TIDMCRS

15 March 2016

Crystal Amber Fund Limited

(the 'Fund' or the 'Company')

Interim Results for the period ended 31 December 2015

The Company announces its interim results for the six months ended 31 December

2015.

Highlights:

* Net asset value ("NAV") per share fell 7.3 per cent over the six-month

period to 155.9p per share at 31 December 2015. Including the dividend paid

in August 2015, NAV total return per share over the six months ended 31

December 2015 was -5.9 per cent. Over the 2015 calendar year, NAV rose 2.1

per cent and NAV total return per share was 3.7 per cent.

* Net realised gains over the six months to 31 December 2015 were GBP3.1

million.

* Dividends of 2.5p per share were paid in August 2015 and February 2016, in

line with the revised dividend policy announced in December 2014.

* Continued engagement with the Fund's main investee companies, particularly

Grainger plc, Hurricane Energy plc and Pinewood Group plc.

* Significant positive contributions to NAV from Dart Group plc, STV Group

plc and Leaf Clean Energy Company.

* The Fund continued its share buyback programme as part of its discount

management policy. Over the six months to 31 December 2015, the shares

traded at an average 0.7 per cent premium to NAV.

* After the period end, the 6.1 million shares held in treasury were sold at

NAV.

* In February 2016 Pinewood Group plc announced a strategic review to

evaluate ways to maximise value.

* Following the Fund's request to Grainger plc for a strategic review, the

outcome was announced in January 2016. The Fund's active engagement is

continuing.

William Collins, Chairman of Crystal Amber Fund, comments:

"In the six months to 31 December 2015, we intensified our engagement with our

main investee companies and this resulted in significant progress toward

realisation of value in some of our biggest holdings, progress which we expect

to continue in 2016. Though market conditions have been and remain

challenging, the Fund will continue to focus on predominantly asset backed

special situations and our activist approach which has proved its

effectiveness. The Fund continues to maintain a cautious stance, undertaking

portfolio hedging as insurance against a significant fall in markets.

Enquiries

Crystal Amber Fund Limited

William Collins (Chairman) Tel: 01481 716 000

Allenby Capital Limited - Nominated Adviser

David Worlidge/James Thomas Tel: 020 3328 5656

Numis Securities Limited - Broker

Nathan Brown/Hugh Jonathan Tel: 020 7260 1426

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein Tel: 020 7478 9080

Chairman's Statement

I hereby present the interim results of Crystal Amber Fund Limited ("the

Company" or "the Fund"), for the six months to 31 December 2015 ("the period").

Over the period, net asset value ("NAV") per share fell 7.3 per cent to an

unaudited 155.9p per share at 31 December 2015 (168.26p at 30 June 2015). Total

return over the period, including the dividend paid, was -5.9 per cent. This

compares to a total return of -2.0 per cent for the FTSE All Share Index and

-0.9 per cent for the Numis Smaller Companies Index. Over the 2015 calendar

year, the Fund's total return was 3.7 per cent, which compares to a total

return of 1.0 per cent for the FTSE All Share and 8.8 per cent for Numis

Smaller Companies Index.

The economic backdrop was one of fragile recovery in advanced economies, led by

the US, and slowdown and uncertainty in emerging markets, led by China.

Geopolitical instability in the Middle East triggered a refugee and

humanitarian crisis. The Eurozone continued to experience problems, although

there were signs of economic recovery. The US Federal Reserve's first interest

rate rise for seven years did not improve confidence, and falling oil and metal

prices added to nervousness about global economic prospects. The Fund's

outlook and portfolio positioning remained cautious, with portfolio hedging in

place as insurance against a significant fall in markets.

At 31 December 2015, the Fund held GBP13.7m cash, equivalent to 13.8p per share

or 8.8 per cent of NAV. Cash and accrued income amounted to 14.8p per share,

9.5 per cent of NAV; this gives the Fund scope to take advantage of new

investment opportunities.

The discount management policy continued, with further share buybacks. The

Fund's share price traded at an average premium to NAV of 0.7% over the period.

During the period, 250,000 shares were purchased into treasury at an average

cost of 156.85 pence, with a total of 295,000 shares held in treasury being

sold during the period at an average price of 171.56 pence. After the period

end, the 6,118,486 shares held in treasury were sold at NAV.

The Fund continues to purchase FTSE put options as insurance against a

significant market sell-off. The net cost of these options amounted to 1.9 per

cent. of NAV over the period to 31 December 2015. From the period end to 29

February 2016, these options contributed 0.3 per cent. to NAV or 0.5p per

share.

