RNS Number:8287Q

Christie Group PLC

13 September 2000

Christie Group plc

Interim results for the six months to 30 June 2000

Chairman's statement

In the six months to 30 June, Group turnover increased by 13.6% to

#18,502,000, including a three and a half month contribution from Timeless,

our French retail software company (June 1999: #16,284,000), with

like-for-like turnover flat at #16,153,000. Operating profit before goodwill

amortisation in the period was #345,000 (June 1999: #1,194,000). This result

was foreshadowed in my statement at the AGM and was substantially due to the

slowdown in our UK software business. In addition we spent #500,000 more than

in the corresponding period in 1999 investing in both Professional Business

Services, principally in further international development in Christie & Co,

and Information Systems and Services, increasing staff numbers to service the

rapid growth in our Venners stocktaking business.

We propose to pay a maintained interim dividend of 1p per share.

Professional Business Services

The division achieved turnover of #11,032,000 (June 1999: #10,762,000), and

operating profits of #509,000 (June 1999: #647,000). The total number of

businesses sold by Christie & Co increased over the prior period, but there

was an absence of larger transactions. Due to the well publicised

difficulties of healthcare operators in the sale and leaseback market and

uncertainty concerning future new mandatory standards for care, the sector

was slower in the first half. However, in late July the Government published

the Care Standards Bill setting out these guidelines, and since then we have

seen an improved level of confidence return to the healthcare market.

Christie.com has expanded to feature over 3,000 businesses in the UK and

internationally. Almost a third of our business buyers are actively using our

website as a preferred method of communication. Steady incremental use of the

website since its launch in July 1999 has confirmed it as one of the dynamics

of our future.

Our European office network was further strengthened by the opening of a

Barcelona office in July in addition to our presence in Paris (opened March

1998) and Frankfurt (opened February 1999). The Professional Business

Services division has been strengthened through specialist departments for

Leisure & Development, Investment and Rating services, and continued

development of Christie.com.

Information Systems and Services

Turnover increased by 35% to #7,470,000, including Timeless (June 1999:

#5,522,000), with like-for-like turnover down by 7% to #5,121,000. The loss

for the period before goodwill of #164,000 (June 1999: profit of #547,000)

includes a positive contribution from Timeless of #275,000, which is in line

with management expectations. The Y2K changeover adversely affected first

half performance at Venners Computer Systems (VCS) with some carry-over into

the second half.

However, I am now pleased to report that VCS has won a number of new

contracts, including the provision of EPoS for Cine UK and Ster Century

European. VCS has also signed an exclusive contract to supply the Vista

ticketing solution which allows ticket purchases over the internet, utilising

ATMs for on-site ticket collection and purchase. This has been taken up by

Spean Bridge Cinemas internationally. Orders are confirmed for our second

half with further business scheduled for 2001. Other successful installations

have included the 'West One' London fashion chain, while internet kiosk sales

included gadgetshop.com's flagship store on London's Oxford Street.

In March we completed the acquisition of Groupe Timeless SA, which expanded

our international software systems offering. Since then, it has moved to new

larger premises on the quai de Jemmapes in Paris. Timeless continues to win

business with its Colombus retail internet enabled software system. Euro

Sante Beaute (pharmaceuticals, cosmetics and health foods), La Compagnie des

Petits (childrenswear), Rodier (fashion) were among others signing up in the

period.

A joint European strategy for VCS and Timeless is now being implemented.

Our stock-auditing business, Venners, made significant business gains which

required an increase of 25% in operational staff in the first quarter of the

year, but suffered considerable disruption as a result. Since early summer,

Venners has been trading at record levels of licensed trade activity. In

addition to our strong licensed stocktaking business, we continue to gain

retail clients, which during the period included Comet.

Interest Charge

The interest charge at #52,000 compares with interest receivable of #29,000

in 1999 due to increased borrowings to fund the Timeless acquisition. Cash in

hand was #1,578,000 (June 1999: #1,571,000).

Tax Charge

The tax charge has increased from 36% to 39% (excluding goodwill

amortisation) principally due to a higher proportion of the group's earnings

being outside the UK as a result of the Timeless acquisition in France.

