Custodian Property Income REIT plc (CREI)

Custodian Property Income REIT plc: Second quarter trading update shows rental growth supporting fully covered

dividends and stable values

31-Oct-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

31 October 2023

Custodian Property Income REIT plc

("Custodian Property Income REIT" or "the Company")

Second quarter trading update shows rental growth supporting fully covered dividends and stable values

Custodian Property Income REIT (LSE: CREI), which seeks to deliver an enhanced income return by investing in a

diversified portfolio of smaller, regional properties with strong income characteristics across the UK, today provides

a trading update for the quarter ended 30 September 2023 ("Q2" or the "Quarter").

Strong leasing activity continues to support rental growth and underpin fully covered dividends

-- 1.375p dividend per share approved for the Quarter, fully covered by unaudited EPRA earnings, in line

with target of no less than 5.5p for the year ending 31 March 2024, representing a 6.8% yield based on the

prevailing 81p share price[1]

-- EPRA earnings per share[2] of 1.4p for the Quarter (FY24 Q1: 1.5p, FY23 Q4: 1.4p)

-- Nine new leases signed and one rent review settled during the Quarter across a range of property sectors,

on average, in line with ERV and 24% above previous passing rent. These initiatives added GBP1.0m of new annual rent

through letting vacant assets and secured a further GBP0.7m of existing annual rent roll, increasing property capital

value by GBP4.5m

-- ERV has increased by 0.7% since 30 June 2023, driven primarily by capital expenditure. Portfolio ERV

(GBP49.7m) now exceeds passing rent (GBP43.2m) by 15% (30 June 2023: 17%) demonstrating the portfolio's significant

reversionary potential

-- EPRA occupancy[3] increased to 91% (30 June 2023: 90%). 2.8% of ERV is vacant subject to refurbishment

or redevelopment with 2.2% of ERV vacant but under offer to let or sell

Valuations remain stable

-- The valuation of the Company's diversified portfolio of 159 assets decreased like-for-like[4] by 1.8%

(GBP12.3m) to GBP609.8m, net of a GBP4.5m valuation increase from active asset management activity (FY24 Q1: GBP2.0m

increase from asset management)

-- Q2 net asset value ("NAV") total return per share[5] of -1.4%

-- NAV per share of 95.9p (30 June 2023: 98.6p) with a NAV of GBP422.8m (30 June 2023: GBP434.9m)

Redevelopment and refurbishment of existing assets continues to be accretive with an expected yield on cost above

average cost of borrowing

-- GBP6.9m of capital expenditure undertaken during the Quarter, including buying the long-leasehold of a unit

at a 10-unit industrial asset in Knowsley (GBP1.3m) and the refurbishment of: offices in Manchester and Leeds

(GBP2.7m); an industrial unit in Ashby-de-la-Zouch (GBP1.1m) and retail assets in Shrewsbury and Liverpool (GBP0.6m)

-- All ongoing capital works are expected to enhance the assets' valuations and environmental credentials

and, once let, increase rents to give a yield on cost of at least 7%, ahead of the Company's marginal cost of

borrowing

-- Weighted average energy performance certificate rating has improved to C(56) (30 June 2023: C(58)) due

to re-ratings being carried out at three assets following refurbishment (Redditch, Winsford and Liverpool) and one

following a new letting (Grantham), with ongoing capital expenditure initiatives expected to drive further

improvements in subsequent quarters

Prudent debt levels mean gearing remains broadly in line with target, with significant borrowing covenant headroom