The new dividend policy announced in December 2014 aims to distribute income

and net realised gains from investments. In keeping with the policy, a

dividend of 2.5p per share in respect of the six months ended 30 June 2015 was

paid on 14 August 2015 and an interim dividend of 2.5p per share in respect of

the six months ended 31 December 2015 was paid on 19 February 2016, making a

total of 5p per share for the 2015 calendar year. Based on the NAV at 31

December 2015, this represents a dividend yield of approximately 3.2 per cent.

William Collins

Chairman

14 March 2016

Investment Manager's Report

Strategy and performance

During the period, the Fund continued to engage closely with the boards of its

major holdings.

At 31 December 2015, equity holdings represented 90.5 per cent of net assets.

Cash reserves at the period end were GBP13.7 million, and cash and accruals

amounted to GBP14.7 million (14.8p per share).

The table below lists the top ten holdings at 31 December 2015, with the

performance contribution of each during the six month period. The main

positive contributions came from Dart Group plc (2.8 per cent), Leaf Clean

Energy Co. (2.0 per cent) and STV Group plc (1.4 per cent). Negative

contributions over the period included Hurricane Energy PLC (-3.4 per cent),

which has been affected by the continuing weakness of oil prices, and, outside

the top ten holdings, from Tribal Group plc (-3.2 per cent).

Net realised gains for the period were GBP3.1 million. This compares with GBP6.6

million for the six months ended 31 December 2014 and GBP24.4 million for the

year ended 30 June 2015 including an GBP8.7 million gain on its holding in Aer

Lingus and GBP7.5 million on its holding in Thorntons as announced on 8 September

2015, following the takeovers of these companies. While the Fund continues to

work towards realising value from all its holdings, the timing of realisations

is naturally uneven.

Top ten holdings Pence per Percentage of Total Contribution

share investee return over to NAV

equity held the period performance

Grainger plc 35.6 3.4% 2.7% 0.6%

STV Group plc 15.0 6.9% 18.5% 1.4%

Dart Group plc 14.9 1.6% 49.9% 2.8%

Leaf Clean Energy Co. 14.1 29.9% 31.1% 2.0%

Pinewood Group plc 10.9 4.1% -4.6% -0.3%

Hurricane Energy plc 10.0 14.6% -38.8% -3.4%

Sutton Harbour Holdings 9.1 29.3% -11.4% -0.7%

plc

Coats Group plc 8.8 2.4% -4.8% -0.2%

Hansard Global plc 5.1 3.1% 23.3% 0.5%

NBNK Investments plc 4.7 28.2% 4.8% 0.0%

Total of ten largest 128.2

holdings

Other investments 12.9

Cash and accruals 14.8

Total NAV 155.9

Investee Companies

Grainger plc ("Grainger")

Grainger is the UK's largest listed residential property owner and manager.

Since our initial engagement we have urged the board to streamline the

business, cut its administration costs and reduce the quantum and cost of debt.

In July 2015 we requested that Grainger carry out a strategic review.

During the period, Grainger sold its stake in a German joint venture and

announced its intention to sell its wholly-owned German portfolio. It also

refinanced its UK syndicated bank debt, reducing its cost and extending its

maturity, and implemented management changes, following which it now has a new

chief executive officer and finance director.

After the end of the period, on 4 January 2016, Grainger announced the exchange

of contracts, subject to regulatory approval, to sell its Equity Release

division on or before 30 May 2016 for an estimated gross consideration of GBP325

million, comprising GBP175 million cash and the transfer to the buyer of GBP150

million debt. Grainger said the sale would significantly reduce its financial

and operational costs.

On 28 January 2016 Grainger announced the outcome of its strategy review, which

includes plans to reduce overheads through a streamlined structure, exit

non-core development assets and reduce financing costs with a target of 4 per

cent cost of debt. It also announced plans to invest over GBP850 million by 2020

into the private rented sector to drive the growth of rental income and

dividends.

The Fund welcomes and supports Grainger's actions to streamline the business

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

and cut costs; however we remain concerned both with the pace and scope of cost

cutting. We note that last year Grainger, with a GBP900 million market

capitalisation, incurred administrative costs of GBP42 million. Mountview

Estates, a company in the same sector with a market capitalisation of GBP450

million, incurred administrative costs of GBP5 million. Neither is the Fund

convinced of the merits of investing GBP850 million into the private rental

sector rather than reducing debt, particularly at the time of global financial

uncertainty for asset classes.

We continue to believe that further significant value can be realised through

either a spin-off of the regulated tenancies division or a sale of Grainger.

Pinewood Group plc ("Pinewood")

Pinewood's studios are among the leading global facilities in the film

industry. Against a very favourable backdrop of major film releases including

the latest James Bond film, Spectre, and Star Wars Episode VII: - The Force

Awakens, Pinewood's profit after tax for the six months to June 2015 rose just

GBP0.5 million to GBP4.3 million. The Fund believes that the business could be run

more efficiently, that running costs are too high and that consequently

profitability is below potential. The Fund commissioned its own analysis from

industry experts and this concluded that operating profits at Pinewood could be

increased by more than 50 per cent.

