TIDMCSSG

RNS Number : 0933E

Croma Security Solutions Group PLC

09 March 2022

Croma Security Solutions Group Plc

("CSSG", "Croma", "the "Company" or the "Group")

Interim Results

A Solid First Half

Croma Security Solutions Group plc (AIM:CSSG), the total

security services provider is pleased to announce its unaudited

interim results for the six months to 31 December 2021.

Financial Highlights:

-- A good performance in a challenging market

-- Continued steady demand for the Company's security solutions

-- Revenues up by 9% to GBP17.87m (H1 2020: GBP16.36m)

-- Generating EBITDA of GBP0.87m (H1 2020: GBP0.86m)

-- Other than lease liabilities, the Group remains ungeared with

cash balances of GBP3.5m (31 December 2020: GBP3.9m)

-- No interim dividend declared, however the Board expect to pay

a final dividend once the financial year has been completed

Operational Highlights: Expansion of Security Store Portfolio

and New Technology led Partnerships

-- Acquired Manchester based security store in November 2021 and

further opportunities in the pipeline

-- Systems and Locksmiths businesses increased revenues by 16%

despite closing security stores during Covid-19 restrictions

-- In October 2021, announced the Group is the UK strategic

partner for iLOQ, a leading Finnish security business

-- In January 2022, post the period end, the Group announced a

new strategic partnership with Fingo a biometric identity

authentication and payments platform

PROception leading the way for modern security solution

-- Croma PROception the ground-breaking front of house business,

which combines reception and security is establishing a new

standard in building security

-- Overall, manned guarding revenues increased by 8% alongside

offering increased optionality over a wider range of security

solutions

Outlook

-- Second half trading has started well and therefore the Board

believes the business is well placed to deliver a good a trading

performance for the year.

Sebastian Morley, Chairman of CSSG, said: "We are pleased to

have delivered a good performance amidst a challenging market.

Demand from our client base was steady which given the disruption

caused by the pandemic was a solid performance. We completed the

acquisition of a new security store in Manchester, and we believe

we have a good pipeline of further opportunities. Similarly, we see

opportunity in technology led areas such as the tie up with

Biometric expert Fingo and iLOQ the specialist locks business.

Overall, the business is well placed, our balance sheet is strong,

our core businesses are profitable and cash generative and we are

adding to them with bolt on acquisitions and through partnerships

with technology leaders ."

For further information visit www.cssgroupplc.com or

contact:

Croma Security Solutions Group Plc Tel: +44 (0)7768 006 909

Sebastian Morley (Chairman)

WH Ireland Limited Tel: +44 (0)207 220 1666

(Nominated Adviser and Broker)

Mike Coe

Jessica Cave

Sarah Mather

Novella Tel: +44 (0)203 151 7008

Tim Robertson

Fergus Young

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Chairman's Statement

Introduction

I am pleased to report Croma's unaudited interim results for the

six months to 31 December 2021 which saw the Group generate

revenues of GBP17.87 million and EBITDA of GBP0.87 million. A good

performance in a challenging market during which we managed any

change caused by the pandemic and continued to deliver

uninterrupted guarding services for the buildings, assets and

individuals under our protection. Alongside this, the Company

continued to focus on expanding our services and asset base in

pursuit of our objective of establishing Croma as the British

security brand.

Group strategy

Our overall strategy remains focused on:

-- setting new standards in providing premium guarding services,

community awareness schemes and innovative front of house solutions

under the Croma Vigilant and PROception brands;

-- building a national network of Croma Security Centres,

through which all the Group's services are sold; and

-- becoming the British security brand.

Like many businesses, as restrictions associated with the

pandemic recede, we can reflect on what we have learnt from

operating under Covid-19 and have a better understanding of the

flexibility of our teams, operating structures and have uncovered

additional efficiencies all of which we are feeding into the

business and will further support the Company in achieving its

objectives.

With the deeply saddening events unfolding in Ukraine coupled

with the visible inflationary cost increases, all businesses will

need to adapt. While Croma is reasonably positioned to manage

inflationary cost increases, it is likely some customers will be

impacted and may well look to reduce the costs of their security

solutions. Anticipating this, Croma Vigilant has introduced a wider

range of security solutions with more flexible cost structures.

