Crystal Amber Fund Limited Monthly Net Asset Value

October 16 2019 - 2:00AM

UK Regulatory

TIDMCRS

16 October 2019

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value

Crystal Amber Fund announces that its unaudited net asset value ("NAV") per

share at 30 September 2019 was 222.31 pence (31 August 2019: 224.06 pence per

share).

The proportion of the Fund's NAV at 30 September 2019 represented by the ten

largest shareholdings, other investments and cash (including accruals), was as

follows:

Ten largest shareholdings Pence per share Percentage of investee equity

held

Hurricane Energy plc 46.2 5.2%

Northgate plc 38.2 8.2%

Equals Group plc 35.2 21.6%

GI Dynamics Inc. 30.6 71.4%**

De La Rue plc 16.8 6.9%

STV Group plc 12.7 8.3%

Allied Minds plc 9.3 6.9%

Leaf Clean Energy Co 6.6 25.3%

Board Intelligence Ltd* 5.7 *

Kenmare Resources plc 4.1 1.5%

Total of ten largest shareholdings 205.4

Other investments 16.4

Cash and accruals 0.5

Total NAV 222.3

*Board Intelligence Ltd is a private company and its shares are not listed on a

stock exchange. Therefore, the percentage held is not disclosed.

** Following the exercise of warrants on 30 September.

Investment adviser's commentary on the portfolio

Over the quarter to 30 September 2019, NAV per share fell by 10.8%, or 9.8%

adjusting for the 2.5p dividend paid in August.

The top three positive contributors to NAV growth over the quarter to 30

September 2019 were GI Dynamics Inc (2.5%), Leaf Clean Energy Co (1.0%) and STV

Group plc (0.5%). Top detractors were Equals Group plc (-6.0%), Hurricane

Energy (-4.0%) and De La Rue plc (-1.9%).

Hurricane Energy plc ("Hurricane")

Since achieving first oil on 4 June 2019, the company has been producing from

its two Lancaster wells. The reservoir has performed at the higher end of

expectations. Initiatives are under way to increase production over the next

two years. For example, the reactivation of the gas compression system will

enable gas export and increase the production vessel's throughput.

Over the period, Hurricane drilled and tested two new wells at its Great

Warwick Area, funded by Spirit Energy as part of their farm out deal. The

Warwick Deep found hydrocarbons in the target fractured rock, but oil did not

flow at commercial rates. The Lincoln Crestal produced oil at commercial rates

and will be tied back in 2021 to the Lancaster Early Production System (EPS).

This will allow production appraisal and generate additional cash flows at

little additional capital expenditure. One final exploration well is currently

underway.

The excellent results from the EPS have materially de-risked the company.

Whilst the Fund is disappointed that Hurricane's shares fell by 18.9% over the

period, we are encouraged by management's focus on growing cash flows. The

operational initiatives in progress and the addition of the Lincoln Crestal

well to the EPS could see production grow from 2020's guidance of 17k barrels

of oil per day to 30k in 2021. Assuming an oil price of US$60 per barrel, the

base case guidance for operating cash flow could grow from $200m in 2020 to

$300m in 2021. In our view, those cash flows will underpin the optionality that

Hurricane will have to plan its future development.

Northgate

Having instigated the departure of previous Chairman Andrew Page, the Fund

welcomes the appointment of Avril Palmer-Baunack as his successor, and her

initiation of a strategic review "focused on clarifying the significant

intrinsic value of Northgate".

At 325p, Northgate's shares trade at a substantial discount to the company's

reported net tangible asset value of 412p per share as at 30 April 2019.

Northgate's well-managed Spanish business, which generates over half of the

group's operating profit, is the clear leader in its market with a strong

brand, good geographic coverage and an attractive return on assets. Its

performance has benefited from a prolonged macroeconomic recovery, unaffected

by Brexit-related uncertainty. Over the course of several years, the

considerable value of the Spanish business has not been reflected in

Northgate's share price, and the Fund believes that the company should now

prioritise releasing the value of this asset.

The Fund believes that Northgate Spain would be particularly attractive to a

number of multinationals currently attempting to increase their presence within

the European flexible vehicle rental market. The business would be worth more

to these companies than it is to Northgate plc and its UK public equity

shareholder base, given synergies such as lower fleet financing costs, ability

to grow an established flexible rental platform across a larger geographic

market, operational flexibility to move and dispose of vehicles across several

left-hand drive countries, and vehicle procurement savings.

Over the last three years, Northgate Spain has delivered an average ROCE of

11.6%. Northgate considers its post-tax cost of capital to be 5.5%, which is

higher than those of its larger and more diversified peers able to operate with

greater leverage. If the Spanish business were worth to an acquirer a

conservative 30% premium to net asset value (equating to a premium of 16% to

total asset value), then a disposal could release over GBP300m of proceeds net of

debt repayments. At the current share price, investors in Northgate would then

be paying less than one third of net asset value for the residual UK and

Ireland businesses.