The Fund's Investment Adviser met the chief executive of Pinewood, Ivan

Dunleavy, on 2 December 2015 and proposed to Pinewood that it would pay for

management consultants to carry out work at Pinewood to recommend ways in which

profitability could be improved. In January 2016, the board of Pinewood

rejected the proposal.

The Fund believes that management incentives should be closely aligned with

shareholders' interests. Pinewood's chairman, Lord Grade of Yarmouth and chief

executive Ivan Dunleavy, who have been in their posts since 2000, own only

17,500 shares and 177,584 shares respectively, representing a combined 0.34 per

cent of Pinewood's issued share capital.

On 10 February 2016, after the period end, Pinewood said that management's

expectations of performance for the year to 31 March were higher than at the

time of the interim results. Pinewood's board appointed Rothschild "to assist

with a strategic review of the overall capital base and structure, which could

include a sale of the company". The Fund believes that whilst the strategic

review may result in the release of value at Pinewood through a possible sale,

this would have been unnecessary had management run the business more

efficiently.

At 29 February 2016 the Fund held 3.646 million Pinewood shares, equal to 6.35

per cent of Pinewood's issued share capital, with a market value and a cost of

GBP18.5 million and GBP14.4 million respectively.

STV Group plc ("STV")

STV broadcasts "free to air" TV in Scotland through the Channel 3 licence,

which is served by ITV in most of the UK.

On 27 August 2015, STV reported interim results in line with expectations, and

increased its dividend. On 24 February 2016, at its preliminary results, it

announced plans to launch an enhanced digital news service in March 2016.

The Fund regards STV as the holder of a valuable franchise with opportunities

to expand its production activities. Since the period end, the Fund has

increased its holding to 7.07 per cent.

Leaf Clean Energy Company ("Leaf")

Leaf is an investment company focused on clean energy, largely in North

America.

We maintained frequent contact with the Leaf board during the period and are

reassured by the speed and seriousness with which it has tackled the challenges

it inherited.

Since July 2014 Leaf's strategy has been to realise its assets at appropriate

times and return capital to shareholders. On 28 September 2015, Leaf reported

results for the year to June 2015, including the realisation of three

investments and a capital return of 5 pence per share.

In July 2015, Leaf 's main investee company, Invenergy Wind, agreed a disposal

of assets to Terraform Power worth $3 billion. Leaf did not consent to the

disposal and in December 2015 filed a complaint seeking a payment by Invenergy

to Leaf of US$126 million. Leaf expects Invenergy to contest the complaint.

In its 30 June 2015 annual accounts, Leaf valued its 2.3 per cent investment in

Invenergy at US$95 million. This currently equates to approximately 68 pence

per share which compares to Leaf's share price as at 29 February 2016 of 37

pence. The fund holds 35.3million shares in Leaf.

To date, Leaf has been a successful investment for the Fund and an example of

unlocking shareholder value through positive engagement. We support Leaf's

board in its efforts to realise and return value.

Hurricane Energy plc ("Hurricane")

Hurricane is an oil exploration company which targets naturally fractured

basement rock reservoirs in the West of Shetlands area, where it has made two

discoveries.

The steep fall in the crude oil price inevitably affected Hurricane's share

price over the period; the weakness of crude prices has persisted into 2016.

The Fund has engaged with Hurricane and supported its efforts to "farm out" its

assets.

To improve our understanding of Hurricane's assets we commissioned independent

research, which has underpinned our view of their quality and potential value.

The Fund is Hurricane's largest shareholder and firmly believes in the

intrinsic long term value of its assets.

Since the period end, Hurricane's chairman has been replaced, reflecting the

wishes of the Fund.

Dart Group plc ("Dart")

Dart is the parent group of leisure airline Jet2 and fresh produce distributor

Fowler Welch.

On 19 November 2015, Dart reported strong increases in turnover and profits for

the six months to 30 September 2015. During the period Dart announced orders

for a total of 30 new Boeing 737-800NG aircraft. In our view this reflects

confidence in the growth of the airline operation.

We would welcome further engagement with Dart's board and management to provide

a deeper understanding of the business and its potential. We believe that a

wider understanding of the business in the investment community would improve

the shares' rating.

Sutton Harbour Holdings plc ("Sutton Harbour")

Sutton Harbour owns and operates Sutton Harbour in Plymouth's historic old

port, operates the King Point Marina and holds the lease on the 113-acre site

of the former Plymouth Airport.