Longer term, the prospects look unchanged for the Group. The UK

security market continues to be made up of a large number of

smaller enterprises laying the ground for the Group to act as a

consolidator. In the period, the Company completed the acquisition

of a security store in Manchester and there is a good pipeline of

similar opportunities.

The macro security trends also remain unchanged; individuals,

government and business all want to ensure their safety and that of

their assets. Security attacks are increasing and have become more

sophisticated. Consequently, technology is a central part of our

security solutions, and to keep ahead we are significantly evolving

our offer every year. That said, at the heart of all of Croma's

security solutions is a strong military ethos and a focus on

security personnel being a part of a premium service in which

individuals are well trained, well-motivated and well paid. The

combination of a strong team and leading technology continues to

prove to be a compelling commercial proposition.

Croma Vigilant

Croma Vigilant is the largest part of our business providing

manned guarding for assets and individuals. Employing over 950

high-grade security personnel throughout the UK and continued to

deliver an uninterrupted service throughout the period under review

despite the restrictions and staff isolation required to comply

with Covid-19 related rules.

The adaptability of the whole team has been very impressive

coupled with excellent operational organisation. There is no doubt

the pandemic has shown the division what it is capable of, if

required. Croma Vigilant's point of differentiation is that it

offers a premium security solution in all aspects and has built a

successful business based on this proposition. That said, more

recently due to rising cost pressures on customers, it is providing

the same premium manned guarding services but on a more flexible

basis. For example, replacing a 24-hour guarding service of an

office building with regular patrol visits. This flexibility is

important to retain and meet the full range of our customers' needs

and budgets.

Improving on the traditional security offering is fundamental to

the success of the business. The introduction and subsequent demand

for the PROception service is an excellent example of the Group

leading the way for modern security solutions. Making the reception

desk part of a building's security solution has improved the

appearance of the security team, introduced a more technology led

solution and created economies of scale with reception duties being

combined with security. The success of this new modern guarding

concept is reflected in the strong customer demand.

Reflecting the prevailing trends in the market, an increasing

proportion of this division's income is now contracted which

increases visibility over future earnings and enhances our ability

to invest for the future.

Croma Systems & Locksmiths

Croma Systems & Locksmiths, the provider of a range of

innovative security technology services including CCTV, Intruder

Alarms, FastVein (Biometrics) and high security locks, delivered a

resilient performance.

The division now operates through 11 security centres with one

added following the acquisition of a site in Manchester in October

2022. The security centres are all operating under the Croma brand

and are marketing, under one roof, the entire range of the Group's

services.

The Company has also formed two new strategic partnerships both

of which have significant future potential.

In October 2021, the Company announced it had agreed to be the

UK strategic partner for iLOQ, a leading Finnish security business.

Specialising in locks, iLOQ has developed a new battery free door

lock which can be opened by smartphone. The lock is powered by the

mobile phone opening it, a unique feature clearly differentiating

it from competing products. The potential applications for the

mobile iLOQ are significant across multiple industries given its'

advantages relating to security, data collection and central

control. Under the partnership, Croma will sell, install and

maintain iLOQ equipment in the UK.

In January 2022, the Company announced a new strategic

partnership with FinGo, a biometric identity authentication and

payments platform. The Company's existing biometrics solution,

FASTVEIN(TM) which provides quick, easy to use, accurate and

cost-effective identity management, is a natural fit with FinGo.

Working together will allow Croma to expand its product suite to

include payments alongside existing identity and access control

offerings in these sectors. This partnership will also expand

FinGo's digital identity management and payment expertise to

include access management.

Financial Review

Revenue increased by 9% for the six months to 31 December 2021

to GBP17.87m (H1 2020: GBP16.36m). Cash balances at 31 December

2021 are GBP3.5m (30 December 2020: GBP3.9m). Earnings per share

increased 13.8% to 2.97p per share (H1 2020: 2.61p).

Other than lease and short-term trading liabilities, the Group

remains free from borrowings.

Dividend

The Board has decided to maintain the decision to not pay an

interim dividend and instead to consider the payment of a single

final dividend, allowing the business to complete the financial

year before deciding on the level of the dividend to be paid for

the 12-month period. This maintains a slightly more prudent

approach, started during the pandemic, and now reflecting the

continuation of challenging market conditions.

