribution

from our Spanish operation, following two years of significant investment.

In June 2005, our Retail Software Solutions company, VcsTimeless, won the

European Retail Solutions award for Project Implementation of the Year in

association with our customer Lancel, the luxury goods company. Since the

implementation of VcsTimeless' Colombus Retail Software Suite, Lancel has been

able to increase efficiencies, achieve greater inventory availability and

control, improve the speed and accuracy of stock replenishment and raise staff

productivity.

During the period VcsTimeless also signed an accord with Wincor Nixdorf to

create a new EPoS solution for top tier non-food retailers. The solution will

be marketed by VcsTimeless in our existing territories and elsewhere by Wincor

Nixdorf. This EPoS solution is designed to interface with our real time head

office system, code named Magellan, which is set for launch at our 2006 user

conference.

Stock and Inventory Services

Profit in our stocktaking business nearly doubled to #1.1 million (2004: #0.6

million) in its seasonally stronger first half on turnover of #11.5 million

(2004: #11.3 million). Having successfully absorbed a 36% increase in retail

stocktaking business during 2004, we now anticipate further additional work for

the second half of this year and 2006, following business wins from Boots,

Argos, Gieves & Hawkes, Barbour and others.

AIM

Your Board has carefully considered the attractions of moving to the Alternative

Investment Market ("AIM"). AIM is designed for smaller companies and we believe

an AIM Listing would, offer a number of benefits to our business. AIM's

simplification of administrative requirements and a more flexible regulatory

regime have both competitive and cost advantages. It would enable us to agree

and execute transactions more quickly should acquisition opportunities arise.

We envisage no alteration in the standards of reporting and governance which the

Group has always achieved. Thus we see ourselves as continuing to be

attractive to specialist institutional funds while the AIM tax regime will also

make us more attractive to the retail investor.

A circular regarding the proposed move to AIM convening an EGM will be sent to

shareholders shortly.

Outlook

Christie Group enjoys a diverse range of income from the services it provides to

the Retail, Leisure and Care industries throughout Europe. Our established

business operations are both profitable and growing. Although the current

trading environment remains challenging, I believe we are well positioned to

make further progress during the second half of 2005.

Index to the consolidated interim financial statements

Half year to 30 June 2005

Consolidated interim income statement

Consolidated interim balance sheet

Consolidated interim statement of changes in shareholders' equity

Consolidated interim cash flow statement

Notes to the consolidated interim financial statements

1. General information

2. Summary of significant accounting policies

3. Critical accounting estimates and judgements

4. Transition to IFRS

5. Segment information

6. Taxation

7. Earnings per share

8. Dividends per share

9. Retirement benefit obligations

10. Notes to the cash flow statements

11. Fair value and other reserves

Consolidated interim income statement

Half year to Half year to Year ended 31

30 June 2005 30 June 2004 December 2004

#'000 #'000 #'000

(Unaudited) (Unaudited) (Unaudited)*

Note

Revenue 38,878 35,694 69,968

Employee benefit costs (22,171) (19,379) (39,876)

16,707 16,315 30,092

Depreciation and amortisation (639) (540) (1,203)

Other expenses (13,723) (13,542) (24,892)

Operating Profit 2,345 2,233 3,997

Interest payable (884) (833) (1,619)

Interest receivable 683 644 1,290

Exceptional finance credit - - 2,455

Total finance (costs) / credit (201) (189) 2,126

Profit before income tax 2,144 2,044 6,123

Income tax expense 6 (801) (826) (360)

Profit for the period after tax 1,343 1,218 5,763

Minority interest (1) (2) (10)

Profit for the period 1,342 1,216 5,753

Earnings per share (pence)

- Basic 7 5.42p 4.94p 23.32p

- Fully diluted 7 5.36p 4.85p 22.98p

* The UK GAAP income statement was audited for the year ended 31 December 2004.

Consolidated interim balance sheet

Note At 30 June At 30 June At 31 December 2004

2005 2004

#'000 #'000 #'000

(Unaudited) (Unaudited) (Unaudited)*

ASSETS

Non-current assets

Property, plant and equipment 2,484 2,428 2,659

Goodwill 4,025 3,918 3,918

Intangible assets 2,183 370 1,153

Deferred income tax assets 2,231 2,527 2,327

Available-for-sale financial assets 100 100 100

11,023 9,343 10,157

Current assets

Inventories 295 272 355

Trade and other receivables 17,474 16,391 13,371

Available-for-sale financial assets 504 504 504

Current income tax assets - - 413

Cash and cash equivalents 3,019 2,312 3,499

21,292 19,479 18,142

Total assets 32,315 28,822 28,299

EQUITY

Capital and reserves attributable to the Company's equity holders

Share capital 498 495 495

Fair value and other reserves 4,581 4,467 4,484

Cumulative translation adjustment (467) (320) (347)

Retained earnings 3,862 (1,293) 3,002

8,474 3,349 7,634

Minority interest 17 3 16

Total equity 8,491 3,352 7,650

LIABILITIES

Non-current liabilities

Borrowings 2,281 79 2,108

Retirement benefit obligations 9 6,745 6,939 7,067

9,026 7,018 9,175

Current liabilities

Trade and other payables 12,909 11,735 11,200

Current income tax liabilities 325 942 -

Borrowings 1,564 5,775 274

14,798 18,452 11,474

Total liabilities 23,824 25,470 20,649

Total equity and liabilities 32,315 28,822 28,299

These consolidated interim financial statements have been approved for issue by

the Board of Directors on 13 September 2005.