On 1 December 2015 it reported increased profits for the six months to 30

September 2015 and an increase in net asset value per share from 42 pence to

43.1 pence, compared to the current share price (26.65 pence).

Sutton Harbour supports the development of the former airport site, which could

release further value. The report of a government review into the future of

the site is expected, but the date of the report is uncertain.

The Fund continues to engage with Sutton Harbour's board and management and

supports its efforts to release value.

Coats Group plc ("Coats")

Coats Group is the world's largest supplier of thread and the second largest

maker of zips and fasteners.

It has been seeking to resolve historic pension issues, as a resolution could

free Coats to use its cash more productively. The Fund supports Coats' board

and management in these efforts.

In November 2015, Coats announced plans to delist its shares in New Zealand and

Australia in June 2016, following which the shares would trade only on the

London Stock Exchange. Over the two years to November 2015, New Zealand and

Australian investors reduced their holdings from 55 per cent to 14 per cent of

Coats. We will be interested to see how the share price responds when this

selling ends.

Hansard Global plc ("Hansard")

Hansard provides long term savings globally from its base in the Isle of Man.

From our initial investment in 2012 we have engaged actively with Hansard and

advocated the renewal of the board and a new commercial strategy to meet demand

for offshore savings products.

Since 2013 Hansard has appointed a chief executive, a new chairman, made other

management changes and completed a review of its sales strategy with expansion

plans in areas such as the Middle East and Asia. We continue to engage with

the board and support its sales strategy, which we see as having potential to

deliver a lower risk book of business, with potential to scale up.

The new strategy has taken time to implement but we believe the benefits are

now beginning to come through. During the period Hansard reported encouraging

business growth and increased dividends. Following the period end, in January

2016, it reported further strong growth in new business.

NBNK Investments plc ("NBNK")

NBNK was formed in 2010 to seek to build a UK retail bank, primarily by

acquisition. Its board has said that if this plan did not succeed it would

consider whether to return surplus funds to shareholders. On 10 August 2015,

it reported cash of GBP19.8 million (36.8 pence per share). This compares to a

share price on 29 February 2016 of 30 pence.

On 7 January 2016 NBNK reported that it was in discussions with target

companies with "a realistic prospect for an acquisition" and extended its

deadline for considering a return of funds to 11 April 2016.

Other holdings

Outside the top ten holdings the most significant holding with negative

performance was Tribal Group plc (-3.2 per cent) and the most significant

positive contributor was 4imprint Group plc (+0.5 per cent).

Tribal Group plc ("Tribal")

Tribal provides student management systems to schools and colleges in the UK,

Australia and elsewhere. In March 2015 the Fund reduced its holding at 176

pence per share.

On 19 October 2015 Tribal warned that lengthening procurement timelines at its

larger customers would significantly affect operating profits. The Fund then

increased its holding to 6.4 per cent, paying 67 pence per share.

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

On 17 November 2015 Tribal announced board changes including a new chairman. On

14 December 2015 it issued a further profit warning and announced plans to

reduce debt through a rights issue of up to GBP35 million (of which GBP30 million

is underwritten) in the first quarter of 2016.

In February a new CEO was appointed at Tribal.

The size and pricing of the rights issue have yet to be determined. The hiatus

has contributed to a substantial fall in Tribal's share price to 44p, reducing

its market capitalisation to GBP42 million.

The Fund's holding in Tribal represents approximately 1.5 per cent of net asset

value.

Activist investment process

The Fund originates ideas mainly from its screening processes and its network

of contacts, including its institutional shareholders. Companies are valued

with focus on their replacement value, cash generation ability and balance

sheet strength. In the process, the Fund's goal is to examine the company both

'as it is' and also 'as it could be' to maximise shareholder value.

Investments are typically made after an initial engagement, which in some cases

may have been preceded by the purchase of a modest position in the company,

which allows us to meet the company as a shareholder. Engagement includes

dialogue with the company chairman and management, and normally also several

non-executive directors, as we build a network of knowledge around our

holdings. Site visits are undertaken to deepen our research and where

appropriate, independent research is commissioned. We attend investee company

annual general meetings to maintain close contact with the board and other

stakeholders.

Wherever possible, the Fund strives to develop an activist angle and aims to

contribute to the companies' strategy with the goal of maximising shareholder

value. Where value is hidden or trapped, we look for ways to realise it. Most

of the Fund's activism has taken place in private, but the Fund remains willing

to make its concerns public when appropriate. The response of management and

boards to our suggestions has generally been encouraging. We remain determined

to ensure that our investments deliver their full potential for all

shareholders, and are committed to engage to the degree required to achieve

this.

