Net Asset Value(s) (0296B)

April 10 2012 - 7:30AM

UK Regulatory

TIDMCRS

RNS Number : 0296B

Crystal Amber Fund Limited

10 April 2012

10 April 2012

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value

Crystal Amber Fund announces that its unaudited net asset value

("NAV") per share on 31 March 2012 was 105.91p (29 February 2012:

109.48p per share).

The proportion of the Fund's NAV at 31 March 2012 represented by

the five largest holdings, other investments and cash (including

accruals), was as follows:

Top five holdings Pence per share Percentage of investee

equity held

-------------------------- ---------------- -----------------------

TT Electronics plc 20.5 4.9%

Renishaw plc 9.9 0.6%

Sutton Harbour plc 9.3 26.4%

N Brown Group plc 8.2 0.8%

Omega Insurance Holdings

Ltd 8.1 3.2%

Total of five largest

holdings 56.0

Other investments 34.0

Cash and accruals 15.9

-------------------------- ----------------

Total NAV 105.9

-------------------------- ----------------

Commentary on the Portfolio

During the quarter, net asset value grew by 19.4%. The share

price of the Fund's two largest holdings, TT Electronics and

Renishaw, increased by 21% and 33.1%, respectively. Some profits

were taken in late February and March on both holdings, with the TT

Electronics position being reduced by 18.9% and the Renishaw

position by 10%. This was a result of overall asset allocation

following share price strength. TT Electronics remains the Fund's

largest holding.

In January, Sutton Harbour completed a GBP5.7 million

fundraising at 18p per share, in which the Fund was the lead

investor.

In March, Omega Insurance reported tangible net assets of 76p

per share. The company has recently confirmed press speculation

that it has received a cash offer at 65p per share. We would expect

this approach to generate further corporate interest and the Fund

has been and remains an activist.

Performance in the quarter was also assisted by a 76.7% rise in

the share price of Tribal Group plc. The catalyst for the re-rating

was January's announcement that adjusted profit before tax for 2011

would be significantly ahead of the board's previous

expectations.

In February, the Fund took a 7% stake in API Group plc investing

GBP2.2m at 40.5p per share. API Group manufactures specialised

materials for packaging. At the beginning of February, the largest

shareholder in API Group sent a letter to the API Group board to

initiate a sale process. The Investment Adviser met with management

in early March and on 30 March the board announced its intention to

explore a sale process during the third quarter of 2012, when the

benefits of its new laminates contract are more visible. The

current share price is 59p.

Cash levels in the fund have been increased to 15.8p. This

partly reflects strong gains within the portfolio and also the

intention to reinvest in specific opportunities which have recently

been identified.

For further enquiries please contact:

Crystal Amber Fund Limited

William Collins (Chairman)

Tel: 01481 716 000

Merchant Securities Limited - Nominated Adviser

David Worlidge/Simon Clements

Tel: 020 7628 2200

Numis Securities Limited - Broker

Nathan Brown/Hugh Jonathan

Tel: 020 7260 1426

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVGGUCUCUPPGGU

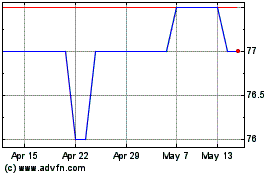

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024