RNS Number:7388K

Christie Group PLC

07 April 2005

CHRISTIE GROUP PLC

7th April 2005

Audited Preliminary Results for the year to 31 December 2004

Christie Group a leading business services and software group, today announces

its preliminary results for the year ended December 2004

Highlights

* Operating profit up 9% to #2.9 million (2003: #2.7 million)

* Turnover up 12% to #70.0 million (2003: #62.5 million)

* Gearing eliminated

* 17p increase in net assets per share

* Opened three additional Christie offices

* Orridge now fully integrated and records first profit as turnover increases

by 44%

* VcsTimeless reports record number of contract wins

Philip Gwyn, Chairman of Christie Group, said:

2004 was a year of continuing development for Christie Group. By investing

further in our operations, systems and people, we sustained the progress of

recent years and consolidated our position in our various markets. I am pleased

that all three divisions had a successful year, and we ended 2004 with a much-

strengthened balance sheet and with the prospect of good growth opportunities in

all divisions in the UK and internationally. We intend to continue our strategy

of growing our top line whilst re-investing for the long-term development of the

Group including, most recently, the January 2005 acquisition of West London

Estates.

Enquiries:

Christie Group 020 7227 0707 Philip Gwyn, Chairman

David Rugg, Chief Executive

Robert Zenker, Finance Director

Brunswick 020 7404 5959 Regina Kilfoyle or Ash Spiegelberg

Notes to Editors

Christie Group plc (CTG.L) is listed on the London Stock Exchange. A leading

business services and software group with three business divisions: Professional

Business Services, Software Solutions; and Stock and Inventory Services. The

three complementary businesses focus on the leisure, retail and care markets.

Christie Group has 31 offices across Europe - located in the UK as well as in

Belgium, France, Germany, Italy and Spain, and 1 office in Canada.

For more information, please go to: www.christiegroup.com

CHAIRMAN'S STATEMENT

I am pleased to be able to report that the Group continued to make progress

during the year under review. Turnover increased to #70.0 million (2003:

#62.5 million) and operating profit to #2.9 million (2003: #2.7 million). The

board proposes a final dividend of 2p per share, bringing the dividend for the

year to 3p per share, the same as in the previous year.

The UK Professional Services businesses (Christie & Co, Christie First and

Pinders) each enjoyed a solid year which has allowed us to open two further

Christie & Co offices in the UK. These are located to the north and south of

London and, when taken together with our central London office, will give us

much stronger representation in the Greater London and suburban areas generally.

The Christie & Co international business, with offices in France, Germany and

Spain, has continued to grow and we have opened a second office in Germany

(adding Berlin to Frankfurt) which gives some measure of our confidence in these

markets.

The two software solutions businesses, based in France and the UK, have been

successfully merged. This allows for more coherent management and we have been

able to attract more new customers to these businesses while the planned product

development continues through 2005.

In our Stock and Inventory division, Orridge increased sales by 44% and traded

profitably. This was our second full year of ownership. Venners, which has

formed part of the Group for many years, continued to trade successfully.

Two features have acted to improve our balance sheet. During the year, we

renegotiated loans made to one of our subsidiaries and, in addition, the tax

authorities accepted dual residence status for our European agency offices with

the result that start-up losses can be set against UK profits. The net effect

of these moves was to strengthen our balance sheet by #3.8 million.

At the profit level, agency expansion and the development of the software

business continues to depress results but we remain confident that they will

contribute to the results in years ahead.

I thank all our colleagues throughout our businesses which contributed to these

results.

PRELIMINARY STATEMENT OF AUDITED RESULTS

AUDITED CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31 DECEMBER 2004

Notes 2004 2003

#000 #000

Turnover 2 69,968 62,457

Staff costs (40,390) (34,933)

29,578 27,524

Other operating charges before goodwill amortisation (26,095) (24,279)

Goodwill amortisation (548) (551)

Total other operating charges (26,643) (24,830)

Operating profit 2 2,935 2,694

Finance costs net (176) (206)

Exceptional finance credit 3 2,455 -

Total finance credit/(costs) 2,279 (206)

Profit on ordinary activities before taxation 5,214 2,488

Tax on profit on ordinary activities 4 (240) (1,469)

Profit on ordinary activities after taxation 4,974 1,019

Minority interest (10) -

Profit for the financial year 4,964 1,019

Dividends 5 (710) (722)

Retained profit for the year 4,254 297

Earnings per share

- basic 6 20.09p 4.15p

- fully diluted 6 19.79p 4.14p

- basic before exceptional finance credit and credit for prior year tax

losses 6 6.04p 4.15p

All amounts derive from continuing activities.