-- Net gearing[6] was 29.6% loan-to-value as of 30 September 2023 (30 June 2023: 28.0%), broadly in line

with the Company's 25% target

-- GBP185.0m of drawn debt comprising GBP140m (76%) of fixed rate debt and GBP45m (24%) drawn under the Company's

revolving credit facility ("RCF"). We expect that sales proceeds from the disposal of properties under offer will

reduce drawn debt over the remainder of the financial year

-- Aggregate borrowings have a weighted average cost of 4.2%

-- Fixed rate debt facilities have a weighted average term of 6.5 years and a weighted average cost of 3.4%

offering significant medium-term interest rate risk mitigation

Asset recycling continues to generate proceeds in excess of valuation

-- At 30 September 2023 five properties were under offer to sell valued at c.GBP19m which are expected, in

aggregate, to generate proceeds more than 10% in excess of valuation. Proceeds are expected to be invested in the

Company's remaining pipeline of profitable capital expenditure and to reduce variable rate borrowings

-- Of these properties under offer, we have exchanged contracts to sell a children's day nursery in Chesham

for GBP0.55m and out-of-town offices on Pride Park, Derby for GBP2.05m (including receipt of a GBP0.2m deposit)

Net asset value

In line with the portfolio valuation, the Company's unaudited NAV at 30 September 2023 decreased to GBP422.8m, or

approximately 95.9p per share, a decrease of 2.7p (-2.7%) since 30 June 2023:

Pence per share GBPm

NAV at 30 June 2023 98.6 434.9

Valuation movements relating to:

- Asset management activity 1.0 4.5

- General valuation decreases (3.7) (16.8)

Net valuation movement (2.7) (12.3)

EPRA earnings for the Quarter 1.4 6.3

Interim dividend paid[7] during the Quarter (1.4) (6.1)

NAV at 30 September 2023 95.9 422.8

The NAV attributable to the ordinary shares of the Company is

calculated under International Financial Reporting Standards and

incorporates the independent portfolio valuation at 30 September

2023 and net income for the Quarter. The movement in NAV reflects

the payment of an interim dividend of 1.375p per share during the

Quarter, but as usual this does not include any provision for the

approved dividend of 1.375p per share for the Quarter to be paid on

30 November 2023.

Investment Manager's commentary

UK property market

The disconnect between the occupational and investment markets

in UK real estate continues to persist. While the impacts of high

inflation and interest rates appear to weigh heavily on investor

sentiment, perhaps the greater influence has been the marked

re-rating of valuations in the final quarter of 2022, which still

seems to colour investors' attitude to real estate investment.

However, since the start of 2023 valuations have been reasonably

stable across the market, with some sub-sectors showing signs of

recovery while others continue to drift. The outcome for the NAV of

Custodian Property Income REIT has been a marginal decrease of 3.9%

over the past three quarters.

By contrast, occupational demand has been consistently strong

which has led to a reduced vacancy rate and increase in the

portfolio rent roll. We experienced a post lockdown increase in

vacancy to c.10%, but this has steadily improved and based on

lettings under offer, vacancy is expected to reach c.7% by 31

December 2023.

Similarly, the portfolio rent roll has grown 2.9% from GBP42.0m

at the start of the financial year to GBP43.2m at the end of the

Quarter, through both reduced vacancy and rental growth. During the

Quarter, letting vacant units added GBP1.0m (2.3%) to the rent

roll.

It is the strength of the occupational market driving rental

growth and low vacancy that will ultimately support fully covered

dividends and earnings growth. Income/earnings remain a central

focus for Custodian Property Income REIT, and it is income that

will deliver positive total returns for shareholders. On this basis

we remain cautiously optimistic.

Asset management

The Investment Manager has remained focused on active asset

management during the Quarter, completing nine new leases adding

GBP1.0m of new annual rent through letting vacant assets and

secured a further GBP0.7m of existing annual rent roll, increasing

property capital value by GBP4.5m. These new leases had a weighted

average unexpired term to first break or expiry ("WAULT") of 5.5

years, with the overall portfolio WAULT remaining at 4.8 years.