Realisations

Over the period net realised gains amounted to GBP3.1 million. The Fund realised

part of its holding in 4Imprint at a profit of GBP2.0 million. It realised GBP0.9

million of profits from Leaf Clean Energy's share redemption.

Previous profitable exits include Aer Lingus, Thorntons, Pinewood Shepperton,

Norcros, 3i Quoted Private Equity, Delta PLC, Kentz Corporation, Tate & Lyle

and Chloride Group.

Hedging Activity

The Fund continues to purchase FTSE put options as insurance against a

significant market sell-off. The net cost of these options amounted to 1.9 per

cent of NAV over the period to 31 December 2015.

Outlook

A year ago we stated: 'we believe that the underlying causes of the global

financial crisis, including excessive debt, have not been addressed. The key

driver of asset prices has been unprecedented loose monetary policy. In our

view markets remain vulnerable to significantly reduced liquidity when monetary

policies normalise. Our views have not changed. Of late, markets have been weak

amid renewed concerns of financial instability and growing concerns about the

strength of emerging economies, particularly China.

These issues make the global outlook uncertain and challenging. We believe that

the Fund is defensively positioned and its investee companies can look to a

combination of self-help and our active engagement. Our hedging activity gives

us some additional protection against a significant market sell-off. Over the

period from 31 December 2015 to 29 February 2016 the options contributed 0.3

per cent to NAV or 0.5p per share.

Crystal Amber Asset Management (Guernsey) Limited

Investment Manager

Condensed Statement of Comprehensive Income (Unaudited)

For the six months ended 31 December 2015

Six months ended 31 December Six months ended 31 December

2015 2014

(Unaudited) (Unaudited)

Revenue Capital Total Revenue Capital Total

Notes GBP GBP GBP GBP GBP GBP

Income

Dividend income 923,915 - 923,915 1,573,199 - 1,573,199

from listed

investments

Other income - - - 2,226 - 2,226

Fixed deposit 48 - 48 - - -

interest

Bank interest 10,471 - 10,471 2,117 - 2,117

934,434 - 934,434 1,577,542 - 1,577,542

Net gains on

financial assets

at fair value

through profit

or loss

Equities

Net realised 4 - 3,102,272 3,102,272 - 6,645,943 6,645,943

gain

Movement in 4 - (8,957,963) (8,957,963) - (12,822,335) (12,822,335)

unrealised

losses

Money Market

Investments

Realised gain 4 - - - - 4,217 4,217

Movement in 4 - 4,496 4,496 - (4,190) (4,190)

unrealised gains

/(losses)

Derivative

Financial

Instruments

Realised (loss)/ 4 - (190,420) (190,420) - 992,190 992,190

gain

Movement in 4 - (2,727,640) (2,727,640) - (131,995) (131,995)

unrealised

losses

Total income/ 934,434 (8,769,255) (7,834,821) 1,577,542 (5,316,170) (3,738,628)

(loss)

Expenses

Transaction - 133,100 133,100 - 328,170 328,170

costs

Exchange - (378,656) (378,656) - 636,460 636,460

movements on

revaluation of

investments

Management fees 8 1,314,947 - 1,314,947 1,080,166 - 1,080,166

Directors' 57,500 - 57,500 57,408 - 57,408

remuneration

Administration 91,965 - 91,965 70,156 - 70,156

fees

Custodian fees 38,621 - 38,621 29,307 - 29,307

Audit fees 10,091 - 10,091 9,911 - 9,911

Other expenses 97,549 - 97,549 66,301 - 66,301

1,610,673 (245,556) 1,365,117 1,313,249 964,630 2,277,879

(Loss)/Return (676,239) (8,523,699) (9,199,938) 264,293 (6,280,800) (6,016,507)

for the period

Basic and 2 (0.73) (9.20) (9.93) 0.35 (8.27) (7.93)

diluted (loss)/

earnings per

share (pence)

All items in the above statement derive from continuing operations.

The total column of this statement represents the Company's Statement of

Comprehensive Income prepared in accordance with International Financial

Reporting Standards. The supplementary income return and capital return columns

are presented under guidance published by the Association of Investment

Companies ("AIC").

The Notes to the Unaudited Condensed Financial Statements below form part of

these financial statements.