AUDITED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE YEAR ENDED 31 DECEMBER 2004

2004 2003

#000 #000

Profit for the financial year 4,964 1,019

Gain/(loss) on foreign currency translation 11 (240)

Total recognised gains and losses relating to the year 4,975 779

AUDITED CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2004

2004 2003

Restated

(note 1)

#000 #000

Fixed assets

Intangible assets 3,951 3,953

Tangible assets 3,231 2,631

Investment 100 100

7,282 6,684

Current assets

Stocks 355 312

Debtors 13,991 13,080

Property held for resale 504 504

Cash at bank and in hand 3,499 4,346

18,349 18,242

Creditors - amounts falling due within one year (11,955) (17,518)

Net current assets 6,394 724

Total assets less current liabilities 13,676 7,408

Creditors - amounts falling due after more than one year (2,108) (152)

Net assets 11,568 7,256

Capital and reserves

Called up share capital 495 493

Share premium 3,826 3,780

Merger reserve 945 945

Own shares (Employee Share Ownership Plan) (335) (324)

Capital redemption reserve 10 10

Profit and loss account 6,611 2,346

Shareholders' funds - equity interests 11,552 7,250

Minority interest 16 6

11,568 7,256

AUDITED CONSOLIDATED CASHFLOW STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 2004

2004 2003

#000 #000

Net cash inflow from operating activities 3,688 4,151

Returns on investments and servicing of finance (176) (206)

Taxation paid (1,439) (1,067)

Capital expenditure and financial investment (2,308) (1,262)

Equity dividends paid (721) (597)

Cash (outflow)/inflow before financing (956) 1,019

Financing 311 (170)

(Decrease)/increase in cash in the year (645) 849

2004 2003

#000 #000

Reconciliation of net cash flow to movement in net funds/(debt)

(Decrease)/increase in cash in the year (645) 849

Cash (outflow)/inflow from debt and lease financing (486) 185

Change in net funds/(debt) resulting from cash flows (1,131) 1,034

Finance leases (88) (278)

Exceptional finance credit 2,665 -

Foreign currency translation 21 (133)

Movement of net funds/(debt) in the year 1,467 623

Net debt at 1 January 2004 (350) (973)

Net funds/(debt) at 31 December 2004 1,117 (350)

NOTES TO THE PRELIMINARY STATEMENT OF AUDITED RESULTS

1. Accounting Policies

The preliminary announcement has been prepared using accounting policies

that are consistent with the policies detailed in the financial statements for

the year ended 31 December 2003 except as detailed below:

Changes in accounting policy and presentation

Software development costs

Development costs were previously charged to the profit and loss account when

incurred. Anticipating the adoption of International Financial Reporting

Standards the group changed its policy and now capitalises expenditure on

software development which will provide long term commercial benefits. Software

development costs capitalised in the period to 31 December 2004 amounted to

#581,000. This change in accounting policy has had no effect on the results for

the previous year.

UITF Abstracts adoption

The Group policy for accounting and presentation of share schemes was changed

during the year ended 31 December 2004 to comply with UITF Abstract 17 (Revised

2003) "Employee Share Schemes" and UITF Abstract 38 "Accounting for ESOP Trusts

". The impact was to reduce fixed assets investments and shareholders' funds by

#324,000 at 31 December 2003.

The consolidated profit and loss account for the year ended 31 December 2003 has

not been restated as the effect is not material.

2. Segmental information

2004 2004 2004 2003 2003 2003

Operating Operating Restated

Turnover Profit/(loss) Net assets Turnover Profit/(loss) assets net

#000 #000 #000 #000 #000 #000

Professional Business 37,269 3,801 4,810 34,122 4,595 3,259

Services

Software Solutions 12,976 *(1,717) 363 12,523 (1,527) (165)

Stock and Inventory 19,723 **851 1,332 15,812 (374) 1,328

Services

69,968 2,935 6,505 62,457 2,694 4,422

Cash 3,499 4,346

Proposed dividend (481) (492)

Other 2,045 (1,020)

Net assets 11,568 7,256

*The operating loss for Software Solutions includes goodwill amortisation of

#506,000 (2003: #506,000).

**The operating profit for Stock and Inventory Services includes goodwill

amortisation of #42,000 (2003: #45,000).

3. Exceptional Finance Credit

The finance credit of #2,455,000 (net of associated costs) has arisen on the

early renegotiation of the Group's third party borrowings in relation to the

acquisition of Timeless SA in 2000. The directors have no present intention of

selling the subsidiary, but if it were to be sold prior to 18 November 2007 a

payment of a share of the sale consideration to a maximum of Euro3,000,000 would

arise.

4. Tax on profit on ordinary activities

2004 2003

#000 #000

Current tax

UK corporation tax at 30% (2003: 30%) 897 1,490

Foreign tax 75 44

972 1,534

Adjustments in respect of prior years (970) 97

Total current tax 2 1,631

Deferred tax

Origination and reversal of timing differences 238 (162)

Total deferred tax 238 (162)

Total tax on profit on ordinary activities 240 1,469

The adjustments in respect of prior years of #970,000 includes #1,017,000 which

is the benefit of prior year dual residence tax losses.

5. Dividend

A final dividend of 2p (2003: 2p) per Ordinary Share has been proposed, which is

in addition to the interim dividend of 1p (2003: 1p). The ex-dividend date is

1 June 2005, the record date 3 June 2005 and the date payable 30 June 2005.

The Employee Share Ownership Plan (ESOP) has waived any entitlement to the

receipt of dividends in respect of its entire holding of the company's ordinary

shares. As at 31 December 2004 the ESOP held 700,271 shares (2003: 692,212)

with a nominal value of 2p each.