Current Trading

The second half of this year is difficult to predict with any certainty. 1999

benefited from a particularly strong final quarter which is unlikely to be

repeated this year. The Group has continued with its policy of selected

expansion - which is progressing well - to position it for success in the

developing European market.

Philip Gwyn Chairman

13 September 2000

Contacts :

Philip Gwyn, Chairman, Christie Group 020 7227 0707

David Rugg, Chief Executive, Christie Group 020 7227 0707

Robert Zenker, Finance Director, Christie Group 020 7227 0707

Charlotte Elston, Brunswick Group Limited 020 7404 5959

********

Consolidated profit and loss account

Continuing Acquisition

#000 #000

Notes

Turnover 2 16,153 2,349

Net operating costs (16,083) (2,074)

Goodwill amortisation (185) -

Operating profit/(loss) (115) 275

Net Interest (50) (2)

Profit/(loss) on ordinary activities before (165) 273

tax

Tax on profit on ordinary activities 4

Profit/(loss) on ordinary activities after tax

Dividends 5

Retained profit/(loss) for the period

Earnings per share excluding goodwill 6

Earnings per share excluding goodwill - fully

diluted

Earnings/(loss) per share after goodwill 6

Earnings/(loss) per share after goodwill -

fully diluted

Unaudited Unaudited Audited

Half year Half year Year

ended ended ended

30 June 30 June 31 December 1999

2000 1999

Notes Total #000

#000 #000

Turnover 2 18,502 16,284 35,161

Net operating costs (18,157) (15,090) (31,717)

Goodwill amortisation (185) - -

Operating profit/(loss) 160 1,194 3,444

Net Interest (52) 29 53

Profit/(loss) on ordinary 108 1,223 3,497

activities before tax

Tax on profit on ordinary (114) (443) (1,218)

activities 4

Profit/(loss) on ordinary (6) 780 2,279

activities after tax

Dividends 5 (264) (243) (608)

Retained profit/(loss) for (270) 537 1,671

the period

Earnings per share excluding 0.72p 3.24p 9.42p

goodwill 6

Earnings per share excluding 0.70p 3.22p 9.28p

goodwill - fully diluted

Earnings/(loss) per share (0.02)p 3.24p 9.42p

after goodwill 6

Earnings/(loss) per share (0.02)p 3.22p 9.28p

after goodwill - fully

diluted

Statement of Total Recognised Unaudited Unaudited Audited

Gains and Losses Half year Half year Year

ended ended ended

30 June 30 June 31 December

2000 1999 1999

#000 #000 #000

Profit/(loss) on ordinary (6) 780 2,279

activities after taxation

Gain/(loss) on foreign currency (21) 43 14

translation

Total Recognised Gains and (27) 823 2,293

(Losses)

Consolidated balance sheet

Unaudited Unaudited Audited

30 June 30 June 31 December

2000 1999 1999

#000 #000 #000

Fixed Assets

Tangible assets 3,109 2,656 2,778

Goodwill 5,837 - -

Intangible assets 524 - 247

Investment 54 - -

9,524 2,656 3,025

Current assets

Stock 522 378 207

Debtors 9,476 8,094 7,785

Cash at bank and in hand 1,578 1,571 3,318

11,576 10,043 11,310

Creditors - amounts falling due (9,487) (7,357) (7,969)

within one year

Net current assets 2,089 2,686 3,341

Total assets less current 11,613 5,342 6,366

liabilities

Creditors - amounts falling due (3,743) (262) (150)

after more than one year

Net assets 7,870 5,080 6,216

Capital and reserves

Called up equity share capital 509 486 487

Share premium account 3,681 3,623 3,653

Merger reserve 1,895 - -

Profit and loss account 1,785 971 2,076

Shareholders' funds - equity 7,870 5,080 6,216

interests

Consolidated cashflow statement

Unaudited Unaudited Audited

30 June 30 June 31 December

2000 1999 1999

#000 #000 #000

Net Cash inflow from operating 811 192 4,273

activities

Returns on investments and (52) 29 53

servicing of finance

Taxation paid (174) (104) (1,240)

Capital expenditure (549) (534) (1,094)

Acquisitions (7,288) - (331)

Equity dividends paid (368) (481) (601)

Cash inflow/(outflow) before (7,620) (898) 1,060

financing

Financing 5,828 53 (158)

Increase/(decrease) in cash in the (1,792) (845) 902

period

Notes to the interim report

Basis of preparation

The unaudited results continue to be prepared in accordance with the

accounting policies set out in the Financial Statements for the year ended 31

December 1999.