* The UK GAAP balance sheet was audited as at 31 December 2004.

Consolidated interim statement of changes in shareholders' equity

Attributable to the equity holders of the Minority Total

Company Interest equity

Share Fair Value Cumulative Retained

capital and other earnings

reserves Translation

(See note 11) adjustments

Balance at 1 January 2004 493 4,411 (359) (2,029) 6 2,522

Issue of share capital 2 42 - - - 44

Movement on minority interest - - - - (5) (5)

Currency translation adjustments - - 39 - - 39

Net income/(expense) recognised 2 42 39 - (5) 78

directly in equity

Profit for the period - - - 1,216 2 1,218

Total recognised income for the 2 42 39 1,216 (3) 1,296

period

Employee share option scheme:

-value of services provided - 14 - - - 14

Dividend - - - (480) - (480)

Balance at 30 June 2004 495 4,467 (320) (1,293) 3 3,352

Balance at 1 July 2004 495 4,467 (320) (1,293) 3 3,352

Issue of share capital - 4 - - - 4

Movement on minority interest - - - - 5 5

Currency translation adjustments - - (27) - - (27)

Net income/(expenses) recognised - 4 (27) - 5 (18)

directly in equity

Profit for the period - - - 4,537 8 4.545

Total recognised income for the - 4 (27) 4,537 13 4,527

period

Movement in respect of employee - (11) - - - (11)

share scheme

Employee share option scheme:

-value of services provided - 24 - - - 24

Dividend - - - (242) - (242)

Balance at 31 December 2004 495 4,484 (347) 3,002 16 7,650

Balance at 1 January 2005 495 4,484 (347) 3,002 16 7,650

Issue of share capital 3 65 - - - 68

Movement on minority interest - - - - 1 1

Currency translation adjustments - - (120) - - (120)

Net income/(expenses) recognised 3 65 (120) - 1 (51)

directly in equity

Profit for the period - - - 1,342 - 1,342

Total recognised income for the 3 65 (120) 1,342 1 1,291

period

Employee share option scheme:

- value of services provided - 32 - - - 32

Dividend - - - (482) - (482)

Balance at 30 June 2005 498 4,581 (467) 3,862 17 8,491

Consolidated interim cash flow statement

Half year to Half year to Year to

30 June 2005 30 June 2004 31 December

#'000 #'000 2004

(Unaudited) (Unaudited) #'000

(Unaudited)

Note

Cash flow from operating activities

Cash generated from / (used in) operations 10 a) 117 (1,313) 3,688

Interest paid (121) (156) (268)

Income tax received / (paid) 33 (750) (1,439)

Net cash generated from / (used in) operating activities 29 (2,219) 1,981

Cash flow from investing activities

Acquisition of subsidiary (net of cash acquired) 10 b) (139) - -

Purchase of property, plant and equipment (PPE) (523) (462) (1,317)

Proceeds from sale of PPE 103 5 29

Purchase of intangible assets (1,072) (214) (1,020)

Interest received 73 44 92

Net cash used in investing activities (1,558) (627) (2,216)

Cash flow from financing activities

Proceeds from issue of share capital 68 44 48

Investment in ESOP - - (13)

Proceeds from borrowings 510 60 2,121

Repayments of borrowings (27) (15) -

Renegotiation of loan - - (1,730)

Payments of finance lease liabilities (58) (27) (115)

Dividends paid (482) (480) (721)

Net cash generated from / (used in) financing activities 11 (418) (410)

Net decrease in net cash (including bank overdrafts) (1,518) (3,264) (645)

Cash and bank overdrafts at beginning of period 3,354 3,722 3,722

Exceptional gain - - 277

Cash and bank overdrafts at end of period 1,836 458 3,354

Notes to the consolidated interim financial statements

1. General information

Christie Group plc is the parent undertaking of a group of companies covering a

range of related activities. These fall into three divisions - Professional

Business Services, Software Solutions and Stock and Inventory Services.

Professional Business Services principally covers business valuation and agency,

mortgage and insurance services, and business appraisal. Software Solutions

covers EPoS, Head office systems and supply chain management. Stock and

Inventory Services covers Stock and Audit inventory preparation and valuation.

2. Summary of significant accounting policies

Accounting policies for the year ending 31 December 2005

The principal accounting policies adopted in the preparation of these financial

statements are set out below.