Condensed Statement of Financial Position (Unaudited)

As at 31 December 2015

As at As at As at

31 December 30 June 31 December

2015 2015 2014

(Unaudited) (Audited) (Unaudited)

ASSETS Notes GBP GBP GBP

Cash and cash equivalents 7,673,427 19,500,047 1,565,319

Trade and other receivables 347,738 295,487 932,733

Financial assets designated at fair 4 137,009,952 142,663,130 112,682,338

value through profit or loss

Total assets 145,031,117 162,458,664 115,180,390

LIABILITIES

Trade and other payables 227,325 6,253,178 156,057

Total liabilities 227,325 6,253,178 156,057

EQUITY

Capital and reserves attributable to

the Company's equity shareholders

Share capital 5 989,998 989,998 782,297

Treasury shares 6 (8,972,339) (9,009,985) (4,117,527)

Distributable reserve 111,941,615 114,181,017 82,543,503

Retained earnings 40,844,518 50,044,456 35,816,060

Total equity 144,803,792 156,205,486 115,024,333

Total liabilities and equity 145,031,117 162,458,664 115,180,390

Net asset value per share (pence) 3 155.90

168.26 152.72

The financial statements were approved by the Board of Directors and authorised

for issue on 14 March 2016.

Christopher

Waldron

Nigel Ward

Director

Director

14 March

2016

14 March 2016

The Notes to the Unaudited Condensed Financial Statements below form part of

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

these financial statements.

Condensed Statement of Changes in Equity (Unaudited)

For the six months ended 31 December 2015

Share Treasury Distributable Retained earnings Total

Notes Capital Shares Reserve Capital Revenue Total Equity

GBP GBP GBP GBP GBP GBP GBP

Opening balance 989,998 (9,009,985) 114,181,017 49,606,601 437,855 50,044,456 156,205,486

at 1 July 2015

Purchase of 6 - (393,061) - - - - (393,061)

Company shares

into treasury

Sale of Company 6 - 430,707 - - - - 430,707

shares from

treasury

Premium on sale - - 75,405 - - - 75,405

of Company

shares from

treasury

Dividends paid 7 - - (2,314,807) - - - (2,314,807)

in the period

Loss for the - - - (8,523,699) (676,239) (9,199,938) (9,199,938)

period

Balance at 31 989,998 (8,972,339) 111,941,615 41,082,902 (238,384) 40,844,518 144,803,792

December 2015

Share Treasury Distributable Retained earnings Total

Notes Capital Shares Reserve Capital Revenue Total Equity

GBP GBP GBP GBP GBP GBP GBP

Opening balance 782,297 (2,483,196) 82,926,112 41,249,276 583,291 41,832,567 123,057,780

at 1 July 2014

Purchase of - (1,634,331) - - - - (1,634,331)

Company shares

into treasury

Dividends paid - - (382,609) - - - (382,609)

in the period

Return/(Loss) - - - 264,293 (6,280,800) (6,016,507) (6,016,507)

for the period

Balance at 31 782,297 (4,117,527) 82,543,503 41,513,569 (5,697,509) 35,816,060 115,024,333

December 2014

The Notes to the Unaudited Condensed Financial Statements below form part of

these financial statements.

Condensed Statement of Cash Flows (Unaudited)

For the six months ended 31 December 2015

Six months Six months

ended ended

31 December 31 December

2015 2014

(Unaudited) (Unaudited)

GBP GBP

Cashflows from operating activities

Dividend income received from listed investments 679,359 745,983

Fixed deposit interest received 48 -

Bank interest received 11,502 6,103

Other income received - 2,226

Management fees paid (1,314,947) (1,080,168)

Performance fee paid (653,962) (1,747,285)

Directors' fees paid (57,500) (48,271)

Other expenses paid (247,381) (201,469)

Net cash outflow from operating activities (1,582,881) (2,322,881)

Cashflows from financing activities

Purchase of Company shares into treasury (393,061) (1,634,331)

Sale of Company shares from treasury 506,112 -

Dividends paid (2,314,807) (382,609)

Net cash outflow from financing activities (2,201,756) (2,016,940)

Cashflows from investing activities

Purchase of equity investments (16,855,037) (41,878,459)

Sale of equity investments 14,722,108 42,442,053

Purchase of derivative financial instruments (4,845,800) (3,453,005)

Sale of derivative financial instruments 5,069,846 3,900,550

Purchase of money market investments (6,000,000) -

Transaction charges on purchase and sale of investments (133,100) (328,170)

Net cash (outflow)/inflow from investing activities (8,041,983) 682,969

Net decrease in cash and cash equivalents during the (11,826,620) (3,656,852)

period

Cash and cash equivalents at beginning of period 19,500,047 5,222,171

Cash and cash equivalents at end of period 7,673,427 1,565,319

The Notes to the Unaudited Condensed Financial Statements below form part of

these financial statements.

Notes to the Unaudited Condensed Financial Statements

For the six months ended 31 December 2015

General Information

Crystal Amber Fund Limited was incorporated and registered in Guernsey on 22

June 2007 and is governed under the provisions of the Companies (Guernsey) Law,

2008 as amended. The Company has been established to provide shareholders with

an attractive total return which is expected to comprise primarily capital

growth but with the potential for distributions. The Company will achieve this

through the investment in a concentrated portfolio of undervalued companies

which are expected to be predominantly, but not exclusively, listed or quoted

on UK markets and which have a typical market capitalisation of between GBP100

million and GBP1,000 million.