These asset management initiatives included completing:

-- A 10 year lease with fifth year break option to Zavvigroup on

a vacant, comprehensively refurbishedindustrial unit in Winsford at

annual rent of GBP741k, a 75% increase on the previous passing

rent, increasingvaluation by GBP2.2m (24%);

-- A 10 year lease renewal with fifth year break option on an

industrial unit in Hamilton let to IchorSystems at an annual rent

of GBP295k, a 29% increase on the previous passing rent, increasing

valuation by GBP0.8m(27%);

-- A 15 year lease with tenth year break option to JD Gyms on a

vacant retail warehouse unit in Swindon atan annual rent of

GBP150k, in line with ERV, increasing valuation by GBP0.7m

(12%);

-- A 15 year lease with tenth year break to Farmfoods at a

vacant retail warehouse unit in Grantham at anannual rental of

GBP100k, in line with ERV, increasing valuation by GBP0.5m

(22%);

-- A five year lease renewal with Next on a retail warehouse

unit in Evesham, at an annual rent of GBP128k, inline with ERV;

-- A 10 year lease with fifth year break to Aubin & Wills on

a retail unit in Edinburgh at an annual rent ofGBP95k, in line with

ERV, increasing valuation by GBP0.3m (31%);

-- A five year lease renewal with third year break option to

Halfords on a retail warehouse unit in Weymouthat an annual rental

of GBP71k, in line with ERV;

-- A five year lease to Blue Cross on a retail unit in

Shrewsbury at an annual rental of GBP33k, in line withERV; and

-- A three year lease to Community 360 at a retail unit in

Colchester at an annual rental of GBP24k.

During the Quarter the Company also settled an open market rent

review with Charles Stanley at Willow Court, Oxford at GBP111k, a

43% increase on the previous passing level, and completed the

following capital initiatives:

-- Purchased the long leasehold interest of a unit at a 10-unit

industrial asset in Knowsley for GBP1.25m; and

-- Achieved practical completion of a GBP7m redevelopment of an

industrial unit in Redditch.

The impact of these positive outcomes was partially offset by

the Administration of Wilko, which exited the Company's retail unit

in Taunton, decreasing the Company's annual rent roll by

GBP0.1m.

Post Quarter end we exchanged contracts for the disposal of an

out-of-town office property on Pride Park, Derby for GBP2.05m. A

deposit of GBP0.2m was received with completion expected in

December 2023.

Fully covered dividend

The Company paid an interim dividend of 1.375p per share on 31

August 2023 relating to the quarter ended 30 June 2023. The Board

has approved an interim dividend per share of 1.375p for the

Quarter, fully covered by EPRA earnings, payable on 30 November

2023. The Board is targeting aggregate dividends per share[8] of at

least 5.5p for the year ending 31 March 2024. The Board's objective

is to grow the dividend on a sustainable basis, at a rate which is

fully covered by net rental income and does not inhibit the

flexibility of the Company's investment strategy.

Borrowings

At 30 September 2023 the Company had GBP185.0m of debt drawn at

an aggregate weighted average cost of 4.2% with no expiries until

September 2024 and diversified across a range of lenders. This debt

comprised:

-- GBP45m (24%) at a variable prevailing interest rate of 6.84%

and a facility maturity of 1.0 years; and

-- GBP140m (76%) at a weighted average fixed rate of 3.4% with a

weighted average maturity of 6.5 years.

At 30 September 2023 the Company's borrowing facilities are:

Variable rate borrowing

-- GBP45m drawn under the Lloyds RCF.

The Company expects to complete an extension of the Lloyds RCF

during November 2023, increasing the total funds available from

GBP50m to GBP75m for a term of three years, with an option to

extend the term by a further two years subject to Lloyds'

approval.

Fixed rate borrowing

-- A GBP20m term loan with Scottish Widows plc ("SWIP")

repayable on 13 August 2025 with interest fixed at3.935%;

-- A GBP45m term loan with SWIP repayable on 5 June 2028 with

interest fixed at 2.987%; and

-- A GBP75m term loan with Aviva comprising:? A GBP35m tranche

repayable on 6 April 2032 with fixed annual interest of 3.02%; ? A

GBP25m tranche repayable on 3 November 2032 with fixed annual

interest of 4.10%; and ? A GBP15m tranche repayable on 3 November

2032 with fixed annual interest of 3.26%.