2.1 Basis of preparation

These interim consolidated financial statements of Christie Group plc are for

the six months ended 30 June 2005 and are covered by IFRS 1, First-time Adoption

of International Financial Reporting Standards (IFRS), because they are part of

the period covered by the Group's first IFRS financial statements for the year

ended 31 December 2005. The interim financial statements have been prepared in

accordance with those IFRS standards and IFRIC interpretations issued and

effective or issued and early adopted as at the time of preparing these

statements (September 2005). The IFRS standards and IFRIC interpretations that

will be applicable at 31 December 2005, including those that will be applicable

on an optional basis, are not known with certainty at the time of preparing

these interim financial statements.

The policies set out below have been consistently applied to all the periods

presented except for those relating to the classification and measurement of

financial instruments. The Group has made use of the exemption available under

IFRS 1 to only apply IAS 32 and IAS 39 from 1 January 2005. The policies applied

to financial instruments for 2004 and 2005 are disclosed separately below.

Christie Group plc's consolidated financial statements were prepared in

accordance with UK Generally Accepted Accounting Principles (GAAP) until 31

December 2004. GAAP differs in some areas from IFRS. In preparing Christie Group

plc's 2005 consolidated interim financial statements, management has amended

certain accounting, valuation and consolidation methods applied in the GAAP

financial statements to comply with IFRS. The comparative figures in respect of

2004 were restated to reflect these adjustments, except as described in the

accounting policies.

Reconciliations and descriptions of the effect of the transition from GAAP to

IFRS on the Group's equity and its net income and cash flows are provided in

Note 4.

These consolidated interim financial statements have been prepared under the

historical cost convention.

The preparation of financial statements in accordance with IFRS requires the use

of certain critical accounting estimates. It also requires management to

exercise judgement in the process of applying the Company's accounting policies.

The areas involving a higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the consolidated interim financial

statements, are disclosed in Note 3.

2.2 Consolidation

The Group financial statements include the results of Christie Group plc and all

its subsidiary undertakings on the basis of their financial statements to 30

June 2005. The results of businesses acquired or disposed of are included from

the date of acquisition or disposal.

A subsidiary is an entity controlled, directly or indirectly, by Christie Group

plc. Control is regarded as the power to govern the financial and operating

policies of the entity so as to obtain the benefits from its activities.

2.3 Foreign currency translation

Functional and presentation currency

Items included in the financial statements of each of the Group's entities are

measured using the currency of the primary economic environment in which the

entity operates ('the functional currency'). The consolidated financial

statements are presented in pounds sterling, which is the Company's functional

and presentational currency.

Transactions and balances

Foreign currency transactions are translated into the functional currency using

the exchange rates prevailing at the dates of the transactions. Foreign

exchange gains and losses resulting from the settlement of such transactions and

from the translation at year-end exchange rates of monetary assets and

liabilities denominated in foreign currencies are recognised in the income

statement.

Translation differences on non-monetary items, such as equities held at fair

value through profit or loss, are reported as part of the fair value gain or

loss. Translation differences on non-monetary items, such as equities

classified as available-for-sale financial assets, are included in the fair

value reserve in equity.

Group companies

The results and financial position of all the group entities (none of which has

the currency of a hyperinflationary economy) that have a functional currency

different from the presentation currency are translated into the presentation

currency as follows:

a) assets and liabilities for each balance sheet presented are translated

at the closing rate at the date of that balance sheet;

b) income and expenses for each income statement are translated at average

exchange rates (unless this average is not a reasonable approximation of the

cumulative effect of the rates prevailing on the transaction dates, in which

case income and expenses are translated at the dates of the transactions); and

c) all resulting exchange differences are recognised as a separate

component of equity (Cumulative translation adjustment).

On consolidation, exchange differences arising from the translation of the net

investment in foreign entities, and of borrowings and other currency instruments

designated as hedges of such investments, are taken to shareholders' equity.

When a foreign operation is sold, such exchange differences are recognised in

the income statement as part of the gain or loss on sale.

Goodwill and fair value adjustments arising on the acquisition of a foreign

entity are treated as assets and liabilities of the foreign entity and

translated at the closing rate.

2.4 Revenue recognition

Income derived from the Group's principal activities (which is shown exclusive

of applicable sales taxes or equivalents) is recognised as follows:

Agency, valuations and appraisals:

Net agency fees are recognised as income on exchange of contracts. In respect

of valuations, turnover is recognised once the property or business has been

inspected. Appraisal income is recognised upon submission of the completed

report to the client.

Business mortgage broking:

Fee income is taken either when a loan offer is secured or when the loan is

drawn down.

Insurance broking:

Insurance brokerage is accounted for when insurance commences.

Software solutions:

Hardware revenues are recognised on installation. Software revenues are

recognised on the signing of contracts. Revenues on maintenance contracts are

recognised over the period of the contracts.

Stock and inventory services:

Fees are recognised on completion of the visit to client's premises.

Other income is recognised as follows:

Interest income:

Interest income is recognised on a time-proportion basis using the effective

interest method.

Dividend income:

Dividend income is recognised when the right to receive payment is established.

