TIDMCRV

RNS Number : 3629Q

Craven House Capital PLC

29 February 2016

29 February 2016

Craven House Capital Plc ("Craven House" or "the Company")

Interim Report for the period ended 30 November 2015

Highlights

-- Net Asset Value was GBP4.6m compared to GBP4.7m at the year ending May 2015.

For further information please contact:

Craven House Capital Plc Tel: 020 7002 1027

Alexandra Eavis

Company Secretary

www.Cravenhousecapital.com

SPARK Advisory Partners Tel: 0203 368 3550

Limited

Nominated Adviser

Matt Davis/Mark Brady

www.Sparkadvisorypartners.com

CHAIRMAN'S STATEMENT

As an investment company with a variety of assets located in the

emerging markets, we have spent this period focusing on evaluating

our current portfolio companies' ability to withstand the current

market turmoil whilst at the same time conducting a thorough review

of the emerging market economic landscape.

While some of our portfolio companies in South Africa and Brazil

have been battered by rapidly falling currencies, political scandal

and capital flight, we have been impressed by their overall

resilience. Our NAV has dipped marginally as a result of currency

fluctuation but overall we believe our existing investments will

weather this storm and come out the other side as stronger

companies better prepared for future expansion. While we do not see

any imminent exits we are comfortable holding on to our positions.

Perhaps more importantly our strategic review has led us to the

conclusion that once in an economic cycle opportunities are now

available in emerging markets and we intend to increase both our

capacity to invest and our exposure to markets and companies whose

valuations have been reduced dramatically over the past year. While

we know we are incapable of calling a bottom or predicting the near

future, we do believe that the next year or two will present

excellent opportunities to enter or increase our presence in

markets with cyclically low entry points. To this end, during the

period, we announced a new GBP30m structured stock subscription

agreement with GEM and have recently announced our intention to

raise further new capital. Whilst there can be no guarantee that

any capital investment will be made, discussions with prospective

new investors continue to progress well.

Emerging markets are sensitive to a number of variables. Our

view is that the two most important variables after political

stability and the rule of law are international capital flows and

commodity prices. Our assessment is that in many markets the

adherence to the rule of law and political stability are rising

while capital flight is increasing and falling commodity prices are

accelerating. Capital flight is painful for emerging economies.

During the great commodity bull run many emerging economies

benefited from inward capital flows. These include foreign currency

denominated purchases of raw materials as well as financial capital

flooding the local markets in search of growth, higher interest

rates or in many cases the pursuit of a "riskless carry trade".

Investors and speculators alike poured dollars, euros and pounds

into Brazil, Angola, and Nigeria to the point that, as recently as

two years, ago all three governments had policies designed to stop

or slow the flow of capital into their economies for fear of

domestic inflation. Now these very same countries are desperate to

shore up their reserves and prop up their currencies.

This situation is further exacerbated by the modern financial

services industry's fixation on indexing and asset allocation.

Capital aggregators and allocators in distant lands, together with

their clients, determine their exposure to "emerging markets" based

as much on headlines as economics. If emerging market funds managed

in Chicago and Edinburgh are hit with redemptions from its

customers it effects the valuation of shares listed in Lusaka, Rio

and Nairobi. If hundreds of hedge funds borrow Yen to buy Niara,

Kwansa and Reals and then the carry trade unravels small businesses

in Legos, Luanda and Rio feel the pain as their access to capital

dries up. While the economy may slow marginally, the capital

available for transactions, expansion and day-to-day business dries

up at a much faster rate than the changes in the underlying economy

necessitate.

In the past year a slowdown in China and resulting commodity

price collapse combined with the expectation that the United States

Federal Reserve Board will raise interest rates resulted in a rapid

exodus of capital from many emerging markets. In several markets

the stock market multiples have cratered while the currencies

collapsed in dollar terms. This means that companies are selling at

much lower multiples while the cost of buying the shares in local

currency has dropped dramatically. The valuation of private

companies has been even further constrained by the lack of

liquidity in the marketplace.