Outlook

Looking ahead, we believe the business is well placed with no

long-term borrowings and GBP3.5m of cash to support future

investment. All business units are performing well and we are

seeing opportunities to expand organically and via acquisition.

Sebastian Morley

Chairman

9 March 2022

CROMA SECURITY SOLUTIONS GROUP PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR 6 MONTHSED 31 DECEMBER 2021

6 months 6 months Year

ended ended ended

31-Dec-21 31-Dec-20 30-Jun-21

unaudited unaudited audited

Notes GBP000s GBP000s GBP000s

Revenue 17,869 16,362 32,539

Cost of sales (14,431) (13,560) (27,154)

----------

Gross profit 3,438 2,802 5,385

Administrative expenses (2,936) (2,676) (4,898)

Other operating income 62 377 764

---------- ----------

Operating profit 564 503 1,251

Analysed as:

Earnings before interest, tax, depreciation,

impairment, and amortisation of intangible

assets 866 863 1,982

Impairment - - -

Amortisation (45) (83) (166)

Depreciation (257) (277) (565)

Operating profit 564 503 1,251

Finance costs (24) (24) (40)

Profit before tax 540 479 1,211

Tax (97) (91) (234)

Profit/(loss) for the year from continuing

operations 443 388 977

Profit and total comprehensive income

for the period attributable to owners

of the parent 443 388 977

Earnings per share 3

Basic and diluted earnings/(loss)

per share (pence) from continuing

operations 2.97 2.61 6.56

CROMA SECURITY SOLUTIONS GROUP PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2021

31-Dec-21 31-Dec-20 30-Jun-21

unaudited unaudited audited

GBP000s GBP000s GBP000s

Assets

Non-current assets

Goodwill 6,464 6,454 6,454

Other Intangible assets 246 373 290

Property, plant and equipment 1,433 535 488

Right-of-use assets 894 943 997

9,037 8,305 8,229

Current assets

Inventories 800 620 681

Trade and other receivables 6,047 5,440 5,097

Cash and cash equivalents 3,509 3,879 5,433

10,356 9,939 11,211

Total assets 19,393 18,244 19,440

Liabilities

Non-current liabilities

Deferred tax (88) (116) (91)

Lease liabilities (586) (685) (753)

(674) (801) (844)

Current liabilities

Trade and other payables (5,844) (5,353) (5,925)

Borrowings and Lease liabilities (352) (301) (293)

(6,196) (5,654) (6,218)

Total liabilities (6,870) (6,455) (7,062)

Net assets 12,523 11,789 12,378

========== ========== ==========

Issued capital and reserves attributable

to owners of the parent

Share capital 794 794 794

Treasury shares (399) (399) (399)

Share premium 6,133 6,133 6,133

Merger reserve 2,139 2,139 2,139

Capital redemption reserve 51 51 51

Retained earnings 3,805 3,071 3,660

Total equity 12,523 11,789 12,378

========== ========== ==========

CROMA SECURITY SOLUTIONS GROUP PLC

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR 6 MONTHSED 31 DECEMBER 2021

6 months 6 months Year

ended ended ended

31-Dec-21 31-Dec-20 30-Jun-21

unaudited unaudited audited

Notes GBP000s GBP000s GBP000s

Cash flows from operating activities

Profit before taxation 540 479 1,211

Depreciation, amortisation and impairment 314 360 731

(Profit) on sale of property, plant

and equipment (12) (4) (19)

Net changes in working capital 4 (1,017) (420) 374

Financial expenses 24 24 40

Corporation tax paid (131) (72) (182)

Net cash (used)/generated from operations (282) 367 2,155

Cash flows from investing activities

Purchase of business including acquisition

costs net of cash

acquired (137) - -

Purchase of property, plant and equipment (1,093) (65) (138)

Proceeds on disposal of property, plant and

equipment 18 8 28

Net cash used in investing activities (1,212) (57) (110)

Cash flows from financing activities

Payments to reduce lease liabilities (123) (213) (408)

Increase/(reduction) in borrowings (1) 3 11

Dividends paid (298) (291) (291)

Interest paid (8) (6) -

Net cash used in financing activities (430) (507) (688)

Net (decrease)/increase in cash and

cash equivalents (1,924) (197) 1,357

Cash and cash equivalents at beginning

of period 5,433 4,076 4,076

Cash and cash equivalents at end of

the period 3,509 3,879 5,433

CROMA SECURITY SOLUTIONS GROUP PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital

Share Treasury Share Merger Redemption Retained Total

Capital Shares Premium Reserve Reserve Earnings Equity

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

Balance at 1 July 2021 794 (399) 6,133 2,139 51 3,660 12,378

Profit for the period - - - - - 443 443

Dividends paid - - - - - (298) (298)

At 31 December 2021 794 (399) 6,133 2,139 51 3,805 12,523

========= ========= ========= ========= ============ ========== ========

Balance at 1 July 2020 794 (399) 6,133 2,139 51 2,974 11,692

Profit for the period - - - - - 388 388

Dividends paid - - - - - (291) (291)

Balance at 31 December

2020 794 (399) 6,133 2,139 51 3,071 11,789

========= ========= ========= ========= ============ ========== ========

Balance at 1 July 2020 794 (399) 6,133 2,139 51 2,974 11,692

Profit for the year - - - - - 977 977

Dividends paid - - - - - (291) (291)

Balance at 30 June 2021 794 (399) 6,133 2,139 51 3,660 12,378

========= ========= ========= ========= ============ ========== ========

NOTES TO THE INTERIM FINANCIAL STATEMENTS FOR 6 MONTHS TO 31

DECEMBER 2021

1. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the UK. IFRS is subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and the IFRS

Interpretations Committee and there is an ongoing process of review

and endorsement by the UK Endorsement Board. The financial

information has been prepared on the basis of IFRS that the

Directors expect to be adopted by the UK and applicable as at 30

June 2022. The Group has chosen not to adopt IAS 34 "Interim

Financial Statements" in preparing the interim financial

information.

Statutory accounts

Financial information contained in this document does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 ("the Act"). The statutory accounts for the

year ended 30 June 2021 have been filed with the Registrar of

Companies. The report of the auditors on those statutory accounts

was unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under section 498(2) or

(3) of the Act.

The financial information for the six months ended 31 December

2021 and 31 December 2020 is unaudited.

2. Accounting policies

The accounting policies applied by the Group in this interim

report are the same as those applied by the Group in the

consolidated financial statements for the year ended 30 June

2021.

A number of other new and amended standards and interpretations

are effective from 1 January 2021 but they do not have a material

effect on the Group's financial statements.

3. Earnings per share

Earnings per share is based upon the profit for the period and

the weighted average number of shares in issue and ranking for

dividend.

The following reflects the profit and share data used in the

basic and diluted EPS computations:

6 months 6 months Year

ended ended ended

31-Dec-21 31-Dec-20 30-Jun-21

Numerator

Profit/(loss) for the year on continuing

operations and used in EPS (GBP000s) 443 388 977

Denominator

Number of shares (thousands)

Weighted average number of shares

used in basic and diluted EPS 14,902 14,902 14,902

4. Note supporting the cash flow statement

6 months 6 months Year

ended ended ended

31-Dec-21 31-Dec-20 30-Jun-21

unaudited unaudited audited

GBP000s GBP000s GBP000s

Net changes in working capital

(Increase)/Decrease in inventories 17 144 61

(Increase)/decrease in trade and other

receivables (895) (905) 1,628

Increase in trade and other payables (138) 341 9

(1,017) (420) 1,698

5. Financial Information

The Board of Directors approved this interim report on 9 March

2022.

A copy of this report can be obtained by writing to the Finance

Director at our registered office; Unit 7 & 8, Fulcrum 4,

Solent Way, Whiteley, Hampshire PO15 7FT or from our website at

www.cssgroupplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DVLFBLXLLBBX

(END) Dow Jones Newswires

March 09, 2022 02:00 ET (07:00 GMT)

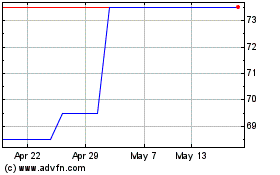

Croma Security Solutions (LSE:CSSG)

Historical Stock Chart

From Sep 2024 to Oct 2024

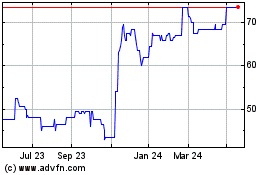

Croma Security Solutions (LSE:CSSG)

Historical Stock Chart

From Oct 2023 to Oct 2024