2.5 Segmental reporting

In accordance with the Group's risks and returns, the definition of segments for

primary and secondary segment reporting reflects the internal management

reporting structure. Segment expenses consist of directly attributable costs

and other costs, which are allocated based on relevant criteria.

A business segment is a group of assets and operations engaged in providing

products or services that are subject to risks and returns that are different

from those of other business segments. A geographical segment is engaged in

providing products or services within a particular economic environment that are

subject to risks and returns that are different from those of components

operating in other economic environments.

2.6 Goodwill

On the acquisition of a business, fair values are attributed to the net assets

acquired. Goodwill arises on the acquisition of subsidiary undertakings,

representing any excess of the fair value of the consideration given over the

fair value of the identifiable assets and liabilities acquired. Goodwill

arising on acquisitions is capitalised and subject to impairment review, both

annually and when there are indications that the carrying value may not be

recoverable. Prior to 1 January 2004, goodwill was amortised over its estimated

useful life, such amortisation ceased on 31 December 2003.

The Group's policy for the years up to 31 March 1998 was to eliminate goodwill

arising on acquisitions against reserves. Under IFRS 1 and IFRS 3, such

goodwill will remain eliminated against reserves.

2.7 Intangibles

Research and Development

Development projects where reasonable certainty exists as regards technical and

commercial viability are capitalised and amortised over the expected product or

system life, commencing in the year when sales of the product are made or the

system used for the first time. Development costs previously recognised as an

expense are not recognised as an asset in a subsequent period. All other

research and development costs are written off in the year in which they are

incurred.

Other

Intangible fixed assets such as software, trademarks and patent rights are

stated at cost, net of amortisation and any provision for impairment.

Amortisation is calculated to write down the cost of all intangible fixed assets

to their estimated residual value by equal annual instalments over their

expected useful economic lives. The expected useful lives are between three and

ten years.

2.8 Property plant and equipment

Tangible fixed assets are stated at cost, net of depreciation and provision for

any impairment. Depreciation is calculated to write down the cost of all

tangible fixed assets to their estimated residual value by equal annual

instalments over their expected useful lives as follows:

Leasehold property Lease term

Fixtures, fittings and equipment 5 - 10 years

Computer equipment 2 - 3 years

Motor vehicles 4 years

The assets' residual values and useful lives are reviewed, and adjusted if

appropriate, at each balance sheet date. An asset's carrying amount is written

down immediately to its recoverable amount if the asset's carrying amount is

greater than its estimated recoverable amount.

Gains and losses on disposals are determined by comparing the disposal proceeds

with the carrying amount and are included in the income statement.

2.9 Leases

Leases where the lessor retains a significant portion of the risks and rewards

of ownership are classified as operating leases. Rentals under operating leases

(net of any incentives received) are charged to the income statement on a

straight-line basis over the period of the lease.

Assets, held under finance leases, which confer rights and obligations similar

to those attached to owned assets, are capitalised as tangible fixed assets and

are depreciated over the shorter of the lease terms and their useful lives. The

capital elements of future lease obligations are recorded as liabilities, whilst

the interest elements are charged to the income statement over the period of the

leases at a constant rate.

2.10 Impairment of assets

Fixed assets are reviewed for impairment whenever events or changes in

circumstances indicate that the carrying amount may not be recoverable. An

impairment loss is recognised for the amount by which the asset's carrying value

exceeds its recoverable amount. The recoverable amount is the higher of an

asset's fair value less costs to sell and value in use. Value in use is based

on the present value of the future cash flows relating to the asset. For the

purposes of assessing impairment, assets are grouped at the lowest levels for

which there are separately identifiable cash flows (cash generating units).

Any assessment of impairment based on value in use takes account of the time

value of money and the uncertainty or risk inherent in the future cash flows.

The discount rates applied are pre-tax and reflect current market assessments of

the time value of money and the risks specific to the asset for which the future

cash flow estimates have not been adjusted.

2.11 Investments

From 1 January 2004 to 31 December 2004

Financial fixed assets include investments in companies other than subsidiaries

and associates, financial receivables held for investment purposes, treasury

stock and other securities. Financial fixed assets are recorded at cost,

including additional direct charges.

Current assets may also include investments and securities acquired as a

temporary investment, which are valued at the lower of cost and market, cost

being determined on a last-in-first-out (LIFO) basis.

From 1 January 2005

The Group classifies its investments in the following categories: financial

assets at fair value through profit or loss, loans and receivables,

held-to-maturity investments and available-for-sale financial assets. The

classification depends on the purpose for which the investments were acquired.

Management determines the classification of its investments at initial

recognition and re-evaluates this designation at every reporting date.

(1) Financial assets at fair value through profit or loss

This category has two sub-categories: financial assets held for trading, and

those designated at fair value through profit or loss at inception. A financial

asset is classified in this category if acquired principally for the purpose of

selling in the short term or if so designated by management.

Derivatives are also categorised as held for trading unless they are designated

as hedges. Assets in this category are classified as current assets if they

either are held for trading or are expected to be realised within 12 months of

the balance sheet date. During the year, the Group did not hold any investments

in this category.