Each facility has a discrete security pool, comprising a number

of individual properties, over which the relevant lender has

security and covenants:

-- The maximum LTV of the discrete security pools is either 45%

or 50%, with an overarching covenant on theproperty portfolio of a

maximum of 35% LTV; and

-- Historical interest cover, requiring net rental receipts from

the discrete security pools, over thepreceding three months, to

exceed either 200% or 250% of the associated facility's quarterly

interest liability.

Portfolio analysis

At 30 September 2023 the portfolio is split between the main

commercial property sectors, in line with the Company's objective

to maintain a suitably balanced investment portfolio. Sector

weightings are shown below:

Valuation

Quarter valuation

30 Sept movement

2023 Weighting by value 30 Quarter valuation Weighting by value 30

Sept 2023 GBPm movement Jun 2023

GBPm

Sector

Industrial 303.2 50% (0.2) - 49%

Retail 127.6 21% (3.7) (3%) 21%

warehouse

Other[9] 78.1 13% (1.8) (2%) 13%

Office 67.5 11% (5.9) (8%) 11%

High street 33.4 5% (0.7) (2%) 6%

retail

Total 609.8 (12.3) (2%) 100%

For details of all properties in the portfolio please see

custodianreit.com/property-portfolio.

- Ends -

Further information:

Further information regarding the Company can be found at the

Company's website custodianreit.com or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numis.com/funds

FTI Consulting

Richard Sunderland / Andrew Davis / Oliver Parsons Tel: +44 (0)20 3727 1000

custodianreit@fticonsulting.com

Notes to Editors

Custodian Property Income REIT plc is a UK real estate

investment trust, which listed on the main market of the London

Stock Exchange on 26 March 2014. Its portfolio comprises properties

predominantly let to institutional grade tenants throughout the UK

and is principally characterised by smaller, regional,

core/core-plus properties.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By principally targeting smaller, regional,

core/core-plus properties, the Company seeks to provide investors

with an attractive level of income with the potential for capital

growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit custodianreit.com and

custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

[1] Price on 30 October 2023. Source: London Stock Exchange.

[2] Profit after tax excluding net gains or losses on investment

property divided by weighted average number of shares in issue.

[3] Estimated rental value ("ERV") of let property divided by

total portfolio ERV.

[4] Adjusting for capital expenditure.

[5] NAV per share movement including dividends paid during the

Quarter.

[6] Gross borrowings less cash (excluding rent deposits) divided

by portfolio valuation.

[7] An interim dividend of 1.375p per share relating to the

quarter ended 30 June 2023 was paid on 31 August 2023.

[8] This is a target only and not a profit forecast. There can

be no assurance that the target can or will be met and it should

not be taken as an indication of the Company's expected or actual

future results. Accordingly, shareholders or potential investors in

the Company should not place any reliance on this target in

deciding whether or not to invest in the Company or assume that the

Company will make any distributions at all and should decide for

themselves whether or not the target dividend yield is reasonable

or achievable.

[9] Comprises drive-through restaurants, car showrooms, trade

counters, gymnasiums, restaurants and leisure units.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 281485

EQS News ID: 1760901

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1760901&application_name=news

(END) Dow Jones Newswires

October 31, 2023 03:00 ET (07:00 GMT)

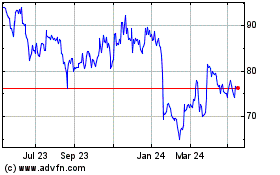

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

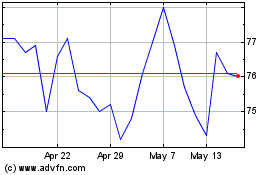

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024