Over the quarter, Northgate's share price fell by 5.0%, or by 1.6% including

the 12.1p dividend paid.

De La Rue

On 23 July 2019, the UK Serious Fraud Office announced the commencement of an

investigation into De La Rue and its associated persons in relation to

suspected corruption in the conduct of business in South Sudan. This caused the

share price to fall by 22% over the subsequent two days.

Notwithstanding this unwelcome development and the company's disappointing

results announcement, the Fund continues to believe that De La Rue enjoys both

strong competitive positions in high return businesses and a range of

attractive growth opportunities. The company's total order book grew by 20%

over the last financial year and its security features revenue increased by

38%.

In the Fund's view, De La Rue has suffered from very poor leadership and

oversight, which has resulted in an unacceptable financial performance over

many years, despite tailwinds from most of the company's end-markets and the

consequent benefits evidently enjoyed by its competitors.

In recent weeks, a new Chairman and new Chief Executive have been appointed.

There is early evidence that the new Chief Executive will adopt a focused and

sensible approach targeted at rebuilding the value of De La Rue's banknote

business and capitalising on the opportunities presented by its high-growth,

high-margin authentication activities. The new Chairman has also made clear his

determination to ensure that the business adheres to the highest standards and

practices.

De La Rue's pension liabilities were restructured during its 2017/18 financial

year. This, in conjunction with the disposal of two businesses for over GBP100m,

has substantially strengthened the balance sheet. Net debt, adjusting the

latest announced figures for the disposal of International Identity Solutions,

is only GBP66m, which equates to less than one times forecast EBITDA.

De La Rue also has obvious strategic value, as evidenced by the takeover

approach from its competitor Oberthur in 2010, at a valuation of around two

times annual revenue. Crane Currency, another banknote producer, was itself

acquired in 2018 for US$800 million, which also equated to around two times

expected annual revenue. De La Rue is currently trading at an enterprise value

of less than one times expected revenue.

Over the quarter, De La Rue's share price fell by 26.7%, or by 21.2% including

the 16.7p dividend paid.

Allied Minds

On 6 August 2019, HawkEye 360, one of Allied Minds' top-four portfolio

companies, announced it had raised US$70 million at a valuation more than

double its September 2018 round. The Fund believes that this fundraising added

at least 8p to Allied Minds' net asset value per share, after accruing for the

Phantom Plan.

On 24 September 2019, Allied Minds announced the sale of its stake in HawkEye

360 for US$65.6m, which represents the first successful exit in the 13 years

since the company commenced investing. Disappointingly, the sale reduced net

asset value per share by about 3p, as it was discounted by more than 13% from

the valuation of the fundraising agreed one month earlier. Furthermore, despite

having ceased all new company investment activity, Allied Minds' management

proposes to return only half of the proceeds to shareholders. Astonishingly,

the sale will trigger a cash payout of almost US$5m out of the remaining

proceeds to current and former executives of Allied Minds under the Phantom

Plan, despite its shareholders having suffered a drop of around 90% in the

share price over the four years since it first invested in HawkEye 360.

On 4 September 2019, Federated Wireless, another of the top-four portfolio

companies, announced it had raised US$51 million at a valuation more than 20%

higher than its September 2017 round, adding around 3.5p to Allied Minds' net

asset value per share. Federated Wireless received regulatory approval for its

Initial Commercial Deployment on 16 September, allowing it to launch its

Citizens Broadband Radio Service (CBRS) offering and begin to generate

meaningful revenues.

Notwithstanding the recent news regarding HawkEye 360 and Federated Wireless,

the Fund notes that the share price of Allied Minds continues to trade at a

very material discount to its estimated net asset value. Following the closure

of Precision Biopsy (a company that received at least $26m of funding from

Allied Minds) and the disposal of HawkEye 360, the portfolio will consist of

only seven investments, one of which has already been written to zero. This

makes it all the more difficult to comprehend the increase in the company's

guidance for ongoing HQ cash operating costs (which excludes other costs such

as severance, share-based payments and Phantom Plan payouts) from US$5-6m as

announced on 26 April 2019, to US$7.5m as stated on 26 September 2019.

Over the quarter, Allied Minds' share price fell by 27.9%. The Fund believes

that the scale of the share price discount has still not been addressed by the

board of Allied Minds and therefore intends to take appropriate action.

Transactions in Own Shares

During the quarter, the Fund issued 125,000 shares to five charities following

the authority granted at its last Annual General Meeting.

The Fund bought back 1,260,000 of its own ordinary shares at a price of 192.56p

per share during the quarter, as part of its buyback programme.

For further enquiries please contact:

Crystal Amber Fund Limited

Chris Waldron (Chairman)

Tel: 01481 742 742

www.crystalamber.com

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner

Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford

Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

END

(END) Dow Jones Newswires

October 16, 2019 02:00 ET (06:00 GMT)

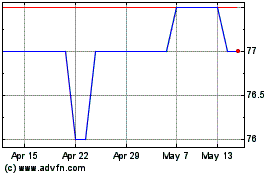

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024