(2) Loans and receivables

Loans and receivables are non-derivative financial assets with fixed or

determinable payments that are not quoted in an active market. They arise when

the Group provides money, goods or services directly to a debtor with no

intention of trading the receivable. They are included in current assets, except

for maturities greater than 12 months after the balance sheet date. These are

classified as non-current assets. Loans and receivables are included in trade

and other receivables in the balance sheet. During the year, the Group did not

hold any investments in this category.

(3) Held-to-maturity investments

Held-to-maturity investments are non-derivative financial assets with fixed or

determinable payments and fixed maturities that the Group's management has the

positive intention and ability to hold to maturity. During the year, the Group

did not hold any investments in this category.

(4) Available-for-sale financial assets

Available-for-sale financial assets are non-derivatives that are either

designated in this category or not classified in any of the other categories.

They are included in non-current assets unless management intends to dispose of

the investment within 12 months of the balance sheet date.

Purchases and sales of investments are recognised on trade date, the date on

which the Group commits to purchase or sell the asset. Investments are initially

recognised at fair value plus transaction costs for all financial assets not

carried at fair value through profit or loss. Investments are derecognised when

the rights to receive cash flows from the investments have expired or have been

transferred and the Group has transferred substantially all risks and rewards of

ownership. Available-for-sale financial assets and financial assets at fair

value through profit or loss are subsequently carried at fair value. Loans and

receivables and held-to-maturity investments are carried at amortised cost using

the effective interest method. Realised and unrealised gains and losses arising

from changes in the fair value of the 'financial assets at fair value through

profit or loss' category are included in the income statement in the period in

which they arise. Unrealised gains and losses arising from changes in the fair

value of non-monetary securities classified as available-for-sale are recognised

in equity. When securities classified as available-for-sale are sold or

impaired, the accumulated fair value adjustments are included in the income

statement as gains and losses from investment securities.

The fair values of quoted investments are based on current bid prices. If the

market for a financial asset is not active (and for unlisted securities), the

Group establishes fair value by using valuation techniques. These include the

use of recent arm's length transactions, reference to other instruments that are

substantially the same, discounted cash flow analysis, and option pricing models

refined to reflect the issuer's specific circumstances.

The Group assesses at each balance sheet date whether there is objective

evidence that a financial asset or a group of financial assets is impaired. In

the case of equity securities classified as available for sale, a significant or

prolonged decline in the fair value of the security below its cost is considered

in determining whether the securities are impaired.

If any such evidence exists for available-for-sale financial assets, the

cumulative loss - measured as the difference between the acquisition cost and

the current fair value, less any impairment loss on that financial asset

previously recognised in profit or loss - is removed from equity and recognised

in the income statement. Impairment losses recognised in the income statement on

equity instruments are not reversed through the income statement.

2.12 Inventories

Inventory held for resale is valued at the lower of cost and net realisable

value.

2.13 Trade receivables

Trade receivables are recognised initially at fair value and subsequently

measured at amortised cost using the effective interest method, less provision

for impairment. A provision for impairment of trade receivables is established

when there is objective evidence that the Group will not be able to collect all

amounts due according to the original terms of the receivables. The amount of

the provision is the difference between the asset's carrying amount and the

present value of estimated future cash flows, discounted at the effective

interest rate. The amount of the provision is recognised in the income

statement.

2.14 Cash and cash equivalents

Cash and cash equivalents are carried in the balance sheet at cost. Cash and

cash equivalents comprise cash on hand, deposits held at call with banks, other

short-term, highly liquid investments with original maturities of three months

or less, and bank overdrafts. Bank overdrafts are included within borrowings in

current liabilities on the balance sheet.

2.15 Borrowings

Borrowings are recognised initially at fair value, net of transaction costs

incurred. Borrowings are subsequently stated at amortised cost; any difference

between proceeds (net of transaction costs) and the redemption value is

recognised in the income statement over the period of the borrowings using the

effective interest method.

Borrowings are classified as current liabilities unless the Group has an

unconditional right to defer settlement of the liability for at least 12 months

after the balance sheet date.

2.16 Taxation including deferred tax

Tax on company profits is provided for at the current rate applicable in each of

the relevant territories.

Deferred income tax is provided in full, using the liability method, on

temporary differences arising between the tax bases of assets and liabilities

and their carrying amounts in the consolidated financial statements. However, if

the deferred income tax arises from initial recognition of an asset or liability

in a transaction other than a business combination that at the time of the

transaction affects neither accounting nor taxable profit or loss, it is not

accounted for. Deferred income tax is determined using tax rates (and laws) that

have been enacted or substantially enacted by the balance sheet date and are

expected to apply when the related deferred income tax asset is realised or the

deferred income tax liability is settled.

Deferred income tax assets are recognised to the extent that it is probable that

future taxable profit will be available, against which the temporary differences

can be utilised.