The financial information in this interim report does not constitute

statutory accounts within the meaning of section 240 of the Companies Act

1985. Statutory accounts for the year ended 31 December 1999, upon which the

auditors gave an unqualified opinion, have been delivered to the Registrar of

Companies.

Segmental information

Turnover and Operating Profit

Half year ended 30 June 2000 Half year ended 30 June

#000 1999

#000

DIVISION Turnover Operating Turnover Operating

(Unaudited) Profit (Unaudited) Profit

(Unaudited) (Unaudited)

Professional 11,032 509 10,762 647

Business

Services

Information 7,470 (349) 5,522 547

Systems and

Services

TOTAL 18,502 160 16,284 1,194

Year ended 31 December 1999

#000

DIVISION Turnover Operating Profit

(audited) (audited)

Professional Business 23,275 2,587

Services

Information Systems and 11,886 857

Services

TOTAL 35,161 3,444

The #349,000 operating loss under Information Systems and Services for the 6

months ended 30 June 2000 is after charging goodwill amortisation of

#185,000.

Turnover by Destination

Half year ended 30 June 2000

#000

Total Professional Information

Business Services Systems and

Services

Europe 17,966 11,032 6,934

Rest of World 536 - 536

TOTAL 18,502 11,032 7,470

Half year ended 30 June 1999

#000

Total Professional Information

Business Services Systems and

Services

Europe 15,534 10,762 4,772

Rest of World 750 - 750

TOTAL 16,284 10,762 5,522

Year ended 31 December 1999

#000

Total Professional Information

Business Services Systems and

Services

Europe 33,485 23,061 10,424

Rest of World 1,676 214 1,462

TOTAL 35,161 23,275 11,886

3.

Particulars of Employees and Staff Costs

Half year ended Half year ended Year ended

30 June 30 June 31 December

2000 1999 1999

The average number of

people employed by the 712 544 555

Group (including

Directors)

Their aggregate 8,886 6,646 14,625

remuneration - #000

4. Taxation

The tax charge for the six months has been based on the estimated effective

tax rate for the year to 31 December 2000 of 39%.

Dividend

The dividend of 1p per share will be payable to shareholders on record on 29

September 2000. The ex-dividend date will be 25 September 2000. The dividend

will be paid on 29 November 2000.

6. Earnings Per Share

Half year ended Half year ended Year ended

30 June 30 June 31 December

2000 1999 1999

Earnings per Share

Profit attributable to 179 780 2,279

shareholders before

goodwill - #000

Profit/(loss) (6) 780 2,279

attributable to

shareholders after

goodwill - #000

Average number of

ordinary shares of 2p

each in issue during

the period 24,985,964 24,076,306 24,195,511

Earnings per Share -

fully diluted

Profit attributable to 179 780 2,279

shareholders before

goodwill - #000

Profit/(loss)

attributable to

shareholders after

goodwill - #000 (6) 780 2,279

Average number of

ordinary shares of 2p

each in issue during

the period after

allowing for the

exercise of

outstanding share

options 25,621,249 24,206,191 24,558,493

Interim report

Copies of the interim report are available from Christie Group plc, 50

Victoria Street, London SW1H ONW.

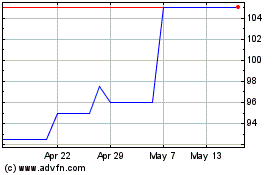

Christie (LSE:CTG)

Historical Stock Chart

From Jul 2024 to Aug 2024

Christie (LSE:CTG)

Historical Stock Chart

From Aug 2023 to Aug 2024