The Company was listed and admitted to trading on the Alternative Investment

Market ('AIM'), operated by the London Stock Exchange, on 17 June 2008. The

Company is also a member of the Association of Investment Companies ('AIC').

1.SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these financial

statements are set out below. These policies have been consistently applied

throughout the current period, unless otherwise stated.

Basis of preparation

The interim financial statements have been prepared in accordance with the

International Accounting Standard ("IAS") 34, Interim Financial Reporting.

The interim financial statements do not include all the information and

disclosures required in the annual financial statements and should be read in

conjunction with the Company's annual financial statements for the year to 30

June 2015. The annual financial statements have been prepared in accordance

with International Financial Reporting Standards ("IFRS").

The same accounting policies and methods of computation are followed in the

interim financial statements as in the annual financial statements for the year

ended 30 June 2015.

The presentation of the interim financial statements is consistent with the

annual financial statements. Where presentational guidance set out in the

Statement of Recommended Practice ("SORP") for Investment Trusts issued by the

AIC in January 2003 (revised November 2014) is consistent with the requirements

of IFRS, the Directors have sought to prepare the financial statements on a

basis compliant with the recommendations of the SORP. In particular,

supplementary information which analyses the Statement of Comprehensive Income

between items of a revenue and capital nature has been presented alongside the

total Statement of Comprehensive Income.

The Company does not operate in an industry where significant or cyclical

variations as a result of seasonal activity are experienced during the

financial year. Income and dividends from investments will vary according to

the construction of the portfolio from time to time.

Going concern

The Directors are confident that the Company has adequate resources to continue

in operational existence for the foreseeable future and do not consider there

to be any threat to the going concern status of the Company.

The Directors have specifically considered the implications of the continuation

vote scheduled to occur every two years on the application of the going concern

basis. At the AGM held on 20 November 2015, an Extraordinary Resolution was

proposed that the Company cease to continue as constituted; the resolution was

not passed. Therefore the Directors conclude that there is no material

uncertainty which may cast significant doubt on the ability of the Company to

continue as a going concern. For this reason, they continue to adopt the going

concern basis in preparing the financial statements.

Segmental reporting

The Board has considered the requirements of IFRS 8 'Operating Segments', and

is of the view that the Company is domiciled in Guernsey and is engaged in a

single segment of business, being investment mainly in UK equity instruments,

and mainly in one geographical area, the UK, and therefore the Company has only

one operating segment. The Board, as a whole, has been determined as

constituting the chief operating decision maker of the Company. The key measure

of performance used by the Board to assess the Company's performance and to

allocate resources is the total return on the Company's Net Asset Value

("NAV"), as calculated under IFRS, and therefore no reconciliation is required

between the measure of profit or loss used by the Board and that contained in

these financial statements.

2.BASIC AND DILUTED EARNINGS PER SHARE

Basic and diluted earnings per share is based on the following data:

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

Six months Six months

ended ended

31 December 31 December

2015 2014

(Unaudited) (Unaudited)

Loss for the period GBP(9,199,938) GBP(6,016,507)

Weighted average number of issued Ordinary 92,674,999 75,916,930

Shares

Basic and diluted earnings per share (pence) (9.93) (7.93)

3.NET ASSET VALUE PER SHARE

Net asset value per share is based on the following data:

As at As at As at

31 December 30 June 31 December

2015 2015 2014

(Unaudited) (Audited) (Unaudited)

Net asset value per statement of GBP144,803,792 GBP156,205,486 GBP115,024,333

financial position

Total number of issued Ordinary shares 92,881,276 92,836,276 75,318,703

(excluding treasury shares)

Net asset value per share (pence) 155.90

168.26 152.72

4.FINANCIAL ASSETS DESIGNATED AT FAIR VALUE THROUGH PROFIT OR LOSS

1 July 1 July 1 July

2015 to 2014 to 2014 to

31 December 30 June 31 December

2015 2015 2014

(Unaudited) (Audited) (Unaudited)

GBP GBP GBP

Equity investments 130,701,056 139,350,130 111,979,688

Money market investments 6,004,496 -

-

Derivative financial instruments 304,400 3,313,000 702,650

137,009,952 142,663,130 112,682,338

Equity investments

Cost brought forward 160,110,908 125,439,328 125,439,328

Purchases 11,492,838 126,294,308 37,822,732

Sales proceeds (14,664,877) (118,083,952) (40,720,310)