Deferred income tax is provided on temporary differences arising on investments

in subsidiaries and associates, except where the timing of the reversal of the

temporary difference is controlled by the Group and it is probable that the

temporary difference will not reverse in the foreseeable future.

2.17 Share capital and share premium

Ordinary shares are classified as equity.

Incremental costs directly attributable to the issue of new shares or options

are shown in equity as a deduction, net of tax, from the proceeds. Incremental

costs directly attributable to the issue of new shares or options, or for the

acquisition of a business, are included in the cost of acquisition as part of

the purchase consideration.

Where any Group company purchases the Company's equity share capital (own

shares), the consideration paid, including any directly attributable

incremental costs (net of income taxes), is deducted from equity attributable to

the Company's equity holders until the shares are cancelled, reissued or

disposed of. Where such shares are subsequently sold or reissued, any

consideration received, net of any directly attributable incremental transaction

costs and the related income tax effects, is included in equity attributable to

the Company's equity holders.

2.18 Dividend distribution

Dividend distribution to the Company's shareholders is recognised as a liability

in the Group's financial statements in the period in which the dividends are

approved by the Company's shareholders. In respect of interim dividends, which

are paid prior to approval by the Company's shareholders they are recognised on

payment.

2.19 Employee benefits

Pension obligations

The Group operates both defined benefit and defined contribution plans. A

defined benefit plan is a pension plan that defines the amount of pension

benefit that an employee will receive on retirement, usually dependent on one or

more factors such as age, years of service and remuneration. A defined

contribution plan is a pension plan under which the Group pays fixed

contributions into a separate entity. The schemes are generally funded through

payments to insurance companies or trustee-administered funds, determined by

periodic actuarial calculations.

Pension obligations - Defined benefit schemes

The liability recognised in the balance sheet in respect of defined benefit

pension plans is the present value of the defined benefit obligation at the

balance sheet date less the fair value of plan assets, together with adjustments

for unrecognised actuarial gains or losses and past service costs. The defined

benefit obligation is calculated annually by independent actuaries using the

projected unit credit method. The present value of the defined benefit

obligation is determined by discounting the estimated future cash outflows using

interest rates of high-quality corporate bonds that are denominated in the

currency in which the benefits will be paid, and that have terms to maturity

approximating to the terms of the related pension liability.

Cumulative actuarial gains and losses arising from experience adjustments and

changes in actuarial assumptions in excess of the greater of 10% and the value

of plan assets or 10% of the defined benefit obligation are charged or credited

to the income statement over the employees' expected average remaining working

lives.

Past-service costs are recognised immediately in income, unless the changes to

the pension plan are conditional on the employees remaining in service for a

specified period of time (the vesting period). In this case, the past-service

costs are amortised on a straight-line basis over the vesting period.

Pension obligations - Personal pension plans

Group companies contribute towards personal pension plans for participating

employees. These employees are currently entitled to such contributions after a

qualifying period has elapsed. Payments to the plan are charged as an employee

benefit expense as they fall due. Prepaid contributions are recognised as an

asset to the extent that a cash refund or a reduction in the future payments is

available. The Group has no further payment obligations once the contributions

have been paid.

Share based compensation

The fair value of employee share option plans, including Save As You Earn (SAYE)

schemes, is calculated using an appropriate option pricing model. In accordance

with IFRS 2 'Share-based Payments' the resulting cost is charged to the income

statement over the vesting period of the options. The value of the charge is

adjusted to reflect expected and actual levels of options vesting.

Share options granted before 7 November 2002 and vested before 1 January 2005.

No expense is recognised in respect of these options. The shares are recognised

when the options are exercised and the proceeds received allocated between share

capital and share premium.

Share options granted after 7 November 2002 and vested after 1 January 2005.

The Group operates an equity-settled, long term incentive plan designed to align

management interests with those of shareholders. The fair value of the

employee's services received in exchange for the grant of the options is

recognised as an expense. The total amount to be expensed over the vesting

period is determined by reference to the fair value of the options granted,

excluding the impact of any non-market vesting conditions (for example,

profitability and sales growth targets). Non-market vesting conditions are

included in assumptions about the number of options that are expected to become

exercisable. At each balance sheet date, the entity revises its estimates of the

number of options that are expected to become exercisable. It recognises the

impact of the revision of original estimates, if any, in the income statement,

and a corresponding adjustment to equity. The proceeds received net of any

directly attributable transaction costs are credited to share capital (nominal

value) and share premium when the options are exercised.

Commissions and bonus plans

The Group recognises a liability and an expense for commissions and bonuses,

based on formula driven calculations. The Group recognises provisions where

contractually obliged or where there is a past practice that has created a

constructive obligation.

2.20 Interim measurement note

(a) Current income tax

Current income tax expense is recognised in these interim consolidated financial

statements based on management's best estimates of the weighted average annual

income tax rate expected for the full financial year.

(b) Costs

Costs that are incurred unevenly during the financial year are anticipated or

deferred in the interim report only if it would also be appropriate to

anticipate or defer such costs at the end of the financial year.