If an investor entered the market at or near the top it is a

painful period. However, a new investor with fresh capital is now

presented with a plethora of buying opportunities. Our view is that

many emerging economies have experienced an overdue and well

deserved correction. Institutional capital spent the last decade

chasing emerging market growth and yield with free money provided

by developed world policy makers. Over a decade billions flooded

into markets ill equipped to withstand the onslaught of hot capital

while the commodity bull market raged on. These same economies were

even less equipped to handle the capital flight, which withdrew

from the market much faster than it entered. Everyone from finance

ministers to shopkeepers have been caught up in the riptide of

capital flight. We believe this has created a once in thirty-year

opportunity to invest in good companies.

Craven House is at its core a deep value investor.

-- .

CRAVEN HOUSE CAPITAL PLC

INCOME STATEMENT

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2015

Six months ended Year

Ended

30 Nov 30 Nov 31 May

2015 2014 2015

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

CONTINUING OPERATIONS

Gross Portfolio return (38) (469) (705)

Administrative expenses (80) (96) (227)

OPERATING (LOSS) (118) (565) (932)

Finance costs 2 (9) (8) (27)

Finance income 5 28 48

------------ ------------ ----------

(LOSS) BEFORE INCOME

TAX (122) (545) (911)

Income tax - - -

------------ ------------ ----------

(LOSS) FOR THE PERIOD (122) (545) (911)

============ ============ ==========

Earnings per share

expressed

In pence per share:

Basic and diluted 6 (0.02) (0.07) (0.11)

STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2015

Six months ended Year

Ended

30 Nov 30 Nov 31 May

2015 2014 2015

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

(LOSS) FOR THE PERIOD (122) (545) (911)

OTHER COMPREHENSIVE - - -

INCOME

TOTAL COMPREHENSIVE

INCOME FOR THE PERIOD (122) (545) (911)

============ ============ ==========

CRAVEN HOUSE CAPITAL PLC

STATEMENT OF FINANCIAL POSITION

AS AT 30 NOVEMBER 2015

Six months ended Year

Ended

30 Nov 30 Nov 31 May

2015 2014 2015

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Investments at fair

value through

profit or loss 4 4,635 5,626 4,673

------------ ------------ ----------

4,635 5,626 4,673

------------ ------------ ----------

CURRENT ASSETS

Trade and other receivables 337 116 312

Cash and cash equivalents 146 296 217

------------ ------------ ----------

483 412 529

------------ ------------ ----------

TOTAL ASSETS 5,118 6,038 5,202

============ ============ ==========

EQUITY

SHAREHOLDERS' EQUITY

February 29, 2016 02:23 ET (07:23 GMT)

At the period end the Company held shares in Royalty Sports

Brands Limited as included in unquoted investments. Mark Pajak was

a Director of Royalty Sports Brands Limited during the period.

At the period end, included in other receivables, is an amount

of GBP220,540 owed to the Company by Royalty Sports Brands

Limited.

Investment in Pressfit Holdings Plc

At the period end the Company held shares in Pressfit Holdings

Plc and a convertible loan was owed to the Company, both of which

were included in unquoted investments. Mark Pajak was Chairman of

Pressfit Holdings Plc during the year

9. EVENTS AFTER THE REPORTING PERIOD

On 5 February 2016 it was announced that Miss A N Eavis had

resigned from the Board of Directors with immediate effect and was

to be replaced with Mr C Morrison. Miss Eavis will remain as

Company Secretary.

On 5 February 2016, at a General Meeting, various resolutions

were passed which approved an increase in the authorised share

capital of the Company.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QQLFLQLFBBBL

(END) Dow Jones Newswires

February 29, 2016 02:23 ET (07:23 GMT)

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Jun 2024 to Jul 2024

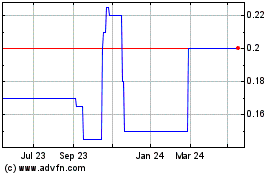

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Jul 2023 to Jul 2024