Crystal Amber Fund Limited Monthly Net Asset Value

January 08 2018 - 2:00AM

UK Regulatory

TIDMCRS

8 January 2018

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value

Crystal Amber Fund announces that its unaudited net asset value ("NAV") per

share at 31 December 2017 was 190.69 pence (30 November 2017: 186.55 pence per

share).

The proportion of the Fund's NAV at 31 December 2017 represented by the ten

largest shareholdings, other investments and cash (including accruals), was as

follows:

Top ten shareholdings Pence per share Percentage of investee equity

held

Hurricane Energy plc 49.9 8.0%

Northgate plc 26.9 5.2%

FairFX Group plc 19.0 15.3%

STV Group plc 18.4 14.5%

NCC Group plc 13.4 2.0%

Ocado Group plc 13.2 0.5%

Leaf Clean Energy Co. 10.1 29.9%

Sutton Harbour Holdings plc 7.9 29.3%

GI Dynamics Inc 4.3 46.7%

Camellia plc 2.9 0.9%

Total of ten largest holdings 166.0

Other investments 26.1

Cash and accruals -1.4

Total NAV 190.7

Investment Adviser's commentary on the portfolio

Over the quarter to 31 December 2017, NAV per share decreased by 6.1%. Taking

into account the 2.5p per share dividend accrued during the period, NAV per

share decreased by 4.9%.

The top contributors over the quarter were Ocado Group plc (+1.7%) and FairFX

Group plc (+1.0%). The main detractors were Northgate plc (-1.6%), Leaf Clean

Energy Co. (-1.5%), GI Dynamics Inc (-1.4%) and Hurricane Energy plc (-1.4%).

Hurricane Energy plc ("Hurricane")

Hurricane's share price fell by 5.3% over the quarter. The Fund notes with

regret the circumstances surrounding the resignation of Hurricane's Chairman,

Rob Arnott. The company also announced the establishment of a Listing and

Governance Committee and the appointment of an Interim Chairman. The Fund has

engaged with Hurricane's Board to improve the company's governance and to

release value. The Fund welcomes the company's announcement in December that it

intends to become fully compliant with UK Corporate Governance Code Provision

B.1.2 regarding the appointment of non-executive directors and its statement

that the director nomination processes, succession planning and Board

evaluations are integral parts of a well-functioning, effective Board, and will

form part of the ongoing Board strengthening activities.

In December, the company published an updated Competent Person's Report, which

acted as a positive catalyst for the stock. The report primarily covers the

Halifax, Lincoln and Warwick assets, and raises the estimate of Hurricane's

total 2P Reserves plus 2C Contingent Resources to 2.6 billion barrels of oil

equivalent.

Hurricane remains on track to achieve "first oil" from its Early Production

System at Lancaster in the first half of 2019, and in December it hosted a

visit to the floating production, storage and offloading vessel in Dubai that

will form the basis of the development once its upgrades are complete.

Northgate plc ("Northgate")

At its Capital Markets Day in October, Northgate's new management team laid out

in considerable detail its strategy to return the UK business to growth and its

three-year growth and margin expectations for the UK and Spain. These imply

earnings growth above analyst forecasts. However, the share price fell by

12.1% over the quarter following earnings downgrades after the H1 results,

largely driven by lower forecasts of profit from the sale of vehicles, despite

residual values having remained stable to date.

The Fund is supportive of management's efforts to arrest market share losses in

the UK, optimise the vehicle hire site network, and maximise the opportunity

presented by the Van Monster retail network and brand. In Spain, Northgate is

the clear leader in the LCV flexible hire market, with a strong brand, good

geographic coverage and attractive return on assets - management expects to

achieve >10% CAGR in vehicles-on-hire over the next three years, together with

the consequent further growth in margins.

The Fund believes that the considerable value of Northgate's Spanish business

is not reflected in its share price and that options to release the value of

this asset should be explored, including ways that could preserve procurement

synergies with the UK, e.g. a partial listing in Spain.

Ocado Group plc ("Ocado")

The Fund's investment thesis is based on the returns arising from Ocado's

technology investment (the Ocado Smart Platform ("OSP")) and Ocado's ability to

monetise this through international partnerships. The Fund believes that Ocado

offers a scalable, efficient solution to major food retailers. In November,

Ocado announced its first major international partnership deal for the OSP,

with Casino in France. Ocado's share price increased by 35.7% over the

quarter.

Sutton Harbour Holdings plc ("Sutton Harbour")

On 7 December 2017, the board of Sutton Harbour recommended to its shareholders

a partial cash offer from FB Investors LLP for up to 70% of its share capital,

which concludes the strategic review process undertaken in conjunction with

Rothschild. The Fund has accepted this offer. On 3 January 2018, the partial

offer was declared wholly unconditional. Sutton Harbour's share price increased

by 7.6% over the quarter.

Transactions in Own Shares

Over the quarter, the Fund bought back 322,482 of its own shares at an average

price of 180.1p per share as part of its buyback programme. These shares are

held in Treasury.

For further enquiries please contact:

Crystal Amber Fund Limited

Chris Waldron (Chairman)

Tel: 01481 716 000

www.crystalamber.com

Allenby Capital Limited - Nominated Adviser

David Worlidge/James Thomas/Liz Kirchner

Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford

Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

END

(END) Dow Jones Newswires

January 08, 2018 02:00 ET (07:00 GMT)

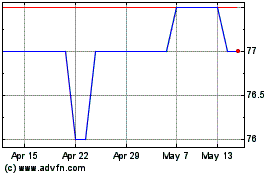

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024