(c) Retirement benefit obligations

The measurement of the expenses and liabilities associated with the Group's

retirement benefit obligations at 30 June 2005 reflects a number of assumptions,

based on the actuarial valuation as at 31 December 2004 after taking into

account actual cash contributions to the schemes. Further details of the

assumptions used are detailed in Note 3.1 (b).

3. Critical accounting estimates and judgements

Estimates and judgements are continually evaluated and are based on historical

experience and other factors, including expectations of future events that are

believed to be reasonable under the circumstances.

3.1 Critical accounting estimates and assumptions

The Group makes estimates and assumptions concerning the future. The resulting

accounting estimates will by definition, seldom equal the related actual

results. The estimates and assumptions that have a significant risk of causing a

material adjustment to the carrying amounts of assets and liabilities within the

next financial year are discussed below.

(a) Estimated impairment of goodwill

Goodwill is subject to an impairment review both annually and when there are

indications that the carrying value may not be recoverable, in accordance with

the accounting policy stated in Note 2.6. The recoverable amounts of

cash-generating units have been determined based on value-in-use calculations.

These calculations require the use of estimates.

(b) Retirement benefit obligations

The assumptions used to measure the expense and liabilities related to the

Group's two defined benefit pension plans are reviewed annually by

professionally qualified, independent actuaries, trustees and management as

appropriate. The measurement of the expense for a period requires judgement

with respect to the following matters, among others:

- the probable long-term rate of increase in pensionable pay;

- the discount rate

- the expected return on plan assets

- the estimated life expectancy of participating employees

The assumptions used by the Group may differ materially from actual results, and

these differences may result in a significant impact on the amount of pension

expense recorded in future periods. In accordance with IAS 19, the Group

amortises actuarial gains and losses outside the 10% corridor, over the average

future service lives of employees. Under this method, major changes in

assumptions, and variances between assumptions and actual results, may affect

retained earnings over several future periods rather than one period, while more

minor variances and assumption changes may be offset by other changes and have

no direct effect on retained earnings.

(c) Income taxes

The Group is subject to income taxes in numerous jurisdictions. Significant

judgement is required in determining the provision for income taxes. There are

many transactions and calculations for which the ultimate tax determination is

uncertain during the ordinary course of business. The Group recognises

liabilities for anticipated tax audit issues based on estimates of whether

additional taxes will be due. Where the final tax outcome of these matters is

different from the amounts initially recorded, such differences will impact the

income tax and deferred tax provisions in the period in which such determination

is made.

4. Transition to IFRS

4.1 Basis of transition to IFRS

4.1.1 Application of IFRS

The Group's financial statements for the year ended 31 December 2005 will be the

first annual financial statements that comply with IFRS. These interim financial

statements have been prepared as described in Note 2.1. The Group has applied

IFRS 1 in preparing these consolidated interim financial statements.

Christie Group plc's transition date is 1 January 2004. The Group prepared its

opening IFRS balance sheet at that date. The reporting date of these interim

consolidated financial statements is 30 June 2005. The Group's IFRS adoption

date is 1 January 2005.

In preparing these interim consolidated financial statements in accordance with

IFRS 1, the Group has applied the mandatory exceptions and certain of the

optional exemptions from full retrospective application of IFRS, as detailed

below.

4.1.2 Exemptions from full retrospective application elected by the Group

Christie Group plc has elected to apply the following optional exemptions from

full retrospective application.

(a) Business combinations exemption

Christie Group plc has applied the business combinations exemption in IFRS 1. It

has not restated business combinations that took place prior to the 1 January

2004 transition date.

(b) Fair value as deemed cost exemption

Christie Group plc has elected to measure certain items of property, plant and

equipment at fair value as at 1 January 2004.

(c) Employee benefits exemption

Christie Group plc has elected to recognise all cumulative actuarial gains and

losses as at 1 January 2004.

(d) Exemption from restatement of comparatives for IAS 32 and IAS 39.

The Group elected to apply this exemption. It applies previous GAAP rules to

derivatives, financial assets and financial liabilities and to hedging

relationships for the 2004 comparative information. The adjustments required for

differences between GAAP and IAS 32 and IAS 39 are determined and recognised at

1 January 2005.

(e) Designation of financial assets and financial liabilities exemption

The Group reclassified various securities as available-for-sale investments and

as financial assets at fair value through profit and loss. The adjustments

relating to IAS 32 and IAS 39 at the opening balance sheet date of 1 January

2005, the IAS 32 / 39 transition date.

(f) Share-based payment transaction exemption

The Group has elected to apply the share-based payment exemption. It applied

IFRS 2 from 1 January 2004 to those options, that were issued after 7 November

2002 but that have not vested by 1 January 2005.

(g) Fair value measurement of financial assets or liabilities at initial

recognition

The Group has not applied the exemption offered by the revision of IAS 39 on the

initial recognition of the financial instruments measured at fair value through

profit and loss where there is no active market. This exemption is therefore not

applicable.