Net realised gain 3,102,272 26,461,224 6,645,943

Cost carried forward 160,041,141 160,110,908 129,187,693

Unrealised losses brought forward (20,171,543) (3,271,624) (3,271,624)

Movement in unrealised losses (8,957,963) (16,899,919) (12,822,335)

Unrealised losses carried forward (29,129,506) (20,171,543) (16,093,959)

Effect of exchange rate movements (210,579) (589,235) (1,114,046)

Fair value of equity investments 130,701,056 139,350,130 111,979,688

Money Market investments

Cost brought forward - 1,543,438 1,543,438

Purchases 6,000,000 20,000,000 -

Sales proceeds - (21,554,308) (1,547,655)

Realised gain - 10,870 4,217

Cost carried forward 6,000,000 - -

Unrealised gains brought forward - 4,190 4,190

Movement in unrealised gains 4,496 (4,190) (4,190)

Unrealised gains carried forward 4,496 - -

Fair value of money market investments 6,004,496 - -

Derivative financial instruments

Cost brought forward 1,078,000 582,051 582,051

Purchases 4,845,800 8,342,932 3,453,005

Sales proceeds (4,936,340) (5,767,065) (3,900,551)

Realised (losses)/gains (190,420) (2,079,918) 992,190

Cost carried forward 797,040 1,078,000 1,126,695

Unrealised gains /(losses) brought forward 2,235,000 (292,050) (292,050)

Movement in unrealised gains/(losses) (2,727,640) 2,527,050 (131,995)

Unrealised (losses)/gains carried forward (492,640) 2,235,000 (424,045)

Fair value of derivative financial instruments 304,400 3,313,000 702,650

Total financial assets designated at fair value 137,009,952 142,663,130 112,682,338

through profit or loss

At the reporting date the Company's derivative financial instruments consisted

of 2 (2014:3) FTSE 100 Index put option positions, purchased as a protection

against a significant market sell-off. The following table details the

Company's positions in derivative financial instruments:

Nominal Amount Value

31 December 2015 GBP

Derivative financial instruments

Puts on UKX P5700 (Expiry: January 2016) 1,000 50,000

Puts on UKX P5700 (Expiry: February 2016) 795 254,400

1,795 304,400

Nominal Amount Value

30 June 2015 GBP

Derivative financial instruments

Puts on UKX P6450 (Expiry: July 2015) 800 608,000

Puts on UKX P6700 (Expiry: July 2015) 1,000 1,975,000

Puts on UKX P6450 (Expiry: August 2015) 500 730,000

2,300 3,313,000

5.SHARE CAPITAL AND RESERVES

The authorised share capital of the Company is 300 million Ordinary shares of GBP

0.01 each.

The issued share capital of the Company is comprised as follows:

31 December 2015 30 June 2015

(Unaudited) (Audited)

Number GBP Number GBP

Opening balance 98,999,762 989,998 782,297

78,229,665

Ordinary shares issued during the period/year - - 20,770,097 207,701

Allotted, called up and fully paid Ordinary shares 98,999,762 989,998 98,999,762

at GBP0.01 each 989,998

6.TREASURY SHARES

Six months ended Year ended

31 December 2015 30 June 2015

(Unaudited) (Audited)

Number GBP Number GBP

Opening balance 6,163,486 1,707,856

9,009,985 2,483,196

Treasury shares purchased 250,000 393,061 4,455,630 6,526,789

during the period/year

Treasury shares sold during (295,000) (430,707) - -

the period/year

Closing balance 6,118,486 8,972,339 6,163,486

9,009,985

During the period ended 31 December 2015, 250,000 (2014: 1,203,106) treasury

shares were purchased at an average cost of 156.85p per share, and 295,000

(2014: Nil) treasury shares were sold at an average price of 171.56p per share.

7.DIVIDENDS

On 7 July 2015 the Company declared an interim dividend of GBP2,314,807, equating

to 2.5p per Ordinary share, which was paid on 14 August 2015 to shareholders on

record on the register on 17 July 2015.

Subsequent to the period end, on 13 January 2016, the Company declared an

interim dividend of GBP2,474,994, equating to 2.5p per ordinary share, which was

paid on 19 February 2016 to shareholders on record on the register on 22

January 2016.

8.RELATED PARTIES

Richard Bernstein is a Director and a member of the Investment Manager, a

member of the Investment Adviser and a holder of 10,000 (2014: 10,000) Ordinary

(MORE TO FOLLOW) Dow Jones Newswires

March 15, 2016 03:00 ET (07:00 GMT)

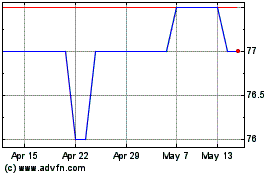

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024