6. Earnings per share

2004 2003

Earnings per share - basic

Profit attributable to shareholders - #000 4,964 1,019

Average number of ordinary shares of 2p each in issue during the year 24,708,768 24,559,471

Earnings per share - fully diluted

Profit attributable to shareholders - #000 4,964 1,019

Average number of ordinary shares of 2p each in issue during the year after

allowing for the exercise of outstanding share options 25,077,304 24,595,162

Earnings per share - basic before exceptional finance credit and credit for

prior year tax losses

Profit attributable to shareholders - #000 1,492 1,019

Average number of ordinary shares of 2p each in issue during the year 24,708,768 24,559,471

7. The financial information does not constitute the statutory accounts

of the Company as defined by section 240 of the Companies Act 1985. It is an

extract from the accounts for the year ended 31 December 2004, which have not

yet been filed with the Registrar of Companies. The auditors' report was

unqualified. The auditors' report does not contain a statement under either

Section 237(2) or (3) of the Companies Act 1985. The group's auditors have

reported on the accounts as required by Section 235 of the Companies Act 1985.

The financial information in respect of the year ended 31 December 2003 has been

abridged from the published group accounts for which an unqualified audit report

was issued and did not contain any statements under Section 237(2) or (3) of the

Companies Act 1985 and which have been filed with the Registrar of Companies.

8. The Report and Accounts are scheduled to be posted to shareholders in

early May. The Annual General Meeting of the Company is scheduled to take

place at 10.00 am on Tuesday 28 June 2005 at:

39 Victoria Street

London SW1H 0EU

CHRISTIE GROUP PLC

Group Companies

Christie Group www.christiegroup.com

Christie Group plc, the holding company for the Group's trading businesses, is

listed on the International Stock Exchange, London.

PROFESSIONAL BUSINESS SERVICES

BUSINESS SALES AND VALUATIONS, CONSULTANCY, FINANCIAL SERVICES

The expertise offered by Christie & Co and Christie First covers all aspects of

valuing, buying, selling, financing and insuring a wide variety of businesses.

Its scope is complemented by the comprehensive appraisal and project management

services available from Pinders.

Christie & Co www.christie.com

The leading firm of surveyors, valuers, consultants and agents specialising in

the leisure, care and retail sectors. International operations based in

London, Paris, Frankfurt and Barcelona. Offices throughout the UK with

valuation, agency, development and investment teams focused on its key sectors.

Christie First www.christiefirst.com

The market leader in finance and insurance for the leisure, care and retail

sectors. Services include finance for business purchase or re-financing

arranged in conjunction with major financial institutions, and the provision of

tailored insurance schemes.

Pinders www.pinders.co.uk and www.pinderpack.com

The UK's leading independent specialist business appraisal company, undertaking

valuations, consultancy, building surveying, project management and professional

services for a broad range of clients in the leisure, care and retail sectors.

SOFTWARE SOLUTIONS

EPOS AND HEAD OFFICE SYSTEMS

The two arms of VcsTimeless specialise in sophisticated IT systems and solutions

designed to capture and control the complex sales data connected with the

management of cinemas, hotels, restaurants, leisure complexes, warehouses and

retail outlets internationally.

VcsTimeless (Hospitality) www.vcstimeless.com

Specialists in software for leisure and hospitality businesses internationally,

including cinemas, visitor attractions, pubs, hotels and restaurants. Solutions

include EPoS, chip and pin, stock control, back office, head office and

ticketing software.

VcsTimeless (Retail) www.vcstimeless.com

Leading specialist in integrated software solutions and related services for the

retail industry - including fashion, sports and home improvements - dedicated to

single and multi-channel retailers. Solutions include head office, in-store,

chip and pin, manufacturing and retail business intelligence software.

STOCK AND INVENTORY SERVICES

STOCK AND INVENTORY CONTROL

Orridge and Venners are the leading specialists in stock control and inventory

management systems. Employing state-of-the-art technologies and bespoke

software, the division is focused on Europe, where both companies have a major

share of the retail and leisure sectors.

Orridge www.orridge.co.uk

Europe's longest established stocktaking business specialising in all fields of

retail stocktaking including high street, warehousing and factory. In

addition, it has a specialised pharmacy division providing data capture

stocktaking services. A full range of stocktaking and inventory management

solutions is provided for a wide range of clients in the UK and Europe.

Venners www.venners.com

Leading supplier of stocktaking, inventory, control audit and related stock

management services to the hospitality and retail sectors. Bespoke software

and systems enable real time management reporting to its customer base using the

most up-to-date technology.

***

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UNUWRVORSRAR

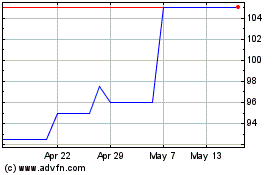

Christie (LSE:CTG)

Historical Stock Chart

From May 2024 to Jun 2024

Christie (LSE:CTG)

Historical Stock Chart

From Jun 2023 to Jun 2024