4.1.3 Exceptions from full retrospective application followed by the Group

Christie Group plc has applied the following mandatory exceptions from

retrospective application.

(a) Derecognition of financial assets and liabilities exception

Financial assets and liabilities derecognised before 1 January 2004 are not

re-recognised under IFRS. The application of the exemption from restating

comparatives for IAS 32 and IAS 39 means that the Group recognised from 1

January 2005 any financial assets and financial liabilities derecognised since 1

January 2004 that do not meet the IAS 39 derecognition criteria. Management did

not choose to apply the IAS 39 derecognition criteria to an earlier date.

(b) Estimates exception

Estimates under IFRS at 1 January 2004 should be consistent with estimates made

for the same date under previous GAAP, unless there is evidence that those

estimates were in error.

(c) Assets held for sale and discontinued operations exception

Management applies IFRS 5 prospectively from 1 January 2005. Any non-current

assets held for sale or discontinued operations are recognised in accordance

with IFRS 5 only from 1 January 2005. Christie Group plc did not have any non-

current assets that met the held-for-sale criteria during the period presented.

No adjustment was required.

4.2 Reconciliations between IFRS and GAAP

The following reconciliations provide a quantification of the effect of the

transition to IFRS. The first reconciliation provides an overview of the impact

on equity of the transition at 1 January 2004, 30 June 2004 and 31 December

2004.

The following seven reconciliations provide details of the impact of the

transition on:

- equity at 1 January 2004 (Note 4.2.2)

- equity at 30 June 2004 (Note 4.2.3)

- equity at 31 December 2004 (Note 4.2.4)

- net income 30 June 2004 (Note 4.2.5)

- net income 31 December 2004 (Note 4.2.6)

- cash flow 30 June 2004 (Note 4.2.7)

- cash flow 31 December 2004 (Note 4.2.8)

4.2.1 Summary of equity

1 January Note 30 June Note 31 December Note

2004 2004 2004

#'000 #'000 #'000

Total equity under UK GAAP 7,256 7,700 11,568

Recognition of post-retirement benefit (7,466) 4.2.2 e) (6,939) 4.2.3 g) (7,067) 4.2.4 g)

obligations under IAS 19

Recognition of deferred tax on Retirement 2,240 4.2.2 c) 2,082 4.2.3 d) 2,120 4.2.4 d)

benefit obligations

Reversal of Goodwill amortised - 269 4.2.3 b) 548 4.2.4 b)

Reversal of proposed ordinary dividends 492 4.2.2 f) 240 4.2.3 h) 481 4.2.4 h)

payable

Total equity under IFRS 2,522 3,352 7,650

4.2.2 Reconciliation of equity at 1 January 2004

Note GAAP Effect of IFRS

transition to IFRS

#'000 #'000 #'000

ASSETS

Non-current assets

Property, plant and equipment a) 2,631 (144) 2,487

Goodwill 3,918 - 3,918

Intangible assets b) 35 144 179

Deferred income tax assets c) 445 2,240 2,685

Available-for-sale financial assets 100 - 100

7,129 2,240 9,369

Current assets

Inventories 312 - 312

Trade and other receivables 12,635 - 12,635

Available-for-sale financial assets 504 - 504

Cash and cash equivalents 4,346 - 4,346

17,797 - 17,797

Total assets 24,926 2,240 27,166

EQUITY

Capital and reserves attributable to the company's

equity holders

Share capital 493 - 493

Fair value and other reserves 4,411 - 4,411

Cumulative translation adjustment d) - (359) (359)

Retained earnings g) 2,346 (4,375) (2,029)

7,250 (4,734) 2,516

Minority interest 6 - 6

Total equity 7,256 (4,734) 2,522

LIABILITIES

Non-current liabilities

Borrowings 121 - 121

Retirement benefit obligations e) - 7,466 7,466

Provisions and other liabilities 31 - 31

152 7,466 7,618

Current liabilities

Trade and other payables f) 11,920 (492) 11,428

Current income tax liabilities 1,023 - 1,023

Borrowings 4,575 - 4,575

17,518 (492) 17,026

Total liabilities 17,670 6,974 24,644

Total equity and liabilities 24,926 2,240 27,166

Explanation of the effect of the transition to IFRS

The following explains the material adjustments to the balance sheet at the date

of transition, 1 January 2004.

#'000

a) Property, plant and equipment

Reclassification of computer software to intangible assets (144)

Total impact - decrease in Property, plant and equipment (144)

Under IAS 38 only computer software that is integral to a related item of hardware should be

included as Property, plant and equipment. This adjustment reclassifies relevant computer

software in accordance with IAS 38.

b) Intangible assets

Reclassification of computer software from Property, plant and equipment 144

Total impact - increase in Intangible assets

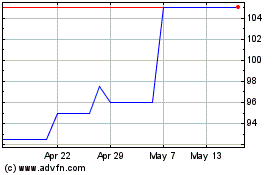

Christie (LSE:CTG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Christie (LSE:CTG)

Historical Stock Chart

From Jul 2023 to Jul 2024